Professional Documents

Culture Documents

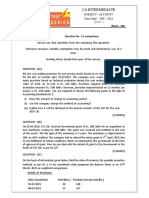

Sample Paper-5

Uploaded by

Keshav GoyalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample Paper-5

Uploaded by

Keshav GoyalCopyright:

Available Formats

Jai Shri Krishna

Time : 2 Hrs. M:M.: 40

PART-A

(Accounting for Not-For-Profit Organisations, Partnership Firms and Companies)

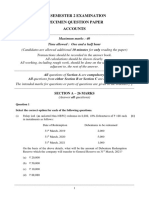

Q.1 From the following information calculate the amount of medicines to be posted to Income and Expenditure

Account of Sargam Hospital for the year ending 31st March, 2022:

Particulars 1.4.2021 (Rs.) 1.4.2022 (Rs.)

Stock of medicines 25,000 20,000

Creditors for medicines 15,000 28,000

Medicines purchased during the year ended 31st March, 2022 was Rs. 1,00,000. (2)

Q.2 Deepa, Neeru and Shilpa were partners in a firm sharing profits in the ratio of 5 : 3 : 2. Neeru retired and

the new profit sharing ratio between Deepa and Shilpa was 2 : 3. On Neeru's retirement, the goodwill of

the firm was valued at Rs. 1,20,000.

Record necessary journal entry for the treatment of goodwill on Neeru's retirement. (2)

Q.3 Bank loan of Rs. 1,00,000 (appeared in the balance sheet) was taken against mortgage of machinery.

Creditors on that date are Rs. 50,000. On dissolution of the firm, cash available is only Rs. 1,25,000. How

much amount will be paid to the liabilities? You are required to state the provisions of Section 48 of the

Partnership Act, 1932. (2)

Q.4 BGP Ltd. invited applications for issuing 15,000, 11% debentures of Rs. 100 each at a premium of Rs. 50

per debenture. The full amount was payable on application. Applications were received for 25,000

debentures. Applications for 5,000 debentures were rejected and the application money refunded.

Debentures were alloted to the remaining applicants on pro-rata basis.

Pass the necessary journal entries for the above transactions in the books of BGP Ltd. (3)

DEEPAK BHATIA CLASSES

OR

Maneesh Ltd. took over assets of Rs. 9,40,000 and liabilities of Rs. 1,40,000 of Ram Ltd. at an agreed

value of Rs. 7,80,000. Maneesh Ltd. paid to Ram Ltd. by issue of 9% debentures of Rs. 100 each at a

premium of 20%.

Pass necessary journal entries to record the above transactions in the books of Maneesh Ltd. (3)

Q.5 Monu, Nigam and Shreya were partners in a firm sharing profits and losses in the ratio of 4 : 3 : 1. The

firm closes its books on 31st March every year. As per the terms of partnership deed on the death of any

partner, the share of goodwill of the deceased partner will be calculated on the basis of 50% of the net

profit credited to that partner's capital account during the last four completed years before death. Monu

died on 1st July 2020.

The profits for last four years were: 2016-17 Rs. 97,000; 2017-18 Rs. 1,05,000; 2018-19 Rs. 30,000; 2019-

20 Rs. 84,000 His share of profit in the year of his death was to be calculated on the basis of sales. Sales

for the year ended 31st March 2020 amounted to Rs. 8,40,000. Sales shows a growth trend of 20% and

percentage of profit earning is reduced by 1%.

(i) Calculate Monu's share of profits till the date of her death.

(ii) Pass necessary journal entries for treatment of goodwill and Monu's share of profits till the date of

her death. (3)

Q.6 From the following extract of Receipt and Payment Account and the additional information, compute the

amount of income from subscriptions and show as how they would appear in the Income and Expenditure

Account for the year ending March 31, 2022 and the Balance Sheet as on that date.

Receipt and Payment Account for the year ending March 31, 2022

Receipts Amount (Rs.)

To Subscriptions:

2020-21 7,000

2021-22 30,000

2022-23 5,000 42,000

DEEPAK BHATIA CLASSES

Additional Information:

Subscriptions outstanding March 31, 2021 Rs. 8,500

Total Subscriptions outstanding March 31, 2022 Rs. 18,500

Subscriptions received in advance as on March 31, 2021 Rs. 4,000 (3)

OR

Present the following items in the Balance Sheet of Queen's Club as at 31st March, 2022:

Receipts Amount (Rs.)

Capital fund (1st April, 2021) 10,80,000

Building fund (1st April, 2021) 4,80,000

Donation received for Building 6,00,000

10% Building fund Investment (1st April, 2021) 4,80,000

Interest received on Building Fund Investments 48,000

Additional Information:

Expenditure on construction of building Rs. 3,60,000. Construction work is in progress and has not yet

been completed. (3)

Q.7 From the following receipts and payments account of Vista Club, prepare an Income and Expenditure

Account for the year ended 31st March, 2022.

Receipts and Payments Account of Vista Club for the year ended 31st March, 2022

Receipts Amt (Rs.) Payments Amt (Rs.)

To Balance b/d 5,000 By Salaries 31,000

To Subscription: By Electricity Expenses 14,500

2020-21 11,600 By Machinery (1.7.2021) 40,000

2021-22 73,000 By 8% Investments 30,000

2022-23 8,000 92,600 By Balance c/d 5,100

To Sale of old furniture (Book value

Rs. 2,000) 800

To Legacy (general) 22,000

To Interest on Investment 200

1,20,600 1,20,600

DEEPAK BHATIA CLASSES

Additional Information:

(i) The club had 50 members each paying an annual subscription of Rs. 1,500. Subscription in arrears

on 31-03-2021 were Rs. 15,000.

(ii) On 31st March, 2022, Outstanding salaries were Rs. 4,000.

(iii) 8% Investments were made on 31st December, 2021.

(iv) The club owned machinery of Rs. 1,00,000 on 1st April, 2021. Depreciate machinery @ 6% p.a. (5)

Q.8 Naina, Uday and Tara were partners in a firm sharing profits and losses in the ratio of 5:3:2. The firm was

dissolved on 31-3-2022. After transfer of asset (other than cash)and external liabilities to Realization

Account, the following transaction took place:

(i) A typewriter completely written off from the books was sold for Rs. 4,000.

(ii) Loan of Rs. 30,000 advanced by the firm to Uday was paid by him.

(iii) Tara was to get remuneration of Rs. 42,000 for completing the dissolution process. Actual

realization expenses amounted to Rs. 51,000 and were paid by the firm.

(iv) Creditors of Rs. 23,000 took over all the investments at Rs. 12,000. Remaining amount was paid to

them in cash.

(v) Machinery (book value Rs. 60,000) was given to creditor at a discount of 20%.

Pass necessary journal entries for the above transactions in the books of the firm. (5)

OR

Narang, Suri and Bajaj are partners in a firm sharing profits and losses in proportion of 1/2, 1/6 and 1/3

respectively. The Balance Sheet on April 1, 2020 was as follows:

Liabilities Amt (Rs.) Assets Amt (Rs.)

Bills Payable 12,000 Freehold Premises 40,000

Sundry Creditors 18,000 Machinery 30,000

Reserves 12,000 Furniture 12,000

Capital Accounts: Stock 22,000

DEEPAK BHATIA CLASSES

Narang 30,000 Sundry Debtors 20,000

Suri 30,000 Less: Provision (1,000) 19,000

Bajaj 28,000 88,000 Bank 7,000

1,30,000 1,30,000

Bajaj retires from the business and the partners agree to the following:

(a) Freehold premises and stock are to be appreciated by 20% and 15% respectively.

(b) Machinery and furniture are to be depreciated by 10% and 7% respectively.

(c) Provision for doubtful debts is to be increased to Rs. 1,500.

(d) Goodwill is valued at Rs. 21,000 on Bajaj's retirement.

Prepare Revaluation Account, Partners' Capital Accounts the Balance Sheet of the reconstituted firm. (5)

Q.9 On 1 October 2021, Raghuveer Limited issued Rs. 10,00,000, 8% debentures as follows to:

Particulars Amount (Rs.)

(i) Sundry Subscribers for Cash at 90% 5,50,000

(ii) Vendor of Machinery for Rs. 2,00,000 in satisfaction of his claim. 2,00,000

(iii) Bankers as Collateral Security for a bank loan worth Rs. 20,00,000 for which 2,50,000

principal security is Business Premises worth Rs. 22,50,000.

The issue (i) and (ii) are redeemable after 5 years at 10% premium. On March 31, 2022 the balance in

Securities Premium Reserve was Rs. 1,00,000. Pass necessary journal entries to record the above

transactions in the books of Raghuveer Limited for the year ended on March 31, 2022. (5)

PART-B

(Analysis of Financial Statements)

Q.10 Classify the following activities into cash flows from operating activities, investing activities and financing

activities or cash equivalents.

(a) Brokerage paid on purchase of non- current investment

(b) Short-term deposit

DEEPAK BHATIA CLASSES

(c) Marketable securities

(d) Trading commission received (2)

Q.11 From the following information extracted from the statement of Profit and Loss for the years ended 31st

March, 2021 and 2022, prepare a Comparative Statement of Profit & Loss.

Particulars 2021-22 2020-21

Revenue from operations Rs. 6,00,000 Rs. 5,00,000

Other income (% of revenue from operations) 20% 20%

Employee benefit expenses (% of Total Revenue) 40% 30%

Tax rate 40% 30%

(3)

OR

Prepare common size balance sheet of R Ltd. and S Ltd. as at March 31, 2022 from the given information:

Particulars Note No. R Ltd. (Rs.) S Ltd. (Rs.)

I. Equity and Liabilities :

1. Shareholders’ Fund

(a) Share Capital 15,00,000 20,00,000

(b) Reserves and Surplus 4,00,000 3,00,000

2. Non-Current Liabilities :

Long-term Borrowings: 6,00,000 9,00,000

3. Current Liabilities :

Trade Payables 2,00,000 3,00,000

Total 27,00,000 35,00,000

II. Assets :

1. Non-Current Assets :

(a) Fixed Assets

Tangible Assets 15,00,000 20,00,000

DEEPAK BHATIA CLASSES

Intangible Assets 6,00,000 9,00,000

2. Current Assets :

(a) Inventories 4,00,000 3,00,000

(b) Cash and Cash Equivalents 2,00,000 3,00,000

Total 27,00,000 35,00,000

(3)

Q.12 From the following Balance Sheet of Ajanta Limited as on March 31, 2022, prepare a Cash Flow

Statement:

Particulars Note No. 31.3.2022 (Rs.) 31.3.2021 (Rs.)

I. Equity and Liabilities :

1. Shareholders’ Fund

(a) Share Capital 10,00,000 10,00,000

(b) Reserves and Surplus 1 2,40,000 1,20,000

2. Non-Current Liabilities :

Long-term Borrowings: 3,20,000 2,40,000

3. Current Liabilities :

(a) Trade Payables 2 1,80,000 2,40,000

(b) Other Current Liabilities 3 1,80,000 1,60,000

Total 19,20,000 17,60,000

II. Assets :

1. Non-Current Assets :

(a) Fixed Assets

- Tangible assets 4 13,40,000 12,00,000

(b) Non-Current Investment 5 2,40,000 1,60,000

2. Current Assets :

(a) Inventories 1,20,000 1,60,000

(b) Trade Receivable 1,60,000 1,60,000

(c) Cash and Cash Equivalents 60,000 80,000

Total 19,20,000 17,60,000

DEEPAK BHATIA CLASSES

Notes to Accounts:

Note No. Particulars 31.3.2022 (Rs.) 31.3.2021 (Rs.)

1. Reserves and Surplus

Securities Premium Reserve 40,000 -

Balance in Statement of Profit & Loss 2,00,000 1,20,000

2,40,000 1,20,000

2. Trade Payables

Creditors 1,40,000 1,20,000

Bills Payable 40,000 1,20,000

1,80,000 2,40,000

3. Other Current Liabilities:

Outstanding Rent 1,80,000 1,60,000

4. Tangible Assets

Plant & Machinery 14,40,000 13,50,000

Less: Accumulated Depreciation (1,00,000) (1,50,000)

13,40,000 12,00,000

5. Non-Current Investments

10% Bonds of Kohinoor Ltd. 2,40,000 1,60,000

Additional Information:

(i) During the year 2021-22, a machinery costing Rs. 50,000 and accumulated depreciation thereon Rs.

15,000 was sold for Rs. 32,000.

(ii) New 9% Debentures were issued on April 1, 2021 at 50% premium.

(iii) New 10% bonds of Kohinoor Ltd. were purchased on 31.3.2022. (5)

DEEPAK BHATIA CLASSES

You might also like

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Accountancy Set 1 QPDocument6 pagesAccountancy Set 1 QPShaurya JainNo ratings yet

- Sanskriti School Dr. S. Radhakrishnan Marg New DelhiDocument7 pagesSanskriti School Dr. S. Radhakrishnan Marg New DelhiAVNEET XII-CNo ratings yet

- SAHODAYAModel Question Acc SET 2Document9 pagesSAHODAYAModel Question Acc SET 2aamiralishiasbackup1No ratings yet

- Accountancy Set 3 QPDocument6 pagesAccountancy Set 3 QPKunal Gaurav100% (2)

- 12 Term t2 AccountancyDocument17 pages12 Term t2 AccountancySIFANA ARIMANICHOLA100% (1)

- Mock 1Document5 pagesMock 1Yashi JainNo ratings yet

- Accountancy-SQP Term2Document8 pagesAccountancy-SQP Term2radhikaNo ratings yet

- Accountancy QP 1 (A) 2023Document5 pagesAccountancy QP 1 (A) 2023mohammedsubhan6651No ratings yet

- XII Accountancy in Eng QPDocument6 pagesXII Accountancy in Eng QPSarang KrishnanNo ratings yet

- ACCOUNTANCY Question Paper 2022 (67-1-1) Set - 1Document6 pagesACCOUNTANCY Question Paper 2022 (67-1-1) Set - 1Manogya GondelaNo ratings yet

- Guru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GDocument6 pagesGuru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GSAURABH JAINNo ratings yet

- Accountancy Pre Board 2Document5 pagesAccountancy Pre Board 2Akshit kumar 10 pinkNo ratings yet

- XII Accounts Test With SolutionDocument12 pagesXII Accounts Test With SolutionKritika Mahalwal100% (1)

- Accountancy QP-Term II-Pre Board 1 - Class XIIDocument6 pagesAccountancy QP-Term II-Pre Board 1 - Class XIIRaunofficialNo ratings yet

- Accountancy Practical Examination Class XII (2021-22) Practice SET ADocument4 pagesAccountancy Practical Examination Class XII (2021-22) Practice SET AAyush ChauhanNo ratings yet

- Single Entry (Accounts From Incomplete Records)Document11 pagesSingle Entry (Accounts From Incomplete Records)hk7012004No ratings yet

- 12 Accountancy SQP 4Document11 pages12 Accountancy SQP 4KandaroliNo ratings yet

- Class 11 Acc FinalDocument3 pagesClass 11 Acc Finalmnmehta1990No ratings yet

- 12 Accountancy SQP 5Document13 pages12 Accountancy SQP 5KandaroliNo ratings yet

- QR Target Term-2 Ultimate Accountany XIIDocument193 pagesQR Target Term-2 Ultimate Accountany XIISatinder SandhuNo ratings yet

- 0 ScheduleDocument7 pages0 ScheduleKusuma MNo ratings yet

- Ist Preboard: D) None of The AboveDocument10 pagesIst Preboard: D) None of The AboveAsNo ratings yet

- Inp 2211 Accounts Question Paper PDFDocument8 pagesInp 2211 Accounts Question Paper PDFSachin ChourasiyaNo ratings yet

- Indian School Sohar UNIT TEST (2021-22) Accountancy Date: Max Marks:50 Class: XII Duration: 2 HoursDocument5 pagesIndian School Sohar UNIT TEST (2021-22) Accountancy Date: Max Marks:50 Class: XII Duration: 2 HoursRitaNo ratings yet

- IncomeTax-IIDocument7 pagesIncomeTax-IIAditya .cNo ratings yet

- Class 12 Accountancy Practical Sample Paper 1Document1 pageClass 12 Accountancy Practical Sample Paper 1Rahul singh device &techNo ratings yet

- Accounts - 12Document8 pagesAccounts - 12Md TariqueNo ratings yet

- Test Series: March, 2021 Mock Test Paper - 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: March, 2021 Mock Test Paper - 1 Foundation Course Paper - 1: Principles and Practice of AccountingUmang AgrawalNo ratings yet

- 858 Accounts Sem II SpecimenDocument7 pages858 Accounts Sem II SpecimenDia JacobNo ratings yet

- Financial AccountingDocument2 pagesFinancial AccountingKartik GurmuleNo ratings yet

- Class 12 Accountancy Practical Sample Paper 2Document1 pageClass 12 Accountancy Practical Sample Paper 2BOBITA DASNo ratings yet

- AccountancyDocument32 pagesAccountancysunil kumarNo ratings yet

- BK Prelims ComDocument6 pagesBK Prelims ComAafreen QureshiNo ratings yet

- Human Resources 3Document104 pagesHuman Resources 3Harsh 21COM1555No ratings yet

- Sunil Panda Commerce Classes (SPCC)Document4 pagesSunil Panda Commerce Classes (SPCC)Higi SNo ratings yet

- MQP Accountancy WMDocument14 pagesMQP Accountancy WMRithik PoojaryNo ratings yet

- Sunil Panda Commerce Classes (SPCC) : Daily Practice Problems (DPP) Term 02 Accounts Not For Profit OrganisationDocument4 pagesSunil Panda Commerce Classes (SPCC) : Daily Practice Problems (DPP) Term 02 Accounts Not For Profit OrganisationHigi SNo ratings yet

- 12 Accounts 2020 21 Practice Paper 4Document14 pages12 Accounts 2020 21 Practice Paper 4Vijey RamalingamNo ratings yet

- 2ND Puc Accountancy QPDocument5 pages2ND Puc Accountancy QPSuhail AhmedNo ratings yet

- MKGM Accounts Question Papers ModelDocument101 pagesMKGM Accounts Question Papers ModelSantvana ChaturvediNo ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Aid To Accountants UDocument171 pagesAid To Accountants UPiya SabooNo ratings yet

- 12 Accounts 2020 21 Practice Paper 2Document8 pages12 Accounts 2020 21 Practice Paper 2Vijey RamalingamNo ratings yet

- CA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test PaperDocument18 pagesCA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test Papersinku123No ratings yet

- Monthly Test - Acc. Aug 2020Document5 pagesMonthly Test - Acc. Aug 2020akash debbarmaNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Class - XII CommerceDocument8 pagesClass - XII CommercehardikNo ratings yet

- TtryuiopDocument6 pagesTtryuiopNAVEENNo ratings yet

- IncomeTax-2Document6 pagesIncomeTax-2Aditya .cNo ratings yet

- Acc Sample Paper 3 Typed by DhairyaDocument5 pagesAcc Sample Paper 3 Typed by DhairyaMaulik ThakkarNo ratings yet

- CA-Foundation Accounts Full Syllabus Test For Dec 2023 StudentsDocument4 pagesCA-Foundation Accounts Full Syllabus Test For Dec 2023 Studentsbabu.bhiwadiNo ratings yet

- Retirement of Partners Cbse Question BankDocument6 pagesRetirement of Partners Cbse Question Bankabhayku1689No ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- Npo Collage SPCC Term 2 NewDocument9 pagesNpo Collage SPCC Term 2 NewTaaran ReddyNo ratings yet

- CH 1 Paper OLDDocument3 pagesCH 1 Paper OLDMaulik ThakkarNo ratings yet

- Class XI Acc SM Arya Annual 2023-24Document5 pagesClass XI Acc SM Arya Annual 2023-24pandeyansh962No ratings yet

- 12th HSC Accounts Sample PaperDocument5 pages12th HSC Accounts Sample Papervaibhavnakashe44No ratings yet

- Uneb U.C.E Mathematics Paper 1 2018Document4 pagesUneb U.C.E Mathematics Paper 1 2018shafickimera281No ratings yet

- Nuclear Power Engineering (MEE 2027) : Fall Semester (2020-2021)Document13 pagesNuclear Power Engineering (MEE 2027) : Fall Semester (2020-2021)AllNo ratings yet

- De DusterDocument6 pagesDe DusterArstNo ratings yet

- JP Selecta IncubatorDocument5 pagesJP Selecta IncubatorAhmed AlkabodyNo ratings yet

- AcousticsDocument122 pagesAcousticsEclipse YuNo ratings yet

- Lista de Precios Agosto 2022Document9 pagesLista de Precios Agosto 2022RuvigleidysDeLosSantosNo ratings yet

- Blake 2013Document337 pagesBlake 2013Tushar AmetaNo ratings yet

- Building For The Environment 1Document3 pagesBuilding For The Environment 1api-133774200No ratings yet

- Monitor Stryker 26 PLGDocument28 pagesMonitor Stryker 26 PLGBrandon MendozaNo ratings yet

- Sample Cross-Complaint For Indemnity For CaliforniaDocument4 pagesSample Cross-Complaint For Indemnity For CaliforniaStan Burman75% (8)

- ICD10WHO2007 TnI4Document1,656 pagesICD10WHO2007 TnI4Kanok SongprapaiNo ratings yet

- Mode of Action of Vancomycin: L D D D D DDocument8 pagesMode of Action of Vancomycin: L D D D D DNolanNo ratings yet

- Fmicb 10 02876Document11 pagesFmicb 10 02876Angeles SuarezNo ratings yet

- Fire Technical Examples DIFT No 30Document27 pagesFire Technical Examples DIFT No 30Daniela HanekováNo ratings yet

- The BetterPhoto Guide To Creative Digital Photography by Jim Miotke and Kerry Drager - ExcerptDocument19 pagesThe BetterPhoto Guide To Creative Digital Photography by Jim Miotke and Kerry Drager - ExcerptCrown Publishing GroupNo ratings yet

- Schneider Contactors DatasheetDocument130 pagesSchneider Contactors DatasheetVishal JainNo ratings yet

- Britannia Volume 12 Issue 1981 (Doi 10.2307/526240) Michael P. Speidel - Princeps As A Title For 'Ad Hoc' CommandersDocument8 pagesBritannia Volume 12 Issue 1981 (Doi 10.2307/526240) Michael P. Speidel - Princeps As A Title For 'Ad Hoc' CommandersSteftyraNo ratings yet

- Biblical Foundations For Baptist Churches A Contemporary Ecclesiology by John S. Hammett PDFDocument400 pagesBiblical Foundations For Baptist Churches A Contemporary Ecclesiology by John S. Hammett PDFSourav SircarNo ratings yet

- Presentation Municipal Appraisal CommitteeDocument3 pagesPresentation Municipal Appraisal CommitteeEdwin JavateNo ratings yet

- CSEC SocStud CoverSheetForESBA Fillable Dec2019Document1 pageCSEC SocStud CoverSheetForESBA Fillable Dec2019chrissaineNo ratings yet

- OVDT Vs CRT - GeneralDocument24 pagesOVDT Vs CRT - Generaljaiqc100% (1)

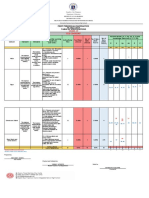

- Revised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10Document6 pagesRevised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10May Ann GuintoNo ratings yet

- PH of Soils: Standard Test Method ForDocument3 pagesPH of Soils: Standard Test Method ForYizel CastañedaNo ratings yet

- Model TB-16Document20 pagesModel TB-16xuanphuong2710No ratings yet

- Using The Monopoly Board GameDocument6 pagesUsing The Monopoly Board Gamefrieda20093835No ratings yet

- Conveyor Control Using Programmable Logic ControllerDocument7 pagesConveyor Control Using Programmable Logic ControllerWann RexroNo ratings yet

- LicencesDocument5 pagesLicencesstopnaggingmeNo ratings yet

- Grade9 January Periodical ExamsDocument3 pagesGrade9 January Periodical ExamsJose JeramieNo ratings yet

- CV ChristianDocument2 pagesCV ChristianAlya ForeferNo ratings yet

- Unit 1 and 2Document4 pagesUnit 1 and 2Aim Rubia100% (1)