Professional Documents

Culture Documents

Fundamentals of Accountancy, Business and Management 2: Quarter 1 - Module Week 6&7

Uploaded by

Joana Jean SuymanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamentals of Accountancy, Business and Management 2: Quarter 1 - Module Week 6&7

Uploaded by

Joana Jean SuymanCopyright:

Available Formats

12

Fundamentals of

Accountancy, Business

and Management 2

Quarter 1 - Module

Week 6&7

SCHOOLS DIVISION OF SURIGAO CITY

Page 2

FABM2 - WEEK 5

First Edition, 2020

Republic Act 8293, section 176 states that: No copyright shall subsist in any work of the

Government of the Philippines. However, prior approval of the government agency or office

wherein the work is created shall be necessary for exploitation of such work for profit. Such

agency or office may, among other things, impose as a condition the payment of royalties.

Borrowed materials (i.e., songs, stories, poems, pictures, photos, brand names, trademarks, etc.)

included in this book are owned by their respective copyright holders. Every effort has been

exerted to locate and seek permission to use these materials from their respective copyright

owners. The publisher and authors do not represent nor claim ownership over them.

Development Team of the Self Learning Module

Writer: Kurt-Airion H. Sumaylo

Editor:

Reviewers:

Layout Artist:

Management Team:

Printed in the Philippines by ______________________________

For the learner:

Welcome to the Fundamentals of Accountancy, Business and Management 2 – Grade 12

Modular Distance Learning (MDL) Self-Learning Module on the Statement of Comprehensive

Income (SCI) of a Merchandising Business!

This module was designed to provide you with fun and meaningful opportunities for guided

and independent learning at your own pace and time. You will be enabled to process the

contents of the learning resource while being an active learner.

Writer: KURT-AIRION H. SUMAYLO

School/Station: CARAGA REGIONAL SCIENCE HIGH SCHOOL

Division: Surigao City

Email Address: kurtairionsumaylo1981@gmail.com

Page 3

Analysis and Interpretation of Financial

WEEK Statements: Stability, Profitability, and Vertical

6&7 Analyses

Name : ____________________________________________ Section : _______________

Objectives

A. Define the solvency/ stability and profitability measurement levels

B. Identify the different ratios under solvency/ stability and profitability

C. Appreciate the significance of these ratios in business operation

D. Define vertical analyses of financial statements

E. Perform vertical analyses of financial statements of a single proprietorship

F. Appreciate the significance of vertical analyses of financial statements

What I know?

Multiple Choice. Directions: Encircle the letter of the best answer.

1. Which ratios measure the capability of an entity to pay long term obligations as they fall due?

a. liquidity

b. solvency

c. profitability

d. flexibility

2. These are financial ratios that measure the ability of the company to generate income from the

use of its assets and invested capital.

a. liquidity

b. solvency

c. profitability

d. flexibility

Writer: KURT-AIRION H. SUMAYLO

School/Station: CARAGA REGIONAL SCIENCE HIGH SCHOOL

Division: Surigao City

Email Address: kurtairionsumaylo1981@gmail.com

Page 4

3. Which among the following shows the proportions of equity and debt that a company is using

to finance its assets? It also signals the extent to which shareholder's equity can fulfill

obligations to creditors, in the event a business declines.

a. time interest earned ratio

b. return on assets ratio

c. debt to total assets ratio

d. debt to equity ratio

4. This _________ gives a manager, investor, or analyst an idea as to how efficient a company's

management is at using its assets to generate earnings.

a. return on assets

b. return on equity

c. profit margin

d. debt to equity

5. Which of the following is the ratio of a company's profit (sales minus all expenses) divided by

its revenue?

a. return on assets

b. debt to equity

c. profit margin

d. asset turn-over

Lesson

Analysis and Interpretation of Financial Statements: Solvency /

Stability and Profitability

Solvency / Stability pertains to the company’s ability to meet its long-term obligations. It

provides measures on whether the company’s assets are sufficient to cover for their liabilities. Also,

Stability analysis investigates how much debt can be supported by the company and whether debt and

equity are balanced.

The following are different ratios under solvency:

a. Debt to total assets ratio

The debt to asset ratio, also known as the debt ratio, is a leverage ratio that

indicates the percentage of assets that are being financed with debt. The higher the

ratio, the greater the degree of leverage and financial risk.

b. Debt to equity ratio

The debt-to-equity ratio shows the proportions of equity and debt a company

is using to finance its assets and it signals the extent to which shareholder's equity can

fulfill obligations to creditors, in the event when business declines.

c. Times interest earned ratio

Writer: KURT-AIRION H. SUMAYLO

School/Station: CARAGA REGIONAL SCIENCE HIGH SCHOOL

Division: Surigao City

Email Address: kurtairionsumaylo1981@gmail.com

Page 5

The times interest earned ratio is also known as the interest coverage ratio

and it’s a metric that shows how much proportionate earnings a company can spend

to pay its future interest costs.

Profitability is a situation in which an entity is generating a profit. Profitability arises when the

aggregate amount of revenue is greater than the aggregate amount of expenses in a reporting period.

Furthermore, different ratios under profitability ratio are the following:

a. Gross profit ratio

The gross profit ratio is a profitability ratio that shows the relationship

between gross profit and total net sales revenue. It is a popular tool to evaluate the

operational performance of the business. The ratio is computed by dividing the gross

profit figure by net sales.

b. Profit margin ratio

The profit margin is a ratio of a company's profit (sales minus all expenses)

divided by its revenue. The profit margin ratio compares profit to sales and tells you

how well the company is handling its finances overall. Profit margin is one of the

commonly used profitability ratios to gauge the degree to which a company or a

business activity makes money. It represents what percentage of sales has turned into

profits.

c. Operating expenses to sales ratio

The operating ratio shows the efficiency of a company's management by

comparing the total operating expense of a company to net sales. The operating ratio

shows how efficient a company's management is at keeping costs low while

generating revenue or sales. The smaller the ratio, the more efficient the company is

at generating revenue versus total expenses.

d. Return on investment or ROI

Return on investment or ROI is a profitability ratio that calculates the profits

of an investment as a percentage of the original cost. In other words, it measures how

much money was made on the investment as a percentage of the purchase price. It

shows investors how efficiently each peso invested in a project is at producing a

profit. Investors not only use this ratio to measure how well an investment performed,

but they also use it to compare the performance of different investments of all types

and sizes.

e. Assets turnover ratio

The asset turnover ratio measures the value of a company's sales or revenues

relative to the value of its assets. The asset turnover ratio can be used as an indicator

of the efficiency with which a company is using its assets to generate revenue.

Writer: KURT-AIRION H. SUMAYLO

School/Station: CARAGA REGIONAL SCIENCE HIGH SCHOOL

Division: Surigao City

Email Address: kurtairionsumaylo1981@gmail.com

Page 6

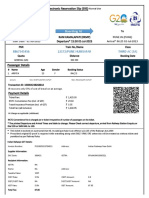

ABC Convenience Store

Take a look at the given figure.

Statement of Financial Position

December 31, 2019 How are you going to evaluate the

data in the given table? What is the

largest component of asset? Why did

Assets you say so?

Cash 100,000 How much percentage of assets are

Accounts Receivable 450,000 financed by equity? Or financed by

debt?

Accrued Income 300,000

To answer those questions,

Inventory 200,000 we need to do a vertical analysis.

Prepaid Expenses 50,000

Long-term Investments 1,250,000 Analysis and Interpretation of

Financial Statements: Vertical

Intangible Assets 500,000 analysis of a Single Proprietorship

Property, Plant, and Equipment 700,000

Total Assets 3,550,000 Vertical analysis, also called

common-size analysis, is a technique

that expresses each financial

Liabilities statement item as a percentage of a

Accounts Payable 250,000 base amount (Weygandt et.al. 2013,

as cited by Monfero et.a. 2016, 65)

Accrued Expenses 100,000

Unearned Income 80,000 In preparing a vertical

ABC Convenience Store

Notes Payable 150,000 analysis of statement of

Statement of Financial Position

Mortgage Payable 500,000 financial position, the total

December 31, 2019

Loans Payable 1,000,000 assets will serve as the base

amount or the 100%. All

Total Liabilities Assets 2,080,000 % the items in the statement of

Cash 100,000 2.82 financial position will be

Accounts Receivable Owner's Equity 450,000 12.68 divided using the base

ABC Equity 1,470,000 amount (Balance of

Accrued Income 300,000 8.45

Total Liabilities and Owner's Equity 3,550,000 Account / Total Assets). It

Inventory 200,000 5.63

is shown in the figure

Prepaid Expenses 50,000 1.41

Long-term Investments 1,250,000 35.21 below:

Intangible Assets 500,000 14.08

(Statement of Financial

Property, Plant, and Equipment 700,000 19.72 Position)

Total Assets 3,550,000 100

The above may be evaluated

Liabilities as follows: The largest

Accounts Payable 250,000 7.04 component of asset is long-

term investment at 35.21%.

Accrued Expenses 100,000 2.82

Prepaid expenses are the

Unearned Income 80,000 2.25 smallest component at

Notes Payable 150,000 4.23 1.41%. On the other hand,

Mortgage Payable 500,000 14.08 58.59% of assets are

financed by debt which is

Loans Payable 1,000,000 28.17

Total Liabilities 2,080,000 58.59

Writer: KURT-AIRION H. SUMAYLO

School/Station: CARAGA REGIONAL SCIENCE HIGH SCHOOL

Division: Surigao City

Email Address: Owner's Equity

kurtairionsumaylo1981@gmail.com

ABC Equity 1,470,000 41.41

Total Liabilities and Owner's Equity 3,550,000 100

Page 7

greater than 41.41% of assets ABC Selling Company

that is financed by equity.

Statement of Comprehensive Income

In the statement of For the year ended December 31, 2019

comprehensive income, all the

items will be divided using the %

base amount which is Net Sales

(balance of account/net sales). Net Sales 920,000.00

For example, by showing the Cost of Goods 570,000.00 61.00

various expense line items in the Sold

income statement as a

Gross Profit 350,000.00 38.00

percentage of sales, one can see

how these are contributing to Operating 164,000 17.00

profit margins and whether Expenses

profitability is improving over Net Income 186,000.00 20.00

time. It thus becomes easier to

compare the profitability of a

company with its peers.

(Vertical Analysis of the Statement of Financial Position)

The above may be evaluated as follows: The cost of goods sold is 61% of sales. The company has a

gross profit rate of 38%. Operating expenses is 17% of sales. The company earns income of P 0.20 for

every peso of sales and gross profit generated is Php .38 for every peso of sale.

(Vertical Analysis of the Statement of Comprehensive Income)

Activity

Activity 1

Directions: Identify if the given financial ratio is solvency or profitability. Put a checkmark in the

column provided.

Solvency Profitability

1. Debt to total assets ratio

Writer: KURT-AIRION H. SUMAYLO

School/Station: CARAGA REGIONAL SCIENCE HIGH SCHOOL

Division: Surigao City

Email Address: kurtairionsumaylo1981@gmail.com

Page 8

2. Gross profit ratio

3. Assets turnover ratio

4. Return on investment

5. Debt to equity ratio

6. Profit margin ratio

7. Times interest earned ratio

8. Operating expenses to sales ratio

9. Return on assets

10. Return on equity

Activity 2:

Directions: Identify the financial ratio being described in each statement. Write your answer in the

space provided.

_____________1. It is a leverage ratio that indicates the percentage of assets that are being financed

with debt.

_____________2. It shows how much profit each peso of common stockholders’ equity generates.

_____________3. The profitability ratio that shows the relationship between gross profit and total net

sales revenue.

_____________4. The profitability ratio that gives a manager, investor, or analyst an idea as to how

efficient a company's management is at using its assets to generate earnings.

_____________5. It measures how much money was made on the investment as a percentage of the

purchase price.

_____________6. This ratio shows the efficiency of a company's management by comparing the total

operating expense of a company to net sales.

_____________7. This determines the proportions of equity and debt a company is using to finance

its assets and it signals the extent to which shareholder's equity can fulfill obligations to creditors, in

the event a business declines.

_____________8. It represents what percentage of sales has turned into profits.

_____________9. Also known as the interest coverage ratio and it’s a metric that shows how much

proportionate earnings a company can spend to pay its future interest costs.

______________10. Pertains to the company’s ability to meet its long-term obligations.

Writer: KURT-AIRION H. SUMAYLO

School/Station: CARAGA REGIONAL SCIENCE HIGH SCHOOL

Division: Surigao City

Email Address: kurtairionsumaylo1981@gmail.com

Page 9

Generalization

There are four main financial statements. They are: (1) balance sheets; (2) income statements;

(3) cash flow statements; and (4) statements of shareholders' equity. Balance sheets show what a

company owns and what it owes at a fixed point in time.

Post-test

A. Directions: Write the word True if the statement is correct, if it is wrong, change the underlined

word with the correct answer.

1. A low debt-to-equity ratio indicates a lower amount of financing by debt via lenders, versus

funding through equity via shareholders.

2. The higher the ratio, the more efficient the company is at generating revenue versus total

expenses.

3. The return on assets ratio shows how much profit each peso of common stockholders’

equity

generates.

4. The profit margin ratio represents the percentage of sales that has turned into profits.

5. The asset turnover ratio can be used as an indicator of the efficiency with which a company

is using its assets to generate revenue.

References:

Licuanan P. (2016). Teaching Guide for Senior High School

Fundamentals of Accountancy, Business and

Management 1

Specialized Subject I ACADEMIC – ABM

Published by the Commission on Higher Education,

Writer: KURT-AIRION H. SUMAYLO

School/Station: CARAGA REGIONAL SCIENCE HIGH SCHOOL

Division: Surigao City

Email Address: kurtairionsumaylo1981@gmail.com

Page 10

Accountingtheory(n.d) Retrieved from http://accountingtheory.weebly.com/nature-

and-scope-of-accounting

Writer: KURT-AIRION H. SUMAYLO

School/Station: CARAGA REGIONAL SCIENCE HIGH SCHOOL

Division: Surigao City

Email Address: kurtairionsumaylo1981@gmail.com

You might also like

- Financial Ratio AnalysisDocument7 pagesFinancial Ratio AnalysisGalibur RahmanNo ratings yet

- Financial Analysis FundamentalsDocument12 pagesFinancial Analysis FundamentalsAni Dwi Rahmanti RNo ratings yet

- BE Sols - FM14 - IM - Ch3Document25 pagesBE Sols - FM14 - IM - Ch3ashibhallauNo ratings yet

- The Modern HackDocument12 pagesThe Modern Hackbrunobboss100% (1)

- Analyzing Financial Ratios to Evaluate a CompanyDocument38 pagesAnalyzing Financial Ratios to Evaluate a Companymuzaire solomon100% (1)

- Ratio Analysis Notes and Practice Questions With SolutionsDocument23 pagesRatio Analysis Notes and Practice Questions With SolutionsAnkith Poojary60% (5)

- Financial Statements Analysis - Q&aDocument6 pagesFinancial Statements Analysis - Q&aNaga NagendraNo ratings yet

- Workbook On Ratio AnalysisDocument9 pagesWorkbook On Ratio AnalysisZahid HassanNo ratings yet

- Tips RatiosDocument8 pagesTips RatiosMelvin Amoh100% (1)

- Brochure Thermoformer Range enDocument52 pagesBrochure Thermoformer Range enJawad LOUHADINo ratings yet

- Therm Coal Out LookDocument27 pagesTherm Coal Out LookMai Kim Ngan100% (1)

- Financial Statement Analysis RatiosDocument6 pagesFinancial Statement Analysis RatiosMonica GarciaNo ratings yet

- Accounting for Managers Final Exam RatiosDocument7 pagesAccounting for Managers Final Exam RatiosGramoday FruitsNo ratings yet

- RATIO ANALYSIS Unit 1Document18 pagesRATIO ANALYSIS Unit 1DWAYNE HARVEYNo ratings yet

- Primer of Financial RatiosDocument2 pagesPrimer of Financial RatiosBeauNo ratings yet

- Fabm2 G12 Q1 M7 WK7 PDFDocument8 pagesFabm2 G12 Q1 M7 WK7 PDFJhoanna Odias100% (2)

- FABM2 Wk7Document6 pagesFABM2 Wk7john lester pangilinanNo ratings yet

- Financial Ratio AnalysisDocument6 pagesFinancial Ratio Analysis5555-899341No ratings yet

- Analyze Financial Ratios to Evaluate Business PerformanceDocument5 pagesAnalyze Financial Ratios to Evaluate Business Performancealfred benedict bayanNo ratings yet

- MIRANDA, ELLAINE - FM - 2021 - ST - Session 3 OutputDocument9 pagesMIRANDA, ELLAINE - FM - 2021 - ST - Session 3 OutputEllaine MirandaNo ratings yet

- Chapter 3 (14 Ed) Analysis of Financial StatementsDocument25 pagesChapter 3 (14 Ed) Analysis of Financial StatementsSOHAIL TARIQNo ratings yet

- Ratio Analysis 1Document5 pagesRatio Analysis 1Justin FullerNo ratings yet

- Finacial Report of Mba ProjectDocument100 pagesFinacial Report of Mba ProjectSaravanan AkashNo ratings yet

- Walt Disney Fa Sem3Document29 pagesWalt Disney Fa Sem3Ami PatelNo ratings yet

- Importance of Financial StatementDocument11 pagesImportance of Financial StatementJAY SHUKLANo ratings yet

- LOVISA V PANDORA FINANCIAL ANALYSIS RATIODocument30 pagesLOVISA V PANDORA FINANCIAL ANALYSIS RATIOpipahNo ratings yet

- Comparing Financial Performance of Tata Motors and Bajaj AutoDocument27 pagesComparing Financial Performance of Tata Motors and Bajaj AutoPatel RuchitaNo ratings yet

- Integrated Case 4-26Document6 pagesIntegrated Case 4-26Cayden BrookeNo ratings yet

- Theory of Ratio AnalysisDocument14 pagesTheory of Ratio AnalysisReddy BunnyNo ratings yet

- Course: FIN201 Section: 05 Semester: Autumn 2020 Group Member: Name IDDocument26 pagesCourse: FIN201 Section: 05 Semester: Autumn 2020 Group Member: Name IDAffan AhmedNo ratings yet

- 02.financial Analysis IDocument8 pages02.financial Analysis ISVS ShanthaNo ratings yet

- VCE Summer Internship Program 2021: Tushar Gupta 1 Equity ResearchDocument7 pagesVCE Summer Internship Program 2021: Tushar Gupta 1 Equity ResearchTushar GuptaNo ratings yet

- Most Appropriate Ratio For Comparing Companies in The Telecommunication IndustryDocument4 pagesMost Appropriate Ratio For Comparing Companies in The Telecommunication Industrymino eatineNo ratings yet

- Financial Reporting and Analysis 21BAT-602: Master of Business AdministrationDocument38 pagesFinancial Reporting and Analysis 21BAT-602: Master of Business AdministrationAshutosh prakashNo ratings yet

- Unit 11Document14 pagesUnit 11Linh Trang Nguyễn ThịNo ratings yet

- Module 2Document27 pagesModule 2MADHURINo ratings yet

- Financial Statement Analysis Ratios GuideDocument55 pagesFinancial Statement Analysis Ratios GuideRocky Bassig100% (1)

- 4.analysis and InterpretationDocument55 pages4.analysis and InterpretationRocky BassigNo ratings yet

- Transcritption - Determining Liquidity and SolvencyDocument6 pagesTranscritption - Determining Liquidity and Solvencymanoj reddyNo ratings yet

- Fabm2 Las Week 7aDocument11 pagesFabm2 Las Week 7aTrunks KunNo ratings yet

- MBA - 101 Accounting for ManagersDocument62 pagesMBA - 101 Accounting for ManagersFaiz MuhammadNo ratings yet

- Ratio Analysis of Mahindra N Mahindra LTDDocument15 pagesRatio Analysis of Mahindra N Mahindra LTDMamta60% (5)

- Comparative Analysis of Prism Cement LTD With JK Cement LTDDocument56 pagesComparative Analysis of Prism Cement LTD With JK Cement LTDBhushan NagalkarNo ratings yet

- Understanding Financial RatiosDocument10 pagesUnderstanding Financial RatiosAira MalinabNo ratings yet

- MS_3609_Financial_Statements_AnalysisDocument6 pagesMS_3609_Financial_Statements_Analysisrichshielanghag627No ratings yet

- Ratio Analysis - Tata and M Amp MDocument38 pagesRatio Analysis - Tata and M Amp MNani BhupalamNo ratings yet

- FM Term Paper On Financial Statement AnalysisDocument8 pagesFM Term Paper On Financial Statement Analysisnahidctg100% (1)

- Prudhvi Pokuru - Accounting For ManagersDocument5 pagesPrudhvi Pokuru - Accounting For ManagersGramoday FruitsNo ratings yet

- Ratio Analysis DefinitionDocument10 pagesRatio Analysis Definitionwubishet wondimuNo ratings yet

- 2M AmDocument27 pages2M AmMohamed AbzarNo ratings yet

- Analysis of Financial Statements: Answers To End-Of-Chapter QuestionsDocument9 pagesAnalysis of Financial Statements: Answers To End-Of-Chapter QuestionsSandraNo ratings yet

- FIN 310 - Chapter 3 Questions With AnswersDocument8 pagesFIN 310 - Chapter 3 Questions With AnswersKelby BahrNo ratings yet

- Smart Task 1 Vardhan ConsultingDocument10 pagesSmart Task 1 Vardhan Consulting2K19/PS/053 SHIVAMNo ratings yet

- BA5103 Accounting For Management 2marks Unit 3Document19 pagesBA5103 Accounting For Management 2marks Unit 3Shanthi PriyaNo ratings yet

- Afs RatioDocument25 pagesAfs Ratioansarimdfarhan100% (1)

- Ratio Analysis Brief Notes: Prof. Mayur Malviya Ratio AnalysisDocument11 pagesRatio Analysis Brief Notes: Prof. Mayur Malviya Ratio AnalysisravikumardavidNo ratings yet

- Financial Statements Analysis and Evaluation Veritas PDFDocument16 pagesFinancial Statements Analysis and Evaluation Veritas PDFEuniceNo ratings yet

- Student Guide Lecture 6-7 - Financial Ratios and Interpretation-1703076682621Document4 pagesStudent Guide Lecture 6-7 - Financial Ratios and Interpretation-1703076682621Navin KumarNo ratings yet

- Fundamentals of Accountancy, Business, and Management 2 SY 2020-2021 QTR1 WK 7 Financial Statement (FS) Analysis MELC/sDocument8 pagesFundamentals of Accountancy, Business, and Management 2 SY 2020-2021 QTR1 WK 7 Financial Statement (FS) Analysis MELC/sAlma Dimaranan-AcuñaNo ratings yet

- Topics For The Exam 2ND BaccDocument4 pagesTopics For The Exam 2ND BaccJose rendonNo ratings yet

- Guide QuestionsDocument1 pageGuide QuestionsJoana Jean SuymanNo ratings yet

- Noli Me Tangere Have A Big Impression On The Narrator Because of This Novel Shows The Real Concept oDocument2 pagesNoli Me Tangere Have A Big Impression On The Narrator Because of This Novel Shows The Real Concept oJoana Jean SuymanNo ratings yet

- Batang PasawayDocument1 pageBatang PasawayJoana Jean SuymanNo ratings yet

- The Revolution According To Raymundo MataDocument5 pagesThe Revolution According To Raymundo MataJoana Jean SuymanNo ratings yet

- 21st CenturyDocument2 pages21st CenturyJoana Jean SuymanNo ratings yet

- Physci SummDocument1 pagePhysci SummJoana Jean SuymanNo ratings yet

- Weeks 1 2 FABM EDITEDDocument35 pagesWeeks 1 2 FABM EDITEDJoana Jean SuymanNo ratings yet

- Week 3Document3 pagesWeek 3Joana Jean SuymanNo ratings yet

- HG G12 Q1 Mod1 RTPDocument10 pagesHG G12 Q1 Mod1 RTPAlysza Ashley M. Daep80% (5)

- Boiling Point Depends On The Molecular Mass of The CompoundDocument1 pageBoiling Point Depends On The Molecular Mass of The CompoundJoana Jean SuymanNo ratings yet

- Physical Science Module 1Document1 pagePhysical Science Module 1Joana Jean SuymanNo ratings yet

- Wrap It Up: 6. Hand-Eye CoordinationDocument7 pagesWrap It Up: 6. Hand-Eye CoordinationJoana Jean SuymanNo ratings yet

- Reseach Political MarketingDocument3 pagesReseach Political MarketingJoana Jean SuymanNo ratings yet

- Face-To-Face Telephone Focus GroupsDocument1 pageFace-To-Face Telephone Focus GroupsJoana Jean SuymanNo ratings yet

- CARAGA REGIONAL SCIENCE HIGH SCHOOL ASSESSMENT #1Document3 pagesCARAGA REGIONAL SCIENCE HIGH SCHOOL ASSESSMENT #1Joana Jean SuymanNo ratings yet

- LAS Q2 FABM 2 Week 2Document9 pagesLAS Q2 FABM 2 Week 2Mahika BatumbakalNo ratings yet

- Fundamentals of Accountancy, Business and Management 2: Quarter 2 - Module Week 1Document9 pagesFundamentals of Accountancy, Business and Management 2: Quarter 2 - Module Week 1Joana Jean SuymanNo ratings yet

- IMFA Real Life ApplicationsDocument2 pagesIMFA Real Life ApplicationsJoana Jean SuymanNo ratings yet

- Background of The StudyDocument1 pageBackground of The StudyJoana Jean SuymanNo ratings yet

- Volleyball History Timeline InfographicDocument1 pageVolleyball History Timeline InfographicJoana Jean SuymanNo ratings yet

- Topic: Statement of Financial Position (SFP) : Individual Performance Task/ Activity (Week 1 in The Module)Document11 pagesTopic: Statement of Financial Position (SFP) : Individual Performance Task/ Activity (Week 1 in The Module)Joana Jean SuymanNo ratings yet

- Fundamentals of Accountancy, Business and Management 2: Quarter 1 - Module Week 9Document12 pagesFundamentals of Accountancy, Business and Management 2: Quarter 1 - Module Week 9Joana Jean SuymanNo ratings yet

- There Is Zero Increase in Owner's Equity However There Is A Decreased by Php50,000. 2Document3 pagesThere Is Zero Increase in Owner's Equity However There Is A Decreased by Php50,000. 2Joana Jean SuymanNo ratings yet

- Summative Quiz Part 2 Week 3suymanDocument3 pagesSummative Quiz Part 2 Week 3suymanJoana Jean SuymanNo ratings yet

- Fundamentals of Accountancy, Business and Management 2: Quarter 1 - Module Week 5Document11 pagesFundamentals of Accountancy, Business and Management 2: Quarter 1 - Module Week 5Joana Jean SuymanNo ratings yet

- Statement of Financial Position LessonDocument6 pagesStatement of Financial Position LessonJoana Jean SuymanNo ratings yet

- LAS Q1 - FABM 1 (Week 3)Document12 pagesLAS Q1 - FABM 1 (Week 3)Joana Jean SuymanNo ratings yet

- Fundamentals of Accountancy, Business and Management 2: Quarter 1 - Module Week 8Document17 pagesFundamentals of Accountancy, Business and Management 2: Quarter 1 - Module Week 8Joana Jean SuymanNo ratings yet

- Activity 1:: End Capital 165,000Document2 pagesActivity 1:: End Capital 165,000Joana Jean SuymanNo ratings yet

- Preparation: Self-Paced Scripting in Servicenow FundamentalsDocument5 pagesPreparation: Self-Paced Scripting in Servicenow FundamentalsCrippled SoulNo ratings yet

- 22172/pune Humsafar Third Ac (3A)Document2 pages22172/pune Humsafar Third Ac (3A)VISHAL SARSWATNo ratings yet

- OM-Module-5 (PM)Document25 pagesOM-Module-5 (PM)Absar SiddiquiNo ratings yet

- Communication Barriers - Effects On Employees EfficiencyDocument27 pagesCommunication Barriers - Effects On Employees Efficiencyvanquish lassNo ratings yet

- Gypsum Mineral DataDocument4 pagesGypsum Mineral Datamalaya tripathy0% (1)

- Production Manager-43-4Document4 pagesProduction Manager-43-4Mohanram PandiNo ratings yet

- MAD Real Estate Report 2015Document479 pagesMAD Real Estate Report 2015Bayarsaikhan SamdanNo ratings yet

- Module Code & Module Title CC6051NI Ethical Hacking Assessment Weightage & Type Weekly AssignmentDocument7 pagesModule Code & Module Title CC6051NI Ethical Hacking Assessment Weightage & Type Weekly AssignmentBipin BhandariNo ratings yet

- Income Tax Raids: Procedures and RightsDocument4 pagesIncome Tax Raids: Procedures and RightsshanikaNo ratings yet

- Business Description: Executive SummaryDocument4 pagesBusiness Description: Executive SummaryYudhi SugataNo ratings yet

- 1 Network Layer Firewalls: Figure 1: Screened Host FirewallDocument3 pages1 Network Layer Firewalls: Figure 1: Screened Host FirewallAnonymous xN0cuz68ywNo ratings yet

- Session 6 OligopolyDocument43 pagesSession 6 OligopolyROKGame 1234No ratings yet

- Infotech JS2 Eclass Computer VirusDocument2 pagesInfotech JS2 Eclass Computer VirusMaria ElizabethNo ratings yet

- Review If Transparent Solar Photovoltaic TechnologiesDocument13 pagesReview If Transparent Solar Photovoltaic TechnologiesSharonNo ratings yet

- Introduction of Hris Chapter No.1: Tayyaba IqbalDocument16 pagesIntroduction of Hris Chapter No.1: Tayyaba IqbalmahnooorNo ratings yet

- Otis PXX Equalizing Prong: Equipment OverviewDocument1 pageOtis PXX Equalizing Prong: Equipment OverviewLydia Eva HariniNo ratings yet

- BSC6900 GSM Technical Description (V900R012C01 - 02)Document113 pagesBSC6900 GSM Technical Description (V900R012C01 - 02)Mohammad Mosabbirul IslamNo ratings yet

- Police Personnel Management and RecordsDocument26 pagesPolice Personnel Management and RecordsLowie Jay Mier OrilloNo ratings yet

- VAT-User-Guide English V0.7.0 User-AmendmentsDocument44 pagesVAT-User-Guide English V0.7.0 User-AmendmentsSami SattiNo ratings yet

- GLSL Specification 1.40.08.fullDocument111 pagesGLSL Specification 1.40.08.fullmushakkNo ratings yet

- Te HEDocument6 pagesTe HEjamieNo ratings yet

- AAN-32 Installation Manual GuideDocument24 pagesAAN-32 Installation Manual GuideFady MohamedNo ratings yet

- Lancaster Paint Monthly Specials April-May 31, 2011Document16 pagesLancaster Paint Monthly Specials April-May 31, 2011SteveNo ratings yet

- Metro BrochureDocument27 pagesMetro BrochureKhaled Saif Al-hakimiNo ratings yet

- Reputed Builders in VadodaraDocument10 pagesReputed Builders in Vadodararomy mattewNo ratings yet

- Section 89 of CPC: Significance and Case LawsDocument10 pagesSection 89 of CPC: Significance and Case LawsPragna NachikethaNo ratings yet