Professional Documents

Culture Documents

Annual Report of IOCL 178

Uploaded by

NikunjCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annual Report of IOCL 178

Uploaded by

NikunjCopyright:

Available Formats

Indian Oil Corporation Limited 3rd Integrated Annual Report 61st Annual Report 2019-20

About the Report

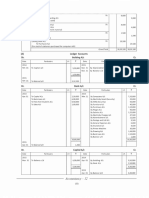

NOTES TO FINANCIAL STATEMENTS NOTES TO FINANCIAL STATEMENTS

Note - 19 : DEFERRED TAX LIABILITIES (NET) Note - 20 : OTHER LIABILITIES (NON FINANCIAL)

(₹ in Crore)

(i) In compliance of Ind AS – 12 on “Income Taxes”, the item wise details of Deferred Tax Liability (net) are as under: Non Current Current

Particulars

Chairman’s Desk

(₹ in Crore) March 31, 2020 March 31, 2019 March 31, 2020 March 31, 2019

From the

Provided Deferred Income 4.41 5.57 1.20 1.81

Provided

during the year Balance as

As on during the Government Grants (refer Note - 43) 1,931.60 1,570.27 171.80 120.57

Particulars in Statement on March 31,

April 1, 2019 year in OCI

of Profit and 2020 Statutory Liabilities - - 6,448.70 7,681.39

(net)

Loss *

Advances from Customers 111.49 23.61 4,913.32 3,799.28

Deferred Tax Liability:

About IndianOil

Others 0.60 - 933.22 872.33

Related to Fixed Assets 23,270.61 (5,301.60) - 17,969.01

TOTAL 2,048.10 1,599.45 12,468.24 12,475.38

Foreign Currency gain on long term monetary item 12.50 (12.50) - -

Total Deferred Tax Liability (A) 23,283.11 (5,314.10) - 17,969.01

Note - 21 : BORROWINGS - CURRENT

Deferred Tax Assets: (₹ in Crore)

Description of Capitals

Provision on Inventories, Debtors, Loans and Advance, Investments 1,020.64 (160.28) - 860.36 Particulars March 31, 2020 March 31, 2019

Compensation for Voluntary Retirement Scheme 9.38 (5.88) - 3.50

SECURED LOANS

43B/40 (a)(ia)/other Disallowances etc. 3,760.28 (1,107.72) 21.32 2,673.88

Loans Repayable on Demand

Carry Forward Business Losses/ Unabsorbed Depreciation 304.67 2,993.00 - 3,297.67

From Banks: A

Remeasurement of defined benefit plan 0.58 - - 0.58

Board of Directors, etc.

Working Capital Demand Loan 7,242.52 3,920.05

Fair valuation of Equity instruments (54.11) - 126.47 72.36

Cash Credit 641.88 4,225.66

MTM on Hedging Instruments (11.85) - (3.63) (15.48)

Foreign Currency Loans 22.67 -

Fair value of debt instruments 5.76 - (150.87) (145.11)

7,907.07 8,145.71

Others (455.37) (362.66) - (818.03)

From Others:

Total Deferred Tax Assets (B) 4,579.98 1,356.46 (6.71) 5,929.73

Loans through Tri-Party Repo Segment (TREPS) of Clearing Corporation of India Ltd.

Directors’ Report

B 2,629.95 2,587.53

MAT/ECS credit entitlement (C) - Net # 2,193.42 (1,593.43) - 599.99 (CCIL)

Deferred Tax Liability net of MAT Credit (A-B-C) 16,509.71 (5,077.13) 6.71 11,439.29 Other Loans A 1,493.38 1,783.98

Total Secured Loans 12,030.40 12,517.22

# Includes generation of MAT Credit of ₹770.05 crores due to alignment of tax provisions with ITR and ₹1,921.13 crores towards MAT

credit written off upon movement to new regime by Holding Company.

* Includes translation reserve of ₹41.30 crores due to translation of Opening Balance at Closing Exchange Rate UNSECURED LOANS

Discussion & Analysis

Management’s

Loans Repayable on Demand

(ii) Reconciliation between the average effective tax rate and the applicable tax rate is as below :

From Banks/ Financial Institutions

2019-20 2018-19 In Foreign Currency 29,937.93 14,157.68

(%) (%)

In Rupee 8,671.85 3,466.88

Applicable tax rate 25.168 34.944

Responsibility Report

38,609.78 17,624.56

Tax effect of income that are not taxable in determining taxable profit 6.12 (2.83)

From Others

Business

Tax effect of expenses that are not deductible in determining taxable profit (4.11) 1.08

Commercial Papers 19,257.26 23,417.51

Tax effect on recognition of previously unrecognised allowance/disallowances 0.84 1.57

Total Unsecured Loans 57,867.04 41,042.07

Tax effect of expenses on share buy back through Equity - 0.02

TOTAL SHORT-TERM BORROWINGS 69,897.44 53,559.29

Tax expenses/income related to prior years (10.08) (1.84)

Corporate Governance

Difference in tax due to income chargeable to tax at special rates 1.48 (0.04) A. Against hypothecation by way of first pari passu charge on Raw Materials, Finished Goods, Stock-in Trade, Sundry Debtors,

Report on

Outstanding monies, Receivables, Claims, Contracts, Engagements to SBI and HDFC Banks.

Tax impact on share of profit of JVs/ Associates added net of tax in PBT of Group 1.97 (0.11)

Tax effect of different or nil tax rates of Group Companies (3.24) (0.90) B. Against pledging of the following to CCIL:

Effect of Taxes in foreign jurisdiction (5.65) 1.55 Government Securities (Including OMC GOI Special Bonds) 3,701.00 2,655.00

Difference due to change in Rate of Tax 61.35 (0.04) Bank Guarantees 1,650.00 1,650.00

Financial Statements

Consolidated

Others 0.01 (0.03)

Average Effective Tax Rate 73.86 33.37

350 Financial Statements Financial Statements 351

You might also like

- Project Work Accountancy 8Document1 pageProject Work Accountancy 8NikunjNo ratings yet

- Project Work Accountancy 22Document1 pageProject Work Accountancy 22NikunjNo ratings yet

- Project Work Accountancy 47Document1 pageProject Work Accountancy 47NikunjNo ratings yet

- Project Work Accountancy 52Document1 pageProject Work Accountancy 52NikunjNo ratings yet

- Project Work Accountancy 25Document1 pageProject Work Accountancy 25NikunjNo ratings yet

- Project Work Accountancy 7Document1 pageProject Work Accountancy 7NikunjNo ratings yet

- Project Work Accountancy 51Document1 pageProject Work Accountancy 51NikunjNo ratings yet

- Project Work Accountancy 46Document1 pageProject Work Accountancy 46NikunjNo ratings yet

- Project Work Accountancy 2Document1 pageProject Work Accountancy 2NikunjNo ratings yet

- Project Work Accountancy 6Document1 pageProject Work Accountancy 6NikunjNo ratings yet

- Project Work Accountancy 53Document1 pageProject Work Accountancy 53NikunjNo ratings yet

- Project Work Accountancy 24Document1 pageProject Work Accountancy 24NikunjNo ratings yet

- Project Work Accountancy 37Document1 pageProject Work Accountancy 37NikunjNo ratings yet

- Rich Dad Poor Dad 188Document1 pageRich Dad Poor Dad 188NikunjNo ratings yet

- Rich Dad Poor Dad 186Document1 pageRich Dad Poor Dad 186NikunjNo ratings yet

- Annual Report of IOCL 69Document1 pageAnnual Report of IOCL 69NikunjNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Class DirDocument12 pagesClass DirUpdatest newsNo ratings yet

- Brigade Enterprises LimitedDocument36 pagesBrigade Enterprises LimitedAnkur MittalNo ratings yet

- Tutorial 5 Jan 2022 Question OnlyDocument8 pagesTutorial 5 Jan 2022 Question OnlyMurali RasamahNo ratings yet

- PFRS 7 Financial Instruments DisclosuresDocument20 pagesPFRS 7 Financial Instruments DisclosureseiraNo ratings yet

- BAFIA FOR RBB Bank CLassDocument29 pagesBAFIA FOR RBB Bank CLassDagendra BasnetNo ratings yet

- FINMAN Handout PDFDocument5 pagesFINMAN Handout PDFHimanshu SharmaNo ratings yet

- Lecture 1 - Financial Analysis PDFDocument84 pagesLecture 1 - Financial Analysis PDFReymark De veraNo ratings yet

- Applying Value Drivers To Hotel ValuationDocument20 pagesApplying Value Drivers To Hotel ValuationErsan YildirimNo ratings yet

- CurrencyPros @ICT - CapitalDocument25 pagesCurrencyPros @ICT - CapitalErigmo92% (13)

- Stock Code: 500265 Stock Code: MAHSEAMLES: Nid AlDocument1 pageStock Code: 500265 Stock Code: MAHSEAMLES: Nid AlLalitNo ratings yet

- Treasury Management: - Functions and OperationsDocument40 pagesTreasury Management: - Functions and Operationsdidi chen100% (2)

- Form ADV Part 2 InstructionsDocument26 pagesForm ADV Part 2 InstructionsghummNo ratings yet

- Metastock Guide PDFDocument20 pagesMetastock Guide PDFraviNo ratings yet

- Dissertation On Stock Market in IndiaDocument5 pagesDissertation On Stock Market in IndiaBuyPsychologyPapersUK100% (1)

- Silabus MRS3201 Pembiayaan ProyekDocument8 pagesSilabus MRS3201 Pembiayaan ProyekDewi Juliyanti SilaenNo ratings yet

- Chapter 13 SolutionsDocument5 pagesChapter 13 SolutionsStephen Ayala100% (1)

- Launchpool - Report 2021Document15 pagesLaunchpool - Report 2021Sam HarveyNo ratings yet

- Paragraph Blue Corporation Acquired Controlling Ownership of Sentence Skyler Corporation On December 31, 20X3, and A Consolidated Balance Sheet Was Prepared Immediately.Document2 pagesParagraph Blue Corporation Acquired Controlling Ownership of Sentence Skyler Corporation On December 31, 20X3, and A Consolidated Balance Sheet Was Prepared Immediately.Kailash KumarNo ratings yet

- bUSINESS STUDIESDocument3 pagesbUSINESS STUDIESuhhwotNo ratings yet

- Asian Paints: Prepared byDocument54 pagesAsian Paints: Prepared bylaxmi joshiNo ratings yet

- Wlcon - PS Wlcon PMDocument10 pagesWlcon - PS Wlcon PMP RosenbergNo ratings yet

- Fortune Brands Inc: FORM 10-QDocument49 pagesFortune Brands Inc: FORM 10-Qtomking84No ratings yet

- Interim Order in The Matter of United Cosmetics Manufacturing (I) Ltd. and Its DirectorsDocument15 pagesInterim Order in The Matter of United Cosmetics Manufacturing (I) Ltd. and Its DirectorsShyam SunderNo ratings yet

- Top Ten ETFDocument4 pagesTop Ten ETFsalah51No ratings yet

- Quizzes - Topic 5 - Impairment of Asset - Attempt ReviewDocument11 pagesQuizzes - Topic 5 - Impairment of Asset - Attempt ReviewThiện Phát100% (1)

- CFPB Mortgage Complaint DatabaseDocument718 pagesCFPB Mortgage Complaint DatabaseSP BiloxiNo ratings yet

- Copie A Fișierului 20 Pip ChallangeDocument3 pagesCopie A Fișierului 20 Pip ChallangeBawriceNo ratings yet

- Schroders Natural Capital Insights - Reconfiguring Supply To Unlock DemandDocument11 pagesSchroders Natural Capital Insights - Reconfiguring Supply To Unlock DemandEric SchwabNo ratings yet

- CFA Level 1 Performance Tracker '23Document21 pagesCFA Level 1 Performance Tracker '23Utsav PatelNo ratings yet

- Ch5 - Test BankDocument12 pagesCh5 - Test BankMALAKNo ratings yet