Professional Documents

Culture Documents

Composite: Vanguard Mid-Cap Index Fund & Vanguard Long-Term Treasury Fund (5YR Performance Analysis)

Uploaded by

Amnuay PraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Composite: Vanguard Mid-Cap Index Fund & Vanguard Long-Term Treasury Fund (5YR Performance Analysis)

Uploaded by

Amnuay PraCopyright:

Available Formats

Report

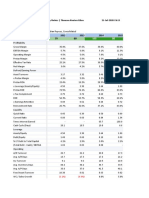

Composite: Vanguard Mid-Cap Index Fund & Vanguard Long-Term Treasury Fund

(5YR Performance Analysis)

End Date 3/31/2016

Yearly Returns YTD Year Year Year Year Year

3/31/2016 2015 2014 2013 2012 2011

Composite Gross 3.32% -2.29% 14.47% 24.87% 10.54% 2.82%

Net 3.27% -3.33% 13.46% 23.19% 9.38% 2.19%

S&P500 Gross 6.45% -2.74% 11.92% 18.99% 14.15% 2.04%

US Corp 1-3 Gross 1.36% 0.74% 1.43% 1.87% 3.59% 2.44%

Composite Gross Hi 10.08% -0.17% 15.07% 36.64% 17.32% 10.61%

Composite Gross Low 1.48% -9.34% 12.51% -2.48% -2.56% -0.80%

Composite # Funds 2 2 2 2 2 2

Rolling returns 1 Year 3 Year 5 Year

Composite Gross 0.96% Gross 13.00% Gross 10.40%

Net 6.20% Net 11.74% Net 9.30%

###

S&P500 Benchmark Gross 3.52% 11.30% 9.94%

US Corp 1-3 RF Gross 2.11% 1.80% 2.29%

###

###

Portfolio θ - Gross 7.37% 7.77%

Sharpe Ratio (Return Adjusted) 1.52% 1.04%

Tracking Error θ 8.68% 8.34%

Information Ratio (Risk Adjusted) 19.67% 5.57%

Mean (Average) 8.68% 0.20%

VAR @ 95% Confidence Level -12.59%

VAR @ 99% Confidence Level -17.89%

###

R2 0.31 0.43

Beta 0.28 0.41

Alpha (Excess Return) 1.71% 0.46%

CAPM (Hurdle Rate) 4.99% 5.59%

###

###

Portfolio θ - Net 7.29% 7.61%

Sharpe Ratio (Return Adjusted) 1.36% 0.92%

Tracking Error θ 8.59% 8.36%

Information Ratio (Risk Adjusted) 19.87% 5.56%

Mean (Average) 8.59% -0.30%

Benchmarks

Index θ 7.40% 7.91%

Mean (Average) 5.14% 4.72%

VAR @ 95% Confidence Level -8.30%

VAR @ 99% Confidence Level -13.69%

RF θ 0.75% 0.84%

Mean (Average) 0.83% 1.08%

VAR @ 95% Confidence Level -0.30%

VAR @ 99% Confidence Level -0.87%

Standard deviation (Excel Population equation)

Summary

Composite: Vanguard Mid-Cap Index Fund & Vanguard Long-Term Treasury

Fund (5 Years Exposure)

End Date 3/31/16

Composite Asset Growth Of $1,000 - 5 Years

2,500

2,000

1,500

1,000

500

-

Dec- Mar- Jun- Sep- Dec- Mar- Jun- Sep- Dec- Mar- Jun- Sep- Dec- Mar- Jun- Sep- Dec- Mar- Jun- Sep- Dec- Mar-

10 11 11 11 11 12 12 12 12 13 13 13 13 14 14 14 14 15 15 15 15 16

Composite Index

Style Composition - 5 Years

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Dec- Mar- Jun- Sep- Dec- Mar- Jun- Sep- Dec- Mar- Jun- Sep- Dec- Mar- Jun- Sep- Dec- Mar- Jun- Sep- Dec- Mar-

10 11 11 11 11 12 12 12 12 13 13 13 13 14 14 14 14 15 15 15 15 16

Fund A Fund B

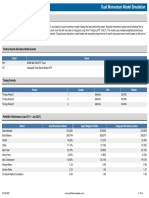

Asset Value changed from 12/31/2005 to 03/31/2016

Cumulative Annualized

Beg Weight End Weight Asset Asset

Beg MV No Exp End MV Include Exp Returns Returns

Fund A-Gross 600,000 60% 789,920 71% 31.65% 3.29%

Fund B-Gross 400,000 40% 367,160 33% -8.21% -0.84%

Subtotal-Gross 1,000,000 100% 1,157,080 104% 15.71% 1.62%

Expense 0 (43,661) -4% -4.37% -0.45%

Total-Net 1,000,000 100% 1,113,419 100% 11.34% 1.17%

Portfolio Contribution Analysis - Single Period Estimate

Asset Return changed from 12/31/2005 to 03/31/2016

(Not Additive) (Additive)** (Additive)***

Annualized Annualized Annualized Annualized

Fund Fund Composite* Composite Composite Composite

Cumulative Cumulative Weighted Weighted Weighted Weighted

Return Return Return Return Return Return

Fund A-Gross 31.65% 3.29% 21.21% 2.20% 2.16% 0.83%

Fund B-Gross -8.21% -0.84% -5.50% -0.56% -0.55% 0.39%

Sum 23.4433% 15.7080% 1.6337% 1.6094% 1.2151%

Subtotal-Gross 15.7080% 15.7080% 1.6226% 1.6094% 1.2151%

Diff: Sum Vs. Subtotal 0.0000% 0.0111% 0.0000% 0.0000%

Expense -4.37% -4.37% -0.45% -0.44% -0.05%

Total-Net 11.34% 11.34% 1.17% 1.17% 1.17%

Fund requires 5 years of returns (quarterly). Ending period must match to instructor request.

Creation Date 12/31/2005

Investment Name Vanguard Mid-Cap Index Fund

Asset Class:

t: Need to add drop

Initial Investment ($) $ 600,000 down

Total Expense (%) 1.16%

Data Frequency Quarter 0.290%

Return Type Net

Actual Return Model Return

Net Gross Up

Date Returns (%) Returns (%)

3/31/16 1.190% 1.480%

12/31/15 3.440% 3.730%

9/30/15 -7.450% -7.160%

6/30/15 -1.160% -0.870%

3/31/15 4.280% 4.570%

12/31/14 6.640% 6.930%

9/30/14 -1.140% -0.850%

6/30/14 4.510% 4.800%

3/31/14 3.270% 3.560%

12/31/13 8.620% 8.910%

9/30/13 7.690% 7.980%

6/30/13 2.360% 2.650%

3/31/13 12.900% 13.190%

12/31/12 2.840% 3.130%

9/30/12 5.210% 5.500%

6/30/12 -5.460% -5.170%

3/31/12 13.420% 13.710%

12/31/11 12.130% 12.420%

9/30/11 -19.130% -18.840%

6/30/11 -0.090% 0.200%

3/31/11 8.220% 8.510%

12/31/10 13.590% 13.880%

9/30/10 12.950% 13.240%

6/30/10 -9.880% -9.590%

3/31/10 8.680% 8.970%

12/31/09 6.580% 6.870%

9/30/09 21.640% 21.930%

6/30/09 18.300% 18.590%

3/31/09 -8.380% -8.090%

12/31/08 -25.620% -25.330%

9/30/08 -15.050% -14.760%

6/30/08 3.020% 3.310%

3/31/08 -10.530% -10.240%

12/31/07 -3.410% -3.120%

9/30/07 -0.910% -0.620%

6/30/07 6.080% 6.370%

3/31/07 4.610% 4.900%

12/31/06 7.400% 7.690%

9/30/06 1.350% 1.640%

6/30/06 -2.890% -2.600%

3/31/06 7.640% 7.930%

Investment Name Vanguard Long-Term Treasury Fund

Asset Class: t: Need to add drop

Initial Investment ($) $ 400,000 down

Total Expense (%) 0.62%

Data Frequency Quarter 0.155%

Return Type Net

Actual Return Model Return

Net Gross Up

Date Returns (%) Returns (%)

3/31/16 8.330% 8.485%

12/31/15 -1.590% -1.435%

9/30/15 5.470% 5.625%

6/30/15 -8.670% -8.515%

3/31/15 3.980% 4.135%

12/31/14 8.550% 8.705%

9/30/14 2.790% 2.945%

6/30/14 4.460% 4.615%

3/31/14 7.590% 7.745%

12/31/13 -3.520% -3.365%

9/30/13 -2.310% -2.155%

6/30/13 -5.750% -5.595%

3/31/13 -2.000% -1.845%

12/31/12 -1.070% -0.915%

9/30/12 0.110% 0.265%

6/30/12 10.900% 11.055%

3/31/12 -5.700% -5.545%

12/31/11 1.530% 1.685%

9/30/11 24.760% 24.915%

6/30/11 3.330% 3.485%

3/31/11 -1.120% -0.965%

12/31/10 -8.210% -8.055%

9/30/10 4.980% 5.135%

6/30/10 12.140% 12.295%

3/31/10 0.930% 1.085%

12/31/09 -5.230% -5.075%

9/30/09 4.560% 4.715%

6/30/09 -6.850% -6.695%

3/31/09 -4.590% -4.435%

12/31/08 17.620% 17.775%

9/30/08 2.430% 2.585%

6/30/08 -2.170% -2.015%

3/31/08 4.090% 4.245%

12/31/07 5.590% 5.745%

9/30/07 4.670% 4.825%

6/30/07 -1.930% -1.775%

3/31/07 0.940% 1.095%

12/31/06 0.540% 0.695%

9/30/06 6.320% 6.475%

6/30/06 -1.250% -1.095%

3/31/06 -3.450% -3.295%

Idenifier Index RF

S&P500 BofA Merrill Lynch US Corp 1-3yr Total Return Index Value

Frequency: Monthly Frequency: Monthly

observation_date SP500 observation_date BAMLCC1A013YTRIV

2006-05-01 1270.09 2006-05-01 1144.96

2006-06-01 1270.20 2006-06-01 1147.29

2006-07-01 1276.66 2006-07-01 1156.68

2006-08-01 1303.82 2006-08-01 1165.89

2006-09-01 1335.85 2006-09-01 1172.59

2006-10-01 1377.94 2006-10-01 1178.06

2006-11-01 1400.63 2006-11-01 1185.02

2006-12-01 1418.30 2006-12-01 1186.37

2007-01-01 1438.24 2007-01-01 1189.54

2007-02-01 1406.82 2007-02-01 1200.01

2007-03-01 1420.86 2007-03-01 1204.99

2007-04-01 1482.37 2007-04-01 1209.83

2007-05-01 1530.62 2007-05-01 1208.85

2007-06-01 1503.35 2007-06-01 1213.78

2007-07-01 1455.27 2007-07-01 1221.21

2007-08-01 1473.99 2007-08-01 1226.62

2007-09-01 1526.75 2007-09-01 1233.95

2007-10-01 1549.38 2007-10-01 1240.02

2007-11-01 1481.14 2007-11-01 1251.71

2007-12-01 1468.36 2007-12-01 1253.63

2008-01-01 1378.55 2008-01-01 1275.13

2008-02-01 1330.63 2008-02-01 1286.04

2008-03-01 1322.70 2008-03-01 1274.44

2008-04-01 1385.59 2008-04-01 1273.49

2008-05-01 1400.38 2008-05-01 1275.65

2008-06-01 1280.00 2008-06-01 1276.62

2008-07-01 1267.38 2008-07-01 1276.72

2008-08-01 1282.83 2008-08-01 1284.04

2008-09-01 1166.36 2008-09-01 1223.09

2008-10-01 968.75 2008-10-01 1183.42

2008-11-01 896.24 2008-11-01 1198.37

2008-12-01 903.25 2008-12-01 1220.08

2009-01-01 825.88 2009-01-01 1242.28

2009-02-01 735.09 2009-02-01 1232.35

2009-03-01 797.87 2009-03-01 1231.95

2009-04-01 872.81 2009-04-01 1269.50

2009-05-01 919.14 2009-05-01 1306.97

2009-06-01 919.32 2009-06-01 1324.53

2009-07-01 987.48 2009-07-01 1344.80

2009-08-01 1020.62 2009-08-01 1362.88

2009-09-01 1057.08 2009-09-01 1376.66

2009-10-01 1036.19 2009-10-01 1389.73

2009-11-01 1095.63 2009-11-01 1401.57

2009-12-01 1115.10 2009-12-01 1399.31

2010-01-01 1073.87 2010-01-01 1416.14

2010-02-01 1104.49 2010-02-01 1420.97

2010-03-01 1169.43 2010-03-01 1425.21

2010-04-01 1186.69 2010-04-01 1432.09

2010-05-01 1089.41 2010-05-01 1426.19

2010-06-01 1030.71 2010-06-01 1434.12

2010-07-01 1101.60 2010-07-01 1448.15

2010-08-01 1049.33 2010-08-01 1455.12

2010-09-01 1141.20 2010-09-01 1463.59

2010-10-01 1183.26 2010-10-01 1470.76

2010-11-01 1180.55 2010-11-01 1468.00

2010-12-01 1257.64 2010-12-01 1467.33

2011-01-01 1286.12 2011-01-01 1473.29

2011-02-01 1327.22 2011-02-01 1476.12

2011-03-01 1325.83 2011-03-01 1477.46

2011-04-01 1363.61 2011-04-01 1487.28

2011-05-01 1345.20 2011-05-01 1493.40

2011-06-01 1320.64 2011-06-01 1492.93

2011-07-01 1292.28 2011-07-01 1499.12

2011-08-01 1218.89 2011-08-01 1492.94

2011-09-01 1131.42 2011-09-01 1484.28

2011-10-01 1253.30 2011-10-01 1495.72

2011-11-01 1246.96 2011-11-01 1489.08

2011-12-01 1257.60 2011-12-01 1493.22

2012-01-01 1312.41 2012-01-01 1509.26

2012-02-01 1365.68 2012-02-01 1516.38

2012-03-01 1408.47 2012-03-01 1520.84

2012-04-01 1397.91 2012-04-01 1523.97

2012-05-01 1310.33 2012-05-01 1521.29

2012-06-01 1362.16 2012-06-01 1526.32

2012-07-01 1379.32 2012-07-01 1538.02

2012-08-01 1406.58 2012-08-01 1544.06

2012-09-01 1440.67 2012-09-01 1551.17

2012-10-01 1412.16 2012-10-01 1555.82

2012-11-01 1416.18 2012-11-01 1557.16

2012-12-01 1426.19 2012-12-01 1560.20

2013-01-01 1498.11 2013-01-01 1563.37

2013-02-01 1514.68 2013-02-01 1566.85

2013-03-01 1569.19 2013-03-01 1568.84

2013-04-01 1597.57 2013-04-01 1573.65

2013-05-01 1630.74 2013-05-01 1571.75

2013-06-01 1606.28 2013-06-01 1565.29

2013-07-01 1685.73 2013-07-01 1571.84

2013-08-01 1632.97 2013-08-01 1571.72

2013-09-01 1681.55 2013-09-01 1578.47

2013-10-01 1756.54 2013-10-01 1584.62

2013-11-01 1805.81 2013-11-01 1588.38

2013-12-01 1848.36 2013-12-01 1587.92

2014-01-01 1782.59 2014-01-01 1592.63

2014-02-01 1859.45 2014-02-01 1596.87

2014-03-01 1872.34 2014-03-01 1596.41

2014-04-01 1883.95 2014-04-01 1600.30

2014-05-01 1923.57 2014-05-01 1606.11

2014-06-01 1960.23 2014-06-01 1606.90

2014-07-01 1930.67 2014-07-01 1605.46

2014-08-01 2003.37 2014-08-01 1608.89

2014-09-01 1972.29 2014-09-01 1607.17

2014-10-01 2018.05 2014-10-01 1610.58

2014-11-01 2067.56 2014-11-01 1613.03

2014-12-01 2058.90 2014-12-01 1606.76

2015-01-01 1994.99 2015-01-01 1615.40

2015-02-01 2104.50 2015-02-01 1616.93

2015-03-01 2067.89 2015-03-01 1620.15

2015-04-01 2085.51 2015-04-01 1622.84

2015-05-01 2107.39 2015-05-01 1624.64

2015-06-01 2063.11 2015-06-01 1622.19

2015-07-01 2103.84 2015-07-01 1623.19

2015-08-01 1972.18 2015-08-01 1620.61

2015-09-01 1920.03 2015-09-01 1625.10

2015-10-01 2079.36 2015-10-01 1628.25

2015-11-01 2080.41 2015-11-01 1627.09

2015-12-01 2043.94 2015-12-01 1623.03

2016-01-01 1940.24 2016-01-01 1627.41

2016-02-01 1932.23 2016-02-01 1628.97

2016-03-01 2059.74 2016-03-01 1642.75

2016-04-01 2065.30 2016-04-01 1649.52

2016-05-01 #N/A 2016-05-01 #N/A

Information extracted from "Index" Tab Information extracted from "Input_MF" Tab

Fund A Gr

Date Year Index 0 Fund A Gr Fund A Net Value

3/31/06 0.0793 0.0764 1.08

4/30/06 1270.09 1144.96 #N/A #N/A 1.08

5/31/06 1270.20 1147.29 #N/A #N/A 1.08

6/30/06 1276.66 1156.68 -0.026 -0.0289 1.05

7/31/06 1303.82 1165.89 #N/A #N/A 1.05

8/31/06 1335.85 1172.59 #N/A #N/A 1.05

9/30/06 1377.94 1178.06 0.0164 0.0135 1.07

10/31/06 1400.63 1185.02 #N/A #N/A 1.07

11/30/06 1418.30 1186.37 #N/A #N/A 1.07

12/31/06 2006 1438.24 1189.54 0.0769 0.074 1.15

1/31/07 1406.82 1200.01 #N/A #N/A 1.15

2/28/07 1420.86 1204.99 #N/A #N/A 1.15

3/31/07 1482.37 1209.83 0.049 0.0461 1.21

4/30/07 1530.62 1208.85 #N/A #N/A 1.21

5/31/07 1503.35 1213.78 #N/A #N/A 1.21

6/30/07 1455.27 1221.21 0.0637 0.0608 1.28

7/31/07 1473.99 1226.62 #N/A #N/A 1.28

8/31/07 1526.75 1233.95 #N/A #N/A 1.28

9/30/07 1549.38 1240.02 -0.0062 -0.0091 1.28

10/31/07 1481.14 1251.71 #N/A #N/A 1.28

11/30/07 1468.36 1253.63 #N/A #N/A 1.28

12/31/07 2007 1378.55 1275.13 -0.0312 -0.0341 1.24

1/31/08 1330.63 1286.04 #N/A #N/A 1.24

2/29/08 1322.70 1274.44 #N/A #N/A 1.24

3/31/08 1385.59 1273.49 -0.1024 -0.1053 1.11

4/30/08 1400.38 1275.65 #N/A #N/A 1.11

5/31/08 1280.00 1276.62 #N/A #N/A 1.11

6/30/08 1267.38 1276.72 0.0331 0.0302 1.15

7/31/08 1282.83 1284.04 #N/A #N/A 1.15

8/31/08 1166.36 1223.09 #N/A #N/A 1.15

9/30/08 968.75 1183.42 -0.1476 -0.1505 0.98

10/31/08 896.24 1198.37 #N/A #N/A 0.98

11/30/08 903.25 1220.08 #N/A #N/A 0.98

12/31/08 2008 825.88 1242.28 -0.2533 -0.2562 0.73

1/31/09 735.09 1232.35 #N/A #N/A 0.73

2/28/09 797.87 1231.95 #N/A #N/A 0.73

3/31/09 872.81 1269.50 -0.0809 -0.0838 0.67

4/30/09 919.14 1306.97 #N/A #N/A 0.67

5/31/09 919.32 1324.53 #N/A #N/A 0.67

6/30/09 987.48 1344.80 0.1859 0.183 0.80

7/31/09 1020.62 1362.88 #N/A #N/A 0.80

8/31/09 1057.08 1376.66 #N/A #N/A 0.80

9/30/09 1036.19 1389.73 0.2193 0.2164 0.97

10/31/09 1095.63 1401.57 #N/A #N/A 0.97

11/30/09 1115.10 1399.31 #N/A #N/A 0.97

12/31/09 2009 1073.87 1416.14 0.0687 0.0658 1.04

1/31/10 1104.49 1420.97 #N/A #N/A 1.04

2/28/10 1169.43 1425.21 #N/A #N/A 1.04

3/31/10 1186.69 1432.09 0.0897 0.0868 1.13

4/30/10 1089.41 1426.19 #N/A #N/A 1.13

5/31/10 1030.71 1434.12 #N/A #N/A 1.13

6/30/10 1101.60 1448.15 -0.0959 -0.0988 1.02

7/31/10 1049.33 1455.12 #N/A #N/A 1.02

8/31/10 1141.20 1463.59 #N/A #N/A 1.02

9/30/10 1183.26 1470.76 0.1324 0.1295 1.16

10/31/10 1180.55 1468.00 #N/A #N/A 1.16

11/30/10 1257.64 1467.33 #N/A #N/A 1.16

12/31/10 2010 1286.12 1473.29 0.1388 0.1359 1.32

1/31/11 1327.22 1476.12 #N/A #N/A 1.32

2/28/11 1325.83 1477.46 #N/A #N/A 1.32

3/31/11 1363.61 1487.28 0.0851 0.0822 1.43

4/30/11 1345.20 1493.40 #N/A #N/A 1.43

5/31/11 1320.64 1492.93 #N/A #N/A 1.43

6/30/11 1292.28 1499.12 0.002 -0.0009 1.43

7/31/11 1218.89 1492.94 #N/A #N/A 1.43

8/31/11 1131.42 1484.28 #N/A #N/A 1.43

9/30/11 1253.30 1495.72 -0.1884 -0.1913 1.16

10/31/11 1246.96 1489.08 #N/A #N/A 1.16

11/30/11 1257.60 1493.22 #N/A #N/A 1.16

12/31/11 2011 1312.41 1509.26 0.1242 0.1213 1.31

1/31/12 1365.68 1516.38 #N/A #N/A 1.31

2/29/12 1408.47 1520.84 #N/A #N/A 1.31

3/31/12 1397.91 1523.97 0.1371 0.1342 1.49

4/30/12 1310.33 1521.29 #N/A #N/A 1.49

5/31/12 1362.16 1526.32 #N/A #N/A 1.49

6/30/12 1379.32 1538.02 -0.0517 -0.0546 1.41

7/31/12 1406.58 1544.06 #N/A #N/A 1.41

8/31/12 1440.67 1551.17 #N/A #N/A 1.41

9/30/12 1412.16 1555.82 0.055 0.0521 1.49

10/31/12 1416.18 1557.16 #N/A #N/A 1.49

11/30/12 1426.19 1560.20 #N/A #N/A 1.49

12/31/12 2012 1498.11 1563.37 0.0313 0.0284 1.53

1/31/13 1514.68 1566.85 #N/A #N/A 1.53

2/28/13 1569.19 1568.84 #N/A #N/A 1.53

3/31/13 1597.57 1573.65 0.1319 0.129 1.73

4/30/13 1630.74 1571.75 #N/A #N/A 1.73

5/31/13 1606.28 1565.29 #N/A #N/A 1.73

6/30/13 1685.73 1571.84 0.0265 0.0236 1.78

7/31/13 1632.97 1571.72 #N/A #N/A 1.78

8/31/13 1681.55 1578.47 #N/A #N/A 1.78

9/30/13 1756.54 1584.62 0.0798 0.0769 1.92

10/31/13 1805.81 1588.38 #N/A #N/A 1.92

11/30/13 1848.36 1587.92 #N/A #N/A 1.92

12/31/13 2013 1782.59 1592.63 0.0891 0.0862 2.09

1/31/14 1859.45 1596.87 #N/A #N/A 2.09

2/28/14 1872.34 1596.41 #N/A #N/A 2.09

3/31/14 1883.95 1600.30 0.0356 0.0327 2.17

4/30/14 1923.57 1606.11 #N/A #N/A 2.17

5/31/14 1960.23 1606.90 #N/A #N/A 2.17

6/30/14 1930.67 1605.46 0.048 0.0451 2.27

7/31/14 2003.37 1608.89 #N/A #N/A 2.27

8/31/14 1972.29 1607.17 #N/A #N/A 2.27

9/30/14 2018.05 1610.58 -0.0085 -0.0114 2.25

10/31/14 2067.56 1613.03 #N/A #N/A 2.25

11/30/14 2058.90 1606.76 #N/A #N/A 2.25

12/31/14 2014 1994.99 1615.40 0.0693 0.0664 2.41

1/31/15 2104.50 1616.93 #N/A #N/A 2.41

2/28/15 2067.89 1620.15 #N/A #N/A 2.41

3/31/15 2085.51 1622.84 0.0457 0.0428 2.52

4/30/15 2107.39 1624.64 #N/A #N/A 2.52

5/31/15 2063.11 1622.19 #N/A #N/A 2.52

6/30/15 2103.84 1623.19 -0.0087 -0.0116 2.50

7/31/15 1972.18 1620.61 #N/A #N/A 2.50

8/31/15 1920.03 1625.10 #N/A #N/A 2.50

9/30/15 2079.36 1628.25 -0.0716 -0.0745 2.32

10/31/15 2080.41 1627.09 #N/A #N/A 2.32

11/30/15 2043.94 1623.03 #N/A #N/A 2.32

12/31/15 2015 1940.24 1627.41 0.0373 0.0344 2.40

1/31/16 1932.23 1628.97 #N/A #N/A 2.40

2/29/16 2059.74 1642.75 #N/A #N/A 2.40

3/31/16 2065.30 1649.52 0.0148 0.0119 2.44

4/30/16 2016 #N/A #N/A #N/A #N/A 2.44

12/29/99 0.00 0.00 #N/A #N/A 2.44

12/29/99 0.00 0.00 #N/A #N/A 2.44

12/29/99 0.00 0.00 #N/A #N/A 2.44

12/29/99 0.00 0.00 #N/A #N/A 2.44

12/29/99 0.00 0.00 #N/A #N/A 2.44

12/29/99 0.00 0.00 #N/A #N/A 2.44

12/29/99 0.00 0.00 #N/A #N/A 2.44

12/29/99 0.00 0.00 #N/A #N/A 2.44

12/29/99 0.00 0.00 #N/A #N/A 2.44

12/29/99 0.00 0.00 #N/A #N/A 2.44

12/29/99 0.00 0.00 #N/A #N/A 2.44

12/29/99 0.00 0.00 #N/A #N/A 2.44

om "Input_MF" Tab MVAGr MVANet

Fund A Net Fund B Gr Fund B Net

Value 600,000 600,000 Fund B Gr Fund B Net Value Value

1.08 647,580 645,840 -0.0345 -0.03295 0.97 0.97

1.08 647,580 645,840 #N/A #N/A 1.00 1.00

1.08 647,580 645,840 #N/A #N/A 1.00 1.00

1.05 630,743 627,175 -0.0125 -0.01095 0.99 0.99

1.05 630,743 627,175 #N/A #N/A 1.00 1.00

1.05 630,743 627,175 #N/A #N/A 1.00 1.00

1.06 641,087 635,642 0.0632 0.06475 1.06 1.06

1.06 641,087 635,642 #N/A #N/A 1.00 1.00

1.06 641,087 635,642 #N/A #N/A 1.00 1.00

1.14 690,387 682,680 0.0054 0.00695 1.01 1.01

1.14 690,387 682,680 #N/A #N/A 1.00 1.00

1.14 690,387 682,680 #N/A #N/A 1.00 1.00

1.19 724,216 714,151 0.0094 0.01095 1.01 1.01

1.19 724,216 714,151 #N/A #N/A 1.00 1.00

1.19 724,216 714,151 #N/A #N/A 1.00 1.00

1.26 770,348 757,572 -0.0193 -0.01775 0.98 0.98

1.26 770,348 757,572 #N/A #N/A 1.00 1.00

1.26 770,348 757,572 #N/A #N/A 1.00 1.00

1.25 765,572 750,678 0.0467 0.04825 1.05 1.05

1.25 765,572 750,678 #N/A #N/A 1.00 1.00

1.25 765,572 750,678 #N/A #N/A 1.00 1.00

1.21 741,686 725,080 0.0559 0.05745 1.06 1.06

1.21 741,686 725,080 #N/A #N/A 1.00 1.00

1.21 741,686 725,080 #N/A #N/A 1.00 1.00

1.08 665,738 648,729 0.0409 0.04245 1.04 1.04

1.08 665,738 648,729 #N/A #N/A 1.00 1.00

1.08 665,738 648,729 #N/A #N/A 1.00 1.00

1.11 687,773 668,320 -0.0217 -0.02015 0.98 0.98

1.11 687,773 668,320 #N/A #N/A 1.00 1.00

1.11 687,773 668,320 #N/A #N/A 1.00 1.00

0.95 586,258 567,738 0.0243 0.02585 1.02 1.03

0.95 586,258 567,738 #N/A #N/A 1.00 1.00

0.95 586,258 567,738 #N/A #N/A 1.00 1.00

0.70 437,759 422,284 0.1762 0.17775 1.18 1.18

0.70 437,759 422,284 #N/A #N/A 1.00 1.00

0.70 437,759 422,284 #N/A #N/A 1.00 1.00

0.64 402,344 386,896 -0.0459 -0.04435 0.95 0.96

0.64 402,344 386,896 #N/A #N/A 1.00 1.00

0.64 402,344 386,896 #N/A #N/A 1.00 1.00

0.76 477,140 457,698 -0.0685 -0.06695 0.93 0.93

0.76 477,140 457,698 #N/A #N/A 1.00 1.00

0.76 477,140 457,698 #N/A #N/A 1.00 1.00

0.93 581,777 556,744 0.0456 0.04715 1.05 1.05

0.93 581,777 556,744 #N/A #N/A 1.00 1.00

0.93 581,777 556,744 #N/A #N/A 1.00 1.00

0.99 621,745 593,378 -0.0523 -0.05075 0.95 0.95

0.99 621,745 593,378 #N/A #N/A 1.00 1.00

0.99 621,745 593,378 #N/A #N/A 1.00 1.00

1.07 677,515 644,883 0.0093 0.01085 1.01 1.01

1.07 677,515 644,883 #N/A #N/A 1.00 1.00

1.07 677,515 644,883 #N/A #N/A 1.00 1.00

0.97 612,542 581,169 0.1214 0.12295 1.12 1.12

0.97 612,542 581,169 #N/A #N/A 1.00 1.00

0.97 612,542 581,169 #N/A #N/A 1.00 1.00

1.09 693,642 656,430 0.0498 0.05135 1.05 1.05

1.09 693,642 656,430 #N/A #N/A 1.00 1.00

1.09 693,642 656,430 #N/A #N/A 1.00 1.00

1.24 789,920 745,639 -0.0821 -0.08055 0.92 0.92

1.24 789,920 745,639 #N/A #N/A 1.00 1.00

1.24 789,920 745,639 #N/A #N/A 1.00 1.00

1.34 857,142 806,930 -0.0112 -0.00965 0.99 0.99

1.34 857,142 806,930 #N/A #N/A 1.00 1.00

1.34 857,142 806,930 #N/A #N/A 1.00 1.00

1.34 858,856 806,204 0.0333 0.03485 1.03 1.03

1.34 858,856 806,204 #N/A #N/A 1.00 1.00

1.34 858,856 806,204 #N/A #N/A 1.00 1.00

1.09 697,048 651,977 0.2476 0.24915 1.25 1.25

1.09 697,048 651,977 #N/A #N/A 1.00 1.00

1.09 697,048 651,977 #N/A #N/A 1.00 1.00

1.22 783,621 731,062 0.0153 0.01685 1.02 1.02

1.22 783,621 731,062 #N/A #N/A 1.00 1.00

1.22 783,621 731,062 #N/A #N/A 1.00 1.00

1.38 891,055 829,171 -0.057 -0.05545 0.94 0.94

1.38 891,055 829,171 #N/A #N/A 1.00 1.00

1.38 891,055 829,171 #N/A #N/A 1.00 1.00

1.31 844,988 783,898 0.109 0.11055 1.11 1.11

1.31 844,988 783,898 #N/A #N/A 1.00 1.00

1.31 844,988 783,898 #N/A #N/A 1.00 1.00

1.37 891,462 824,739 0.0011 0.00265 1.00 1.00

1.37 891,462 824,739 #N/A #N/A 1.00 1.00

1.37 891,462 824,739 #N/A #N/A 1.00 1.00

1.41 919,365 848,162 -0.0107 -0.00915 0.99 0.99

1.41 919,365 848,162 #N/A #N/A 1.00 1.00

1.41 919,365 848,162 #N/A #N/A 1.00 1.00

1.60 1,040,629 957,574 -0.02 -0.01845 0.98 0.98

1.60 1,040,629 957,574 #N/A #N/A 1.00 1.00

1.60 1,040,629 957,574 #N/A #N/A 1.00 1.00

1.63 1,068,206 980,173 -0.0575 -0.05595 0.94 0.94

1.63 1,068,206 980,173 #N/A #N/A 1.00 1.00

1.63 1,068,206 980,173 #N/A #N/A 1.00 1.00

1.76 1,153,449 1,055,548 -0.0231 -0.02155 0.98 0.98

1.76 1,153,449 1,055,548 #N/A #N/A 1.00 1.00

1.76 1,153,449 1,055,548 #N/A #N/A 1.00 1.00

1.91 1,256,221 1,146,537 -0.0352 -0.03365 0.96 0.97

1.91 1,256,221 1,146,537 #N/A #N/A 1.00 1.00

1.91 1,256,221 1,146,537 #N/A #N/A 1.00 1.00

1.97 1,300,942 1,184,028 0.0759 0.07745 1.08 1.08

1.97 1,300,942 1,184,028 #N/A #N/A 1.00 1.00

1.97 1,300,942 1,184,028 #N/A #N/A 1.00 1.00

2.06 1,363,388 1,237,428 0.0446 0.04615 1.04 1.05

2.06 1,363,388 1,237,428 #N/A #N/A 1.00 1.00

2.06 1,363,388 1,237,428 #N/A #N/A 1.00 1.00

2.04 1,351,799 1,223,321 0.0279 0.02945 1.03 1.03

2.04 1,351,799 1,223,321 #N/A #N/A 1.00 1.00

2.04 1,351,799 1,223,321 #N/A #N/A 1.00 1.00

2.17 1,445,479 1,304,550 0.0855 0.08705 1.09 1.09

2.17 1,445,479 1,304,550 #N/A #N/A 1.00 1.00

2.17 1,445,479 1,304,550 #N/A #N/A 1.00 1.00

2.27 1,511,537 1,360,385 0.0398 0.04135 1.04 1.04

2.27 1,511,537 1,360,385 #N/A #N/A 1.00 1.00

2.27 1,511,537 1,360,385 #N/A #N/A 1.00 1.00

2.24 1,498,387 1,344,604 -0.0867 -0.08515 0.91 0.91

2.24 1,498,387 1,344,604 #N/A #N/A 1.00 1.00

2.24 1,498,387 1,344,604 #N/A #N/A 1.00 1.00

2.07 1,391,102 1,244,431 0.0547 0.05625 1.05 1.06

2.07 1,391,102 1,244,431 #N/A #N/A 1.00 1.00

2.07 1,391,102 1,244,431 #N/A #N/A 1.00 1.00

2.15 1,442,990 1,287,240 -0.0159 -0.01435 0.98 0.99

2.15 1,442,990 1,287,240 #N/A #N/A 1.00 1.00

2.15 1,442,990 1,287,240 #N/A #N/A 1.00 1.00

2.17 1,464,346 1,302,558 0.0833 0.08485 1.08 1.08

2.17 1,464,346 1,302,558 #N/A #N/A 1.00 1.00

2.17 1,464,346 1,302,558 #N/A #N/A 1.00 1.00

2.17 1,464,346 1,302,558 #N/A #N/A 1.00 1.00

2.17 1,464,346 1,302,558 #N/A #N/A 1.00 1.00

2.17 1,464,346 1,302,558 #N/A #N/A 1.00 1.00

2.17 1,464,346 1,302,558 #N/A #N/A 1.00 1.00

2.17 1,464,346 1,302,558 #N/A #N/A 1.00 1.00

2.17 1,464,346 1,302,558 #N/A #N/A 1.00 1.00

2.17 1,464,346 1,302,558 #N/A #N/A 1.00 1.00

2.17 1,464,346 1,302,558 #N/A #N/A 1.00 1.00

2.17 1,464,346 1,302,558 #N/A #N/A 1.00 1.00

2.17 1,464,346 1,302,558 #N/A #N/A 1.00 1.00

2.17 1,464,346 1,302,558 #N/A #N/A 1.00 1.00

MVBGr MVBNet TMVGr TMVNet

400,000 400,000 1,000,000 1,000,000

386,200 386,820 1,033,780 1,032,660

400,000 400,000 1,047,580 1,045,840

400,000 400,000 1,047,580 1,045,840

395,000 395,620 1,025,743 1,022,795

400,000 400,000 1,030,743 1,027,175

400,000 400,000 1,030,743 1,027,175

425,280 425,900 1,066,367 1,061,542

400,000 400,000 1,041,087 1,035,642

400,000 400,000 1,041,087 1,035,642

402,160 402,780 1,092,547 1,085,460

400,000 400,000 1,090,387 1,082,680

400,000 400,000 1,090,387 1,082,680

403,760 404,380 1,127,976 1,118,531

400,000 400,000 1,124,216 1,114,151

400,000 400,000 1,124,216 1,114,151

392,280 392,900 1,162,628 1,150,472

400,000 400,000 1,170,348 1,157,572

400,000 400,000 1,170,348 1,157,572

418,680 419,300 1,184,252 1,169,978

400,000 400,000 1,165,572 1,150,678

400,000 400,000 1,165,572 1,150,678

422,360 422,980 1,164,046 1,148,060

400,000 400,000 1,141,686 1,125,080

400,000 400,000 1,141,686 1,125,080

416,360 416,980 1,082,098 1,065,709

400,000 400,000 1,065,738 1,048,729

400,000 400,000 1,065,738 1,048,729

391,320 391,940 1,079,093 1,060,260

400,000 400,000 1,087,773 1,068,320

400,000 400,000 1,087,773 1,068,320

409,720 410,340 995,978 978,078

400,000 400,000 986,258 967,738

400,000 400,000 986,258 967,738

470,480 471,100 908,239 893,384

400,000 400,000 837,759 822,284

400,000 400,000 837,759 822,284

381,640 382,260 783,984 769,156

400,000 400,000 802,344 786,896

400,000 400,000 802,344 786,896

372,600 373,220 849,740 830,918

400,000 400,000 877,140 857,698

400,000 400,000 877,140 857,698

418,240 418,860 1,000,017 975,604

400,000 400,000 981,777 956,744

400,000 400,000 981,777 956,744

379,080 379,700 1,000,825 973,078

400,000 400,000 1,021,745 993,378

400,000 400,000 1,021,745 993,378

403,720 404,340 1,081,235 1,049,223

400,000 400,000 1,077,515 1,044,883

400,000 400,000 1,077,515 1,044,883

448,560 449,180 1,061,102 1,030,349

400,000 400,000 1,012,542 981,169

400,000 400,000 1,012,542 981,169

419,920 420,540 1,113,562 1,076,970

400,000 400,000 1,093,642 1,056,430

400,000 400,000 1,093,642 1,056,430

367,160 367,780 1,157,080 1,113,419

400,000 400,000 1,189,920 1,145,639

400,000 400,000 1,189,920 1,145,639

395,520 396,140 1,252,662 1,203,070

400,000 400,000 1,257,142 1,206,930

400,000 400,000 1,257,142 1,206,930

413,320 413,940 1,272,176 1,220,144

400,000 400,000 1,258,856 1,206,204

400,000 400,000 1,258,856 1,206,204

499,040 499,660 1,196,088 1,151,637

400,000 400,000 1,097,048 1,051,977

400,000 400,000 1,097,048 1,051,977

406,120 406,740 1,189,741 1,137,802

400,000 400,000 1,183,621 1,131,062

400,000 400,000 1,183,621 1,131,062

377,200 377,820 1,268,255 1,206,991

400,000 400,000 1,291,055 1,229,171

400,000 400,000 1,291,055 1,229,171

443,600 444,220 1,288,588 1,228,118

400,000 400,000 1,244,988 1,183,898

400,000 400,000 1,244,988 1,183,898

400,440 401,060 1,291,902 1,225,799

400,000 400,000 1,291,462 1,224,739

400,000 400,000 1,291,462 1,224,739

395,720 396,340 1,315,085 1,244,502

400,000 400,000 1,319,365 1,248,162

400,000 400,000 1,319,365 1,248,162

392,000 392,620 1,432,629 1,350,194

400,000 400,000 1,440,629 1,357,574

400,000 400,000 1,440,629 1,357,574

377,000 377,620 1,445,206 1,357,793

400,000 400,000 1,468,206 1,380,173

400,000 400,000 1,468,206 1,380,173

390,760 391,380 1,544,209 1,446,928

400,000 400,000 1,553,449 1,455,548

400,000 400,000 1,553,449 1,455,548

385,920 386,540 1,642,141 1,533,077

400,000 400,000 1,656,221 1,546,537

400,000 400,000 1,656,221 1,546,537

430,360 430,980 1,731,302 1,615,008

400,000 400,000 1,700,942 1,584,028

400,000 400,000 1,700,942 1,584,028

417,840 418,460 1,781,228 1,655,888

400,000 400,000 1,763,388 1,637,428

400,000 400,000 1,763,388 1,637,428

411,160 411,780 1,762,959 1,635,101

400,000 400,000 1,751,799 1,623,321

400,000 400,000 1,751,799 1,623,321

434,200 434,820 1,879,679 1,739,370

400,000 400,000 1,845,479 1,704,550

400,000 400,000 1,845,479 1,704,550

415,920 416,540 1,927,457 1,776,925

400,000 400,000 1,911,537 1,760,385

400,000 400,000 1,911,537 1,760,385

365,320 365,940 1,863,707 1,710,544

400,000 400,000 1,898,387 1,744,604

400,000 400,000 1,898,387 1,744,604

421,880 422,500 1,812,982 1,666,931

400,000 400,000 1,791,102 1,644,431

400,000 400,000 1,791,102 1,644,431

393,640 394,260 1,836,630 1,681,500

400,000 400,000 1,842,990 1,687,240

400,000 400,000 1,842,990 1,687,240

433,320 433,940 1,897,666 1,736,498

400,000 400,000 1,864,346 1,702,558

400,000 400,000 1,864,346 1,702,558

400,000 400,000 1,864,346 1,702,558

400,000 400,000 1,864,346 1,702,558

400,000 400,000 1,864,346 1,702,558

400,000 400,000 1,864,346 1,702,558

400,000 400,000 1,864,346 1,702,558

400,000 400,000 1,864,346 1,702,558

400,000 400,000 1,864,346 1,702,558

400,000 400,000 1,864,346 1,702,558

400,000 400,000 1,864,346 1,702,558

400,000 400,000 1,864,346 1,702,558

400,000 400,000 1,864,346 1,702,558

You might also like

- Balanced Scorecard Report: Corporate Owner Fresnillo OperationsDocument4 pagesBalanced Scorecard Report: Corporate Owner Fresnillo OperationsShun De VazNo ratings yet

- Cac 40 20180329Document3 pagesCac 40 20180329Anirban BanerjeeNo ratings yet

- How to build an optimal portfolio using different mutual fundsDocument4 pagesHow to build an optimal portfolio using different mutual fundsMuhammad AqibNo ratings yet

- Analisis FinancieroDocument124 pagesAnalisis FinancieroJesús VelázquezNo ratings yet

- TH TH TH TH ST TH TH TH TH ST TH TH TH TH STDocument1 pageTH TH TH TH ST TH TH TH TH ST TH TH TH TH STNiraj DugarNo ratings yet

- MA Case Study Financial Ratio AnalysisDocument35 pagesMA Case Study Financial Ratio AnalysisAtikah DarayaniNo ratings yet

- DIPM Presentation 27022016Document7 pagesDIPM Presentation 27022016Kanchanit BangthamaiNo ratings yet

- Result 7Document2 pagesResult 7John Michael SibayanNo ratings yet

- SBI Magnum Index FundDocument1 pageSBI Magnum Index Fundvinodmapari105No ratings yet

- Residence Department Position MarketGroup FrequenciesDocument5 pagesResidence Department Position MarketGroup FrequenciesBeugh RiveraNo ratings yet

- D-Mart (Full Financial Model)Document51 pagesD-Mart (Full Financial Model)HaRi See RamNo ratings yet

- DCF template_v1Document1 pageDCF template_v1prathmesh KolteNo ratings yet

- WACC AnalysisDocument9 pagesWACC AnalysisFadhilNo ratings yet

- Analysis IDocument4 pagesAnalysis IBeugh RiveraNo ratings yet

- Risk-Return Analysis of Stocks and PortfoliosDocument8 pagesRisk-Return Analysis of Stocks and PortfoliosZNo ratings yet

- Compare Fund - MutualfundindiaDocument2 pagesCompare Fund - MutualfundindiaSujesh SasiNo ratings yet

- AMFEIX - Monthly Report (April 2020)Document16 pagesAMFEIX - Monthly Report (April 2020)PoolBTCNo ratings yet

- Proximus Consensus Ahead of q1 2023Document4 pagesProximus Consensus Ahead of q1 2023Laurent MillerNo ratings yet

- UTI Infrastructure Equity FundDocument16 pagesUTI Infrastructure Equity FundArmstrong CapitalNo ratings yet

- ATARAXIA FUND Long/Short Performance and Risk Measures. June 2019.Document4 pagesATARAXIA FUND Long/Short Performance and Risk Measures. June 2019.JBPS Capital ManagementNo ratings yet

- Bond Duration - Price Sensitivity Using DurationDocument3 pagesBond Duration - Price Sensitivity Using Durationapi-3763138No ratings yet

- Profitability Study of MPAA Rated MoviesDocument4 pagesProfitability Study of MPAA Rated MoviesMónicaNo ratings yet

- VIAC Global 60 May FactsheetDocument2 pagesVIAC Global 60 May FactsheetJozef CulenNo ratings yet

- Hero MotorCorp Beta, Cost of Equity, Growth Rate and WACC AnalysisDocument2 pagesHero MotorCorp Beta, Cost of Equity, Growth Rate and WACC AnalysisDivyansh SinghNo ratings yet

- Model Portfolios: Individual Etfs: Conservative Cautious Balanced Assertive AggressiveDocument2 pagesModel Portfolios: Individual Etfs: Conservative Cautious Balanced Assertive AggressiveTushar PatelNo ratings yet

- Excel Model The Body Shop International PLC 2001: An Introduction To Financial ModelingDocument29 pagesExcel Model The Body Shop International PLC 2001: An Introduction To Financial Modelingalka murarka33% (6)

- DCF ConeDocument37 pagesDCF Conejustinbui85No ratings yet

- Company Equity Enterprise Value Sales Gross Profit: Market Valuation LTM Financial StatisticsDocument34 pagesCompany Equity Enterprise Value Sales Gross Profit: Market Valuation LTM Financial StatisticsRafał StaniszewskiNo ratings yet

- Kotak Infrastructure and Economic Reform FundDocument14 pagesKotak Infrastructure and Economic Reform FundArmstrong CapitalNo ratings yet

- Benitez, Jewel Ann Q. Analysis #3Document7 pagesBenitez, Jewel Ann Q. Analysis #3MIKASANo ratings yet

- AMFEIX - Monthly Report (March 2020)Document17 pagesAMFEIX - Monthly Report (March 2020)PoolBTCNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Q3 2022-FinalDocument71 pagesQ3 2022-FinalcarunsbbhNo ratings yet

- Emerson Capital Quarterly Performance - 3Q 2009Document1 pageEmerson Capital Quarterly Performance - 3Q 2009Joseph HarrisonNo ratings yet

- HDFC Life Presentation - H1 FY19 - F PDFDocument43 pagesHDFC Life Presentation - H1 FY19 - F PDFMaithili SUBRAMANIANNo ratings yet

- Key Operating Financial DataDocument1 pageKey Operating Financial DataShbxbs dbvdhsNo ratings yet

- Model Description: Ticker NameDocument14 pagesModel Description: Ticker NameOleg KondratenkoNo ratings yet

- AMFEIX - Monthly Report (August 2019)Document5 pagesAMFEIX - Monthly Report (August 2019)PoolBTCNo ratings yet

- Profitability and solvency ratios show Varun Beverages' strong financial performanceDocument8 pagesProfitability and solvency ratios show Varun Beverages' strong financial performancesanket patilNo ratings yet

- Samsung FY16 Q4 PresentationDocument8 pagesSamsung FY16 Q4 PresentationJeevan ParameswaranNo ratings yet

- F23 - OEE DashboardDocument10 pagesF23 - OEE DashboardAnand RNo ratings yet

- CEB 1Q2015 Results of OperationsDocument15 pagesCEB 1Q2015 Results of OperationsJon Ulriko TubalNo ratings yet

- The Warren Buffett Spreadsheet v16 - PreviewDocument589 pagesThe Warren Buffett Spreadsheet v16 - PreviewNikhil SharmaNo ratings yet

- Common-Size Consolidated Income Statement: 12 Months Ended: Dec 31, 2021Document2 pagesCommon-Size Consolidated Income Statement: 12 Months Ended: Dec 31, 2021Lavay bhatiaNo ratings yet

- Gold's "War-Premium" Rush: Strategic Relevance of GoldDocument4 pagesGold's "War-Premium" Rush: Strategic Relevance of GoldNishant SinhaNo ratings yet

- CitiGroup On TrendFollowingDocument49 pagesCitiGroup On TrendFollowingGabNo ratings yet

- Risk and Return Chapter 5Document55 pagesRisk and Return Chapter 5sundas younasNo ratings yet

- AMFEIX - Monthly Report (May 2020)Document17 pagesAMFEIX - Monthly Report (May 2020)PoolBTCNo ratings yet

- ControlvalueDocument15 pagesControlvaluePro ResourcesNo ratings yet

- IACFM Presentations Feb 2020 PDFDocument51 pagesIACFM Presentations Feb 2020 PDFZack StraussNo ratings yet

- Stitch Fix Inc NasdaqGS SFIX FinancialsDocument41 pagesStitch Fix Inc NasdaqGS SFIX FinancialsanamNo ratings yet

- Complete DCF Template v3Document1 pageComplete DCF Template v3javed PatelNo ratings yet

- Examining risk and return of two asset portfolioDocument10 pagesExamining risk and return of two asset portfoliosushant ahujaNo ratings yet

- Comparative Analysis With Key Retail Sector OrganizationsDocument3 pagesComparative Analysis With Key Retail Sector OrganizationsMuhammad ImranNo ratings yet

- Chapter 4.risk Management For Changing Interest Rates - StudentDocument22 pagesChapter 4.risk Management For Changing Interest Rates - StudentQuynh NguyenNo ratings yet

- Prataap Snacks DCF Valuation Upside CaseDocument41 pagesPrataap Snacks DCF Valuation Upside CaseCharanjitNo ratings yet

- CalPERS Trust Level Review Risk Management SummaryDocument9 pagesCalPERS Trust Level Review Risk Management SummaryOluwaloseyi SekoniNo ratings yet

- Deloitte Tax Challenge 2012Document4 pagesDeloitte Tax Challenge 2012伟龙No ratings yet

- CaseDocument2 pagesCasezubNo ratings yet

- AFAR Partnership-ExercisesDocument37 pagesAFAR Partnership-ExercisesChelsy SantosNo ratings yet

- Topic No. 4 Retained Earnings Appropriation and Quasi ReorganizationDocument29 pagesTopic No. 4 Retained Earnings Appropriation and Quasi ReorganizationGale KnowsNo ratings yet

- CBM FinalDocument37 pagesCBM FinalSaili SarmalkarNo ratings yet

- 2009-08-04 172654 Happy 2Document6 pages2009-08-04 172654 Happy 2gazer beamNo ratings yet

- Week 2Document15 pagesWeek 2corina_mirica100% (2)

- Mafv 2017 09Document2 pagesMafv 2017 09emirav2No ratings yet

- Kalina Cycle and Cement IndustryDocument8 pagesKalina Cycle and Cement IndustryEhab SabryNo ratings yet

- Valuation of Bonds & Stocks - Lecture NotesDocument109 pagesValuation of Bonds & Stocks - Lecture NotesMadhav Chowdary TumpatiNo ratings yet

- NSP2 AnnualReportDocument76 pagesNSP2 AnnualReportEli PritykinNo ratings yet

- Impact of Demonetization on India's Financial SectorDocument7 pagesImpact of Demonetization on India's Financial SectorPartha Sarathi BarmanNo ratings yet

- Advance Fuels CorporationDocument11 pagesAdvance Fuels CorporationQuyen Huynh100% (1)

- Stockholders of F. Guanzon and Sons, Inc. vs. Register of Deeds of ManilaDocument5 pagesStockholders of F. Guanzon and Sons, Inc. vs. Register of Deeds of ManilaGracelyn Enriquez BellinganNo ratings yet

- Issue of Bonus Shares-Companies Act 2013 PDFDocument3 pagesIssue of Bonus Shares-Companies Act 2013 PDFNageswara ReddyNo ratings yet

- MB0052 SLM Unit 10Document30 pagesMB0052 SLM Unit 10SarlaJaiswalNo ratings yet

- Supreme Court Appeal on Non-Compete Agreement and Takeover OfferDocument26 pagesSupreme Court Appeal on Non-Compete Agreement and Takeover OfferShivendu PandeyNo ratings yet

- Income Statement PDFDocument4 pagesIncome Statement PDFMargarete DelvalleNo ratings yet

- Lecture 4.2 - Global Market - Entry Strategies - Licensing, Investment, and Strategic AlliancesDocument24 pagesLecture 4.2 - Global Market - Entry Strategies - Licensing, Investment, and Strategic AlliancesronNo ratings yet

- Customer Satisfaction Survey - Internet Banking "Bank of Baroda" by - Amit DubeyDocument56 pagesCustomer Satisfaction Survey - Internet Banking "Bank of Baroda" by - Amit Dubeyamit_ims351480% (20)

- Quantitative Aptitude Question BankDocument42 pagesQuantitative Aptitude Question BankarvindNo ratings yet

- Safal Niveshak Stock Analysis Excel Version 5 0Document47 pagesSafal Niveshak Stock Analysis Excel Version 5 0Yati GargNo ratings yet

- My Think, Feel and Do ProfileDocument29 pagesMy Think, Feel and Do ProfileCherie Lee100% (1)

- Acctg 371 NotesDocument37 pagesAcctg 371 NotesCindy YinNo ratings yet

- Commercial Mortgage Alert For 09 11 09Document16 pagesCommercial Mortgage Alert For 09 11 09levittjNo ratings yet

- Session 2-Charting A Company's DirectionDocument34 pagesSession 2-Charting A Company's DirectionJosephine MargarettaNo ratings yet

- Adansi Baptist Credit UnionDocument12 pagesAdansi Baptist Credit Unionjules abrokwahNo ratings yet

- Mutual FundsDocument8 pagesMutual FundsHarmanSinghNo ratings yet

- IEB Report For Penn National 9.18.13Document307 pagesIEB Report For Penn National 9.18.13MassLiveNo ratings yet