Professional Documents

Culture Documents

A Study On Financial Planning and Foreca

Uploaded by

Ra JaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study On Financial Planning and Foreca

Uploaded by

Ra JaCopyright:

Available Formats

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 29

Volume 2, No. 7, July 2013

A Study on Financial Planning and Forecasting with Special

Reference to HDFC Bank at Thanjavur

R. Buvaneswari, Research Scholar, (Asst. Prof. Department of Commerce,) Srimad Andavan Arts & Science College,

Trichy

Dr. Prakash Babu, Associate Professor, Department of Commerce, AVVM Sri Pushpam College (Autonomous),

Poondi, Thanjavur.

M. Kavitha, Research Scholar, (Asst. Prof. Department of Commerce,) AVVM Sri Pushpam College (Autonomous),

Poondi, Thanjavur

ABSTRACT The financial management deals with short term items and

long term items. It is immense for every financial analyst

The financial management deals with short term items and in which the working capital has the special in present day

long term items. It is immense for every financial analyst of industrial function. The important aspect is the

in which the working capital has the special in present estimation of how much cash, stock and other liquid assets

day of industrial function. The important aspect is the of the firm can keep operating day to-day function.

estimation of how much cash, stock and other liquid assets

of the firm can keep operating day to-day function. Here, Financial analysis is the process of identifying the

financial analysis helps the management to make the best financial strengths and weakness of the firm by properly

use of its financial strength and to spot out the financial establishing relationship between the item of the balance

weakness to take corrective actions. Thus, it could be sheet and profit and loss account.

stated that it is starting point for using any sophisticated

forecasting a planning procedures. Business finance Financial management is the operational activity of a

mainly involves, rising of funds and their effective business that is responsible for obtaining and effectively

utilization keeping in view the overall objectives of the utilizing the funds necessary for efficient operation.” By

firm. This requires great caution and wisdom on the part Joseph& Mass.

of management.

Forecasting in financial management is used to estimate

Forecasting in financial management is used to estimate firm future financial needs. If the financial manager has

firm future financial needs. If the financial manager has not attempted to anticipate his firm’s future financing

not attempted to anticipate his firm’s future financing requirements, then a crisis occurs every time the firms

requirements, then a crisis occurs every time the firms cash inflows fall below its cash outflow.

cash inflows fall below its cash outflow. Planning for

growth, it means that the financial manager can OBJECTIVES OF THE STUDY

To know the liquidity position of the bank

anticipate the firms financing requirements and plan for

To study the various aspect of assets and liabilities

them well in advance of the needs. Financial planning is

essentially concerned with the economical procurement

To analysis the capital structure of the bank and its

and profitable use of funds a use which determined by of the bank

realistic investment decisions.

To identify the changes in the components of

effectiveness.

The main function of bank is accepting deposits and

lending money to the people. The percentage of credit to working capital``

working capital and deposit is showing an increasing

trend, during this study period. SCOPE OF THE STUDY

INTRODUCTION 1. The study covers all deposits and loans of the HDFC

Bank. Provide as over views of working capital and

The financial management deals with short term items and measure the effectiveness of the various aspect of

long term items. It is immense for every financial analyst current assets and liabilities.

in which the working capital has the special in present day 2. It gives the overview performance of the bank, and

of industrial function. The important aspect is the various challenges and opportunities ahead for the

estimation of how much cash, stock and other liquid assets HDFC Bank.

of the firm can keep operating day to-day function.

i-Xplore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 30

Volume 2, No. 7, July 2013

NEED OF THE STUDY TECHNOLOGY DEVELOPMENT

Working capital is considered as the blood of business. HDFC Bank has always prided itself on a highly

Inadequate working capital disturbs the continuous automated environment, be it in terms of information

production, when there is adequate working capital the technology or communication systems. All the branches

payment to creditors is done without failure. As result, the of the bank boast of online connectivity with the other,

bank gains goodwill. It will also help to get loans and cash ensuring speedy funds transfer for the clients. At the same

discounts. Excess of working capital affects the time, the bank's branch network and Automated Teller

profitability of the firm; inadequate working capital Machines (ATMs) allow multi-branch access to retail

prevents the firm from fulfilling the current obligations. clients. The bank makes use of its up-to-date technology,

along with market position and expertise, to create a

competitive advantage and build market share.

LIMITATION OF THE STUDY

CAPITAL STRUCTURE

1. The study covers a period of five years only that is

from 2006 to 2011. This research has been contained only

to financial statement available in the bank. At present, HDFC Bank boasts of an authorized capital of

2. The analysis of past performance of the bank can give Rs 550 crore (Rs5.5 billion), of this the paid-up amount is

broad outline only it predicts the future only to some Rs 424.6 crore (Rs.4.2 billion). In terms of equity share,

extent. This study has been made on the basis information the HDFC Group holds 19.4%. Foreign Institutional

contained in the financial statement. Investors (FIIs) have around 28% of the equity and about

17.6% is held by the ADS Depository (in respect of the

As this study is confined of the HDFC Bank limited alone bank's American Depository Shares (ADS) Issue). The

a comparative study of the working of similar banks is bank has about 570,000 shareholders. Its shares find a

prohibit from its scope. This is due to the constrains of listing on the Stock Exchange, Mumbai and National

time & finance. Through it is being a case study of Stock Exchange, while its American Depository Shares

particular bank it is findings and the suggested remedial are listed on the New York Stock Exchange (NYSE),

measures definitely will brave relevance to other central under the symbol 'HDB'.

bank in general.

PERSONAL BANKING SERVICES

Housing Development Finance Corporation Limited, more

popularly known as HDFC Bank Ltd, was established in Savings Accounts Investments & Insurance

the year 1994, as a part of the liberalization of the Indian Salary Accounts Forex Services

Banking Industry by Reserve Bank of India (RBI). It was Current Accounts Payment Services

one of the first banks to receive an 'in principle' approval

Fixed Deposits Net Banking

from RBI, for setting up a bank in the private sector. The

Demat Account InstaAlerts

bank was incorporated with the name 'HDFC Bank

Safe Deposit Lockers Mobile Banking

Limited', with its registered office in Mumbai. The

Loans Insta Query

following year, it started its operations as a Scheduled

Credit Cards ATM

Commercial Bank. Today, the bank boasts of as many as

Debit Cards Phone Banking

1412 branches and over 3275 ATMs across in India.

Prepaid Cards

AMALGAMATIONS

CURRENT RATIO

In 2002, HDFC Bank witnessed its merger with Times Current ratio is the relationship between current assets and

Bank Limited (a private sector bank promoted by Bennett, current liabilities.

Coleman & Co. / Times Group). With this, HDFC and Current Assets

Times became the first two private banks in the New Current ratio = ------------------------

Generation Private Sector Banks to have gone through a Current liabilities

merger. In 2008, RBI approved the amalgamation of

Centurion Bank of Punjab with HDFC Bank. With this, A current ratio of 2:1 is considered deal. That is, for every

the Deposits of the merged entity became Rs. 1,22,000 one rupee of current of current liability there must be

crore, while the Advances were Rs. 89,000 crore and current assets of Rs.2. If the ratio is less than two, it may

Balance Sheet size was Rs. 1,63,000 crore. be difficult for a firm to pay current liabilities. If the ratio

is more than two, it is an indicator of idle funds.

i-Xplore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 31

Volume 2, No. 7, July 2013

TABLE:1

COMPARISION OF CURRENT ASSETS AND CURRENT LIABILITIES

Year Current assets Current liabilities Current ratio

Rs. Rs.

2006-2007 34,11,632,023.00 4,52,356,122.90 7.54

2007-2008 36,32,537,472.00 28,112,711.40 12.92

2008-2009 39,72,974,626.00 4,02,578,779.10 9.87

2009-2010 33,43,344,429.00 2,70,988,816.60 12.33

2010-2011 42,56,811,622.00 2,45,802,025.00 17.31

Source: Secondary data

TABLE – 2

HDFC BANK LTD – SCHEDULING OF CHANGE IN WORKING CAPITAL DURING THE YEAR

2009 -2010

2009 2010 Increasing Decreasing

Particulars

Rs. Rs. Rs. Rs.

Current assets

Cash in hand 1,00,805,731.08 1,04,482,628.31 36,76,897.30 -

Cash at bank 11,15,338.23 15,56,514.57 4,41,176.34 -

Advances 36,26,770,501.01 30,83,139,733.91 - 5,43,630,768.00

Interest receivable 2,17,127,801.80 1,29,711,894.00 - 87,415,907.80

Bills receivable 95,12,737.07 36,27,443.28 - 58,85,293.79

Other assets 17,642,517.04 20,826,216.13 31,83,699.09 -

Total current assets

39,72,974,626.00 33,43,344,429.00

[A]

Less: current

Liabilities

Interest payable 76,904,398.59 1,18,210,763.00 - 41,306,364.41

Branch adjustment 14,548,097.71 17,540,388.22 - 29,92,290.51

Bills for collection 95,12,737.07 36,27,443.28 58,85,293.79 -

Overdue interest

2,59,247,964.00 68,314,561.00 1,90,933,402.00 -

reserve

Other liabilities 42,365,581.69 63,295,660.05 - 20,930,078.36

Total current

4,02,578,779.10 2,70,988,815.60

Liabilities (B)

Net working capital

35,70,395,847.00 30,72,355,613.00 2,04,120,468.50 7,02,160,702.90

[A-B]

Decrease in working

- 4,98,040,234.00 4,98,040,234.40 -

capital

Total 35,70,395,847.00 35,70,395,847.00 7,02,160,702.90 7,02,160,702.90

Source: Secondary data

TABLE - 3

HDFC BANK LTD – SCHEDULING OF CHANGE IN WORKING CAPITAL DURING THE YEAR

2010 -2011

2010 2011 Increasing Decreasing

Particulars

Rs. Rs. Rs. Rs.

Current assets

Cash in hand 1,04,482,628.31 1,02,434,124.43 - 20,48,503.90

Cash at bank 15,56,514.57 35,74,160.57 20,17,646.00 -

Advances 30,83,139,733.91 40,83,572,728.06 10,00,432,995.00 -

Interest receivable 1,29,711,894.00 47,303,167.00 - 82,408,727.00

i-Xplore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 32

Volume 2, No. 7, July 2013

Bills receivable 36,27,443.28 26,59,322.59 - 9,68,120.69

Other assets 20,826,216.13 17,268,119.03 - 35,58,097.10

Total current assets

33,43,344,429.00 42,56,811,682.00

[A]

Less : current

Liabilities

Interest payable 1,18,210,763.00 86,959,299.00 31,251,464.00 -

Branch adjustment 17,540,388.22 97,21,554.18 78,18,834.04 -

Bills for collection 36,27,443.28 26,59,322.59 9,68,121.00 -

Overdue interest

68,314,561.00 32,628,860.00 35,685,702.00 -

reserve

Other liabilities 63,295,660.05 1,13,832,989.50 - 50,537,329.45

Total current

2,70,988,815.60 2,45,802,025.30

Liabilities (B)

Net working capital

30,72,355,613.00 40,11,009,597.00 10,78,174,762.00 1,39,520,778.10

[A-B]

Increase in working

9,38,653,984.00 - - 9,38,653,984.00

capital

Total 40,11,009,597.00 40,11,009,597.00 10,78,174,762.00 10,78,174,762.00

Source: Secondary data

TABLE - 4

HDFC BANK LTD – COMPARATIVE BALANCE SHEET

DURING THE YEAR 2010-2011

Particulars 2010 2011 Increase/ Decrease %

Rs. Rs. Rs. Increase or

Decrease

Current assets

Cash in hand 1,04,482,628.31 1,02,434,124.43 -20,48,503.90 -1.96

Cash at bank 15,56,514.57 35,74,160.57 +20,17,646.00 +129.63

Advances 30,83,139,733.91 40,83,572,728.06 +10,00,432,995.00 +32.45

Interest receivable 1,29,711,894.00 47,303,167.00 -82,408,727.00 -63.53

Bills receivable 36,27,443.28 26,59,322.59 -9,68,120.69 -26.69

Other assets 20,826,216.13 17,268,119.03 -35,58,097.10 -17.08

Total current assets 33,43,344,429.00 42,56,811,622.00 +9,13,467,193.00 +27.32

[A]

Fixed assets

Investment 7,64,757,857.37 8,96,197,335.37 +1,31,439,478.00 +17.19

Consortium finance 70,500,000.00 1,53,989,000.00 +83,489,000.00 +118.42

Govt. loan discount 6,32,589,278.38 6,32,589,278.38 - -

Premises 55,53,291.00 53,97,364.00 -1,55,927.00 -2.81

Furnishers & fixtures 16,11,759.50 44,54,844.40 +28,43,084.90 +176.39

Vehicles & library 3,48,444.00 6,04,771.95 +2,56,327.95 +73.56

Non banking assets 7,480.00 7,480.00 - -

Profit & loss 1,85,045,798.40 2,18,325,336.10 +33,279,537.70 +17.98

Total fixed assets [B] 16,60,413,909.00 19,11,565,410.00 +2,51,151,501.00 +15.13

Total assets [A+B] 50,03,758,338.00 61,68,377,032.00 +11,64,618,694.00 +23.27

Current liability

Interest payable 1,18,210,763.00 86,959,299.00 -31,251,464.00 -26.44

Branch adjustment 17,540,388.22 97,21,554.18 -78,18,834.04 -44.58

Bills for collection 36,27,443.28 26,59,322.59 -9,68,120.69 -26.69

i-Xplore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 33

Volume 2, No. 7, July 2013

Overdue interest 68,314,561.00 32,628,860.00 -35,685,701.00 -52.24

reserve

Other liabilities 63,295,660.05 1,13,832,989.50 +50,537,329.45 +79.84

Total current liability 2,70,988,815.60 2,45,802,025.30 -25,186,790.30 -9.29

[c]

Long term liability

Capital 3,14,462,750.00 4,59,024,400.00 +1,44,561,650.00 +45.97

Reserve Fund 5,77,316,647.95 6,40,752,622.95 +63,435,975.00 +10.99

Deposit 24,05,524,274.65 30,47,624,908.06 +6,42,100,634.00 +26.69

Borrowing 13,64,965,850.70 16,21,184,076.60 +2,56,218,226.00 +18.77

Consortium 70,500,000.00 1,53,989,000.00 +83,489,000.00 +118.42

Total long term 47,32,769,522.00 59,22,575,007.00 +11,89,805,485.00 +25.14

liability (D)

Total liability [C+D] 50,03,758,338.00 61,68,377,032.00 +11,64,618,693.00 +23.27

FINDINGS 8. The central and state government is spending a

The Current Ratios are in satisfactory level. It was substantial amount to improve the standard of work

Increasing that, the bank liquidity position is done by the bank employees. The management

may take into consideration while revising the pay

satisfactory.

The comparative statement shows the current and structure of the staff

long term financial position of the bank activities.

The common size statement shows the movement CONCLUSION

of cash position and changes of financial position

in the bank The HDFC Bank has been serving the people of

Thanjavur and surrounding areas for the past 95 years.

SUGGESTIONS The main function of bank is accepting deposits and

lending money to the people. The percentage of credit to

1. The bank management may take necessary steps to working capital and deposit is showing an increasing

employ more numbers of staff considering the trend, during this study period. It clearly indicates lack of

burden of work load. scientific portfolio management, of the HDFC bank.

2. The bank work can be performed smoothly and

successfully only if it has sufficient number of BIBLIOGRAPHY

staff. At present the number of staff in the bank is

inadequate. [1] N.L.Hingorani, A..R.Ramanathan and

3. The capacity of members in bank, it can still T.S.Grewal, 2000 – Management

increase through motivation and specialized [2] Accounting, Fifth edition, New Delhi.

service. [3] C.R.Kothari, 2004 – Research methodology,

4. The bank has extend adequate financial assistance second edition, New Delhi Willey Fastern

to the members to develop in trade and industry. Limited.

5. Advertisement and publicity should be given so as [4] Dr.S.N.Maheswari, 2006 – Financial

to make the awareness to the public. Management, Fourth edition, New Delhi.

6. The bank should increase the share capital. [5] T.S.Reddy And J.Hari Prasad, 2007 –

7. Special types of deposits scheme have to be Management Accounting, Third edition, Margam

introduced the benefit of the deposit. Publications.

i-Xplore International Research Journal Consortium www.irjcjournals.org

You might also like

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Study of Assessment Methods of Working Capital Requirement For Bank of Maharashtra by Vaibhav JagatDocument91 pagesStudy of Assessment Methods of Working Capital Requirement For Bank of Maharashtra by Vaibhav JagatSrinivas TanneruNo ratings yet

- Credit & Recovery - HDFCDocument50 pagesCredit & Recovery - HDFCPushpak Reddy GattupalliNo ratings yet

- Working Capitral of HDFC BANK Final ProjectDocument110 pagesWorking Capitral of HDFC BANK Final ProjectyashNo ratings yet

- Working Capital Management and FinanceFrom EverandWorking Capital Management and FinanceRating: 3.5 out of 5 stars3.5/5 (8)

- Cash Management. 1docxDocument50 pagesCash Management. 1docxMAndarNo ratings yet

- Camels Analysis of HDFC BankDocument31 pagesCamels Analysis of HDFC Bankasifbhaiyat33% (3)

- UntitledDocument9 pagesUntitledBig FanNo ratings yet

- About IndustryDocument36 pagesAbout IndustryHardik AgarwalNo ratings yet

- WCM PSBDocument41 pagesWCM PSBVISHAKHA BHALERAONo ratings yet

- "Management of Non Performing Assets": A Project Report ONDocument64 pages"Management of Non Performing Assets": A Project Report ONshivanimittal1737No ratings yet

- Project On HDFC BANKDocument70 pagesProject On HDFC BANKAshutosh MishraNo ratings yet

- "A Study On Financial Institutions Offering Home Loans" Study Conducted atDocument64 pages"A Study On Financial Institutions Offering Home Loans" Study Conducted atSumit BansalNo ratings yet

- Working Capital Management of JK BankDocument98 pagesWorking Capital Management of JK BankAkifaijaz100% (1)

- Industrial Background: Meaning of BankDocument9 pagesIndustrial Background: Meaning of BankgeethadevikNo ratings yet

- Bharath Project COMPLETEDocument52 pagesBharath Project COMPLETENithin GowdaNo ratings yet

- Summer Training Project: Role of Working Capital in MSME at HDFC BANK (EEG Chandigarh)Document17 pagesSummer Training Project: Role of Working Capital in MSME at HDFC BANK (EEG Chandigarh)VISHAL RATHOURNo ratings yet

- Bharat Yadav ThesisDocument41 pagesBharat Yadav Thesisशुन्य बिशालNo ratings yet

- Financial Management ProjectDocument41 pagesFinancial Management Projectdivyasuvarna222No ratings yet

- Idbi McomDocument82 pagesIdbi McomShweta GuptaNo ratings yet

- Literature Review of HDFC BankDocument5 pagesLiterature Review of HDFC Bankafmzubsbdcfffg100% (1)

- HDFC Bank Project On CRMDocument70 pagesHDFC Bank Project On CRMfurqAnNo ratings yet

- Credit AppraisalDocument89 pagesCredit AppraisalSkillpro KhammamNo ratings yet

- Yashu HDFC Trainning Project ReportDocument58 pagesYashu HDFC Trainning Project ReportabhasaNo ratings yet

- Research Paper On NpaDocument4 pagesResearch Paper On Npaafeazleae100% (1)

- Assignment On Technical AnalysisDocument18 pagesAssignment On Technical AnalysisHappie SynghNo ratings yet

- Report On Credit Appraisal in PNBDocument76 pagesReport On Credit Appraisal in PNBSanchit GoyalNo ratings yet

- Wholesale Banking Operation HDFCDocument43 pagesWholesale Banking Operation HDFCVishal Sonawane50% (2)

- Compare Govt and Private BankDocument68 pagesCompare Govt and Private BankRuman KhanNo ratings yet

- Npa Management ThesisDocument6 pagesNpa Management ThesisBuyingCollegePapersBatonRouge100% (1)

- HDFC BankDocument20 pagesHDFC Bankmohd.irfanNo ratings yet

- Magma Project ReportDocument39 pagesMagma Project Report983858nandini80% (5)

- NBFC FinalDocument100 pagesNBFC FinalDivyangi WaliaNo ratings yet

- Icici BankDocument15 pagesIcici BankSatyam Kumar vatsNo ratings yet

- Suhel 1Document86 pagesSuhel 1Faizan DonNo ratings yet

- HDFC BankDocument6 pagesHDFC Bankdipakbora5No ratings yet

- Working Capital ManagementDocument78 pagesWorking Capital ManagementDrj Maz50% (2)

- Banking Project.Document29 pagesBanking Project.pappyjainNo ratings yet

- An Anlitical Study of Loan Scheames of Icici Bank in Nagpur CityDocument52 pagesAn Anlitical Study of Loan Scheames of Icici Bank in Nagpur CityVipin KushwahaNo ratings yet

- Wholesale Banking Operation HDFCDocument43 pagesWholesale Banking Operation HDFCAnonymous H1RRjZmhzNo ratings yet

- Roll No 97 Loans and Advances SynopsisDocument5 pagesRoll No 97 Loans and Advances SynopsisMOHD ZUBAIRNo ratings yet

- Capital Adequency Ratio (CAR) and Determinants Case Study Islamic Banking in IndonesiaDocument10 pagesCapital Adequency Ratio (CAR) and Determinants Case Study Islamic Banking in IndonesiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Synopsis Of: Retail Finance of HDFC BankDocument15 pagesSynopsis Of: Retail Finance of HDFC BankPankaj GargNo ratings yet

- Report of Umanga PaudyalDocument31 pagesReport of Umanga PaudyalbinuNo ratings yet

- In A Partial Fulfillment of Requirement For The Degree of Bachelor of Business Studies (B.B.S)Document6 pagesIn A Partial Fulfillment of Requirement For The Degree of Bachelor of Business Studies (B.B.S)Bishal ChaliseNo ratings yet

- PNB Summer Internship ReportDocument90 pagesPNB Summer Internship ReportAnil Anayath88% (42)

- Dena Bank Working Capital and Ratio Analysis VinayDocument106 pagesDena Bank Working Capital and Ratio Analysis Vinayविनय गुप्ता75% (4)

- Literature Review of Financial Analysis of HDFC BankDocument5 pagesLiterature Review of Financial Analysis of HDFC BankafmzfgmwuzncdjNo ratings yet

- Co-Operative Company LimitedDocument9 pagesCo-Operative Company Limitedrk shahNo ratings yet

- Project Cash Management in Banks ProjectDocument45 pagesProject Cash Management in Banks Projectkedar dhuriNo ratings yet

- Research Paper On Npa ManagementDocument8 pagesResearch Paper On Npa Managementd1fytyt1man3100% (1)

- MT 2 NPADocument30 pagesMT 2 NPAPri AgarwalNo ratings yet

- Statement of The Problem: - : PageDocument14 pagesStatement of The Problem: - : PageNivedita NandaNo ratings yet

- Working Capital of HDFCDocument9 pagesWorking Capital of HDFCVijeta HatiholiNo ratings yet

- Project ReportDocument66 pagesProject ReportRupali JindalNo ratings yet

- Credit Appraisal at PNBDocument76 pagesCredit Appraisal at PNBpankhu_0686% (7)

- Project-Kotak BankDocument63 pagesProject-Kotak BankAli SaqlainNo ratings yet

- Gaining Sustainable Advantage in The Time of Pandemic 244Document2 pagesGaining Sustainable Advantage in The Time of Pandemic 244Ra JaNo ratings yet

- Segmentation McDonald SDocument5 pagesSegmentation McDonald SRa JaNo ratings yet

- Q.no.8200 - English Partner - 10.01.2022Document2 pagesQ.no.8200 - English Partner - 10.01.2022Ra JaNo ratings yet

- Q.no.8194 - English Partner - 07.01.2022Document1 pageQ.no.8194 - English Partner - 07.01.2022Ra JaNo ratings yet

- Q.no.8197 - English Partner - 08.01.2022Document2 pagesQ.no.8197 - English Partner - 08.01.2022Ra JaNo ratings yet

- For - Checking - International Trade (Returned)Document58 pagesFor - Checking - International Trade (Returned)Ra JaNo ratings yet

- Working Capital by Shilpa MadamDocument27 pagesWorking Capital by Shilpa MadamRa JaNo ratings yet

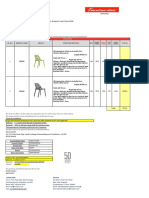

- Q.no8243 R1 - SVB Tech Park (Cafe Chairs) - 08.02.2022Document1 pageQ.no8243 R1 - SVB Tech Park (Cafe Chairs) - 08.02.2022Ra JaNo ratings yet

- ChernobylDocument20 pagesChernobylRa JaNo ratings yet

- Dress Catalogue 2Document30 pagesDress Catalogue 2Ra JaNo ratings yet

- Q.no.8253 - Lambodhara Textiles LTD - 07.02.2022Document5 pagesQ.no.8253 - Lambodhara Textiles LTD - 07.02.2022Ra JaNo ratings yet

- Business Ethics: January 2012Document6 pagesBusiness Ethics: January 2012Ra JaNo ratings yet

- Seating SolutionsDocument36 pagesSeating SolutionsSudhakar PNo ratings yet

- Preparation Material For Business EthicsDocument14 pagesPreparation Material For Business EthicsRa JaNo ratings yet

- OE Youtube APAC India WEBDocument11 pagesOE Youtube APAC India WEBRa JaNo ratings yet

- 10 PT AgendaDocument3 pages10 PT AgendaRa JaNo ratings yet

- World - Economy - Global - Outlook - Overview 1Document55 pagesWorld - Economy - Global - Outlook - Overview 1Ra JaNo ratings yet

- Economies: Trade Balance E Evidence From European Union CountriesDocument15 pagesEconomies: Trade Balance E Evidence From European Union Countriesstarduster starNo ratings yet

- World Economic Situation and Prospects As of Mid-2021: United Nations New York, 2021Document31 pagesWorld Economic Situation and Prospects As of Mid-2021: United Nations New York, 2021Ra JaNo ratings yet

- Internal Analysis As On 10.9.21Document56 pagesInternal Analysis As On 10.9.21Ra JaNo ratings yet

- Ded 07 Block 03 1520929473Document96 pagesDed 07 Block 03 1520929473Gihane GuirguisNo ratings yet

- Kantar BrandZ Global 2021 InfographicDocument1 pageKantar BrandZ Global 2021 InfographicroberttothNo ratings yet

- MacroDocument70 pagesMacroSowmiya SanthanamNo ratings yet

- Trade TheoriesDocument20 pagesTrade TheoriesRa JaNo ratings yet

- Ditcinf2021d2 enDocument8 pagesDitcinf2021d2 enseafishNo ratings yet

- Ditcinf2021d2 enDocument8 pagesDitcinf2021d2 enseafishNo ratings yet

- World Economic Outlook: Managing Divergent RecoveriesDocument192 pagesWorld Economic Outlook: Managing Divergent RecoveriesRafa BorgesNo ratings yet

- Key Statistics and Trends: in International TradeDocument35 pagesKey Statistics and Trends: in International Tradetatiana postolachi100% (1)

- Ditcinf2021d2 enDocument8 pagesDitcinf2021d2 enseafishNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument15 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancechandbashaNo ratings yet

- Acct Statement XX3696 10102023Document3 pagesAcct Statement XX3696 10102023surajaswal.saNo ratings yet

- Acct Statement XX9595 30032022Document3 pagesAcct Statement XX9595 30032022Prashant ShahNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument7 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancesknagarNo ratings yet

- Toppic List Summer TrainingDocument9 pagesToppic List Summer TrainingDinesh SinghNo ratings yet

- Chapter 1-Introduction 1.1 The Topic: "Recruitment Process in HDFC Bank"Document61 pagesChapter 1-Introduction 1.1 The Topic: "Recruitment Process in HDFC Bank"Sanchi JainNo ratings yet

- HDFC Competition Analysis-CharuDocument97 pagesHDFC Competition Analysis-Charudheeraj_kush100% (1)

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument9 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancePrince RajputNo ratings yet

- Acct Statement XX1725 11072021Document2 pagesAcct Statement XX1725 11072021Sanjeev JoshiNo ratings yet

- Summer Internship Project HDFC Bankpdf PDFDocument108 pagesSummer Internship Project HDFC Bankpdf PDFAkNo ratings yet

- The Business-: White-Label With HDFC Bank For B2B Payments. Contracted With Jio PlatformsDocument15 pagesThe Business-: White-Label With HDFC Bank For B2B Payments. Contracted With Jio PlatformsravuvenNo ratings yet

- Analysis HDFC BANKDocument83 pagesAnalysis HDFC BANKsilent readersNo ratings yet

- Bank Statment 6 MonthsDocument5 pagesBank Statment 6 MonthsSHAMSHER SINGHNo ratings yet

- ProjectDocument50 pagesProjectPavan KumarNo ratings yet

- Acct Statement XX0311 07062022Document4 pagesAcct Statement XX0311 07062022RAJKUMAR NAYAKNo ratings yet

- NIGO's ProjectDocument119 pagesNIGO's ProjectAhmad MustafaNo ratings yet

- Process NoteDocument1 pageProcess NoteIreneNo ratings yet

- Sadaf StatementDocument37 pagesSadaf StatementadilfaqiNo ratings yet

- Acct Statement XX8355 22112022Document3 pagesAcct Statement XX8355 22112022Vaibhav JadhavNo ratings yet

- Market Wizard Newsletter Issue 66 - Sip BasketDocument81 pagesMarket Wizard Newsletter Issue 66 - Sip Basketsudheera cNo ratings yet

- ST Harry PDFDocument10 pagesST Harry PDFharjinder singhNo ratings yet

- HDFC-Offer-Croma Electronics - Online Electronics Shopping - Buy Electronics OnlineDocument1 pageHDFC-Offer-Croma Electronics - Online Electronics Shopping - Buy Electronics OnlineSahil VishwasNo ratings yet

- Project For Academic Year 2021-22: Class: T. Y. B. A. F. Sem. VIDocument12 pagesProject For Academic Year 2021-22: Class: T. Y. B. A. F. Sem. VIhrishikesh pandeyNo ratings yet

- Banking and Financial Awareness Digest June 2021Document9 pagesBanking and Financial Awareness Digest June 2021Sakshi GuptaNo ratings yet

- Analysis On Financial Health of HDFC Bank and Icici BankDocument11 pagesAnalysis On Financial Health of HDFC Bank and Icici Banksaket agarwalNo ratings yet

- Jan 2023 News ArchiveDocument18 pagesJan 2023 News ArchiveYugantar GuptaNo ratings yet

- Final Camels FrameworkDocument75 pagesFinal Camels FrameworkParth ShahNo ratings yet

- PAN India Pickup Request From 1st Mar 2023Document1,272 pagesPAN India Pickup Request From 1st Mar 2023pranay.phadke.contrNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument7 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceGagan DhingraNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument7 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancebadenagaNo ratings yet