Professional Documents

Culture Documents

Upward Trend in Oil Prices: February 8, 2022

Uploaded by

Kone YacouOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Upward Trend in Oil Prices: February 8, 2022

Uploaded by

Kone YacouCopyright:

Available Formats

February 8th,2022

This bulletin is written by ESPE students. The content and views

expressed in this document reflect only the opinion of the authors and not

of the School.

upward trend in oil prices

Geopolitical tensions and a growing dispa- the physical oil demand has proven stron-

rity between supply and demand have ger than previously expected in its latest

driven up prices. Brent crude touched $90 Oil Market Report. Based on this surpri-

per barrel briefly this week for the first time sing turn of events, the IEA revised up its

ESPE STUDENT ENERGY

in years. This latest surge was attributed to 2022 oil demand forecast by 200,000 bpd.

tensions around Ukraine, but this is the Even with this estimate, oil demand will

most transitory reason for oil price rises. not only return to pre-pandemic levels but

The overall reasons boil down to funda- exceed them, reaching 99.7 million bpd by

mentals. And $90 per barrel of Brent may the end of the year.

be only the beginning. JP Morgan earlier

this month warned that Brent could rise to The pandemic depressed energy prices in

$125 per barrel as OPEC's spare production 2020, even sending the U.S. benchmark oil

capacity falls to 4 percent of total capacity price below zero for the first time ever. But

by the fourth quarter of 2022. prices have recovered faster and stron-

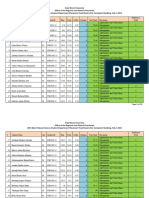

ger,Oil price, today, from January to

West Texas Intermediate crude futures, the February 2022 is dancing a symphony of

U.S. oil benchmark, gained more than 2% highest prices as shown in below graph.

to trade as high as $91.92 per barrel. The

last time prices were above the $90

threshold was October 2014. Brent crude

futures rose 1.7% to trade at $92. Brent

topped $90 on Jan. 26. Oil’s had a bliste-

BULLETIN

ring rally since falling to record lows in

April 2020. WTI briefly traded in negative

territory, as demand has returned but

producers have kept supply in check. Geo-

political tensions between Russia and

Ukraine as well as in the Middle East have

also sent jitters through the market.

As oil prices push higher, a number of Wall

Street analysts have forecasted $100 as the

closest hit. According to the International

Energy Agency, Source : https://tradingeconomics.com/commodity/crude-oil

You might also like

- FOCUS REPORT: U.S. Shale Gale under Threat from Oil Price PlungeFrom EverandFOCUS REPORT: U.S. Shale Gale under Threat from Oil Price PlungeRating: 2 out of 5 stars2/5 (1)

- The Upward Trend in Oil Prices: February 10, 2022Document1 pageThe Upward Trend in Oil Prices: February 10, 2022Kone YacouNo ratings yet

- Special Report On Crude OilDocument8 pagesSpecial Report On Crude OilDeepakNo ratings yet

- CommoditiesDocument5 pagesCommoditiesky.salasNo ratings yet

- Translation II - U7Document1 pageTranslation II - U7Sáng ĐinhNo ratings yet

- Correlation of Price Hike An Dollar CrisisDocument11 pagesCorrelation of Price Hike An Dollar CrisisSidratul MuntahaNo ratings yet

- IES April First Pricing Window ReviewDocument2 pagesIES April First Pricing Window ReviewJoseph Appiah-DolphyneNo ratings yet

- How Crude Become Negative!Document1 pageHow Crude Become Negative!Shaishav MistryNo ratings yet

- FGE - Weekly Oil Market and Refining Update - 1 November 2021Document21 pagesFGE - Weekly Oil Market and Refining Update - 1 November 2021Marlow Touch RugbyNo ratings yet

- BBG Commodity Market PDFDocument9 pagesBBG Commodity Market PDFsabljicaNo ratings yet

- Energy Monthly Report - JanuaryDocument5 pagesEnergy Monthly Report - JanuaryLi ZhangNo ratings yet

- 10-Cent Increase in Oil Prices Set Jan. 9Document2 pages10-Cent Increase in Oil Prices Set Jan. 9Ashley Nicole MahilumNo ratings yet

- FGE - Weekly Oil Market and Refining Update - 27 JuneDocument16 pagesFGE - Weekly Oil Market and Refining Update - 27 JunenoobcatcherNo ratings yet

- Oil / Black Gold / Texas TDocument3 pagesOil / Black Gold / Texas TArmin NurakNo ratings yet

- RodaineDocument2 pagesRodainejohnbertlacastesantosNo ratings yet

- OIES Oil Monthly Issue 26 - 12 July 2023Document5 pagesOIES Oil Monthly Issue 26 - 12 July 2023Baja TechinNo ratings yet

- Target Price: 100$/ BarellDocument1 pageTarget Price: 100$/ BarellNigelCabralNo ratings yet

- FGE - Weekly Oil Market and Refining Update - 04 JulyDocument17 pagesFGE - Weekly Oil Market and Refining Update - 04 JulynoobcatcherNo ratings yet

- O&G Price Forecast Q4 enDocument28 pagesO&G Price Forecast Q4 enCTV CalgaryNo ratings yet

- Ups and Downs of Oil Prices: Former Ambassador To UNDocument18 pagesUps and Downs of Oil Prices: Former Ambassador To UNmuki10No ratings yet

- Thi Van Anh Ha Macro-Writting 1673680 1366127580Document13 pagesThi Van Anh Ha Macro-Writting 1673680 1366127580Hà VânNo ratings yet

- Opec Business ReportDocument4 pagesOpec Business Reportapi-633570160No ratings yet

- Xclusiv Weekly 2022 07 18Document7 pagesXclusiv Weekly 2022 07 18Ekvazis TarsachNo ratings yet

- Why Are Gas Prices So High in 2022 Blame PutinDocument1 pageWhy Are Gas Prices So High in 2022 Blame PutinRachel TranNo ratings yet

- OPEC and Russia Aim To Raise Oil Prices With Supply Cut - The New York TimesDocument5 pagesOPEC and Russia Aim To Raise Oil Prices With Supply Cut - The New York TimesozzzzzNo ratings yet

- Oil Outlook 2021Document24 pagesOil Outlook 2021BlasNo ratings yet

- Slide in Oil Demand: Said in A Statement Last MonthDocument2 pagesSlide in Oil Demand: Said in A Statement Last MonthShantanu YadavNo ratings yet

- Deloitte Price Forecast Oil & Gas Mar 2022Document28 pagesDeloitte Price Forecast Oil & Gas Mar 2022rodrigo belloNo ratings yet

- The International Energy AgencyDocument2 pagesThe International Energy AgencyMarthin SiburianNo ratings yet

- Oil Prices Core GeorgetownDocument196 pagesOil Prices Core GeorgetownMichael LiNo ratings yet

- Energy Data Highlights: Natural Gas Ends 2011 at 27-Month LowDocument9 pagesEnergy Data Highlights: Natural Gas Ends 2011 at 27-Month LowchoiceenergyNo ratings yet

- 14DEC2022 OilMarketReportDocument74 pages14DEC2022 OilMarketReportCheng KellynNo ratings yet

- CMO-October-2022-Executive-Summary Pink SheetDocument6 pagesCMO-October-2022-Executive-Summary Pink SheetMbongeni ShongweNo ratings yet

- (备份)2022年政府工作报告(阿文)Document6 pages(备份)2022年政府工作报告(阿文)zhengyan wangNo ratings yet

- BNW - CNBC - Com-Oil Slumps 6 Snaps Seven Week Winning StreakDocument2 pagesBNW - CNBC - Com-Oil Slumps 6 Snaps Seven Week Winning Streak12CV2-11 Hoàng Gia HuyNo ratings yet

- NBKGCC& Egypt Outlook May 2022 EnglishDocument20 pagesNBKGCC& Egypt Outlook May 2022 EnglishFady AhmedNo ratings yet

- Oil Market Report (июнь 2023) IEADocument47 pagesOil Market Report (июнь 2023) IEAmaryli121212No ratings yet

- Report By: Mohit Goyal M SatyamDocument48 pagesReport By: Mohit Goyal M Satyamfaishal hafizhNo ratings yet

- Adding Fuel To The Fire: Cheap Oil During The PandemicDocument24 pagesAdding Fuel To The Fire: Cheap Oil During The Pandemicmichel mboueNo ratings yet

- What Awaits Crude Oil in Q4 of 2021Document9 pagesWhat Awaits Crude Oil in Q4 of 2021Barrister Ahmed WilliamsNo ratings yet

- Russia Ukraine Oil Market OutlookDocument20 pagesRussia Ukraine Oil Market OutlookArio Arief IswandhaniNo ratings yet

- Oil Prices: The Ups and The DownsDocument6 pagesOil Prices: The Ups and The DownsMeerim BakirovaNo ratings yet

- Weekly Energy Review For November 5, 2014: Banking On Cheap Oil Prices Not EasyDocument17 pagesWeekly Energy Review For November 5, 2014: Banking On Cheap Oil Prices Not Easyd_stepien43098No ratings yet

- Report 3 PDFDocument1 pageReport 3 PDFD Akhil ReddyNo ratings yet

- PM 031124Document9 pagesPM 031124phang.zhaoying.darrenNo ratings yet

- EIA Short Term Energy OutlookDocument53 pagesEIA Short Term Energy OutlookStephen LoiaconiNo ratings yet

- Short Term Energy Outlook JulyDocument57 pagesShort Term Energy Outlook JulyTim MooreNo ratings yet

- Oil Market Outlook 022013Document9 pagesOil Market Outlook 022013Venkatakrishnan IyerNo ratings yet

- Russias Invasion of Ukraine New Oil OrderDocument35 pagesRussias Invasion of Ukraine New Oil OrderAmrit IyerNo ratings yet

- Canadian Oil Out LookDocument10 pagesCanadian Oil Out LookbblianceNo ratings yet

- Historia Moderna de IsraelDocument19 pagesHistoria Moderna de IsraelManuel Moreno GarcíaNo ratings yet

- Energy Data Highlights: NYMEX January Gas Futures Contract Falls 2.6 Cents Midday TuesdayDocument9 pagesEnergy Data Highlights: NYMEX January Gas Futures Contract Falls 2.6 Cents Midday TuesdaychoiceenergyNo ratings yet

- Crude Oil CommentaryDocument5 pagesCrude Oil CommentaryMphatso ManyambaNo ratings yet

- EIA May Short-Term Energy OutlookDocument52 pagesEIA May Short-Term Energy OutlookTim MooreNo ratings yet

- POE AssignmentDocument10 pagesPOE Assignmentavani mishraNo ratings yet

- Because When The Price of Crude Oil Fell in 2014, The Land Rose SignificantlyDocument3 pagesBecause When The Price of Crude Oil Fell in 2014, The Land Rose SignificantlyJulianaNo ratings yet

- Current Oil Price SituationDocument7 pagesCurrent Oil Price SituationJamalNo ratings yet

- Short-Term Energy Outlook: Forecast HighlightsDocument55 pagesShort-Term Energy Outlook: Forecast HighlightsRaja Churchill DassNo ratings yet

- ABN Amro 2019 OilDocument5 pagesABN Amro 2019 OilK MNo ratings yet

- Economic of Oil and Gas CWKDocument14 pagesEconomic of Oil and Gas CWKMnawer HadidNo ratings yet

- CV Petroleum ENGINEER Modify ScholarshipDocument1 pageCV Petroleum ENGINEER Modify ScholarshipKone YacouNo ratings yet

- Document de Description de Sujet - Anglais KONE - YACOUDocument2 pagesDocument de Description de Sujet - Anglais KONE - YACOUKone YacouNo ratings yet

- Modèle DiapositiveDocument5 pagesModèle DiapositiveKone YacouNo ratings yet

- Nosa Omorodion Crawford University Convocation Lecture FinalDocument16 pagesNosa Omorodion Crawford University Convocation Lecture FinalKone YacouNo ratings yet

- Day 2 Report of The TrainingDocument1 pageDay 2 Report of The TrainingKone YacouNo ratings yet

- Raport 5 ARSTMDocument1 pageRaport 5 ARSTMKone YacouNo ratings yet

- Call For Master Students ProPlantR-01 - 2022Document3 pagesCall For Master Students ProPlantR-01 - 2022Kone YacouNo ratings yet

- Report On GulftideDocument1 pageReport On GulftideKone YacouNo ratings yet

- Day 4 ReportDocument1 pageDay 4 ReportKone YacouNo ratings yet

- Exercise: 1H30mm: Entry TestDocument1 pageExercise: 1H30mm: Entry TestKone YacouNo ratings yet

- Report M.ambroise 1Document6 pagesReport M.ambroise 1Kone YacouNo ratings yet

- SenseDocument1 pageSenseKone YacouNo ratings yet

- Raport 5 ARSTMDocument1 pageRaport 5 ARSTMKone YacouNo ratings yet

- Notes Project 1Document4 pagesNotes Project 1Kone YacouNo ratings yet

- Never Give Up, If There Is A Will, There Is A WayDocument1 pageNever Give Up, If There Is A Will, There Is A WayKone YacouNo ratings yet

- Gasoline Price Increases in Côte D' Ivoire: April. 04, 2022Document1 pageGasoline Price Increases in Côte D' Ivoire: April. 04, 2022Kone YacouNo ratings yet

- Job Announcement RA Agronomist - AB - BRDocument2 pagesJob Announcement RA Agronomist - AB - BRKone YacouNo ratings yet

- When I Was Still YoungDocument1 pageWhen I Was Still YoungKone YacouNo ratings yet

- Stay Focus On Your GoalDocument1 pageStay Focus On Your GoalKone YacouNo ratings yet

- Be Creative, Is The Most ImportantDocument1 pageBe Creative, Is The Most ImportantKone YacouNo ratings yet

- Stay Focus On Your GoalDocument1 pageStay Focus On Your GoalKone YacouNo ratings yet

- The Best Living Life Is Those Who Work HardDocument1 pageThe Best Living Life Is Those Who Work HardKone YacouNo ratings yet

- Mathematics Is The Mather of All SciencesDocument1 pageMathematics Is The Mather of All SciencesKone YacouNo ratings yet

- Parameters Well 3/9 A2 FIT15 Reservoir ParametersDocument3 pagesParameters Well 3/9 A2 FIT15 Reservoir ParametersKone YacouNo ratings yet

- I Do, What It's Going Straight in My HeartDocument1 pageI Do, What It's Going Straight in My HeartKone YacouNo ratings yet

- Be Lasy Man IsnDocument1 pageBe Lasy Man IsnKone YacouNo ratings yet

- Be Fluent in EnglishDocument1 pageBe Fluent in EnglishKone YacouNo ratings yet

- Education Education Is The Key of The WorldDocument1 pageEducation Education Is The Key of The WorldKone YacouNo ratings yet

- Sense Have A Good Sense in EverythingDocument1 pageSense Have A Good Sense in EverythingKone YacouNo ratings yet

- Applicable Retail Prices of MS, HSD & HOBC at Shell Pakistan Petrol PumpsDocument12 pagesApplicable Retail Prices of MS, HSD & HOBC at Shell Pakistan Petrol PumpsSalman AhmadNo ratings yet

- SVP and Helix Promo Site List ShellDocument3 pagesSVP and Helix Promo Site List Shellمحمد ابوبكرNo ratings yet

- Анализ предложенийDocument784 pagesАнализ предложенийМаксим ИльинNo ratings yet

- Summary April. 2016Document21 pagesSummary April. 2016JudeRamosNo ratings yet

- Argus Crude (2022-08-04) PDFDocument37 pagesArgus Crude (2022-08-04) PDFJaffar MazinNo ratings yet

- Position Limits NymexDocument162 pagesPosition Limits NymexBảo HuỳnhNo ratings yet

- Crude Oil Prices and Charts - Data From QuandlDocument4 pagesCrude Oil Prices and Charts - Data From QuandlPrakarn KorkiatNo ratings yet

- Argus Crude (2023-01-03) PDFDocument41 pagesArgus Crude (2023-01-03) PDFJaffar MazinNo ratings yet

- MS HSD Sep 2021Document205 pagesMS HSD Sep 2021Neha MadanNo ratings yet

- Atlantic 2021 CCN ResultsDocument74 pagesAtlantic 2021 CCN ResultsGina SolorzanoNo ratings yet

- 2015 Batch Natural Science Placement Result Final Feb 3, 2024Document13 pages2015 Batch Natural Science Placement Result Final Feb 3, 2024yohannisyohannis54No ratings yet

- Benchmark (Crude Oil)Document3 pagesBenchmark (Crude Oil)Anoj pahathkumburaNo ratings yet

- Platts History of Oil Infographic NoDocument1 pagePlatts History of Oil Infographic Nojohndo3No ratings yet

- Platts July 2011 Crude Oil Market Wire PDFDocument13 pagesPlatts July 2011 Crude Oil Market Wire PDFJun BordeosNo ratings yet

- Closprice Date - 21-03-2023Document1 pageClosprice Date - 21-03-2023sanjay sharmaNo ratings yet

- RODATA - ODISHA HP Petrol Pump OwnerDocument6 pagesRODATA - ODISHA HP Petrol Pump Ownerabhiman beheraNo ratings yet

- PLATTS Crude 20190809Document24 pagesPLATTS Crude 20190809Huixin dong100% (1)

- Case Analysis 2012 Fuel Hedging at JetBlDocument3 pagesCase Analysis 2012 Fuel Hedging at JetBlPritam Karmakar0% (1)

- Organization of The Petroleum Exporting Countries (Opec) & Opec+Document6 pagesOrganization of The Petroleum Exporting Countries (Opec) & Opec+Vikas KhichiNo ratings yet

- Com 20220906Document34 pagesCom 20220906杨舒No ratings yet

- CMOHistorical Data MonthlyDocument297 pagesCMOHistorical Data MonthlyAnish AnishNo ratings yet

- SUMMARYDocument1 pageSUMMARYLouise LaneNo ratings yet

- Production Lifestock Beef by ProvinsiDocument12 pagesProduction Lifestock Beef by ProvinsiIjonk NathanNo ratings yet

- Oil Price FallDocument1 pageOil Price FalldeepakNo ratings yet

- Crude Oil PricesDocument6 pagesCrude Oil Pricesshubhanjali kesharwaniNo ratings yet

- Chemistry OF Hydrocarbon: Topic Bench Mark CrudesDocument20 pagesChemistry OF Hydrocarbon: Topic Bench Mark CrudesHatif AlamNo ratings yet

- TFWP 2023q3 Pos enDocument1,654 pagesTFWP 2023q3 Pos enadelope075No ratings yet

- Uniform Requirement 2019Document36 pagesUniform Requirement 2019Asif KhanNo ratings yet

- CCDCDocument820 pagesCCDCUtkarsh SakhalkarNo ratings yet

- Applicable Retail Prices of MS, HSD at Shell Pakistan Petrol PumpsDocument17 pagesApplicable Retail Prices of MS, HSD at Shell Pakistan Petrol PumpsMushhood SiddiquiNo ratings yet