Professional Documents

Culture Documents

Defi NI TI On, Formula, and Calculator of Contents: Berkshire Hathaway'S Stock Pri

Defi NI TI On, Formula, and Calculator of Contents: Berkshire Hathaway'S Stock Pri

Uploaded by

shoaib zamanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Defi NI TI On, Formula, and Calculator of Contents: Berkshire Hathaway'S Stock Pri

Defi NI TI On, Formula, and Calculator of Contents: Berkshire Hathaway'S Stock Pri

Uploaded by

shoaib zamanCopyright:

Available Formats

WHATI

S SHARE

I

NTRI

NSI

DEFI

NI

C VAL

T

I

UE?

ON,FORMULA,AND CALCULAT

OR

T

ABLE

OFCONT

ENT

S

Too of

ten,especi

all

yintoday’

smar ketenvi

ronment

,thepr

iceofa s

tocki

s 1.I

NTRI

NSI

C VALUEDEFI

NIT

ION

confused wi

ththevalueofa s

tock.

Phi

lFi

sherf

amous l

ysaid,“t

hest

ockmarketisf

il

led wi

thi

ndi

vidual

swho know t

he 2.WHYDO INVEST

ORSAND

pri

ceofeveryt

hing,buttheval

ueofnot

hing.” COMPANIESCAREABOUTTHE

Butwhatexact

lyi

sthei

ntr

ins

icval

ueofa s

tock? I

NTRI

NSI

C VALUE?

3.I

NTRI

NSI

C VALUEEXAMPLES

4.HOW TO CALCULAT

ET HE

I

NTRINSI

C VALUEOFA ST

OCK?

5.I

NTRI

NSI

C VALUE

CALCULAT

OR

6.FREERESOURCES

1

WHATI

SINT

RINSI

C VAL

UE

Theint

rins

icvalueiswhata gi venas setors ecuri

tyi

sactual

lyworth.T

hepriceofa s t

ockisthecos t

youmus tpayto buysuchanas s

et,wher east heint

ri

nsi

cvalueiswhatthatassetisactuall

yworth.

Jus

tbecaus eyoupay$10f ora s har

eofs t

ock,doesnotmeant hatst

ockiswor t

h$10— i tcould be

more,itcoul

d beless.To det

er minethei ntri

nsicval

ueofanas s

et,therear

es everalvaluati

on

methodsyoucoul d use.

WHYDO I

NVESTORSAND COMPANIES

CAREABOUTTHEINT

RINSI

C VAL

UE?

Deter

mini

ng t

heint

ri

nsi

cvalueofanas seti

simpor

tant

becausei

tcanhelpinves

torsr

ecogniz

ewhet hert

he

marketpr

iceofanasseti

sunderval

ued orover

valued.

2

I

nves torssuchasWar renBuffett

,Char li

eMunger ,and

PhilFi

sher,havepopul ari

zed and broughtt othe

for

ef r

ontt heimportanceoff ocusing onval uewhen

Pres

tonPyshandSt

igBroder

senexplai

n i

nves ti

ng.T heval

ueofanas set,inrelati

ont oits

theimport

anceofi

ntr

insi

cval

ueinthis purchas epr i

ce,i

scrucialwheni nvesting becaus eitis

YouTubevi

deo. arguabl ythemos timportantfactorindet ermining the

fut

ur ereturnsofa company.

ST

OCKI

NVEST

ING T

OOL

S

Fi

nd i

nves

tment

syou’

reconf

identi

nwi

thouts

acr

if

ici

ng al

lyourf

reet

ime.

ST

ARTUSI

NG FORFREE

I

NTRI

NSI

C VAL

UE PORTFOLI

O MOMENTUM PRI

CE

CALCUL

ATOR TRACKER NOT

IFI

CATI

ON

3

I

NTRI

NSI

C VAL

UEEXAMPL

ES

Let

’slookatanexampl

e.It’

sa s

impli

sti

cexample,

asthereismor

ecomplexi

tyinr

eal-

wor l

dscenar

ios

,buti

til

lus

trat

est

hepoi

nt.

AssumeI nvestorA buyscompanyABC at$100pers hare,whil

ebel i

evi

ng thecompany’ss

tocki

sworth$500pers hare.

Atthes amet ime,InvestorBbuyscompanyXYZ’sst

ockat$10pers har

ebecaus ether

eisa l

otofhypearound the

st

ock.They’ r

enots urewhatt heybel

ievetheval

uet o be,asther

e’sno consi

der

ati

ongiventotheunderl

ying s

tock’s

value,butsinceitwasonl y$10pershare,i

tmustbe“cheaper ”thancompanyABC and thehypemus tmeant her

e

arepos i

ti

vef utur

er et

urns.

Overthenextfiveyears

,bothinvestorsholdt

heirpos

iti

onsand t

hemar

ketr

epr

icesi

tsel

f,ul

ti

mat

elyr

ever

ti

ng t

o

under

lyi

ng i

ntr

insi

cvalues,asi

thist

oricall

yhas.

I

nvest

orA wasri

ghtwi

ththei

rthesi

s— thecompany’

sst

ockwasact

ual

lywor

th$500pers

har

eand t

radesatt

hat

pri

cefi

veyearsaft

ert

heystar

ted t

hei

rposi

ti

on.

However,I

nvestorBwaswr ong wi

ththei

rthesi

s.CompanyXYZ’sst

ockwasn’tactual

ly“cheaper”thanABC’sst

ocklike

I

nvest

orBt hought.I

nstead,whenal loft

hehypewor eoffand thetr

uebusi

nesspresent

ed it

sel

f,XYZwasonlyworth

$5pershare.Si

milarto companyABC’ sstock,companyXYZ’

sstockwascorrect

lypri

ced overthefi

veyearholdi

ng

per

iod and t

raded at$5pers hare.

Agai

n,thi

sisa s

impl

isti

cexampl ewit

hr ound number s,buti

til

lustr

atestheimport

anceofvalue,and being r

ightabout

t

hevalue.Inves

torA calcul

ated t

hevalueofs tockABC cor r

ect l

yand purchas

ed ata pr

icebelow t

heval ue.While

I

nves

torBgaveno cons ider

ationtotheunder l

ying valueand theref

oreult

imatel

ypurchased aboveit

.Thi

sill

ustr

ates

whyi

ndivi

dualinves

torscareaboutthei ntr

insi

cvalueofas sets.

Whennew i

nvestorsbegi

ninvest

ing i

nthestockmarket

,they’r

ealmostal

waysfocus

ed onthepr i

ce,nottheval

ue.

Thepr

iceofa s

tock,byit

self

,isi

rr

elevant

.Itmustbeconsider

ed i

nrel

ati

ontotheunderl

ying company’sval

ueto

haveanycontext.

WhenI’mspeaking wi

thnew i

nvest

ors

,Iloveto us

ethesetwo companiesasexamples:Ber

kshi

reHat

haway

(

“Ber

kshi

re”)(

Ticker

:BRK.

A)and Snap,Inc.(

“Snap”)(Ti

cker

:SNAP).Ias

knew inves

tors

,whichcompanyischeaper

?

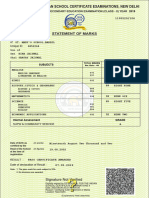

BERKSHI

REHAT

HAWAY’

SST

OCKPRI

CEAND CHART

asoft

hiswr

it

ing

SNAP’

SST

OCKPRI

CEAND CHART

asoft

hiswr

it

ing

Everysi

nglenew i

nves

torthatIhaveas ked thatquesti

onhass ai

d Snap i

s“cheaper

”.T

heiranswerwasdri

venbya

pri

ce-bias

.Theycanclearlyseethatones t

ockcos tsnearl

y$400,000to buy,whi

let

heotheri

sunder$60.I

ftheywer

e

asked whi

chstockcostsl

ess,youcould ar

guet heiransweriscor

rect.

I

tdoescos tl

esst

o buya s

har

eofSnap thanitdoesBerks

hire’

sA s

har

es.ButIwoul

d ar

guethatSnap i

sn’

tnecess

ari

ly

cheaper.Whenwet al

kabout“cheapness”,we’

retal

king aboutt

hepri

ceinrel

ati

ontothevalue.T

heval uei

swhat

matter

s,notthepri

ce.

Pri

ceisirr

elevantwi

thoutcons

ider

ati

onoftheunder

lyi

ng val

uebecaus

eofthewayownershi

pina companyi

sspl

it

.

Let’st

hinkofanentir

ecompanyasa pie,wit

heachpieceoft hepi

eequal

ing a s

har

eofs

tock.

Youcancutup yourf

avorit

eapplepi

ei nt

o 5,8,or20pi eces

,orr

eal l

yanynumberofpiecesyouwant.Butno mat

ter

how manypi

ecesyoucutt hatpi

eint

o,you’ r

el eftwi

ththesameamountofpie.It

’st

hes amewitha company.The

companycanbes pli

tint

o asmany“pieces”,thinkst

ock,asit

’dl

ike,butt

heval

ueoft hecompanydoes n’

tchange.

T

akea companyworth$100.I

fyouspl

iti

tinto 50shar

es,eachs t

ockiswort

h$2pers har

e.However,i

fyouspl

iti

tint

o5

s

hares

,eachstocki

sworth$20.I

nthesecond s cenar

io,t

hes t

ockcosts$20to buy,whereasi

tonl

ycos t

s$2inthefi

rst

s

cenari

o,butt

hevalueofthecompanyi sthes ame— onl yt

hepr i

cehaschanged.

Rel

ated:Podcas

tEpi

sode–I

ntr

ins

icVal

ueAs

ses

smentofBer

kshi

reHat

haway

BUI

LDING AMARKET-BEAT

ING

PORTFOLI

O DOESN’THAVETO BE

AMYST ERY…

wi

thoutt

her

ighti

nves

ti

ngt

ool

s,i

t’

sgoi

ngt

ocos

tyou…

•Al

lyourf

reet

ime •You’

llwonderi

fyour

etur

nsar

easgoodast

heycanbe

•You’

llmi

ssf

indi

nggr

eati

nves

tment

sear

ly •You’

llkeepcat

chi

ngf

all

i

ngkni

ves

•Mi

ssoutont

hous

andsofdol

l

arsi

ninves

tmentr

etur

ns •Youwon’

tknow i

fyou’

rebuyi

ngatt

her

ightpr

ice

Youdon’thavetospendal l

yourtimedoi

ngmanual calculati

ons.

J

oinTI

PF i

nanceandgetever yt

hingyouneedt obecomeas uccessful

inves

tor

whodoes n’

tguessi

ftheyar

ebuyi ngatagoodpr i

ce— you’ l

lactuall

yknow

how t

obuil

dapor t

fol

i

oyou’r

econfidenti

n.

ST

ARTUSI

NG FORFREE

4

HOW TO CALCULATE

THEI

NTRINSI

C VALUEOFA ST

OCK?

Themostcommonwayt

o cal

cul

atea company’

sint

ri

nsi

cval

uei

sto us

ea Di

scount

ed Cas

hFl

ow Model

or“DCFModel

”.

I

fyour

ead Berkshir

eHat haway’smanual ,Buf

fettsays,“Thei ntr

insi

cvaluecanbedef i

ned si

mply.Iti

sthedi scounted

val

ueoft

hecas hthatcanbet akenoutofa bus i

nessdur i

ng itsremaining l

if

e.Asourdef i

nit

ionsuggests,i

ntrins

ic

val

uei

sanes t

imat eratherthana pricefi

gure.And itisdefinit

elyanes timatet hatmustbechanged asi nterestrates

moveorf

orecas torfut

urecas hflowsarerevis

ed.T wo peopl elooking atthes ames etoff

act sal

mos ti

nevitably

comeup wi

ths l

ightl

ydiffer

entint

rins

icvaluefi

gures.”

Whatdoeshemeanby“Cas

hthatcanbet

akenoutoft

hebus

ines

sdur

ing i

tsr

emai

ning l

if

e”?

Buf

fet

twasref

err

ing t

othi

s,“I

fIcoul

dt akeoutal

lthepr

ofi

tthecompany’

sgoi

ng t

o makeoverXnumberofyear

sI’

d

ownit

,how muchwoul dt

hatadd up t

o?”

Hediditfor10yearsintothefutur

eto comparethatamountthathewould coll

ectto whathewoul

d makeof

fofa

zer

o-r

iski

nvest

ment ,whichshould bet

he10-YearTreas

ury.T

hereasonthi

sisa z

ero-

ri

skinvest

menti

sbecausei

tis

backed bytheful

lfai

t hand cr

editoftheUni

ted St

atesGovernment.

Futur

ecashf l

owsmus tbediscounted t

orefl

ectwhatthosecashf

lowsareworthintoday’sdoll

ars

.A dol

larf

iveyears

fr

om now i

snotwor t

ha dollartoday,butwhatisi

tworth?Thedol

larf

iveyear

sfrom now mustbedi s

counted back,

givena di

scountr

ate,to calcul

atewhatit’

sworthtoday.Thes

amehappenswi thcashflows.

T

herearegeneral

lytwo wayst

o cal

cul

atet hei

ntr

ins

icval

ueus

ing t

heDCFmodel

.Let

’sl

ookatbot

hmet

hods

,

s

tar

ti

ng wi

ththediscountr

atemethod f

ir

st.

I

NTRI

NSI

C VAL

UEFORMUL

A:DI

SCOUNTRAT

EMET

HOD

I

nthef

ir

stmet

hod,f

oll

ow t

hes

tepsbel

ow:

1.Youmustforecastwhatyouexpectthecompany’ scashf

lowst

o beoverthenext10year

s;

2.Dis

countallfut

urecashfl

owsbackt ot

oday’spresentval

ueusi

ng di

scountr

ate;

3.Thensum t

hepr esentval

uet

o arr

iveatthei

ntr

insi

cvalue.

We’

llas

sumet

hef

oll

owi

ng cas

hfl

owsf

orCompanyABC:

I

nthi

sexample,Iam going t

o us

e8% asmydi scountr at

e.Thi

sincl

udestheri

sk-f

reerat

eofa 10-YearTr

eas ur

y,aswel

l

asanequit

yri

skpremium.Thiswouldresul

tina presentval

ueofjustabout$830.Remember,t

hisisfort

heent i

re

company,notpershar

e.Youmus tdi

videthet

ot alcompany’svaluebythetotalnumberofsharesoutstanding.

I

fCompanyABC has100s haresouts

tandi

ng,youmustdi

vide$830by100,whichwoul

d meaneachs har

eiswor

th

$8.

30.I

fyoucould buyi

tfor$4-

$5,youmaywantto cons

ideri

t.I

fyoucould onl

ybuyi

tfor$16-

$20,youmaynot

wanttoinves

tini

t.

I

NTRI

NSI

C VAL

UEFORMUL

A:PROBABI

LIST

IC APPROACH

Let

’sl

ookatthesamesit

uati

onusi

ng t

heprobabil

ist

icapproach,whi

chi

sbel

ieved t

o be

Buf

fet

t’sappr

oach.I

nthesecond met

hod,fol

low t

hestepsbelow:

1.Youmus tf

orecastwhatyouexpectt hecompany’ scashfl

owst o beoverthenext10years

;

2.Rathert

handi scounti

ng t

hecashfl

owsbackt othepr es

entvalueus i

ng a di

scountrat

e,

youcanappl ya weighted aver

ageappr oach,ora probabil

is

ticappr oachto eachcashf

low;

3.Thensum thos

eval uesto ar

ri

veatt

hei nt

rins

icvalue.

We’l

lus

ethesamecompanyand cashfl

ow numbersasabove,butadd a pr

obabi

li

typer

cent

age

t

o eachone,bas

ed onhow l

ikel

ywet

hinkeachist

o occur

.

Us

ing t

heabovepr obabi

li

ti

eswouldresul

tina val

uat

ionofabout$848fort

heenti

recompanyofABC.Again,you

woul

d need t

o di

videthetotalcompany’sval

uebythenumberofs har

esouts

tandi

ng t

o ar

ri

veatt

heint

ri

nsi

cvalue

ona per-

shar

ebas i

s.

Anot hervar i

ati

ont othepr obabilist

icappr oachisto choosea Year0cas hfl

ow fi

gur e,ora starti

ng point,t

henappl y

thr

eedi f

ferentgrowthrat estothes tarti

ng cashflow fi

gure,witheachgr owt hrat

ehavi ng a differ

entper cent

chanceofoccur r

ing.Int hi

scase,youwoul dsayint hebest-cases cenario,Iexpectt hecompanyt o grow at10% per

yearand t here’sa 30% thathappens .Inthemos tli

kelyscenario,thecompanywi lll

ikel

ygr ow at5% peryearand

there’sa 50% chancet hatoccur s.Int hewor st

-cases cenari

o,thecompanywon’ tgr ow atall,witha 0% growthrate,

and a 20% chanceofoccur ri

ng.Youwoul dthencal cul

atethewei ghted averageofeachs cenar i

o and arr

iveatthe

i

ntri

ns i

cvalue.T hi

sappr oachi sver ys i

mi l

artothes econd scenario wel ooked atabove,i tisjusta sl

ightl

ydiffer

ent

appr oacht o applyi

ng probabi l

it

iest of utur

ecas hflows.

I

NTRINSI

C VALUE

5

CALCULATOR

6

RESOURCES

I

nourTIPFi

nancet ool,wehavea ver ysi

mple-to-

usecalculatort

hatall

owsyouto cal

cul

ate

t

heint

ri

nsicvalueofa stock,and s

eeyourpot enti

alr

eturnsifyoupurchas

ed att

oday’spri

ce.

I

tus

esthes econd pr

obabi l

is

ticapproachthatwedi s

cussed above.

I

NTRI

NSIC VAL

UE PORT

FOLI

O MOMENTUM &PRI

CE

CALCULATOR T

RACKER NOT

IFI

CATION

Ourcal

cul

atormakesi

t Nomor espreadsheetsand Nevermi s

soneofyour

easi

ert

hanevert

ofind usi

ngmul t

ipl

eplatf

orms, i

nvestmentoppor t

uni

ti

es

t

hetr

ueval

ueofas t

ock. tr

ackyourentir

estock again,getnoti

fi

edwhen

port

fol

i

oandi tsr

eturns thepriceormoment um

ri

ghtinTI

PF i

nance. changes.

ST

ARTUSI

NG FORFREE

I

fyouwouldli

ketoseea stockval

uat

iontakeplaceli

veusi

ng ani

ntr

ins

icval

uecal

cul

ator

,youcans

eea val

uat

ion

ofAut

oZone,I

nc.here,oryoucanals

o watchthevideo:

Asyoumovef orward asaninves

tor

,Ichallengeyoutorememberand cons

iderwhatPhilFi

shers

aid,“T

hes

tock

marketi

sfi

ll

ed wit

hindivi

dualswho know t

hepriceofever

ythi

ng,butt

hevalueofnothi

ng. ”

Wi

thmor

econt

ent

,feat

ures

,andupdat

esaddedr

egul

arl

y!

SUBSCRI

BING T

OTIPFINANCEI

S

ASEASYAS1,2,3…

1 2 3

GETACCESS MASTERSTOCK GROW YOUR

Subscri

beforjus

t ANALYSI

S PORTF

OL I

O

$47/mont htogetful

l Thr

eemaj orpartsofstock Youdon’thavet ol

eaveit

accesstoallourst

ock analys

isarecal cul

at i

ngit

s uptochance.Youjust

i

nvest

ingtools

.Cancel i

ntri

nsicvalue, needagui de.Getacces s

anyt

ime. understandingt he t

oTIPFandfeelconf

ident

f

inancial

s,andknowi ngit

s t

hatyourport

fol

iowil

lgrow.

moment um.T IPFinance

helpsyoumat erthem all

.

ST

ARTUSI

NG FORFREE

SHARE

You might also like

- Competency Model v4Document157 pagesCompetency Model v4shanmuga8992% (12)

- Bitch Planet Vol. 1: Extraordinary MachineFrom EverandBitch Planet Vol. 1: Extraordinary MachineRating: 4.5 out of 5 stars4.5/5 (11)

- AC72063 AFM PT 5 Tactics For Stability PDFDocument198 pagesAC72063 AFM PT 5 Tactics For Stability PDFKebede Michael100% (2)

- Do This FirstDocument4 pagesDo This FirstYarod EL93% (15)

- What Is Intrinsic ValueDocument5 pagesWhat Is Intrinsic Valuemichalmarko.zi99No ratings yet

- Final Ud SheetsDocument28 pagesFinal Ud Sheetskshitij sarafNo ratings yet

- Evaluating A Business For Facebook Advertising ScorecardDocument1 pageEvaluating A Business For Facebook Advertising ScorecardmuscdalifeNo ratings yet

- Business EvaluationDocument1 pageBusiness Evaluationzakaria zakariyaNo ratings yet

- Welding Inspection ReportDocument2 pagesWelding Inspection Reportsharif1974No ratings yet

- Ta CovidDocument1 pageTa CovidMark Jhun CalimpongNo ratings yet

- ARE YOU OUR Next I NternDocument1 pageARE YOU OUR Next I NternAnand YamarthiNo ratings yet

- Millennium ParkDocument1 pageMillennium Parklastreef2004No ratings yet

- Sscer 196852264Document1 pageSscer 196852264Anshu JaiswalNo ratings yet

- Mashal Saghi R: Graphi C Desi GnerDocument1 pageMashal Saghi R: Graphi C Desi GnerMishaal SaghirNo ratings yet

- Architecture Portfolio ...Document12 pagesArchitecture Portfolio ...HIMANSHU MAGANTINo ratings yet

- CB Case Study 1Document1 pageCB Case Study 1Sanjana SudeepNo ratings yet

- Concept: F Unct I ON Compone NT S & Combi NAT I ON Possi BL I T I E SDocument5 pagesConcept: F Unct I ON Compone NT S & Combi NAT I ON Possi BL I T I E SGopi KrishnaNo ratings yet

- Sia Door SupervisorDocument1 pageSia Door Supervisorxantrix10000No ratings yet

- Flyer3 30 11Document1 pageFlyer3 30 11KirstieNo ratings yet

- WhizDocument1 pageWhizpoornimaNo ratings yet

- Created TO Inspire AN Exceptional Performance: 1. 2L VVT Petrol Engine NEW Dualjet, Dual VVT EngineDocument1 pageCreated TO Inspire AN Exceptional Performance: 1. 2L VVT Petrol Engine NEW Dualjet, Dual VVT EngineSANJAY K R NairNo ratings yet

- The Talent and Psionics - SheetDocument2 pagesThe Talent and Psionics - SheetKaz CentenoNo ratings yet

- Education Internships: Comput Er Engi Neer I NG GR Aduat eDocument1 pageEducation Internships: Comput Er Engi Neer I NG GR Aduat eChachito12345No ratings yet

- Volumetric Analysis & Acid-Base TitrationDocument3 pagesVolumetric Analysis & Acid-Base TitrationKyle Del FrancoNo ratings yet

- FX Carbon Brazi NG Steeri NG Wheel User Manual (Versi ON V1. 1)Document16 pagesFX Carbon Brazi NG Steeri NG Wheel User Manual (Versi ON V1. 1)Joe RamiroNo ratings yet

- Curri Culumvi TAE: Ki R Ansal Unkhe5471@gmai L - ComDocument2 pagesCurri Culumvi TAE: Ki R Ansal Unkhe5471@gmai L - ComKiran Ganpati SalunkheNo ratings yet

- Weld Inspection Report: CC Ep T R Ej Ec TDocument2 pagesWeld Inspection Report: CC Ep T R Ej Ec TSanofar ShamsudeenNo ratings yet

- Anshi Kami Shra: Phone +8602241357 Emai LDocument2 pagesAnshi Kami Shra: Phone +8602241357 Emai LAvanshika MishraNo ratings yet

- Anshi Kami Shra: Phone +8602241357 Emai LDocument2 pagesAnshi Kami Shra: Phone +8602241357 Emai LAvanshika MishraNo ratings yet

- Kali Ngastateuni Versi TY: Collegeofengi Neeri Ngandi Nformati Ontechnology Theoryofstructures2ModuleDocument17 pagesKali Ngastateuni Versi TY: Collegeofengi Neeri Ngandi Nformati Ontechnology Theoryofstructures2ModuleMarvin LopezNo ratings yet

- EVT ITCC RecruitmentOpenHouseDocument1 pageEVT ITCC RecruitmentOpenHouseABHISHEK BHATNAGARNo ratings yet

- Apphb17a0603b EN Web PDFDocument122 pagesApphb17a0603b EN Web PDFRicardo Palafox MejiaNo ratings yet

- Sustainable CityDocument1 pageSustainable CityAyesha RifaqatNo ratings yet

- Bulletin Edesu April 2023Document5 pagesBulletin Edesu April 2023Fikri HidayatNo ratings yet

- Pallavi Content WriterDocument2 pagesPallavi Content WriterSandeep TekkaliNo ratings yet

- 4Sem-Mini-Porject Synopsis - 1NH20CS303Document2 pages4Sem-Mini-Porject Synopsis - 1NH20CS303Ahmad RazaNo ratings yet

- Performance Evaluati ON Tools FOR Sustai Nable BUI LDI NGS: Chai RDocument2 pagesPerformance Evaluati ON Tools FOR Sustai Nable BUI LDI NGS: Chai RAshlin AarthiNo ratings yet

- GT4 Carbon Brazi NG Steeri NG Wheel User Manual (Versi ON V1. 1)Document20 pagesGT4 Carbon Brazi NG Steeri NG Wheel User Manual (Versi ON V1. 1)Joe RamiroNo ratings yet

- Asphalt EneDocument11 pagesAsphalt EnealiNo ratings yet

- System Integration and Architecture FinalDocument36 pagesSystem Integration and Architecture FinalJOGIET ICMNo ratings yet

- PL Ateno:Aa48593: OfficialreceiptDocument1 pagePL Ateno:Aa48593: OfficialreceiptLyka Marie TernolaNo ratings yet

- Difference Between Financial Accounting and Management AccountingDocument2 pagesDifference Between Financial Accounting and Management AccountingZoha AdilNo ratings yet

- Derek Vigil: Skills ExperienceDocument1 pageDerek Vigil: Skills Experienceapi-27441505No ratings yet

- TC003Document1 pageTC003r.karthidbtechNo ratings yet

- THEORY Rubric 2018-2019Document6 pagesTHEORY Rubric 2018-2019Romualdo ChurchlouieNo ratings yet

- Education Internships: Comput Er Engi Neer I NG GR Aduat eDocument1 pageEducation Internships: Comput Er Engi Neer I NG GR Aduat eChachito12345No ratings yet

- TheraCOm Infographics Group6 MARIANO AlessandraDocument1 pageTheraCOm Infographics Group6 MARIANO AlessandraAlessandra Dominique MarianoNo ratings yet

- NDIPZIOYX Piera GIACHEDocument1 pageNDIPZIOYX Piera GIACHERaihan KhairyNo ratings yet

- Three Moment Equation FormulasDocument4 pagesThree Moment Equation FormulasMarvin LopezNo ratings yet

- CONCEPTDocument1 pageCONCEPTGayathri KathiravanNo ratings yet

- Aluminum Ladder Flyer 03.30Document1 pageAluminum Ladder Flyer 03.30viksursNo ratings yet

- Smart gateway-ENDocument2 pagesSmart gateway-ENKrishna DewataNo ratings yet

- PGDIM PGDSM Admission Brochure 2021 - 0Document41 pagesPGDIM PGDSM Admission Brochure 2021 - 0Evan ReignsNo ratings yet

- TBT Basic Principles of Temp WorksDocument2 pagesTBT Basic Principles of Temp WorksFrancine MagninNo ratings yet

- Williamskenzel ResumeDocument1 pageWilliamskenzel Resumeapi-542423116No ratings yet

- Cis PDFDocument4 pagesCis PDFSam FernandeNo ratings yet

- FX Pro - User ManualDocument16 pagesFX Pro - User ManualJoe RamiroNo ratings yet

- Top 5Document1 pageTop 5mk4141No ratings yet

- NOFRNCompetencies Updated March2016 PDFDocument63 pagesNOFRNCompetencies Updated March2016 PDFamandeep kaurNo ratings yet

- ACE37 Oct90Document172 pagesACE37 Oct90lerainlawlietNo ratings yet

- CLNT Server ConnectionDocument3 pagesCLNT Server ConnectionKalegzer SisayNo ratings yet

- Technical Data Sheet Gardoclean A 5722Document2 pagesTechnical Data Sheet Gardoclean A 5722Christian del CastilloNo ratings yet

- Promotion of Climate-Friendly Cooking Bangladesh Kenya and SenegalDocument29 pagesPromotion of Climate-Friendly Cooking Bangladesh Kenya and SenegalNorma Arisanti KinasihNo ratings yet

- Tesla Coil Instruction DiyDocument7 pagesTesla Coil Instruction Diydmj90464100% (1)

- 13 - Digital Controller DesignDocument22 pages13 - Digital Controller DesignEverton CollingNo ratings yet

- Review of Literature: 2.1 Risk PerceptionDocument31 pagesReview of Literature: 2.1 Risk PerceptionTrixNo ratings yet

- 12V - 37 V ConverterDocument1 page12V - 37 V ConverterTspi RitzelNo ratings yet

- English Proverbs With Hindi Meaning Starting With HDocument6 pagesEnglish Proverbs With Hindi Meaning Starting With Habhishek kunalNo ratings yet

- Mark Fisher - What Is HauntologyDocument10 pagesMark Fisher - What Is Hauntologychuazinha100% (2)

- 04443720AA Masterpact NW User ManualDocument1 page04443720AA Masterpact NW User ManualdaywalkeryNo ratings yet

- A Field Guide To Assessing Creative Thinking in Schools - March2022Document88 pagesA Field Guide To Assessing Creative Thinking in Schools - March2022sagheer ahmadNo ratings yet

- Transportation Chapter 3Document17 pagesTransportation Chapter 3Tuan NguyenNo ratings yet

- Compressor Performance TestDocument13 pagesCompressor Performance Testdhanu_aqua100% (1)

- Lisa Mullen MSA Seminar PaperDocument6 pagesLisa Mullen MSA Seminar PaperRaluca BibiriNo ratings yet

- 1 HR Research Report Mba Sem 4Document55 pages1 HR Research Report Mba Sem 4Priyanka YaduvanshiNo ratings yet

- IDC MinutesDocument30 pagesIDC MinutesANAND SHARMANo ratings yet

- Diesel Fuel Shutoff ValveDocument2 pagesDiesel Fuel Shutoff ValveAlejandroMuñozNo ratings yet

- DinoGenics RulebookDocument16 pagesDinoGenics RulebookstetsonNo ratings yet

- The Marcus Device ControversyDocument8 pagesThe Marcus Device ControversyaasdasNo ratings yet

- Kennedy Teaching PhilosophyDocument2 pagesKennedy Teaching PhilosophyAngela KennedyNo ratings yet

- QM TablesDocument31 pagesQM TablesmansurskNo ratings yet

- Beach Mineral 109MN0585 PDFDocument66 pagesBeach Mineral 109MN0585 PDFmanipalaniusaNo ratings yet

- BT1 - Đề TADocument4 pagesBT1 - Đề TA2157011009No ratings yet

- EN1994 2 KuhlmannDocument108 pagesEN1994 2 KuhlmannJoão Duarte CanhaNo ratings yet

- MSTK 10d - Key Data Entry - Data Access ConsiderationsDocument2 pagesMSTK 10d - Key Data Entry - Data Access ConsiderationsNaveed UllahNo ratings yet

- ReadmeDocument3 pagesReadmeArslan AjmalNo ratings yet

- Msmbau 09 HRFN 1 QRD 0 GWDocument42 pagesMsmbau 09 HRFN 1 QRD 0 GWВладимир МиховNo ratings yet

- Scada Pro - 7 - Example - Masonry - Ec8 - EN PDFDocument47 pagesScada Pro - 7 - Example - Masonry - Ec8 - EN PDFrelu59No ratings yet

- Nineteenth Century English Novel - Week 4Document21 pagesNineteenth Century English Novel - Week 4Mustafa CANLINo ratings yet