Professional Documents

Culture Documents

Fmi Assignment

Uploaded by

Ahsan Ali MemonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fmi Assignment

Uploaded by

Ahsan Ali MemonCopyright:

Available Formats

FMI ASSIGNMENT

Ans: The monetary policy committee (MPC) lifted the trade rate by 150 basis points to

8.75 percent, implying that the risk of inflation and the balance of payments has grown

while GDP has improved. The risk is related to both global and domestic reasons, and if

we look at the current scenario, pricing pressure has generated supply chain disruption.

As a result of the current scenario, the central bank has tightened monetary policy. When

it comes to Pakistan, greater import prices have resulted in higher CPI, SPI, and inflation.

The current account deficit was larger than expected in December and October, with

rising oil and commodity prices affecting the rupee. As a result, we can conclude that the

balance of risk has shifted away from growth and toward inflation. The current account

deficit was larger than expected in December and October, with rising oil and commodity

prices affecting the rupee. As a result, we can conclude that the balance of risk has shifted

away from growth and toward inflation. With all of this in mind, it's critical to normalise

monetary policy in order to combat inflation and promote stability and growth; an

increase in the current rate is one approach to achieve these objectives.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hybrid Mode SheetDocument5 pagesHybrid Mode SheetAhsan Ali MemonNo ratings yet

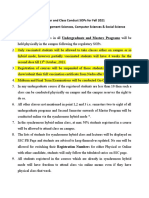

- Semester and Class Conduct Sops For Fall 2021 Departments of Management Sciences, Computer Sciences & Social ScienceDocument3 pagesSemester and Class Conduct Sops For Fall 2021 Departments of Management Sciences, Computer Sciences & Social ScienceAhsan Ali MemonNo ratings yet

- Table 6.1 National Savings Schemes (Net Investment)Document2 pagesTable 6.1 National Savings Schemes (Net Investment)Ahsan Ali MemonNo ratings yet

- 8-Trade and PaymentDocument16 pages8-Trade and PaymentAhsan Ali MemonNo ratings yet

- TABLE 7.1 (A) Price IndicesDocument14 pagesTABLE 7.1 (A) Price IndicesAhsan Ali MemonNo ratings yet

- Field & Stream - August 2021Document112 pagesField & Stream - August 2021Ahsan Ali MemonNo ratings yet

- 5-Money and CreditDocument8 pages5-Money and CreditAhsan Ali MemonNo ratings yet

- 4-Fiscal DevelopmentDocument5 pages4-Fiscal DevelopmentAhsan Ali MemonNo ratings yet

- Faizashahani - 42 - 3564 - 1 - MARKETING PRINCIPLES Final AssignementDocument4 pagesFaizashahani - 42 - 3564 - 1 - MARKETING PRINCIPLES Final AssignementAhsan Ali MemonNo ratings yet

- Afzal - 72 - 3564 - 1 - Ob Test 2Document2 pagesAfzal - 72 - 3564 - 1 - Ob Test 2Ahsan Ali MemonNo ratings yet

- Marketing AssignmentDocument7 pagesMarketing AssignmentAhsan Ali MemonNo ratings yet

- Proposal For Mentoring School For Youth in PakistanDocument6 pagesProposal For Mentoring School For Youth in PakistanAhsan Ali MemonNo ratings yet

- Business ProposalDocument6 pagesBusiness ProposalAhsan Ali MemonNo ratings yet

- Bec Business ProposalDocument6 pagesBec Business ProposalAhsan Ali MemonNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)