Professional Documents

Culture Documents

Form No. 36 Form of Appeal To The Appellate Tribunal: Applicable)

Uploaded by

saurav royOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form No. 36 Form of Appeal To The Appellate Tribunal: Applicable)

Uploaded by

saurav royCopyright:

Available Formats

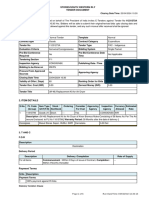

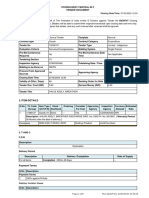

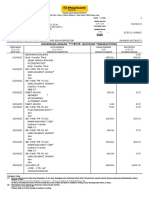

FORM NO.

36

[See rule 47(1)]

Form of Appeal to the Appellate Tribunal

In the Income-tax Appellate Tribunal New Delhi

Appeal No……………………...

M/s Mihama India Private Limited Versus ld.A.O., National Faceless Assessment Centre, Delhi

Appellant Respondent

Name / designation of the Appellant (as M/s Mihama India Private Limited.

applicable)

Appellant’s Personal Information

PAN (if available) AAJCM4404G

TAN (if available) RTKM08025D

Complete address for sending notices B-138 Ansal Pioneer Industrial

Park, Near Bilaspur Chowk Village:

Pathredi, Tehsil, Manesar,

Gurugram, Haryana

State Haryana

Pin Code 122413

Phone No. with STD code / Mobile No. 9990889606

Email Address saurav-roy@mihama.com

Name or designation of the Respondent Ld. A.O., National Faceless

Respondent ‘s Personal Information

(as applicable) Assessment Centre, Delhi

PAN (if available)

TAN (if available)

Complete address for sending notices Delhi

State Delhi

Pin Code Not Available

Phone No. with STD code / Mobile No. Not Available

(if available)

Email Address (if available) Not Available

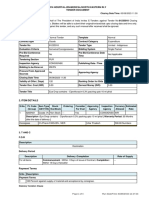

1 Assessment year in connection 2017-18

with which the appeal is preferred

2 Total income declared by the (4,29,38,955)

assessee for the assessment year

referred to in item 1

3 Details of the order appealed

against

Appeal Details

a Section and sub-section under 143(3) r.w.s.144C (13) read with

which the order is passed section 144B of the Act

b Date of order 22/02/2022

c Date of service or 24/02/2022

communication of the order.

4 Income-tax Authority passing the Ld. A.O., National Faceless

order appealed against Assessment Centre, Delhi

5 The State and District in which the Delhi

jurisdictional Assessing Officer is

located

6 Section and sub-section under 143(3) r.w.s.144C (13) read with

which the original order is passed section 144B of the Act

7 If appeal relates to any

assessment: -

a Total income as computed by Rs 1,12,10,050/-

the Assessing Officer for the

Amounts disputed in appeal

assessment year referred to

in item 1

b Total amount of additions or Rs 5,41,49,002/-

disallowances made in the

assessment.

c Amount disputed in appeal Rs.5,41,49,002/-

8 If appeal relates to any penalty :-

a Total amount of penalty NA

imposed as per order

b Amount of penalty disputed NA

in appeal

9 If appeal relates to any other

matter: -

a Amount disputed in appeal NA

10 Grounds of Appeal Tax effect relating to each Ground

of appeal

(see note below)

1. As per attachment As per attachment

Total tax effect (see note below) 56,96,685/-

11 Whether there is any delay in filing No

of appeal

(if yes, please attach application

Appeal filing details

seeking condonation of delay)

12 Details of Appeal Fees Paid

BSR Code Date of Sl. No. Amount

Payment

6390340 18/04/2022 03409 10000

--------------------------------------

Signed

(Appellant)

Name: Sameer Munshi

Designation: Director

VERIFICATION

I, Sameer Munshi, in the capacity of Director of the Appellant-Company, do hereby declare that

what is stated above is true to the best of my information and belief.

-----------------------------------------

Place: New Delhi Signature

Date: Name: Sameer Munshi

Designation: Director

You might also like

- JERES-J-607 Burner Management Systems For SRU TrainsDocument24 pagesJERES-J-607 Burner Management Systems For SRU TrainsMahi IndraNo ratings yet

- Form No. 36 ITATDocument5 pagesForm No. 36 ITATsubbuNo ratings yet

- 1 UntitledDocument8 pages1 UntitledCA N RajeshNo ratings yet

- Form No.36: (See Rule 47 (1) )Document2 pagesForm No.36: (See Rule 47 (1) )itat hyderabadNo ratings yet

- Form No. 35Document2 pagesForm No. 35NitishNo ratings yet

- Form No.35 Appeal To The Commissioner of Income Tax (Appeals) - 1, NashikDocument3 pagesForm No.35 Appeal To The Commissioner of Income Tax (Appeals) - 1, NashikNitin RautNo ratings yet

- Form For Appeal To Appellate Authority: B. Sriman Narayana ReddyDocument2 pagesForm For Appeal To Appellate Authority: B. Sriman Narayana ReddySamachara HakkuNo ratings yet

- Moot PropositionDocument38 pagesMoot PropositionshantanuNo ratings yet

- DY - CMM Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No 61180789Document5 pagesDY - CMM Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No 61180789GS OfficeNo ratings yet

- Hi Telling PersonDocument12 pagesHi Telling PersonyashNo ratings yet

- Underdeck Insualtion (Enq 1406021 - Fale Ceiling Flooring)Document13 pagesUnderdeck Insualtion (Enq 1406021 - Fale Ceiling Flooring)Anonymous i8hifn7No ratings yet

- Manu Singh Vs BPTP - v1.2 - 06.08.2020Document19 pagesManu Singh Vs BPTP - v1.2 - 06.08.2020sivank yoNo ratings yet

- viewNitPdf 4529552Document6 pagesviewNitPdf 4529552dghosh76No ratings yet

- Form No. 15Cb: (See Rule 37BB)Document3 pagesForm No. 15Cb: (See Rule 37BB)Live GracefullyNo ratings yet

- viewNitPdf 3049011Document6 pagesviewNitPdf 3049011RajkumarNo ratings yet

- Del 1119 at 0001116Document4 pagesDel 1119 at 0001116waseemNo ratings yet

- Synopsis - Circular and Annexure - 0Document9 pagesSynopsis - Circular and Annexure - 0tskk9896No ratings yet

- 2.form of Appeal ACIR - MDocument4 pages2.form of Appeal ACIR - Mwasim nisarNo ratings yet

- Form 15CB - Filed FormDocument4 pagesForm 15CB - Filed FormBhagya RajoriaNo ratings yet

- Augustus Capital JudgmentDocument23 pagesAugustus Capital Judgmentchrispattinson06No ratings yet

- P 4Document4 pagesP 4Ghanshyam GaurNo ratings yet

- Northern Railway - Immunoglobulin - 1 PDFDocument4 pagesNorthern Railway - Immunoglobulin - 1 PDFaditgupta243No ratings yet

- Pre Authorization LetterDocument3 pagesPre Authorization LetterDharmavir Singh GautamNo ratings yet

- viewNitPdf 4294059Document4 pagesviewNitPdf 4294059TECHNICAL BOYNo ratings yet

- Form PDF 846262881191220Document80 pagesForm PDF 846262881191220Ravi KumarNo ratings yet

- Incometax2020 2021Document83 pagesIncometax2020 2021Suman jhaNo ratings yet

- Marsh RoseDocument19 pagesMarsh RosepvtNo ratings yet

- Consumer Condonation of DelayDocument4 pagesConsumer Condonation of DelayAryan ShankarNo ratings yet

- viewNitPdf - 4474111 260224Document4 pagesviewNitPdf - 4474111 260224jvtamilanbanNo ratings yet

- 1 Judgment-WPL 11293-21.odtDocument30 pages1 Judgment-WPL 11293-21.odtAlok SinghNo ratings yet

- viewNitPdf 4371865Document4 pagesviewNitPdf 4371865Prem ShahiNo ratings yet

- आयकर अपीलीय अिधकरण " यायपीठ पुणे म । (Through Virtual Court)Document8 pagesआयकर अपीलीय अिधकरण " यायपीठ पुणे म । (Through Virtual Court)Saksham ShrivastavNo ratings yet

- Appeal FormatDocument3 pagesAppeal FormatSumairNo ratings yet

- Commercial Mediation FormDocument3 pagesCommercial Mediation Formrahul BAROTNo ratings yet

- Advance RulingProcedureDocument13 pagesAdvance RulingProcedureshubhamt25No ratings yet

- Cta Eb CV 02562 D 2023apr27 RefDocument20 pagesCta Eb CV 02562 D 2023apr27 RefFirenze PHNo ratings yet

- PCMM Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No 11205214DDocument4 pagesPCMM Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No 11205214Da k singhNo ratings yet

- Form GST Rfd11Document63 pagesForm GST Rfd11forbooksNo ratings yet

- PCMM Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No 80191199Document4 pagesPCMM Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No 80191199ANILNo ratings yet

- Form PDF 327010041310321Document124 pagesForm PDF 327010041310321Ravi KumarNo ratings yet

- viewNitPdf 4483046Document8 pagesviewNitPdf 4483046pujadagaNo ratings yet

- Wbhs Opd App Form EmpDocument3 pagesWbhs Opd App Form EmpDrive NameNo ratings yet

- 01.01.2020 - 80190015B - 1130Document4 pages01.01.2020 - 80190015B - 1130ANILNo ratings yet

- Due 16.01.23Document5 pagesDue 16.01.23S.k. VermaNo ratings yet

- Road Traffic Accident Small ClaimsDocument8 pagesRoad Traffic Accident Small ClaimsAmbroseNo ratings yet

- GeM Bidding 6117881Document9 pagesGeM Bidding 6117881Rohit ThetendersNo ratings yet

- Anjali Chahar Form FDocument4 pagesAnjali Chahar Form Fsabihasqi2No ratings yet

- GeM Bidding 5706382Document6 pagesGeM Bidding 5706382pratik modiNo ratings yet

- viewNitPdf 4036432Document4 pagesviewNitPdf 4036432Raj DoshiNo ratings yet

- Undp Deic Equipment 06 2015Document34 pagesUndp Deic Equipment 06 2015mnagaaNo ratings yet

- FORMDocument6 pagesFORMRIVA CHEMICALNo ratings yet

- Ambarish Kumar Shukla & Ors. vs. Ferrous Infrastructure Pvt. Ltd. 2016 SCC OnLine NCDRC 1117Document14 pagesAmbarish Kumar Shukla & Ors. vs. Ferrous Infrastructure Pvt. Ltd. 2016 SCC OnLine NCDRC 1117Saurabh ChaudharyNo ratings yet

- GeM Bidding 5653277Document9 pagesGeM Bidding 5653277jagdishsimariyaNo ratings yet

- Maxbupa Preauthorised Amount FinalDocument4 pagesMaxbupa Preauthorised Amount FinalraviNo ratings yet

- Court of Appeals: Chairperson, andDocument32 pagesCourt of Appeals: Chairperson, andMarcy BaklushNo ratings yet

- Stamp Duty On Arbitration AwardDocument5 pagesStamp Duty On Arbitration AwardranjanjhallbNo ratings yet

- ITR-5 Indian Income Tax ReturnDocument34 pagesITR-5 Indian Income Tax ReturnGurpreetNo ratings yet

- Euro-Med Laboratories Vs Province of BatangasDocument8 pagesEuro-Med Laboratories Vs Province of BatangasChengChengNo ratings yet

- In The High Court of Delhi at New Delhi W.P. (C) 6905/2022 & CM Appls.21038-21039/2022 and 21119/2022Document5 pagesIn The High Court of Delhi at New Delhi W.P. (C) 6905/2022 & CM Appls.21038-21039/2022 and 21119/2022AMAR GUPTANo ratings yet

- Before Hon'Ble Joint Commissioner (Appeals) : Central Goods and Service Tax: Delhi IndexDocument11 pagesBefore Hon'Ble Joint Commissioner (Appeals) : Central Goods and Service Tax: Delhi IndexUtkarsh KhandelwalNo ratings yet

- A Guide to District Court Civil Forms in the State of HawaiiFrom EverandA Guide to District Court Civil Forms in the State of HawaiiNo ratings yet

- ASC Group - Budget 2021 HighlightsDocument32 pagesASC Group - Budget 2021 Highlightssaurav royNo ratings yet

- Books CLDocument1 pageBooks CLsaurav royNo ratings yet

- EclDocument1 pageEclsaurav royNo ratings yet

- 0469 MihamaDocument1 page0469 Mihamasaurav royNo ratings yet

- Ecr CHLN Rec GNGGN1598512000 2032203007818 1646896593596 2022031045993596652Document1 pageEcr CHLN Rec GNGGN1598512000 2032203007818 1646896593596 2022031045993596652saurav royNo ratings yet

- GST ITC & Tax Liability SummaryDocument12 pagesGST ITC & Tax Liability Summarysaurav royNo ratings yet

- Attachment - 1Document2 pagesAttachment - 1Abhilash KurianNo ratings yet

- Sperry BM E S Band Scanner Tech SpecDocument2 pagesSperry BM E S Band Scanner Tech SpecBeto GallardoNo ratings yet

- Progress Test 2 (Units 4-6) : Name - ClassDocument6 pagesProgress Test 2 (Units 4-6) : Name - ClassРусланNo ratings yet

- Omkar Shende: Education SkillsDocument1 pageOmkar Shende: Education Skillseema yoNo ratings yet

- Guide To Computer Forensics and Investigations 5th Edition Bill Test BankDocument11 pagesGuide To Computer Forensics and Investigations 5th Edition Bill Test Bankshelleyrandolphikeaxjqwcr100% (30)

- NetworksDocument6 pagesNetworksscribdNo ratings yet

- F612/F627/F626B: Semi-Lugged Gearbox Operated Butterfly Valves PN16Document1 pageF612/F627/F626B: Semi-Lugged Gearbox Operated Butterfly Valves PN16RonaldNo ratings yet

- MSMQ Service Failing To StartDocument2 pagesMSMQ Service Failing To Startann_scribdNo ratings yet

- NAA Standard For The Storage of Archival RecordsDocument17 pagesNAA Standard For The Storage of Archival RecordsickoNo ratings yet

- Accelerating IceCubes Photon Propagation Code WitDocument11 pagesAccelerating IceCubes Photon Propagation Code WitNEed for workNo ratings yet

- Module 11A.5.2 L1 2016-08-16Document234 pagesModule 11A.5.2 L1 2016-08-16Abdul Aziz KhanNo ratings yet

- PMA A403Gr304L EN 13480Document1 pagePMA A403Gr304L EN 13480CRISTIAN SILVIU IANUCNo ratings yet

- ECE114 LogicCrkt&SwtchngTheory CM4Document13 pagesECE114 LogicCrkt&SwtchngTheory CM4Kai MoraNo ratings yet

- Ibs Kota Bharu 1 30/06/22Document7 pagesIbs Kota Bharu 1 30/06/22Nik Suraya IbrahimNo ratings yet

- Computer DealersDocument43 pagesComputer DealersZafar Mirza100% (1)

- Multi DIALOG MDM - MDT. MDM 10-20kVA Single - Single-Phase and Three - Single-Phase MDT 10-80kVA Three - Three-Phase NETWORK RANGEDocument8 pagesMulti DIALOG MDM - MDT. MDM 10-20kVA Single - Single-Phase and Three - Single-Phase MDT 10-80kVA Three - Three-Phase NETWORK RANGEMARCOS LARA ROMERO DE AVILANo ratings yet

- Running IDocument3 pagesRunning IQuality Design & ConstructionNo ratings yet

- The Memory Palace CISSP by Prashant Mohan 4th EditionDocument144 pagesThe Memory Palace CISSP by Prashant Mohan 4th EditionAhmed AbbasNo ratings yet

- Cryptography and Its Types - GeeksforGeeksDocument2 pagesCryptography and Its Types - GeeksforGeeksGirgio Moratti CullenNo ratings yet

- BM3 PlusDocument2 pagesBM3 Pluscicik wijayantiNo ratings yet

- Selva Kumar: Ocean Operations, Global Business Operations, Health & Safety & OM ImportsDocument3 pagesSelva Kumar: Ocean Operations, Global Business Operations, Health & Safety & OM ImportssenisagoodboyNo ratings yet

- Hero Pleasure Scooter Part Catalogue Mar 2010 EditionDocument78 pagesHero Pleasure Scooter Part Catalogue Mar 2010 EditionAmanNo ratings yet

- The Environment and Corporate Culture: True/False QuestionsDocument21 pagesThe Environment and Corporate Culture: True/False QuestionsĐỗ Hiếu ThuậnNo ratings yet

- Advance Adgressor 3220D Parts ManualDocument52 pagesAdvance Adgressor 3220D Parts Manualerik49No ratings yet

- No. 304 (171) 2021/PA Admn 111!: To, Centre ExcellenceDocument9 pagesNo. 304 (171) 2021/PA Admn 111!: To, Centre ExcellenceSanjeev kumarNo ratings yet

- PesisirDocument1 pagePesisirMohammad Hafiz MahadzirNo ratings yet

- Mausritter CoverDocument2 pagesMausritter CoverКaloyan PanovNo ratings yet

- Comprehensive Comparison of 99 Efficient Totem-Pole PFC With Fixed PWM or Variable TCM Switching FrequencyDocument8 pagesComprehensive Comparison of 99 Efficient Totem-Pole PFC With Fixed PWM or Variable TCM Switching FrequencyMuhammad Arsalan FarooqNo ratings yet

- Guide Wire Installation: MaintenanceDocument26 pagesGuide Wire Installation: MaintenanceMichael HunterNo ratings yet