Professional Documents

Culture Documents

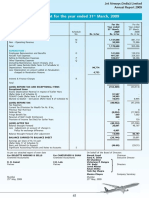

Jet Airways 2015, Improvement

Uploaded by

Ranjan DasguptaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jet Airways 2015, Improvement

Uploaded by

Ranjan DasguptaCopyright:

Available Formats

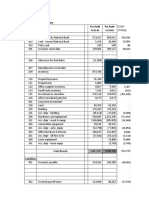

12.

Tangible Assets

(` in lakhs)

Nature of Assets Gross Block (At Cost / Valuation) Depreciation Impairment Net Block

As at 1st Additions / Deductions / As at 31st As at 1st Retained Additions / Deductions / As at As at 31st As at 31st As at 31st

April, 2014 Adjustments Adjustments March, April, Earnings Adjustments Adjustments 31st March, 2015 March, March,

during the during the 2015 2014 (Refer note during the during the March, [Refer note 2015 2014

year year 4 below) year year 2015 3(i) below]

Owned Tangible Assets

Freehold Land 32 - - 32 - - - - - - 32 32

Plant and Machinery 753 - 2 751 274 - 65 1 338 - 413 479

Furniture and Fixtures 3,261 129 59 3,331 1,754 103 446 46 2,257 - 1,074 1,507

Electrical Fittings 2,359 66 103 2,322 860 166 467 77 1,416 - 906 1,499

Data Processing Equipments 7,730 1,134 442 8,422 6,861 129 707 437 7,260 - 1,162 869

Office Equipment 4,404 84 69 4,419 1,986 2,111 156 68 4,185 - 234 2,418

Ground Support Equipment 7,045 570 113 7,502 3,271 307 836 108 4,306 - 3,196 3,774

Vehicles 465 - 26 439 275 31 47 23 330 - 109 190

Ground Support Vehicles 7,301 783 79 8,005 5,108 14 894 79 5,937 - 2,068 2,193

Simulators 21,455 - 514 20,941 9,889 - 1,836 375 11,350 - 9,591 11,566

Aircraft and Spare Engines (Narrow 175,242 162,225 157,322 180,145 69,069 - 8,566 3 77,632 - 102,513 106,173

Body-

Refer note 1 below)

Leased Assets

Leasehold Land 193,001 - - 193,001 14,113 - 1,015 - 15,128 112,920 64,953 65,968

Aircraft (Narrow Body- 23,180 125 - 23,305 12,822 - 1,098 - 13,920 - 9,385 10,358

Refer note 1 below)

Aircraft (Wide Body) 1,098,077 28,984 - 1,127,061 355,960 - 55,731 - 411,691 - 715,370 742,117

Improvement on Leased Aircraft 18,080 1,236 - 19,316 6,886 - 2,109 - 8,995 - 10,321 11,194

Improvement on Leased Property 6,051 199 - 6,250 5,442 - 291 - 5,733 - 517 609

TOTAL 1,568,436 195,535 158,729 1,605,242 494,570 2,861 74,264 1,217 570,478 112,920 921,844 960,946

Previous Year 1,609,871 79,203 120,638 1,568,436 452,556 87,238 45,224 494,570 112,920 960,946

1) All the Aircraft (except one) are acquired on Hire-purchase / Finance Lease basis. Such Aircraft are charged by the Hirers / Lessors against the financing arrangements obtained by them.

2) Additions to Aircraft during the year include ` 23,292 lakhs [Net loss] (Previous Year ` 72,827 lakhs (Net Loss)) on account of Exchange Loss / (Gain) (Refer note 30).

3) Details of Revaluation

i. The Company had revalued the leasehold land taken from MMRDA situated at Bandra Kurla Complex on 31st March, 2008. The Company reassessed the value of the land together with its entitled share

of the building based on the project cost estimates as of 31st March, 2014 and as of 31st March, 2015 provided by Godrej Buildcon Private Limited, the Developer and an amount of ` 29,916 lakhs and

` Nil have been adjusted as on 31st March, 2014 and 31st March, 2015 respectively against the Revaluation Reserve. The cumulative amount adjusted against the revaluation reserve is ` 112,920 lakhs

as on 31st March 2015.

ii. Narrow Body Aircraft were revalued on 31st March, 2008 with reference to the then current market prices; amount added on revaluation was ` 118,133 lakhs; the revalued amount substituted for book

value on 31st March, 2008 was ` 346,396 lakhs. Revalued amount as on 31st March, 2015 was ` 6,624 lakhs (Previous Year ` 6,624 lakhs).

4) Pursuant to the Company adopting the useful life of fixed assets as indicated in part C of Schedule II of the Companies Act, 2013, coming in to effect from 1st April, 2014, the depreciation charge for year ended

31st March, 2015 is lower (net) by ` 11,150 lakhs. Further, in respect assets which have completed their useful life as at 1st April, 2014, their carrying value amounting to ` 2,861 lakhs has been adjusted against

Notes to the Financial Statements for the Year Ended 31st March, 2015 (Contd.)

retained earnings.

85

You might also like

- Drilling Fluids Processing HandbookFrom EverandDrilling Fluids Processing HandbookRating: 4.5 out of 5 stars4.5/5 (4)

- HDFC NL-7-operating-expenses-scheduldDocument2 pagesHDFC NL-7-operating-expenses-scheduldSatyamSinghNo ratings yet

- Boeing 7E7 - UV6426-XLS-ENGDocument85 pagesBoeing 7E7 - UV6426-XLS-ENGjk kumarNo ratings yet

- Change Analysis: Balance Sheet AccountsDocument10 pagesChange Analysis: Balance Sheet AccountsIndra HadiNo ratings yet

- Anavar AprilDocument3 pagesAnavar AprilIsna IslamuddinNo ratings yet

- Securex (PVT) LTDDocument2 pagesSecurex (PVT) LTDBiplob K. SannyasiNo ratings yet

- Understanding FSexerciseDocument14 pagesUnderstanding FSexerciseheyzzupNo ratings yet

- Xls031 Xls EngDocument8 pagesXls031 Xls EngLi JishuNo ratings yet

- Account Number Account Name Preliminary: Paje 1Document4 pagesAccount Number Account Name Preliminary: Paje 1Maria Fatima AlambraNo ratings yet

- Fixed AssetsDocument33 pagesFixed AssetsmehboobalamNo ratings yet

- Caso Ceres en ClaseDocument4 pagesCaso Ceres en ClaseAdrian PeranNo ratings yet

- Airasia Financial StatementDocument35 pagesAirasia Financial StatementDyna AzmirNo ratings yet

- ICICI Form-Nl-7-Operating-Expenses-ScheduleDocument2 pagesICICI Form-Nl-7-Operating-Expenses-ScheduleSatyamSinghNo ratings yet

- Pakistan State Oil Company Limited (Pso)Document6 pagesPakistan State Oil Company Limited (Pso)Maaz HanifNo ratings yet

- Fixed Asset 31122022Document1,406 pagesFixed Asset 31122022kelsykalokiNo ratings yet

- Caso Ceres en ClaseDocument6 pagesCaso Ceres en ClaseYerly DescanseNo ratings yet

- Notes To The Financial Statements: 3. Property, Plant and EquipmentDocument4 pagesNotes To The Financial Statements: 3. Property, Plant and EquipmentBagus Hutama PutraNo ratings yet

- VODA Quarterly ResultsDocument4 pagesVODA Quarterly ResultsIbrahim ChambusoNo ratings yet

- Electricity: Commodity BalancesDocument5 pagesElectricity: Commodity BalancesWILLIAM FRANCISCO MENDIETA BENAVIDESNo ratings yet

- 4019 XLS EngDocument13 pages4019 XLS EngAnonymous 1997No ratings yet

- ASP - PNL2022 - MAY 2023-RevisedDocument47 pagesASP - PNL2022 - MAY 2023-RevisedIan Jasper NamocNo ratings yet

- Profit & Loss Accounts: For The Month Ended January 31, 2017Document2 pagesProfit & Loss Accounts: For The Month Ended January 31, 2017farsi786No ratings yet

- Ceres Gardening Company - Spreadsheet For StudentsDocument1 pageCeres Gardening Company - Spreadsheet For Studentsandres felipe restrepo arango0% (1)

- 4019 XLS EngDocument4 pages4019 XLS EngAnonymous 1997No ratings yet

- A. Change Analysis Apple Blossom Cologne Company Working Trial Balance - Balance Sheet 12-31-03 Per Audit 12-31-02 Per Books 12-31-03 Dollar ChangeDocument6 pagesA. Change Analysis Apple Blossom Cologne Company Working Trial Balance - Balance Sheet 12-31-03 Per Audit 12-31-02 Per Books 12-31-03 Dollar ChangeLintang UtomoNo ratings yet

- Etiqa Family Takaful Berhad (ENG)Document12 pagesEtiqa Family Takaful Berhad (ENG)Panji RaharjoNo ratings yet

- 3rd Quarter Report 2018Document1 page3rd Quarter Report 2018Tanzir HasanNo ratings yet

- Budget 2019-20Document21 pagesBudget 2019-20Pranati ReleNo ratings yet

- AnnualReport2016 - en 81 120 PDFDocument40 pagesAnnualReport2016 - en 81 120 PDFminandiego29No ratings yet

- Depreciation Table - PPEDocument4 pagesDepreciation Table - PPEgoerginamarquezNo ratings yet

- Depreciation Table - PPE and F&FDocument4 pagesDepreciation Table - PPE and F&FgoerginamarquezNo ratings yet

- AirAsia Group BerhadDocument6 pagesAirAsia Group BerhadMUHAMMAD SYAFIQ SYAZWAN BIN ZAKARIA STUDENTNo ratings yet

- 4.3 Financial Analysis 4.3.1 Financial Statements For The Year Ended December 31, 2014Document8 pages4.3 Financial Analysis 4.3.1 Financial Statements For The Year Ended December 31, 2014mustiNo ratings yet

- LVB Audited Financials 31032019Document9 pagesLVB Audited Financials 31032019Maran VeeraNo ratings yet

- Sharif Feed Mills (PVT.) Limited: Disposal/ AdjustmentsDocument9 pagesSharif Feed Mills (PVT.) Limited: Disposal/ AdjustmentsRashid AzeemNo ratings yet

- Bloody Practice !!Document4 pagesBloody Practice !!Hardesh Kumar HiraNo ratings yet

- "Study of Fixed Assets Module and Its Integration in Erp": Kec International Ltd. !!Document22 pages"Study of Fixed Assets Module and Its Integration in Erp": Kec International Ltd. !!rohitfafatNo ratings yet

- CFR HUBCO CalculationsDocument9 pagesCFR HUBCO CalculationsMaira SalmanNo ratings yet

- (RDMP) BQ Piping Smp3 170601 Iti Rev0Document365 pages(RDMP) BQ Piping Smp3 170601 Iti Rev0Fahmy FlipNo ratings yet

- JMA 2021 BudgetDocument8 pagesJMA 2021 BudgetJerryJoshuaDiazNo ratings yet

- Heidelbergcement Annual Report 2016Document308 pagesHeidelbergcement Annual Report 2016someshNo ratings yet

- LAC2023Q3MDAandFinancials 1Document41 pagesLAC2023Q3MDAandFinancials 1sabrinawang0405No ratings yet

- Zeal Pak Cement Factory Ltd. Project Feasibility StudyDocument38 pagesZeal Pak Cement Factory Ltd. Project Feasibility StudyIrfan NasrullahNo ratings yet

- Ceres Gardening CalculationsDocument9 pagesCeres Gardening CalculationsJuliana Marques0% (2)

- TeslaDocument5 pagesTeslaRajib ChatterjeeNo ratings yet

- UBL Annual Report 2018-103Document1 pageUBL Annual Report 2018-103IFRS LabNo ratings yet

- Trade and PaymentsDocument17 pagesTrade and PaymentsmazamniaziNo ratings yet

- MFF 2021-2027 Breakdown Current PricesDocument2 pagesMFF 2021-2027 Breakdown Current PricesCaelum DsfmnnNo ratings yet

- Part D.2-Vertical AnalysisDocument32 pagesPart D.2-Vertical AnalysisQuendrick Surban100% (1)

- Hanson Annual ReportDocument296 pagesHanson Annual ReportmohanesenNo ratings yet

- Ifrs 16 Example Lease Rent Free PeriodDocument4 pagesIfrs 16 Example Lease Rent Free Periodaldwin006No ratings yet

- (Rs. in '000s) Year Ended March 31, 2010 Year Ended March 31, 2009Document27 pages(Rs. in '000s) Year Ended March 31, 2010 Year Ended March 31, 2009Shankar NathNo ratings yet

- Petron Corp - Financial Analysis From 2014 - 2018Document4 pagesPetron Corp - Financial Analysis From 2014 - 2018Neil Nadua100% (1)

- CIA DraftDocument10 pagesCIA DraftJohnsey RoyNo ratings yet

- Financials VTL FinalDocument19 pagesFinancials VTL Finalmuhammadasif961No ratings yet

- Tesla Inc ModelDocument57 pagesTesla Inc ModelRachel GreeneNo ratings yet

- Airasia Quarter ReportDocument34 pagesAirasia Quarter ReportChee Meng TeowNo ratings yet

- 2.0 MR01 - Jan 2015 Total Project Cost - Overall Summary WO Fee FOREX Below TotalDocument1 page2.0 MR01 - Jan 2015 Total Project Cost - Overall Summary WO Fee FOREX Below TotalWilmer Lapa QuispeNo ratings yet

- Daily Report 04 February 2011Document5 pagesDaily Report 04 February 2011abhijit_athalyeNo ratings yet

- IISER BSMS Curriculum 2021Document162 pagesIISER BSMS Curriculum 2021ADWYTH GNAIRNo ratings yet

- Spice Jet 2015 - IGAAPDocument1 pageSpice Jet 2015 - IGAAPRanjan DasguptaNo ratings yet

- Profit and Loss Account For The Year Ended 31 March, 2009: ST STDocument2 pagesProfit and Loss Account For The Year Ended 31 March, 2009: ST STRanjan DasguptaNo ratings yet

- Indas 2Document28 pagesIndas 2Ranjan DasguptaNo ratings yet

- Balance Sheet: As at March 31, 2017Document2 pagesBalance Sheet: As at March 31, 2017Ranjan DasguptaNo ratings yet

- FAR - Learning Module - EDITEDDocument37 pagesFAR - Learning Module - EDITEDSire John LloydNo ratings yet

- Capital Structure PlanningDocument25 pagesCapital Structure PlanningSumit MahajanNo ratings yet

- Satyam Fiasco Corporate Governance FailuDocument11 pagesSatyam Fiasco Corporate Governance FailuRam IyerNo ratings yet

- Tranche II Prospectus-201905091526497973703 PDFDocument193 pagesTranche II Prospectus-201905091526497973703 PDFAnil GuptaNo ratings yet

- Financial Accounting Weekly PlanDocument2 pagesFinancial Accounting Weekly PlanASMARA HABIBNo ratings yet

- Comercial BanksDocument21 pagesComercial BanksSanto AntonyNo ratings yet

- UltraTech Cement LimitedDocument172 pagesUltraTech Cement LimitedBelim Imtiyaz100% (1)

- Dental Clinic AnswerDocument16 pagesDental Clinic AnswerMaria Licuanan100% (1)

- Start-Up Guide - Networks OnlineDocument74 pagesStart-Up Guide - Networks OnlineAmina VejselovićNo ratings yet

- Bad Debt and Provision For Bad Debt/: Dou B T F U L de B T SDocument7 pagesBad Debt and Provision For Bad Debt/: Dou B T F U L de B T SAejaz MohamedNo ratings yet

- Mid Year Outlook Report 2023Document83 pagesMid Year Outlook Report 2023Aa XhrjNo ratings yet

- Company Detailed Report - Pakistan International Bulk Terminal LimitedDocument13 pagesCompany Detailed Report - Pakistan International Bulk Terminal LimitedAbdullah UmerNo ratings yet

- Accounting Changes CH 22Document62 pagesAccounting Changes CH 22chloekim03No ratings yet

- Investment BankingDocument24 pagesInvestment BankingLakshmiNo ratings yet

- A Comparative Financial Analysis of Commercial Banks in NepalDocument122 pagesA Comparative Financial Analysis of Commercial Banks in NepalPushpa Shree PandeyNo ratings yet

- Gurkanwal Kaur Roll No. 232 Section D B.com LLBDocument11 pagesGurkanwal Kaur Roll No. 232 Section D B.com LLBBani AroraNo ratings yet

- Accounting What The Numbers Mean Marshall 10th Edition Test BankDocument27 pagesAccounting What The Numbers Mean Marshall 10th Edition Test BankEricaPhillipsaszpc100% (37)

- AFR End of Semester Examination 2022-2023 - SUGGESTED SOLUTIONS AND MARKING GUIDEDocument17 pagesAFR End of Semester Examination 2022-2023 - SUGGESTED SOLUTIONS AND MARKING GUIDESebastian MlingwaNo ratings yet

- Conceptual Framework & AcctgDocument30 pagesConceptual Framework & AcctgCasey Collera MedianaNo ratings yet

- SSRN Id2206253Document28 pagesSSRN Id2206253Alisha BhatnagarNo ratings yet

- Chapter 7: Intercompany Profit Transactions - Bonds: Advanced AccountingDocument14 pagesChapter 7: Intercompany Profit Transactions - Bonds: Advanced AccountingDivya rezkyNo ratings yet

- Merger and Acquisition of Banks": Bank Lending ProjectDocument15 pagesMerger and Acquisition of Banks": Bank Lending ProjectkaranbillaNo ratings yet

- 14 Working Capital Management 2020Document6 pages14 Working Capital Management 2020JemNo ratings yet

- Mangal V Jha: G - Wing Samanvay Park Maintenance StatementDocument6 pagesMangal V Jha: G - Wing Samanvay Park Maintenance StatementNew GmailNo ratings yet

- Intro To Accounting - One Credit Assignment ContdDocument8 pagesIntro To Accounting - One Credit Assignment Contdapi-342895963No ratings yet

- 10-Column Worksheet FormDocument1 page10-Column Worksheet Formobrie diazNo ratings yet

- Neraca Saldo B SiwiDocument2 pagesNeraca Saldo B SiwiSiwi Tri UtamiNo ratings yet

- Pensonic Ar2021 BursaDocument152 pagesPensonic Ar2021 BursaHakimie RosleNo ratings yet

- Types of Major AccountsDocument27 pagesTypes of Major AccountsLala dela Cruz - FetizananNo ratings yet

- Intangible Assets Problems and Solutions2Document22 pagesIntangible Assets Problems and Solutions2Destiny LazarteNo ratings yet