Professional Documents

Culture Documents

Cheeklist

Uploaded by

Nahum DaichaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cheeklist

Uploaded by

Nahum DaichaCopyright:

Available Formats

STBC

Department of accounting and finance

P. by Genanew workie

Individual assignment cheek list

Cheeklist

Assignment will be done by individual

Target group 2rd year accounting and finance student ( evening )

A maximum mark 20%

All are ready to present.

Submission date June 1/914

Good hand writing will have value, this may not restrict writing in computer

1. What does mean financial management?

2. How financial management link with other disciplines? Express with example?

3. Why you learn financial management?

4. What is the objective of financial management?

5. Write limitation of profit maximization?

6. Why we make ratio analysis?

7. List and discuss types of ratio analysis?

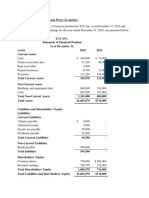

Abc Company

Balance sheet

December 31, 2014

Assets

Current assets

Cash 360,000

Marketable security 70,000

Accounts receivable 500,000

Inventories 290,000

Total current assets 1,220,000

Fixed assets 4,670,000

Less: accumulated depreciation 2,290,000

Net fixed assets 2,380,000

Total assets 3,600,000

Liabilities and stockholders equity

Current liabilities

Accounts payable 380,000

Notes payable 80,000

Accruals 160,000

Total current liabilities 620,000

Long term debts 1,020,000

Total liabilities 1,640,000

Stockholders equity

Preferred stock 200,000

Common stock 620,000

Retained earnings 1,140,000

Total stockholders equity 1,960,000

Total liabilities and stockholders equity 3,600,000

Abc company

Income statement

For the year ended on Dec. 31, 2014

Sales 3,200,000

Less: sales returns 130,000

Net sales 3,070,000

Less: cost of goods sold 2,090,000

Gross profit 980,000

Less: operating expenses 570,000

Operating profits 410,000

Less: interest expense 90,000

Net profit before taxes 320,000

Less: taxes 90,000

Net Profit after taxes 230,000

Required

1. Determine the liquidity position of the firm (current ratio, acid test ratio and cash ratio) and intrprate the result?

2. Compute inventory turnover, average age of inventory, account receivable turn over, average collection period,

fixed assets turn over and total assets turnover ratio and interpret the result?

3. Calculate the leverage ratio analysis and interpret based on computed result?

You might also like

- Radio Drama (Rubric)Document1 pageRadio Drama (Rubric)Queenie BalitaanNo ratings yet

- Raiseyourvoice SFDocument26 pagesRaiseyourvoice SFAttila Engin100% (1)

- CHAPTER TWO FM Mgt-1Document18 pagesCHAPTER TWO FM Mgt-1Belex Man100% (1)

- ENVIRONMENTAL HEALTH (Compiled) PDFDocument119 pagesENVIRONMENTAL HEALTH (Compiled) PDFHarlyn PajonillaNo ratings yet

- Financial Ratios Midterm ExamDocument4 pagesFinancial Ratios Midterm Examzavria100% (1)

- Pharmacology Ain Shams 123 - Compress 1Document552 pagesPharmacology Ain Shams 123 - Compress 1ahmed hoty100% (1)

- Mid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121Document10 pagesMid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121rabab balochNo ratings yet

- D41P-6 Kepb002901Document387 pagesD41P-6 Kepb002901LuzioNeto100% (1)

- Financial Management ExercisesDocument6 pagesFinancial Management ExercisesLeanne Quinto100% (1)

- Addtional Cash Flow Problems and SolutionsDocument7 pagesAddtional Cash Flow Problems and SolutionsHossein ParvardehNo ratings yet

- Module 010 Financial Statements and The Ratio AnalysisDocument9 pagesModule 010 Financial Statements and The Ratio AnalysisHo Ming LamNo ratings yet

- Mayes 8e CH03 Problem SetDocument8 pagesMayes 8e CH03 Problem SetBunga Mega WangiNo ratings yet

- CH03 ProblemDocument3 pagesCH03 Problemtrangtran01010No ratings yet

- Financial Ratio Questions 1Document7 pagesFinancial Ratio Questions 1Afnan QusyairiNo ratings yet

- Accounting AssignmentDocument2 pagesAccounting Assignmentsadif sayeed100% (2)

- Management Accounting Final ExamDocument4 pagesManagement Accounting Final Examacctg2012No ratings yet

- Baker Corporation Financial Statements and RatiosDocument1 pageBaker Corporation Financial Statements and RatiosNextdoor CosplayerNo ratings yet

- Fall FIN 254.10 Mid QuestionsDocument2 pagesFall FIN 254.10 Mid QuestionsShariar NehalNo ratings yet

- Accounting Questions Cover Depreciation, Bank Reconciliation, Cash FlowDocument2 pagesAccounting Questions Cover Depreciation, Bank Reconciliation, Cash FlowFaiaz ShahreearNo ratings yet

- Solve Cash Flow ProblemsDocument3 pagesSolve Cash Flow ProblemsMichelle ManuelNo ratings yet

- ACCT 213 Exercise (Chapter 18) STDocument5 pagesACCT 213 Exercise (Chapter 18) STMohammedNo ratings yet

- Advance Financia AnalysesDocument35 pagesAdvance Financia AnalysesXsellence AccountsNo ratings yet

- Chapter 2 FM For BMDocument22 pagesChapter 2 FM For BMMeron TemisNo ratings yet

- CH 13Document4 pagesCH 13Sri HimajaNo ratings yet

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision QuestionskelvinmunashenyamutumbaNo ratings yet

- University of Business& Technology: Worksheet # 4Document3 pagesUniversity of Business& Technology: Worksheet # 4nikowawaNo ratings yet

- FABM2 W6 No Answer KeyDocument4 pagesFABM2 W6 No Answer KeyClintwest Caliste Autida BartinaNo ratings yet

- FINANCIAL RATIO ANALYSISDocument8 pagesFINANCIAL RATIO ANALYSISFATIMAH ZAHRA BINTI ABDUL HADI KAMELNo ratings yet

- Managerial Finance - Midterm ExamDocument4 pagesManagerial Finance - Midterm ExamNerissaNo ratings yet

- Individual AssignmentDocument5 pagesIndividual AssignmentMuhammad Faiyam Shafiq 1911819630No ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- Prelims - Ratio AnalysisDocument3 pagesPrelims - Ratio AnalysisMarinel Mae ChicaNo ratings yet

- Finman FinalsDocument4 pagesFinman FinalsDianarose RioNo ratings yet

- Financial Ratio AnalysisDocument34 pagesFinancial Ratio AnalysisamahaktNo ratings yet

- CH-2 Advanced Financial MGTDocument60 pagesCH-2 Advanced Financial MGTMusxii TemamNo ratings yet

- FINMAN MIDTERMS FinalDocument5 pagesFINMAN MIDTERMS FinalJennifer RasonabeNo ratings yet

- Unit 2 Financial AnalysisDocument12 pagesUnit 2 Financial AnalysisGizaw BelayNo ratings yet

- Indian Institute of Management Rohtak: End Term ExaminationDocument14 pagesIndian Institute of Management Rohtak: End Term ExaminationaaNo ratings yet

- Sadecki Corp ratios reveal improved profitabilityDocument9 pagesSadecki Corp ratios reveal improved profitabilitymohitgaba19No ratings yet

- Financial Strength AnalysisDocument15 pagesFinancial Strength AnalysisMuhammad AsimNo ratings yet

- TugasDocument3 pagesTugasLina EkaNo ratings yet

- Midterm Fin 254 Summer 2020Document5 pagesMidterm Fin 254 Summer 2020Salauddin Imran MumitNo ratings yet

- Problem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowDocument2 pagesProblem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowChristy YouNo ratings yet

- The Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceDocument3 pagesThe Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceAbdullah Tousif MajumderNo ratings yet

- AEG Enterprises Financial AnalysisDocument5 pagesAEG Enterprises Financial AnalysisGing freexNo ratings yet

- CSS Ratio AnalysisDocument9 pagesCSS Ratio AnalysisMasood Ahmad AadamNo ratings yet

- WEEK 4 FINANCIAL STATEMENT ANALYSIS Part 2Document42 pagesWEEK 4 FINANCIAL STATEMENT ANALYSIS Part 2GIRLNo ratings yet

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- FS Analysis Horizontal Vertical ExerciseDocument5 pagesFS Analysis Horizontal Vertical ExerciseCarla Noreen CasianoNo ratings yet

- Republic CompanyDocument2 pagesRepublic CompanyLy CostalesNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Template - MIDTERM EXAM INTERMEDIATE 1Document7 pagesTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuNo ratings yet

- Quiz FMDocument3 pagesQuiz FMMarcos Jose AveNo ratings yet

- Finance Assignment File 1 SolvedDocument5 pagesFinance Assignment File 1 SolvedIQRAsummers 2021No ratings yet

- FABM2-Chapter4 NDocument10 pagesFABM2-Chapter4 NArchie CampomanesNo ratings yet

- Practice Exercise Ch18Document3 pagesPractice Exercise Ch18ngocanhhlee.11No ratings yet

- Accounts DDocument13 pagesAccounts DRahit MitraNo ratings yet

- Copy 1 ACC 223 Practice Problems for Financial Ratio AnalysisDocument3 pagesCopy 1 ACC 223 Practice Problems for Financial Ratio AnalysisGiane Bernard PunayanNo ratings yet

- Act201 AssignmentDocument4 pagesAct201 Assignmentmahmud100% (1)

- Group Assignment 2Document2 pagesGroup Assignment 2sebsibeboki01No ratings yet

- Chapter Two HandoutDocument24 pagesChapter Two HandoutNati AlexNo ratings yet

- Ratio Analysis Insights for Investors and ManagersDocument7 pagesRatio Analysis Insights for Investors and ManagersAhmad vlogsNo ratings yet

- Chapter 7Document4 pagesChapter 7Aisha AlarimiNo ratings yet

- Assessment Cash PracticeDocument19 pagesAssessment Cash PracticeNahum DaichaNo ratings yet

- Project - Ch-1&ch-2Document37 pagesProject - Ch-1&ch-2Nahum DaichaNo ratings yet

- The Implementation of Systematic Sampling For Behavioural Migration Survey in Klang Valley (Latest)Document8 pagesThe Implementation of Systematic Sampling For Behavioural Migration Survey in Klang Valley (Latest)Nahum DaichaNo ratings yet

- Fim Ug 4Document21 pagesFim Ug 4Nahum DaichaNo ratings yet

- Regulation of The Commercial Banking Sector (CBS)Document8 pagesRegulation of The Commercial Banking Sector (CBS)Nahum DaichaNo ratings yet

- FA II Chapter 1 - 1Document53 pagesFA II Chapter 1 - 1Nahum DaichaNo ratings yet

- Chapter Two Financial Institutions in The Financial System: Saving and Loan Associations (S&LS)Document13 pagesChapter Two Financial Institutions in The Financial System: Saving and Loan Associations (S&LS)Nahum DaichaNo ratings yet

- C.MGT Relevant of Chapter 2 STBCDocument12 pagesC.MGT Relevant of Chapter 2 STBCNahum DaichaNo ratings yet

- Chapter Iii. Master Budget: An Overall Plan: Page 1 of 19Document19 pagesChapter Iii. Master Budget: An Overall Plan: Page 1 of 19Nahum DaichaNo ratings yet

- Bài Tập Phần Project ManagementDocument11 pagesBài Tập Phần Project ManagementhunfgNo ratings yet

- JKSTREGIESDocument59 pagesJKSTREGIESmss_singh_sikarwarNo ratings yet

- St. Anthony College Calapan City Syllabus: Course DescriptionDocument6 pagesSt. Anthony College Calapan City Syllabus: Course DescriptionAce HorladorNo ratings yet

- Is Iso 2692-1992Document24 pagesIs Iso 2692-1992mwasicNo ratings yet

- WISECO 2011 Complete CatalogDocument131 pagesWISECO 2011 Complete CatalogfishuenntNo ratings yet

- Business Judgment Rule and Directors' Duty to Inform in Smith v Van GorkomDocument1 pageBusiness Judgment Rule and Directors' Duty to Inform in Smith v Van GorkomDorothy ParkerNo ratings yet

- T WiZ60Document6 pagesT WiZ60leon liNo ratings yet

- Hunk 150Document2 pagesHunk 150Brayan Torres04No ratings yet

- Sem Iii Sybcom Finacc Mang AccDocument6 pagesSem Iii Sybcom Finacc Mang AccKishori KumariNo ratings yet

- Red Lion Edict-97 - Manual PDFDocument282 pagesRed Lion Edict-97 - Manual PDFnaminalatrukNo ratings yet

- MKTG 2126 - Assignment 3Document2 pagesMKTG 2126 - Assignment 3omar mcintoshNo ratings yet

- Sipmos Power Transistor: BUZ 104LDocument10 pagesSipmos Power Transistor: BUZ 104LAlexsander MeloNo ratings yet

- Bai Tap Bo TroDocument6 pagesBai Tap Bo TroKhiết TrangNo ratings yet

- DataSheet IMA18-10BE1ZC0K 6041793 enDocument8 pagesDataSheet IMA18-10BE1ZC0K 6041793 enRuben Hernandez TrejoNo ratings yet

- Chapter 6 Managing Quality (Sesi 3)Document68 pagesChapter 6 Managing Quality (Sesi 3)Nurmala SariNo ratings yet

- Effect of Upstream Dam Geometry On Peak Discharge During Overtopping Breach in Noncohesive Homogeneous Embankment Dams Implications For Tailings DamsDocument22 pagesEffect of Upstream Dam Geometry On Peak Discharge During Overtopping Breach in Noncohesive Homogeneous Embankment Dams Implications For Tailings DamsHelvecioNo ratings yet

- Top-Down DesignDocument18 pagesTop-Down DesignNguyễn Duy ThôngNo ratings yet

- Computer ViruesDocument19 pagesComputer ViruesMuhammad Adeel AnsariNo ratings yet

- IBM TS2900 Tape Autoloader RBDocument11 pagesIBM TS2900 Tape Autoloader RBLeonNo ratings yet

- Introduction To Drug DiscoveryDocument45 pagesIntroduction To Drug Discoveryachsanuddin100% (5)

- European Journal of Internal MedicineDocument4 pagesEuropean Journal of Internal Medicinesamer battatNo ratings yet

- Batt ChargerDocument2 pagesBatt Chargerdjoko witjaksonoNo ratings yet

- 2iccas2005 Paper 377Document5 pages2iccas2005 Paper 377Cristian BandilaNo ratings yet

- Fellowship in OncotherapeutDocument3 pagesFellowship in OncotherapeutNayan ChaudhariNo ratings yet

- BC Sample Paper-3Document4 pagesBC Sample Paper-3Roshini ANo ratings yet