Professional Documents

Culture Documents

TH TH TH TH ST TH TH TH TH ST TH TH TH TH ST

Uploaded by

Niraj Dugar0 ratings0% found this document useful (0 votes)

8 views1 pagerrt

Original Title

Life Insurance Cos

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentrrt

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageTH TH TH TH ST TH TH TH TH ST TH TH TH TH ST

Uploaded by

Niraj Dugarrrt

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

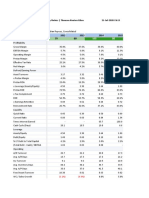

SBI Life ICICI Life HDFC Life

AUM Rs 97,736 Cr Rs 122,919 Cr Rs 91,737 Cr

Embedded Value Rs 16,538 Cr Rs 16,184 Cr Rs 12,389 Cr

RoEV 23% 16.5% 21%

ROA 0.99% 1.37% 0.97%

ROE 17.55% 26.24% 25.7%

ROIC 87.86% 34.34% 41%

RoNW 18.56% 22.33% 23.23%

VNB Margin 15.4% 10.1% (Q1FY18 – 10.7%) 21.6%

Commission 3.73% 3.6% 4.1%

Ratio

Operating 7.83% 11.4% 12.6%

Expense Ratio

Market Share Retail Weighted – 20.69% Retail Weighted – 22.33% Retail Weighted – 12.67%

Total Premium – 17.82% Total Premium – 18.96% Total Premium – 16.49%

Bancassurance SBI, SIB, PSB and 17 RRBs ICICI, SCB HDFC, RBL, Saraswat Co-

Partners op

Persistency 13th – 81% 13th – 86% 13th – 81%

(by premium) 25th- 73% 25th- 74% 25th- 73%

37th- 66% 37th- 67% 37th- 64%

49th – 65% 49th – 59% 49th – 58%

61st- 68% 61st- 56% 61st- 57%

Product Mix Protection – 1.48% Protection –3.9% Protection –21.8%

(New Business) ULIPs – 78.97% ULIPs –84% ULIPs – 52%

Non par- 2.66% Non par- 1.1 % Non par- 13%

Par – 16.89% Par – 9.6% Par –35%

Distribution Bancassurance – 54.58% Bancassurance – 57% Bancassurance – 52%

(New Business) Ind. Agent – 43.69% Ind. Agent – 23% Ind. Agent – 31%

Direct – Direct – 1.7% Direct – 11%

Corp Agent – Corp Agent – 6.1% Corp Agent – 3%

Others - Others – 11.9% Others -3%

Net Cash Added 53.9% 32.9% 48.7%

Ratio

Claim Settlement 97.98% 96.9% 99.16%

Ratio

Solvency Ratio 204% 281% 192%

Mis-selling Ratio 0.2% 0.76% 0.6%

Branches 803 512 414

You might also like

- HDFC Life Presentation - H1 FY19 - F PDFDocument43 pagesHDFC Life Presentation - H1 FY19 - F PDFMaithili SUBRAMANIANNo ratings yet

- Common Size P&L - VEDANTA LTDDocument20 pagesCommon Size P&L - VEDANTA LTDVANSHAJ SHAHNo ratings yet

- TechnoFunda Investing Screener Excel Template - NeDocument37 pagesTechnoFunda Investing Screener Excel Template - NeDaknik CutieTVNo ratings yet

- ITC Financial ModelDocument150 pagesITC Financial ModelKaushik JainNo ratings yet

- ITC Financial ModelDocument24 pagesITC Financial ModelKaushik JainNo ratings yet

- FY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualDocument7 pagesFY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualramNo ratings yet

- Vadilal Stage 2+ Final Deal Price CalculationsDocument77 pagesVadilal Stage 2+ Final Deal Price Calculationssid lahoriNo ratings yet

- Vadilal ValuationDocument77 pagesVadilal Valuationsid lahoriNo ratings yet

- Mangmao Talk 2019 PresentationDocument167 pagesMangmao Talk 2019 PresentationSarut Beer67% (3)

- Scoops and Dips Ratio AnalysisDocument2 pagesScoops and Dips Ratio AnalysisjaseyNo ratings yet

- Jindal Steel Ratio AnalysisDocument1 pageJindal Steel Ratio Analysismir danish anwarNo ratings yet

- Comparative Analysis With Key Retail Sector OrganizationsDocument3 pagesComparative Analysis With Key Retail Sector OrganizationsMuhammad ImranNo ratings yet

- Group 6 - Commercial BanksDocument3 pagesGroup 6 - Commercial Bankskanika patwariNo ratings yet

- Balanced Scorecard Report: Corporate Owner Fresnillo OperationsDocument4 pagesBalanced Scorecard Report: Corporate Owner Fresnillo OperationsShun De VazNo ratings yet

- Earth RhythmDocument8 pagesEarth Rhythmpankhuri wasonNo ratings yet

- Composite: Vanguard Mid-Cap Index Fund & Vanguard Long-Term Treasury Fund (5YR Performance Analysis)Document21 pagesComposite: Vanguard Mid-Cap Index Fund & Vanguard Long-Term Treasury Fund (5YR Performance Analysis)Amnuay PraNo ratings yet

- Asian Paint FMVRDocument20 pagesAsian Paint FMVRdeepaksg787No ratings yet

- Sandeep Kothari Infinite Game FIL With The Masters June2023Document36 pagesSandeep Kothari Infinite Game FIL With The Masters June2023SiddharthNo ratings yet

- Country Risk EXDocument6 pagesCountry Risk EXIfechukwu AnunobiNo ratings yet

- Albermarle Financial ModelDocument38 pagesAlbermarle Financial ModelParas AroraNo ratings yet

- Titan DCF Valuation ModelDocument21 pagesTitan DCF Valuation ModelPrabhdeep DadyalNo ratings yet

- The Unidentified Industries - Residency - CaseDocument4 pagesThe Unidentified Industries - Residency - CaseDBNo ratings yet

- ST BK of IndiaDocument42 pagesST BK of IndiaSuyaesh SinghaniyaNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Ratio Analysis TamoDocument1 pageRatio Analysis Tamomir danish anwarNo ratings yet

- ACC LTD - Financial ModelDocument11 pagesACC LTD - Financial Modelmundadaharsh1No ratings yet

- Coca-Cola Co.: Common-Size Consolidated Balance Sheet: AssetsDocument6 pagesCoca-Cola Co.: Common-Size Consolidated Balance Sheet: AssetsVibhor Dutt SharmaNo ratings yet

- Compare Fund - MutualfundindiaDocument2 pagesCompare Fund - MutualfundindiaSujesh SasiNo ratings yet

- Fundamentals Ratios For YPF SA: Growth Rates 2020 2019 2018 2017 2016Document3 pagesFundamentals Ratios For YPF SA: Growth Rates 2020 2019 2018 2017 2016Isra MachicadoNo ratings yet

- Samsung Electronics: Earnings Release Q4 2020Document8 pagesSamsung Electronics: Earnings Release Q4 2020Aidə MəmmədzadəNo ratings yet

- Tata Motors ForetradersDocument18 pagesTata Motors Foretradersguptaasoham24No ratings yet

- Cipla Valuation ModelDocument17 pagesCipla Valuation ModelPuneet GirdharNo ratings yet

- Earnings Quality Score 28 20: State Bank of India - Income Statement 11-Sep-2021 21:30Document36 pagesEarnings Quality Score 28 20: State Bank of India - Income Statement 11-Sep-2021 21:30Naman KalraNo ratings yet

- HDFC Bank LTD - Income Statement 11-Sep-2021 21:22Document7 pagesHDFC Bank LTD - Income Statement 11-Sep-2021 21:22Naman KalraNo ratings yet

- Imf CDocument12 pagesImf Cerich canaviriNo ratings yet

- FDIC Certificate # 9092 Salin Bank and Trust CompanyDocument31 pagesFDIC Certificate # 9092 Salin Bank and Trust CompanyWaqas Khalid KeenNo ratings yet

- Income Statement AnalysisDocument11 pagesIncome Statement Analysisshashwat shuklaNo ratings yet

- Description 2019 2018 2017 2016: Statement of Consolidated Cash FloDocument1 pageDescription 2019 2018 2017 2016: Statement of Consolidated Cash FloAspan FLNo ratings yet

- Excel 8 - Performance MeasurementDocument11 pagesExcel 8 - Performance MeasurementHassaan ImranNo ratings yet

- Bankmanagement AssignmentDocument4 pagesBankmanagement AssignmentHasan Motiur RahmanNo ratings yet

- Net Income Based Operating Income Based EBITDA Based Gross Income BasedDocument2 pagesNet Income Based Operating Income Based EBITDA Based Gross Income BasedAl-Quran DailyNo ratings yet

- Financial Overview5Document8 pagesFinancial Overview5Nishad Al Hasan SagorNo ratings yet

- 2017 4Q Earnings Release Samsung ElectronicsDocument8 pages2017 4Q Earnings Release Samsung ElectronicsAlin RewaxisNo ratings yet

- Banks RatiosDocument4 pagesBanks RatiosYAKUBU ISSAHAKU SAIDNo ratings yet

- Keterangan 2015 2016 2017: Year To Year Anylisis Analisis Common SizeDocument9 pagesKeterangan 2015 2016 2017: Year To Year Anylisis Analisis Common SizeSahirah Hafizhah TaqiyyahNo ratings yet

- Mutual FundsDocument4 pagesMutual FundsSujesh SasiNo ratings yet

- PI Industries Limited BSE 523642 Financials RatiosDocument5 pagesPI Industries Limited BSE 523642 Financials RatiosRehan TyagiNo ratings yet

- Key Operating Financial DataDocument1 pageKey Operating Financial DataShbxbs dbvdhsNo ratings yet

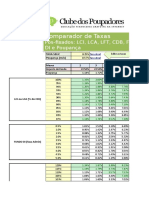

- CP Comparador de Taxas LCI LCA LFT CDB Poupanca FundosDIDocument5 pagesCP Comparador de Taxas LCI LCA LFT CDB Poupanca FundosDIeduardolavratiNo ratings yet

- Portfolio Overview JUN 20th, 2020 Report DateDocument2 pagesPortfolio Overview JUN 20th, 2020 Report DateEstéfano ZárateNo ratings yet

- Tasas Ponderadas MensualesDocument2 pagesTasas Ponderadas MensualesErika SalazarNo ratings yet

- Reporte de Ratios Nasdaq - Mayo 2020Document10 pagesReporte de Ratios Nasdaq - Mayo 2020Pety SuarNo ratings yet

- Investors / Analyst's Presentation For December 31, 2016 (Company Update)Document16 pagesInvestors / Analyst's Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Comprador TaxasDocument4 pagesComprador TaxasRenan MartinelliNo ratings yet

- Industry Median 2018 2017 2016 2015 2014 2013 2012Document10 pagesIndustry Median 2018 2017 2016 2015 2014 2013 2012AnuragNo ratings yet

- CAGR W.R.T First Year: (All Figures in INR Lakhs Unless Stated Otherwise)Document22 pagesCAGR W.R.T First Year: (All Figures in INR Lakhs Unless Stated Otherwise)Garima GulatiNo ratings yet

- Asignación Portafolio FEDocument1 pageAsignación Portafolio FEAndrea Torres EchevarríaNo ratings yet

- RELAXODocument82 pagesRELAXOFIN GYAANNo ratings yet

- Example of PresentationDocument22 pagesExample of PresentationAygerim NurlybekNo ratings yet

- The Law of ContractDocument19 pagesThe Law of Contractadamaiman1003No ratings yet

- Sa150-Notes 2018 PDFDocument15 pagesSa150-Notes 2018 PDFNechifor Laurenţiu-CătălinNo ratings yet

- ESISDocument28 pagesESISDhananjaySalgaonkarNo ratings yet

- Test Bank For Introduction To Risk Management and Insurance 10th Edition by Dorfman DownloadDocument15 pagesTest Bank For Introduction To Risk Management and Insurance 10th Edition by Dorfman DownloadTeresaMoorecsrby100% (42)

- Public Finance Chapter 4Document36 pagesPublic Finance Chapter 4LEWOYE BANTIENo ratings yet

- Company Website Persona First Namelast Namedesignatiocontact IdDocument39 pagesCompany Website Persona First Namelast Namedesignatiocontact IdSiddharthNo ratings yet

- 121-Article Text-199-1-10-20200219Document10 pages121-Article Text-199-1-10-20200219Kepal MiloNo ratings yet

- November 19, 2014Document10 pagesNovember 19, 2014The Delphos HeraldNo ratings yet

- Birla Sun Life Century SIPDocument33 pagesBirla Sun Life Century SIPmaakabhawan26No ratings yet

- "Employee Motivation at Bajaj Allianz Insurance": A Project Report ONDocument71 pages"Employee Motivation at Bajaj Allianz Insurance": A Project Report ONaurorashiva1100% (2)

- PerformaDocument34 pagesPerformaLillian AlfordNo ratings yet

- CMO Marketing Communications VP in New York Resume Jean WiskowskiDocument3 pagesCMO Marketing Communications VP in New York Resume Jean WiskowskiJeanWiskowskiNo ratings yet

- List of FraudsDocument5 pagesList of FraudsHugh Fox III65% (17)

- The Attorney Planning For ProbateDocument16 pagesThe Attorney Planning For ProbaterobertkolasaNo ratings yet

- Civil Law Review Ii: Case DigestDocument68 pagesCivil Law Review Ii: Case DigestHadjieLim100% (1)

- MCQ (New Topics-Special Laws) - PartDocument2 pagesMCQ (New Topics-Special Laws) - PartJEP WalwalNo ratings yet

- Test Bank For Community Health Nursing A Canadian Perspective 5th Edition Lynnette Leeseberg Stamler Lynnette Leeseberg Stamler Lucia Yiu Aliyah Dosani Josephine Etowa Cheryl Van Daalen SmithDocument86 pagesTest Bank For Community Health Nursing A Canadian Perspective 5th Edition Lynnette Leeseberg Stamler Lynnette Leeseberg Stamler Lucia Yiu Aliyah Dosani Josephine Etowa Cheryl Van Daalen SmithLinda Burnham100% (31)

- Tax Facts and Figures 2014Document68 pagesTax Facts and Figures 2014Adapaura GodwinNo ratings yet

- Est Rad ADocument4 pagesEst Rad AMonica Ivy EstradaNo ratings yet

- SafecoDocument2 pagesSafecoKEITH CHABOTNo ratings yet

- BIR MonitorDocument9 pagesBIR MonitorCandiceCocuaco-ChanNo ratings yet

- Your Steps To A 720 Credit ScoreDocument15 pagesYour Steps To A 720 Credit Scorecharlesthurston100% (4)

- Neiipp 2007Document2 pagesNeiipp 2007sjcbaoxomNo ratings yet

- 2019 Report To MembersDocument32 pages2019 Report To MembersC H LNo ratings yet

- The American Dream, Quantified at Last - The New York TimesDocument4 pagesThe American Dream, Quantified at Last - The New York TimeslkplmlhNo ratings yet

- By Gerald SwabyDocument20 pagesBy Gerald SwabySyahirahNo ratings yet

- TAXESDocument26 pagesTAXESPurchiaNo ratings yet

- Bank of America Leaks Allege Fraud Forced Placed InsuranceDocument3 pagesBank of America Leaks Allege Fraud Forced Placed Insurance83jjmack100% (1)

- SeminarDocument18 pagesSeminarBalakrishna ShyamsundarNo ratings yet

- DnnoDocument3 pagesDnnoDjordje PopovicNo ratings yet