Professional Documents

Culture Documents

Act. 3 FOA Checking

Uploaded by

Joven Sayod0 ratings0% found this document useful (0 votes)

7 views4 pagesFoa

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFoa

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views4 pagesAct. 3 FOA Checking

Uploaded by

Joven SayodFoa

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

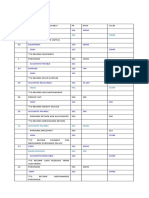

Date Particulars PR Debit (DR) Credit (CR)

Jun 1* Cash 101 P 500,000

Merchandise Inventory 109 50,000

Owner’s Equity 301 P 550,000

Initial Investment of Owner

1* Taxes and Licenses Expense 705 P 1260

Cash 101 P 1260

Payment of licenses

1 Purchases 501 P 48,000

Accounts Payable 201 P 48,000

Purchase of Office Equipment

1* Freight-In 502 P 2,000

Cash 101 P 2,000

Payment of equipment

1* Rent Expense 702 P 45,000

Cash 101 P 45,000

Payment of Rent

1* Office Supplies Expense 704 P 1,250

Cash 101 P 1,250

Office Supplies Bought

1 Purchases 501 P 40,000

Freight-In 502 P 1,600

Cash 101 P 41,600

1* Advertising Expense 602 P 10,000

Cash 101 P 10,000

Payment of Advertisement

2* Purchases 501 P 19,800

Cash 101 P 19,800

Cash purchase

3 Sales 401 P 82,560

Cash 101 P 82,560

Cash Sales

5* Furniture and Fixtures 102 P 42,650

Accounts Payable 201 P 42,560

Equipment Bought

6 Accounts Payable 201 P 2,650

Purchase Return & Allowances 503 P 2,650

Purchase Return

7 Cash 101 P 75,000

Owner’s Equity 301 P 75,000

Additional Investments

8 Purchases 501 P 16,000

Freight-In 502 800

Cash 101 P 16,800

10* Accounts Receivable 103 P 36,500

Freight-Out 603 P 920

Sales 401 P 36,500

Cash 101 P 920

11* Accounts Receivable 103 P 12,500

Sales 401 P 12,500

Sold Merchandise

12 Accounts Payable 201 P 6,500

Sales Returns & Allowances 402 P 6,500

Sales Return

15* Sales Salaries Expense 601 P 12,000

Office Salaries Expense 701 P 18,000

Accounts Payable 201 P 30,000

Paid of Expences

15* Cash 101 P 200,000

Loan Payable 251 P 200,000

Borrowed money

15* Owner’s Drawing 302 P 10,000

Cash 101 P 10,000

Cash Withdrawal

15* Delivery Van 121 P 680,000

Accounts Payable 201 P 680,000

Bought Delivery Van

16 Accounts Payable 201 P 20,000

Cash 101 P 20,000

Partial Payment

16 Accounts Receivable 103 P 23,000

*

Sales 401 P 23,000

Sold Merchandise

18* Purchases 501 P 8,000

Notes Payable 202 P 8,000

Bought Merchandise

18* Purchases 501 P 18,000

Accounts Payable 201 P 18,000

Bought Merchandise

19* Accounts Receivable 103 P 34,000

Freight-Out 603 P 2,200

Sales 401 P 34,000

Cash 101 P 2,200

19* Purchases 501 P 16,000

Account Payable 201 P 16,000

Purchase Merchandise

20 Accounts Payable 201 P 20,000

Freight-Out 603 P 920

Cash 101 P 17,920

Sales Discount 403 P 3,000

21 Accounts Payable 201 P 10,000

Cash 101 P 10,000

Partial Payment

21 Accounts Payable 201 P 4,000

Sales Returns & Allowances 402 P 4,000

Sales Return

21* Accounts Payable 201 P 2,500

Purchase Returns & Allowances 503 P 2,500

Purchase Returns

23 Accounts Payable 201 P 11,000

Cash 101 P 11,000

Partial Payment

25* Accounts Receivable 103 P 26,000

Sales 401 P 26,000

Sold to Alhambra

26* Sales 401 P 6,000

Note Receivable 102 P 6,000

Receive Notes

27 Cash 101 P 2,000

Accounts Receivable 103 P 2,000

Received cash

28* Sales Returns & Allowances 402 P 1,200

Cash 101 P 1,200

Gave Cash

29 Accounts Payable 201 P 11,000

Freight Out 603 P 2,200

Cash 101 P 11,700

Sale Discounts 403 P 1,500

29* Purchases 501 P 20,000

Account Payable 201 P 20,000

Purchase Merchandise

30* Owner’s Drawing 302 P 12,000

Cash 101 P 12,000

Cash Withdrawal

30* Prepaid Insurance 107 P 24,000

Cash 101 P 24,000

Paid Insurance

30* Sales Salaries Expense 601 P 12,000

Office Salaries Expense 701 P 15,000

Accounts Payable 201 P 27,000

Paid of Expences

30* Light and Water Expense 706 P 20,500

Cash 101 P 20,500

Utilities Paid

30* Cash 101 P 4,000

Rental Income 802 P 4,000

Rent income

30 Sales 401 P 46,000

Cash 101 P 46,000

Cash Sales

30* Accounts Payable 201 P 20,000

Cash 101 P 19,400

Purchase Discounts 504 P 600

Paid full

You might also like

- GJ-1 Date Particulars Folio Debit CreditDocument8 pagesGJ-1 Date Particulars Folio Debit Creditnovemar mendezNo ratings yet

- General Journal BookkeeppingDocument4 pagesGeneral Journal BookkeeppingDas Sein Mozart GeworfenheitNo ratings yet

- Template General Journal2Document4 pagesTemplate General Journal2jessicalee01230No ratings yet

- Accounting 1 (SHS) - Week 12 - Journalizing J. Tan Merchandise - PeriodicDocument2 pagesAccounting 1 (SHS) - Week 12 - Journalizing J. Tan Merchandise - PeriodicAustin Capal Dela CruzNo ratings yet

- JT Merchandise Navasquez (Periodic)Document14 pagesJT Merchandise Navasquez (Periodic)John cook100% (1)

- Book 1Document3 pagesBook 1into the unknownNo ratings yet

- Mam Karina Template Periodic 1Document21 pagesMam Karina Template Periodic 1Claudine bea NavarreteNo ratings yet

- PeriodicDocument36 pagesPeriodicmama's cornerNo ratings yet

- Practice ActivityDocument23 pagesPractice ActivityLouremie Delos Reyes MalabayabasNo ratings yet

- Perpetual Pre Assessment 1 1Document17 pagesPerpetual Pre Assessment 1 1reginaaguztinz10No ratings yet

- Periodic Inventory MethodDocument13 pagesPeriodic Inventory Methodthegianthony100% (1)

- Perpetual MethodDocument17 pagesPerpetual MethodVictoria Camello100% (1)

- Journal 3Document15 pagesJournal 3RishiiieeeznNo ratings yet

- General Journal Page 1 Date Description P/R Debit CreditDocument10 pagesGeneral Journal Page 1 Date Description P/R Debit CreditGonzalo FerrerNo ratings yet

- Sanchez General MerchandisingDocument3 pagesSanchez General MerchandisingRechelle Ramos100% (1)

- Reviewer For Bookkeeping NCIIIDocument18 pagesReviewer For Bookkeeping NCIIIAngelica Faye95% (20)

- Dole DistributorsDocument14 pagesDole DistributorsFebie Gayap FelixNo ratings yet

- Problem 3Document16 pagesProblem 3Jay ann TolentinoNo ratings yet

- Handout For Review For Bookkeeping NciiiDocument18 pagesHandout For Review For Bookkeeping Nciiiangelica de jesus100% (5)

- Chapter 1 - Review of The Accounting CycleDocument30 pagesChapter 1 - Review of The Accounting CyclekimberlynroqueNo ratings yet

- Sem Plang Merchandising Perpetual Problem With AnswersDocument21 pagesSem Plang Merchandising Perpetual Problem With AnswersJayson Miranda100% (1)

- Answer - Quiz No. 7 (B)Document9 pagesAnswer - Quiz No. 7 (B)CPA SangcapNo ratings yet

- Page 287 Special JournalDocument30 pagesPage 287 Special JournalAgent348No ratings yet

- Date Account Titles PR Debit Credit: Initial Investment in Barios TradingDocument10 pagesDate Account Titles PR Debit Credit: Initial Investment in Barios TradingRishaan DominicNo ratings yet

- Chua Periodic AnswerDocument13 pagesChua Periodic AnswerCoolveticaNo ratings yet

- Practice Exam - Set ADocument11 pagesPractice Exam - Set ATin PangilinanNo ratings yet

- Sem Plang Merchandising Periodic Problem With AnswersDocument21 pagesSem Plang Merchandising Periodic Problem With Answerscole sprouse100% (1)

- 1 Turo General Journal Answer SheetDocument4 pages1 Turo General Journal Answer SheetFritzie Ann ZartigaNo ratings yet

- Case Problem Hanievon MerchandisingDocument20 pagesCase Problem Hanievon MerchandisingPrincessjane Largo100% (1)

- Virtudazo Ween Trading GJDocument15 pagesVirtudazo Ween Trading GJMary Rose Ann VirtudazoNo ratings yet

- Bernabe Accounting-FirmDocument33 pagesBernabe Accounting-FirmElla Ramos100% (1)

- Merchandising Business (Finals Assignment 2)Document9 pagesMerchandising Business (Finals Assignment 2)Myrna AlcantaraNo ratings yet

- NC 3 Bookeeping Prcatice SetDocument39 pagesNC 3 Bookeeping Prcatice SetJEFFREY GALANZA71% (7)

- JournalizingDocument5 pagesJournalizingMikee ChoiNo ratings yet

- AC Ace StoreDocument9 pagesAC Ace StoreNicole San JuanNo ratings yet

- Finals Lecture Discussion On Special JournalsDocument36 pagesFinals Lecture Discussion On Special JournalsGarpt Kudasai100% (1)

- TESDA NC III PERPETUAL Ans Key PDFDocument13 pagesTESDA NC III PERPETUAL Ans Key PDFMarvin Bueno91% (11)

- Buenaflor WorksheetDocument10 pagesBuenaflor WorksheetRaff LesiaaNo ratings yet

- Act 1.3 - Pilardo Gabucan, C.P.A.Document7 pagesAct 1.3 - Pilardo Gabucan, C.P.A.Joshua AlvarezNo ratings yet

- Final Activity ManangatDocument4 pagesFinal Activity ManangatjudymarNo ratings yet

- Financial LLLDocument13 pagesFinancial LLLMaica MedranoNo ratings yet

- Chart of AccountsDocument7 pagesChart of AccountsMalou Ang100% (1)

- Answer KeyDocument33 pagesAnswer KeyRenz TitongNo ratings yet

- FDNACCT - Group Case Analysis - Bacosa, Fung, Jacinto, SebastianDocument15 pagesFDNACCT - Group Case Analysis - Bacosa, Fung, Jacinto, SebastianLance FungNo ratings yet

- Riverdale Mechanical Supply Chart of Accounts Includes The FollowingDocument15 pagesRiverdale Mechanical Supply Chart of Accounts Includes The FollowingJames Benedict BantilingNo ratings yet

- Magnus ExerciseDocument13 pagesMagnus ExerciseLucas BantilingNo ratings yet

- Comp 2 Activity 5 SUPER FINAL1Document11 pagesComp 2 Activity 5 SUPER FINAL1Jhon Lester MagarsoNo ratings yet

- General JournalDocument14 pagesGeneral JournalHana SantiagoNo ratings yet

- 2nd Quiz Aud ProbDocument4 pages2nd Quiz Aud ProbJohn Patrick Lazaro AndresNo ratings yet

- Problem 2 JCDocument1 pageProblem 2 JCJay ann TolentinoNo ratings yet

- Beginning Balances Debit CreditDocument23 pagesBeginning Balances Debit CreditRaff LesiaaNo ratings yet

- AC Kendra Raphia Dress ShopDocument13 pagesAC Kendra Raphia Dress ShopNicole San JuanNo ratings yet

- Periodic Answer KeyDocument9 pagesPeriodic Answer KeyAngel AmbrosioNo ratings yet

- Finals Graded Exercises 002 Final Special Journals For Dist. FinalDocument4 pagesFinals Graded Exercises 002 Final Special Journals For Dist. FinalGarpt Kudasai100% (1)

- PerpetualDocument13 pagesPerpetualEcho ClarosNo ratings yet

- Everr Greene CorrectDocument12 pagesEverr Greene CorrectRonNo ratings yet

- Industrial Disputes Act1947 Cases: By: Anil Ashish Topno ROLL NO: 12003 Retail Management 2 YearDocument15 pagesIndustrial Disputes Act1947 Cases: By: Anil Ashish Topno ROLL NO: 12003 Retail Management 2 YearAnil Ashish Topno100% (1)

- Module 1 Ethernet and VLAN: Lab 1-1 Ethernet Interface and Link Configuration Learning ObjectivesDocument15 pagesModule 1 Ethernet and VLAN: Lab 1-1 Ethernet Interface and Link Configuration Learning ObjectivesChaima BelhediNo ratings yet

- Managing Digital Transformations - 1Document105 pagesManaging Digital Transformations - 1RamyaNo ratings yet

- 6-GFM Series: Main Applications DimensionsDocument2 pages6-GFM Series: Main Applications Dimensionsleslie azabacheNo ratings yet

- CW 3 - Non-Profit Making Organisation Sekolah Harapan Bangsa ACADEMIC YEAR 2020/2021Document3 pagesCW 3 - Non-Profit Making Organisation Sekolah Harapan Bangsa ACADEMIC YEAR 2020/2021Adrian WensenNo ratings yet

- List of Ambulance Services in Rajahmundry - PythondealsDocument5 pagesList of Ambulance Services in Rajahmundry - PythondealsSRINIVASARAO JONNALANo ratings yet

- Student Counseling Management System Project DocumentationDocument4 pagesStudent Counseling Management System Project DocumentationShylandra BhanuNo ratings yet

- Bc-6800plus Series Auto Hematology Analyzer Operator's ManualDocument322 pagesBc-6800plus Series Auto Hematology Analyzer Operator's ManualHenock MelesseNo ratings yet

- RidleyBoxManual1 17Document63 pagesRidleyBoxManual1 17Sergio Omar OrlandoNo ratings yet

- Technical Sheet Azud Watertech WW EngDocument2 pagesTechnical Sheet Azud Watertech WW EngMiguel Torres ObrequeNo ratings yet

- Operation - Manual Cubase 5Document641 pagesOperation - Manual Cubase 5Samiam66682% (17)

- Analog Circuits - IDocument127 pagesAnalog Circuits - IdeepakpeethambaranNo ratings yet

- S.No Company Name Location: Executive Packers and MoversDocument3 pagesS.No Company Name Location: Executive Packers and MoversAli KhanNo ratings yet

- Class 10th IMO 5 Years EbookDocument71 pagesClass 10th IMO 5 Years EbookAdarsh Agrawal100% (1)

- Creating A New Silk UI ApplicationDocument2 pagesCreating A New Silk UI Applicationtsultim bhutiaNo ratings yet

- Carbon Fiber 395GPA Structural Ansys ReportDocument13 pagesCarbon Fiber 395GPA Structural Ansys ReportKrish KrishnaNo ratings yet

- Right To Self OrganizationDocument7 pagesRight To Self OrganizationSALMAN JOHAYRNo ratings yet

- MPS LTD Valuation ReportDocument1 pageMPS LTD Valuation ReportSiddharth ShahNo ratings yet

- Kendra Penningroth 8-08Document2 pagesKendra Penningroth 8-08api-355965189No ratings yet

- Ordinary Differential Equations Multiple Choice Questions and Answers - SanfoundryDocument7 pagesOrdinary Differential Equations Multiple Choice Questions and Answers - SanfoundrySaiman PervaizNo ratings yet

- Tendon Grouting - VSLDocument46 pagesTendon Grouting - VSLIrshadYasinNo ratings yet

- Algebra 1 Vocab CardsDocument15 pagesAlgebra 1 Vocab Cardsjoero51No ratings yet

- Pre Int Work Book Unit 9Document8 pagesPre Int Work Book Unit 9Maria Andreina Diaz SantanaNo ratings yet

- American Bar Association American Bar Association JournalDocument6 pagesAmerican Bar Association American Bar Association JournalKarishma RajputNo ratings yet

- Design of Earth Air Tunnel To Conserve Energy - FinalDocument19 pagesDesign of Earth Air Tunnel To Conserve Energy - FinalApurva AnandNo ratings yet

- Motion For Forensic Examination - Cyber CasedocxDocument5 pagesMotion For Forensic Examination - Cyber CasedocxJazz Tracey100% (1)

- Datasheet Solis 3.6K 2G US 1phase 20170613Document2 pagesDatasheet Solis 3.6K 2G US 1phase 20170613Jimmy F HernandezNo ratings yet

- Guide Book - Investing and Doing Business in HCMC VietnamDocument66 pagesGuide Book - Investing and Doing Business in HCMC VietnamemvaphoNo ratings yet

- 1.1.4.A PulleyDrivesSprockets FinishedDocument4 pages1.1.4.A PulleyDrivesSprockets FinishedJacob DenkerNo ratings yet

- Practice Questions SheetDocument4 pagesPractice Questions Sheetsaif hasanNo ratings yet