Professional Documents

Culture Documents

Wipro Accounting Report Analysis of Financial Statements: Group Number - 7 Group Members

Uploaded by

shivani khare0 ratings0% found this document useful (0 votes)

1 views3 pagesOriginal Title

Accounting Report

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views3 pagesWipro Accounting Report Analysis of Financial Statements: Group Number - 7 Group Members

Uploaded by

shivani khareCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Group Number – 7

Group Members:

Arushi Tewari - 21020072

Shivani Khare - 21020037

Supriya - 21020034

Tanmay Srivastava - 21020030

Wipro Accounting Report

Analysis of Financial Statements

Wipro Limited is a company that specialises in IT, consulting, and business process

outsourcing. It follows a mass market business approach and makes no

distinctions based on firm size. It offers services in the fields of education,

banking, manufacturing, and telecommunications. The corporation follows a

straight-line approach to depreciation. Non-current and current deposits are

invested in by the corporation in accordance with banks, generally on the basis of

term deposits held as margin money. There are no significant gains or losses on

derivative transactions in the company's basic and diluted EPS. The chairman's

statement contains information about the company's activities, strategies,

research, labour relations, major accomplishments, future goals, and growth. The

directors' report, on the other hand, comprises information on the state of the

organization's undertakings, including profits, reserves, and dividends, substantial

changes, and commitments, if any, energy conservation, technology absorption,

and foreign exchange earnings.

The information offered by the company, such as business strategy and

technology change, gives investors and analysts a clear picture of the company's

long-term goals. Corporate governance is a complicated subject in which the

structures and principles define the rights and responsibilities of different people.

The knowledge about a company's management creates a powerful feeling,

encouraging others, and being real, but it also has a flip side, leading to fear of

rejection, rage, pity, violence, and disappointment.

The cash flows from the company's ordinary revenue-generating, investment, and

financing activities are separated. Noncash expenses like as depreciation and

amortisation are included in the cash flow statement under operating operations.

Depreciation expense is included in net income because it reduces net income but

does not affect cash flow. It lowers a company's taxable income.

Interest receivable refers to interest generated on investments, loans, or past-due

invoices that has not yet been paid. The term "interest receivable" refers to a

company's expected interest revenue. Dividend income is similar to cash

dividends paid to corporation shareholders. Dividends are paid out to the

company's shareholders in the form of stock dividends. As a result, they're on an

even footing.The interest expense equals the interest paid, according to the cash

flow statement.

The cash flow statement represents changes in working capital, it is preferable to

first establish a schedule of changes in working capital before generating the Cash

Flow Statement. Profit and cash flow are both important characteristics of a

company. It is critical for a company to earn profits while also functioning with

positive cash flow in order to be successful in the long run. Profit is computed by

deducting total revenue from costs of sales, operating expenditures, depreciation,

interest, amortisation, and taxes. Cash flow from operations, on the other hand, is

included in the cash flow statement. The cash flow statement is a financial

statement that shows how much cash and cash equivalents are coming in and

going out of a business. The profit and loss statement, balance sheet, and cash

flow statement are all interconnected, as we all know. Finally, several sorts of

ratios such as per share, profitability, liquidity, leverage, and others can be used

to analyse the company's financial records.

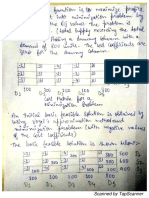

ANNEXURE:

You might also like

- Fine Print in Annual ReportsDocument1 pageFine Print in Annual ReportsVasudevan Sanoor KrishnamurthyNo ratings yet

- 3Document26 pages3JDNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Financial Management.... PGDocument17 pagesFinancial Management.... PGManali PatilNo ratings yet

- Fm108 ModuleDocument17 pagesFm108 ModuleKarl Dennis TiansayNo ratings yet

- An Overview of Business Finance-1Document24 pagesAn Overview of Business Finance-1HamzaNo ratings yet

- Chapter-3 FINANCIAL STATEMENT PREPARATIONDocument21 pagesChapter-3 FINANCIAL STATEMENT PREPARATIONWoldeNo ratings yet

- Applied Nusiness Finance AssignmentDocument13 pagesApplied Nusiness Finance AssignmentHajra HaroonNo ratings yet

- Ratio Analysis Draft 1Document9 pagesRatio Analysis Draft 1SuchitaSanghviNo ratings yet

- What Are Financial Statements?: AssetsDocument4 pagesWhat Are Financial Statements?: AssetsRoselyn Joy DizonNo ratings yet

- Financial: StatementDocument31 pagesFinancial: StatementGrace Joy100% (1)

- Cashflow AnalysisDocument19 pagesCashflow Analysisgl101No ratings yet

- Financial StatementDocument16 pagesFinancial StatementCuracho100% (1)

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Financial Projections: How To Make A Financial Projection?Document5 pagesFinancial Projections: How To Make A Financial Projection?pooja dayamaNo ratings yet

- Cash Flow AnalysisDocument19 pagesCash Flow Analysisanwar_pblNo ratings yet

- BSBFIA402 Assessment 1 VF FinanzasDocument10 pagesBSBFIA402 Assessment 1 VF FinanzasLiliana Cañon GomezNo ratings yet

- HCL StudyDocument13 pagesHCL StudyJyotirmay SahuNo ratings yet

- Investment Decision - Edited (1) .EditedDocument2 pagesInvestment Decision - Edited (1) .EditedDavid JumaNo ratings yet

- 804 I.A Ahmadu Bello UniversityDocument5 pages804 I.A Ahmadu Bello Universityayo kunleNo ratings yet

- Financial StatementDocument7 pagesFinancial StatementJan Marini Lopez MiguelNo ratings yet

- FSA3e HW Answers Modules 1-4Document39 pagesFSA3e HW Answers Modules 1-4bobdole0% (1)

- What Is Financial Statement AnalysisDocument4 pagesWhat Is Financial Statement AnalysisDivvy JhaNo ratings yet

- Executive Finance and Strategy Tiffin en 23071Document5 pagesExecutive Finance and Strategy Tiffin en 23071EdgarAnchondoNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Financial TrainingDocument15 pagesFinancial TrainingGismon PereiraNo ratings yet

- Chapter-8 Assessing A New Venture's Financial Strength and ViabilityDocument53 pagesChapter-8 Assessing A New Venture's Financial Strength and ViabilityHtet Pyae ZawNo ratings yet

- Cashflow Project+SandhyaDocument71 pagesCashflow Project+Sandhyaabdulkhaderjeelani1480% (5)

- 1 Financial Statements Cash Flows and TaxesDocument13 pages1 Financial Statements Cash Flows and TaxesAyanleke Julius OluwaseunfunmiNo ratings yet

- What Are Financial StatementsDocument4 pagesWhat Are Financial StatementsJustin Era ApeloNo ratings yet

- 1 Introduction Financial Accounting 1 (Cuacm105)Document17 pages1 Introduction Financial Accounting 1 (Cuacm105)priviledgeshambare2004No ratings yet

- Consolidated Financial StatementsDocument32 pagesConsolidated Financial StatementsPeetu WadhwaNo ratings yet

- Financial Accounting-Unit-5-SYMBDocument19 pagesFinancial Accounting-Unit-5-SYMBGarima KwatraNo ratings yet

- Financial Management ABADDocument7 pagesFinancial Management ABADKumaingking Daniell AnthoineNo ratings yet

- TEAM 7 - Activities in Business OrganizationsDocument26 pagesTEAM 7 - Activities in Business OrganizationsEduardo BautistaNo ratings yet

- Faca ShristiDocument11 pagesFaca Shristishristi BaglaNo ratings yet

- Financial Accounting - Ian C. Dagatan HRT-ADocument31 pagesFinancial Accounting - Ian C. Dagatan HRT-AVanessa Franca DagatanNo ratings yet

- Financial Statement AnalysisDocument5 pagesFinancial Statement Analysisyashvardan shahNo ratings yet

- Aim 1004Document28 pagesAim 1004Emily HoeNo ratings yet

- Individual Assignment: Name Id Number K.K.Kavitharane A/P Kuppusamy 1207201012Document8 pagesIndividual Assignment: Name Id Number K.K.Kavitharane A/P Kuppusamy 1207201012Tha RaniNo ratings yet

- 13 - Chapter 7 PDFDocument30 pages13 - Chapter 7 PDFLoveleena RodriguesNo ratings yet

- Lecture 3 - Cash Flow AnalysisDocument12 pagesLecture 3 - Cash Flow AnalysisJF FNo ratings yet

- OcfDocument2 pagesOcfMd Rasel Uddin ACMANo ratings yet

- Polytechnic University of The Philippines Office of The Pup Graduate School Dean G/F M.H. Delpilar Campus Sta. Mesa, ManilaDocument11 pagesPolytechnic University of The Philippines Office of The Pup Graduate School Dean G/F M.H. Delpilar Campus Sta. Mesa, ManilaJennybabe SantosNo ratings yet

- How To Use A Cash Flow StatementDocument2 pagesHow To Use A Cash Flow StatementSha RonNo ratings yet

- Cash FlowDocument10 pagesCash Flowbharti guptaNo ratings yet

- Financial StatementsDocument10 pagesFinancial StatementsFraulien Legacy MaidapNo ratings yet

- Introduction Cash FlowDocument10 pagesIntroduction Cash FlowAmrit TejaniNo ratings yet

- ABE FMDocument21 pagesABE FMaung sanNo ratings yet

- Accounting 3 Cash Flow Statement DiscussionDocument6 pagesAccounting 3 Cash Flow Statement DiscussionNoah HNo ratings yet

- Financial Statement PresentationDocument33 pagesFinancial Statement Presentationcyrene jamnagueNo ratings yet

- Marketing Strategies For Emerging Markets - Haier Case Study - Shivani Khare - 21020037 - MBA 2021Document3 pagesMarketing Strategies For Emerging Markets - Haier Case Study - Shivani Khare - 21020037 - MBA 2021shivani khareNo ratings yet

- Jindal Global Business School: Course OutlineDocument10 pagesJindal Global Business School: Course Outlineshivani khareNo ratings yet

- Marketing Plan - Marks DistributionDocument4 pagesMarketing Plan - Marks Distributionshivani khareNo ratings yet

- Assignment 2-Devyani Gupta - MADocument4 pagesAssignment 2-Devyani Gupta - MAshivani khareNo ratings yet

- Market Analytics - CP Assignment - Shivani Khare - 21020037 - MBA 2021Document14 pagesMarket Analytics - CP Assignment - Shivani Khare - 21020037 - MBA 2021shivani khareNo ratings yet

- 15 3 23Document2 pages15 3 23shivani khareNo ratings yet

- Consumer Brand Rating DataDocument23 pagesConsumer Brand Rating Datashivani khareNo ratings yet

- Prescriptive Analytics - MaximizationDocument6 pagesPrescriptive Analytics - Maximizationshivani khareNo ratings yet

- Running Head: ESSAY 1Document3 pagesRunning Head: ESSAY 1shivani khareNo ratings yet

- Attachment 1Document2 pagesAttachment 1shivani khareNo ratings yet

- Attendance-January 2022Document1 pageAttendance-January 2022shivani khareNo ratings yet

- Analysis of Covid - Oeson TaskDocument38 pagesAnalysis of Covid - Oeson Taskshivani khareNo ratings yet

- Coca Cola Decision MakingDocument7 pagesCoca Cola Decision MakingShishan AhmadNo ratings yet

- BRM - MBA-2021 - Set 1 - Vinayak A DraveDocument6 pagesBRM - MBA-2021 - Set 1 - Vinayak A Draveshivani khareNo ratings yet

- Assignment 2Document1 pageAssignment 2shivani khareNo ratings yet

- Vrio Analysis Forsun PharmaDocument7 pagesVrio Analysis Forsun Pharmashivani khareNo ratings yet

- 1) Survey:: Applicability in The IndustryDocument6 pages1) Survey:: Applicability in The Industryshivani khareNo ratings yet

- Risk Management Oco Internship Task 2Document7 pagesRisk Management Oco Internship Task 2shivani khareNo ratings yet

- AI in TransportationDocument8 pagesAI in Transportationshivani khare100% (1)

- Workforce Management Crisis at J Mitra & Co.: Answer 1Document8 pagesWorkforce Management Crisis at J Mitra & Co.: Answer 1shivani khareNo ratings yet

- Causes of Project Delay and The Mitigation Measures - Task8Document4 pagesCauses of Project Delay and The Mitigation Measures - Task8shivani khareNo ratings yet

- ARIMA Model: This Acronym Is Descriptive, Capturing The Key Aspects of The Model Itself. Briefly, They AreDocument2 pagesARIMA Model: This Acronym Is Descriptive, Capturing The Key Aspects of The Model Itself. Briefly, They Areshivani khareNo ratings yet

- Part A: Cottle Taylor: Expanding The Oral Care Group in IndiaDocument14 pagesPart A: Cottle Taylor: Expanding The Oral Care Group in Indiashivani khareNo ratings yet

- Shivani Khare - Financial Management Assignment 1Document18 pagesShivani Khare - Financial Management Assignment 1shivani khareNo ratings yet

- Deloitte Case Study SolutionDocument4 pagesDeloitte Case Study Solutionshivani khareNo ratings yet

- MidTerm Ans - 1Document1 pageMidTerm Ans - 1shivani khareNo ratings yet

- Arushi FM AssignmentDocument56 pagesArushi FM Assignmentshivani khareNo ratings yet

- Operations Research Assignment - Shivani Khare - SecB - 21020037Document9 pagesOperations Research Assignment - Shivani Khare - SecB - 21020037shivani khareNo ratings yet

- Shivani Khare - 21020037Document1 pageShivani Khare - 21020037shivani khareNo ratings yet

- Shivani Khare - Research Analyst - Human BehaviourDocument2 pagesShivani Khare - Research Analyst - Human Behaviourshivani khareNo ratings yet

- Valuation of Goodwill As On 21 12 2020Document13 pagesValuation of Goodwill As On 21 12 2020jeevan varmaNo ratings yet

- Financial Reporting Paper 2.1Document24 pagesFinancial Reporting Paper 2.1abbeangedesireNo ratings yet

- Covalent: Term Loan For Expansion and Modernization: Submitted By: Group 10Document12 pagesCovalent: Term Loan For Expansion and Modernization: Submitted By: Group 10Pratyush BaruaNo ratings yet

- Stryker Corporation: Capital BudgetingDocument8 pagesStryker Corporation: Capital Budgetinggaurav sahuNo ratings yet

- FABM2 Module 5. Statement of Cash FlowsDocument7 pagesFABM2 Module 5. Statement of Cash FlowsSITTIE RAYMAH ABDULLAHNo ratings yet

- Activity Sheet 6 10Document9 pagesActivity Sheet 6 10Yaxi AxhiaNo ratings yet

- Eba200 Midterm v2022Document4 pagesEba200 Midterm v2022Jason Saberon Quiño100% (1)

- CIR v. Amex (Inc)Document3 pagesCIR v. Amex (Inc)Eva TrinidadNo ratings yet

- Definition of SavingsDocument3 pagesDefinition of SavingsGhulam Mohammad KhanNo ratings yet

- Basic Acctg MCQDocument20 pagesBasic Acctg MCQJohn Ace100% (2)

- Addis Ababa Institute of TechnologyDocument34 pagesAddis Ababa Institute of TechnologyhanoseNo ratings yet

- Jeter AA 4e SolutionsManual Ch16Document22 pagesJeter AA 4e SolutionsManual Ch16Dian Ayu Permatasari100% (1)

- Simple and Compound InterestDocument2 pagesSimple and Compound InterestRaymond EdgeNo ratings yet

- 31 August 2023 Purple Group Company AFSDocument53 pages31 August 2023 Purple Group Company AFSmkhize.christian.21No ratings yet

- Dasar Akmen 4 - Variable Costing and Full CostingDocument42 pagesDasar Akmen 4 - Variable Costing and Full CostingDiandra OlivianiNo ratings yet

- Tata Steel - Q2FY23 Result Update - 02112022 - 02-11-2022 - 12Document9 pagesTata Steel - Q2FY23 Result Update - 02112022 - 02-11-2022 - 12AnirudhNo ratings yet

- Business Taxation Notes B.com Part 2 Income Tax Sales TaxDocument79 pagesBusiness Taxation Notes B.com Part 2 Income Tax Sales TaxMehwish Akram 48No ratings yet

- Ifrs VS Us GaapDocument118 pagesIfrs VS Us GaapAhmed SabirNo ratings yet

- Dividendinvesting PaperDocument13 pagesDividendinvesting PaperCan EbeNo ratings yet

- Foundations of Financial Management 16th Edition by Block TB Testbank and Solution ManualDocument25 pagesFoundations of Financial Management 16th Edition by Block TB Testbank and Solution ManualIbrahim Khalil Ullah0% (1)

- External Financing Needs, Corporate Governance, and Firm ValueDocument16 pagesExternal Financing Needs, Corporate Governance, and Firm ValueGabriella TanjungNo ratings yet

- MS - 43 Solved AssignmentDocument13 pagesMS - 43 Solved AssignmentIGNOU ASSIGNMENTNo ratings yet

- Exercise Stock ValuationDocument2 pagesExercise Stock ValuationUmair ShekhaniNo ratings yet

- 6.1 PFRS For SmeDocument9 pages6.1 PFRS For SmecookiedoughNo ratings yet

- Supreme Poultry FarmDocument11 pagesSupreme Poultry FarmAsifyes AsifNo ratings yet

- CMA Part 2 Slides PDFDocument80 pagesCMA Part 2 Slides PDFmohamedNo ratings yet

- Rushil Decor 2019Document149 pagesRushil Decor 2019Puneet367No ratings yet

- Market and Financial Feasibility Study For Great Wolf Resorts in Collier County - Feb. 23, 2021Document31 pagesMarket and Financial Feasibility Study For Great Wolf Resorts in Collier County - Feb. 23, 2021Omar Rodriguez OrtizNo ratings yet

- Compilation of FMSM Telegram McqsDocument17 pagesCompilation of FMSM Telegram McqsAddvit ShrivastavaNo ratings yet

- Test 1: Note If You Are Facing Any Difficulty Uploading Your Answers, Please Inform MeDocument3 pagesTest 1: Note If You Are Facing Any Difficulty Uploading Your Answers, Please Inform MewakeyyNo ratings yet