Professional Documents

Culture Documents

Accounting Voucher

Uploaded by

Shubham SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Voucher

Uploaded by

Shubham SinghCopyright:

Available Formats

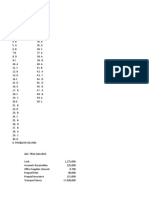

GST INVOICE

SUNIL ENTERPRISES Invoice No. Dated

OPP. LADHA DHARAMSHALA, SE/2391/20-21 8-Nov-20

P.R. MARG AJMER (RAJ.)

0145-2623274,9828278978

Delivery Note Mode/Terms of Payment

9887253974 CASH

GSTIN/UIN: 08BQCPP5189A1ZS

State Name : Rajasthan, Code : 08 Reference No. & Date. Other References

Contact : 9828278978, 9887253974

E-Mail : suryabatteryajmer@gmail.com

Buyer’s Order No. Dated

Buyer (Bill to)

Cash Dispatch Doc No. Delivery Note Date

State Name : Rajasthan, Code : 08 Dispatched through Destination

Terms of Delivery

Sl Description of Goods HSN/SAC Quantity Rate Rate per Disc. % Amount

No. Shipped Billed (Incl. of Tax)

1 GQP1050 8504 1 Nos 1 Nos 5,000.00 4,237.29 Nos 4,237.29

12V 1050VA GQP PURE SINE WAVE INVERTERZ

92072034264

2 IT500 850700 1 Nos 1 Nos 17,500.01 13,671.88 Nos 13,671.88

FEI0-IT500 FC

A3I0Z146455

17,909.17

C GST 2,295.42

S GST 2,295.42

Less : ROUND OFF (-)0.01

Total 2 Nos 2 Nos 22,500.00

Amount Chargeable (in words) E. & O.E

INR Twenty Two Thousand Five Hundred Only

HSN/SAC Taxable Central Tax State Tax Total

Value Rate Amount Rate Amount Tax Amount

8504 4,237.29 9% 381.36 9% 381.36 762.72

850700 13,671.88 14% 1,914.06 14% 1,914.06 3,828.12

Total 17,909.17 2,295.42 2,295.42 4,590.84

Tax Amount (in words) : INR Four Thousand Five Hundred Ninety and Eighty Four paise Only

Company’s Bank Details

Bank Name : State Bank of India

A/c No. : 36227694686

Branch & IFS Code : PR Marg Ajmer & SBIN0001568

Declaration

for SUNIL ENTERPRISES

1. Goods once sold will not be taken back.

2. Interest @ 24% p.a. will be charged if the payment is

not made with in the stipulated time Authorised Signatory

SUBJECT TO AJMER JURISDICTION

This is a Computer Generated Invoice

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Sub Dealer I Sub Dealer Name Dealer Code Dealer Namesub Dealer Msub Dealer AcDocument15 pagesSub Dealer I Sub Dealer Name Dealer Code Dealer Namesub Dealer Msub Dealer AcShubham SinghNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Lovely Professional University Online Assignment 1 Analyzes Business ChallengesDocument3 pagesLovely Professional University Online Assignment 1 Analyzes Business ChallengesShubham SinghNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Lovely Professional University Online Assignment 1 Analyzes Business ChallengesDocument3 pagesLovely Professional University Online Assignment 1 Analyzes Business ChallengesShubham SinghNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Rtgs Incentive - N-PB - 0.50% Veh (Wo-Erk) Car 2WL % of Achievent Till 27th Feb End of The MonthDocument2 pagesRtgs Incentive - N-PB - 0.50% Veh (Wo-Erk) Car 2WL % of Achievent Till 27th Feb End of The MonthShubham SinghNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Analyzing business impacts of environmental changesDocument7 pagesAnalyzing business impacts of environmental changesShubham SinghNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- MGNDocument4 pagesMGNShubham SinghNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Lovely Professional University: Academic Task - 2 Mittal School of BusinessDocument2 pagesLovely Professional University: Academic Task - 2 Mittal School of BusinessShubham SinghNo ratings yet

- The Impact of Political Communication On Voting Behaviour: A Comparative Study in Karnataka, Kerala & Tamil NaduDocument17 pagesThe Impact of Political Communication On Voting Behaviour: A Comparative Study in Karnataka, Kerala & Tamil NaduShubham SinghNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Lovely Professional University Academic Task No. 1 Mittal School of BusinessDocument3 pagesLovely Professional University Academic Task No. 1 Mittal School of BusinessShubham SinghNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Sport Performance AnalyticsDocument9 pagesSport Performance AnalyticsAbrahamNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Nigiria School DataDocument2 pagesNigiria School DataShubham SinghNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Security Reliability of e BusinessDocument27 pagesSecurity Reliability of e BusinessShubham SinghNo ratings yet

- Building and Launching E-Business: Oxford University Press 2012. All Rights Reserved. E-BusinessDocument27 pagesBuilding and Launching E-Business: Oxford University Press 2012. All Rights Reserved. E-BusinessShubham SinghNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Annexure-V - Cover P Age A Cademic TasksDocument8 pagesAnnexure-V - Cover P Age A Cademic TasksShubham SinghNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Case Analysis of Performance Management in Football ClubDocument5 pagesCase Analysis of Performance Management in Football ClubShubham SinghNo ratings yet

- LOVELY PROFESSIONAL UNIVERSITY ACADEMIC TASKDocument2 pagesLOVELY PROFESSIONAL UNIVERSITY ACADEMIC TASKChetan NarasannavarNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- MKT507 Ambika Sur 11900472Document12 pagesMKT507 Ambika Sur 11900472Shubham SinghNo ratings yet

- Creating E-Business Plan: Oxford University Press 2012. All Rights Reserved. E-BusinessDocument29 pagesCreating E-Business Plan: Oxford University Press 2012. All Rights Reserved. E-BusinessShubham SinghNo ratings yet

- Chapter - 9 Back End SystemDocument27 pagesChapter - 9 Back End SystemShubham SinghNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Value Creation and Business Strategies in E-Age: Oxford University Press 2012. All Rights Reserved. E-BusinessDocument33 pagesValue Creation and Business Strategies in E-Age: Oxford University Press 2012. All Rights Reserved. E-BusinessShubham SinghNo ratings yet

- E-Business Applications: Oxford University Press 2012. All Rights Reserved. E-BusinessDocument21 pagesE-Business Applications: Oxford University Press 2012. All Rights Reserved. E-BusinessShubham SinghNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- E-Business: Oxford University Press 2012. All Rights Reserved. E-BusinessDocument45 pagesE-Business: Oxford University Press 2012. All Rights Reserved. E-BusinessShubham SinghNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Knowledge Management and Business Intelligence For Strategic E-BusinessDocument21 pagesKnowledge Management and Business Intelligence For Strategic E-BusinessShubham SinghNo ratings yet

- Last Report CapDocument59 pagesLast Report CapShubham SinghNo ratings yet

- Chapter - 2 E Busines ModelsDocument41 pagesChapter - 2 E Busines ModelsShubham SinghNo ratings yet

- E-Business Competitive and Business Strategy: Oxford University Press 2012. All Rights Reserved. E-BusinessDocument27 pagesE-Business Competitive and Business Strategy: Oxford University Press 2012. All Rights Reserved. E-BusinessShubham SinghNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Wrong Company for ChangeDocument2 pagesWrong Company for ChangeKristel Coleen Sumibcay100% (1)

- Research On The Relationship Between The Growth of OTT Service Market and The Change in The Structure of The Pay-TV MarketDocument49 pagesResearch On The Relationship Between The Growth of OTT Service Market and The Change in The Structure of The Pay-TV MarketShubham SinghNo ratings yet

- Case Study Analysis ReportDocument9 pagesCase Study Analysis ReportShubham SinghNo ratings yet

- Webpay 170410200339Document125 pagesWebpay 170410200339jeyanthan88100% (2)

- Main Objects Clause in MOADocument5 pagesMain Objects Clause in MOApradeep15101981100% (1)

- Mortgage Lab Signature AssignmentDocument15 pagesMortgage Lab Signature Assignmentapi-385294359No ratings yet

- Ghassan George Ojeil: Financial Analysis/ReportingDocument2 pagesGhassan George Ojeil: Financial Analysis/ReportingElie DiabNo ratings yet

- Midterm FinacDocument4 pagesMidterm FinacShaira Nicole VasquezNo ratings yet

- University of Mauritius: Reduit VacanciesDocument3 pagesUniversity of Mauritius: Reduit Vacanciespankaj_pandey_21No ratings yet

- Exercises - ManufacturingDocument7 pagesExercises - ManufacturingRiana CellsNo ratings yet

- Auditing Lecture 8 VouchingDocument40 pagesAuditing Lecture 8 VouchingMr BalochNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Simon Property Group - Quick ReportDocument1 pageSimon Property Group - Quick Reporttkang79No ratings yet

- Outline Bank Management and Fintech 2030 Dermine FBLDocument6 pagesOutline Bank Management and Fintech 2030 Dermine FBLSaim RashidNo ratings yet

- MD Shohag Al-Mamun MBS ACMADocument6 pagesMD Shohag Al-Mamun MBS ACMATaslima AktarNo ratings yet

- Inflation Reduction Act 2022Document273 pagesInflation Reduction Act 2022Maria MeranoNo ratings yet

- RHB BG Application FormDocument4 pagesRHB BG Application Formken limNo ratings yet

- DuPont analysis assignmentDocument5 pagesDuPont analysis assignmentআশিকুর রহমান100% (1)

- Diane chptr1 DoneDocument13 pagesDiane chptr1 DoneRosemenjelNo ratings yet

- Cash JournalDocument7 pagesCash JournalASHOKA GOWDANo ratings yet

- AVT Natural Products LTD 2014-15Document101 pagesAVT Natural Products LTD 2014-15Anonymous NnVgCXDwNo ratings yet

- Accounting for Tax Amnesty Assets and LiabilitiesDocument13 pagesAccounting for Tax Amnesty Assets and LiabilitiesHeriyanto MonmonNo ratings yet

- Midterm Exam Review for Accounting StudentsDocument5 pagesMidterm Exam Review for Accounting StudentsRuby Amor Doligosa100% (1)

- Compound Interest FormulaDocument21 pagesCompound Interest FormulaFrancis De GuzmanNo ratings yet

- Philippine tax obligations calculation resident citizenDocument3 pagesPhilippine tax obligations calculation resident citizenKatrina Dela CruzNo ratings yet

- Estate Duty Calculation for Late Mr Jones MpofuDocument17 pagesEstate Duty Calculation for Late Mr Jones Mpofukelvin mkweshaNo ratings yet

- Case Study - Manufacturing Accounting - 10Document2 pagesCase Study - Manufacturing Accounting - 10nadwa dariah50% (2)

- University MCQs SAMPLE For Project ManagementDocument11 pagesUniversity MCQs SAMPLE For Project Managementasit kandpalNo ratings yet

- Polar SportsDocument15 pagesPolar SportsjordanstackNo ratings yet

- 1099a Example For 1041Document1 page1099a Example For 1041jigger manNo ratings yet

- Ali Cloud Investment ProfileDocument23 pagesAli Cloud Investment ProfileFarhan SheikhNo ratings yet

- Predicting probability of default of Indian corporate bonds using logistic and Z-score modelsDocument20 pagesPredicting probability of default of Indian corporate bonds using logistic and Z-score modelsraqthesolidNo ratings yet

- Overview of Insurance Industry of BanglaDocument20 pagesOverview of Insurance Industry of BanglamR. sLimNo ratings yet

- Bank Reconciliation Book to Bank MethodDocument5 pagesBank Reconciliation Book to Bank MethodNika BautistaNo ratings yet