Professional Documents

Culture Documents

S&P 500 Index Etf: Horizons

Uploaded by

Celestien LaperierreOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

S&P 500 Index Etf: Horizons

Uploaded by

Celestien LaperierreCopyright:

Available Formats

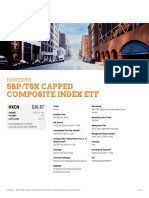

HORIZONS

S&P 500 INDEX ETF ®

HXS $59.36 Ticker:

HXS

Benchmark:

S&P 500® Index

CHANGE $0.59 +1.00%

Inception Date: Bloomberg Index Ticker:

VOLUME1 26822

November 30, 2010 SPXT

LAST CLOSE $58.77

Net Assets2: Management Fee:

Prices delayed by 15 minutes.

3,325,729,136 (as at 2021-12-10) 0.10% (plus applicable sales tax)

Last trade: Dec 10, 2021 05:00 PM

Consolidated Prior Day Volume3: Management Expense Ratio 4:

149,466 (for 2021-12-10) 0.10% (AS AT 2021-06-30)

Average Daily Trading Volume Over A 12 Swap Fee:

Month Period5: No more than 0.30%

155,234 (as at 2021-11-30)

Currency:

Exchange: CAD

Toronto Stock Exchange

Counterparty Exposure6:

Investment Manager: 42.83% (as at 2021-11-30)

Horizons ETFs Management (Canada) Inc.

LEI 7:

Eligibility: 5493002V1ZGRP2SB0E49

All Registered and Non-Registered Accounts

Horizons - S&P 500® Index ETF (Timestamp: December 12, 2021) 1 of 4

Investment Objective

Horizons HXS seeks to replicate, to the extent possible, the performance of the S&P 500® Index (Total Return), net of PRICE AND NAV

as at December 10, 2021

expenses. The S&P 500® Index (Total Return) is designed to measure the performance of the large-cap market segment

of the U.S. equity market. Nav/Unit: $59.356

Price: $59.36

Daily NAV (Since Inception) HXS Volume

Premium Discount: $0.00

$50.00 Premium Discount Percentage: 0.01%

Outstanding Shares: 56,030,200

$25.00

$0.00 INDEX INVESTMENT METRICS

as at October 31, 2021

Index 12-Month Trailing Yield8: 1.30

Current Index Yield9: 1.32

2012 2014 2016 2018 2020 2022

The NAV chart above only shows the historical daily net asset value per unit (NAV) of the ETF, and identifies the various distributions made by the ETF,

if any. The distributions are not treated as reinvested, and it does not take into account sales, redemption, distribution or optional charges or income INDEX SECTOR ALLOCATION

taxes payable by any securityholder. The NAV values do contemplate management fees and other fund expenses. The chart is not a performance as at November 30, 2021

chart and is not indicative of future NAV values which will vary.

Growth Of 10K (Since Inception)

$80k

$60k

$40k Information Technology

(29.35%)

Consumer Discretionary

$20k (13.17%)

Health Care (12.72%)

Financials (10.84%)

$0k Communication Services

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 (10.36%)

Industrials (7.80%)

The Growth of 10K chart above is based on the historical daily net asset value per unit (NAV) of the ETF, and represents the value of an initial Consumer Staples (5.58%)

investment into the ETF of $10,000 since its inception, on a total return basis. Distributions, if any, are treated as reinvested, and it does not take into

account sales, redemption, distribution or optional charges or income taxes payable by any security holder. The NAV values do contemplate Energy (2.71%)

management fees and other fund expenses where paid by the fund. The chart is not a performance chart and is not indicative of future value which will Real Estate (2.62%)

vary.

Materials (2.50%)

Utilities (2.37%)

Annualized Performance*

1 Mo 3 Mo 6 Mo YTD 1 Yr 3 Yr 5 Yr 10 Yr SIR**

Horizons S&P 500® Index ETF 2.47 2.49 15.53 23.16 25.31 18.33 16.24 18.40 17.28

**Performance since inception on November 30, 2010, as at November 30, 2021

Calendar Year Performance*

2013 2014 2015 2016 2017 2018 2019 2020

ETF (HXS) 37.95 23.80 20.11 8.24 13.58 3.41 24.56 15.58

S&P 500 Index Total Return 41.42 24.25 20.70 8.90 13.47 3.99 25.25 16.48

Horizons - S&P 500® Index ETF (Timestamp: December 12, 2021) 2 of 4

Horizons HXS is listed in both Cdn$ and US$. The performance of the US$ units of Horizons HXS directly corresponds to

the performance, in U.S. dollar terms, of the S&P 500® Index (Total Return), net of expenses. The performance of the

Cdn$ units of Horizons HXS will generally, but not directly, correspond to the performance, in Canadian dollar terms, of the

S&P 500® Index (Total Return), net of expenses. The difference in the performance of the Cdn$ units of Horizons HXS

compared to the performance, in Canadian dollar terms, of the S&P 500® Index (Total Return), net of expenses, is solely a

result of the differences in daily FX rates used by the ETF and the Index provider to determine the NAV and Index level

respectively, in Canadian Dollar terms. These differences are not an accurate representation of the index tracking for

Horizons HXS in meeting its investment objective. Please refer to the HXS.U Annualized Performance for an accurate

representation of the index tracking for Horizons HXS.

Prior to April 1, 2013, the investment objective of HXS included hedging its exposure back to the Canadian dollar. As of

April 1, 2013, that hedging component was removed. Had it been retained, the ETF’s performance since then would have

been higher or lower depending on the direction of the CAD/USD exchange rate fluctuations.

Index Top 10 Holdings

as at November 30, 2021

Security Name Weight

APPLE INC 6.70%

MICROSOFT CORP 6.41%

AMAZON.COM INC 3.94%

TESLA INC 2.40%

ALPHABET INC 2.20%

NVIDIA CORP 2.10%

ALPHABET INC 2.07%

META PLATFORMS INC 2.00%

BERKSHIRE HATHAWAY INC 1.32%

JPMORGAN CHASE & CO 1.22%

For more information, please click here:

S&P 500® Index

Horizons - S&P 500® Index ETF (Timestamp: December 12, 2021) 3 of 4

WWW.HORIZONSETFS.COM

1

Volume: Real-time volume on the Toronto Stock Exchange only.

2

Net Assets: The value of all assets, less the value of all liabilities, at a particular point in time. (Includes all classes of this ETF) .

3

Consolidated Prior Day Volume: The ETF’s aggregate volume traded on all Canadian exchanges.

4 Average Daily Trading Volume over 12 Month Period: The ETF’s aggregate average daily trading volume over a 12 month period traded on all Canadian exchanges.

5

Counterparty Exposure: represents a net amount owed to or owed from the ETF’s Bank Counterparty(ies), as a percentage of the total net assets of the ETF. If the

figure is negative, there is no counterparty risk as the ETF has more cash collateral than the net assets of the ETF and the ETF owes that net amount to its Bank

Counterparty(ies). If the figure is positive, there is counterparty risk for the net amount owed to the ETF by the Bank Counterparty(ies). Counterparty risk generally refers

to the credit risk with respect to the amount an ETF expects to receive from its Bank Counterparty(ies) to the financial instruments entered into by the ETF.

6

LEI: The Legal Entity Identifier (LEI) is the International ISO standard 17442. LEIs are identification codes that enable consistent and accurate identification of all

legal entities that are parties to financial transactions, including non-financial institutions.

7

Estimated Annualized Yield: An estimate of the annualized yield an investor would receive if the most recent distribution rate stayed the same for the next twelve

months, stated as a percentage of the net asset value per unit on the date before the ex-dividend date of the current distribution.

8

Current Index yield: Sum of the weighted dividend indicated yields of all index constituent securities. The dividend indicated yield is defined as the most recently

announced dividend amount, annualized based on the dividend frequency, then divided by the market price as at the close of the last business day of the last month

end. Gross or net dividend amount is used based on market convention.

Commissions, management fees and expenses all may be associated with an investment in exchange traded products managed by Horizons ETFs Management

(Canada) Inc. (the "Horizons Exchange Traded Products"). The Horizons Exchange Traded Products are not guaranteed, their values change frequently and past

performance may not be repeated. The prospectus contains important detailed information about the Horizons Exchange Traded Products. Please read the prospectus

before investing.

Standard & Poor's® and S&P 500®

“Standard & Poor’s®” and “S&P®” are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and “TSX®” is a registered trademark of the TSX Inc.

(“TSX”). These marks have been licensed for use by Horizons ETFs Management (Canada) Inc. The ETF is not sponsored, endorsed, sold, or promoted by the S&P, TSX

or their affiliated companies and none of these parties make any representation, warranty or condition regarding the advisability of buying, selling or holding

units/shares of the ETF.

*The indicated rates of return are the historical annual or annual compounded total returns (as indicated) including changes in per unit value and reinvestment of all

dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would

have reduced returns. The rates of return shown in the table are not intended to reflect future values of the ETF [the Index/Indices] or returns on investment in the ETF

[the Index/Indices is not/are not directly investable]. Only the returns for periods of one year or greater are annualized returns. Display of index returns utilize the 4pm

London WM FX Rate. Prior to April 1, 2013, the investment objective of HXS included hedging its exposure back to the Canadian dollar. As of April 1, 2013, that hedging

component was removed. Had it been retained, the ETF’s performance would have been higher or lower depending on the direction of the CAD/USD exchange rate

fluctuations.

Horizons - S&P 500® Index ETF (Timestamp: December 12, 2021) 4 of 4

You might also like

- S&P 500 Index Etf: HorizonsDocument4 pagesS&P 500 Index Etf: HorizonsChrisNo ratings yet

- S&P/TSX Capped Composite Index Etf: HorizonsDocument4 pagesS&P/TSX Capped Composite Index Etf: HorizonsCelestien LaperierreNo ratings yet

- S&P/TSX 60 Index Etf: HorizonsDocument4 pagesS&P/TSX 60 Index Etf: HorizonsCelestien LaperierreNo ratings yet

- CDN Select Universe Bond Etf: HorizonsDocument4 pagesCDN Select Universe Bond Etf: HorizonsCelestien LaperierreNo ratings yet

- CDN High Dividend Index Etf: HorizonsDocument4 pagesCDN High Dividend Index Etf: HorizonsCAT CYLINDERNo ratings yet

- S&P/TSX 60 Index Etf: HorizonsDocument4 pagesS&P/TSX 60 Index Etf: HorizonsLesterNo ratings yet

- HXX - FactSheet EN - 2023 07 13 - 12 58pmDocument11 pagesHXX - FactSheet EN - 2023 07 13 - 12 58pmTHE LEGEND INDIANo ratings yet

- Psychedelic Stock Index Etf: HorizonsDocument4 pagesPsychedelic Stock Index Etf: HorizonsananNo ratings yet

- BLOKDocument6 pagesBLOKjsbaby2002No ratings yet

- Resources FundDocument2 pagesResources Fundb1OSphereNo ratings yet

- Hang Seng TECH Index: FeaturesDocument2 pagesHang Seng TECH Index: FeaturesGoldfish2021No ratings yet

- Performance As of October 31, 2020 Holdings by Company Size: Institutional ClassDocument1 pagePerformance As of October 31, 2020 Holdings by Company Size: Institutional ClassLjubisa MaticNo ratings yet

- BH Macro Limited: Monthly Shareholder ReportDocument6 pagesBH Macro Limited: Monthly Shareholder ReportdanehalNo ratings yet

- Performance As of October 31, 2020 Holdings by Company Size: Institutional ClassDocument1 pagePerformance As of October 31, 2020 Holdings by Company Size: Institutional ClassLjubisa MaticNo ratings yet

- Schroder Dana Likuid OKTOBER 2022-1Document1 pageSchroder Dana Likuid OKTOBER 2022-1Dhanik JayantiNo ratings yet

- Crude Oil 2X Daily Bull Etf: BetaproDocument4 pagesCrude Oil 2X Daily Bull Etf: BetaproHelen ZhangNo ratings yet

- Aapl 2021 06 24,01Document19 pagesAapl 2021 06 24,01eciffONo ratings yet

- BH Macro Limited: Monthly Shareholder ReportDocument6 pagesBH Macro Limited: Monthly Shareholder ReportdanehalNo ratings yet

- Performance As of October 31, 2020 Holdings by Company Size: Institutional ClassDocument1 pagePerformance As of October 31, 2020 Holdings by Company Size: Institutional ClassLjubisa MaticNo ratings yet

- What Is Mutual FundDocument6 pagesWhat Is Mutual Fund2K19/EE/116 ISH MISHRANo ratings yet

- CH0117044732 Fact-Sheet enDocument6 pagesCH0117044732 Fact-Sheet enscribd69No ratings yet

- Hste CheDocument2 pagesHste ChePriyanshu kakkarNo ratings yet

- Wealth-Insight - Apr 2021 PDFDocument64 pagesWealth-Insight - Apr 2021 PDFGanshNo ratings yet

- COSCO - PH Cosco Capital Inc. Financial Statements - WSJDocument1 pageCOSCO - PH Cosco Capital Inc. Financial Statements - WSJjannahaaliyahdNo ratings yet

- CASH - FactSheet EN - 2023 09 19 - 11 50pmDocument8 pagesCASH - FactSheet EN - 2023 09 19 - 11 50pmsilva.mathew29No ratings yet

- Factsheet Nifty High Beta50 PDFDocument2 pagesFactsheet Nifty High Beta50 PDFRajeshNo ratings yet

- XTEK Presentation - 22 November 22Document19 pagesXTEK Presentation - 22 November 22Vishnoo PrathapNo ratings yet

- UBS (Lux) Equity SICAV - All China: Fund Description Performance (Share Class P-Acc Basis USD, Net of Fees)Document2 pagesUBS (Lux) Equity SICAV - All China: Fund Description Performance (Share Class P-Acc Basis USD, Net of Fees)J. BangjakNo ratings yet

- BMO Balanced ETF Portfolio - Advisor: Reasons To Invest in The Fund Fund DetailsDocument2 pagesBMO Balanced ETF Portfolio - Advisor: Reasons To Invest in The Fund Fund DetailsJasonJin93No ratings yet

- Legg Mason Value Fund - Dec 2022 PDFDocument2 pagesLegg Mason Value Fund - Dec 2022 PDFJeanmarNo ratings yet

- L&T India Value FundDocument1 pageL&T India Value Fundjaspreet AnandNo ratings yet

- RoyalBankofCanadaTSXRY PublicCompanyDocument1 pageRoyalBankofCanadaTSXRY PublicCompanyGDoingThings YTNo ratings yet

- Pictet-Human-R EUR - FACTSHEET - LU2247920262 - EN - DEFAULT - 31jan2022Document4 pagesPictet-Human-R EUR - FACTSHEET - LU2247920262 - EN - DEFAULT - 31jan2022ATNo ratings yet

- Kotak Standard Multicap Fund (G)Document4 pagesKotak Standard Multicap Fund (G)Rudhra MoorthyNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)m KumarNo ratings yet

- Quant Tax Plan - Fact SheetDocument1 pageQuant Tax Plan - Fact Sheetsaransh saranshNo ratings yet

- Marijuana Life Sciences Index Etf: HorizonsDocument4 pagesMarijuana Life Sciences Index Etf: HorizonsAlex CajelaisNo ratings yet

- Fund Facts - HDFC Focused 30 Fund - July 2021Document2 pagesFund Facts - HDFC Focused 30 Fund - July 2021Tarun TiwariNo ratings yet

- Infosys Technologies Ltd. Equity: Filing & Other Info Peer Group ChartingDocument26 pagesInfosys Technologies Ltd. Equity: Filing & Other Info Peer Group Chartinglaxmantej77No ratings yet

- Ar2015e 0Document276 pagesAr2015e 0ed bookerNo ratings yet

- Performance Overview: As of Sep 13, 2023Document2 pagesPerformance Overview: As of Sep 13, 2023Tirthkumar PatelNo ratings yet

- ALFM Global Multi Asset Income Fund Inc. UMF 202208Document2 pagesALFM Global Multi Asset Income Fund Inc. UMF 202208Edgard SaloNo ratings yet

- Performance As of October 31, 2020 Holdings by Company Size: Institutional ClassDocument1 pagePerformance As of October 31, 2020 Holdings by Company Size: Institutional ClassLjubisa MaticNo ratings yet

- CFRAEquityResearch DaeyangPaperMfgCoLtd Aug 31 2021Document9 pagesCFRAEquityResearch DaeyangPaperMfgCoLtd Aug 31 2021Camila CalderonNo ratings yet

- Jamna Auto Share Price, Jamna Auto Stock Price, JDocument2 pagesJamna Auto Share Price, Jamna Auto Stock Price, Jmuthu27989No ratings yet

- 3 - Neutral: Global X Funds: Global X NASDAQ 100 Covered Call ETFDocument3 pages3 - Neutral: Global X Funds: Global X NASDAQ 100 Covered Call ETFphysicallen1791No ratings yet

- Security Level Portfolio As On January 14 2022 For 6 Schemes Being Wound UpDocument30 pagesSecurity Level Portfolio As On January 14 2022 For 6 Schemes Being Wound UpRashmi LNo ratings yet

- SfeiDocument156 pagesSfeiKit WooNo ratings yet

- eStatementFile 20230112102731Document3 pageseStatementFile 20230112102731wai ling tsangNo ratings yet

- Ind Nifty Financial ServicesDocument2 pagesInd Nifty Financial Servicesswaroopr8No ratings yet

- 3 - Neutral: ETF Series Solutions: Nationwide Nasdaq-100 Risk-Managed Income ETFDocument3 pages3 - Neutral: ETF Series Solutions: Nationwide Nasdaq-100 Risk-Managed Income ETFphysicallen1791No ratings yet

- Kotak Small Cap Fund - 20220201190020276Document1 pageKotak Small Cap Fund - 20220201190020276Kunal SinhaNo ratings yet

- Performance As of October 31, 2020 Holdings by Company Size: Institutional ClassDocument1 pagePerformance As of October 31, 2020 Holdings by Company Size: Institutional ClassLjubisa MaticNo ratings yet

- Trading Comps (Template)Document11 pagesTrading Comps (Template)jhoncmdoNo ratings yet

- Finance Ca2 FinalDocument25 pagesFinance Ca2 Finalmasthan shaikNo ratings yet

- Microsoft Corp. $260.36 Rating: Neutral Neutral NeutralDocument3 pagesMicrosoft Corp. $260.36 Rating: Neutral Neutral Neutralphysicallen1791No ratings yet

- FSD CH0497631082 SWC CH enDocument6 pagesFSD CH0497631082 SWC CH enshuzefaNo ratings yet

- Ind Nifty Financial ServicesDocument2 pagesInd Nifty Financial ServicesSyed ZaheerNo ratings yet

- Vanguard VTIDocument110 pagesVanguard VTIRaka AryawanNo ratings yet

- The BCG Growth-Share Matrix: Theory and Applications: The key to portfolio managementFrom EverandThe BCG Growth-Share Matrix: Theory and Applications: The key to portfolio managementRating: 2 out of 5 stars2/5 (1)

- The Contemporary Wold Lesson 2Document35 pagesThe Contemporary Wold Lesson 2Kylie Marine CaluyongNo ratings yet

- RK M-Banking Mandiri Adeng Januari 24Document4 pagesRK M-Banking Mandiri Adeng Januari 24Novi LegitaNo ratings yet

- G Avin's VSA Trading Plan - Extended Edition (Tom Williams Additional Comments)Document11 pagesG Avin's VSA Trading Plan - Extended Edition (Tom Williams Additional Comments)vipmen143No ratings yet

- Chapter 32 Exchange Rates Balance of Payments and International DebtDocument18 pagesChapter 32 Exchange Rates Balance of Payments and International DebtMary Chrisdel Obinque GarciaNo ratings yet

- Jewishcoins00reiniala BWDocument130 pagesJewishcoins00reiniala BWKerr CachaNo ratings yet

- Icelandic Finanical CrisisDocument3 pagesIcelandic Finanical CrisisAman BurmanNo ratings yet

- Anatomy of A Stablecoin Failure The Terra-Luna CaseDocument20 pagesAnatomy of A Stablecoin Failure The Terra-Luna CaseMichael PengNo ratings yet

- 37th IQ Model PaperDocument7 pages37th IQ Model PaperThanuNo ratings yet

- Large Ptolemaic Bronzes in Third-Century Egyptian Hoards / Catharine C. LorberDocument41 pagesLarge Ptolemaic Bronzes in Third-Century Egyptian Hoards / Catharine C. LorberDigital Library Numis (DLN)No ratings yet

- UIMS IF Lecture 01Document25 pagesUIMS IF Lecture 01nainaNo ratings yet

- Bitinvestoptions Home Page 2Document1 pageBitinvestoptions Home Page 2George StraitNo ratings yet

- Translation QuestionsDocument6 pagesTranslation QuestionsVeenal BansalNo ratings yet

- Bispap 143Document190 pagesBispap 143qhycvhx8jmNo ratings yet

- Pi NetworkDocument4 pagesPi Networklien nguyenNo ratings yet

- Balance of PaymentsDocument44 pagesBalance of PaymentsHusain IraniNo ratings yet

- Paper Money PDFDocument16 pagesPaper Money PDFsezra1No ratings yet

- Business Environment: Prasanth VenpakalDocument49 pagesBusiness Environment: Prasanth Venpakalviji alexNo ratings yet

- 8.f.248 Salary Distribution FormDocument5 pages8.f.248 Salary Distribution FormGenesis Frias PeñaNo ratings yet

- Instant Transfer - Bank: CE No: 235499832Document1 pageInstant Transfer - Bank: CE No: 235499832Emmanuel Toreta100% (1)

- Risk Management A Case Study On DerivativeDocument22 pagesRisk Management A Case Study On DerivativeDivya PrabhakarNo ratings yet

- Theories of Foeign Exchange DeterminationDocument57 pagesTheories of Foeign Exchange DeterminationPakki Harika MeghanaNo ratings yet

- Dissertation: Analysis, Impact and The Future of CryptocurrenciesDocument41 pagesDissertation: Analysis, Impact and The Future of Cryptocurrenciesjoseph mainaNo ratings yet

- Forex Made Simple - Alpha Balde PDFDocument26 pagesForex Made Simple - Alpha Balde PDFHeitor Mirakel100% (2)

- Exchangerate Dateofpublication 10 04 2023Document15 pagesExchangerate Dateofpublication 10 04 2023Shravani ShreyaNo ratings yet

- The Effects of Changes in Foreign Rates: ExchangeDocument50 pagesThe Effects of Changes in Foreign Rates: ExchangeBethelhem50% (2)

- Release Waiver and Quitclaim: Project in ChargeDocument1 pageRelease Waiver and Quitclaim: Project in ChargeWendell MaunahanNo ratings yet

- TarpaulinDocument18 pagesTarpaulinMarie grace UmpayNo ratings yet

- Unit 6 Money and BankingDocument70 pagesUnit 6 Money and BankingTrần Diệu MinhNo ratings yet

- J RGNUL Student Research Review Kkartikeya14 Gmailcom 20200508 235403Document18 pagesJ RGNUL Student Research Review Kkartikeya14 Gmailcom 20200508 235403kumar kartikeyaNo ratings yet

- Azrul Ikhwan Bin Azmi (2020414356) - Self ReflectionDocument8 pagesAzrul Ikhwan Bin Azmi (2020414356) - Self ReflectionAZRUL IKHWAN AZMINo ratings yet