Professional Documents

Culture Documents

ACCT 1221 Assignment 2

Uploaded by

Ali ShahCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCT 1221 Assignment 2

Uploaded by

Ali ShahCopyright:

Available Formats

ACCT 1221: Accounting 2 1

Assignment 5

File name: Acct 1221_T00615142_Ali Shah Ali_Assignment 5

Q1 P18-3B Page 1110 25 Marks (20-30 min.)

Req. 1 (20-30 min.) P 18-3B

Show percentages to one decimal place so that the level of precision is comparable to

the Industry Averages.

.

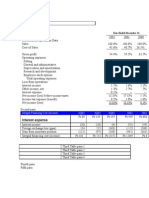

Bella Tiles Inc.

Common-Size Income Statement Compared to Industry Average

For the Year Ended December 31, 2017

BELLA TILES INDUSTRY

INC. AVERAGE

Net sales 100% 100%

Cost of goods sold (17.6/29.2) 60.3% 65.9%

Gross margin (11.6/29.2) 39.7% 34.1%

Operating expenses (8.4/29.2) 28.8% 28.1%

Operating income (3.8/29.2) 11.0% 6.0%

Other expenses (0.2/29.2) 0.7% 0.4%

Net Income (3.0/29.2) 10.3% 5.6%

Bella Tiles Inc.

Common-Size Balance Sheet Compared to Industry Average

December 31, 2017

BELLA TILES INDUSTRY

INC. AVERAGE

Current assets (10.4/18.6) 55.9% 66.6%

Property, plant, equip,, net (8/18.6) 43.0% 32.3%

Other assets (0.2/18.6) 1.1% 1.1%

Total assets 100% 100%

Current liabilities (6.2/18.6) 33.3% 35.6%

TRU Open Learning

2 Assignment 5 Template

Long-term liabilities (5.2/18.6) 28.0% 19.0%

Shareholders’ equity (7.2/18.6) 38.7% 45.4%

Total liabilities and shareholders’ equity 100% 100.0%

TRU Open Learning

ACCT 1221: Accounting 2 3

Req. 2

Doing a profitability analysis of Bella Tiles Inc. shows that the ratio of gross margin, ratio of

operating income, and the ratio of net income are all definitely stronger than the industry average,

which would also show the overall performance of the company is stronger than the Industry

Average.

Req. 3

After a financial analysis of the company balance sheet it shows that the ratio of current assets

and its ratio of shareholders equity are worse than the industry average but even though other

accounts such as properties are higher than the average, the company liabilities account is under

the industry average so overall I would say that the company is financially operating lower than

the industry average.

TRU Open Learning

4 Assignment 5 Template

Q2 P18-5B Page 1111 25 Marks (20-30 min.)

Req. 1

Please highlight the ratio in yellow

Avenger Hardware Ltd.

(Dollar amounts in thousands)

2017 2016

292 251.5 = 1.82

a. Current ratio: = 2.07

141 138.5

201 155

b. Inventory turnover: = 1.41 = 1.39

(149 + 137) / 2 (137 + 86) / 2

c. Accounts receivable 351.5 310

= 3.58 = 4.34

turnover: (116 + 80.5) / 2 (80.5 + 62.5) / 2

d. Times-interest- 85.5 84

= 3.29 = 4.20

earned ratio: 26 20

40.5 + 26 41.5 + 20

e. Return on assets: (446.5 + 395) / 2 = 15.8% (395 + 351.5) / = 16.5%

2

f. Return on common 40.5 – 3 41.5 - 3

shareholders’ = 28.1% = 41.7%

(161 + 105.5) / 2 (105.5 + 79) / 2

equity:

g. Earnings per 40.5 - 3 41.5 - 3

= $2.50 = $3.21

common share: 15 12

19.00 31.00

h. Price-earnings ratio: = 7.60 = 9.66

2.50 3.21

i. Book value per 161 = $10.73 105.5 = $8.79

TRU Open Learning

ACCT 1221: Accounting 2 5

common share: 15 12

Req. 2

Decisions:

a.

Avenger Hardware’s ability to pay its debts deteriorated during the 2017 year because the

receivable turnover ratio and interest earned ratio decreased. The inventory turnover improved a

just a bit because of the inventory turnover ratio improved a bit.

The attractiveness of the common shares dropped in 2017 because of the drop in the market price

of the common shares although the book value of the common shares did increase.

Req. 3

This question gave me an idea as to how to compute different ratios and percentages that can help

me analyze companies and see for example how they are performing with respect to previous

years, as well see the company’s ability to pay its debits on time or if it is a worthwhile company

to invest in.

TRU Open Learning

6 Assignment 5 Template

Q3 P18-8B Page 1115 50 Marks (40-60 min.)

Req. 1

Show percentage to one decimal place.

Jens Hardware Inc.

Horizontal Analysis of Balance Sheets

December 31, 2017 and 2016

CHANGE %

ASSETS (Change / 2016 Accounts)

Cash $6,000 38.5

Accounts receivable 12,050 57.4

Merchandise inventory (4000) (9.5)

Prepaid expenses (500) (33.5)

Property, plant, and equipment 13,000 (8.3)

Accumulated amortization 10,000 (41.7)

Goodwill 0 0

Total assets $16,550 7.3

LIABILITIES

Accounts Payable (3,500) (18.9)

Notes Payable (1,500) (42.9)

Mortgage Payable (5,000) (11.1)

Total Liabilities (10,000) (14.9)

SHAREHOLDERS’ EQUITY

Preferred Shares 0 0

Common Shares 16,000 24.6

Retained Earnings 10,550 21.9

Total Shareholders’ Equity 26,550 16.5

Total liabilities and shareholders’ equity $16,550 7.3

There are a couple points to analyze, first there is a reduction in inventory which could call

into question the company’s ability to fulfill customer orders. Secondly, there is a big

accounts receivable hike which can also be a cause for worry because of the timeliness of

the payments. Lastly, we can look and see the issuance of common shares, which may

have paid some liabilities but that also means for ownership of the company was given up

in return.

TRU Open Learning

ACCT 1221: Accounting 2 7

TRU Open Learning

8 Assignment 5 Template

Req. 2

Jens Hardware Inc.

Vertical Income Statement Analysis

December 31, 2017

AMOUNT %

Net Sales $330,000 100

Cost of Goods Sold 190,000 57.6

Gross Margin 140,000 42.4

Operating Expenses:

Selling Expenses 40,000 12.1

Administrative Expenses 23,000 7.0

Interest Expense 6,000 1.8

Total operating expense 69,000 20.9

Operating Income 71,000 21.5

Income Tax 21,300 6.5

Net Income $49,7000 15.1

TRU Open Learning

ACCT 1221: Accounting 2 9

Req. 3

Highlight the ratio in yellow

a. Current ratio:

(21,600 + 33,050 +38,000 + 1000) = 5.51

(15,000 + 2,000)

b. Acid-test ratio:

21,600+33,050 = 3.21

15,000 + 2,000

c. Inventory turnover:

190,000 = 4.75

(38,000 + 42,000) / 2

d. Days’ sales in receivables:

(33,050 + 21,000) / 2 = 29.89 Days

(330,000 / 365)

e. Debt ratio: 57,000 / 244,650

= 0.233

f. Times-interest-earned ratio:

71,000 + 6,000 = 12.83

6,000

g. Rate of return on net sales: 49,700 / 330,000

= 15.1%

h. Rate of return on total assets:

49,700 + 6,000 = 23.6%

(244,650 + 228,100) / 2

TRU Open Learning

10 Assignment 5 Template

i. rate of return on common shareholders’ equity:

49,700 – 16,000 = 26.6%

(161,100 – 48,000) + (187,650 – 48,000) / 2

j. Price–earnings ratio:

9 = 2.67

(49,700 – 16,000) / ((12,000 + 8,000) / 2)

k. Dividend yield:

23,150 /

12,000 = 21.44%

9

Req. 4

A. Current ratio:

Jen’s Hardware’s current ratio is very high compared to the industry average, this tells us that

they are a good amount of cash to invest with and grow the company and they their risk to

creditors is low.

B. Debt ratio:

The debt ratio is lower than the industry average, this means that they owe less money to creditors

and can probably make their payments on time. They also would be able to borrow more

money in order to use it to grow the company in terms of equipment or investment.

C. Price-earnings ratio:

The price earnings ratio is lower than industry average so there most probably is not much

potential in the market for high growth.

D. Dividend yield:

The yield is a lot higher compared to industry average and so they must have had a unique

dividend paid out considering it takes a big portion of their net income.

Overall:

TRU Open Learning

ACCT 1221: Accounting 2 11

Overall, the company has strong assets, and small amount of liabilities in comparison,

also they should probably borrow some money to bring down the rate of dividends that

the company pays by buying some of the shares back.

TRU Open Learning

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (1)

- Analysis of Ryan Company's Financial Ratios and StatementsDocument6 pagesAnalysis of Ryan Company's Financial Ratios and StatementsAbhishek KamdarNo ratings yet

- q3-2020Document8 pagesq3-2020Vivek SinghNo ratings yet

- Menkeu Kelompok 2Document12 pagesMenkeu Kelompok 2FACHRI OMALEYNo ratings yet

- Monmouth VfinalDocument6 pagesMonmouth VfinalAjax100% (1)

- Case Study FinanceDocument6 pagesCase Study Financesamer abou saadNo ratings yet

- Reading 23 Residual Income Valuation - AnswersDocument47 pagesReading 23 Residual Income Valuation - Answerstristan.riolsNo ratings yet

- Millions of Dollars Except Per-Share DataDocument23 pagesMillions of Dollars Except Per-Share DataPedro José ZapataNo ratings yet

- NSS Exploring Economics 2 (3rd Edition) Answers To Exercises Chapter 11 Production in The Short Run and Long RunDocument18 pagesNSS Exploring Economics 2 (3rd Edition) Answers To Exercises Chapter 11 Production in The Short Run and Long RundizzelNo ratings yet

- Group 7 - FPT - Financial AnalysisDocument2 pagesGroup 7 - FPT - Financial AnalysisNgọcAnhNo ratings yet

- Monmouth Case SolutionDocument16 pagesMonmouth Case SolutionAjaxNo ratings yet

- Millions of Dollars Except Per-Share DataDocument7 pagesMillions of Dollars Except Per-Share DataalejandroNo ratings yet

- 107 10 DCF Sanity Check AfterDocument6 pages107 10 DCF Sanity Check AfterDavid ChikhladzeNo ratings yet

- MyfileDocument1 pageMyfilevdkvaibhav100% (1)

- Finance Questions 4Document3 pagesFinance Questions 4asma raeesNo ratings yet

- Enph EstimacionDocument38 pagesEnph EstimacionPablo Alejandro JaldinNo ratings yet

- Lbo W DCF Model SampleDocument33 pagesLbo W DCF Model Samplejulita rachmadewiNo ratings yet

- IS Participant - Simplified v3Document7 pagesIS Participant - Simplified v3luaiNo ratings yet

- Singapore Airlines Recent Half Year Report AnalysisDocument13 pagesSingapore Airlines Recent Half Year Report AnalysisRJ DimaanoNo ratings yet

- Dollars and Sales AnalysisDocument5 pagesDollars and Sales AnalysisXimena Isela Villalpando BuenoNo ratings yet

- Lec 11 Cash Flow Estimation Risk Analysis Part 2 21102021 121652pmDocument62 pagesLec 11 Cash Flow Estimation Risk Analysis Part 2 21102021 121652pmosamaNo ratings yet

- 1 Walmart and Macy S Case StudyDocument3 pages1 Walmart and Macy S Case StudyMihir JainNo ratings yet

- 3 Statement Model - BlankDocument6 pages3 Statement Model - BlankAina MichaelNo ratings yet

- Corporate Finance - Exercises Session 1 - SolutionsDocument5 pagesCorporate Finance - Exercises Session 1 - SolutionsLouisRemNo ratings yet

- Assignment 3 by Ameen KolachiDocument3 pagesAssignment 3 by Ameen KolachiAmeen KolachiNo ratings yet

- S6 E Working FinalDocument9 pagesS6 E Working FinalROHIT PANDEYNo ratings yet

- Millions of Dollars Except Per-Share DataDocument14 pagesMillions of Dollars Except Per-Share DataAjax0% (1)

- DCF Analysis for Robertson Tool CompanyDocument14 pagesDCF Analysis for Robertson Tool Companyhao pengNo ratings yet

- Analisis FinancieroDocument124 pagesAnalisis FinancieroJesús VelázquezNo ratings yet

- Bayer Annual Report 2016Document344 pagesBayer Annual Report 2016Ojo-publico.comNo ratings yet

- Monmouth Case SolutionDocument19 pagesMonmouth Case Solutiondave25% (4)

- Xpress Holdings LTD Unaudited Results For Full Year Ended 31 Jul 09Document24 pagesXpress Holdings LTD Unaudited Results For Full Year Ended 31 Jul 09WeR1 Consultants Pte LtdNo ratings yet

- Veto SwitchgearsDocument44 pagesVeto Switchgearssingh66222No ratings yet

- Estadosfinancieros FerreycorpDocument2 pagesEstadosfinancieros Ferreycorpluxi0No ratings yet

- Alembic Chemicals Ltd P&L and Balance Sheet AnalysisDocument8 pagesAlembic Chemicals Ltd P&L and Balance Sheet AnalysisSANKET SAHOONo ratings yet

- Hoàng Lê Hải Yến-Internal AuditDocument3 pagesHoàng Lê Hải Yến-Internal AuditHoàng Lê Hải YếnNo ratings yet

- Aptech Equity Research: Key Financial FiguresDocument7 pagesAptech Equity Research: Key Financial FiguresshashankNo ratings yet

- Five-Year Performance OverviewDocument2 pagesFive-Year Performance OverviewAjees AhammedNo ratings yet

- Colgate Ratio Analysis SolvedDocument12 pagesColgate Ratio Analysis SolvedAnurita PariharNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument27 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener Tutorialrahul wareNo ratings yet

- Deutsche Bank Annual Review 2009 StrengthDocument436 pagesDeutsche Bank Annual Review 2009 StrengthCebotar AndreiNo ratings yet

- MIRANDA - Post Task 3,4,5 Compilation PDFDocument9 pagesMIRANDA - Post Task 3,4,5 Compilation PDFSHARMAINE CORPUZ MIRANDANo ratings yet

- Lakshmi Electrical Control SupportDocument14 pagesLakshmi Electrical Control SupportAmeesha DubeyNo ratings yet

- Plantillas Excel Vio - IiDocument29 pagesPlantillas Excel Vio - IiEduardo Lopez-vegue DiezNo ratings yet

- A E L (AEL) : Mber Nterprises TDDocument8 pagesA E L (AEL) : Mber Nterprises TDdarshanmadeNo ratings yet

- Is Participant - Simplified v3Document7 pagesIs Participant - Simplified v3Ajith V0% (1)

- Financial Highlights: Profit and Loss AccountDocument2 pagesFinancial Highlights: Profit and Loss AccountSaad ZiaNo ratings yet

- BCTA-RR (2QFY19) - LTHB-FinalDocument4 pagesBCTA-RR (2QFY19) - LTHB-FinalZhi_Ming_Cheah_8136No ratings yet

- Additional Information: Ratio AnalysisDocument7 pagesAdditional Information: Ratio Analysisashokdb2kNo ratings yet

- Assignment 01Document18 pagesAssignment 01Md. Real MiahNo ratings yet

- Gulf Oil ExhibitsDocument20 pagesGulf Oil Exhibitsaskpeeves1No ratings yet

- Research Needed For Question 5Document4 pagesResearch Needed For Question 5Ahmed MahmoudNo ratings yet

- Jollibee Foods Corporation PSE JFC FinancialsDocument38 pagesJollibee Foods Corporation PSE JFC FinancialsJasper Andrew AdjaraniNo ratings yet

- Valuation SheetDocument7 pagesValuation SheetHarsh MaheshwariNo ratings yet

- Term Valued CFDocument14 pagesTerm Valued CFEl MemmetNo ratings yet

- MonmouthDocument28 pagesMonmouthAndrew SumirNo ratings yet

- Ratan GoyalDocument6 pagesRatan GoyalArjun KhoslaNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- Confidential: Topic Number: QUESTION:Supply Chain Management /logistics Today IsDocument6 pagesConfidential: Topic Number: QUESTION:Supply Chain Management /logistics Today IsMohd Azmezanshah Bin SezwanNo ratings yet

- Bahrain Email ListDocument15 pagesBahrain Email ListSR Solutions0% (3)

- Eco & MRKTG - 7 To 9Document13 pagesEco & MRKTG - 7 To 9shilpaNo ratings yet

- HRM 21 Collective BargainingDocument16 pagesHRM 21 Collective BargainingMahima MohanNo ratings yet

- The Impact of Upstream Supply and Downstream Demand Integration On Quality Management and Quality PerformanceDocument20 pagesThe Impact of Upstream Supply and Downstream Demand Integration On Quality Management and Quality PerformancejoannakamNo ratings yet

- Salesforce Trailhead AssignmnetDocument5 pagesSalesforce Trailhead AssignmnetSaikiran JadavNo ratings yet

- Checking Account and Debit Card SimulationDocument62 pagesChecking Account and Debit Card SimulationSandra_Zimmerman100% (1)

- Airbnb Payments Terms of ServiceDocument25 pagesAirbnb Payments Terms of ServiceAlexandra CojanNo ratings yet

- Cosmetics Business PlanDocument46 pagesCosmetics Business PlanLaica LagulaoNo ratings yet

- Project Management Question BankDocument2 pagesProject Management Question BankBramodh JayanthiNo ratings yet

- IIM Lucknow Final Placements BrochureDocument41 pagesIIM Lucknow Final Placements BrochureAnurag BhatiaNo ratings yet

- Bobs Coffee ShopDocument1 pageBobs Coffee Shopz zzzNo ratings yet

- Porter's Five Forces Analysis Reveals Low Barriers to Entry for AJ's Cereal CoDocument2 pagesPorter's Five Forces Analysis Reveals Low Barriers to Entry for AJ's Cereal CoNguyễnQuangNgọcNo ratings yet

- Decision Making in CostingDocument21 pagesDecision Making in CostingParamjit Sharma67% (3)

- ICAEW Professional Level Business Strategy & Technology Question & Answer Bank March 2016 To March 2020Document475 pagesICAEW Professional Level Business Strategy & Technology Question & Answer Bank March 2016 To March 2020Optimal Management SolutionNo ratings yet

- The RedBus Case StudyDocument6 pagesThe RedBus Case StudyGretaNo ratings yet

- Epicor Data DiscoveryDocument3 pagesEpicor Data Discoverygary kraynakNo ratings yet

- Audit of ERP SystemsDocument45 pagesAudit of ERP SystemssrilakshmiNo ratings yet

- Case Analysis 1Document6 pagesCase Analysis 1Fu Maria JoseNo ratings yet

- CN-464 Quotation (Rev)Document2 pagesCN-464 Quotation (Rev)syed WajihNo ratings yet

- Cement Distribution Proposal for Addis AbabaDocument21 pagesCement Distribution Proposal for Addis AbabaTesfaye Degefa100% (5)

- Funded & Non-Funded FacilitiesDocument3 pagesFunded & Non-Funded Facilitiesbhavin shahNo ratings yet

- tN3m1M3RSIu-nMy8h46e6g Stakeholder-AnalysisDocument1 pagetN3m1M3RSIu-nMy8h46e6g Stakeholder-Analysisstd105219No ratings yet

- Chapter 1 - Management ReportingDocument36 pagesChapter 1 - Management ReportingGabriel IbarrolaNo ratings yet

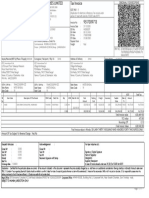

- Tax Invoice for ACSR ZEBRA CONDUCTOR, UNGREASED from APAR INDUSTRIES LIMITED to KEC International LtdDocument1 pageTax Invoice for ACSR ZEBRA CONDUCTOR, UNGREASED from APAR INDUSTRIES LIMITED to KEC International LtdDoita Dutta ChoudhuryNo ratings yet

- Training Brochure - Advance Financial Management in Power BI (B34) CorporateDocument18 pagesTraining Brochure - Advance Financial Management in Power BI (B34) CorporateDr CashNo ratings yet

- Training Needs Assessment of LGUs On The Project Management of Local Infrastructure - FinalDocument6 pagesTraining Needs Assessment of LGUs On The Project Management of Local Infrastructure - Finalaeron antonioNo ratings yet

- Ch16 Cost Allocation Joint Products and ByproductsDocument11 pagesCh16 Cost Allocation Joint Products and ByproductsChaituNo ratings yet

- International AdvertisingDocument22 pagesInternational Advertisingvivek yadavNo ratings yet

- Vencatachellum & Mathuvirin 72Document18 pagesVencatachellum & Mathuvirin 72Reji MolNo ratings yet