Professional Documents

Culture Documents

Ejercicios Finanzas Básicas

Uploaded by

Denisse Zamarripa PalomoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ejercicios Finanzas Básicas

Uploaded by

Denisse Zamarripa PalomoCopyright:

Available Formats

Alumna: Torres Bravo Melenie Aydee

Ejercicios de Finanzas Básicas

Clave única: 310555

Ejercicio 1

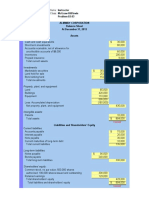

A. Prepare a balance sheet at September 30, 2018

CRYSTAL AUTO WASH

Balance Sheet

September 30, 2002

Assets Liabilities & Owners’Equity

Cash $9,200 Liabilities:

Accounts Receivable 800 Notes Payable $29,000

Supplies 400 Accounts Payable 14,000

Land 68,000 Salaries Payable. 3,000

Buildings 52,000 Total liabilities. $46,000

Machinery &

Equipment 65,000 Owners’ equity:

Capital Stock $100,000

Retained Earnings 49,400

Total $195,400 Total $195,400

B. Does this balance sheet indicate that the Company is in a strong financial

position? Explain briefly.

La empresa no tiene liquidez, porque las obligaciones son a corto plazo, la

posición financiera es débil porque los unicos activos liquidos, efectivo y por

cobrar, totalizan solo $10,000, pero la compañía tiene $46,000 en deudas

vencidas en el futuro cercano.

Ejercicio 2

Sun Corporation

ASSETS LIABILITIES & OWNERS’ EQUITY

Cash 18,000 Liabilities

Accounts receivable 26,000 Notes payable (due in 60

12,400

Land 37,200 days)

Building 38,000 Accounts payable 9,600

Office Equipment 1,200

Stockholders’ equity

Capital Stock 60,000

Retained Earnings 38,400

Total 120,400 Total 120,400

Terra Corporation

ASSETS LIABILITIES & OWNERS’ EQUITY

Cash 4,800 Liabilities

Accounts receivable 9,600 Notes payable (due in 60

22,400

Land 96,000 days)

Building 60,000 Accounts payable 43,200

Office Equipment 12,000

Stockholders’ equity

Capital Stock 72,000

Retained Earnings 44,800

Total 182,400 Total 182,400

Instructions

a. Assume that you are a banker and that each Company has applied to you for

a 90-day loan of 12,000. Wich would you consider to be more favorable

prospect? Explain your answer fully.

Comparando los activos, utilidades retenidas y los pasivos, la alternativa

más posible para seder el prestamos es Sun Corporation y que tiene una

utilidad retenida menor a Terra Corporation, todo lo mencionado provoca

que la organización Sun Corporation tenga una mejor solvencia para

liquidar el prestamo a diferencia de la segunda.

b. Assume that you are an investor considering purchasing all the capital stock

of one or both of the companies. For which business would you be willing to

pay the higher Price? Do you see any indication of a financial crisis that you

might face shortly after buying either Company? Explain your answer fully.

(For either decisión, additional information would be useful, but you are to

reach your decisión on the basis of the information avaible).

La mejor opción es la primer empresa ya que aunque tiene menor capital

sus deudas son menores por lo que el riesgo al invetir en ella es menor en

comparación con la segunda empresa que si bien tiene mayor capital sus

deudas son mucho mayores si decisimos invertir en esta nos arriesgamos

más, ahora bien si invertimos en ambas el riesgo se vuelve mucho mayor

por lo que lo mejor sería unicamente invertir en la empresa Sun

Corporation.

You might also like

- The Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItFrom EverandThe Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItRating: 5 out of 5 stars5/5 (1)

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Corporate Bonds and Structured Financial ProductsFrom EverandCorporate Bonds and Structured Financial ProductsRating: 5 out of 5 stars5/5 (1)

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- ASSIGNMENTSDocument13 pagesASSIGNMENTSJpzelleNo ratings yet

- Accounting - Text & Cases - 13 Edition Basic Accounting Concepts: The Balance SheetDocument7 pagesAccounting - Text & Cases - 13 Edition Basic Accounting Concepts: The Balance SheetV Hemanth KumarNo ratings yet

- Statement of Financial Position: Quiz 1: Multiple ChoiceDocument6 pagesStatement of Financial Position: Quiz 1: Multiple Choicedanica dimaculanganNo ratings yet

- Macp Latest Book 2022 23Document189 pagesMacp Latest Book 2022 23gajendraNo ratings yet

- Diss MarxismDocument14 pagesDiss MarxismLyka Celine De Jesus33% (3)

- Partnership FormatDocument2 pagesPartnership FormatGlenn Taduran100% (2)

- Financial PositionDocument2 pagesFinancial PositionKatherine BorjaNo ratings yet

- ClientsDocument24 pagesClientsmohammeddashtiNo ratings yet

- Corporate Liquidation & ReorganizationDocument6 pagesCorporate Liquidation & ReorganizationNahwi KimpaNo ratings yet

- Problem 2-2: J.L. Gregory CompanyDocument5 pagesProblem 2-2: J.L. Gregory CompanyKAPIL MBA 2021-23 (Delhi)No ratings yet

- Quiz 1 - Corporate Liquidation ReorganizationDocument4 pagesQuiz 1 - Corporate Liquidation ReorganizationJane GavinoNo ratings yet

- Sayna Plastic Shubham Plastic IndustriesDocument111 pagesSayna Plastic Shubham Plastic Industries325 hiral doshiNo ratings yet

- Cash Flow Tutorial QnsDocument13 pagesCash Flow Tutorial QnsCristian Renatus100% (1)

- M4 - Problem Exercises - Statement of Financial Position PDFDocument7 pagesM4 - Problem Exercises - Statement of Financial Position PDFCamille CastroNo ratings yet

- Joint ArrangementDocument3 pagesJoint ArrangementAlliah Mae AcostaNo ratings yet

- Chapter 10 Exercise 6Document11 pagesChapter 10 Exercise 6Tri HartonoNo ratings yet

- Liquidity Ratios - Practice QuestionsDocument14 pagesLiquidity Ratios - Practice QuestionsOsama SaleemNo ratings yet

- E5 8, E5 11, P5 3, P5 6Document12 pagesE5 8, E5 11, P5 3, P5 6CellinejosephineNo ratings yet

- INSTRUCTIONS: Select The Best Answer For Each of The Following Attempted. Mark Only One Answer For Each Item On The Answer SheetDocument13 pagesINSTRUCTIONS: Select The Best Answer For Each of The Following Attempted. Mark Only One Answer For Each Item On The Answer SheetMac Ferds100% (2)

- Fa5 Nov20Document8 pagesFa5 Nov20Ridzuan SharifNo ratings yet

- Balance Sheet With ExplanationDocument2 pagesBalance Sheet With ExplanationTrinadh KNo ratings yet

- Joint ArrangementsDocument3 pagesJoint ArrangementsCha EsguerraNo ratings yet

- AFAR 1.3 - Corporate LiquidationDocument5 pagesAFAR 1.3 - Corporate LiquidationKile Rien MonsadaNo ratings yet

- Midterm Ass2 BUSSCOMDocument44 pagesMidterm Ass2 BUSSCOMkristine torresNo ratings yet

- 05 Corporate LiquidationDocument4 pages05 Corporate LiquidationEric CauilanNo ratings yet

- (ANSWER) - 04 - Completing The Accounting CycleDocument9 pages(ANSWER) - 04 - Completing The Accounting CycledeltakoNo ratings yet

- F&AQPmidsem Summer22Document2 pagesF&AQPmidsem Summer22kanika thakurNo ratings yet

- RequiredDocument1 pageRequiredMingxNo ratings yet

- 2 - BuscomDocument9 pages2 - BuscomDeryl GalveNo ratings yet

- Business Combination Asset Acquisition: Third YearDocument6 pagesBusiness Combination Asset Acquisition: Third YearRosalie Colarte LangbayNo ratings yet

- ClassificationDocument2 pagesClassificationKate ParanaNo ratings yet

- Bali Company Worksheet For The Year Ended December 31, 2020: InstructionsDocument4 pagesBali Company Worksheet For The Year Ended December 31, 2020: Instructionsshera haniNo ratings yet

- ABM 14 - Casañas - BALANCE SHEETDocument1 pageABM 14 - Casañas - BALANCE SHEETCasañas, Gillian DrakeNo ratings yet

- ACC 201 Lesson Two - Conversion of Partnership To Limited Liability Companies-1Document4 pagesACC 201 Lesson Two - Conversion of Partnership To Limited Liability Companies-1Egede DavidNo ratings yet

- Chapter 3 - Excel SolutionsDocument8 pagesChapter 3 - Excel SolutionsHalt DougNo ratings yet

- Practice Question Paper - Financial AccountingDocument6 pagesPractice Question Paper - Financial AccountingNaomi SaldanhaNo ratings yet

- AC213 Ch03 ExerciseSolutionsDocument24 pagesAC213 Ch03 ExerciseSolutionsJoshua Miguel R. SevillaNo ratings yet

- P2Document40 pagesP2Michiko Kyung-soonNo ratings yet

- Question No 1: Journal EntriesDocument3 pagesQuestion No 1: Journal EntriesMUKHTALIFNo ratings yet

- Corporation LiquidationDocument2 pagesCorporation LiquidationPatrishaNo ratings yet

- Class Problems CH 4Document9 pagesClass Problems CH 4Eduardo Negrete100% (2)

- Accounting 315 - Quiz Business CombinationDocument5 pagesAccounting 315 - Quiz Business CombinationAlexNo ratings yet

- Company AccountsDocument10 pagesCompany AccountsLawrence101No ratings yet

- Revision - Additional ExercisesDocument2 pagesRevision - Additional ExercisesĐào Huyền Trang 4KT-20ACNNo ratings yet

- AFAR-02 Corporate LiquidationDocument2 pagesAFAR-02 Corporate LiquidationRamainne RonquilloNo ratings yet

- FUFA Question Paper - Compre - FOFA (ECON F212) 1st Sem 2018-19Document2 pagesFUFA Question Paper - Compre - FOFA (ECON F212) 1st Sem 2018-19vineetchahar0210No ratings yet

- Tutorials Topic 7Document9 pagesTutorials Topic 7haniNo ratings yet

- LAB 2 - LatihanDocument9 pagesLAB 2 - LatihanAlvira FajriNo ratings yet

- Hsslive Xii Acc 5 Dissolution of A Partnership Firm KeyDocument6 pagesHsslive Xii Acc 5 Dissolution of A Partnership Firm Keypirated wallahNo ratings yet

- Review Accounting NotesDocument9 pagesReview Accounting NotesJasin LujayaNo ratings yet

- Toaz - Info Prelim Midterm PRDocument98 pagesToaz - Info Prelim Midterm PRClandestine SoulNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Sample Problems Part FormDocument4 pagesSample Problems Part FormkenivanabejuelaNo ratings yet

- ACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationDocument2 pagesACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationRyan PedroNo ratings yet

- Acct615 NjitDocument14 pagesAcct615 NjithjnNo ratings yet

- Conversion or Sale of Partnership Firm Into Limited CompanyDocument24 pagesConversion or Sale of Partnership Firm Into Limited CompanyMadhav TailorNo ratings yet

- Afar 2Document7 pagesAfar 2Diana Faye CaduadaNo ratings yet

- CH 05Document10 pagesCH 05Antonios Fahed0% (1)

- Set A: Problem 1Document6 pagesSet A: Problem 1FINAH MEL DIVINANo ratings yet

- 1001 Practice QuestionsDocument95 pages1001 Practice QuestionsMohamad El-JadayelNo ratings yet

- Build, Borrow, Buy Build (Organic Growth)Document2 pagesBuild, Borrow, Buy Build (Organic Growth)Elisten DabreoNo ratings yet

- B2 Reading Topics-Evaluacion PetDocument15 pagesB2 Reading Topics-Evaluacion PetEmerson ChivarriNo ratings yet

- Cic-Recovery SwornDocument2 pagesCic-Recovery SwornHendrix VillameroNo ratings yet

- DRAFT Southern Highlands Destination Plan 2020-2030Document36 pagesDRAFT Southern Highlands Destination Plan 2020-2030Vera DemertzisNo ratings yet

- Name? Sector Company? Location? Contact No. ?: Manufacturer & Exporter of Black Leather Belts, Leather BeltsDocument3 pagesName? Sector Company? Location? Contact No. ?: Manufacturer & Exporter of Black Leather Belts, Leather BeltsChogle VishalNo ratings yet

- Xia Expansion PDFDocument8 pagesXia Expansion PDFPaul TurnetNo ratings yet

- Indiabulls Ventures (Dhani Services)Document4 pagesIndiabulls Ventures (Dhani Services)Kushagra KejriwalNo ratings yet

- Centre DetailsDocument3 pagesCentre Detailsrishi rishNo ratings yet

- List 04 05Document491 pagesList 04 05web2roNo ratings yet

- File 5Document436 pagesFile 5Irshad mohammedNo ratings yet

- Accountancy Question Paper For H S Final Examination 2022Document20 pagesAccountancy Question Paper For H S Final Examination 2022Dhruba J DasNo ratings yet

- Item Name HSN Code GST Rate QTY Taxable Rate Taxable ValueDocument5 pagesItem Name HSN Code GST Rate QTY Taxable Rate Taxable ValueAnup gurung100% (2)

- Subject Expert Qa - 1 - (2015-16) Module - 2Document7 pagesSubject Expert Qa - 1 - (2015-16) Module - 2Keyur PopatNo ratings yet

- Current LiabilitiesDocument5 pagesCurrent LiabilitiesPhoebe Dayrit CunananNo ratings yet

- TOP Important Questions For SBI PO/ IBPS Clerk/ IBPS PO Prelims Exams - Error Spotting QuestionsDocument11 pagesTOP Important Questions For SBI PO/ IBPS Clerk/ IBPS PO Prelims Exams - Error Spotting QuestionsDeepak ChandravanshiNo ratings yet

- Comparative Analysis of Insurance Product of HDFC BankDocument67 pagesComparative Analysis of Insurance Product of HDFC BankUmar ThukarNo ratings yet

- Chapter - 20 Cash and Liquidity ManagementDocument17 pagesChapter - 20 Cash and Liquidity ManagementBayem BusukNo ratings yet

- Debates On End of Ideology & End of History PDFDocument12 pagesDebates On End of Ideology & End of History PDFAadyasha MohantyNo ratings yet

- Careers in Banking and Finance 200910Document50 pagesCareers in Banking and Finance 200910Paulo PereiraNo ratings yet

- CBSE Class 12 Economics Sample Paper 01 (2019-20)Document21 pagesCBSE Class 12 Economics Sample Paper 01 (2019-20)Anonymous 01HSfZENo ratings yet

- Pascual Rivera Pimentel Memorial AcademyDocument12 pagesPascual Rivera Pimentel Memorial AcademyEb JovenNo ratings yet

- QuizDocument1 pageQuizAbegail PanangNo ratings yet

- Addis Ababa University Addis Ababa Institute of TechnologyDocument3 pagesAddis Ababa University Addis Ababa Institute of TechnologyBukti NegalNo ratings yet

- Alastair McMichael - Rider Levett BucknallDocument45 pagesAlastair McMichael - Rider Levett BucknallVida VidaNo ratings yet

- Project Appraisal ExamDocument4 pagesProject Appraisal ExamVasco CardosoNo ratings yet

- Cash Flow Statement Analysis Between Commercial BaDocument9 pagesCash Flow Statement Analysis Between Commercial Baशिवम कर्णNo ratings yet