Professional Documents

Culture Documents

Daily Equity Market Report - 07.04.2022

Uploaded by

Fuaad DodooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Equity Market Report - 07.04.2022

Uploaded by

Fuaad DodooCopyright:

Available Formats

7TH APRIL 2022

DAILY EQUITY MARKET REPORT

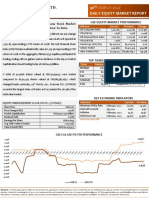

GSE EQUITY MARKET PERFORMANCE

EQUITY MARKET HIGHLIGHTS: GSE-CI lost 1.19 points Indicator Current Previous Change

GSE-Composite Index 2,692.98 2,694.17 -1.19 pts

to close at 2,692.98; returns -3.45% YTD. YTD (GSE-CI) -3.45% -3.41% 1.17%

The benchmark GSE Composite Index (GSE-CI) declined by 1.19 points GSE-Financial Stock Index 2,212.94 2,215.12 -2.18 pts

YTD (GSE-FSI) 2.84% 2.94% -3.40%

on the day to close at 2,692.98 representing a YTD return of -3.45%. The Market Cap. (GH¢ MN) 64,004.35 64,016.89 -12.54

GSE Financial Stock Index (GSE-FSI) also lost 2.18 points to close trading Volume Traded 924,250 320,441 188.43%

Value Traded (GH¢) 758,125.0 298,354.4 154.10%

at 2,212.94 translating into a YTD return of 2.84%.

TOP TRADED EQUITIES

In the aggregate, fifteen (15) equities participated in trading, ending

Ticker Volume Value (GH¢)

with only one decliner namely Cal Bank PLC. (CAL) as it lost GH¢0.02 to CAL 661,366 568,863.42

close at GH¢0.86 representing a YTD return of -1.15%. Market POP 148,982 98,328.12

MTNGH 39,747 39,880.00

Capitalization closed trading today at GH¢64.00 billion.

ETI 38,340 7,668.00

RBGH 21,580 12,948.00 75.04%

A total of 924,250 shares valued at GH¢758,125.00 were traded

compared to 320,441 shares valued at GH¢298,354.37 which changed

hands yesterday, 6th April, 2022. CAL accounted for 75.04% of the total KEY ECONOMIC INDICATORS

Indicator Current Previous

value traded, representing the largest share of trades. Monetary Policy Rate February 2022 17.00% 14.50%

Real GDP Growth Q3 2021 6.6% 3.9%

Inflation February 2022 15.7% 13.9%

EQUITY UNDER REVIEW: SCANCOM PLC. (MTNGH)

Reference rate February 2022 14.01% 13.90%

Share Price GH¢1.00 Source: GSS, BOG, GBA

Price Change (YtD) -9.91%

Market Capitalization GH¢12,290.47 million

Dividend Yield 0.00% DECLINER

Earnings Per Share GH¢0.1633 Ticker Close Price Open Price Change YTD

Avg. Daily Volume Traded 2,025,771 (GH¢) (GH¢) Change

Value Traded (YtD) GH¢267,518,496 CAL 0.86 0.88 -2.27% -1.15%

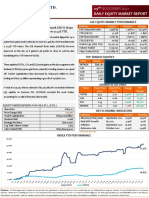

GSE-CI & GSE-FSI YTD PERFORMANCE 2.84%

4.00%

2.00%

0.00%

6-Jan

12-Jan

28-Jan

27-Mar

24-Jan

13-Feb

19-Feb

4-Jan

26-Jan

30-Jan

13-Mar

19-Mar

31-Mar

11-Feb

15-Feb

17-Feb

10-Jan

18-Jan

11-Mar

15-Mar

17-Mar

4-Apr

6-Apr

3-Feb

3-Mar

9-Mar

14-Jan

16-Jan

22-Jan

1-Feb

5-Feb

9-Feb

23-Feb

1-Mar

5-Mar

23-Mar

29-Mar

2-Apr

8-Jan

20-Jan

7-Feb

21-Feb

25-Feb

27-Feb

7-Mar

21-Mar

25-Mar

-2.00%

-4.00%

-6.00% -3.45%

GSE-CI GSE-FSI

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Daily Equity Market Report - 05.04.2022Document1 pageDaily Equity Market Report - 05.04.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.04.2022Document1 pageDaily Equity Market Report - 06.04.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 16.12.2021 2021-12-16Document1 pageDaily Equity Market Report 16.12.2021 2021-12-16Fuaad DodooNo ratings yet

- Daily Equity Market Report 04.04.2022 2022-04-04Document1 pageDaily Equity Market Report 04.04.2022 2022-04-04Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2021Document1 pageDaily Equity Market Report - 11.10.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.03.2022Document1 pageDaily Equity Market Report - 15.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 03.08.2022Document1 pageDaily Equity Market Report - 03.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.08.2021Document1 pageDaily Equity Market Report - 24.08.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.03.2022Document1 pageDaily Equity Market Report - 22.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 12.10.2021 2021-10-12Document1 pageDaily Equity Market Report 12.10.2021 2021-10-12Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.08.2021Document1 pageDaily Equity Market Report - 26.08.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.07.2022Document1 pageDaily Equity Market Report - 27.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.08.2022Document1 pageDaily Equity Market Report - 08.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.09.2021Document1 pageDaily Equity Market Report - 01.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 10.03.2022Document1 pageDaily Equity Market Report - 10.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.09.2021Document1 pageDaily Equity Market Report - 09.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report 25.10.2021 2021-10-25Document1 pageDaily Equity Market Report 25.10.2021 2021-10-25Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.09.2022Document1 pageDaily Equity Market Report - 06.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.03.2022Document1 pageDaily Equity Market Report - 02.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.02.2022Document1 pageDaily Equity Market Report - 08.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.07.2022Document1 pageDaily Equity Market Report - 07.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 31.08.2022Document1 pageDaily Equity Market Report - 31.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.02.2022Document1 pageDaily Equity Market Report - 07.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.07.2022Document1 pageDaily Equity Market Report - 21.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.07.2022Document1 pageDaily Equity Market Report - 28.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 25.08.2022Document1 pageDaily Equity Market Report - 25.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.06.2022Document1 pageDaily Equity Market Report - 14.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.03.2022Document1 pageDaily Equity Market Report - 30.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.08.2022Document1 pageDaily Equity Market Report - 17.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.05.2022Document1 pageDaily Equity Market Report - 11.05.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 29.10.2021Document2 pagesWeekly Capital Market Report - Week Ending 29.10.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.09.2022Document1 pageDaily Equity Market Report - 01.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 20.07.2022Document1 pageDaily Equity Market Report - 20.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.07.2022Document1 pageDaily Equity Market Report - 14.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.06.2022Document1 pageDaily Equity Market Report - 15.06.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 02.12.2021 2021-12-02Document2 pagesWeekly Capital Market Report Week Ending 02.12.2021 2021-12-02Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.05.2022Document1 pageDaily Equity Market Report - 24.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.09.2022Document1 pageDaily Equity Market Report - 15.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.06.2022Document1 pageDaily Equity Market Report - 30.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 25.07.2022 2022-07-25Document1 pageDaily Equity Market Report 25.07.2022 2022-07-25Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 31.12.2021Document2 pagesWeekly Capital Market Report - Week Ending 31.12.2021Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 10.12.2021Document2 pagesWeekly Capital Market Report - Week Ending 10.12.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 31.05.2022Document1 pageDaily Equity Market Report - 31.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report-10.01.2022Document1 pageDaily Equity Market Report-10.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 29.11.2021 2021-11-29Document1 pageDaily Equity Market Report 29.11.2021 2021-11-29Fuaad DodooNo ratings yet

- Daily Equity Market Report - 12.07.2022Document1 pageDaily Equity Market Report - 12.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.03.2022Document1 pageDaily Equity Market Report - 01.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 06.07.2022 2022-07-06Document1 pageDaily Equity Market Report 06.07.2022 2022-07-06Fuaad DodooNo ratings yet

- Daily Equity Market Report - 10.05.2022Document1 pageDaily Equity Market Report - 10.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.08.2022Document1 pageDaily Equity Market Report - 15.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.08.2022Document1 pageDaily Equity Market Report - 11.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 01.06.2022 2022-06-01Document1 pageDaily Equity Market Report 01.06.2022 2022-06-01Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.09.2022Document1 pageDaily Equity Market Report - 05.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 07.06.2022 2022-06-07Document1 pageDaily Equity Market Report 07.06.2022 2022-06-07Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.03.2022Document1 pageDaily Equity Market Report - 09.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.11.2021Document1 pageDaily Equity Market Report - 09.11.2021Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Aerocomp, Inc Case Study Week 7Document2 pagesAerocomp, Inc Case Study Week 7John Patrick LaspiñasNo ratings yet

- Economics and Significance PDFDocument8 pagesEconomics and Significance PDFJeswaanth GogulaNo ratings yet

- Adkar 01Document8 pagesAdkar 01angymaryNo ratings yet

- Dividend Discount Model: AssumptionsDocument27 pagesDividend Discount Model: AssumptionsSairam GovarthananNo ratings yet

- Chapter 6Document5 pagesChapter 6vivianguo23No ratings yet

- Test Bank For Microeconomics Principles Applications and Tools 8 e 8th Edition Arthur Osullivan Steven Sheffrin Stephen PerezDocument24 pagesTest Bank For Microeconomics Principles Applications and Tools 8 e 8th Edition Arthur Osullivan Steven Sheffrin Stephen Perezbethfrazierczsawbtioq100% (33)

- Chapter 4 Theory of The FirmDocument40 pagesChapter 4 Theory of The FirmSerajus Salekin TamimNo ratings yet

- Bain Worldwide Luxury Goods Report 2014Document36 pagesBain Worldwide Luxury Goods Report 2014Felipe MNP0% (2)

- The Brexit and The Rejection of GLOBALISATIONDocument2 pagesThe Brexit and The Rejection of GLOBALISATIONMihai Si Cristina PiticNo ratings yet

- Chapter 3 - Entry StrategiesDocument22 pagesChapter 3 - Entry StrategiesApril N. AlfonsoNo ratings yet

- APPLIED ECONOMICS - SyllabusDocument4 pagesAPPLIED ECONOMICS - SyllabusryeNo ratings yet

- Coho Capital 2018 Q4 LetterDocument8 pagesCoho Capital 2018 Q4 LetterPaul AsselinNo ratings yet

- What Are The Accounting Entries in A LCMDocument3 pagesWhat Are The Accounting Entries in A LCMratna8282No ratings yet

- Monopoly BehaviourDocument9 pagesMonopoly BehaviourOscar de CastroNo ratings yet

- Implementing The Circular Economy For Sustainable Development 1St Edition Hans Wiesmeth Full ChapterDocument67 pagesImplementing The Circular Economy For Sustainable Development 1St Edition Hans Wiesmeth Full Chapterjames.litecky523100% (9)

- 1 What Is Portfolio Performance EvaluationDocument17 pages1 What Is Portfolio Performance EvaluationDarshan GadaNo ratings yet

- OAD Assignment 1Document5 pagesOAD Assignment 1Sanim AmatyaNo ratings yet

- Small Scale Industries Unit 3Document108 pagesSmall Scale Industries Unit 3Kismat SharmaNo ratings yet

- Q1Document16 pagesQ1satyamNo ratings yet

- Guardians and SpendersDocument14 pagesGuardians and SpendersAsia ButtNo ratings yet

- Economic Analysis: Ceteris Paribus AssumptionDocument2 pagesEconomic Analysis: Ceteris Paribus AssumptionKavieswarNo ratings yet

- The Circular Flow of Economic ActivityDocument18 pagesThe Circular Flow of Economic ActivityRamos, Christian S.No ratings yet

- SAVANA 1204.text - MarkedDocument30 pagesSAVANA 1204.text - MarkedAndre Bonifacio VilanculoNo ratings yet

- Market SegmentationDocument11 pagesMarket Segmentationshabid786No ratings yet

- Foreign Direct InvestmentDocument20 pagesForeign Direct InvestmentRabiadz SoufNo ratings yet

- Theory - Letza 2004Document21 pagesTheory - Letza 2004Elma UmmatiNo ratings yet

- IB Theories of TradeDocument42 pagesIB Theories of TradevijiNo ratings yet

- Microeconomics For Life Smart Choices For You Canadian 2nd Edition Cohen Solutions ManualDocument26 pagesMicroeconomics For Life Smart Choices For You Canadian 2nd Edition Cohen Solutions ManualBrettClinewdjc100% (54)

- BBA 2nd TH Sem B EDocument3 pagesBBA 2nd TH Sem B ENeha SinghNo ratings yet

- Analysis On P&GDocument10 pagesAnalysis On P&Gsai_dendukuriNo ratings yet