Professional Documents

Culture Documents

Impact of Microfinance on Women Entrepreneurship Performance

Uploaded by

Dibyas Sanjay Dubey0 ratings0% found this document useful (0 votes)

151 views11 pagesOriginal Title

Ede Microproject

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

151 views11 pagesImpact of Microfinance on Women Entrepreneurship Performance

Uploaded by

Dibyas Sanjay DubeyCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

MAHARASHTRA STATE BOARD OF TECHNICAL EDUCATION

GOVERNMENT POLYTECHNIC,

VIKRAMGAD

MICRO PROJECT

ACADEMIC YEAR:-2021-22

TITLE OF PROJECT

THE IMPACT OF MICRO FINANCING ON THE

PERFORMANCE OF WOMEN ENTERPRENEURS.

PROGRAM :- ENTERPRENEURSHIP CODE:-22032

DEVLOPMENT

COURSE:- MECHANICAL ENGINEERING DATE:-

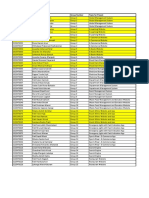

GROUP DETAILS:-

NAME ROLL NO ENROLLMENT SEAT NO

NO

VIRAJ NAIK 3412 1915470050

MANISH 3413 1915470051

PATIL

HARDIK 3414 1915470052

BHOIR

SAHIL 3415 1915470053

DESHMUKH

SUBJECT TEACHER:- Mr. S.M.Saryam

SIGN:-

Impact of Microfinance on Women Entrepreneurship

Abstract

Micro Finance is growing as a powerful instrument for poverty

alleviation in the new economy. A majority of the microfinance

programmes has come up with the clear goal of reducing poverty

and empowering women. In addition, an increasing number of

microfinance institutions (MFIs) prefer women members as they

believe that they are more responsible and trustworthy.

Microfinance programs like the Self Help Bank Linkage Program in

India have been progressively promoting for their positive economic

impact and the belief that they empower women The SHG

Programme has come up with a new system of saving and lending

that is group lending and liability as a way of delivering microfinance

to its predominantly female members. Research has shown that

investing in women offers the most effective means to improve

health, nutrition, hygiene, and educational standards for families and

consequently for the whole of society. Thus, a special support for

women in both financial and non - financial services is necessary.

Many leading public and private sector banks are offering schemes

exclusively designed for women to set up their own ventures. Even

the unorganized sector has been heading into microfinance

movement. The present work is an attempt to study the role of

microfinance as an effective instrument in promoting women

entrepreneurship in India.

Introduction

Ashok K. Pokhriyal,, Rekha Rani,, Jaya Uniyal (2014) mentioned

in their study that Working women contribute to national

income of the country and maintain a sustainable livelihood of

the families and communities, throughout the world. As they

face many socio- cultural attitude, legal barriers, lack of

education and personal difficulties. Traditionally, women have

been marginalized. They are rarely financially independent and

often they are more vulnerable members of society. About 70%

of world’s poor are women. Yet they have no access to credit

and other financial services. Therefore, microfinance often

target women. Microfinance is a critical tool to empower

women from poor household. So, particularly women can get

benefit from microfinance institutions as many microfinance

institutions target only women, to empower them. Here in this

paper a small effort has been made on the empowerment of

women through the tool Micro-finance.

The term micro finance is of recent origin and is commonly use

d in addressing issues related to poverty alleviation, financial

support to micro entrepreneurs, gender development etc.

There is, however, no statutory definition of micro finance. The

taskforce on supportitative policy and Regulatory Framework

for Microfinance has defined microfinance as “Provision of

thrift, credit and other financial services and products of very

small amounts to the poor in rural, semi - urban or urban areas

for enabling them to raise their income levels and improve

living standards”. The term “Micro” literally means “small”. But

the task force has not defined any amount. However as per

Micro Credit Special Cell of the Reserve Bank Of India.

All over the world, the significant of women entry into the

workforce over the past three decades has produced profound

transformations in the organization of families, society, the

economy, and urban life. Since the late 1950s, women's

economic activities have been steadily increasing.

Women have always actively participated in their local

economies . In Africa, for example, women produce 80 percent

of the food and in Asia 60 percent and in Latin America 40

percent. In many cases, women not only produce the food but

market it as well, which gives them a well-developed

knowledge of local markets and customers.

This is a small example of the importance of women's work in

society. It does not illustrate the real extent of women's

contribution, especially in developing countries, not only to the

labour force, but also their role as a significant income-source

for the family.

Women, especially poor mothers, must divide their time

between work "productive role" and family "reproductive role",

and balancing all the demands. Time is valuable for these

women, as their livelihoods depend largely on their abilit y to

fulfil the multiple demands of the household and the

marketplace.

In spite of the remarkable importance of women's

participation, their jobs have been considered as an "extra

income" to family survival or simply to improve its living

conditions. Moreover, microenterprises owned by women have

been considered as a way to meet primary needs instead of a

profitable source of income.

Role of Microfinance in Women Entrepreneurship

Although men, as well as women, face difficulties in

establishing an additional enterprise, women have barriers to

overcome. Among them are negative socio - cultural attitudes,

legal barriers, practical external barriers, lack of education and

personal difficulties.

In spite of this, for women and especially for poor women,

microenterprise ownership has emerged as a strategy for

economical survival. One of the most essential factors

contributing to success in micro entrepreneurship is access to

capital and financial services. For various reasons, women have

had less access to these services than men.

In this context, credit for microenterprise development has

been a crucial issue over the past two decades. Research has

shown that investing in women offers the most effective means

to improve health, nutrition, hygiene, and educationl standards

for families and consequently for the whole of society. Thus, a

special support for women in both financial and non-financial

services is necessary.

Regarding limited-access to financial services, women depend

largely on their own limited cash resources or, in some cases,

loans from extended family members for investment capital.

Smaller amounts of investment capital effectively limit women

to a narrow range of low-return activities which require

minimal capital outlays, few tools and equipment and rely on

farm produce or inexpensive raw materials.

In general, women need access to small loans (especially for

working capital), innovative forms of collateral, frequent

repayment schedules more appropriate to the cash flows of

their enterprises, simpler application procedures and improved

access to saving accounts.

Surveys have shown that many elements contribute to make it

more difficult for women in small businesses to make a profit.

These elements are:

• Lack of knowledge of the market and potential profitability,

thus making the choice of business difficult.

• Inadequate bookkeeping.

• Employment of too many relatives which increases social

pressure to share benefits.

• Setting prices arbitrarily.

• Lack of capital.

• High interest rates.

• Inventory and inflation accounting is never undertaken.

• Credit policies that can gradually ruin their business (many

customers cannot pay cash; on the other hand, supplier s are

very harsh towards women).

Banking sector has been emerging in a big way to participate in

the microfinance movement. At present many commercial

banks are taking much interest in developing schemes

exclusively for women. Various leading public and private

sector banks have been providing finance under different

schemes to the women entrepreneurs with a relief in interest

rate on credit. Some of these schemes are listed in below.

With the support of Government and Public Sector organisation

Women entrepreneurship is growing at a rapid rate in the

world. The factors influencing these women across sectors

globally are opportunities created by globalisation, integrated

markets and jobs, support from the family, major support from

the government through various programmes started

internationally and domestically for women entrepreneurs,

improvement in their standards, and health and education.

This includes rise in income, self worth, self confidence and

social status in life. Due to empowerment and motivation,

women entrepreneurs create employment for many more

women in the communit y and in a country. Then only a

country will be considered inclusive. The number of female -

owned enterprises is growing at a faster pace than that of male

counterparts.

In India, women entrepreneurs identified majorly with micro,

small and medium enterprises because many women start their

enterprises with a very low net worth (low budget enterprise)

and ensure low risk. Therefore, women participation as per

revenue is less due to the size of their enterprises, but create

more volume and employment in various sectors (Annual

report of MSME 2012 –13) (Figure 3). As per the fourth All India

census of MSME, the number of women enterprises in the

registered sector are 2.15 lakh (13.72 per cent) and

unregistered sector are 18.06 lakh (9.09 per cent) of the total

sectors. This figure clearly shows the number of women

enterprises that are under the unregistered sector. This

indicates that many women enterprises would start up their

enterprises if the government makes policies for unregistered

sector where more benefits can be reaped by women

entrepreneurs. They could get more opportunities and benefits

if they come under the registered sector.

The MSME sector contributes to 44.7 million enterprises. It

creates employment for more than 80million jobs, this being

the second largest after agriculture. It contributes 45 per cent

of the total industrial manufacturing and above 40 per cent of

India’s total exports. The microenterprise and micro -finance

widely accepted development strategy for poverty reduction.

This responsibility has been equally taken up by government,

commercial banks and civil society. The role of SHGs in

providing micro -finance has been enormous in last one

decade. Self help groups with micro finance are effective in

reducing poverty, empowerment women and creating self

sufficiency in rural development.

Karnataka, and Tamil Nadu are such examples where women

entrepreneurship and micro-enterprises have grown due to

extensive support of SHGs. They have provided micro-finances,

capacity building programmes by training women, and have

nurtured them with their financial support. Today, the reserve

bank of India (RBI) also understands the role and importa nce

of SHGs in financing, and has extended medium sized loans to

women entrepreneurs in support with NABARD. The beauty of

women entrepreneurs is the motivation for other women to

come up and participate with equal opportunities and maintain

their enterprises. Across the world maximum start ups have

failed due to financial problems faced by women

entrepreneurs, but today due to SHGs, trust has been built

amongst the women entrepreneurs to realize and make their

dreams come true. Therefore, this type of growth is truly an

inclusive growth in India.

Conclusion :-

Women entrepreneurship is both about women‟s position in

the society and about the role of entrepreneurship in the same

society. Women entrepreneurs face many obstacles,

specifically in marketing their product (including family

responsibilities), that have to be overcome in order to give

them access to the same opportunities as men. The entry of

rural women in micro - enterprises must be encouraged and

aggravated. Rural women can do wonders by their effectual

and competent involvement in entrepreneurial activities. The

rural women have the basic indigenous knowledge, skill,

potential and resources to establish and manage enterprise.

Now, the need is for knowledge regarding accessibility to loans,

various funding agencies, procedures regarding certification,

awareness on government welfare programmes, motivation,

technical skill l and support from family government and other

organisation.

You might also like

- JPR FinalDocument16 pagesJPR Finaladinath moreNo ratings yet

- CPP Project ReportDocument45 pagesCPP Project ReportLucky AnsariNo ratings yet

- Study Storm Botnet Trojan VirusDocument23 pagesStudy Storm Botnet Trojan VirusMorris jonsonNo ratings yet

- Python MicroprojectDocument24 pagesPython MicroprojectSushant kakadeNo ratings yet

- Css ProjectDocument28 pagesCss ProjectSneha GuledNo ratings yet

- Search and utilize UML tools to model softwareDocument11 pagesSearch and utilize UML tools to model softwareMahesh DarvankarNo ratings yet

- Java Patient Management SystemDocument7 pagesJava Patient Management SystemSohan WaghNo ratings yet

- Projects in Software TestingDocument8 pagesProjects in Software TestingPremashish KumarNo ratings yet

- Student Management System in PythonDocument18 pagesStudent Management System in PythonMR VIJAYNo ratings yet

- Ajp ProjectDocument4 pagesAjp ProjectMISBAH NAIK0% (1)

- Diploma in Computer Technology Academic Year 2020-21.: Notes AppDocument24 pagesDiploma in Computer Technology Academic Year 2020-21.: Notes AppRehan PathanNo ratings yet

- Android Application Math Based Game: SIES (Nerul) College of Arts, Science and Commerce NAAC Re-Accredited A' GradeDocument23 pagesAndroid Application Math Based Game: SIES (Nerul) College of Arts, Science and Commerce NAAC Re-Accredited A' GradeTejas GuptaNo ratings yet

- Government Polytechnic, Jalna Computer Engineering DepartmentDocument8 pagesGovernment Polytechnic, Jalna Computer Engineering Departmentसचिन एसNo ratings yet

- MGT MicroprojectDocument13 pagesMGT Microproject02 - CM Ankita AdamNo ratings yet

- Mad MicrprjctDocument19 pagesMad Micrprjct68 Nitesh PundgeNo ratings yet

- Ajp 1Document15 pagesAjp 1Yuva Neta Ashish PandeyNo ratings yet

- Library Management ERDDocument14 pagesLibrary Management ERDUNIQU videosNo ratings yet

- Bank Management System: Maharashtra State Board of Technical Education, MumbaiDocument10 pagesBank Management System: Maharashtra State Board of Technical Education, MumbaisakshiNo ratings yet

- JAVA MicroprojectDocument31 pagesJAVA Microprojectᴠɪɢʜɴᴇꜱʜ ɴᴀʀᴀᴡᴀᴅᴇ.No ratings yet

- MSBTE Sample Question Paper: Remember Level 1MDocument35 pagesMSBTE Sample Question Paper: Remember Level 1MEeeeewwNo ratings yet

- Final Project of GUI .PDF 2Document28 pagesFinal Project of GUI .PDF 2RahulNo ratings yet

- CSS MicroprojectDocument15 pagesCSS MicroprojectAbdullah ShaikhNo ratings yet

- Micro Project Report: " Climate Change An Global Issue. "Document13 pagesMicro Project Report: " Climate Change An Global Issue. "Assad MujawarNo ratings yet

- Osy Microproject ReportDocument13 pagesOsy Microproject ReportHarish chafakarandeNo ratings yet

- Article Information System Micro-Project ReportDocument15 pagesArticle Information System Micro-Project ReportSonali ManeNo ratings yet

- Government Polytechnic, Jalna Computer Engineering DepartmentDocument23 pagesGovernment Polytechnic, Jalna Computer Engineering Departmentjaya bhutekarNo ratings yet

- " Crime File Management System ": Rasiklal M. Dhariwal Institute of TechnologyDocument11 pages" Crime File Management System ": Rasiklal M. Dhariwal Institute of TechnologyShreya SawantNo ratings yet

- EdeDocument16 pagesEdeDipesh BaviskarNo ratings yet

- Government Polytechnic, Jalna: "Test Case of Hospital Appointment Booking "Document23 pagesGovernment Polytechnic, Jalna: "Test Case of Hospital Appointment Booking "abhay garodiNo ratings yet

- Restaurant Management System SynopsisDocument25 pagesRestaurant Management System SynopsisAftabNo ratings yet

- Microproject FormatDocument8 pagesMicroproject FormatTAJKAZINo ratings yet

- OSY Micro-Project Report - SurajDocument33 pagesOSY Micro-Project Report - SurajMorris jonsonNo ratings yet

- Annexure I: SR - No Student Name Roll NoDocument6 pagesAnnexure I: SR - No Student Name Roll No30 Om GhugareNo ratings yet

- Latthe Education Society's Polytechnic, Sangli: Report of Micro ProjectDocument5 pagesLatthe Education Society's Polytechnic, Sangli: Report of Micro ProjectMansi SamantNo ratings yet

- "Project Title": Diploma in Computer EngineeringDocument24 pages"Project Title": Diploma in Computer Engineeringpriyanka patilNo ratings yet

- EST MicroprojectDocument15 pagesEST Microproject28 chavan snehaNo ratings yet

- STE Micro-Project Report - SurajDocument24 pagesSTE Micro-Project Report - SurajMorris jonsonNo ratings yet

- AJP MicroprojectDocument13 pagesAJP MicroprojectPriyanka BhideNo ratings yet

- Store Management YstemDocument14 pagesStore Management YstemAshish BhoirNo ratings yet

- STE Final MicroprojectDocument34 pagesSTE Final Microprojectanjali bondarNo ratings yet

- Library system using data structuresDocument14 pagesLibrary system using data structuresŠhùbhãm PàťìľNo ratings yet

- Osy Micro-Project Report-2Document15 pagesOsy Micro-Project Report-2Shinde MNo ratings yet

- A Micro Project On Different UNIX Commands and Their FunctionsDocument13 pagesA Micro Project On Different UNIX Commands and Their FunctionsShubham DahatondeNo ratings yet

- Micro Project Report On: Food Ordering SystemDocument6 pagesMicro Project Report On: Food Ordering Systemsahil bhoir100% (1)

- JPR ProposalDocument4 pagesJPR ProposalVishal Kesharwani100% (2)

- CSS Microproject Report2Document13 pagesCSS Microproject Report2Anand 28No ratings yet

- Chat Application in JavaDocument19 pagesChat Application in JavaRohanNo ratings yet

- Check if string is palindrome using JavaScript formDocument10 pagesCheck if string is palindrome using JavaScript formAvinash Lokhande100% (1)

- Certificate for Completing Micro Project in Advanced Java ProgrammingDocument15 pagesCertificate for Completing Micro Project in Advanced Java ProgrammingRitesh SulakheNo ratings yet

- DTE MircroprojectDocument5 pagesDTE MircroprojectSanskruti Dudhe100% (2)

- Maximum and Minimum Using Divide and ConquerDocument17 pagesMaximum and Minimum Using Divide and ConquerAshutosh PatilNo ratings yet

- MVPS's Rajarshi Shahu Maharaj Polytechnic, Nashik: Department of Information TechnologyDocument20 pagesMVPS's Rajarshi Shahu Maharaj Polytechnic, Nashik: Department of Information TechnologyVaibhav Bhagwat100% (1)

- AJP MicroprojectDocument10 pagesAJP MicroprojectshubhaM100% (1)

- Gad MicroDocument25 pagesGad MicroSandy Borale100% (1)

- Rainwater Harvesting: Vivekanand Education Society PolytechnicDocument26 pagesRainwater Harvesting: Vivekanand Education Society Polytechnicsidhhart kunkololNo ratings yet

- "Software Testing On Flipkart E-Commerce Website: Diploma in Computer EngineeringDocument4 pages"Software Testing On Flipkart E-Commerce Website: Diploma in Computer EngineeringAshutosh PatilNo ratings yet

- Online Laptop Shopping SiteDocument39 pagesOnline Laptop Shopping SiteSatyam Yendhe.100% (2)

- Impact of Microfinance on Women EntrepreneurshipDocument12 pagesImpact of Microfinance on Women EntrepreneurshipSunitaNo ratings yet

- Microfinance and Women EmpowermentDocument6 pagesMicrofinance and Women EmpowermentRasel Talukder100% (1)

- New Syl RD Sem IVDocument4 pagesNew Syl RD Sem IVAbhay JadhavNo ratings yet

- केटीचे लीस्ट confirmDocument5 pagesकेटीचे लीस्ट confirmDibyas Sanjay DubeyNo ratings yet

- Display PRTDocument1 pageDisplay PRTDibyas Sanjay DubeyNo ratings yet

- Python Exp1Document3 pagesPython Exp1Dibyas Sanjay DubeyNo ratings yet

- Report JavaDocument5 pagesReport JavaDibyas Sanjay DubeyNo ratings yet

- Cpe 24022024Document1 pageCpe 24022024Dibyas Sanjay DubeyNo ratings yet

- Maharashtra State Board of Technical Education: (AUTONOMOUS) (ISO 9001:2008) (ISO/IEC: 27001:2013)Document1 pageMaharashtra State Board of Technical Education: (AUTONOMOUS) (ISO 9001:2008) (ISO/IEC: 27001:2013)Dibyas Sanjay DubeyNo ratings yet

- STG AnextureDocument3 pagesSTG AnextureDibyas Sanjay DubeyNo ratings yet

- Summer 23 UT 1 TimetableDocument1 pageSummer 23 UT 1 TimetableDibyas Sanjay DubeyNo ratings yet

- 3rd CsDocument17 pages3rd CsDibyas Sanjay DubeyNo ratings yet

- PHP PDFDocument85 pagesPHP PDFDibyas Sanjay Dubey100% (1)

- Mini Project 2 Guess The NumberDocument3 pagesMini Project 2 Guess The NumberDibyas Sanjay DubeyNo ratings yet

- Exam form नोटिस-4 Summer-2023 - 8Document1 pageExam form नोटिस-4 Summer-2023 - 8Dibyas Sanjay DubeyNo ratings yet

- 1208 EEC MIcroprojectDocument16 pages1208 EEC MIcroprojectDibyas Sanjay DubeyNo ratings yet

- New NagrikDocument14 pagesNew NagrikDibyas Sanjay DubeyNo ratings yet

- Graphical User Interface (GUI) : CE790 Digital KVM ExtenderDocument8 pagesGraphical User Interface (GUI) : CE790 Digital KVM ExtenderDibyas Sanjay DubeyNo ratings yet

- The importance of effective communication in business managementDocument19 pagesThe importance of effective communication in business managementMarullzNo ratings yet

- New Doc 2022-05-18 11.06.31 - 5Document1 pageNew Doc 2022-05-18 11.06.31 - 5Dibyas Sanjay DubeyNo ratings yet

- 1208co Dibyas DUBEY Workshop Project .Docx 1234Document15 pages1208co Dibyas DUBEY Workshop Project .Docx 1234Dibyas Sanjay DubeyNo ratings yet

- 1208 Dibyas Dubey 2.identify Active and Passive Components in Given Circuits PDFDocument6 pages1208 Dibyas Dubey 2.identify Active and Passive Components in Given Circuits PDFDibyas Sanjay DubeyNo ratings yet

- If Any Web Resources Required.: Sub Dim As NewDocument3 pagesIf Any Web Resources Required.: Sub Dim As New68 DEEPAK GAUNDNo ratings yet

- "Employee Management System": Submitted byDocument10 pages"Employee Management System": Submitted byDibyas Sanjay DubeyNo ratings yet

- Imports Imports Public Class Private Sub As Object As Handles Mybase Dim As NewDocument5 pagesImports Imports Public Class Private Sub As Object As Handles Mybase Dim As NewDibyas Sanjay DubeyNo ratings yet

- Public Class Private Sub As Object As Handles: Form1Document4 pagesPublic Class Private Sub As Object As Handles: Form1Dibyas Sanjay DubeyNo ratings yet

- If Any Web Resources Required.: Sub Dim As NewDocument3 pagesIf Any Web Resources Required.: Sub Dim As New68 DEEPAK GAUNDNo ratings yet

- Chapter 3 Business Formation and Small Business PDFDocument21 pagesChapter 3 Business Formation and Small Business PDFAlazar workneh tessemaNo ratings yet

- T.L.E. - Business 3rd Term ReviewerDocument12 pagesT.L.E. - Business 3rd Term ReviewerDaniel TorralbaNo ratings yet

- Sheryl D. Tomas, Mba: Program Chair-Bachelor of Science in EntrepreneurshipDocument20 pagesSheryl D. Tomas, Mba: Program Chair-Bachelor of Science in EntrepreneurshipIam MaroseNo ratings yet

- FIP 3Qtr2013Document8 pagesFIP 3Qtr2013Karol Mikhail Ra NakpilNo ratings yet

- Etsy Seller Census CADocument16 pagesEtsy Seller Census CAAlfred YangaoNo ratings yet

- Factors Affecting MSEs in Bakko TownDocument35 pagesFactors Affecting MSEs in Bakko TownMuktar jiboNo ratings yet

- Status of Food Micro-Businesses Around Brgy. Dumaloong Gandara, Samar During PandemicDocument29 pagesStatus of Food Micro-Businesses Around Brgy. Dumaloong Gandara, Samar During PandemicShanina LouiseNo ratings yet

- Marketplace Lending PartnershipsDocument8 pagesMarketplace Lending PartnershipsCrowdfundInsiderNo ratings yet

- OPD Business Plan 2017-19Document49 pagesOPD Business Plan 2017-19JosephNo ratings yet

- MicrofinanceDocument65 pagesMicrofinanceRahul AksHNo ratings yet

- UntitledDocument234 pagesUntitledlesliebrodieNo ratings yet

- Vidhya PDFDocument67 pagesVidhya PDFVidhya.pNo ratings yet

- Growth of Micro-Enterprises Empirical Evidence FroDocument22 pagesGrowth of Micro-Enterprises Empirical Evidence FroeferemNo ratings yet

- Chapter 5. The Small, For-Profit Business Model and Environmentalism in EthiopiaDocument32 pagesChapter 5. The Small, For-Profit Business Model and Environmentalism in EthiopiaAlene AmsaluNo ratings yet

- Market Based Strategies For Povery AlleviationDocument28 pagesMarket Based Strategies For Povery Alleviationram kesavanNo ratings yet

- MSME Concept PaperDocument7 pagesMSME Concept PaperJoshua ReyesNo ratings yet

- Start Me Up English Final 11feb2019 PDFDocument195 pagesStart Me Up English Final 11feb2019 PDFmeirin100% (1)

- 2 2 FGD Guide QuestionsDocument2 pages2 2 FGD Guide QuestionsWaiswa JeremyNo ratings yet

- Mba M2a ChitrakshDocument125 pagesMba M2a ChitrakshAnkush SharmaNo ratings yet

- Livelihood Project For The Poor in OmanDocument6 pagesLivelihood Project For The Poor in OmanInternational Journal of Business Marketing and ManagementNo ratings yet

- Belay DabaDocument86 pagesBelay DabaBelay DabaNo ratings yet

- The Role of Rural Bank in The Development of SME'sDocument42 pagesThe Role of Rural Bank in The Development of SME'sNero_90No ratings yet

- Mekidelawit Tamrat MBAO9550.14BDocument34 pagesMekidelawit Tamrat MBAO9550.14BmkdiNo ratings yet

- Small Business Strategies For Company Profitability and SustainabDocument130 pagesSmall Business Strategies For Company Profitability and SustainabCriselle Joy LaviñaNo ratings yet

- Volume7 Issue8 (2) 2018Document357 pagesVolume7 Issue8 (2) 2018diah savitriNo ratings yet

- Pov HazelDocument5 pagesPov HazelHazel Ebrona MaquilanNo ratings yet

- CBM 122Document3 pagesCBM 122Jahara Obedencio CalaycaNo ratings yet

- MPRA Paper 33142Document32 pagesMPRA Paper 33142Nikhil BoggarapuNo ratings yet

- Idosa Tolesa Final PaperDocument63 pagesIdosa Tolesa Final PaperIdosa Tolesa100% (1)

- Đề Thi Thử THPT 2021 - Tiếng Anh - GV Vũ Thị Mai Phương - Đề 11 - Có Lời GiảiDocument15 pagesĐề Thi Thử THPT 2021 - Tiếng Anh - GV Vũ Thị Mai Phương - Đề 11 - Có Lời GiảiHanh YenNo ratings yet

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (87)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4 out of 5 stars4/5 (26)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (58)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessFrom EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessRating: 4.5 out of 5 stars4.5/5 (24)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- Your Next Five Moves: Master the Art of Business StrategyFrom EverandYour Next Five Moves: Master the Art of Business StrategyRating: 5 out of 5 stars5/5 (798)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsFrom EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsRating: 5 out of 5 stars5/5 (2)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:From EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Rating: 5 out of 5 stars5/5 (2)

- Anything You Want: 40 lessons for a new kind of entrepreneurFrom EverandAnything You Want: 40 lessons for a new kind of entrepreneurRating: 5 out of 5 stars5/5 (46)

- The Kingdom Driven Entrepreneur's Guide: Doing Business God's WayFrom EverandThe Kingdom Driven Entrepreneur's Guide: Doing Business God's WayRating: 5 out of 5 stars5/5 (42)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisFrom EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisRating: 4.5 out of 5 stars4.5/5 (3)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- Faith Driven Entrepreneur: What It Takes to Step Into Your Purpose and Pursue Your God-Given Call to CreateFrom EverandFaith Driven Entrepreneur: What It Takes to Step Into Your Purpose and Pursue Your God-Given Call to CreateRating: 5 out of 5 stars5/5 (33)

- Don't Start a Side Hustle!: Work Less, Earn More, and Live FreeFrom EverandDon't Start a Side Hustle!: Work Less, Earn More, and Live FreeRating: 4.5 out of 5 stars4.5/5 (30)

- Without a Doubt: How to Go from Underrated to UnbeatableFrom EverandWithout a Doubt: How to Go from Underrated to UnbeatableRating: 4 out of 5 stars4/5 (23)

- The Master Key System: 28 Parts, Questions and AnswersFrom EverandThe Master Key System: 28 Parts, Questions and AnswersRating: 5 out of 5 stars5/5 (62)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldFrom Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldRating: 5 out of 5 stars5/5 (20)

- Sprint: How to Solve Big Problems and Test New Ideas in Just Five DaysFrom EverandSprint: How to Solve Big Problems and Test New Ideas in Just Five DaysRating: 4.5 out of 5 stars4.5/5 (180)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andFrom EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andRating: 4.5 out of 5 stars4.5/5 (708)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelFrom EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelRating: 5 out of 5 stars5/5 (51)

- Expert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceFrom EverandExpert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceRating: 5 out of 5 stars5/5 (363)

- Invention: A Life of Learning Through FailureFrom EverandInvention: A Life of Learning Through FailureRating: 4.5 out of 5 stars4.5/5 (28)

- Built to Serve: Find Your Purpose and Become the Leader You Were Born to BeFrom EverandBuilt to Serve: Find Your Purpose and Become the Leader You Were Born to BeRating: 5 out of 5 stars5/5 (24)