Professional Documents

Culture Documents

Classification

Uploaded by

Kate ParanaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Classification

Uploaded by

Kate ParanaCopyright:

Available Formats

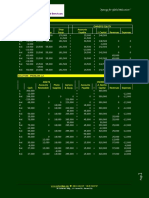

ACTIVITY 1 : CLASSIFICATION 48 Bad Debts Expense EXPENSE

CA – CONTRA-

49 Allowance for doubtful accounts ASSET ASSET

Identify what major account and classify if the

50 Copyright ASSET NCA

following items below are current or non-current

(Current Asset or Non-Current Asset / Current

Liabilities or Non-Current Liabilities).

ACTIVITY 2

Classification I. PROBLEM SOLVING

Major

Accounts for Assets and

Account

Liabilities Solve the following accounting problems.

1 Cash ASSET CA

1.On October 1, Morgan Company has a total assets amounting to P100,000 and

2 Petty Cash Fund ASSET CA total liabilities amounting to P30,000. On October 2, the company paid P2,000 as

partial payment of its outstanding account. How much is the capital balances

3 Cash on Hand ASSET CA after October 2 transactions?

Cash in Bank SOL: ASSETS = LIABILITIES + EQUITY

4 ASSET CA

100,000 = 30,000 + 70,000

5 Investment in Trading Securities ASSET CA Oct.2 (2,000) = (2,000) + 0

98,000 = 28,000 + 70,000

6 Trade and Other Receivables ASSET CA 98,000 = 98,000

7 Accounts Receivable ASSET CA

2. The assets of the business at the start of the month is P2,000,000 and the

8 Notes Receivable ASSET CA owner's equity is P800,000. Equipment worth P600,000 were purchased during

the month of which only 30% of the amount was paid for. At the end of the

9 Commission Receivable ASSET CA month, liabilities will become?

10 Interest Receivable ASSET CA SOL: ASSETS = LIABILITIES + EQUITY

2,000,000 = 1,200,000 + 800,000

11 Rent Receivable ASSET CA Transaction:

purchase eqt. 600,000 = 420,000 + 0

12 Advances to Employees ASSET CA (180,000)

13 Prepaid Expenses ASSET CA 2,420,000 = 1,620,000 + 800,000

2,420,000 = 2,420,000

14 Prepaid Advertising ASSET CA

15 Prepaid Insurance ASSET CA

3. The following are found in these records

Prepaid Rent Prepaid

16 subscriptions ASSET CA

Cash 500,000 Accounts payable 25,000

17 Merchandise Inventory ASSET CA

Accounts 50,000 Notes payable 4,000

18 Property, Plant, and Equipment ASSET NCA Receivable

19 Land ASSET NCA

Prepaid Expenses 3,000 Unearned income 12,000

20 Building ASSET NCA

21 Machinery ASSET NCA Office Equipment 48,000 Service income 200,000

22 Furniture and Fixtures ASSET NCA Furniture 70,000 Operating 36,000

Office Equipment expenses

23 ASSET NCA

24 Store Equipment ASSET NCA How much is the total assets and the total liabilities?

25 Transportation Equipment ASSET NCA Solution: Cash 500,000 Accounts payable 25,000

NCA – CONTRA Receivables 50,000 Notes payable 4,000

26

Accumulated Depreciation ASSET ASSET Prepaid expenses 3,000 Unearned income 12,000

27 Intangible Assets ASSET NCA Office equipment 48,000 Total Liabilities 41,000

Furniture 70,000

28 Accrued Income ASSET CA Total Assets 671,000

29 Short term investments ASSET CA

30 Long term Investments ASSET NCA

31 Owner's Capital EQUITY

32 Owner's Drawing EQUITY

33 Service Revenue REVENUE

34 Rent Income REVENUE

35 Dividend Income REVENUE

36 Commission Income REVENUE

37 Gain of sale of fixed assets REVENUE

38 Advertising Expense EXPENSE

39 Office Supplies Expense EXPENSE

40 Rent expense EXPENSE

41 Professional fee EXPENSE

42 Salaries Expense EXPENSE

43 Repair and maintenance expense EXPENSE

44 Travel Expense EXPENSE

45 Utilities Expense EXPENSE

46 Depreciation Expense EXPENSE

47 Miscellaneous Expense EXPENSE

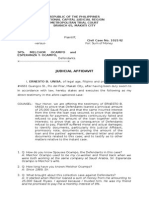

PREPARATION OF JOURNAL ENTRIES:

Mr. Alfredo Ignacio began a professional practice as a system

analyst on October. He plans to prepare monthly financial

statements for September, the owner completed the A. Business B.

transaction or DEBIT CREDIT

transactions: Non-business

transaction

1. Oct 1. Mr. Ignacio invested P150,000 cash along with (YES/NO)

furniture and fixtures that had a P30,000 market value 1. YES Cash Ignacio, Capital

2 years ago but was now worth P20,000. Furniture and

Fixtures

2. Oct 2. Paid P15,000 cash for September rent of a

2 YES Rent expense Cash

fully furnished office space at the Makati Building.

3. Oct 4. Purchased P90,000 worth of equipment on 3 YES Equipment Accounts payable

credit for 12 monthly equal installment payments. 4 YES Office supplies Cash

4. Oct 6. Purchased office supplies for cash, P2,500

5 YES Cash Service Revenue

from Miriam Bookstore.

6 YES Accounts receivable Service revenue

5. Oct 8. Completed work for a client and immediately

collected the P25,000 cash earned. 7 YES Salaries expense Cash

6. Oct 10. Completed work for clients and sent bills for 8 YES Cash Accounts Receivable

P45,000 to be paid within 30 days. 9 YES Cash Service revenue

7. Oct 15. Paid the salary of assistant, P8,000 cash as Accounts receivable

wages for 15 days. 10 YES Ignacio, Drawing Cash

8. Oct 18. Collected 50% of the amount owed by the 11 YES Accounts payable Cash

client on September 10.

12 YES Salaries Expense Cash

9. Oct 25. Completed work for another client who, paid

13 YES Utilities expense Cash

P20,000 or 50% of the total computerized system.

The client promised to pay the balance in thirty days. 14 YES Supplies expense Office supplies

10. Oct 28. Owner withdrew P3,000 cash for personal

use.

11. Oct 29. Paid the first installment of the liability on the

equipment purchased.

12. Oct 30. Paid salary of assistant.

13. Oct 31. Received Globe Telecom bill, P1,200 and

Meralco bill P5,800. (auto expense)

14. Oct 31. Used up P1,000 worth of supplies.

Directions:

a. Identify the above transactions whether it is to be recorded

or not to be recorded.

b. Analyze the transactions as to the accounts affected and its

effect whether increase or decrease following the rules of debit

and credit.

c. Journalize accounts affected and the effects of the

transactions by recording the journalize entries.

CHART OF ACCOUNTS

ASSETS

101 Cash

112 Accounts Receivable

114 Office Supplies

115 Equipment

116 Furnitires and Fixtures

LIABILITIES

201 Accounts Payable

OWNER'S EQUITY

301 Ignacio, Capital

302 Ignacio, Drawing

REVENUE

401 Service Revenue

EXPENSES

501 Rent Expense

502 Salaries Expense

503 Supplies Expense

504 Utilities Expense

You might also like

- Intervention in Fabm 1: PHP 35,000 PHP 15,000 PHP 107,000 PHP 70,000 PHP 120,000 22Document12 pagesIntervention in Fabm 1: PHP 35,000 PHP 15,000 PHP 107,000 PHP 70,000 PHP 120,000 22sarah macatangayNo ratings yet

- Fabm-2 2Document33 pagesFabm-2 2KIRSTEN HENRYK CHINGNo ratings yet

- Hourly Employee Earnings Rate M T W TH F Reg. OT GrossDocument6 pagesHourly Employee Earnings Rate M T W TH F Reg. OT GrossAislin Joy SabusapNo ratings yet

- Fabm - Q2 - Las-For LearnersDocument113 pagesFabm - Q2 - Las-For LearnersABM-AKRISTINE DELA CRUZNo ratings yet

- ACTIVITY 6 JournalizingDocument1 pageACTIVITY 6 JournalizingJay-ar Castillo Watin Jr.50% (4)

- G12 Fabm2 Week 8Document11 pagesG12 Fabm2 Week 8Whyljyne GlasanayNo ratings yet

- Topic: Accounting Cycle of A Service BusinessDocument5 pagesTopic: Accounting Cycle of A Service BusinessJohn Rey BusimeNo ratings yet

- Accounting I: Jordan River Laundry Service TransactionsDocument1 pageAccounting I: Jordan River Laundry Service TransactionsMikaela Jean63% (8)

- CAT 1 Module 1 SolutionsDocument21 pagesCAT 1 Module 1 SolutionsKizyll0% (1)

- Fundamentals of Abm 2 Q2 Module 1 Week 1 2Document13 pagesFundamentals of Abm 2 Q2 Module 1 Week 1 2ganda dyosaNo ratings yet

- FABM 2 Worksheet 1 Q4Document4 pagesFABM 2 Worksheet 1 Q4Darwin MenesesNo ratings yet

- CHAPTER 2 Horizontal-AnalysisDocument1 pageCHAPTER 2 Horizontal-AnalysisAiron Bendaña0% (1)

- Adjusting EntryDocument38 pagesAdjusting EntryNicaela Margareth YusoresNo ratings yet

- Chapter18 - Answer PDFDocument25 pagesChapter18 - Answer PDFAvon Jade RamosNo ratings yet

- Abm Abm Abm AbmDocument27 pagesAbm Abm Abm AbmNoaj Palon100% (1)

- ROCO - SCI Unit TestDocument9 pagesROCO - SCI Unit TestRaymond Roco100% (1)

- Fundamentals of Accountancy, Business and Management 2: Statement of Comprehensive IncomeDocument9 pagesFundamentals of Accountancy, Business and Management 2: Statement of Comprehensive IncomeBea allyssa CanapiNo ratings yet

- Accounting Cycle of A Merchandising BusinessDocument21 pagesAccounting Cycle of A Merchandising Businesszedrick edenNo ratings yet

- Name: - Date: - Grade Level & SectionDocument11 pagesName: - Date: - Grade Level & SectionCynthia Santos100% (1)

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- 2016 Jan 1 Cash Computer Equipment Lok, Capital: General Journal Date ParticularsDocument25 pages2016 Jan 1 Cash Computer Equipment Lok, Capital: General Journal Date ParticularsMoon Binn100% (2)

- B.1 Directions: Prepare Journal Entries For The Following Transactions Using A Periodic Inventory SystemDocument4 pagesB.1 Directions: Prepare Journal Entries For The Following Transactions Using A Periodic Inventory SystemJestine AlcantaraNo ratings yet

- August 1 2 8 9 15 16 Trade DiscountDocument26 pagesAugust 1 2 8 9 15 16 Trade DiscountEDSERLITO REÑOS100% (2)

- Lesson 9.4 Adjusting EntriesDocument36 pagesLesson 9.4 Adjusting EntriesDanica Medina50% (2)

- Commision BMATDocument4 pagesCommision BMATMylen Noel Elgincolin Manlapaz0% (1)

- Cash Flow Statement Activities Transactions PreparationDocument1 pageCash Flow Statement Activities Transactions PreparationAdoree Ramos75% (4)

- Exercise #1: Transactions of Bud's Computer Are As FollowsDocument19 pagesExercise #1: Transactions of Bud's Computer Are As FollowsMejias, Janrey80% (10)

- Accounting Cycle and Trial BalanceDocument20 pagesAccounting Cycle and Trial BalanceJoseph Entera100% (2)

- General Journal: Date Account Titles and Explanation Ref Debit CreditDocument17 pagesGeneral Journal: Date Account Titles and Explanation Ref Debit CreditPrecious NosaNo ratings yet

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Firm (Part 1)Document35 pagesBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Firm (Part 1)Ponsica Romeo50% (2)

- Business Finance: Financial Planning Tools and ConceptsDocument14 pagesBusiness Finance: Financial Planning Tools and ConceptsElyzel Joy Tingson100% (1)

- Production BudgetDocument11 pagesProduction BudgetSamson, Ma. Louise Ren A.No ratings yet

- ServiceDocument37 pagesServiceDanica Balleta0% (2)

- CHAPTER 2 Vertical-AnalysisDocument1 pageCHAPTER 2 Vertical-AnalysisAiron BendañaNo ratings yet

- Activity in IT202Document3 pagesActivity in IT202Tine Robiso100% (1)

- Obien, Francine Denise Eleanor G. Abm 12 Y1-7Document2 pagesObien, Francine Denise Eleanor G. Abm 12 Y1-7Emar Kim0% (1)

- FABM2 Module 5 - FS AnalysisDocument11 pagesFABM2 Module 5 - FS AnalysisKimberly Abella CabreraNo ratings yet

- Senior 12 FundamentalsofABM2 - Q1 - M4 For PrintingDocument27 pagesSenior 12 FundamentalsofABM2 - Q1 - M4 For PrintingIrish PradoNo ratings yet

- Simple InterestDocument3 pagesSimple Interestjohn gabriel bondoyNo ratings yet

- Customer Relationship Report Demo RevisedDocument16 pagesCustomer Relationship Report Demo RevisedLaila Mae PiloneoNo ratings yet

- Quiz 021612Document2 pagesQuiz 021612kattNo ratings yet

- Fabm Analysis and Interpretation of Financial Statements 1Document4 pagesFabm Analysis and Interpretation of Financial Statements 1Mylen Noel Elgincolin Manlapaz67% (6)

- Sales Cost of SalesDocument4 pagesSales Cost of SalesRio Awitin50% (2)

- Agatha Trading Financial Statement 2019Document1 pageAgatha Trading Financial Statement 2019Jasmine Acta0% (1)

- 1.2 Accounting Concepts and PrinciplesDocument4 pages1.2 Accounting Concepts and PrinciplesVillamor NiezNo ratings yet

- Learning Module: A. Ethical Issues in Employer-Worker Relations Learning ObjectivesDocument19 pagesLearning Module: A. Ethical Issues in Employer-Worker Relations Learning ObjectivesQueenieCatubagDomingo100% (1)

- Journalizing & Posting TransactionsDocument33 pagesJournalizing & Posting TransactionsGUILA REIGN MIRANDANo ratings yet

- Rovelyn E. Forcadas ABM-11 Activity #9-BDocument2 pagesRovelyn E. Forcadas ABM-11 Activity #9-BRovelyn E. ForcadasNo ratings yet

- COMMISSIONDocument15 pagesCOMMISSIONAAAAANo ratings yet

- Performance Task No. 2 Preparation of BudgetDocument3 pagesPerformance Task No. 2 Preparation of BudgetChristine Nathalie Balmes100% (2)

- A.) Income StatementDocument2 pagesA.) Income StatementShawn Mendez100% (2)

- Fundamentals of ABM 1 Accounting CycleDocument47 pagesFundamentals of ABM 1 Accounting CycleHarrold HarryNo ratings yet

- Statement of Changes in EquityDocument3 pagesStatement of Changes in EquityAnonymousNo ratings yet

- Lesson 4-3Document20 pagesLesson 4-3Alexis Nicole Joy Manatad100% (3)

- Ocean Laundry Shop Journal Entries & Trial BalanceDocument45 pagesOcean Laundry Shop Journal Entries & Trial BalanceRachellyn Limentang100% (1)

- Corporate Liquidation & Reorganization Chapter ExplainedDocument4 pagesCorporate Liquidation & Reorganization Chapter ExplainedJane GavinoNo ratings yet

- Corporate Liquidation & ReorganizationDocument6 pagesCorporate Liquidation & ReorganizationNahwi KimpaNo ratings yet

- Corporate Liquidation QuizDocument4 pagesCorporate Liquidation QuizMarinoNo ratings yet

- 05 Corporate LiquidationDocument4 pages05 Corporate LiquidationEric CauilanNo ratings yet

- Ejercicios Finanzas BásicasDocument2 pagesEjercicios Finanzas BásicasDenisse Zamarripa PalomoNo ratings yet

- 1990Document2 pages1990Kate ParanaNo ratings yet

- Law on Sales SummaryDocument25 pagesLaw on Sales SummaryESTELA AGNONo ratings yet

- 2 1+Bonds+Payable+and+EIMDocument69 pages2 1+Bonds+Payable+and+EIMKate ParanaNo ratings yet

- But No One Was Ever Charged or Convicted of The Crime.: Williams InstituteDocument1 pageBut No One Was Ever Charged or Convicted of The Crime.: Williams InstituteKate ParanaNo ratings yet

- © Boardworks LTD 2006 1 of 37Document37 pages© Boardworks LTD 2006 1 of 37Kate ParanaNo ratings yet

- Foreign StudiesDocument3 pagesForeign StudiesKate ParanaNo ratings yet

- LGBTQ Health, Social Issues & Policy ReviewDocument2 pagesLGBTQ Health, Social Issues & Policy ReviewKate ParanaNo ratings yet

- 1 Statement of Financial PositionDocument46 pages1 Statement of Financial Positionapi-267023512100% (1)

- Fading Rainbow - Abm Sycipgroup 1 1Document14 pagesFading Rainbow - Abm Sycipgroup 1 1Kate ParanaNo ratings yet

- Critical Approaches - Literary Theory PowerPointDocument20 pagesCritical Approaches - Literary Theory PowerPointDwi Setiawan100% (2)

- LGBTQ Health, Social Issues & Policy ReviewDocument2 pagesLGBTQ Health, Social Issues & Policy ReviewKate ParanaNo ratings yet

- Fundamentals of Accountancy Business and Management 1 PDFDocument164 pagesFundamentals of Accountancy Business and Management 1 PDFKate Parana67% (3)

- Fading Rainbow - Abm Sycipgroup 1 1Document14 pagesFading Rainbow - Abm Sycipgroup 1 1Kate ParanaNo ratings yet

- LGBTQ Health, Social Issues & Policy ReviewDocument2 pagesLGBTQ Health, Social Issues & Policy ReviewKate ParanaNo ratings yet

- RRL LocalDocument2 pagesRRL LocalKate ParanaNo ratings yet

- Fading Rainbow - Abm Sycipgroup 1 1Document14 pagesFading Rainbow - Abm Sycipgroup 1 1Kate ParanaNo ratings yet

- Fading Rainbow - Abm Sycipgroup 1 1Document14 pagesFading Rainbow - Abm Sycipgroup 1 1Kate ParanaNo ratings yet

- Subject OrientationDocument3 pagesSubject OrientationKate ParanaNo ratings yet

- The 2020 Online and Self-Guided Pfa Modules: Supplementaltothe SeesmanualDocument20 pagesThe 2020 Online and Self-Guided Pfa Modules: Supplementaltothe SeesmanualKate Parana100% (1)

- Grade 12 Modular Class Program (Sy 2020-2021) : Department of EducationDocument6 pagesGrade 12 Modular Class Program (Sy 2020-2021) : Department of EducationKate ParanaNo ratings yet

- Endo GenicDocument38 pagesEndo GenicKate ParanaNo ratings yet

- Fundamentals of Accountancy Business and Management 1 PDFDocument164 pagesFundamentals of Accountancy Business and Management 1 PDFKate Parana67% (3)

- Subject OrientationDocument3 pagesSubject OrientationKate ParanaNo ratings yet

- Grade 12 Modular Class Program (Sy 2020-2021) : Department of EducationDocument6 pagesGrade 12 Modular Class Program (Sy 2020-2021) : Department of EducationKate ParanaNo ratings yet

- CHAPTER 3. Lesson 2. Writing A Research Title 2Document4 pagesCHAPTER 3. Lesson 2. Writing A Research Title 2Kate Parana100% (2)

- Arrative: Personal and Story WritingDocument26 pagesArrative: Personal and Story WritingKate ParanaNo ratings yet

- Determinants of S and D PDFDocument2 pagesDeterminants of S and D PDFKate ParanaNo ratings yet

- RocksDocument20 pagesRocksKate ParanaNo ratings yet

- Workshop and Preparation of Marketing PlanDocument27 pagesWorkshop and Preparation of Marketing PlanKate Parana100% (3)

- Insurance: M.J.Malik-Sba-Ahmedabad-09879094925MWPADocument21 pagesInsurance: M.J.Malik-Sba-Ahmedabad-09879094925MWPAkrunalk2003100% (1)

- Wa0000.Document4 pagesWa0000.Suresh Kanbi100% (1)

- PROPOSED NOTES ON TAXESDocument9 pagesPROPOSED NOTES ON TAXESMary Grace Caguioa AgasNo ratings yet

- HSBC Arranges $333m Loans For BPDBDocument2 pagesHSBC Arranges $333m Loans For BPDBshakilNo ratings yet

- Tutorial Letter 102/3/2019: Financial Accounting Principles For Law PractitionersDocument41 pagesTutorial Letter 102/3/2019: Financial Accounting Principles For Law Practitionersall green associatesNo ratings yet

- Invitation For Bids Tender - Proposed Electrical Flood Masts Installation Within Kiambu County in Every Ward.Document1 pageInvitation For Bids Tender - Proposed Electrical Flood Masts Installation Within Kiambu County in Every Ward.Kiambu County Government -Kenya.No ratings yet

- PH Judicial Affidavit: Loan Collection Case Against Spouses OcampoDocument5 pagesPH Judicial Affidavit: Loan Collection Case Against Spouses OcampoRoy Rojas Aquino100% (1)

- Nicmar GPQS-12 - PPPDocument7 pagesNicmar GPQS-12 - PPPshajbabyNo ratings yet

- Optimum Capital StructureDocument7 pagesOptimum Capital StructureOwenNo ratings yet

- 881 PDFDocument80 pages881 PDFNirman DuttaNo ratings yet

- VOLUNTARY DEALINGS WITH REGISTERED LANDSDocument7 pagesVOLUNTARY DEALINGS WITH REGISTERED LANDSJosel SantiagoNo ratings yet

- What Every CEO Needs To Know About Financing An ESOPDocument6 pagesWhat Every CEO Needs To Know About Financing An ESOPheenaieibsNo ratings yet

- CRM Implementation in National Bank of PakistanDocument12 pagesCRM Implementation in National Bank of Pakistanshahid bhatti100% (1)

- Asc June 19 For WebDocument48 pagesAsc June 19 For WebOrhan Mc MillanNo ratings yet

- #4 Republic GlassDocument3 pages#4 Republic Glassirish kitongNo ratings yet

- ByD DemoScript Cash and Liquidity MGMTDocument38 pagesByD DemoScript Cash and Liquidity MGMTLakhbir SinghNo ratings yet

- Measuring Cash Flows: Hawawini & Viallet 1Document25 pagesMeasuring Cash Flows: Hawawini & Viallet 1Kishore ReddyNo ratings yet

- Synopsis Cannra BankDocument3 pagesSynopsis Cannra BankGagan KauraNo ratings yet

- Report On Debt ManagementDocument79 pagesReport On Debt ManagementSiddharth Mehta100% (1)

- Chapter 4 - AbelDocument11 pagesChapter 4 - AbelShuvro Kumar Paul75% (4)

- Get Paid for Online Surveys: Register with Top Survey SitesDocument6 pagesGet Paid for Online Surveys: Register with Top Survey SitesYoga GuruNo ratings yet

- Debit CardDocument3 pagesDebit CardSan AwaleNo ratings yet

- Sample Legal Notice 138Document2 pagesSample Legal Notice 138R Ranjan100% (7)

- Szolgáltatások: Autóbérlés, Biztosítások/fajtái, Utazási Irodák/bankok, Javítások/garancia, Közüzemi SzolgáltatásokDocument3 pagesSzolgáltatások: Autóbérlés, Biztosítások/fajtái, Utazási Irodák/bankok, Javítások/garancia, Közüzemi SzolgáltatásokHorváth LillaNo ratings yet

- SARFAESI Checklist: Steps for Secured Asset RecoveryDocument4 pagesSARFAESI Checklist: Steps for Secured Asset RecoverypraveenparthivNo ratings yet

- Internship Report On Credit Management Published by RahulDocument78 pagesInternship Report On Credit Management Published by Rahulrahulpalit126No ratings yet

- The Evolution of Ras Laffan Liquefied Natural Gas Co. Ltd. (Rasgas) L'Evolution de La Companie Ras Laffan Liquefied Natural Gas Co. Ltd. (Rasgas)Document10 pagesThe Evolution of Ras Laffan Liquefied Natural Gas Co. Ltd. (Rasgas) L'Evolution de La Companie Ras Laffan Liquefied Natural Gas Co. Ltd. (Rasgas)jbloggs2007No ratings yet

- .Capital Structure and Profitability of A FirmDocument26 pages.Capital Structure and Profitability of A FirmRomaan QamarNo ratings yet

- Madhya Pradesh HC upholds rejection of interim maintenance applicationDocument2 pagesMadhya Pradesh HC upholds rejection of interim maintenance applicationPrasadNo ratings yet

- Banking and FinanceDocument6 pagesBanking and FinanceJohn Arthur100% (1)