Professional Documents

Culture Documents

Annual Report of IOCL 114

Uploaded by

NikunjCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annual Report of IOCL 114

Uploaded by

NikunjCopyright:

Available Formats

Indian Oil Corporation Limited 3rd Integrated Annual Report 61st Annual Report 2019-20

About the Report

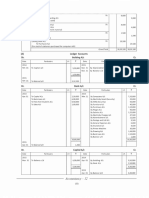

NOTES TO FINANCIAL STATEMENTS NOTES TO FINANCIAL STATEMENTS

Note - 22 : TRADE PAYABLES Note - 24 : OTHER INCOME

(₹ in Crore) (₹ in Crore)

Particulars March 31, 2020 March 31, 2019 Particulars 2019-2020 2018-2019

Chairman’s Desk

Dues to Micro and Small Enterprises 232.47 235.24 Interest on: A

From the

Dues to Related Parties 852.02 1,313.50 Financial items:

Dues to Others A 24,167.09 35,833.85 Deposits with Banks 6.16 19.52

TOTAL 25,251.58 37,382.59 Customers Outstandings 342.10 423.83

A. Includes amount related to Micro and Small enterprises for which payment to be made to Oil Companies GOI SPL Bonds/ Other Investments 825.50 914.04

2.51 1.21

About IndianOil

financial institutions in pursuance of bills discounted by them

Other Financial Items 623.61 239.68

Total interest on Financial items 1,797.37 1,597.07

Note - 23 : REVENUE FROM OPERATIONS

(₹ in Crore) Non-Financial items 119.86 99.34

Particulars 2019-2020 2018-2019 1,917.23 1,696.41

Description of Capitals

Sale of Products and Crude 5,73,843.13 6,08,378.66 Dividend: B

Less: Discounts 13,466.07 12,158.7 From Related Parties 882.06 488.45

Sales (Net of Discounts) 5,60,377.06 5,96,219.96 From Other Companies 709.96 860.18

Sale of Services 152.55 131.39 1,592.02 1,348.63

Other Operating Revenues (Note “23.1”) 4,861.98 5,010.15 Fair value Gain on Investments/ Provision Written Back (Net) - 1.60

Board of Directors, etc.

5,65,391.59 6,01,361.50 Gain on Derivatives - 0.32

Net Claim/(Surrender) of SSC 100.20 310.66 Other Non Operating Income 62.14 81.55

Subsidy From Central/State Governments 161.68 150.00 TOTAL 3,571.39 3,128.51

Grant from Government of India 1,296.17 4,110.18 A 1. Includes Tax Deducted at Source 8.43 24.62

TOTAL 5,66,949.64 6,05,932.34 A 2. Includes interest received under section 244A of the Income Tax Act. 45.75 90.14

Particulars relating to Revenue Grants are given in Note - 46.

Directors’ Report

A 3. Include interest on:

Current Investments 516.93 644.36

Note - 23.1 : OTHER OPERATING REVENUES Non-Current Investments 308.57 269.68

(₹ in Crore)

Particulars 2019-2020 2018-2019 A 4. Total interest income (calculated using the effective interest method) for financial

assets:

Sale of Power and Water 337.19 429.56

Discussion & Analysis

In relation to Financial Assets classified at amortised cost 971.87 683.03

Management’s

Revenue from Construction Contracts 8.11 6.50

In relation to Financial Assets classified at FVOCI 772.28 874.79

Unclaimed / Unspent liabilities written back 155.27 312.03

In relation to Financial Assets classified at FVTPL 53.22 39.25

Provision for Doubtful Debts, Advances, Claims, and Stores written back 628.10 58.93

B.1 Dividend Income consists of Dividend on:

Provision for Contingencies written back 1,353.49 1,492.97

Current Investments 5.65 17.44

Recoveries from Employees 15.46 11.98

Responsibility Report

Non-Current Investments 1,586.37 1,331.19

Retail Outlet License Fees 1,117.06 1,187.82

Business

B.2 Dividend on Non Current Investments Includes Dividend from Subsidiaries 556.54 230.64

Income from Non Fuel Business 170.47 244.67

Commission and Discount Received 3.75 5.45

Sale of Scrap 213.62 235.06 Note - 25 : COST OF MATERIAL CONSUMED

(₹ in Crore)

Corporate Governance

Income from Finance Leases 5.03 2.48

Particulars 2019-2020 2018-2019

Amortization of Capital Grants 134.30 99.99

Report on

Opening Stock 28,359.50 25,743.40

Revenue Grants 43.66 219.35

Add: Purchases 2,43,784.87 2,72,295.71

Commodity Hedging Gain (Net) - 27.58

2,72,144.37 2,98,039.11

Terminalling Charges 56.85 83.13

Less: Closing Stock 19,350.20 28,359.50

Financial Statements

Other Miscellaneous Income 619.62 592.65

Less: Transfer to Exceptional Items 5,717.14 -

Standalone

TOTAL 4,861.98 5,010.15

TOTAL 2,47,077.03 2,69,679.61

222 Financial Statements Financial Statements 223

You might also like

- Project Work Accountancy 47Document1 pageProject Work Accountancy 47NikunjNo ratings yet

- Project Work Accountancy 22Document1 pageProject Work Accountancy 22NikunjNo ratings yet

- Project Work Accountancy 52Document1 pageProject Work Accountancy 52NikunjNo ratings yet

- Project Work Accountancy 8Document1 pageProject Work Accountancy 8NikunjNo ratings yet

- Project Work Accountancy 25Document1 pageProject Work Accountancy 25NikunjNo ratings yet

- Project Work Accountancy 51Document1 pageProject Work Accountancy 51NikunjNo ratings yet

- Project Work Accountancy 7Document1 pageProject Work Accountancy 7NikunjNo ratings yet

- Project Work Accountancy 6Document1 pageProject Work Accountancy 6NikunjNo ratings yet

- Project Work Accountancy 53Document1 pageProject Work Accountancy 53NikunjNo ratings yet

- Project Work Accountancy 2Document1 pageProject Work Accountancy 2NikunjNo ratings yet

- Rich Dad Poor Dad 186Document1 pageRich Dad Poor Dad 186NikunjNo ratings yet

- Project Work Accountancy 24Document1 pageProject Work Accountancy 24NikunjNo ratings yet

- Project Work Accountancy 37Document1 pageProject Work Accountancy 37NikunjNo ratings yet

- Rich Dad Poor Dad 188Document1 pageRich Dad Poor Dad 188NikunjNo ratings yet

- Project Work Accountancy 46Document1 pageProject Work Accountancy 46NikunjNo ratings yet

- Annual Report of IOCL 69Document1 pageAnnual Report of IOCL 69NikunjNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- LYON Conditions of Secondment 3500EUR enDocument4 pagesLYON Conditions of Secondment 3500EUR enabdu1lahNo ratings yet

- Company Catalogue 1214332018Document40 pagesCompany Catalogue 1214332018Carlos FrancoNo ratings yet

- HEAS 1000 Health Assessment: Reflection of PracticeDocument4 pagesHEAS 1000 Health Assessment: Reflection of PracticePreet ChahalNo ratings yet

- Installation Manual: 1.2 External Dimensions and Part NamesDocument2 pagesInstallation Manual: 1.2 External Dimensions and Part NamesSameh MohamedNo ratings yet

- Course Weekly Schedule Health Science TheoryDocument6 pagesCourse Weekly Schedule Health Science Theoryapi-466810096No ratings yet

- Immobilization of E. Coli Expressing Bacillus Pumilus CynD in Three Organic Polymer MatricesDocument23 pagesImmobilization of E. Coli Expressing Bacillus Pumilus CynD in Three Organic Polymer MatricesLUIS CARLOS ROMERO ZAPATANo ratings yet

- Insulating Oil TestingDocument6 pagesInsulating Oil TestingnasrunNo ratings yet

- Exam Questions: Exam Title: Chapter MEK 8Document4 pagesExam Questions: Exam Title: Chapter MEK 8vishnu sharmaNo ratings yet

- 1.8 SAK Conservations of Biodiversity EX-SITU in SITUDocument7 pages1.8 SAK Conservations of Biodiversity EX-SITU in SITUSandipNo ratings yet

- Evidence-Based Strength & HypertrophyDocument6 pagesEvidence-Based Strength & HypertrophyAnže BenkoNo ratings yet

- Celltac MEK 6500Document3 pagesCelltac MEK 6500RiduanNo ratings yet

- Oral Rehydration SolutionDocument22 pagesOral Rehydration SolutionAlkaNo ratings yet

- R. Nishanth K. VigneswaranDocument20 pagesR. Nishanth K. VigneswaranAbishaTeslinNo ratings yet

- Pamet and PasmethDocument4 pagesPamet and PasmethBash De Guzman50% (2)

- Indirect Current Control of LCL Based Shunt Active Power FilterDocument10 pagesIndirect Current Control of LCL Based Shunt Active Power FilterArsham5033No ratings yet

- NT PotentialMiningDevelopmentsDocument13 pagesNT PotentialMiningDevelopmentsho100hoNo ratings yet

- Airport - WikipediaDocument109 pagesAirport - WikipediaAadarsh LamaNo ratings yet

- 365 Days (Blanka Lipińska)Document218 pages365 Days (Blanka Lipińska)rjalkiewiczNo ratings yet

- 1 SMDocument10 pages1 SMAnindita GaluhNo ratings yet

- The Aging Brain: Course GuidebookDocument126 pagesThe Aging Brain: Course GuidebookIsabel Cristina Jaramillo100% (2)

- ESR 2538 ChemofastDocument14 pagesESR 2538 ChemofastEduardo Antonio Duran SepulvedaNo ratings yet

- Phoenix Contact DATA SHEETDocument16 pagesPhoenix Contact DATA SHEETShivaniNo ratings yet

- Natu Es Dsmepa 1ST - 2ND QuarterDocument38 pagesNatu Es Dsmepa 1ST - 2ND QuarterSenen AtienzaNo ratings yet

- Dermatology Mini-OSCEDocument322 pagesDermatology Mini-OSCEMarrkNo ratings yet

- Class 7 Work Book Answers Acid Bases and SaltsDocument2 pagesClass 7 Work Book Answers Acid Bases and SaltsGaurav SethiNo ratings yet

- S108T02 Series S208T02 Series: I (RMS) 8A, Zero Cross Type Low Profile SIP 4pin Triac Output SSRDocument13 pagesS108T02 Series S208T02 Series: I (RMS) 8A, Zero Cross Type Low Profile SIP 4pin Triac Output SSRnetiksNo ratings yet

- Hema Lec HematopoiesisDocument8 pagesHema Lec HematopoiesisWayne ErumaNo ratings yet

- Janssen Vaccine Phase3 Against Coronavirus (Covid-19)Document184 pagesJanssen Vaccine Phase3 Against Coronavirus (Covid-19)UzletiszemNo ratings yet

- CH 10 - Reinforced - Concrete - Fundamentals and Design ExamplesDocument143 pagesCH 10 - Reinforced - Concrete - Fundamentals and Design ExamplesVeronica Sebastian EspinozaNo ratings yet

- T W H O Q L (Whoqol) - Bref: Skrócona Wersja Ankiety Oceniającej Jakość ŻyciaDocument6 pagesT W H O Q L (Whoqol) - Bref: Skrócona Wersja Ankiety Oceniającej Jakość ŻyciaPiotrNo ratings yet