Professional Documents

Culture Documents

Customer Complaint Record Form

Uploaded by

Krys TelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Customer Complaint Record Form

Uploaded by

Krys TelCopyright:

Available Formats

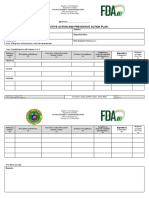

Reference No.

: ____________________

DBP CUSTOMER COMPLAINT RECORD FORM

Date:

CUSTOMER INFORMATION

Name of Customer (Pangalan ng Kliyente): Account Number: Contact Number (Telepono): Email Address: Signature of Customer:

NATURE OF COMPLAINT

Transacting Unit: Date of Transaction:

FOR BANK USE ONLY

Classification of Complaint Severity: Financial Loss (estimated amount):

1. Personnel Minor None-P10,000 P100,001-P1,000,000

1.1 Technical Skills: Speed, Efficiency, Knowledge Moderate P10,001-P100,000 Above P1,000,000

1.2 Behavior and Demeanor (Overall Attitude Major

Displayed, Customer Handling Skills, Customer- Severe Reputational Loss:

Friendliness, Service Orientation, Problem Unlikely Likely

Handling & Resolution Skills) Simple Possible Certain

1.3 Professional Appearance (Grooming and Decorum) Complex

1.4 Personal Dispute with DBP Personnel

Description of the Complaint:

2. Discrepancies and Dispute (For Items 2.3, 2.4, 2.5 and 3.1, please use back page)

2.1 Passbook and Statement Entries ____________________________________________________________________

2.2 Account Balance and Transactions ____________________________________________________________________

2.3 Debit without Dispense (ATM) ____________________________________________________________________

2.4 Botched Fund Transfers ____________________________________________________________________

2.5 Botched Bills Payments ____________________________________________________________________

2.6 Errors in Customer Record (Please use back page as necessary)

3. Fraud

3.1 ATM Card Skimming Desired Output:

3.2 Online Phishing ____________________________________________________________________

3.3 Document Fraud ____________________________________________________________________

3.4 DBP Employee Fraud ____________________________________________________________________

3.5 Other Fraudulent Modus Operandi ____________________________________________________________________

____________________________________________________________________

4. Queuing & Processing Time

4.1 Overall Waiting Time

4.2 Processing Time Attended by:

4.3 Queue Management

5. Turn-Around Time on Requests and Transactions

5.1 Deposits Concerns

5.2 Loans Concerns

5.3 Other Service Requests Root Cause:

5.4 Action/Resolution on Complaints ____________________________________________________________________

6. Rates & Fees ____________________________________________________________________

6.1 Interest Rates on Deposits ____________________________________________________________________

6.2 Interest Rates on Investments ____________________________________________________________________

6.3 Interest Rates on Loans ____________________________________________________________________

6.4 Bank Fees and Charges ____________________________________________________________________

7. Bank Procedures Actions Taken & TAT:

7.1 Red Tape, Bureaucratic 1 __________________________________________________________________

7.2 Outdated: Other Banks More Streamlined __________________________________________________________________

7.3 Onerous: Burdensome, Unnecessary Requirement 2 __________________________________________________________________

or Imposition on Customer __________________________________________________________________

8. Systems & Infrastructure (use back page as necessary)

8.1 Bank System

8.2 ATM Status Monitoring:

8.3 Point of Sale

8.4 Online Banking Open Closed

8.5 Other Bank Systems Remarks: ___________________________________________________________

8.6 Branch and Facilities ____________________________________________________________________

____________________________________________________________________

9. Products

9.1 Lacking/Missing Product Open Closed

9.2 Product Feature Remarks: ___________________________________________________________

9.3 Competitiveness ____________________________________________________________________

____________________________________________________________________

10. Reputation and Image

10.1 Reputation of Staff or Officer

Endorsed

10.2 Market News or Information about DBP

10.3 Overall Image of Bank

11. Others ____________________________________________ Noted by: __________________________________________________________

OCL 03915

(Rev 2 - 25Jan17)

----------------------------------------------------------------------------------------- cut here ------------------------------------------------------------------------------------------

CUSTOMER’S COPY

Reference No. Date Filed Date to Follow Up

Name of Servicing Officer Contact Number Email Address

For Card Related Complaints

Card Number Bank/Branch of Account Transaction Amount

Transaction Time Trace No. (if applicable) Terminal No. (to be filled by the attending personnel)

TRANSACTION DETAILS

Name of Bank (Where withdrawal/transfer was made)

ATM Withdrawal

Point of Sale (POS)/ Merchant Name / Location / Address (Where purchase was made)

Online Purchase

Name of Bank (Where fund was intended for transfer) Beneficiary Account Number Erroneous Account Number

Interbank Fund Transfer (if applicable)

Name of Institution Subscriber Account No.

Bills Payment

COMPLAINT DETAILS

No/Short Cash Dispensed Erroneous/Unposted Bills Payment

Amount Withdrawn P_______________________ Card Captured

Amount Dispensed P_______________________ Erroneous/Unposted InterBank Fund Transfer (IBFT)

Others (Pls. specify) _______________________________________

Unauthorized Transaction (probable fraud)

(If necessary, use below section of this form to document other details)

ACTIONS TAKEN

(For Bank Use Only)

Cancelled Card (for fraud related): Results of validation:

On : ________________________________________________

By : ________________________________________________

Coordinated with ATM/CMS Operations: Advised Issuer Branch :

Thru : _______________________________________________________ Thru : ___________________________________________________

On : _______________________________________________________ On : ___________________________________________________

By : _______________________________________________________ By : ___________________________________________________

Other Remarks:

You might also like

- Cenrr TravelDocument2 pagesCenrr Travelcharissa maeNo ratings yet

- Corrective Action and Preventive Action Plan: RFO/CODocument3 pagesCorrective Action and Preventive Action Plan: RFO/COJose GualbertoNo ratings yet

- COA Prescribed FormDocument32 pagesCOA Prescribed FormEden EscaloNo ratings yet

- Serology Serology Serology Serology Dengue Duo Rapid Test Dengue Duo Rapid Test Dengue Duo Rapid Test Dengue Duo Rapid TestDocument3 pagesSerology Serology Serology Serology Dengue Duo Rapid Test Dengue Duo Rapid Test Dengue Duo Rapid Test Dengue Duo Rapid TestJohn DoeNo ratings yet

- Common Registration Form RevisedDocument2 pagesCommon Registration Form RevisedSunny AgrawalNo ratings yet

- CUTN050004524YXNK2Document2 pagesCUTN050004524YXNK2manirajNo ratings yet

- Urcarf Emds Agency 2022-2-2Document1 pageUrcarf Emds Agency 2022-2-2christineibayNo ratings yet

- Bank Concurrent Audit Report FormatDocument105 pagesBank Concurrent Audit Report FormatAdesh Nahar100% (1)

- Exercise 4 - The Rule of Debit and CreditDocument9 pagesExercise 4 - The Rule of Debit and CreditMichael DiputadoNo ratings yet

- SAP ISU Master DATACreationDocument33 pagesSAP ISU Master DATACreationKalyan Abap100% (5)

- Retiree Request Form OR NoDocument1 pageRetiree Request Form OR NoFranco SalazarNo ratings yet

- Questionnaire: Applying To Become MECO Stockiest DealerDocument10 pagesQuestionnaire: Applying To Become MECO Stockiest DealerNikesh ShahNo ratings yet

- Indicators of Reputation: Residency & Ties With The CommunityDocument4 pagesIndicators of Reputation: Residency & Ties With The CommunityDivina GammootNo ratings yet

- OTGCI Truckers Accreditation Form 2019 PDFDocument3 pagesOTGCI Truckers Accreditation Form 2019 PDFOmar FrianezaNo ratings yet

- 2023 - 10 - 30 Handouts - Govt Tendering and Contract ManagementDocument41 pages2023 - 10 - 30 Handouts - Govt Tendering and Contract ManagementpraveeniitkiasNo ratings yet

- Btìgò Atéßò BTQ Tèvt: Bank of BarodaDocument4 pagesBtìgò Atéßò BTQ Tèvt: Bank of BarodaDebargha 2027No ratings yet

- FCMBOnline Client Activation FormDocument5 pagesFCMBOnline Client Activation FormJonathan QueenxNo ratings yet

- 2019 June 03 Chapter 2 Problems and SolutionDocument23 pages2019 June 03 Chapter 2 Problems and SolutionZisanNo ratings yet

- Loan Application: Annex 1Document18 pagesLoan Application: Annex 1NinoSawiranNo ratings yet

- MYTV Vendor Registration FormDocument11 pagesMYTV Vendor Registration FormShida Yunus100% (1)

- Support Site Manual Completed (2016)Document56 pagesSupport Site Manual Completed (2016)Anonymous jlCnpFogzNo ratings yet

- Policyloanapplicationform PDFDocument2 pagesPolicyloanapplicationform PDFEdgar Compala100% (1)

- Franchise Application161208Document11 pagesFranchise Application161208Jaime OliveNo ratings yet

- Business Plan Booklet 1Document3 pagesBusiness Plan Booklet 1Amr AbdelMoneimNo ratings yet

- Tenant Application Form.10716Document1 pageTenant Application Form.10716Ervin TanNo ratings yet

- Kajal Questionnaire For Customers-1Document4 pagesKajal Questionnaire For Customers-1Mukesh GiriNo ratings yet

- 01-Corporate Application Form - 112021Document2 pages01-Corporate Application Form - 112021FandENo ratings yet

- Part I. Process of Repair Check-In (Identification)Document6 pagesPart I. Process of Repair Check-In (Identification)Abbie Joyce De GuzmanNo ratings yet

- Tulungan Application Form Rev. 7Document1 pageTulungan Application Form Rev. 7joyce DtNo ratings yet

- Credit Appraisal Format For Limits Above Rs.2 Crore (For MSME Above Rs.5 Crore)Document34 pagesCredit Appraisal Format For Limits Above Rs.2 Crore (For MSME Above Rs.5 Crore)SAWAN KUMARNo ratings yet

- Sbi QuestionnaireDocument2 pagesSbi QuestionnaireNivesh GurungNo ratings yet

- Form 135Document4 pagesForm 135TechnetNo ratings yet

- Supplier Registration-Update FormDocument6 pagesSupplier Registration-Update FormMoiz EhsanNo ratings yet

- Risk Mgt. Survey Questionnaire 2023Document3 pagesRisk Mgt. Survey Questionnaire 2023jamaica tarayaoNo ratings yet

- SBIapplicationformDocument5 pagesSBIapplicationformSufi DarweshNo ratings yet

- Article: Lesson 42 Chapter-13 Accounts-Receivables Management Unit 5 Management of Working CapitalDocument37 pagesArticle: Lesson 42 Chapter-13 Accounts-Receivables Management Unit 5 Management of Working CapitalTakreem AliNo ratings yet

- Abm Terminus WorksheetsDocument10 pagesAbm Terminus WorksheetsMichael WachsNo ratings yet

- User Request/Certification of Access Rights Form For Emds (For Agency)Document2 pagesUser Request/Certification of Access Rights Form For Emds (For Agency)Philip Jansen Guarin50% (6)

- Customer Request Forms - LoansDocument1 pageCustomer Request Forms - LoansChiragNo ratings yet

- IT AssessmentDocument6 pagesIT AssessmentFerdinand OsernyNo ratings yet

- Credit Facility Form (Grand)Document2 pagesCredit Facility Form (Grand)cyed mansoorNo ratings yet

- 03 RedemptionFormDocument1 page03 RedemptionFormMinhaj HussainNo ratings yet

- CRF - Merino Industires LimitedDocument5 pagesCRF - Merino Industires LimitedAbhimanyu MahadikNo ratings yet

- Bsplink Manual Airlines: November 23, 2020Document166 pagesBsplink Manual Airlines: November 23, 2020WNo ratings yet

- Union Share ApplicationDocument4 pagesUnion Share ApplicationBalasubramanyam M DNo ratings yet

- Secure Mobile Banking SRSDocument7 pagesSecure Mobile Banking SRSVinay JainNo ratings yet

- Survey For Credit Flow To Sme SectorDocument4 pagesSurvey For Credit Flow To Sme SectorSwapnil MadgulwarNo ratings yet

- NoticeDocument2 pagesNoticerajat20101998No ratings yet

- Final Terms Condition For Sub BrokerDocument7 pagesFinal Terms Condition For Sub Brokersandeep_bhandariNo ratings yet

- SBM (Summary Notes - Alternative)Document172 pagesSBM (Summary Notes - Alternative)Sofia NicoriciNo ratings yet

- Facilities ManagementDocument4 pagesFacilities ManagementSamantha Louise MoldesNo ratings yet

- Retiree Request Form 8 Rong Hua XingDocument1 pageRetiree Request Form 8 Rong Hua XingAlfy TanNo ratings yet

- Account Closure FormDocument1 pageAccount Closure FormSam MustNo ratings yet

- Branch Office - Dholewal - : 4a.notional Concessions For 6 MonthsDocument7 pagesBranch Office - Dholewal - : 4a.notional Concessions For 6 Monthsifb.ludhianaNo ratings yet

- Corporate Online BankingDocument6 pagesCorporate Online BankingdynamiclovelineNo ratings yet

- Angeles University Foundation College of Business and AccountancyDocument9 pagesAngeles University Foundation College of Business and AccountancyAlyssa AlejandroNo ratings yet

- Salary AutrorizationDocument1 pageSalary AutrorizationWi Perocurement100% (1)

- HRCPC - Loan Application FormsDocument15 pagesHRCPC - Loan Application FormsAtul GuptaNo ratings yet

- Routing SlipDocument12 pagesRouting SlipSean Palacpac-ResurreccionNo ratings yet

- Bonus Loan ApplicationDocument1 pageBonus Loan ApplicationAugieray D. MercadoNo ratings yet

- Declaration of Absence of Conflict of InterestsDocument1 pageDeclaration of Absence of Conflict of InterestsKrys TelNo ratings yet

- Dayoc Ferrer DRCDocument16 pagesDayoc Ferrer DRCKrys TelNo ratings yet

- MK KaSuSy2021Document15 pagesMK KaSuSy2021Krys TelNo ratings yet

- School Form 1 (SF 1) School RegisterDocument3 pagesSchool Form 1 (SF 1) School RegisterKrys TelNo ratings yet

- 3rdquarter SF7 501159 BogoCalabatIS ElemDocument163 pages3rdquarter SF7 501159 BogoCalabatIS ElemKrys TelNo ratings yet

- 1stquarter SF7 501159 BogoCalabatIS ElemDocument163 pages1stquarter SF7 501159 BogoCalabatIS ElemKrys TelNo ratings yet

- .Archsf7 Bogo Calabat Is 501159Document164 pages.Archsf7 Bogo Calabat Is 501159Krys TelNo ratings yet

- Bogo Calabat Is Form 7 Secondary 2021 2022Document164 pagesBogo Calabat Is Form 7 Secondary 2021 2022Krys TelNo ratings yet

- Iit Tender CCTVDocument86 pagesIit Tender CCTVdgrsriNo ratings yet

- Fedai Daily Quiz Questions Archives - Ecb - Fdi - Odi - Branch or Project OfficeDocument27 pagesFedai Daily Quiz Questions Archives - Ecb - Fdi - Odi - Branch or Project OfficeSomdutt Gujjar100% (2)

- Fund Factsheets IndividualDocument60 pagesFund Factsheets IndividualCA RAHUL KHANDELWALNo ratings yet

- Black Book NewDocument52 pagesBlack Book NewPragya SinghNo ratings yet

- Financial Performance of DCC Bank With Special Reference To Vijayapur DistrictDocument4 pagesFinancial Performance of DCC Bank With Special Reference To Vijayapur DistrictAnjum Ansh KhanNo ratings yet

- 8th BPS 020605Document70 pages8th BPS 020605Haris11328No ratings yet

- Famous QuotesDocument49 pagesFamous QuotesthatcanadaguyNo ratings yet

- Press Release: YFC Projects Private LimitedDocument5 pagesPress Release: YFC Projects Private Limitedlalit rawatNo ratings yet

- Services Marketing NotesDocument96 pagesServices Marketing NotesKarthikNo ratings yet

- Types of Financial Instruments of Money MarketDocument2 pagesTypes of Financial Instruments of Money MarketMian Abdul HaseebNo ratings yet

- Passive IncomeDocument20 pagesPassive IncomeushabalamuruganNo ratings yet

- Scotia Bank BookletDocument84 pagesScotia Bank BookletTuhin Mishuk PaulNo ratings yet

- ABL Annual Report 2015 UpdatedDocument266 pagesABL Annual Report 2015 Updatedali.khan10No ratings yet

- An To Composable: BankingDocument28 pagesAn To Composable: BankingimperatronNo ratings yet

- PinoyInvestor Free Version - 18 Nov 2013 FlytDocument52 pagesPinoyInvestor Free Version - 18 Nov 2013 FlytJay GalvanNo ratings yet

- Presented by DR Jey at BIRD LucknowDocument16 pagesPresented by DR Jey at BIRD LucknowvijayjeyaseelanNo ratings yet

- CIPP-US Prep Guide-HL01Document263 pagesCIPP-US Prep Guide-HL01dalyn carlNo ratings yet

- CHECKLIST Asset Liability ManagementDocument6 pagesCHECKLIST Asset Liability ManagementMazharul Islam RafiNo ratings yet

- Account Statement 010721 210122Document30 pagesAccount Statement 010721 210122PhanindraNo ratings yet

- Updated 2002 - 2009Document172 pagesUpdated 2002 - 2009Laila SarhanNo ratings yet

- Financial Institutions and Markets ProjectDocument10 pagesFinancial Institutions and Markets ProjectPallavi AgrawallaNo ratings yet

- Sample Ltr2 FudiciaryTrustee4 OIDs 3 - 2020Document3 pagesSample Ltr2 FudiciaryTrustee4 OIDs 3 - 2020ricetech100% (22)

- Central Bank of Sri LankaDocument6 pagesCentral Bank of Sri LankaGain GainNo ratings yet

- CAMELSDocument5 pagesCAMELSAmmar Arif100% (1)

- Islamic Finance by Dr. Humaira Awais ShahidDocument61 pagesIslamic Finance by Dr. Humaira Awais ShahidIbn SadiqNo ratings yet

- Bouncing Check & Bank Secrecy LawDocument19 pagesBouncing Check & Bank Secrecy LawDave A Valcarcel0% (1)

- BAF 202 Corporate Finance and Financial ModellingDocument62 pagesBAF 202 Corporate Finance and Financial ModellingRhinosmikeNo ratings yet

- CB1 CMP Upgrade 2022Document80 pagesCB1 CMP Upgrade 2022Linh TinhNo ratings yet

- Allen Overy 3 49729Document10 pagesAllen Overy 3 49729Jose CarterNo ratings yet

- Iesha Indi June Statement 2021Document1 pageIesha Indi June Statement 2021Sharon JonesNo ratings yet