Professional Documents

Culture Documents

Seatwork - Partnership Liquidation

Uploaded by

Jevyl CajandabOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Seatwork - Partnership Liquidation

Uploaded by

Jevyl CajandabCopyright:

Available Formats

SYSTEMS PLUS COLLEGE FOUNDATION

COLLEGE OF BUSINESS

A.Y. 2021-2022

ACCOUNTING FOR PARTNERSHIP CORPORATION

Partnership Liquidation

Seatwork

Name: _______________________ Date: ___________________ Yr. & Section:

_________________ Score: __________________

Partnership Liquidation (Lump sum)

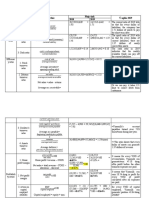

1. The partnership Alpha, Beta, and Charlie was liquidated on May 31, 2021, and the

account balances after all noncash assets are converted to cash on July 1, 2021, along

with residual profit and loss ratios, are:

Cash P262,500 Accounts Payable P630,000 Beta, Capital (30%) P315,000 Alpha,

Capital (30%) P472,500 Charlie, Capital (40%) P525,000

Total P1,102,500 Total P1,102,500

Personal assets and Liabilities of the partners at July 1, 2021 are:

Personal Assets Personal Liabilities

Alpha P420,000 P472,500

Beta P525,000 P320,250

Charlie P997,500 P420,000

If Charlie contributed P367,500 to the partnership to provide cash to pay the creditors, what

amount of Alpha’s P472,500 partnership equity would appear to be recoverable? (10 points)

Show your solution.

a. P414,750

b. P425,250

c. P472,500

d. 0

1 Partnership Liquidation (Lump sum)

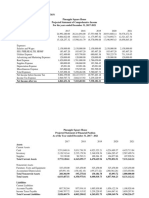

2. LenLen and BabyM decided to liquidate their partnership business on June 1, 2021 under

lump sum liquidation. The partners had been sharing profit and losses on a 60:40 ratio. The

statement of financial position prepared on the day of liquidation began as follows:

Assets Liabilities and Capital Cash P18,000 Accounts Payable P42,000 Receivables

P75,000 LenLen, Loan P24,000 Inventory P90,000 LenLen, Capital P102,000 Other

Assets P84,000 BabyM, Capital P90,000 BabyM, Withdrawal P9,000 Total P267,000

Total P267,000

During June, one third of the receivables was collected; P45,000 of inventory was sold at an

average of 70% of book value; other asset were sold for P36,000.

How much should LenLen and BabyM received upon liquidation? (10 points) Show your

solution.

LenLen BabyM

a. P32,100 P36,400

b. P8,100 P27,400

c. P40,200 P41,800

d. P59,100 P54,400

2 Partnership Liquidation (Lump sum)

SOLUTION

1. c. P472,500

Cash 262,500 Account Payable 630,000

Beta, Capital 315,000

Alpha, Capital 472,500

Charlie, Capital 525,000

Total assets 262,500 Total Liabilities and Capital 1,942,500

Beta, Capital (30%) Alpha, Capital(30%) Charlie,Capital(40%)

315,000 472,500 525,000

(367,500)

315,000 472,500 (157,500)

(204,750) (52,500) (577,500)

110,250 420,000 420,000

2. A. lenlen P32,100 babym P36,400

Carrying amount of non-cash (75,000+90,000+84,000) =249,000

Realized from sale (1/3x75,000)+(70%x 45,000)+36,000 =(92,475)

Loss Realization 156,525

Cash 18,000+ 92,475= 110,475-42,000=68,475

Cash Available 68,475

Capital Balance (225,000)

156,525

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Quiz MKDocument3 pagesQuiz MKvano aldiNo ratings yet

- Transfer Pricng SolutionDocument3 pagesTransfer Pricng SolutionchandraprakashNo ratings yet

- Problem16 5acctgDocument2 pagesProblem16 5acctgAleah kay BalontongNo ratings yet

- Comedor Sa Dalan Restaurante Projected Income Statement For The Year Ended December 31, 2017-2021 2018Document6 pagesComedor Sa Dalan Restaurante Projected Income Statement For The Year Ended December 31, 2017-2021 2018Alili DudzNo ratings yet

- CHAPTER 4 Financials Velas Encendida Candles 3 12 19Document18 pagesCHAPTER 4 Financials Velas Encendida Candles 3 12 19JenilynNo ratings yet

- Partnership Formation Problem No. 1Document8 pagesPartnership Formation Problem No. 1tide podsNo ratings yet

- Mount Moreland Hospital: Perform Financial CalculationsDocument9 pagesMount Moreland Hospital: Perform Financial CalculationsJacob Sheridan0% (1)

- Bulletin November 2022Document12 pagesBulletin November 2022St. Anthony Shrine100% (1)

- NP EX19 9a JinruiDong 2Document9 pagesNP EX19 9a JinruiDong 2Ike DongNo ratings yet

- Accounting Review QuestionsDocument34 pagesAccounting Review Questionsjoyce KimNo ratings yet

- Holoease: Jacob Sheridan 4/13/2020 To Perform A Financial Analysis For The Startup Tech Company, HoloeaseDocument11 pagesHoloease: Jacob Sheridan 4/13/2020 To Perform A Financial Analysis For The Startup Tech Company, HoloeaseJacob SheridanNo ratings yet

- Adv AssignmentDocument3 pagesAdv AssignmentBromanineNo ratings yet

- Afar 2 Practice Test (3rd Year)Document8 pagesAfar 2 Practice Test (3rd Year)Rianne NavidadNo ratings yet

- CH 13Document14 pagesCH 13Trang VânNo ratings yet

- Partnership Deed:: Business Project Legal Plan ReasonDocument5 pagesPartnership Deed:: Business Project Legal Plan ReasonTayyiba ShahidNo ratings yet

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocument6 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnSkarlz ZyNo ratings yet

- Lembar Jawaban Mahesa - SalinDocument10 pagesLembar Jawaban Mahesa - Salinricoananta10No ratings yet

- Accounting ReviewDocument76 pagesAccounting Reviewjoyce KimNo ratings yet

- Module 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)Document3 pagesModule 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)ariannealcaraz6No ratings yet

- Afar-Chapter 3 AssignmentDocument38 pagesAfar-Chapter 3 AssignmentJeane Mae BooNo ratings yet

- ch6Document6 pagesch6YuitaNo ratings yet

- Seatwork #2: What Is The Capital Balances of All The Partners in The New Partnership?Document4 pagesSeatwork #2: What Is The Capital Balances of All The Partners in The New Partnership?Tifanny MallariNo ratings yet

- Homework ch4 11-4-2020Document5 pagesHomework ch4 11-4-2020Qasim MansiNo ratings yet

- CH02 ProblemDocument3 pagesCH02 ProblemTuyền Võ ThanhNo ratings yet

- Aqua Chilled - MARKETING PLAN DraftDocument4 pagesAqua Chilled - MARKETING PLAN DraftKyle TimonNo ratings yet

- Five-Year Financial Projection Pineapple Square House Projected Statement of Comprehensive Income For The Years Ended December 31, 2017-2021Document4 pagesFive-Year Financial Projection Pineapple Square House Projected Statement of Comprehensive Income For The Years Ended December 31, 2017-2021Rey PordalizaNo ratings yet

- Problem 1: Journal EntryDocument11 pagesProblem 1: Journal EntrySarah Nelle PasaoNo ratings yet

- CFI - FMVA Practice Exam Case Study ADocument18 pagesCFI - FMVA Practice Exam Case Study AWerfelli MaramNo ratings yet

- Instructions: Submit Within Due DateDocument4 pagesInstructions: Submit Within Due DateDanish SajjadNo ratings yet

- Consolidation at Subsequent DateDocument7 pagesConsolidation at Subsequent DateJulie Mae Caling MalitNo ratings yet

- Income Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpDocument11 pagesIncome Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpmoreNo ratings yet

- Assignment Part OneDocument3 pagesAssignment Part Onetovi0821No ratings yet

- Intermediate Accounting ExamDocument6 pagesIntermediate Accounting ExamPISONANTA KRISETIANo ratings yet

- Dividend and BondsDocument3 pagesDividend and BondsJanuary Ann Bete100% (1)

- 2011-02-09 035108 Finance 14Document4 pages2011-02-09 035108 Finance 14SamNo ratings yet

- Cash Flow Statement Illustration (IAS 7)Document2 pagesCash Flow Statement Illustration (IAS 7)amahaktNo ratings yet

- AFAR Set CDocument12 pagesAFAR Set CRence GonzalesNo ratings yet

- 001 AdvanceDocument6 pages001 AdvanceSa BilNo ratings yet

- Income Statement of Apple IncDocument6 pagesIncome Statement of Apple IncBharat PanthiNo ratings yet

- Competency AssessmentDocument5 pagesCompetency AssessmentMiracle FlorNo ratings yet

- Financial Study - Garden of EdenDocument16 pagesFinancial Study - Garden of EdenEumar FabruadaNo ratings yet

- UAS PA 2020-2021 Ganjil - JawabanDocument27 pagesUAS PA 2020-2021 Ganjil - JawabanNuruddin AsyifaNo ratings yet

- FS of Infinity Adventure Farm and ResortDocument35 pagesFS of Infinity Adventure Farm and ResortbeldiansitsolutionsNo ratings yet

- FINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)Document2 pagesFINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)ISABELA QUITCONo ratings yet

- Suggested Solution: For Corrections and Clarifications, Just Private Message Me, Okay?Document12 pagesSuggested Solution: For Corrections and Clarifications, Just Private Message Me, Okay?lixvanter0% (1)

- BASIC MODEL - Construction.Document10 pagesBASIC MODEL - Construction.KAVYA GUPTANo ratings yet

- Test 01 21 - Tri3 - FINA309Document9 pagesTest 01 21 - Tri3 - FINA309Kateryna Ternova100% (1)

- Accounting For Special Transactions Partnership AccountingDocument15 pagesAccounting For Special Transactions Partnership AccountingJessaNo ratings yet

- Accounting ReviewDocument74 pagesAccounting Reviewjoyce KimNo ratings yet

- Is Consolidation Acc312Document4 pagesIs Consolidation Acc312Richard SantosNo ratings yet

- Financial Plan 1Document10 pagesFinancial Plan 1Krizza Mae Dela CruzNo ratings yet

- SampleFinancialModel 5 Years Long VersionDocument56 pagesSampleFinancialModel 5 Years Long Versionadamnish8812No ratings yet

- Lembar Jawab Laporan KeuanganDocument10 pagesLembar Jawab Laporan Keuanganricoananta10No ratings yet

- Faculty of Accountancy Bachelor of Accountancy (Hons.)Document8 pagesFaculty of Accountancy Bachelor of Accountancy (Hons.)Syafahani SafieNo ratings yet

- Managerial Finance AssingmentDocument9 pagesManagerial Finance AssingmentEf AtNo ratings yet

- Cash FlowDocument1 pageCash FlowNicole Velasco NuquiNo ratings yet

- MMS 2022-24 QP Financial AccountingDocument6 pagesMMS 2022-24 QP Financial AccountingnimeshnarnaNo ratings yet

- Pfrs 13 Fair Value MeasurementDocument22 pagesPfrs 13 Fair Value MeasurementShane PasayloNo ratings yet

- Partnership - DissolutionDocument8 pagesPartnership - DissolutionJay Mayca TyNo ratings yet

- AuditingDocument2 pagesAuditingMaria Del Carmen LeonNo ratings yet

- Chapter 2: Accounting Equation and The Double-Entry SystemDocument15 pagesChapter 2: Accounting Equation and The Double-Entry SystemSteffane Mae SasutilNo ratings yet

- Capital Budgeting TopicDocument8 pagesCapital Budgeting TopicraderpinaNo ratings yet

- Session 19 - Risk Management-ClassDocument28 pagesSession 19 - Risk Management-ClassKOTHAPALLI VENKATA JAYA HARIKA PGP 2019-21 BatchNo ratings yet

- Takeover Code FinalDocument15 pagesTakeover Code FinalSameer GopalNo ratings yet

- IAS 10 Events After The Reporting Period-A Closer LookDocument7 pagesIAS 10 Events After The Reporting Period-A Closer LookFahmi AbdullaNo ratings yet

- Securities and Exchange Commission: SEC Bldg. EDSA, Greenhills, Mandaluyong City Office of The General CounselDocument5 pagesSecurities and Exchange Commission: SEC Bldg. EDSA, Greenhills, Mandaluyong City Office of The General CounselIvy Clarize Amisola BernardezNo ratings yet

- Annual Report of NIBL FY-2078-079Document188 pagesAnnual Report of NIBL FY-2078-079Nitesh Yadav50% (2)

- Bài tập chương 3 Financil ratiosDocument14 pagesBài tập chương 3 Financil ratiosThu LoanNo ratings yet

- Notes - General Banking LawDocument4 pagesNotes - General Banking LawJingle BellsNo ratings yet

- 2018mornbfi PDFDocument1,280 pages2018mornbfi PDFAlexander Prillo100% (1)

- Lec 3 AFM Types of CorporationsDocument47 pagesLec 3 AFM Types of CorporationsJunaidNo ratings yet

- 18bco23c U3Document17 pages18bco23c U3Prasad IyengarNo ratings yet

- LEVERAGEDocument19 pagesLEVERAGEraka1010100% (10)

- Investments 3Document5 pagesInvestments 3Marinel AbrilNo ratings yet

- BW ControversyDocument5 pagesBW ControversyJacquelyn RamosNo ratings yet

- Struktur OrganisasiDocument2 pagesStruktur OrganisasiJulianNo ratings yet

- RTP June 19 AnsDocument27 pagesRTP June 19 AnsbinuNo ratings yet

- CPA 1 Past Paper 1 - Financial AccountingDocument8 pagesCPA 1 Past Paper 1 - Financial AccountingInnocent Won Aber65% (34)

- Restaurant Brands International: Investment BriefDocument4 pagesRestaurant Brands International: Investment BriefrickescherNo ratings yet

- Financial Accounting .2013 PDFDocument317 pagesFinancial Accounting .2013 PDFhalime100% (1)

- CMA Exam: Multiple-Choice Questions HandoutDocument16 pagesCMA Exam: Multiple-Choice Questions HandoutPink MagentaNo ratings yet

- KEYDocument7 pagesKEYMinh Thuy NguyenNo ratings yet

- Organization Chart: © 2014 Holcim LTDDocument1 pageOrganization Chart: © 2014 Holcim LTDSoumik BanerjeeNo ratings yet

- Zimbabwe Stock Exchange Pricelist: 20 June, 2019Document1 pageZimbabwe Stock Exchange Pricelist: 20 June, 2019Research BoyNo ratings yet

- SSA BUS 5111 Financial Management Unit 1 Written Assignment 1Document6 pagesSSA BUS 5111 Financial Management Unit 1 Written Assignment 1Charles Irikefe100% (2)

- Foreign Currency Translation - Modified.aDocument71 pagesForeign Currency Translation - Modified.asamuel debebeNo ratings yet

- Date Payment Interest Principal Present Value: Table of AmortizationDocument6 pagesDate Payment Interest Principal Present Value: Table of AmortizationJekoeNo ratings yet