Professional Documents

Culture Documents

Marketing Value To Price-Sensitive Customers Durin

Uploaded by

Mahmood BarzanjyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Marketing Value To Price-Sensitive Customers Durin

Uploaded by

Mahmood BarzanjyCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/313033190

Marketing “Value” to Price-Sensitive Customers during the Tendering

Process

Article in Vikalpa · October 2013

DOI: 10.1177/0256090920130404

CITATIONS READS

3 201

3 authors, including:

Abhishek Kumar Singh D.V.R. Seshadri

Delhi Technological University 21 PUBLICATIONS 200 CITATIONS

74 PUBLICATIONS 298 CITATIONS

SEE PROFILE

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

Hafta Bazaar View project

All content following this page was uploaded by Abhishek Kumar Singh on 10 February 2021.

The user has requested enhancement of the downloaded file.

RESEARCH Marketing “Value” to Price-Sensitive

includes research articles that

focus on the analysis and

Customers during the Tendering Process

resolution of managerial and

academic issues based on

Abhishek Kumar Singh, Mandar Nayak, and D V R Seshadri

analytical and empirical or case

research

Executive Given the importance of tendering for procurement in B2B markets in India, this paper

explores how value may be showcased in tendering situations. It analyses the various

Summary

perceptions surrounding the tendering process and recommends possible mechanisms

to capture customer value from two perspectives – marketing techniques to be em-

ployed by suppliers to ensure commensurate and fair return for value delivered and

potential design changes in the price-discovery mechanism in tendering.

This paper discusses the tendering process from structural, supplier, and buyer per-

spectives. It explores mechanisms through which superior value delivered by the sup-

plier firm can be captured in the tendering process. For this, 26 supplier and customer

firm managers from 10 government and private organizations were interviewed to

understand the current practices for value capture in tendering. Several case studies

drawn from these discussions are presented to illustrate the ideas developed in the

paper.

The study finds that suppliers can extract returns for the value of their offerings in a

tendering situation by early engagement with buyers before the specifications are

frozen by leveraging relationships with the buyer organization and at pre-bid meet-

ings, and by exploiting opportunities provided through technical loading after the

KEY WORDS

specifications are decided. Additionally, it is suggested that the buyer organization

Procurement should leverage the opportunities inherently available to further improve price-dis-

Marketing Value covery via structural changes to the tendering process by using a tiered adjusted-price

bid mechanism.

Value Assessment

Framework

The alternate pricing method discussed in the paper could be used to aid the decision-

E-bidding

making process in tendering and enable a robust value capturing mechanism.

Open Tender

Limited Tender

Public Sector Undertakings

VIKALPA • VOLUME 38 • NO 4 • OCTOBER - DECEMBER 2013 49

I

n the Indian context, a significant proportion of pro- their products and services and are therefore unable to

curement by government, public sector as well as pri- meaningfully compete in many of the tendering situa-

vate companies is carried out through the tendering tions. Secondly, the firm that wins the contract is often

process. In most situations, especially those that involve unable to meet the contractual commitments with the price

significant monetary transactions, buyers are often man- being driven down to very low levels during the bidding

dated to follow the tendering process, either by their man- process (Holt, Olomolaiye, & Harris, 1995). Worse still,

agements or the funding agencies such as the World Bank such an environment has the potential to stifle innova-

and the Finance Departments. The procedures (General tion on the part of the supplier firm (Craig, 1999).

Financial Rules, 2005) followed by the government and

From the buyer firm’s perspective, tendering lowers the

Public Sector Undertakings (PSU) in India are as per the

cost of acquisition. Once the shortlisted suppliers adhere

policies and guidelines monitored by the Chief Vigilance

to the technical specifications of the tender, the buyer pits

Commission (CVC). A central government organization

multiple suppliers against one another, thereby achiev-

in India, CVC is entrusted with the task of assuring a fair,

ing steep reduction in the price (Amihud, 1976). The ten-

transparent, and equitable process during procurement.

dering process does not guarantee the best price to the

Consequently, most government agencies and public sec-

buyer firms from the selected supplier firm’s offerings.

tor corporations use tendering mechanisms, which re-

Thus, the buyer firms need to upgrade the tendering proc-

quire them to maintain a list of suppliers construed as

ess to assess the suitability of the process to capture value

being suitable. This list is periodically updated with new

elements offered by supplier firms through innovations,

suppliers, while the performance of existing suppliers is

better service, superior technical specifications, etc. Buy-

evaluated on various parameters on an on-going basis.

ers in some countries have made efforts to ensure that

The situation with regard to tendering in the private sec-

innovation by suppliers is effectively incorporated into

tor, while being different, has structural similarities to

the tendering process (Department of Enterprise, Trade

the tendering process of the government and PSUs.

and Employment, Ireland, 2009). However, they are si-

With a bulk of the procurement in B2B markets being car- lent on how supplier firms can incorporate other value

ried out through the tendering process, marketing value elements into the tendering process.

is a challenge faced by many suppliers, and an equally

formidable challenge faced by buyers who seek to cap- RESEARCH OBJECTIVES

ture value while resorting to tendering. Before proceed- The different players participating in the tendering proc-

ing further, it is useful to note that in business markets, ess have varying points of view about the tendering proc-

value is a cornerstone in decision-making by a buyer firm ess as it exists today. Practising managers of both buyer

to acquire products/services from supplier firms. Value and supplier firms have widespread concerns about the

in business markets can be defined as the difference be- suitability of the tendering process to capture value.

tween the benefits that a buyer firm gets by using a sup-

plier firm’s market offering less the costs other than price In business markets, developing a value model to arrive

that the buyer firm incurs over the lifetime of the market at appropriate pricing is a prudent method to communi-

offering (Anderson & Narus, 2006). Market offering is a cate customer value and subsequently to establish price

bundle of products, services, systems, and programmes (Anderson & Narus, 1998). The value framework expands

that a supplier firm offers to buyer firms for a price, to the scope of discussions with customers beyond price, to

fulfill a need of the buyer firm. Value is customer-defined, encompass customer problems and possible solutions.

opaque, contextual, multi-dimensional, relative, a trade- Though the value management system would arguably

off, and is a mindset (Sawhney, 2003). be an ideal methodology to follow, especially in large sales

(Rackham, 1988), in the tendering context, the value frame-

Suppliers generally believe that the tendering process work is largely seen by many suppliers as being irrelevant.

does not adequately appraise the competing (bidding)

suppliers’ market offerings. Also, the process wherein the A major concern of supplier firms is that the tendering

lowest price bid wins the contract has challenges for the process greatly reduces incentives to innovate (Craig,

supplier firms. Firstly, supplier firms with superior mar- 1999), by standardizing the customer’s requirements, es-

ket offerings are unable to showcase (market) the value of sentially placing all suppliers on an even keel. Suppliers

50 MARKETING “VALUE” TO PRICE-SENSITIVE CUSTOMERS DURING THE TENDERING PROCESS

participating in the tendering process usually concen- search on the subject. Various government rules and regu-

trate on meeting the minimum bid specifications at the lations regarding procurement and tendering were stud-

lowest price. Consequently, a supplier firm that partici- ied in the Indian context. A dialogue with the government

pates in tendering contracts is unlikely to encourage in- officers and practising managers was crucial to get a

novation, since it would seek to cater to the minimum closer understanding of the tendering process. In this re-

acceptable specifications sought by its buyers, and com- gard, a total of 26 supplier and customer firm managers

pete on price rather than value. Such a situation has det- were interviewed from 10 government and private organi-

rimental consequences on the supplier firm’s ability to zations to better understand the tendering process. Since

compete in other markets, where innovation is essential tendering often involves large monetary value, and ten-

to compete successfully. dering decisions are subject to extensive scrutiny well

after the contracts have been awarded, often the concerned

Published research work has focused mainly on the bid-

managers are not willing to share information and their

ding process (Ioannou & Leu, 1993) and has not discussed

insights into the process. The important criteria used for

the tendering process from a value sharing perspective.

selecting the sample of firms and managers was access to

Though several models (Ngai et al., 2002, Cui & Hastak,

and willingness of the managers to be a part of this re-

2006), frameworks (Tadelis & Uni, 2006); and alternate

search and openly share their perspectives. The primary

bidding systems (Liu, Lai, & Wang, 2001) have been pro-

mode of conducting interviews was a structured ques-

posed, the focus has been on the bidding process. Though

tionnaire which allowed the managers to reflect on their

Yang and Wang (2003) have discussed an alternative ten-

experience with tendering. Typically, each interview

dering method, which could be enhanced to incorporate

lasted for about two hours, although in some cases, the

value, marketing value through the tendering process is

authors met the managers multiple times. The views of

a topic that is very much under-researched. Most previ-

various interviewees were collated and analysed for their

ous research on tendering does not provide guidance to

content, to draw conclusions that are presented in this

either the supplier or the buyer firms on how to incorpo-

paper. The organizations covered in the interviews have

rate value into the decision-making process, a gap that

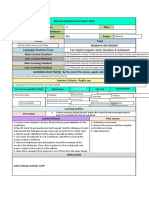

been mapped in a grid (See Figure 1).

this research seeks to fill.

Value-driven innovation is the key in the B2B market for TENDERING AS A PROCUREMENT PROCESS

suppliers to differentiate their market offerings vis-à-vis Tendering is a process of procuring goods and services

the next best alternative and gain strategic advantage (Organization for Economic Co-operation and Develop-

(Seshadri & Maital, 2007; Govindarajan & Trimble, 2005). ment, 2009). Procurement of services, raw materials, etc.

One of the objectives of this paper is to demonstrate that is paramount for the smooth functioning of a business.

tendering and delivering superior customer value through The tendering process is commonly employed for acquir-

innovation are compatible and can co-exist. The chal-

lenges faced by the supplier and buyer firms in terms of Figure 1: Research Participants

capturing value in a tendering process, need to be stud-

Private State-owned Enterprise

ied further and addressed. Through the study of responses

provided by practising managers, this paper provides a • Larsen & Toubro • Bharat Heavy Electrical

• Philips Limited

framework for communicating value in the tendering proc- • Bharat Earth Movers

• SKF

Buyer

ess and offers a practical approach to address challenges • Centre for Monitoring Limited

faced by buyers and suppliers to capture value in the Indian Economy

• Private Project

process. The paper discusses the various capabilities that Counsulting firm

supplier firms should develop to be able to market value

in a tendering situation. It also suggests a framework to • Philips • Department of

• Honeywell Commerce, Ministry of

include value from the buyer’s perspective in a tendering Finance

Supplier

process. • Indian Railways

• Bharat Heavy Electrical

Limited

RESEARCH METHODOLOGY • Bharat Earth Movers

Limited

This research was initiated by examining the extant re-

VIKALPA • VOLUME 38 • NO 4 • OCTOBER - DECEMBER 2013 51

ing raw materials, capital equipment, finished invento- provides greater flexibility of choice as compared to Sin-

ries, services as well as suppliers for execution of projects gle tender.

- that are required for the normal functioning of the busi-

Finally, buyers often use the Advertised/Open tendering

ness. The typical criteria for effective procurement are high

process which is commonly floated via newspapers and

quality, reasonable price, and timely delivery. Organiza-

other media. This requires the potential suppliers to meet

tions resort to one of the three purchasing orientations:

a qualifying requirement to submit their bid for the ten-

buying orientation which seeks to minimize price; pro-

der. There are two scenarios wherein Open tender is pre-

curement orientation that seeks to minimize total cost;

ferred, the first being a case where the buyer does not

and supply management orientation that seeks to maxi-

have a registered supplier for a given procurement, and

mize value from the buyer perspective (Anderson, Narus,

second, where global tenders are floated.

& Rossum, 2006).

The procurement process using tendering comprises Rate contracts are another variant of tendering used dur-

three phases, “(i) pre-tendering, including needs assess- ing procurement of bulk items over a period of time. They

ment, planning and budgeting, definition of requirements are used for procurement of low complexity offering. Rate

and choice of procedures; (ii) tendering, including the contracts involve floating a tender to limited number of

invitation to tender, evaluation and award; and (iii) post- suppliers. In most cases, the contract is awarded to mul-

tendering, including contract management, order and tiple suppliers at the price of the L1 bid - the largest share

payment” (OECD, 2009). being given to the supplier with the original L1 quote. For

instance, a limited tender is floated for the procurement

The Tendering Process of commodity X to supplier A, B, and C. Supplier A quotes

the L1 price, followed by supplier B who quotes L2, and

For practical purposes, tendering can be divided into iden-

supplier C who quotes L3. Hence supplier A, who quoted

tifying potential supplier; evaluation of the offering; price

L1 is given a contract for supplying 60 percent of the com-

discovery and the accompanying bidding mechanism

modity X, while suppliers B and C are given contracts for

often used for this purpose.

25 percent and 15 percent of the total quantity of Com-

modity X if they agree to match the L1 price of supplier A

Identifying Potential Supplier

(General Financial Rules, 2005).

The potential set of suppliers invited for tendering varies

as a function of complexity of the offering, the prevailing Evaluation

competitive environment, the available time to complete

The bidding process requires the evaluation of the tech-

procurement, and the existing culture at the buyer organi-

nical feasibility of a submitted bid. The buyer evaluates

zation. The three most commonly used methods are: Sin-

the offering of the respective suppliers to identify the ones

gle tender, Limited tender, and Advertised/Open tender

that meet the minimum needs of the buyer – which is also

(General Financial Rules, 2005).

published when the tender is floated – and considered

Single tender is a method wherein a single supplier is for price opening. Additionally, the commercial terms are

asked to submit a quote. There are three circumstances reviewed to understand the compliance of the supplier to

under which a buyer resorts to this mode, the first being a buyers’ commercial procedures.

proprietary technology which necessitates going to a sin-

gle supplier, the second being a case where a specific Price Discovery

supplier is picked by the buyers, and finally, when there The bidding process helps to fine-tune the right buying

is only one supplier which replies to a quote (General price. Price discovery is one of the most important ele-

Financial Rules, 2005). ments in a tendering process and much research related

to tendering has consequently focused on the bidding

In Limited tendering, a core group of registered supplier

process. In this sense, bidding becomes a subset of the

members, usually more than three, are asked to submit

tendering process.

their bids for a tender. Limited tendering appears to be a

preferred choice with most buyers. This process helps In case of Limited tender and Open tender, the contract is

reduce the cost as compared to an Open tender and also awarded to the L1 bid. The conventional process of iden-

52 MARKETING “VALUE” TO PRICE-SENSITIVE CUSTOMERS DURING THE TENDERING PROCESS

tifying L1 supplier by opening the price bid along with Figure 2: Latitude Available for Each Buyer/Supplier

the technical bid has been replaced by contemporary proc- Combination

esses like e-bidding and reverse auction which enable

Enterprise

A D

owned

suppliers to compete on prices against other suppliers in

State-

Low High

a dynamic manner. The most recent improvements in Flexibiliy Flexibility

Buyer

price discovery has been the concept of adjusted price bid

– the quoted price of the supplier is loaded with the addi- B C

Private

Sector

Medium - Medium

tional value their offering provides vis-à-vis the compet- High Flexibility Flexibility

ing supplier – used to capture value of an offering into

price. Private State-owned

Sector Enterprise

In cases of Single tender, L1 is the lone supplier who is Supplier

asked to submit the quote. The price discovery is done by

either using cost plus methodology or by negotiating the

Consequently, the approach that the supplier is inclined

mutually agreed upon price between the buyer and sup-

to take is transactional in nature.

plier by using historical data in many cases.

Quadrant B: Supplier-Private and Buyer-Private: It is

Tendering as a Value-based Procurement Process tempting to conclude that the degree of flexibility in these

With regard to the tendering process, the typical mindset cases should be medium to high. In the context of tender-

of both the buyer and the supplier firms is that once the ing, however, even in this situation, the buyer would tend

buyer firm shortlists the eligible suppliers, the process is to maximize its returns at the cost of the suppliers by

limited to selecting the lowest priced supplier, and hence forcing aggressive competitive pricing between suppli-

the widespread belief among practitioners, corroborated ers.

by the authors’ discussions with them, is that the tender- Quadrant C: Supplier-State-owned Enterprise and Buyer-

ing process is very rigid, with no scope for deviating from private: Although a private buyer would be expected to

this ‘lowest price’ norm (often referred to as the ‘L1’ basis manifest profit maximization behaviour and hence be

for supplier selection) (CVC, 2007). This paper proposes aggressive in the tendering situation, in reality, however,

that such rigidity is not necessary and there are sufficient the private buyer dealing with a state-owned enterprise

avenues for the buyer firm to choose a supplier who has as supplier would typically be flexible in order to associ-

not necessarily quoted the lowest price, by factoring in ate itself with state-owned enterprises to help enhance its

the value provided by each supplier. Such latitude avail- reputation, and leverage this connection in other contexts.

able to the buyer is referred to as ‘flexibility’. This flexibil-

ity is analysed in four different scenarios, involving the Quadrant D: Supplier-State-owned Enterprise and Buyer-

buyer and supplier firms being either a state-owned en- State-owned Enterprise: The degree of flexibility would

terprise (SOE) or a private sector firm. be the highest and value is best shared in an equitable

manner. These cases also result in more innovation in the

The identities of the prospective supplier and buyer firms procurement process.

(whether each of them is a government department/state-

owned enterprise or a private company) determine the The interviews reveal that the low flexibility in the ten-

extent of flexibility (as defined above) available in the dering process as perceived by both supplier and buyer

tendering process. The resultant four combinations with firm managers results in value drains for both. The gen-

varying degrees of flexibility are shown in Figure 2. It eral perception among government/SOE buyers is that

reflects the assessment of managers interviewed with re- the stringent stipulations of the government do not en-

gard to the degree of flexibility in each of the four result- courage creating conditions that allow for flexibility.

ing buyer-supplier situations. However, the authors have come across several cases

where suppliers to government/SOE have succeeded in

Quadrant A: Supplier-Private and Buyer-State-owned innovatively communicating value. Understanding of

enterprise: The resulting system manifests low flexibility. such cases is presented later in the paper.

VIKALPA • VOLUME 38 • NO 4 • OCTOBER - DECEMBER 2013 53

Supplier Perspective - Existing Tendering Process ples and cases derived from actual situations, it discusses

In the previous sections, the tendering process has been the methods that the suppliers can deploy and capabili-

presented to understand the different forms of tendering ties that they can demonstrate to buyers to effectively com-

practised. This section examines the tendering process in municate value.

more detail to identify and explore the value communica- Figure 3 provides the various stages of the tendering proc-

tion opportunities available to suppliers. Using exam- ess in schematic form. It maps the key DMU members of

Figure 3: Tendering Process

○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○

○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○

Process Steps Primary DMU Member Available Value Vehicles

START • Procurement • Pre-Notice Inviting

Material Procurement Process – Department Tender (NIT) Meeting

Starting from the indent • Engineering/Product

Development

Department

Pre-NIT Meeting, asking the

vendors for their inputs on

technical specification

Deciding on Technical • Execution Team • Consultative

Specification/Preparing the tender, Committee Meeting

enquiry document, a.k.a. RFP

Deciding on type of tendering

process (e.g. public or limited tender)

Dispatching the tender and • Procurement • Pre-Bid Meetings

doing the publicity Department • Congenial

Commercial and

Technical

Pre-bid meeting for Specifications

vendor clarifications

Tender Opening - e.g. Two-bid system • Finance Department

• Procurement

Department

Meet Stop

No

Technical Spec Supplier

eliminated

Yes

Terms of Stop

No

Commercial Contract Supplier

eliminated

Yes

Stop • Finance Department • Alternative Bidding

Price (L1/or L1 No • User Department Processes

Supplier

via adjusted Price • Procurement

eliminated

Department

Yes

STOP

Supplier Chosen

54 MARKETING “VALUE” TO PRICE-SENSITIVE CUSTOMERS DURING THE TENDERING PROCESS

the buyer firm who play crucial roles in each of the stages. meeting held with all the suppliers simultaneously be-

The Figure also suggests mechanisms available to the fore NIT is called the ‘Pre-NIT’ meeting. After the inter-

supplier to communicate value at each of the tendering ested suppliers respond to the tender, the buyer commen-

stages. These ideas are elaborated further in this section. ces evaluation, which has two sub-stages: technical evalu-

The various steps and activities as shown in the boxes ation and commercial evaluation. Individual DMU mem-

and the rationale for the arrows in Figure 3 have been bers attach varying degrees of importance to each of these

identified based on the insights gained from interactions stages as Table 1 shows.

with the managers of buyer and supplier firms and an

understanding of the tendering process broadly outlined A FRAMEWORK FOR MARKETING VALUE

under the General Financial Rules, 2005 of the Depart- To understand the communication avenues available

ment of Expenditure, Ministry of Finance, Government of within the tendering process, the departments of the sup-

India. plier and the buyer at different stages of the tendering

process were mapped. To illustrate, there are three possi-

DMU’s in the Tendering Process ble participants in the system:

Individual members of the buyer’s decision-making unit

a) A private firm, which is a supplier to either state-

(DMU) have differing needs and/or differing relative

owned enterprises or the Government of India depart-

importance of the same needs (Moriarty & Bateson, 1982),

which can be mapped to the various stages of the tender- ments (GoI);

ing cycle. The value communication process must take b) State-owned enterprise (SoE) that is either a buyer to

this into account. This is best done by influencing deci- private suppliers or a supplier to government depart-

sion makers at the appropriate stages of the procurement ments;

process. c) The various government departments as buyers.

These ideas are illustrated through a simple example, The conclusions relevant for private firm as supplier and

where the DMU has four members, viz., user, influencer, SoE as buyer are also applicable in a scenario where the

purchaser, and decider. Table 1 provides the relative im- government department is a buyer. Hence for simplicity,

portance of different stages in the tendering process with only two scenarios — private firm as supplier and SoE as

respect to the different DMU members. The rows in the buyer and SoE as supplier and government department

matrix (Table 1) illustrate typical stages in the tendering as buyer — are examined. Likewise, the scenario where

process. Here three significant stages have been listed for private firm is a buyer has not been presented as the level

illustration. They are also the major avenues available to of flexibility in such a scenario is much higher.

the supplier to communicate value.

Based on the research, the departments of the supplier

In the consultative committee meeting(s), which is held and buyer involved in the value communication process

before freezing the specifications and before the tender is under two different scenarios are presented in Figure 4.

evolved, the buyer invites all suppliers simultaneously to In the Figure, the various departments as shown in the

discuss the offering and its features. This is a free-format boxes and the rationale for the arrows shown therein are

meeting. The formal kick-off of the tendering process starts identified based on the insights gained from our interac-

with the Notice Inviting Tenders (NIT), wherein suppli- tions with the managers of buyer and supplier firms. The

ers are invited to collect the tender documents from desig- arrows indicate the suggested communication avenues.

nated locations during a specified time-window. The

Table 1: Relative Importance of Different Stages in the Tendering Process by Different DMU Members

Degree of Importance User Influencer Purchaser Decider

Consultative Committee Meetings Medium High Low NA

Pre-NIT Meeting NA Medium Medium Low

Technical Evaluation High Low High Medium

VIKALPA • VOLUME 38 • NO 4 • OCTOBER - DECEMBER 2013 55

Figure 4: Avenues for Value Selling in the Tendering Context

Private Supplier Buyer SoE Supplier SoE Buyer GoI

Finance Consultative

Marketing Committee

Pre-NIT Meetings

Services

Meetings

Team Finance Civil

Procurement Accounts

Department

Procurement Alternate

to Bidding

Marketing Procedures

Pre-Sales Services

Activities Marketing

Team

Services

Team

User

New Product Department

Development (Railways/

Team Electrcity

Engineering/ Board, etc.)

Inputs towards

Product

Specifications Pre-Sales

Dev. Team

Tendering/ Activities

Quantity Engineering/

Survey/ New Product

Product

Adjusted Specification Development

Development

Price Bids Wing Team

Team

Scenario 1 Scenario 2

To illustrate, in Scenario 1, Similarly, in Scenario 2, where the supplier is a SoE and

the buyer is the Government of India, consultative com-

• Pre-sales activities are avenues through which the sup-

mittee meetings are viable avenues which can be used to

pliers’ marketing services team can discuss with the

communicate value by using methods such as Negoti-

buyer’s marketing services department and under-

ated Contract and Maintenance & Annual Repair Con-

stand buyer requirements and specifications well in

tract (MARC).

advance.

• Pre-NIT meetings are viable avenues where the suppli-

Marketing Value in the Present Tendering Process

er’s marketing services team can meet with the buy-

er’s procurement department and the finance depart- The tendering process is a means through which the buyer

ment to communicate the value of their offerings and essentially seeks to ensure predictability and mitigate risk.

thus gain advantage over other suppliers. The interviews revealed that this is one of the big motiva-

• Inputs towards specifications - The supplier’s engineer- tions of a buyer firm resorting to the tendering process.

ing department along with the marketing services de- The structured format of the tendering process enhances

partment can actively engage with the buyer’s engi- predictability from the buyer’s perspective. Details of the

neering team and the tendering QSS (Quantity Survey procurement process and specifications for deliverables

and Specifications) to work out the specifications and from the contract that the buyer firm expects are clearly

features to be included in the tender document. defined and standardized in the tender documents

• Additionally, Adjusted Price Bids (discussed later in through formats, time schedules, measurement norms and

the paper) are also alternative channels through which metrics, dimensions, quality standards, etc. The tender-

value can be communicated and captured in a tender- ing process, in effect, is a process by which sources of

ing process. uncertainty associated with the project are envisaged in

56 MARKETING “VALUE” TO PRICE-SENSITIVE CUSTOMERS DURING THE TENDERING PROCESS

advance of the award of the tender. The tendering proc- Mapping Supplier Pre-sales Activities with the Buying

ess thus helps to envisage risks and address them. Process

Essentially, the sales cycle followed by the suppliers con-

Further, the bidding documents, prepared after detailed

sists of the lead generation stage, followed by identifica-

discussions between the buyer and the supplier through

tion of the prospect firm, submission of the proposal, and

consultative committee meeting(s), Pre-NIT meetings, etc.,

finally obtaining the order. In the tendering scenario, the

serve as a documented platform for the basis of shared

sales cycle would consist of an extra stage called cus-

value transfer between the supplier and the buyer. The

tomer tendering phase which gets interspersed between

tendering process thus needs to be seen as a structured

the proposal and sales closure phases as shown in Fig-

mechanism which enables the buyer to appraise the value

ure 5. This Figure, which represents the steps involved in

provided by the supplier. For the supplier, the tendering

procurement from a supplier firm’s perspective, is based

process is an opportunity to communicate its value offer-

on our adaptation of the ‘Buyer’s Procurement Cycle’ de-

ing to the buyer within the structured approach followed

veloped by Neil Rackham (1989). A typical supplier firm

in the process.

bidding in a competitive tendering situation directs the

Finally, the tendering process allows for learnings from selling efforts during the proposal and customer tender-

past projects to be incorporated - through tighter proce- ing phase. However, based on this research, the authors

dures and more stringent specifications. However, de- believe that this is too late a stage for the supplier to un-

spite the perceived rigidity of the process, there are still dertake active selling, since by this time the buyer has

mechanisms through which value can be communicated essentially concluded on the value elements of the offer-

by suppliers. Suppliers need to adopt innovative ap- ing being procured that are most important to the buyer

proaches which facilitate educating the buyer on the value firm.

being delivered. However, success in this regard is con-

tingent on the supplier having built sound relationships Figure 5: Sales Cycle from Supplier Firm’s Perspective

with the buyer firm over a period of time, prior to com- in the Context of Tendering

mencement of the tendering process.

Zone of Influence

A good approach is to understand the buyer needs - and

the rationale behind these needs - prior to the prepara-

tion of the price offer. Understanding of the buyer needs

well in advance can then be effectively used to construct

Lead Generation/

the offering. During the tendering process, there are dis- Prospect Identification

crete stages (Figure 3), which the supplier can use to com-

municate and promote the value elements in their

offerings. The suppliers can either utilize existing forums

Order

to communicate value or proactively use some of the steps Fulfilment Proposal

embedded in the tendering process to create such forums. Submission/

Customer

Tendering

Supplier Capabilities to Address the Buyer

Priorities

Instances where the suppliers could differentiate them-

selves prior to the tender include communicating value Obtaining

during pre-bid meetings and during the consultative the Order

Negotiations

meetings where applicable. Here, attempts to gather cus-

tomer intelligence well in advance of the imminent bid

would help understand the buyer needs better. Such mar-

keting measures would also serve to incorporate relevant

(Adapted from ‘Buyer’s Procurement Cycle developed by Rackham

value elements in the offerings. (1989))

VIKALPA • VOLUME 38 • NO 4 • OCTOBER - DECEMBER 2013 57

For an early and effective communication of the value In the following, three cases are presented, respectively

proposition by supplier firm, it would be prudent to initi- depicting effective value communication, consultative

ate the sales activity earlier in the procurement life cycle. selling, and relationship building in different tendering

In the context of tendering, suppliers need to demonstrate situations. These are presented to show instances where

the value of their offerings during the need identification suppliers could overcome the perceived constraints in

phase of the buyer. This essentially translates into the the tendering process.

lead or prospect stage of the supplier’s sales cycle – re-

ferred to in Figure 5 as the “Zone of Influence”. It is im- Effective Value Communication

portant that the supplier firm maps its selling cycle to Suppliers need to effectively communicate the value of

closely track the buyer’s cycle. In Table 2, a one-to-one their offering to help create the perception of the differen-

mapping of the buyer’s cycle and the corresponding stages tial value of their offering vis-à-vis the next best alterna-

in the supplier’s sales cycle is presented. tive. One approach here involves doing a thorough ana-

lysis of the requirements of the buyer and tailoring their

Table 2: Buyer’s Procurement and Supplier’s Sales Cycle

offering to meet their needs (Cova, Ghauri, & Salle, 2002).

Stages in Buyer’s Cycle Corresponding Stages in Negotiated tender is a prime example of understanding

Supplier’s Sales Cycle the buyer’s need, tailoring the offering to maximize cus-

Recognition of needs Lead generation stage tomer value, and leveraging relationship with the buyer

Identifying the prospect firm to effectively communicate value elements leading to a

Evaluation of options Submitting the proposal contract win even without going through the tendering

Customer tendering stage process.

Resolution of concerns Negotiations

Decision Obtaining the order (Closure)

Implementation Order fulfillment Case 1: Negotiated Tender

Changes over time Recycles back to lead generation

In 2001, a State government agency in India was planning

to set up seven-grid interactive power plants to meet the

During the lead generation stage, suppliers need to iden-

increasing need of power fuelled by the burgeoning economic

tify the influencers in the procurement process and sub-

growth of the state. Two-thirds of the subsidy for the project

sequently communicate value to the respective decision-

was given by the Government of India and one-third by the

makers. At this stage, the supplier’s communication helps

state government. The contract involved the commissioning

the buyer understand the value that the new features/

of seven-grid interactive solar power plants - 100KW solar

functionalities provide. This presents an opportunity for

photovoltaic each - at a total cost of about ` 21 crore. The

the supplier’s value elements to become a part of the speci-

project was to be decided on a tendering basis with the L1

fications. Likewise, in every other phase of the buyer’s

player being awarded the contract.

cycle, it is important for the supplier firm to identify the

appropriate decision-makers and address their needs Solar power is a viable non-conventional renewable energy

through appropriate communication. source. The primary issue with these power plants is the

expensive service and maintenance required by them. Con-

Methods to achieve this could include tapping into buyer

sequently, the tender included a service and maintenance

requirements during earlier contract periods and infor-

clause for a minimum period of five years after the commis-

mal meetings with member of the DMU - to realize and

sioning of the power plants. The maintenance specifications

communicate order winners. Further, understanding the

in the tender were very stringent and few suppliers were

nature and dynamics of the buyer’s cycle is crucial for

interested in bidding for the project.

developing a winning proposal. A value management

system based on the above approach, wherein tangible However, one supplier did a comprehensive site survey to

value elements are identified for incorporating into the study the requirements of the project. The supplier came up

supplier’s offering, would result in the maximization of with a detailed project proposal and demonstrated the value

fit between buyer’s needs and supplier’s offering in a ten- proposition of his offering to the buyer. It was the only firm

dering situation. ready to adhere to the stringent maintenance clause of the

58 MARKETING “VALUE” TO PRICE-SENSITIVE CUSTOMERS DURING THE TENDERING PROCESS

tender. The supplier was able to communicate clear under- process of tender preparation and the value-based analy-

standing of the buyer’s needs and engage in a dialogue with sis would be useful to the buyer during the tender evalu-

key decision-makers at appropriate times. ation stage.

The supplier won the contract by negotiating with the state

Case 2: Consultative Meetings

electricity board, obviating the tendering process which was

initially decided upon. A state-owned enterprise wanted to decide on the technical

specs and commercial contract for the forthcoming financial

year. Instead of the normal practice of doing this in an iso-

The negotiated tender demonstrates that the purchasing

lated manner, it called for a meeting with the relevant sup-

orientation of state-owned enterprises need not necessar-

pliers to decide on the specifications. The meeting was a

ily be a buying orientation, i.e. transactional in nature.

success and it enabled the suppliers to showcase the value-

Buyers in tendering situations are often receptive to the

adding elements of their products. The buyer then incorpo-

value elements being marketed by a supplier firm, as long

rated the elements in its specification as well.

as it is done through the right channel and in a fair and

transparent manner. The practice followed in the above case was taken a step

further and the meeting process was subsequently made a

Clearly, the marketing initiatives undertaken have to be

part of the pre-procurement process.

in-line with the nature of product or service being offered.

Keeping in mind that value needs to be established and In the past, the communication gap between the buyer and

promoted effectively, creating resonating value proposi- the supplier often led to different perceptions of value by the

tions for market offerings in a tendering situation could two parties. There was a felt need to establish a forum where

be quite challenging (Anderson et al., 2006). Most value government officials, policy-making decision departments

elements become equalizers in the tendering processes and suppliers came together and understood the procure-

and are quickly incorporated into the tender specifica- ment parameters.

tions. Unless a unique value element is convincingly dem-

onstrated, there is very little chance for the value element Consultative committee meetings, as they subsequently came

to get across as a decisive influencing factor in the award to be known as, thus evolved out of the above deliberations

of the contract. On the other hand, cleverly differentiated and are gaining popularity to kick-start the tendering proc-

value elements have a very high probability of being rec- ess.

ognized as essential value elements and are influential

in bagging large order contracts. Most policy changes made by the government (as buyer)

have to be in line with the transparency and parity guide-

Marketing during Pre-NIT Proceeding – Consultative lines, and the above reform process is a good example of

Meeting to Consultative Selling

the value sensitivity of the government. The government

Pre-NIT proceedings organized by the buyer prior to pre- is willing to incorporate value elements that are relevant

bid meetings serve as critical forums to discuss differenti- and marketed appropriately without jeopardizing proc-

ating value elements. At this stage, the tender specifica- esses that ensure transparency and fairness. Though the

tions and the commercial terms and conditions are in a tender is awarded to the L1 Bid, the mechanism of ‘con-

fluid state. Suppliers, therefore, have the opportunity to sultative committee meeting’ enables a consultative sell-

discuss the parameters of their offerings. A value-based ing approach (Hanan, 2003), provides an opportunity to

analysis, communicated on the basis of benefits and costs suppliers to communicate value elements of their offer-

accrued by the buyer, would serve to differentiate the sup- ings, and builds solutions around customer requirements

plier’s offering with respect to the competition. (Cova et al., 2002).

Such an approach is taken favourably by the buyer since In recent times, there has been a paradigm shift in the

the extent of rigidity experienced by the buyer is low at procurement processes employed by some SoE’s from the

this stage. Market-informed buyers would be more than transactional selling paradigm constraining new ideas,

glad to accept the analysis of the offering as it aids in the to a more open environment which is conducive to inno-

VIKALPA • VOLUME 38 • NO 4 • OCTOBER - DECEMBER 2013 59

vation. This is facilitated by mechanisms such as con- integral part of business marketing (Cannon & Perreault,

sultative committee meetings. 1999). Suppliers can leverage the relationship built on

trust and execution excellence to influence the specifica-

Inputs towards Specifications – Building Relationships tions of subsequent tenders and win contracts.

Suppliers need to make marketing efforts to influence

buyer requirements early (Cova & Hoskins, 1997). This Value Communication in the Tendering Process

research reveals that suppliers with most of their specifi- It is observed that in some cases, value communication

cations included in the tender stand a better chance to forums do exist whereas in others, the well-informed

win the contract. In this context, thorough investigation supplier has to resort to innovative marketing skills as

of buyer’s needs by the suppliers can help in evolution of discussed above. We could see that the myths and the

tender specifications thereby enabling customization of common perceptions held by practising managers about

offerings before the release of the tender. In some cases, a tendering being antagonistic to value are not tenable.

long-term relationship between the buyer and the sup-

plier has the potential to avoid the competitive bidding Innovation has a place in the tendering process through

process completely (Lamming & Cox, 1995). two mechanisms:

• Explicit mechanism which adjusts the price bid and

Case 3: Maintenance & Annual Repair normalize the price vis-à-vis the offerings across the

Contract (MARC) board for all suppliers.

• The mechanism of technical loading which allows bet-

A price-sensitive SoE floated a tender for procuring office ter features to get the required importance.

automation equipment. The contract included supplying

office equipment, computers, printers, scanners, and provid- Through either of these mechanisms, suppliers are able

ing service, maintenance, and support to the users. The con- to get commensurate returns for the additional value pro-

tract was awarded to a well-reputed Indian firm. vided by them. The key for the supplier firm is to timely

communicate the value of the superior features of its of-

Over the subsequent period, the contract fulfillment exceeded fering to the buyer.

the buyer’s expectations. At the time of contract renewal, the

There are several opportunities for the supplier to influ-

existing supplier’s inputs on the features were considered

ence the buyer during the various phases of the product

by the buyer and incorporated in the specifications of the

life cycle and/or procurement cycle, by demonstrating

subsequent tender.

the efficacy of the various functionalities of its offering.

Though the tendering process was followed for contract re- Additionally, there is opportunity, for existing suppliers,

newal, it was won by the existing supplier. The existing to influence the buyer through relationship building, and

supplier could achieve this through pre-tender marketing for new suppliers, to demonstrate value through proactive

and the relationship built with the buyer during the execu- marketing by influencing the requirements (Cova &

tion of the contract. Hoskins, 1997).

Negotiated tender and the Maintenance and Annual Re-

An effective phase for the supplier to market value ele- pair Contract (MARC) suggest that there are available

ments is the pre-tendering stage. The general myth is that forums for show-casing supplier value, although they

marketing in the pre-tendering phase can be done via require perseverance and insightfulness on the part of

exhibitions and seminars. However, a better approach is the supplier firm’s sales team. Relationship Marketing

to engage in alternative pre-tender marketing activity fa- and Consultative Selling demonstrate that suppliers need

cilitated by the relationship built with the buyer during a to make efforts to understand the requirements of the L1

previous episode of delivering other market offerings to centric buyers, in-order to be able to leverage the superior

the buyer. From this perspective, it may be useful for the value delivered by them. Such an understanding would

supplier to adopt a ‘foot-in-the-door’ approach rather than help suppliers to create, establish, and market their value

an ‘all-at-once’ strategy for entry into the buyer organiza- propositions, even in tendering situations. The value-

tion (Das, 2002). Buyer and supplier relationship is an based approach as discussed above and demonstrated

60 MARKETING “VALUE” TO PRICE-SENSITIVE CUSTOMERS DURING THE TENDERING PROCESS

through the examples provide adequate handles to sup- valuable, which may not be the case for the operator of

plier firms to communicate value. corporate jets or defence aircraft. However, all these

aircrafts are typically procured through tendering. Addi-

This paper has discussed the various avenues through tionally, sub-assemblies that go into manufacturing of

which a supplier firm can gain competitive advantage these aircrafts are also sourced through tendering. From

over its competitors in a tendering situation. This pre- a buyer’s perspective, in a tendering situation, it is im-

supposes that the supplier firm has several unique value portant to have adequate handles that factor these differ-

elements embedded in its offering. The traditional ten- ences. This could be done by assigning weights to value

dering process focuses almost exclusively on minimiz- elements while building the tailored value model in the

ing the cost of acquisition of the offering. From this procurement process for tendering situations. While

perspective, even if a supplier firm convinces the buyer to weighting is now new, the advocacy of weighting value

incorporate its value elements in the tendering specifica- elements through the novel framework is primarily ori-

tion, the buyer who is focused only on the acquisition ented towards helping the buyer in the price discovery

cost will nevertheless award the contract ultimately based process.

on L1. It is therefore necessary to develop a framework by

which important value elements from a buyer’s perspec- Traditionally, an important factor that has stood in the

tive are incorporated in determining the L1 price. way of using weights is that it is amenable to manipula-

tion by vested interests to tilt decisions in favour of one

VALUE-BASED TENDERING PROCESS supplier over another. Hence, an important prerequisite

Value models have been deployed increasingly by sup- in assigning weights is to ensure fairness and transpar-

pliers to showcase the monetized value of their market ency. One way of doing this would be to have a procure-

ment committee which decides the weights assigned to

offerings for a given segment of customers (Anderson &

Narus, 1995). This concept is extended here in the con- individual value elements in advance of the tendering

text of tendering situations to provide a robust framework process. In a related practice followed in Taiwan (Yang &

for value assessment by the buyers. To showcase the util- Wang, 2003), a procurement committee helps to openly

ity of this method, a situation wherein this method was discuss the weights associated with each value element

successfully used is also presented. as relevant to the procurement process at hand.

For being an effective tool for selling in B2B, customer Most existing literature on tendering suggests statistical

value must be translated into monetary value from a cus- measures to analyse or model the tendering process. One

tomer’s perspective (Sawhney, 2003). Once the monetary such approach (Cui & Hastak, 2006) discusses the ten-

value of each element is determined, traditional value dering process from a historical perspective, taking into

models tend to aggregate into a single monetary measure account past events to understand the process. They sug-

which is expected to be a proxy for the value of the sup- gest and advocate awarding the contract on the basis of

plier’s market offering. probabilistic approach. However, this does not provide a

tool for easy deployment by the buyer organization. This

However, in a tendering situation, this is likely to present approach is also silent on monetary value obtained by

significant limitations, as innovations by supplier firms the buyer organization. A second approach widely dis-

that are important to the buyer are unlikely to get ad- cussed in literature (Ioannou & Leu, 1993) advocates as-

equate attention. For instance, the operator of a commer- signing weights to value elements of the supplier’s

cial airline would be very concerned about fuel costs offering along with the bid price in the tendering process.

which typically account for 30-40 percent of the operat- The problem with such a one-dimensional approach in

ing expenses. For an operator of jets for corporate leaders, assigning weights is that it puts all value elements into

fuel costs may not be as important as factors such as power, one bucket and forces the buying organization to assign

climb-rate, speed, distance, luxury, comfort, aesthetics, weights to these diverse elements within this single bucket.

etc. A similar situation would prevail for procurement of

defence aircraft where the factors like stealth and accel- This research suggests that buyers are more comfortable

eration may be of higher value. Thus, any innovation in if they can evaluate suppliers using a structured approach

fuel efficiency for a commercial airline operator would be which allows them to disaggregate the various value ele-

VIKALPA • VOLUME 38 • NO 4 • OCTOBER - DECEMBER 2013 61

ments to any desired level of granularity and prioritize erational cost, and maintenance cost, and they are given

them as per their requirement, rather than having to evalu- weights, termed as “Percentage Assessment Values”

ate an amorphous and disjointed set of value elements. It (PAV). The total PAV should add up to 100 points. Al-

is in this context that the paper presents a two-tiered ap- though in the following illustrative example, the value

proach which the buyers can use to evaluate the suppli- elements in each of these value categories are presented,

ers. the actual composition of elements that go into each cat-

egory is very specific to each context.

At a gross level, diverse value element categories are put

into different buckets with tier1 weights assigned to each Four key scorecards are required for the illustrative two-

of the categories. Within each bucket, weights are assigned tiered approach. The first scorecard, Adjusted Bid Price

to different value elements depending on their relative Table, captures the PAV for a given procurement. The

importance to the buyer organization. This results in the other three scorecards, to be used to assess the market

second tier of weighting. The process of making tiers can offering under the respective value categories, are Acqui-

go on until the buyer is convinced that the weighting has sition, Operational, and Maintenance Tables. Once the

been optimally addressed. It is conceivable in this ap- values of the offerings under the value categories are cal-

proach to have three or even four tiers of weighting. How- culated, they are applied to an adjusted bid formula. Thus,

ever, having too many tiers can also make the process the outputs of the four scorecards, fed into the bid adjust-

very complex. Hence a key decision that the buyer or- ment formula, provide us with a revised L1 bid (lowest

ganization must make before the start of the tendering bid). The methodology in the context of a specific tender-

process is the optimal number of tiers for weighting. ing situation is presented here.

In order to further elucidate the model, a case to capture Adjusted Bid Price Table

the concept of value assessment framework is presented

The Adjusted Bid Price Table (Table 3) can be construed

followed by the discussion of the framework.

to be the pivot in the approach. This table provides the

choice to the buyer to decide the manner in which the

Case 4: Adjusted Price Bid procurement process is conducted.

A large enterprise in India floated a tender to acquire heavy The PAV assigned to each of the three value categories is

equipment worth crores of rupees for one of their local sub- a function of the offering being procured and would vary

sidiaries. The tender was open to national and international on a case-by-case basis. Providing inordinate high or low

suppliers for bidding. The two-bid system was followed in values of PAV to the categories would skew the process

the tendering process – the technical bid followed by the of value assessment. Hence a preliminary analysis to pro-

price bid. The uniqueness of the tendering process was that vide optimal values of PAV needs to be conducted. The

the L1 bidder at the end of the price bid did not secure the weights are assigned by the buyers based on their deep

contract. Rather a more complicated adjusted price bid proc- understanding of the requirement of the specific procure-

ess was followed, as described below, which resulted in the ment.

supplier who was initially L3 in winning the contract.

Table 3: Adjusted Bid Price Table

Value Assessment Framework Assessment Values PAV

Acquisition cost As evaluated by the buyer

In-order to elaborate on the framework, a two-tiered ap-

Operational cost (in percentage for each row)

proach is used. It is quite conceivable however that in

Maintenance cost

more complex situations, there could be three or even four

tiers, although this will add further complexity to the Acquisition Table

model. The first tier, termed as ‘value categories’, com-

prise the major components to be measured across the The Acquisition Table (Table 4) provides absolute num-

offering’s life-cycle, The ‘value elements’ (Anderson & bers to compute the cost of acquisition. Though in many

Narus, 1998) subdividing the value categories form the cases, the cost of installation is included in the offerings

second tier. The value categories are acquisition cost, op- cost, we have differentiated between the bid cost of the

62 MARKETING “VALUE” TO PRICE-SENSITIVE CUSTOMERS DURING THE TENDERING PROCESS

product and the installation cost. In certain cases wherein Maintenance Table

the cost of customizing or fitting the offering into a buyer The Maintenance Table (Table 6) tries to capture the value

location is a separate activity, these costs can be included accrued to the buyer through supplier’s maintenance re-

additionally. lated activities during the complete life cycle of the prod-

uct. The various value elements for maintenance would

Table 4: Acquisition Table have to be listed down in the Maintenance Table.

Cost Elements Total Price

Bid price Table 6: Maintenance Table

Cost of Installation Maintenance Value Maximum Percentage

As submitted (quoted)

• Labour cost by the bidder in Elements Percentage Weight

• Transportation cost currency (`, $, etc.) Weight

• Other costs (Initial Replacement/Repair charges

Provisioning etc.) • Number of service centres As evaluated

Acquisition Cost Sum Total (in Currency) • Geographic location As determined by the buyer

of warehouse, etc. by the buyer for a particular

(In percentage bid (In

Once the corresponding numbers have been put into the Mean time between failure

for each row) percentage

Table, we have the total cost of acquisition (X from Table Warranty for each row)

4) of the market offering which is considered to be the Other maintenance

parameters

actual bid price of the offering. It should be noted that this

Percentage Weight 100% Sum Total

is the only cost input that is taken from the supplier.

out of 100 (in percent)

Operational Table

Similar to the Operational Table, the total value in per-

The Operational Table (Table 5) attempts to capture the centage is gathered for this category and then used in the

operational efficiency and the functional benefit accrued adjusted price bid formula.

to the buyers over the complete life cycle of the product. It

considers the percentage values instead of the absolute Price Adjustment Formula

numbers. Once all the categories were populated and the percent-

age value for each of them added, the Adjusted Bid Price

Table 5: Operational Table

formula was used to calculate the new price of the offer-

Operational Value Maximum Percentage ings. Adjusted as per the various value elements, the for-

Elements Percentage Weight mula loads the actual bid price to an Adjusted Bid Price.

Weight

Power consumption Adjusted Acquisition Cost

Weight advantage As determined

As evaluated Bid Price = (Acquisition PAV + Operational Weight *

by the buyer for

Fuel efficiency by the buyer Operations PAV + Maintenance Weight *

a particular bid

Technical merit (In percentage

(in percentage

Maintenance PAV)

for each row)

Other operational for each row)

parameters Hence the new bid price for all the suppliers submitting

Percentage Weight 100% Sum Total the tender is calculated. The final contract is awarded to

out of 100 (in percent) the supplier whose Adjusted Bid Price is L1. However, it

should be noted that the price at which the contract is

The total weight under this category is 100 with each awarded is not the Adjusted Bid Price but the actual bid

value element in the Table being given a maximum value. price that the suppliers initially tendered – i.e. the Acqui-

The total sum of each of these elements is added up to get sition Cost. Thus, through the Adjusted Bid Price method,

the percentage that an offering is awarded for this cat- a bidding process conducive to both the supplier as well

egory. The sum can only be a maximum of 100. as the buyer can be created and also the value utilized

and shared between them.

VIKALPA • VOLUME 38 • NO 4 • OCTOBER - DECEMBER 2013 63

Appendix 1 demonstrates how this process is deployed comes easier with only empanelled suppliers being pro-

in an actual tendering situation, through numerical il- vided access to the bidding process. Needless to say, the

lustration for better understanding. In the case of Adjusted electronic process helps achieve economies of scale in

Price Bid (Case 4), the operational and maintenance value documentation by reducing paper work, faster process-

categories were combined into one value category. The ing of the technical and price bids, and reducing the cycle

value elements within the categories were defined accord- time between bidding and award of contract (Smeltzer &

ingly. The PAV assigned to the cost of acquisition was 85 Carr, 2003). Inherently, e-commerce has advantages which

percent, while the PAV assigned to the combined opera- enable the procurement process to become market-effi-

tional and maintenance category accounted for 15 per- cient, unbiased, and reduce transaction costs (Malone,

cent. A three-tier process was used wherein the value Yates, & Benjamin, 1987).

elements ‘technical evaluation of goods’ and ‘compat-

ibility and service support’ were further elaborately de- But on the flip side, the process tends to accord very little

fined. The specific parameters under the above value chance to the suppliers to differentiate on the basis of

elements were allocated weights and the weighted score customer value. Suppliers believe that e-bidding forces

was considered for the value elements. After the price bid them into a scenario of ‘price war’. Suppliers face a ‘profit

was opened and the complete iteration of the calcula- squeeze’ (Gulledge, 2002) and hence have lower incen-

tions performed, the supplier that was L3 became L1 and tives to participate in an electronic market place. Yet, many

was consequently awarded the contract. suppliers are forced to participate in e-bidding due to the

potentially large volume of business that they are likely

E-bidding in conjunction with the Value Framework to gain in case they succeed or due to various other com-

pulsions. Usually, the buyer gains significantly, while

This section demonstrates how some of the research find- the suppliers get into desperate price drops (Tudler &

ings can be used in the context of e-bidding. Given the Mol, 2002). It tends to be a win-lose situation. Given that

pervasive nature of internet, e-bidding is turning out to the price-bids are quoted and finalized within a pre-set

be a very important vehicle for large-ticket procurement time gap set by the buyer, suppliers are often known to

by buyer firms. The learnings from this paper can be ap- resort to bidding much below the cost of executing a

plied with minimal modification to the e-bidding process project. Supplier offerings are relegated to commodity sta-

to help buyers evaluate supplier firms, while factoring in tus, leading to value drains and inability on the part of

the value elements being delivered by each supplier firm the supplier to communicate value to the buyer.

into the evaluation process.

The e-bidding process provides a good opportunity for

E-bidding system has been the latest addition to the price using this model. The structural change in the process

discovery mechanism in the tendering process. The e-bid- itself is minimal, the only major one being that the suppli-

ding system consists of an IT (Information Technology)- ers now compete on the value of their offering. The main

based infrastructure which enables the suppliers to simul- changes happen on the backend, where instead of price,

taneously compete and bid for the lowest price. Also re- the value of the offering is factored-in as defined earlier.

ferred to as reverse auctions, bidders either get together at The various PAVs are already input into the system and

a single location or bid remotely. so are the respective weights for the value elements under

In the tendering context, the electronic market brings each of the value categories.

benefits to both the supplier and the buyer (Hazra, The value elements and the elemental weights for value

Mahadevan, & Seshadri, 2004). With widespread use of categories should be shared with the supplier in the ten-

internet, the communication lines between the buyer and der document. The supplier thus has a good understand-

the supplier become clear and transparent. Internet also ing of the value as perceived by the buyer. Suppliers can

helps to rationalize bidding across different time zones position their offerings suitably in an attempt to maxi-

in case of global tenders. In most cases, the buyer pro- mize the fit between the value of their offerings and the

vides the tender and the bid documents on the web, ena- buyers’ expectation of value. It is essential for the buyer to

bling suppliers to access them in reasonably short time a priori fix the number of tiers as well as the weights as a

periods. Also short-listing and selection of suppliers be- part of the Request for Proposal.

64 MARKETING “VALUE” TO PRICE-SENSITIVE CUSTOMERS DURING THE TENDERING PROCESS

Once these numbers are put into the system, the suppli- of the buyer firm have been mapped and methods to un-

ers are free to change the bid price. Suppliers are assessed dertake this communication process have been presented.

on the complete value of the respective offerings. For each Additionally, several avenues to build and leverage rela-

supplier, the value is calculated by the system based on tionships between the buyer and supplier in the tender-

pre-determined adjusted bid price formula. Hence the ing context have been presented.

approach potentially changes the decision-making pa-

The suggested value assessment framework was built to

rameter to ‘value’ instead of ‘price’. Given that the con-

encompass the procurement of product and/or services

tract is awarded on the basis of the adjusted bid-price

either through Limited tendering or Open tendering. A

formula, the above leads to a bidding process which is

broad conceptual framework was presented to incorpo-

conducive to both the supplier as well as the buyer.

rate customer value into the tendering process by break-

An important factor to be noted is that the premise on ing the entire process into tiers and value elements. The

which the approach works is that none of the suppliers framework can be used in scenarios where there are ‘sin-

would resort to a dumping strategy just to win the con- gle bid’ systems, ‘two bid’ systems (discussed earlier in

tracts. Dumping refers to a supplier getting the contract, the paper) or in situations where ‘e-bidding’ is followed.

but is unable to execute the contract. However, the ad-

From a practitioner’s perspective, this paper has presented

verse effect of dumping can be mitigated by stringent pre-

a step-by-step process, by which both suppliers and buy-

qualification of potential suppliers and steep liquidity

ers can fold value into their offerings and assessments

damages that are contractually enforceable in case of fail-

respectively in tendering. In the absence of such a navi-

ure to deliver as per contractual obligations. This will

gational aid, managers tend to get distraught about value

serve as a significant deterrent for desperate bids.

not being relevant in the context of tendering. The au-

CONCLUDING REMARKS thors hope that this paper would convince managers that

tendering and customer value are compatible.

The paper examines the tendering process in detail to

identify and explore the value communication opportu- In the three key areas, viz., better understanding of the

nities available to suppliers. It presents a deep under- tendering process, value communication, and value as-

standing of the dynamics of the tendering process and sessment, there is considerable scope for continued re-

the steps involved from both buyer and supplier firms’ search. Areas for further research could include the

perspective to effectively navigate through the complex- variations in the tendering process for different types of

ity inherent in tendering. The key highlights of the contri- procurement situations. The steps and processes for value

bution of this paper towards a better understanding of communication in turnkey projects is an important area

the tendering process are briefly summarized here. for research. In the context of value assessment, research

is also required towards better understanding of the

It is essential for suppliers participating in tendering to weights to be accorded to the value elements. Also, fur-

continue to innovate for profitable growth. This paper ther research and analysis to arrive at the optimal number

has presented some levers through a framework, from of tiers in different tendering situations would help en-

both buyer and supplier perspectives, to factor in the ad- hance the framework presented here.

ditional value that such innovation yields. Based on the

research of a variety of private and public sector firms, it The basic thrust of this research was to enhance the level

has conclusively demonstrated that supplier firms can of transparency, and to ensure that value is adequately

effectively showcase, communicate, and leverage the su- captured by the buyer while making decisions, in a ten-

perior customer value that the supplier firms provide to dering situation. It has also taken a fresh look at several

buyer firms using the tendering process as the vehicle for important questions that have plagued tendering since

their procurement. It has identified the different stages in its advent. The authors have stressed on the need for buyer

the tendering process in which value communication by and supplier firms to continue to innovate in the tender-

the supplier firm can take place. The avenues available to ing process to help maximize value creation and sharing.

various departments of the supplier firm to communicate In the age of widespread Internet as well as pressures

value at each of these stages to the relevant departments from lobbies like Right to Information, this will ensure

VIKALPA • VOLUME 38 • NO 4 • OCTOBER - DECEMBER 2013 65

that large ticket procurements are done in a manner that situations. The findings are based on experiences of prac-

takes care of the best interest of all stakeholders involved titioners. However, as has been noted above, many open-

in the tendering process. ended questions arise, that set the agenda for the need for

continued theoretical contributions to the important area

Theoretical contribution to the understanding of tender- of tendering, which accounts for significant and increas-

ing from a practitioner’s perspective is at its infancy. This ing proportion of procurement in business markets. Such

paper has focused on many of the challenges faced by theoretical contributions can further strengthen practice

managers of both buyer and supplier firms in tendering in a symbiotic relationship.

APPENDIX 1

Adjustment Bid Price Table PAV

Assessment Values PAV 50% 30% 20%

Acquisition Cost a% Acquisition Operational Maintenance

Operational Cost b%

Maintenance Cost c%

Acquisition Table

Cost Elements Total Price Comp1 Comp2 Comp 3

Bid Price Pre-adjusted 100 110 120

Installation Cost Bid Price L1 L2 L3

Labour Cost

Transportation Cost

Other Costs (Initial Provisioning, etc.)

Acquisition Cost X

Operational Table

Operational Value Elements Percentage Comp1 Comp2 Comp 3

Weightage y1 20% 5% 15% 15%

Power Consumption y1 y2 20% 7% 18% 18%

Weight Advantage y2 y3 20% 2% 12% 16%