Professional Documents

Culture Documents

Ia2 Prob 1-20 & 21

Uploaded by

maryani0 ratings0% found this document useful (0 votes)

174 views2 pagesia2 prob 1-20 & 21

Original Title

ia2 prob 1-20 & 21

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentia2 prob 1-20 & 21

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

174 views2 pagesIa2 Prob 1-20 & 21

Uploaded by

maryaniia2 prob 1-20 & 21

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

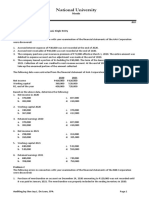

Problem 1-20 (AICPA Adapted)

Dunne Company sells equipment service contracts that a two-year period. The sale price

of each contract is P600

The past experience is that, of the total pesos spent to repairs on service contracts. 40% is

incurred evenly dun the first contract year and 60% evenly during the second contract

year.

The entity sold 1,000 contracts evenly throughout 2020.

1. What is the contract revenue for 2020

a. 120,000 b. 240,000 c. 300,000 d. 150,000

2. What amount should be reported as deferred service revenue on December 31, 2020?

a. 540,000 b. 480,000 c. 360,000 d. 300,000

3. What is the contract revenue for 2021?

a. 180,000 b. 360,000 c. 300,000 d. 120,000

4. What is the contract revenue for 2022?

a. 240,000 b. 360,000 c. 180,000 d. 0

Problem 1-21 (AICPA Adapted)

Cobra Company sells appliance service contracts ageeing to repair appliances for two-

year period.

The past experience is that, of the total amount spent for repairs on service contracts, 40%

is incurred evenly during the first contract year and 60% is incurred evenly during the

second contract year.

Receipts from service contract sales are P500,000 for 2020 and P600,000 for 2021.

Receipts from contracts are credited to unearned service revenue. All sales are made

evenly during the year.

1. What is the contract revenue for 2020?

a. 100,000 b. 200,000 c. 250,000 d. 500,000

2. What is the unearned revenue on December 31, 2020?

a. 300,000 b. 400,000 c. 200,000 d. 150,000

3. What is the contract revenue for 2021?

a. 240,000 b. 360,000 c. 370,000 d. 250,000

4. What is unearned revenue on December 31, 2021?

a. 360,000 b. 470,000 c. 480,000 d. 630,000

You might also like

- Ia2 Prob 1-24 & 25Document2 pagesIa2 Prob 1-24 & 25maryaniNo ratings yet

- 8506 - Installment SalesDocument4 pages8506 - Installment SalesAnonymous iNRMC4mgORNo ratings yet

- AE 16 Prelims Problem SolvingDocument6 pagesAE 16 Prelims Problem SolvingJheally SeirNo ratings yet

- FAR-04 Share Based PaymentsDocument3 pagesFAR-04 Share Based PaymentsKim Cristian Maaño0% (1)

- Alom Ia FoDocument18 pagesAlom Ia FoLea Yvette SaladinoNo ratings yet

- Construction ContractttttDocument6 pagesConstruction ContractttttMARTINEZ, EmilynNo ratings yet

- Assumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceDocument4 pagesAssumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceAireyNo ratings yet

- Numbers 36 and 37 (Installment Sales)Document2 pagesNumbers 36 and 37 (Installment Sales)elsana philipNo ratings yet

- 8506 - Installment Sales - 113910598Document4 pages8506 - Installment Sales - 113910598Ryan CornistaNo ratings yet

- Afar 3Document7 pagesAfar 3Diana Faye CaduadaNo ratings yet

- Long Term Construction Contract AssignmentDocument2 pagesLong Term Construction Contract Assignmentcali cdNo ratings yet

- Prelim Lecture 1 Assignment: Multiple ChoiceDocument4 pagesPrelim Lecture 1 Assignment: Multiple Choicelinkin soyNo ratings yet

- Activity in E3 - LiabilitiesDocument9 pagesActivity in E3 - LiabilitiesPaupau100% (1)

- Intangibles: Problem 1Document7 pagesIntangibles: Problem 1Jeric Lagyaban AstrologioNo ratings yet

- AP-200Q (Quizzer - Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document10 pagesAP-200Q (Quizzer - Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Bernadette Panican100% (1)

- Problems - Final ExaminationDocument3 pagesProblems - Final Examinationjhell de la cruzNo ratings yet

- Seatwork-Liabilities1st2023 StudentDocument5 pagesSeatwork-Liabilities1st2023 StudentpadayonmhieNo ratings yet

- Errors - Discussion ProblemsDocument2 pagesErrors - Discussion ProblemsHaidee Flavier SabidoNo ratings yet

- Chapter 18 HomeworkDocument3 pagesChapter 18 HomeworkTracy LeeNo ratings yet

- CIPDocument3 pagesCIPLaurence GuevarraNo ratings yet

- Installment SalesDocument4 pagesInstallment Saleskat kaleNo ratings yet

- Quiz - QUIZ 01 - Spec 1Document13 pagesQuiz - QUIZ 01 - Spec 1Alliana CunananNo ratings yet

- NU - Correction of Errors Single Entry Cash To AccrualDocument8 pagesNU - Correction of Errors Single Entry Cash To AccrualJem ValmonteNo ratings yet

- 207A Midterm ExaminationDocument5 pages207A Midterm ExaminationAldyn Jade Guabna100% (1)

- Bac 202 Second CatDocument2 pagesBac 202 Second CatBrian MutuaNo ratings yet

- Accountancy Auditing 2021Document5 pagesAccountancy Auditing 2021Abdul basitNo ratings yet

- PUP Review Handout 5 OfficialDocument2 pagesPUP Review Handout 5 OfficialDonalyn CalipusNo ratings yet

- Numbers 46, 47 and 48 (Construction Contract - Percentage of Completion Method)Document3 pagesNumbers 46, 47 and 48 (Construction Contract - Percentage of Completion Method)happy filesNo ratings yet

- Revised Accounting 16Document20 pagesRevised Accounting 16Jennifer GarnetteNo ratings yet

- ACCTG 105 Midterm - Quiz No. 02 - Accounting Changes and Errors (Answers)Document2 pagesACCTG 105 Midterm - Quiz No. 02 - Accounting Changes and Errors (Answers)Lucas BantilingNo ratings yet

- LiabilitiesDocument2 pagesLiabilitiesFrederick AbellaNo ratings yet

- Liabilities - ManuDocument7 pagesLiabilities - ManuClara MacallingNo ratings yet

- Installment-Sales-Supplementary-Problems & NotesDocument3 pagesInstallment-Sales-Supplementary-Problems & NotesAlliah Mae ArbastoNo ratings yet

- Audit of Liabilities Q&ADocument3 pagesAudit of Liabilities Q&ALyca MaeNo ratings yet

- Accounting 4 Provisions and ContingenciesDocument4 pagesAccounting 4 Provisions and ContingenciesMicaela EncinasNo ratings yet

- SHARE-BASED COMPENSATION Share Appreciation RightsDocument8 pagesSHARE-BASED COMPENSATION Share Appreciation RightsMiko ArniñoNo ratings yet

- Test AfarDocument24 pagesTest AfarZyrelle Delgado100% (3)

- ACY 53 Summative Exam 2 CH 26 28 Answer KeyDocument3 pagesACY 53 Summative Exam 2 CH 26 28 Answer KeyAMIKO OHYANo ratings yet

- FAR Problem Quiz 1Document6 pagesFAR Problem Quiz 1Ednalyn CruzNo ratings yet

- Current LiabilitiesDocument9 pagesCurrent LiabilitiesErine ContranoNo ratings yet

- Ca Zambia June 2021 QaDocument415 pagesCa Zambia June 2021 QaESGNo ratings yet

- Accounts and Statistics 2Document41 pagesAccounts and Statistics 2BrightonNo ratings yet

- FAR Practical Exercises Liabilities PDFDocument8 pagesFAR Practical Exercises Liabilities PDFRemy Caperocho80% (5)

- FAR Problem SET A PDFDocument11 pagesFAR Problem SET A PDFNicole Aragon0% (1)

- Accountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsDocument2 pagesAccountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsBella IlaganNo ratings yet

- May 2020 Error SHE Intangibles Liabilities LeasesDocument14 pagesMay 2020 Error SHE Intangibles Liabilities Leasesiraleigh17No ratings yet

- Chapter 1 Practice Test - Problems (Answers)Document12 pagesChapter 1 Practice Test - Problems (Answers)anonymousNo ratings yet

- Installment Sales Multiple QuestionsDocument36 pagesInstallment Sales Multiple QuestionsTrixie CapisosNo ratings yet

- Cash and Accrual Basis - ExercisesDocument2 pagesCash and Accrual Basis - ExercisesTrisha Mae AlburoNo ratings yet

- Auditing Problems MidtermDocument20 pagesAuditing Problems MidtermjasfNo ratings yet

- AFAR Self Test - 9002Document7 pagesAFAR Self Test - 9002Jennifer RueloNo ratings yet

- Afar QuestionsDocument16 pagesAfar Questionspopsie tulalianNo ratings yet

- Instructions: Choose The BEST Answer For Each of The Following ItemsDocument18 pagesInstructions: Choose The BEST Answer For Each of The Following ItemsVaughn TheoNo ratings yet

- ACC 121 Chapter 55Document4 pagesACC 121 Chapter 55Mohammad saripNo ratings yet

- Use The Following Information For The Next Two (2) QuestionsDocument15 pagesUse The Following Information For The Next Two (2) QuestionsAbdulmajed Unda Mimbantas100% (2)

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Economic Indicators for Eastern Asia: Input–Output TablesFrom EverandEconomic Indicators for Eastern Asia: Input–Output TablesNo ratings yet

- Economic Indicators for Southeast Asia and the Pacific: Input–Output TablesFrom EverandEconomic Indicators for Southeast Asia and the Pacific: Input–Output TablesNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Problem 1-22 (AICPA Adapted) : Hart Company Sells Subscriptions To A Specialized Directory That Is Published Semi-AnnuallyDocument1 pageProblem 1-22 (AICPA Adapted) : Hart Company Sells Subscriptions To A Specialized Directory That Is Published Semi-AnnuallymaryaniNo ratings yet

- Ia 3 Problem 4-36 Multiple Choice (IAA)Document2 pagesIa 3 Problem 4-36 Multiple Choice (IAA)maryaniNo ratings yet

- Lesson 2: Historiography: Internal and External Criticism: What Is Historical Criticism?Document3 pagesLesson 2: Historiography: Internal and External Criticism: What Is Historical Criticism?maryaniNo ratings yet

- Ia2 Prob 1-32 & 33Document1 pageIa2 Prob 1-32 & 33maryaniNo ratings yet

- Non-Written Sources of HistoryDocument2 pagesNon-Written Sources of HistorymaryaniNo ratings yet

- Ia2 Prob 1-16 & 17Document1 pageIa2 Prob 1-16 & 17maryaniNo ratings yet

- Money Market Financial InstrumentsDocument5 pagesMoney Market Financial InstrumentsmaryaniNo ratings yet

- Market and The Primary MarketDocument2 pagesMarket and The Primary MarketmaryaniNo ratings yet

- Primary Versus Secondary SourcesDocument1 pagePrimary Versus Secondary SourcesmaryaniNo ratings yet

- Other Steps For Managing Foreign Exchange RiskDocument2 pagesOther Steps For Managing Foreign Exchange RiskmaryaniNo ratings yet

- Problem 4-16 (IFRS) : 1. What Is The Amount of Undiscounted Cash Flows For The Provision?Document2 pagesProblem 4-16 (IFRS) : 1. What Is The Amount of Undiscounted Cash Flows For The Provision?maryaniNo ratings yet

- Problem 1 With SolutionDocument3 pagesProblem 1 With SolutionmaryaniNo ratings yet

- Problem 4-33 Multiple ChoiceDocument2 pagesProblem 4-33 Multiple ChoicemaryaniNo ratings yet

- Prob Chap 4-18 To 19Document1 pageProb Chap 4-18 To 19maryaniNo ratings yet

- Prob Chap 4Document2 pagesProb Chap 4maryaniNo ratings yet

- Problem 4-9Document2 pagesProblem 4-9maryaniNo ratings yet

- Prob 4-10 To 12Document2 pagesProb 4-10 To 12maryaniNo ratings yet

- Problem 4-26 To 28Document1 pageProblem 4-26 To 28maryaniNo ratings yet

- Problem 4-29 To 31Document1 pageProblem 4-29 To 31maryaniNo ratings yet

- The Water Molecule: Are The Outside Valences Full?Document3 pagesThe Water Molecule: Are The Outside Valences Full?maryaniNo ratings yet