Professional Documents

Culture Documents

Law MCQ

Uploaded by

priyal0 ratings0% found this document useful (0 votes)

32 views8 pageslaw mcq q

Original Title

law mcq

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentlaw mcq q

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views8 pagesLaw MCQ

Uploaded by

priyallaw mcq q

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

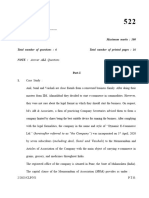

Test Series: March, 2022

MOCK TEST PAPER 1

INTERMEDIATE: GROUP – I

PAPER – 2: CORPORATE AND OTHER LAWS

Division A is compulsory

In Division B, Question No.1 is compulsory

Attempt any Three questions out of the remaining Four questions

Time Allowed – 3 Hours Maximum Marks – 100

Division A (30 Marks)

I. Sourabh Publishers Ltd., a listed entity, passed a resolution in its Board meeting for appointment of Jain

& Jain, a Chartered Accountants firm, as Statutory Auditor of the company. The company obtained t he

consent in writing from Jain & Jain and also placed this recommendation before the general meeting of

the shareholder and got it approved.

The company thereafter informed the CA Firm about their appointment and also filed a notice of

appointment with the Registrar of Companies within the prescribed time.

Jain & Jain, Chartered Accountants firm is having 3 partners namely, Mridula Jain, Shyamla Jain, Parul

Jain. In this firm Mayank Jain and Shashank Jain were associates and were being paid on case-to-case

basis and not on fixed salary.

Prior to the appointment of Jain & Jain, the previous auditor was Agrawal Jain & Associates. In this CA

firm there were 6 partners namely, Prashant Agrawal, Vikas Agrawal, Vishal Agrawal, Vyom Agrawal,

Mayank Jain and Shashank Jain.

Mayank Jain and Shashank Jain were common persons in both the firms.

While working with Sourabh Publishers Ltd., Jain & Jain started facing a lot of issues with the

management of the company. After sometime, due to these disputes with the management, Jain & Jain

resigned from the company.

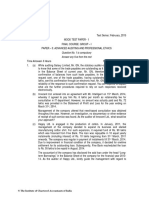

Multiple Choice Questions [3 MCQs of 2 Marks each: Total 6 Marks]

1. The newly appointed CA Firm (Jain & Jain) and retiring CA Firm (Agrawal Jain & Associates) have

common persons i.e., Mayank Jain and Shashank Jain. Whether the appointment of Jain & Jain in

Sourabh Publishers Ltd. is valid as per the provisions of the Companies Act, 2013:

(a) It not valid since both the CA Firms (New and Old) have common persons

(b) Mayank Jain and Shashank Jain are the associates in Jain & Jain and not the partners, hence

appointment of Jain & Jain, is valid

(c) Jain & Jain should expel Mayank Jain and Shashank Jain in order to retain its appointment

(d) Agrawal Jain & Associates should expel Mayank Jain and Shashank Jain

2. What would have been the position if, Mayank Jain and Shashank Jain are partners in Jain & Jain:

(a) The position will remain same as MCQ 1 above

(b) There shall be no change and the Jain & Jain may continue as audit firm

(c) The appointment of Jain & Jain would not have been in terms of the provisions of the

Companies Act, 2013

(d) The company may obtain permission from the shareholders in the general meeting by way of

Special Resolution for continuation of appointment of Jain & Jain

1

© The Institute of Chartered Accountants of India

3. In the given case, Jain & Jain due to some dispute with the management on some issues resigned

from the company. Choose the correct option in respect to filling of this vacancy:

(a) Jain & Jain cannot resign and has to hold the office till the conclusion of the next annual

general meeting

(b) The resignation is tendered by the auditor, the Board of Directors shall appoint new auditor

within 30 days and such appointment shall also be approved by the shareholders in the

general meeting within 3 months of the recommendation of the Board

(c) This vacancy of auditor can be filled by the shareholders in consultation of the Central

Government

(d) This vacancy of auditor can be filled by the Board of Directors in consultation of the

Comptroller and Auditor-General of India

II. Rupesh took a house loan of ` 80 lakhs from Best Bank Ltd. While granting the house loan, the bank

insisted to provide a guarantee. Rupesh’s neighbour, Mithun gave the guarantee for such housing loan.

Rupesh also purchased a life insurance policy on his life from A-One Life Insurance Company Ltd., for

a sum assured of ` 1 crore for a policy term of 20 years. He paid the first premium to the insurance

company. This policy was purchased by Rupesh in order to protect his family, in case of untimely death

of Rupesh. Rupesh made nomination of the policy in favour of Archana, his wife.

After some time Rupesh’s business started running into losses and he was not able to pay the

instalments of housing loan to the bank. As a result, his loan account was classified by the bank as Non -

Performing Asset (NPA) and the bank initiated to recover its pending dues. The Bank first sent the

reminder letters/ mails to both the borrower and his guarantor and thereafter a legal notice was served.

Even after notices, when the loan account was not regularised, the bank filed a suit in Debt Recovery

Tribunal (DRT) against the guarantor. The guarantor objected and asked the bank to first get it recover ed

from the borrower and if the borrower does not pay, then only the guarantor will be liable to pay. But the

bank continued to follow up the matter in DRT and ultimately the decree was passed in favour of the

Bank to recover the dues from the guarantor.

Bank recovered entire outstanding loan from the guarantor as per the decree. Now the guarantor filed

a suit against Rupesh to pay the amount, which he paid to the bank. Mithun also requested to the court

to provide the possession and ownership of the house, if Rupesh is not able pay such amount.

Meanwhile, Rupesh met with an accident and died on the spot. Claim was lodged by his wife and the

insurance company paid the sum assured along with bonus amount to Archana (nominee of the

deceased). Archana paid the amount to Mithun, which had been paid by Mithun to the bank in discharge

of his guarantee and settled down all the issues.

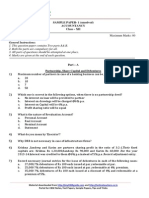

Multiple Choice Questions [2 MCQs of 2 Marks each: Total 4 Marks]

4. In the given case, who is discharging the liability of a third person in case of his default in relation

to the contract of guarantee?

(a) Mithun

(b) Rupesh

(c) Archana

(d) The Bank

© The Institute of Chartered Accountants of India

5. What is the consideration in case of contract between Mithun and the Bank?

(a) Promise made for the benefit of the principal debtor to avail loan on the guarantee of the

surety

(b) In contract of guarantee, there is no consideration involved between surety and the creditor

(c) Mithun can freely utilise the house

(d) Any past consideration

6. Kamya Ltd. is incorporated on 3 rd January, 2021. As per the Companies Act, 2013, what will be the

financial year for the company:

(a) 31st March, 2021

(b) 31st December, 2021

(c) 31st March, 2022

(d) 30th September, 2022 (2 Marks)

7. As per the provisions of the Companies Act, 2013, which of the following statement is correct with

respect to the surplus arising out of the CSR activities:

(a) The surplus cannot exceed five percent of total CSR expenditure of the company for the

financial year.

(b) The surplus shall not form part of the business profit of a company

(c) The surplus cannot exceed 10 percent of total CSR expenditure of the company for the

financial year.

(d) The surplus shall form part of the business profit of a company (1 Mark)

8. Birthday Card Limited, a listed company can appoint or re-appoint, Mishra & Associates (a firm of

Chartered Accountants), as their statutory auditors for:

(a) One year only

(b) One term of 3 consecutive years only

(c) One term of 4 consecutive years only

(d) Two terms of 5 consecutive years (1 Mark)

9. Vinod is a director of Prem Limited. He intends to participate in the board meeting through video

conferencing and has intimated the same to the chairperson at the beginning of calendar year.

Advise, Vinod for how long such declaration shall be valid.

(a) 1 month

(b) 6 month

(c) 1 year

(d) She has to furnish declaration for each meeting separately (1 Mark)

10. An interest or lien created on the property or assets of a company or any of its undertakings or

both as security is known as:

(a) Debt

3

© The Institute of Chartered Accountants of India

(b) Charge

(c) Liability

(d) Hypothecation (1 Mark)

11. Awareness Limited’s General Meetings are held at its registered office situated in Delhi. The minute

book of General meetings of Awareness Limited will be kept at:

(a) That place where members of Awareness Limited will decide.

(b) That place where all employees of Awareness Limited will decide.

(c) Registered office of Awareness Limited.

(d) That place where senior officials of Awareness Limited will decide. (1 Mark)

12. Shares issued by a company to its directors or employees at a discount or for a consideration other

than cash for their providing know-how or making available rights in the nature of intellectual

property rights or value additions, by whatever name called are known as:

(a) Equity Shares

(b) Preference Shares

(c) Sweat Equity Shares

(d) Redeemable preference shares (1 Mark)

13. The time limit within which a copy of the contract for the payment of underwriting commission is

required to be delivered to the Registrar is:

(a) Three days before the delivery of the prospectus for registration

(b) At the time of delivery of the prospectus for registration

(c) Three days after the delivery of the prospectus for registration

(d) Five days after the delivery of the prospectus for registration (1 Mark)

14. Goals Limited, a listed company has authorised share capital of ` 25,00,000 (issued, subscribed

and paid up capital of ` 20,00,000). The company has planned to buy back shares worth

` 10,00,000. What is the maximum amount of equity shares that the company is allowed to buy

back based on the total amount of equity shares?

(a) ` 2,00,000

(b) ` 5,00,000

(c) ` 6,25,000

(d) ` 8,00,000 (2 Marks)

15. Fin Limited is accepting deposits of various tenures from its members from time to time. The current

Register of Deposits, maintained at its registered office is complete. State the minimum period for

which it should mandatorily be preserved in good order.

(a) Four years from the financial year in which the latest entry is made in the Register.

(b) Six years from the financial year in which the latest entry is made in the Register.

(c) Eight years from the financial year in which the latest entry is made in the Register.

4

© The Institute of Chartered Accountants of India

(d) Ten years from the latest date of entry. (1 Mark)

16. According to the ___________, the words of the statute are to be given their plain and ordinary

meaning. —

(a) Literal rule

(b) golden rule

(c) natural rule

(d) mischief rule (1 Mark)

17. When there is a conflict between two or more statues or two or more parts of a statute then which

rule is applicable:

(a) Welfare construction

(b) Strict construction

(c) Harmonious construction

(d) Mischief Rule (1 Mark)

18. As per the provisions of the General Clauses Act, 1897, where an act or omission constitutes an

offence under two or more enactments, then the offender shall be liable to be prosecuted and

punished under:

(a) Under either or any of those enactments

(b) Twice for the same offence

(c) Either (a) or (b) as per the discretion of the court

(d) Under the cumulative effect of both the enactments (1 Mark)

19. Where an act of parliament does not expressly specify any particular day as to the day of coming

into operation of such Act, then it shall come into operation on the day on which :

(a) It receives the assent of the President

(b) It receives the assent of the Governor General

(c) It receives assent of both the houses of Parliament

(d) It receives assent of the Prime Minister (1 Mark)

20. The date of maturity of a bill payable hundred days after sight and which is presented for sight on

4th May, 2021, is:

(a) 13 August, 2021

(b) 14 August, 2021

(c) 15 August, 2021

(d) 16 August, 2021 (2 Marks)

21. The Rule in Heydon’s case is also known as—

(a) Purposive construction

(b) Mischief Rule

5

© The Institute of Chartered Accountants of India

(c) Golden Rule

(d) None of the Above (1 Mark)

22. Pick the odd one out of the following aids to interpretation—

(a) Preamble

(b) Marginal Notes

(c) Proviso

(d) Usage (1 Mark)

Division B (70 Marks)

1. (a) Kapila Limited issued equity shares of ` 1,00,000 (10,000 shares of ` 10 each) on 01.04.2021

which have been fully subscribed, whereby Kusha Limited holds 4000 shares and Prem Limited

holds 2000 shares in Kapila Limited. Kapila Limited is also holding 20% equity shares of Red

Limited before the date of issue of equity shares stated above. Red Limited controls the

composition of Board of Directors of Kusha Limited and Prem Limited from 01.08.2021. Examine

with relevant provisions of the Companies Act, 2013:

(i) Whether Kapila Limited is a subsidiary of Red Limited?

(ii) Whether Kapila Limited can hold shares of Red Limited? (6 Marks)

(b) Advise as per the provisions of the Companies Act, 2013, with regard to appointment of auditor:

(i) Mr. Shepra is a practising Chartered Accountant. He holds shares in X Limited. The nominal

value of these shares is ` 50,000. Whether X Limited can appoint Mr. Shepra as auditor?

(ii) Mr. Showik, a practising Chartered Accountant has business relationship with Primus Hotels

Limited. The hotel used to provide services to Mr. Showik frequently, on the same price as

charged from other customers. Whether Primus Hotels Limited can appoint Mr. Showik as its

auditor? (6 Marks)

(c) Anay bailed 100 kg of high quality sugar to Saksham, who owned a kirana shop, promising to give

` 800 at the time of taking back the bailed goods. Saksham’s employee, unaware of this, mixed

the 100 kg of sugar belonging to Anay with the sugar in the shop and packaged it for sale when

Saksham was away. This came to light only when Anay came asking for the sugar he had bailed

with Saksham, as the price of the specific quality of sugar had trebled. What is the remedy available

to Anay, as per the provisions of the Indian Contract Act, 1872? (4 Marks)

(d) Discuss with reasons, whether the following persons can be called as a ‘holder’ under the

Negotiable Instruments Act, 1881:

(i) Madan was going to office through metro rail. He found a cheque payable to bearer, on the

floor of coach number 6 and retains it.

(ii) Preeti, the agent of Mr. Rajesh, is entrusted with an instrument without indorsement by

Mr. Rajesh, who is the payee. (3 Marks)

2. (a) Examine the validity of the following statements in respect of Annual General Meeting (AGM) as

per the provisions of the Companies Act, 2013:

(i) The first AGM of a company shall be held within a period of six months from the date of closing

of the first financial year.

© The Institute of Chartered Accountants of India

(ii) The Registrar may, for any special reason, extend the time within which the first AGM shall

be held. (4 Marks)

(b) Aura Ltd. is a listed company having a paid-up share capital of ` 25 crore as at

31st March, 2021 and turnover of ` 100 crore during the financial year 2020-21. The Company

Secretary has advised the Board of Directors that Aura Ltd. is not required to appoint 'Internal

Auditor' as the company's paid up share capital and turnover are less than the threshold limit

prescribed under the Companies Act, 2013. Do you agree with the advice of the Company

Secretary? Explain your view referring to the provisions of the Companies Act, 2013. (6 Marks)

(c) Shiva appoints Ganesh as Shiva's agent to sell Shiva's land. Ganesh, under the authority of Shiva,

appoints Gauri as agent of Ganesh. Afterwards, Shiva revokes the authority of Ganesh but not of

Gauri. What is the status of agency of Gauri? Advise whether the said agency shall be terminated

as per the provisions of the Indian Contract Act, 1872. (4 Marks)

(d) What are the essential characteristics of Negotiable Instruments. (Write any five) (3 Marks)

3. (a) Swati Limited is intending to issue its securities on private placement basis. Explain to the directors

of the company, the provisions of the Companies Act, 2013, on the following matters:

(i) Meaning of Private Placement

(ii) ‘Time Limit for Allotment of Securities’ and ‘repayment of application money in case of default

in allotment.’ (5 Marks)

(b) The Board of Directors of Mines Limited, a listed company appointed Mr. Guru, Chartered

Accountant as its first auditor within 30 days of the date of registration of the company to hold office

from the date of incorporation to conclusion of the first Annual General Meeting (AGM). At the first

AGM, Mr. Guru was re-appointed to hold office from the conclusion of its first AGM till the

conclusion of 6th AGM. In the light of the provisions of the Companies Act, 2013, examine the

validity of appointment/ reappointment in the following cases:

(i) Appointment of Mr. Guru by the Board of Directors.

(ii) Re-appointment of Mr. Guru at the first AGM in the above situation. (5 Marks)

(c) A bill of exchange is drawn by ‘A’ in Berkley where the rate of interest is 15% and accepted by ‘B’

payable in Washington where the rate of interest is 6%. The bill is indorsed in India and is

dishonoured. An action on the bill is brought against ‘B’ in India.

Advise as per the provisions of the Negotiable Instruments Act, 1881, what rate of interest ‘B’ is

liable to pay? (4 Marks)

(d) Write short note on:

(i) Proviso

(ii) Explanation,

with reference to interpretation of Statutes, Deeds and Documents. (3 Marks)

4. (a) (i) "The offer of buy-back of its own shares by a company shall not be made within a period of

six months from the date of the closure of the preceding offer of buy-back, if any and cooling

period to make further issue of same kind of shares including allotment of further shares shall

be a period of one year from the completion of buy back subject to certain exceptions."

Examine the validity of this statement by explaining the provisions of the Companies Act,

2013 in this regard. (3 Marks)

© The Institute of Chartered Accountants of India

(ii) ABC Limited proposes to issue series of debentures frequently within a period of one year to

raise the funds without undergoing the complicated exercise of issuing the prospectus every

time of issuing a new series of debentures. Examine the feasibility of the proposal of ABC

Limited having taken into account the concept of deemed prospectus dealt with under the

provisions of the Companies Act, 2013. (3 Marks)

(b) The Promoters of Green Limited contributed in the form of unsecured loan to the company in

fulfilment of the margin money requirements stipulated by State Industries Development

Corporation Ltd. (SIDCL) for granting loan. In the light of the provisions of the Companies Act,

2013 and Rules made thereunder whether the unsecured loan will be regarded as Deposit or not ?

(4 Marks)

(c) Examine the validity of the following statements with reference to the General Clauses Act, 1897:

(i) ‘Things attached to the earth’ have been held to be immovable property.

(ii) The word "bullocks" could be interpreted to include "cows". (4 Marks)

(d) “Associate words to be understood in common sense manner.” Explain this statement with

reference to rules of interpretation of statutes. (3 Marks)

5. (a) Gully Gilli Danda Club was formed as a Limited Liability Company under section 8 of the

Companies Act, 2013 with the object of promoting Gilli Danda by arranging introductory courses at

district level and friendly matches. The club has been earning surplus. Of late, the affairs of the

company are conducted fraudulently and dividend was paid to its members. Mr. A, a member

decided to make a complaint with Regulatory Authority to curb the fraudulent activities by cancelling

the licence given to the company.

(i) Is there any provision under the Companies Act, 2013 to revoke the licence? If so, state the

provisions.

(ii) Whether the company may be wound up?

(iii) Whether the Gully Gilli Danda Club can be merged with Stick Private Limited, a company

engaged in the business of networking? (5 Marks)

(b) A Ltd. held its Annual General Meeting on September 15, 2021. The meeting was presided over

by Mr. B, the Chairman of the Company's Board of Directors. On September 17, 2021, Mr. B, the

Chairman, without signing the minutes of the meeting, left India to look after his father who fell sick

in London. Referring to the provisions of the Companies Act, 2013, state the manner in which the

minutes of the above meeting are to be signed in the absence of Mr. B and by whom? (5 Marks)

(c) Enumerate the following as per the provisions of the Indian Contract Act, 1872:

(i) Meaning of contract of guarantee

(ii) Parties to a contract of guarantee. (4 Marks)

(d) "The act done negligently shall be deemed to be done in good faith."

Comment with the help of the provisions of the General Clauses Act, 1897. (3 Marks)

© The Institute of Chartered Accountants of India

You might also like

- Bills of Exchange Act 1882Document43 pagesBills of Exchange Act 1882Kai Norman100% (28)

- Business phrases email lettersDocument5 pagesBusiness phrases email lettersSumit SharmaNo ratings yet

- Lodge Officers Duties of The LodgeDocument2 pagesLodge Officers Duties of The LodgeKeny DrescherNo ratings yet

- Articles of Incorporation SampleDocument7 pagesArticles of Incorporation SampleJubert DimakataeNo ratings yet

- Business Law IIDocument7 pagesBusiness Law IIGrace Law0% (1)

- GPSA Engineering Data Book 14th Edition: Revision Date Reason (S) For RevisionDocument15 pagesGPSA Engineering Data Book 14th Edition: Revision Date Reason (S) For RevisionAsad KhanNo ratings yet

- Sample Accounting Issues Memo 1 - Gross Vs NetDocument4 pagesSample Accounting Issues Memo 1 - Gross Vs NetAnkit MrCub Patel100% (1)

- Continuing Airworthiness Management ExpositionDocument6 pagesContinuing Airworthiness Management ExpositionbudiaeroNo ratings yet

- Nov 23 MTP-1 (Q)Document8 pagesNov 23 MTP-1 (Q)luciferNo ratings yet

- MTP LAW IIDocument11 pagesMTP LAW IIAbhishant KapahiNo ratings yet

- May 2023Document7 pagesMay 2023Bharadwaj NdNo ratings yet

- Prospectus, Meetings & Dividend Question Paper - 1223261 - 2024 - 01 - 22 - 00 - 53Document2 pagesProspectus, Meetings & Dividend Question Paper - 1223261 - 2024 - 01 - 22 - 00 - 53Anjali SomaniNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument17 pages© The Institute of Chartered Accountants of IndiaFentorNo ratings yet

- Model Test Papers Accounts Class 12Document171 pagesModel Test Papers Accounts Class 12Ruchi AgarwalNo ratings yet

- MTP 3 15 Questions 1680696400Document7 pagesMTP 3 15 Questions 1680696400Umar MalikNo ratings yet

- Test 5Document3 pagesTest 5mangla.harsh77No ratings yet

- Test Series: November, 2021 Mock Test Paper 1 Intermediate: Group - I Paper - 2: Corporate and Other LawsDocument8 pagesTest Series: November, 2021 Mock Test Paper 1 Intermediate: Group - I Paper - 2: Corporate and Other Lawssunil1287No ratings yet

- Company Law and PracticeDocument16 pagesCompany Law and PracticePrabhakar TripathiNo ratings yet

- Audit Question 15Document4 pagesAudit Question 15JINENDRA JAINNo ratings yet

- Company Law New Syllabus Question PaperDocument6 pagesCompany Law New Syllabus Question PaperCma Sankaraiah100% (1)

- 71810bos57772 Inter p2qDocument9 pages71810bos57772 Inter p2qSakshi KhandelwalNo ratings yet

- 5 6176943427335225437Document46 pages5 6176943427335225437JINENDRA JAINNo ratings yet

- Corporate and Allied Laws Paper: Key ConceptsDocument13 pagesCorporate and Allied Laws Paper: Key ConceptssourabhNo ratings yet

- Mock Test Paper - 1Document9 pagesMock Test Paper - 1kirankumar sirikiNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument8 pages© The Institute of Chartered Accountants of IndiaMenuka SiwaNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument16 pages© The Institute of Chartered Accountants of IndiaFentorNo ratings yet

- Law Mock Test May 2019Document12 pagesLaw Mock Test May 2019Roshinisai VuppalaNo ratings yet

- Accounts - 12Document8 pagesAccounts - 12Md TariqueNo ratings yet

- CA Inter Law Test 1Document6 pagesCA Inter Law Test 1SwAti KiNiNo ratings yet

- In Division B, Question No.1 Is Compulsory Attempt Any Three Questions Out of The Remaining Four QuestionsDocument7 pagesIn Division B, Question No.1 Is Compulsory Attempt Any Three Questions Out of The Remaining Four QuestionsKartik GuptaNo ratings yet

- XII Accountancy Sample PQ & MS (23-24)Document30 pagesXII Accountancy Sample PQ & MS (23-24)umangchh2306No ratings yet

- CLASS 12 Accountancy-PQDocument27 pagesCLASS 12 Accountancy-PQSanjay PanickerNo ratings yet

- Accountancy PQDocument15 pagesAccountancy PQseema chadhaNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestMehul JainNo ratings yet

- 79 Law TestDocument3 pages79 Law TestKrushna MateNo ratings yet

- 2) LawDocument13 pages2) LawvgbhNo ratings yet

- Paper - 2: Auditing Questions: Accounting Treatment of The Above Receipt of Rs. 50 Lacs?Document20 pagesPaper - 2: Auditing Questions: Accounting Treatment of The Above Receipt of Rs. 50 Lacs?tpsbtpsbtpsbNo ratings yet

- Intermediate Mock Test Series: Corporate and Other LawsDocument8 pagesIntermediate Mock Test Series: Corporate and Other Lawspradhiba meenakshisundaramNo ratings yet

- CA Inter Law Ans Dec 2021Document21 pagesCA Inter Law Ans Dec 2021Punith KumarNo ratings yet

- Andhra Pradesh State Financial Corporation: Hyderabad Special Terms and Conditions of The Sanction (Term Loans) : M/s.Gemini Digital PressDocument48 pagesAndhra Pradesh State Financial Corporation: Hyderabad Special Terms and Conditions of The Sanction (Term Loans) : M/s.Gemini Digital PressAnonymous EjJ7JFNo ratings yet

- MTP Ques Bus. Law & Bcr-23!11!2023Document7 pagesMTP Ques Bus. Law & Bcr-23!11!2023RohitNo ratings yet

- Guideline Answers: Professional Programme (New Syllabus)Document71 pagesGuideline Answers: Professional Programme (New Syllabus)Lekshminarayanan KrishnanNo ratings yet

- 78338bos62701 10Document10 pages78338bos62701 10nerises364No ratings yet

- CA Intermediate Chapter 1-3 MCQsDocument4 pagesCA Intermediate Chapter 1-3 MCQsadsaNo ratings yet

- INTER LAW Sample Paper-IDocument15 pagesINTER LAW Sample Paper-Imshivam617No ratings yet

- Practice Questions Company LawDocument8 pagesPractice Questions Company LawAditi SinghNo ratings yet

- Law - QuestionsDocument8 pagesLaw - Questionssinglatanmay84No ratings yet

- 2) LawDocument11 pages2) LawKrushna MateNo ratings yet

- Answer PDFDocument7 pagesAnswer PDFManjunath ANo ratings yet

- Corporate & Other Laws: Premium Test Paper-1Document4 pagesCorporate & Other Laws: Premium Test Paper-1hfdghdhNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The Restritz meshNo ratings yet

- Sample Paper Accountancy Class XIIDocument6 pagesSample Paper Accountancy Class XIIAcHu TanNo ratings yet

- You Are Required To:: Time Allowed - 3.30 Hours Total Marks - 100Document4 pagesYou Are Required To:: Time Allowed - 3.30 Hours Total Marks - 100Bizness Zenius HantNo ratings yet

- CA FOUNDATION MOCK TEST SERIESDocument11 pagesCA FOUNDATION MOCK TEST SERIESPuru GuptaNo ratings yet

- Monthly Test Xii Acc September 2023-24Document2 pagesMonthly Test Xii Acc September 2023-24Deepak patidarNo ratings yet

- Law March MTPDocument16 pagesLaw March MTPritz meshNo ratings yet

- RTP - May 2022 - Paper 3Document26 pagesRTP - May 2022 - Paper 3SSRA ARTICALSNo ratings yet

- Blaw Rise Test QP With Solution Autumn 2021 Regards Fahad IrfanDocument40 pagesBlaw Rise Test QP With Solution Autumn 2021 Regards Fahad IrfanAanis aliNo ratings yet

- Ind As 1Document4 pagesInd As 1BODA RAMAM & CO, Chartered AccountantsNo ratings yet

- Solved Answer LAW CA PCC June 2009Document10 pagesSolved Answer LAW CA PCC June 2009nikhil92007No ratings yet

- New Scheme - May 2022 Ca Inter - Group 1 Paper 2-Syllabus 100A Question PaperDocument14 pagesNew Scheme - May 2022 Ca Inter - Group 1 Paper 2-Syllabus 100A Question PaperPunith KumarNo ratings yet

- PPM 158-QP PDFDocument3 pagesPPM 158-QP PDFAnanditaKarNo ratings yet

- NK Academy For Ca: Revision Exam - 2Document5 pagesNK Academy For Ca: Revision Exam - 2S SNo ratings yet

- LAW Smart WorkDocument10 pagesLAW Smart WorkmaacmampadNo ratings yet

- Test-5 - RevisedDocument8 pagesTest-5 - Revisedmangla.harsh77No ratings yet

- Law Test Question Paper 3Document5 pagesLaw Test Question Paper 3uneet opNo ratings yet

- Belouo 2N2 Os A) 4no 9+: PoditonDocument6 pagesBelouo 2N2 Os A) 4no 9+: PoditonpriyalNo ratings yet

- Ipc Cre NumericalsDocument6 pagesIpc Cre NumericalspriyalNo ratings yet

- Corporate and Other Laws: Ntermediate OurseDocument181 pagesCorporate and Other Laws: Ntermediate Oursepriyal100% (1)

- CostDocument11 pagesCostpriyalNo ratings yet

- Formed Police Units in United Nations Peacekeeping OperationsDocument26 pagesFormed Police Units in United Nations Peacekeeping OperationsparapoliticalNo ratings yet

- Philippines Supreme Court Upholds Murder Conviction in Fatal Stabbing CaseDocument3 pagesPhilippines Supreme Court Upholds Murder Conviction in Fatal Stabbing CaseVen ChristianNo ratings yet

- Business Roundtable Statement On The Purpose of A Corporation With SignaturesDocument12 pagesBusiness Roundtable Statement On The Purpose of A Corporation With SignaturesMadeleineNo ratings yet

- ComplaintDocument25 pagesComplaintThe GuardianNo ratings yet

- CMI SFA04N02 Guidelines To CMS LicenseesDocument31 pagesCMI SFA04N02 Guidelines To CMS LicenseesBhoumika LucknauthNo ratings yet

- American Vs Director of PatentsDocument1 pageAmerican Vs Director of PatentsKidrelyne vic BonsatoNo ratings yet

- Kingspan ks1000rw Trapezoidal Roof Panel Data Sheet en AuDocument6 pagesKingspan ks1000rw Trapezoidal Roof Panel Data Sheet en AuShane BelongNo ratings yet

- Executive Order No. 292 (BOOK IV/Chapter 2-Secretaries, Undersecretaries, and Assistant Secretaries)Document2 pagesExecutive Order No. 292 (BOOK IV/Chapter 2-Secretaries, Undersecretaries, and Assistant Secretaries)Carmela LopezNo ratings yet

- Wi Gs Assignment 3 Wigs A3Document12 pagesWi Gs Assignment 3 Wigs A3Linh PhươngNo ratings yet

- Marbella-Bobis V BobisDocument2 pagesMarbella-Bobis V BobisJohn Basil ManuelNo ratings yet

- L5 - Nature of Clinical Lab - PMLS1Document98 pagesL5 - Nature of Clinical Lab - PMLS1John Daniel AriasNo ratings yet

- Basel 3Document287 pagesBasel 3boniadityaNo ratings yet

- Basque and Catalan nationalism before the Spanish Civil War: Explaining differences in programmatic characterDocument30 pagesBasque and Catalan nationalism before the Spanish Civil War: Explaining differences in programmatic charactergerardglledaNo ratings yet

- Kushaq New Price List 01-04-2023Document1 pageKushaq New Price List 01-04-2023Điwakar MudhirajNo ratings yet

- Nationalities Problem in USSR: Discord Over Nagorno-KarabakhDocument4 pagesNationalities Problem in USSR: Discord Over Nagorno-KarabakhalmaNo ratings yet

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocument2 pagesCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsNo ratings yet

- The 1899 Malolos Constitution - Official Gazette of The Republic of The PhilippinesDocument25 pagesThe 1899 Malolos Constitution - Official Gazette of The Republic of The PhilippinesJamille YapNo ratings yet

- Thursday, May 29, 2014 EditionDocument20 pagesThursday, May 29, 2014 EditionFrontPageAfricaNo ratings yet

- Business Communication & Ethics (HS-304) : Maheen Tufail DahrajDocument13 pagesBusiness Communication & Ethics (HS-304) : Maheen Tufail DahrajFaizan ShaikhNo ratings yet

- Income Taxation Mcqs&ProblemsDocument14 pagesIncome Taxation Mcqs&ProblemsJayrald LacabaNo ratings yet

- Maharashtra Private Forests Acquisition) Act 1975Document23 pagesMaharashtra Private Forests Acquisition) Act 1975Asmita AlkarNo ratings yet

- Technical Services Registration Scheme: Organisation InformationDocument4 pagesTechnical Services Registration Scheme: Organisation Information_ARCUL_No ratings yet