Professional Documents

Culture Documents

Maize June 2020

Uploaded by

Rajveer ChauhanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maize June 2020

Uploaded by

Rajveer ChauhanCopyright:

Available Formats

Maize Outlook, June 2020

Maize Outlook – June 2020

Maize or corn (Zea mays) is cultivated globally being one of the most important cereal

crops Worldwide. As per USDA, U.S corn exports reached 29.01 MMT in 2019-20 marketing

year. At 1.35 MMT (for the period 22nd to 28th May, 2020) US corn exports were up 27 percent

from the previous week and 7 percent from the prior 4 week average; mainly for the destinations

like Japan (447,900 MT), Mexico (233,300 MT), South Korea (206,800 MT) and Guatemala

(60,800 MT). It expects that increase in export demand for U.S corn could support to CBOT corn

prices. In U.S, corn plantings as on 31 May 2020 stand at 93%, up by 29 percentage points from

same time last year. Rapid U.S planting progress is likely to put pressure on CBOT corn prices.

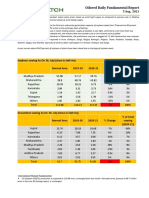

Table 1: International Grain Council’s World Corn Projections (in million metric tonnes)

2018/19 2019/20 2020/21

(Estimated) (Forecast) (Projected)

Opening Stocks 340.5 322.6 297.0

Production 1129.0 1118.3 1168.6

Imports 164.8 167.9 174.8

Total Availability 1469.5 1440.9 1465.7

Food 127.8 129.5 130.2

Industrial 303.9 293.6 310.2

Feed 675.3 682.1 698.0

Others 39.9 38.7 38.8

Total Consumption 1146.9 1143.9 1177.2

Exports 164.8 167.9 174.8

Ending Stocks 322.6 297.0 288.5

Source: https://www.igc.int/en/markets/marketinfo-sd.aspx

Table 2: International Grain Council’s Indian corn Projections (in million metric tonnes)

2018/19 2019/20

(Estimated) (Forecast)

Opening Stocks 2.5 1.42

Production 22.72 28.98

Imports 0.21 0.34

Total Supply 25.43 30.7

Export 0.58 0.47

Domestic Consumption 23.43 22.62

Total Demand 24.01 23.09

Ending Stock 1.42 7.65

Monthly Use 2 1.92

Stock to Use Ratio 5.92% 17.50%

Source: www.agriwatch.com

Agricultural Market Intelligence Centre, PJTSAU Page1

Maize Outlook, June 2020

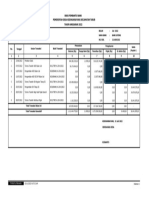

Table 3: Month-wise average prices of Maize at various markets

% %

Change Change

Market 2020-May 2020-Apr 2019-May from from

Prev. Prev.

Month Year

Delhi 1382 Closed 2041 - -32.29

Davangere 1356 1394 2252 -2.73 -39.79

Shimoga 1376 1552 2190 -11.34 -37.17

Bagalkot 1290 1271 2116 2.2 -38.61

Gadag 1349 1420 2102 -5 -35.82

Nizamabad NA Closed 1965 - -

Khanna 1327 Closed 1971 - -32.67

Sangli (NCDEX Quality) NA Closed 2297 - -

Gulabbagh(NCDEX Quality) 1229 1397 1816 -12.03 -32.32

Naugachia 1206 Closed 1759 - -31.44

Erode (NCDEX Quality) NA Closed 2335 - -

Source: www.agriwatch.com

In India, rabi maize was sown in around 16.98 lakh hectares (41.95 lakh acres) as on

st

31 January2020 which is higher than 14.78 lakh hectares(36.52 lakh acres) covered during

corresponding period of last year. Major maize growing states are Bihar 5.05 lakh ha (12.47 lakh

acres), Maharashtra 2.27 lakh ha (5.60 lakh acres), Tamil Nadu 1.48 lakh ha (3.65 lakh acres),

West Bengal 1.12 lakh ha (2.76 lakh acres), Gujarat 1.32 lakh ha (3.26 lakh acres), Telangana

(1.49 lakh ha (3.68 lakh acres) and Andhra Pradesh 1.67 lakh ha (4.12 lakh acres) as of

31stJanuary 2020.

In Telangana, it has been sown in 2.53 lakh hectares (6.25 lakh acres) as on 25thMay

2020which is higher than 1.26 lakh hectares (3.11 lakh acres) covered during corresponding

period of last year. Major growing districts of rabi maize are Warangal 0.44 lakh ha (1.10 lakh

acers), khammam 0.36 lakh ha (0.91 lakh acres), Nirmal 0.33 lakh ha (0.83 lakh acres),

Mehabubabad 0.17 lakh ha (0.42 lakh acres) and Warangal (Urban) 0.16 lakh ha (0.41 lakh acres).

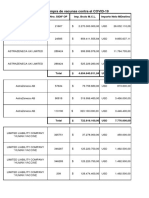

As per trade sources, India exported around 19,713 MT of maize for the month of

April’20 at an average FoB of $242.71/ MT. Out of which, around 15,369 MT Indian maize was

exported mainly to Nepal at an average FoB of $244.36/MT; mainly through Raxaul followed by

Jogbani ICD and Nepalgunj Road port. India imported around 268.5 MT of maize for the month

of April’20. Out of this, around 193.5 MT was imported from Myanmar at Kolkata port (145.5

MT @ $261.04 USD/MT) and Chennai port (48 MT @ $249.98 USD/MT).

Agricultural Market Intelligence Centre, PJTSAU Page2

Maize Outlook, June 2020

Corn on CBOT rose by 1.28 USD/MT to 127.26 USD/MT for July’20 contract compared

to previous month due to increase in demand for U.S corn for ethanol. However, higher corn

production prospects in U.S could limit the firmness.

Maize Price Outlook

Maize cash markets traded weak during the month of May’20 compared to previous

month and corresponding period of last year due to sluggish demand from poultry feed industry

in the wake of corona virus amid new crop arrivals. For the month of June’20, it expects that

maize could trade steady to range bound amid limited demand and supply. In Bihar, maize is

being traded in a range of Rs. 1225-1250 per quintal (Bilty Price) amid limited demand and

arrival. Stockiest demand has come down as recent rains have impacted the arrival quality.

In Nizamabad, maize market remained officially closed from 21stMarch to 26thMay, 2020

due to lockdown. After that, first trade was reported on 2 June 2020 at Rs. 1600 per quintal

(Bilty Price).Farmers were not bringing their produce to the market, preferring to sell to the

Government.

Telangana State Cooperative Marketing Federation (TS-MARKFED) has procured about

6.94 lakh tones of maize as of 25thMay, 2020. As per AP MARKFED, from the current rabi crop,

2.75 lakh tonnes of maize has been procured by A.P government as of 25thMay, 2020. The

procurement is still ongoing.

Maize from Devangere region of Karnataka is moving towards Bangalore and Tamil

Nadu at Rs. 1450 per quintal and Rs. 1550 per quintal (Delivered Price) respectively. As per

trade sources, each maize grower in the Karnataka state is getting a cash relief of ₹5,000 to

compensate the impact of low maize prices. As per media news, five cattle feed manufacturing

plants of the Karnataka Cooperative Milk Producers’ Federation Ltd. has started purchase of the

produce at Rs.1760 per quintal from 12th May’20. The maximum quantity of purchase has been

capped at 50 quintals from each farmer.

Maize acreage in Kharif 2020-21 may turn out to be higher than that in Kharif 2019-20 as

farmers in Karnataka, Rajasthan, Maharashtra and Madhya Pradesh would prefer less labour

intensive crops. Seed availability is expected to remain sufficient as transportation of agriculture

related materials has become almost normal after the relaxations in lockdown.

Expectation of good monsoon amid proposed increase in MSP by Rs. 90 per quintal at

Rs. 1850 per quintal for the Kharif season 2020-21; are all good motivating factors for farmers to

grow more maize for this Kharif season. However, in Telangana, maize area is likely to shift

towards more remunerative and high yield crops likes pulses.

Under these circumstances, Agricultural Market Intelligence Centre, PJTSAU expects that

maize could trade in price range of Rs. 1350 - 1520 quintal during the month of June, 2020.

Agricultural Market Intelligence Centre, PJTSAU Page3

You might also like

- JPC Market Price Retail For 1St June 2021Document2 pagesJPC Market Price Retail For 1St June 2021Rohit Malasi 7ANo ratings yet

- List Member PIPALDocument38 pagesList Member PIPALFahad khandokerNo ratings yet

- How Interest Rates Affect The Stock MarketDocument7 pagesHow Interest Rates Affect The Stock MarketSandeep BabajiNo ratings yet

- Maize January 2022Document4 pagesMaize January 2022nandarulsNo ratings yet

- Economic Outlook - July 2020Document8 pagesEconomic Outlook - July 2020KaraNo ratings yet

- Castor August 2021Document4 pagesCastor August 2021archawdaNo ratings yet

- Economic Outlook - May 2020Document8 pagesEconomic Outlook - May 2020KaraNo ratings yet

- Maize Outlook-October 2023Document4 pagesMaize Outlook-October 2023SRINIVASAN TNo ratings yet

- India Paddy-May-2022Document5 pagesIndia Paddy-May-2022SRINIVASAN TNo ratings yet

- Textile Industry May23Document19 pagesTextile Industry May23udayansari786No ratings yet

- Monthly Report On Tomato For June, 2020Document9 pagesMonthly Report On Tomato For June, 2020KhalilNo ratings yet

- Cotton SectorDocument6 pagesCotton Sectormahadevrao suryavanshiNo ratings yet

- Paddy June 2021Document5 pagesPaddy June 2021RAMAKRISHNANo ratings yet

- Castor January 2024Document4 pagesCastor January 2024himanshu rawalNo ratings yet

- Monthly Report On Tomato For May, 2020Document9 pagesMonthly Report On Tomato For May, 2020RahmanNo ratings yet

- Gradual Increase in Rice Production Area and Reduction of Post-Harvest LossesDocument4 pagesGradual Increase in Rice Production Area and Reduction of Post-Harvest LossesDodong MelencionNo ratings yet

- 10-Groundnut Outlook Report - January To December 2022Document8 pages10-Groundnut Outlook Report - January To December 2022dmuchebyNo ratings yet

- Sugar Profile July 2019Document9 pagesSugar Profile July 2019Ahmed OuhniniNo ratings yet

- Pes02 AgricultureDocument24 pagesPes02 AgricultureAr RehmanNo ratings yet

- GetarchreportpathDocument6 pagesGetarchreportpathAbuNo ratings yet

- Agriculture: Agriculture Performance During FY2020Document25 pagesAgriculture: Agriculture Performance During FY2020Muhammad WaqasNo ratings yet

- GetarchreportpathDocument6 pagesGetarchreportpathAbuNo ratings yet

- Monthly Report On Onion For April, 2020 - 0Document9 pagesMonthly Report On Onion For April, 2020 - 0eximahmedNo ratings yet

- Statistical AppendixDocument6 pagesStatistical AppendixVenus PlanetNo ratings yet

- GetarchreportpathDocument6 pagesGetarchreportpathAbuNo ratings yet

- Release Statement June 2022Document2 pagesRelease Statement June 2022MalikNisarAwanNo ratings yet

- Wheat Profile July 2018Document8 pagesWheat Profile July 2018Vineet SinghNo ratings yet

- Rice Outlook Monthly Tables February 2020Document12 pagesRice Outlook Monthly Tables February 2020Akash NeupaneNo ratings yet

- Rice Outlook Monthly Tables November 2021Document13 pagesRice Outlook Monthly Tables November 2021jun njkNo ratings yet

- Monthly Report On Potato For May, 2020Document9 pagesMonthly Report On Potato For May, 2020souravroy.sr5989No ratings yet

- SORGHUM OUTLOOK REPORT - January To May 2021Document5 pagesSORGHUM OUTLOOK REPORT - January To May 2021sachin yadavNo ratings yet

- EC 052 Dt. 14.06.2022 Import of Veg. Oils Nov.21 May 22 - CompressedDocument7 pagesEC 052 Dt. 14.06.2022 Import of Veg. Oils Nov.21 May 22 - CompressedSAMYAK PANDEYNo ratings yet

- Sugar - Profile - July - 2019 ImportentDocument10 pagesSugar - Profile - July - 2019 ImportentMohit SharmaNo ratings yet

- Market Intelligence Report Soya Beans Issue 4 of 2022Document28 pagesMarket Intelligence Report Soya Beans Issue 4 of 2022Oudano MomveNo ratings yet

- Market Research: OCTOBER 2020Document20 pagesMarket Research: OCTOBER 2020Mudit ChauhanNo ratings yet

- OCP Agriculture Africa Report 2021Document35 pagesOCP Agriculture Africa Report 2021Saloua ElboustatiNo ratings yet

- Agriculture Statistical Information - FinalDocument14 pagesAgriculture Statistical Information - FinalRoshma PandeyNo ratings yet

- PR-063 DT - 20.02.2023 - Export of Oilmeals - Apr.'22 To Jan.'23Document5 pagesPR-063 DT - 20.02.2023 - Export of Oilmeals - Apr.'22 To Jan.'23SAMYAK PANDEYNo ratings yet

- 02 AgricultureDocument27 pages02 AgricultureRk SunnyNo ratings yet

- US Bangladesh RelationDocument5 pagesUS Bangladesh RelationSayedur RahmanNo ratings yet

- Dgcis Report Kolkata PDFDocument12 pagesDgcis Report Kolkata PDFABCDNo ratings yet

- Table 2. U.S. International Trade in Goods-: ContinuesDocument5 pagesTable 2. U.S. International Trade in Goods-: ContinuesHailee HayesNo ratings yet

- Cereals ImportsDocument18 pagesCereals ImportsAlex's PrestigeNo ratings yet

- Privilege Speech For Food Security On Rice Price StabilizationDocument8 pagesPrivilege Speech For Food Security On Rice Price StabilizationTajNo ratings yet

- Soyabean January 2022Document4 pagesSoyabean January 2022Ghif GhifNo ratings yet

- Karnatka PPT - 0Document22 pagesKarnatka PPT - 0basana patilNo ratings yet

- Statistics 0001Document12 pagesStatistics 0001Saurav kumarNo ratings yet

- EC-083 Dt. 12.07.2022 - Import of Veg. Oils - Nov.'21 - June '22Document7 pagesEC-083 Dt. 12.07.2022 - Import of Veg. Oils - Nov.'21 - June '22SAMYAK PANDEYNo ratings yet

- Fiscal Year 2019-20 Rupees Dollar Per Capita Income GDP Services Sector Whole Sale and Retail SectorDocument2 pagesFiscal Year 2019-20 Rupees Dollar Per Capita Income GDP Services Sector Whole Sale and Retail SectorHamza MirajNo ratings yet

- Cotton Profile May 2019Document10 pagesCotton Profile May 2019Jahanvi KhannaNo ratings yet

- Final Publication-2010Document187 pagesFinal Publication-2010tiwarivikasNo ratings yet

- Daily Market Report Dated As On 16.01.2023.rabDocument3 pagesDaily Market Report Dated As On 16.01.2023.rabtanvir.ahmadNo ratings yet

- Paper Industry Apr23Document16 pagesPaper Industry Apr23anshul suryanNo ratings yet

- EU Cereals MarketDocument29 pagesEU Cereals MarketCatalin PlatonNo ratings yet

- Agriculture: Performance During 2017-18Document20 pagesAgriculture: Performance During 2017-18Malik Shaheen SultanNo ratings yet

- Chap 2Document17 pagesChap 2Nagina MemonNo ratings yet

- Rice Monthly Research Report 5 October-2020Document13 pagesRice Monthly Research Report 5 October-2020AbuNo ratings yet

- FINAL CLAFA 2 2023 Sharing 20 AprilDocument91 pagesFINAL CLAFA 2 2023 Sharing 20 AprilKennedy MabehlaNo ratings yet

- Release Statement Feb 2023Document2 pagesRelease Statement Feb 2023sajjad aliNo ratings yet

- Year Total Exporttotal Impo Export Grimport Growth Rate (%) : Balance of TDocument15 pagesYear Total Exporttotal Impo Export Grimport Growth Rate (%) : Balance of TAurora IqbalNo ratings yet

- Monthly Report On Tomato For April, 2020Document9 pagesMonthly Report On Tomato For April, 2020KhalilNo ratings yet

- The Determinants of Low Wheat Productivity in KenyaDocument5 pagesThe Determinants of Low Wheat Productivity in KenyaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Promoting Agrifood Sector Transformation in Bangladesh: Policy and Investment PrioritiesFrom EverandPromoting Agrifood Sector Transformation in Bangladesh: Policy and Investment PrioritiesNo ratings yet

- BCG Matrix of Coca ColaDocument2 pagesBCG Matrix of Coca ColaRajveer ChauhanNo ratings yet

- Sustainable Agriculture - Chapter 12 - 9-33Document25 pagesSustainable Agriculture - Chapter 12 - 9-33Rajveer ChauhanNo ratings yet

- FMCG Risks 2016Document2 pagesFMCG Risks 2016Rajveer ChauhanNo ratings yet

- Dobling Farmers IncomeDocument2 pagesDobling Farmers IncomeRajveer ChauhanNo ratings yet

- Ertman, Thomas. Birth of The Leviathan Building States and Regimes in Medieval and Early Modern Europe. Cambridge Cambridge University Press, 1997.Document7 pagesErtman, Thomas. Birth of The Leviathan Building States and Regimes in Medieval and Early Modern Europe. Cambridge Cambridge University Press, 1997.HippiasNo ratings yet

- Fin424 - Final Report - 19104153 - Maliha Tahsin Shafa - Sec-3Document8 pagesFin424 - Final Report - 19104153 - Maliha Tahsin Shafa - Sec-3maliha tahsinNo ratings yet

- Particulars of Directors/Officers: Corporate InformationDocument4 pagesParticulars of Directors/Officers: Corporate Informationtalib aliNo ratings yet

- Pagos Efectuados A LaboratoriosDocument14 pagesPagos Efectuados A LaboratoriosCronista.comNo ratings yet

- Swot Analysis of AssetsDocument8 pagesSwot Analysis of Assetsshinjan bhattacharyaNo ratings yet

- The Outlook For Sulphur and Sulphuric Acid. CreonDocument36 pagesThe Outlook For Sulphur and Sulphuric Acid. CreonSudeep MukherjeeNo ratings yet

- YubarajDocument4 pagesYubarajYubraj ThapaNo ratings yet

- Account Statement From 1 Mar 2019 To 29 Feb 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument9 pagesAccount Statement From 1 Mar 2019 To 29 Feb 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancenaveen kumarNo ratings yet

- Chap 1 - Portfolio Risk and Return Part1Document91 pagesChap 1 - Portfolio Risk and Return Part1eya feguiriNo ratings yet

- Special Different TreatmentDocument2 pagesSpecial Different TreatmentreinharduyNo ratings yet

- People Express Airlines: Rise and DeclineDocument9 pagesPeople Express Airlines: Rise and Declinepreeti jhaNo ratings yet

- Be Unit IDocument15 pagesBe Unit Ishiva saiNo ratings yet

- Laporan Cit Harian 2021-2022Document198 pagesLaporan Cit Harian 2021-2022mas sudarsonoNo ratings yet

- Bernard Q-Gun: Custom Select Ordering System For Bernard Q-GunsDocument13 pagesBernard Q-Gun: Custom Select Ordering System For Bernard Q-GunsJeffin JojimonNo ratings yet

- Ge 113 Module 2Document17 pagesGe 113 Module 2Jean Ann CatanduanesNo ratings yet

- Accounting Theory 6-2023-1Document31 pagesAccounting Theory 6-2023-1Titu magNo ratings yet

- Kristen Case SolutionDocument3 pagesKristen Case SolutionMayank JoshiNo ratings yet

- Case StudyDocument4 pagesCase StudyjanakNo ratings yet

- EFBS - Glossary - UNIT 23 THE BUSINESS CYCLEDocument5 pagesEFBS - Glossary - UNIT 23 THE BUSINESS CYCLEHÀO TIẾT VĨNo ratings yet

- Notice AssessmentDocument2 pagesNotice AssessmentAnthony Angel TejaresNo ratings yet

- Searching List BrandsDocument3 pagesSearching List Brandsihateu1No ratings yet

- Buku Pembantu Bank Tahun Anggaran 2022 Pemerintah Desa Kedokansayang Kecamatan TarubDocument1 pageBuku Pembantu Bank Tahun Anggaran 2022 Pemerintah Desa Kedokansayang Kecamatan TarubDanyep IdrisNo ratings yet

- Accounting Cycle ProblemsDocument3 pagesAccounting Cycle ProblemsCHRISHA PARAGASNo ratings yet

- The Dell Theory of Conflict PreventionDocument2 pagesThe Dell Theory of Conflict PreventionNhi Bùi Võ YếnNo ratings yet

- Money Vocabulary - Taboo Game (CEFR C1)Document3 pagesMoney Vocabulary - Taboo Game (CEFR C1)cathiemignoneNo ratings yet

- LG Final Case StudyDocument1 pageLG Final Case StudyYahya Hajj ShehadehNo ratings yet

- CV Ips, 2021Document4 pagesCV Ips, 2021अहा मधुमक्खीपालनNo ratings yet