Professional Documents

Culture Documents

Spice Jet 2015 - IGAAP

Spice Jet 2015 - IGAAP

Uploaded by

Ranjan DasguptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Spice Jet 2015 - IGAAP

Spice Jet 2015 - IGAAP

Uploaded by

Ranjan DasguptaCopyright:

Available Formats

Notes to the financial statements for the period ended March 31, 2015

(All amounts are in millions of Indian Rupees, unless otherwise stated)

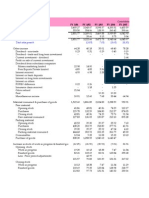

12 TANGIBLE ASSETS

Particulars Plant & Rotable & Office Computers Furniture Motor Leasehold Aircraft^ Total

Machinery Tools Equipment & Fixtures Vehicles Improvements

Cost or Valuation

As at April 1, 2013 373.56 1,108.63 77.72 161.34 26.08 259.29 332.68 16,965.23 19,304.53

Additions during the year 113.74 302.69 12.40 26.95 1.48 167.10 103.44 - 727.80

31st Annual Report 2014-15

Disposals 7.46 13.84 2.35 11.58 0.87 27.30 - - 63.40

Other adjustments* - - - - - - - 1,539.75 1,539.75

As at March 31, 2014 479.84 1,397.48 87.77 176.71 26.69 399.09 436.12 18,504.98 21,508.68

Additions during the year 2.64 62.67 4.00 11.33 1.15 35.68 3.80 - 121.27

Disposals 2.42 11.95 6.90 25.55 2.04 1.25 - 1,233.40 1,283.51

Other adjustments* - - - - - - - 547.72 547.72

As at March 31, 2015 480.06 1,448.20 84.87 162.49 25.80 433.52 439.92 17,819.30 20,894.16

Depreciation

As at April 1, 2013 62.95 190.85 12.20 90.97 10.29 89.55 78.60 843.67 1,379.08

Charge for the year 21.50 74.60 4.81 20.77 2.03 38.80 314.42 965.17 1,442.10

Disposals 3.12 2.85 1.08 10.11 0.50 23.29 - - 40.95

As at March 31, 2014 81.33 262.60 15.93 101.63 11.82 105.06 393.02 1,808.84 2,780.23

Charge for the year 34.56 81.41 22.47 41.70 2.96 53.27 14.66 974.66 1,225.69

Disposals 1.66 2.40 6.10 25.23 1.77 1.21 - 212.17 250.54

Other adjustments # 0.99 - 8.99 11.85 - 2.57 - - 24.40

As at March 31, 2015 115.22 341.61 41.29 129.95 13.01 159.69 407.68 2,571.33 3,779.78

Net Block -

As at March 31, 2014 398.51 1,134.88 71.84 75.08 14.87 294.03 43.10 16,696.14 18,728.45

As at March 31, 2015 364.84 1,106.59 43.58 32.54 12.79 273.83 32.24 15,247.97 17,114.38

^ Under the agreement with the lender, the title to the aircrafts vest with the lessor and the Company shall take title to aircrafts at the end of the lease period upon

payment of all dues under the lease agreements. Also refer note 6 (b).

* Represents foreign exchange loss capitalised during the year and depreciation thereon.

# Represents impact of adoption of useful lives of fixed assets as prescribed under Schedule II to the Act, which has been adjusted with the balance carried forward in

the statement of profit and loss (deficit). Also refer note 5.

67

You might also like

- Projections 20.11.20Document7 pagesProjections 20.11.20Pawan GuptaNo ratings yet

- Kalyan JewellersDocument8 pagesKalyan Jewellersaarushikhunger12No ratings yet

- Nilkamal Student DataDocument13 pagesNilkamal Student DataGurupreet MathaduNo ratings yet

- DCF ValuationV!Document80 pagesDCF ValuationV!Sohini DeyNo ratings yet

- Cipla P&L ExcelDocument9 pagesCipla P&L ExcelNeha LalNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- Balancesheet - Tata Motors LTDDocument9 pagesBalancesheet - Tata Motors LTDNaveen KumarNo ratings yet

- Section A - Group 4Document22 pagesSection A - Group 4AniketNo ratings yet

- Appendices PDFDocument2 pagesAppendices PDFMohammed FazlullahNo ratings yet

- Company Finance Profit & Loss (Rs in CRS.) : Company: State Bank of India Industry: Banks - Public SectorDocument4 pagesCompany Finance Profit & Loss (Rs in CRS.) : Company: State Bank of India Industry: Banks - Public Sectorprasadkh90No ratings yet

- Ratio Analysis TanyaDocument10 pagesRatio Analysis Tanyatanya chauhanNo ratings yet

- Kingston Educational Institute: Ratio AnalysisDocument1 pageKingston Educational Institute: Ratio Analysisdhimanbasu1975No ratings yet

- Fem CareDocument16 pagesFem Careapi-3702531No ratings yet

- Larsen & Toubro LTDocument21 pagesLarsen & Toubro LTakshay BhiseNo ratings yet

- Ratios Ispat Industries Limited JSW Steel Limited SharestatisticsDocument7 pagesRatios Ispat Industries Limited JSW Steel Limited SharestatisticsAbhishek DhanukaNo ratings yet

- Acara 3Document3 pagesAcara 3Amrana AnaNo ratings yet

- Mahindra & MahindraDocument11 pagesMahindra & Mahindramohitchordiya74No ratings yet

- Mahindra Ratio Sesha SirDocument9 pagesMahindra Ratio Sesha SirAscharya DebasishNo ratings yet

- Hathway CableDocument12 pagesHathway CableFIN GYAANNo ratings yet

- PUBLIC SECTOR BANKS Consolidated Balance SheetsDocument2 pagesPUBLIC SECTOR BANKS Consolidated Balance SheetsJogenderNo ratings yet

- FM Varsity Main-Model Chapter-4Document8 pagesFM Varsity Main-Model Chapter-4AnasNo ratings yet

- I Am Sharing 'Vitta Hackathon 2023 PPT' With YouDocument34 pagesI Am Sharing 'Vitta Hackathon 2023 PPT' With YouRoin HiraniNo ratings yet

- AFM Project-Team D With SOPL CompletedDocument26 pagesAFM Project-Team D With SOPL Completednilesh.das22hNo ratings yet

- Abridged Statement - Sheet1 - 2Document1 pageAbridged Statement - Sheet1 - 2KushagraNo ratings yet

- FSA ASSIGNMENT-3 AnchalDocument4 pagesFSA ASSIGNMENT-3 AnchalAnchal ChokhaniNo ratings yet

- HDFC Bank Annual Report 2009 10Document137 pagesHDFC Bank Annual Report 2009 10yagneshroyalNo ratings yet

- Company Name Last Historical Date Currency: State Bank of India (SBIN) 31-Mar-19 in Crore INRDocument40 pagesCompany Name Last Historical Date Currency: State Bank of India (SBIN) 31-Mar-19 in Crore INRshivam vermaNo ratings yet

- Trent LTD Ratio Analysis Excel Shivam JhaDocument6 pagesTrent LTD Ratio Analysis Excel Shivam JhaVandit BatlaNo ratings yet

- Balance Sheet of Mahindra and Mahindra LTDDocument32 pagesBalance Sheet of Mahindra and Mahindra LTDPragati AgarwalNo ratings yet

- Venugopal Gopinatha N Nair: Shoppers Stop LimitedDocument2 pagesVenugopal Gopinatha N Nair: Shoppers Stop LimitedAkchikaNo ratings yet

- Amara Raja BatteriesDocument28 pagesAmara Raja Batteriesgaurav khandelwalNo ratings yet

- Dabur India LTD.: Standalone Balance SheetDocument21 pagesDabur India LTD.: Standalone Balance SheetAniketNo ratings yet

- Consolidated Balance Sheet: As at 31st March, 2016Document15 pagesConsolidated Balance Sheet: As at 31st March, 2016Saswata ChoudhuryNo ratings yet

- Daksh Agarwal FSA&BV Project On Ratio Analysis of United BreweriesDocument42 pagesDaksh Agarwal FSA&BV Project On Ratio Analysis of United Breweriesdaksh.agarwal180No ratings yet

- Consolidated Balance Sheet of Cipla - in Rs. Cr.Document7 pagesConsolidated Balance Sheet of Cipla - in Rs. Cr.Neha LalNo ratings yet

- PCBL ValuationDocument6 pagesPCBL ValuationSagar SahaNo ratings yet

- 21 - Rajat Singla - Reliance Industries Ltd.Document51 pages21 - Rajat Singla - Reliance Industries Ltd.rajat_singlaNo ratings yet

- Analysis of Financial StatementsDocument7 pagesAnalysis of Financial StatementsGlen ValereenNo ratings yet

- Foreign Portfolio (Equity & Bond)Document10 pagesForeign Portfolio (Equity & Bond)Ibeh CosmasNo ratings yet

- Year 2013 2014 2015 2016 2017 Latest: CompetitionDocument3 pagesYear 2013 2014 2015 2016 2017 Latest: CompetitionDahagam SaumithNo ratings yet

- Vodafone Idea Limited: Consolidated Balance Sheet of Vodafone For 5 YearsDocument5 pagesVodafone Idea Limited: Consolidated Balance Sheet of Vodafone For 5 YearsDeepak ChaharNo ratings yet

- Income Statement of RaymondsDocument2 pagesIncome Statement of RaymondsShashank PatelNo ratings yet

- Gujarat Mineral Development Corporation Standalone Balance Sheet (In Rs. CR.)Document128 pagesGujarat Mineral Development Corporation Standalone Balance Sheet (In Rs. CR.)Riya ShahNo ratings yet

- Invesment LabDocument16 pagesInvesment Labtapasya khanijouNo ratings yet

- Analysis of 2005.08 HCL TechDocument10 pagesAnalysis of 2005.08 HCL TechsantoshviswaNo ratings yet

- Dealer Scrap Price List-23rdMar22-EXIDEDocument1 pageDealer Scrap Price List-23rdMar22-EXIDEShubham SinghNo ratings yet

- Formula Perhitungan SP 09 BLP - R1Document50 pagesFormula Perhitungan SP 09 BLP - R1Imam GozaliNo ratings yet

- United Breweries Holdings LimitedDocument7 pagesUnited Breweries Holdings Limitedsalini sasiNo ratings yet

- SUNDARAM CLAYTONDocument19 pagesSUNDARAM CLAYTONELIF KOTADIYANo ratings yet

- Asian Paints DCF ValuationDocument64 pagesAsian Paints DCF Valuationsanket patilNo ratings yet

- UltraTech Financial Statement - Ratio AnalysisDocument11 pagesUltraTech Financial Statement - Ratio AnalysisYen HoangNo ratings yet

- Trailing QTR ResultsDocument1 pageTrailing QTR ResultsbhuvaneshkmrsNo ratings yet

- Jil + Jpil: GeneratorsDocument4 pagesJil + Jpil: GeneratorsAamirMalikNo ratings yet

- Financial ModelDocument64 pagesFinancial ModelPawni GoyalNo ratings yet

- Bombay DyeingDocument3 pagesBombay DyeingJinal_Punjani_5573No ratings yet

- Ten Years Performance For The Year 2006-07Document1 pageTen Years Performance For The Year 2006-07api-3795636No ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Fundamentals of Drilling Engineering: MCQs and Workout Examples for Beginners and EngineersFrom EverandFundamentals of Drilling Engineering: MCQs and Workout Examples for Beginners and EngineersNo ratings yet

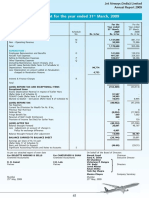

- Jet Airways 2015, ImprovementDocument1 pageJet Airways 2015, ImprovementRanjan DasguptaNo ratings yet

- Profit and Loss Account For The Year Ended 31 March, 2009: ST STDocument2 pagesProfit and Loss Account For The Year Ended 31 March, 2009: ST STRanjan DasguptaNo ratings yet

- Indas 2Document28 pagesIndas 2Ranjan DasguptaNo ratings yet

- Balance Sheet: As at March 31, 2017Document2 pagesBalance Sheet: As at March 31, 2017Ranjan DasguptaNo ratings yet

- VSF UEq JQZXQ PRG ECVr Iohpu X4 A ZTTBo 7 ZIq DJ U9 BF 0Document42 pagesVSF UEq JQZXQ PRG ECVr Iohpu X4 A ZTTBo 7 ZIq DJ U9 BF 0Nikhil PahariaNo ratings yet

- Iso 12151 5 2007Document9 pagesIso 12151 5 2007Jackson PhinniNo ratings yet

- OK Tubrod 15.14Document1 pageOK Tubrod 15.14Tiberiu MunteanuNo ratings yet

- Catalogue Circular Connectors 2006: Gimota Ag: SwitzerlandDocument162 pagesCatalogue Circular Connectors 2006: Gimota Ag: SwitzerlandAndreas HausbergerNo ratings yet

- Epiroc. Presentation - enDocument23 pagesEpiroc. Presentation - enد.محمد العصارNo ratings yet

- Location, Facilities and Capacity PlanningDocument6 pagesLocation, Facilities and Capacity PlanningharabassNo ratings yet

- Index: Stock Management SystemDocument22 pagesIndex: Stock Management SystemSharad Purohit0% (1)

- Ubeam LawsuitDocument28 pagesUbeam LawsuitRebeccaBorisonNo ratings yet

- ICCCVo LIIDocument430 pagesICCCVo LIIBharat JainNo ratings yet

- Brand Observation Portfolio-Cadbury DairymilkDocument33 pagesBrand Observation Portfolio-Cadbury Dairymilkjanedoh100% (2)

- Buyer Persona - HubSpotDocument18 pagesBuyer Persona - HubSpotTushar ShodwaniNo ratings yet

- 2021 BC - Chapter 13.2 - Writing Cover Letter & Building Linkedin ProfileDocument30 pages2021 BC - Chapter 13.2 - Writing Cover Letter & Building Linkedin ProfileKhánh NgọcNo ratings yet

- Surface Vehicle Recommended Practice: Vehicle Identification Number SystemsDocument6 pagesSurface Vehicle Recommended Practice: Vehicle Identification Number SystemsGM MaquinariaNo ratings yet

- Mis Final ReportDocument21 pagesMis Final Reportmuhammadsaadkhan50% (4)

- Project Paytm IPODocument35 pagesProject Paytm IPOnaina karraNo ratings yet

- Simulation and Training For Lean ImplementationDocument14 pagesSimulation and Training For Lean ImplementationIvica KorenNo ratings yet

- 1137-19-TEO-004 Rev02 Work Excecution PlanDocument40 pages1137-19-TEO-004 Rev02 Work Excecution PlanrichardykeNo ratings yet

- Affidavit of Non Identity Form MinnesotaDocument13 pagesAffidavit of Non Identity Form MinnesotaBobNo ratings yet

- RFP Final Wosusokas & Aattachment 04052021Document167 pagesRFP Final Wosusokas & Aattachment 04052021Yodya Engineering100% (1)

- Internship CompaniesDocument22 pagesInternship CompaniesKhalil FanousNo ratings yet

- Unit 2: SAP S/4HANA - Finance EssentialsDocument23 pagesUnit 2: SAP S/4HANA - Finance Essentialszulfiqar26100% (1)

- Cipla Q3FY23 Press ReleaseDocument4 pagesCipla Q3FY23 Press ReleaseMantu HugarNo ratings yet

- 1 Perspective: As Shown " Proposed One-Storey Water Refilling Station " AR-01Document1 page1 Perspective: As Shown " Proposed One-Storey Water Refilling Station " AR-01Jotham CamposanoNo ratings yet

- SBP AssignmentDocument4 pagesSBP AssignmentNawaal NazimNo ratings yet

- SB Order No 23 2021 With Form No 12Document5 pagesSB Order No 23 2021 With Form No 127132 Saumya SinghNo ratings yet

- Prashant Shah Trading The MarketsDocument475 pagesPrashant Shah Trading The Marketsramana_60No ratings yet

- C2021.23 Supply Install & Commissioning of 09nos Containerised Plant (EBid)Document105 pagesC2021.23 Supply Install & Commissioning of 09nos Containerised Plant (EBid)LEED Sales & Marketing-1No ratings yet

- Bahauddin Zakariya University Multan, PakistanDocument3 pagesBahauddin Zakariya University Multan, PakistansohaibNo ratings yet

- Chapter 7 - Trade and Investment EnvironmentDocument7 pagesChapter 7 - Trade and Investment EnvironmentMa. Cristel Rovi RibucanNo ratings yet

- Project Pt.2 - OPTP CustomersDocument5 pagesProject Pt.2 - OPTP CustomersNaveed SheikhNo ratings yet