Professional Documents

Culture Documents

Finance

Uploaded by

SUDHANSHU SINGHOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance

Uploaded by

SUDHANSHU SINGHCopyright:

Available Formats

L&T is a diversified conglomerate and the lion share of the revenue comes from the

construction business which is very subjective and the profits are only when there is

a momentum in the economy and when people are building industry and there is a

infrastructure spending.

In the last decade L&T also tried to merge with Satyam computers to diversify its

business model and enter into the service IT sector of this business but lost to the

cutthroat bid of 2900 crores from Tech Mahindra and failed to acquire Satyam

computers in 2013.

Now to diversify their revenue L&T strategically wanted to expand the growing

service sector of industry and service fee which is largely technology and financial

services with this it will help the company to play with the mass market and acquire

more customer base in the form of construction and as well as the service sector of

the industry.

Plan to Acquire

Founder promoter only had 13 percent of the company and the single largest

shareholder was Vijay Siddhartha who was literally the quasi promoted with largest

shareholder of 20.4%.

Siddharth needed an exit because he was having his own security pressure and was

highly levered, so he approached L&T and asked them if they would buy his shares

L&T sensed an opportunity and agreed to the offer but the management resisted by

saying that L&T working ethos is very different from theirs.

Founders only had 13% of the shares and try to launch a buyback now as discussed

in the class there are certain rules to buy back in this country you can only do a

buyback of 25% of your net worth but that won’t cut for the founder group as L&T

was Buying 20.4% from Siddhartha and then they asked their 2 corporate brokers

axis and Citi lure of 31 % from the other shareholders and FPI which will make 20+31

= 51 and they would also and they also offered an additional of 15% of open offer

the public at the price of 980 per share which will make the total of 66%. And

successfully acquired 60% of the shareholding in the mindtree in June 2019.

Now two things cannot happen simultaneously once you have said you are going to

launch an open offer a Buy back which is a counter from mindtree can only happen

after the open offer window is closed. If the open offer happen first and successful

then mind tree could not do anything and buy back would be null and void. Which

pretty much happened in this particular hostile takeover.

L&T Infotech, Mindtree, their shareholders, their management and a lot many

others. As they say 1+1 = 11. This acquisitions seems to prove that.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Affiliate Marketing Step by StepDocument27 pagesAffiliate Marketing Step by StepJulia FawcettNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Exxonmobil Interview Questions and AnswersDocument60 pagesExxonmobil Interview Questions and Answersrajkamal eshwar100% (3)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Enron Case StudyDocument23 pagesEnron Case StudyJayesh Dubey100% (1)

- Basic Rules For Steel ErectionDocument71 pagesBasic Rules For Steel Erectionfoller2No ratings yet

- Tomorrow Is WaitingDocument8 pagesTomorrow Is WaitingsrplsmskNo ratings yet

- Air ConditionerDocument131 pagesAir ConditionerRahul AnsariNo ratings yet

- Sys-Am-14 Designing An 'Iaq Ready' Air Handler SystemDocument71 pagesSys-Am-14 Designing An 'Iaq Ready' Air Handler SystemtpqnhatNo ratings yet

- Submarines and SubmersiblesDocument28 pagesSubmarines and Submersiblespraveench1888No ratings yet

- Blockchain Unconfirmed Transaction Hack ScriptDocument10 pagesBlockchain Unconfirmed Transaction Hack ScriptPrecious Clement100% (4)

- Architecture As SpaceDocument31 pagesArchitecture As Spaceazimkhtr50% (4)

- IBS Site Survey ReportDocument101 pagesIBS Site Survey ReportSyed Zahid ShahNo ratings yet

- 2022 Case FileDocument304 pages2022 Case FileSUDHANSHU SINGHNo ratings yet

- Course Outlines - Sem V - ADR (Clinical)Document11 pagesCourse Outlines - Sem V - ADR (Clinical)SUDHANSHU SINGHNo ratings yet

- CG-01 - Garcia Damages ModelDocument97 pagesCG-01 - Garcia Damages ModelSUDHANSHU SINGHNo ratings yet

- Combined Study of Section 12-15Document2 pagesCombined Study of Section 12-15SUDHANSHU SINGHNo ratings yet

- TR-01 - Rochelle Damages ModelDocument150 pagesTR-01 - Rochelle Damages ModelSUDHANSHU SINGHNo ratings yet

- Course Outlines - Sem V - Transfer of Property ActDocument4 pagesCourse Outlines - Sem V - Transfer of Property ActSUDHANSHU SINGHNo ratings yet

- Course Outlines - Sem V - Civil Procedure CodeDocument7 pagesCourse Outlines - Sem V - Civil Procedure CodeSUDHANSHU SINGHNo ratings yet

- Ruary: - R 4 N F ! R - R .)Document2 pagesRuary: - R 4 N F ! R - R .)SUDHANSHU SINGHNo ratings yet

- Cross Examination Moot: (Please Use The University'S Letter Template)Document1 pageCross Examination Moot: (Please Use The University'S Letter Template)SUDHANSHU SINGHNo ratings yet

- Constitution 1 - Updated and NewDocument13 pagesConstitution 1 - Updated and NewSUDHANSHU SINGHNo ratings yet

- Ajay Pandit at Jagdish Dayabhai ... Vs State of Maharashtra On 17 July, 2012Document9 pagesAjay Pandit at Jagdish Dayabhai ... Vs State of Maharashtra On 17 July, 2012SUDHANSHU SINGHNo ratings yet

- Time Series (Sudhanshu Singh)Document18 pagesTime Series (Sudhanshu Singh)SUDHANSHU SINGHNo ratings yet

- Law of EvidenceDocument4 pagesLaw of EvidenceSUDHANSHU SINGHNo ratings yet

- Chapter 4 Introduction of Maritime LawDocument10 pagesChapter 4 Introduction of Maritime LawSUDHANSHU SINGHNo ratings yet

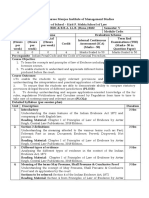

- SVKM's Narsee Monjee Institute of Management Studies Name of School - Kirit P. Mehta School of LawDocument11 pagesSVKM's Narsee Monjee Institute of Management Studies Name of School - Kirit P. Mehta School of LawSUDHANSHU SINGHNo ratings yet

- Law of Crimes II CRPCDocument6 pagesLaw of Crimes II CRPCSUDHANSHU SINGHNo ratings yet

- Padma Vibhushan N. A. Palkhivala Memorial National Moot Court (Virtual) Competition, 2021Document9 pagesPadma Vibhushan N. A. Palkhivala Memorial National Moot Court (Virtual) Competition, 2021SUDHANSHU SINGHNo ratings yet

- Case Analysis CRPC ICADocument7 pagesCase Analysis CRPC ICASUDHANSHU SINGHNo ratings yet

- 2566761727INdian INfrastructure Jul 2020 - Chairperson PPT (2) - 3Document23 pages2566761727INdian INfrastructure Jul 2020 - Chairperson PPT (2) - 3SUDHANSHU SINGHNo ratings yet

- Padma Vibhushan N.A. Palkhivala Memorial National Moot Court Competition, 2021Document23 pagesPadma Vibhushan N.A. Palkhivala Memorial National Moot Court Competition, 2021SUDHANSHU SINGHNo ratings yet

- Contract I CasesDocument11 pagesContract I CasesSUDHANSHU SINGHNo ratings yet

- Ba LLB Research Paper (CRPC) (2019-2024)Document9 pagesBa LLB Research Paper (CRPC) (2019-2024)SUDHANSHU SINGHNo ratings yet

- Corporate Governance, Pressure-Insensitive Institutional Investors and Firm Performance: Evidence From IndiaDocument19 pagesCorporate Governance, Pressure-Insensitive Institutional Investors and Firm Performance: Evidence From IndiaSUDHANSHU SINGHNo ratings yet

- Asset Management Company: I. Small-Cap FundsDocument4 pagesAsset Management Company: I. Small-Cap FundsSUDHANSHU SINGHNo ratings yet

- A Survey of China's Economic Contract Law: UCLA Pacific Basin Law Journal January 1986Document18 pagesA Survey of China's Economic Contract Law: UCLA Pacific Basin Law Journal January 1986SUDHANSHU SINGHNo ratings yet

- CSR ReportDocument13 pagesCSR Reportrishabh agarwalNo ratings yet

- Summer Internship in JaipurDocument12 pagesSummer Internship in JaipurLinuxWorldIndiaNo ratings yet

- D457778-0460 Te Connectivity LTD Product Details: Part Number: Firstbom Part: Category: Manufacturer: ApplicationsDocument3 pagesD457778-0460 Te Connectivity LTD Product Details: Part Number: Firstbom Part: Category: Manufacturer: Applicationsfarhood ranjbarkhanghahNo ratings yet

- Op 275Document13 pagesOp 275cvbNo ratings yet

- Representing Inverse Functions Through Tables and GraphsDocument18 pagesRepresenting Inverse Functions Through Tables and GraphsJoseph BaclayoNo ratings yet

- Maxillary Sinus Augmentation: Tarun Kumar A.B, Ullas AnandDocument13 pagesMaxillary Sinus Augmentation: Tarun Kumar A.B, Ullas Anandyuan.nisaratNo ratings yet

- Users of Accounting InformationDocument4 pagesUsers of Accounting InformationfharnizaparasanNo ratings yet

- Amazing Race Math QuestionsDocument2 pagesAmazing Race Math QuestionsROSALEN M. CUNANANNo ratings yet

- Impact of Phragmanthera Capitata (Sprenge.) Balle On Pod and Beans Production of Two Cocoa Clones in Nkoemvone Seed Fields (South Cameroun) - JBES @scribdDocument9 pagesImpact of Phragmanthera Capitata (Sprenge.) Balle On Pod and Beans Production of Two Cocoa Clones in Nkoemvone Seed Fields (South Cameroun) - JBES @scribdInternational Network For Natural SciencesNo ratings yet

- Classroom of The Elite Volume 12Document276 pagesClassroom of The Elite Volume 12Kaung Khant100% (1)

- Op QuesDocument7 pagesOp QuessreelakshmiNo ratings yet

- Lecture 9Document26 pagesLecture 9Tesfaye ejetaNo ratings yet

- MGM College of Engineering and Pharmaceutical Sciences: First Internal ExaminationDocument2 pagesMGM College of Engineering and Pharmaceutical Sciences: First Internal ExaminationNandagopan GNo ratings yet

- h8183 Disaster Recovery Sphere Vmax SRDF Vplex WPDocument31 pagesh8183 Disaster Recovery Sphere Vmax SRDF Vplex WParvindNo ratings yet

- Tugas 2.grammar Translation Exercises 03Document2 pagesTugas 2.grammar Translation Exercises 03Daffa SyahraniNo ratings yet

- Nidhi Mittal ReportDocument123 pagesNidhi Mittal Reportarjun_gupta0037No ratings yet

- Criteria For SQF Certification Bodies: 7th EditionDocument12 pagesCriteria For SQF Certification Bodies: 7th EditioncristinaNo ratings yet

- 143256-DW-0500-M-328 - Rev 3 - Rev 3.1.0Document1 page143256-DW-0500-M-328 - Rev 3 - Rev 3.1.0Leonel Gamero CardenasNo ratings yet

- ITALY 1940-41: Bersaglieri Support List List OneDocument1 pageITALY 1940-41: Bersaglieri Support List List OneXijun Liew0% (1)