Professional Documents

Culture Documents

6) Case Study - Asian Paints

6) Case Study - Asian Paints

Uploaded by

Adarsh Unny0 ratings0% found this document useful (0 votes)

7 views2 pagesCase Study Solutions

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCase Study Solutions

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pages6) Case Study - Asian Paints

6) Case Study - Asian Paints

Uploaded by

Adarsh UnnyCase Study Solutions

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

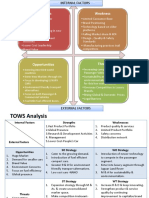

Case Study -

Asian Paints Questions DATA

Story

1) How would IB contribute ROCE - Return on Capital Employed.

Asian Paints International - Set up in

to APL's vision over next 3

1999.

years? Global Paints ROCE - 10 to 20%

Examining Internal Business Division Paint Industry :

2) Which products,

categories and markets to 1500 manufactures.

Fast growth - 23 countries. grow? Decorative and Industrial paints.

Profitable since 2004 but individual 83 Billion in 2007 - Growth rate of 5%.

markets in the red. Rapid gains in emerging markets.

3) How to balance today's Top 10 players - 51% in 2004.

performance with Private Labling a new phenomenon.

IB ROCE <10% (25% DOMESTIC)

tomorrows potential and Major paint manufactures focused on core

segements - Cost advantage to be major

vice versa?

IB will not receive financial subsidies player.

from parent company. Room for smaller players in niche market -

product differentiation to be market leader.

4) How to leverage APLs

Asian Paints History history?

Price based

important.

competition/Brand Equity

New trends for consumers.

1942 - Mumbai

Not capital intensive but working capital

intensive (50% of sales - cost of raw

Market leader since 1967. materials_

1998 Aim - Top 5 in the world.

Expansion to Sri Lanka, JVs, Berger

JV,

Key

Globalization Players

Acquisition of Berger International in

2002.

Jalaj Dani - President

International (Asian Plants

21 subsidaries in 2005. Limited)

Derisking approach to globalization

5) All India Distribution network -

Strategy Competitive Advantage strong relationships, exclusivity

(important in the space)

1) Customer needs identification.

Matrix - Size of economy, Size of Paint

Identify gaps. Grow in segments. All

Market, Nature of Competition and 6) Best talent hired.

price points covered. Higher quality

Investment Potential.

paints. Innovations such as Colour

7) Strong brand equity.

GDP Growth potential of 6%+, limited World tinting system, Helplines,

competition and market that could Home solutions and Kids World.

provide the opportunity for APL to be top

3 in five years. 2) Mainframe computer + satellite.

IT for demand forecasting, inventory

Emerging markets - similar to India, less management and lower working

expensive to buy leading player and no

capital costs.

single MNC across all emerging markets.

Localized manufacturing. 3) Larger scale - distribution,

Growth through JVs. marketing, manufacturing and

Market segementation - leadership sourcing advantages.

markets, growth markets and turnaround

markets. 4) R&D investments.

India

9% growth last decade. 13 to 15% next

decade. Danis Action Plan

IB Structure - Global, Regional and Local. Consolidation plan for IB.

Leverage expertise at global level,

Issues of Micro management.

syngerize operations at regional level and

Global branding.

empower decisions at local level.

Management of indivduals - Future

Leaders

You might also like

- Investment Banking Guide FinalDocument28 pagesInvestment Banking Guide FinalAditya100% (2)

- Asian PaintsDocument28 pagesAsian PaintsBhavani Kanth100% (1)

- Asian Paints PDFDocument36 pagesAsian Paints PDFPreeti AroraNo ratings yet

- Swot AnalysisDocument6 pagesSwot AnalysisPragati1711No ratings yet

- Gann Master Forex Course 13Document54 pagesGann Master Forex Course 13Trader RetailNo ratings yet

- Case Studies On Marketing FinalDocument67 pagesCase Studies On Marketing FinalManish Singh100% (1)

- Ac312, Assignment 1, Dela CruzDocument4 pagesAc312, Assignment 1, Dela CruzChelsea Dela CruzNo ratings yet

- Case Studies On InnovationDocument29 pagesCase Studies On Innovationmshamashirgi100% (1)

- 18-40 Spoilage in Job Costing: 1. What Is The Normal Spoilage Rate?Document4 pages18-40 Spoilage in Job Costing: 1. What Is The Normal Spoilage Rate?Von Andrei Medina100% (1)

- Final Analysis of Paint IndustryDocument54 pagesFinal Analysis of Paint IndustryRishikesh Mishra100% (1)

- BAB 8 STRATEGI INTERNASIONAL NewDocument39 pagesBAB 8 STRATEGI INTERNASIONAL Newangella surya darma100% (3)

- Asian Paints LTD.: International Business Division Presented by Group 1Document20 pagesAsian Paints LTD.: International Business Division Presented by Group 1Divya Prakash SinhaNo ratings yet

- Asian Paints: Mehul RasadiyaDocument45 pagesAsian Paints: Mehul RasadiyaSandeepNo ratings yet

- Relationship Marketing in Asian Paints (India) Limited and Kansai Nerolac Paints LimitedDocument29 pagesRelationship Marketing in Asian Paints (India) Limited and Kansai Nerolac Paints LimitedShiksha AgarwalNo ratings yet

- SWOTDocument8 pagesSWOTassg USMNo ratings yet

- Ambit - Disruption - Vol-1 - Asian PaintsDocument7 pagesAmbit - Disruption - Vol-1 - Asian PaintsamitNo ratings yet

- AsianpaintsDocument14 pagesAsianpaintsNeel DhumalNo ratings yet

- Demb 11: .Assignment Topics For - Business Policy and Strategic Management EXECUTIVE M.B.A, May, 2012Document11 pagesDemb 11: .Assignment Topics For - Business Policy and Strategic Management EXECUTIVE M.B.A, May, 2012Ali SaifyNo ratings yet

- Rajshree Jaiswal A Comparative Study of Advertising Strategies Adopted by Apollo and MRF TyresDocument48 pagesRajshree Jaiswal A Comparative Study of Advertising Strategies Adopted by Apollo and MRF Tyreszainab.siddiquiNo ratings yet

- International Strategy: Pendahuluan/overviewDocument41 pagesInternational Strategy: Pendahuluan/overviewFajar ChrisNo ratings yet

- Apple Inc Presentation: Vanita Them Mary Tebby Gibril SophiaDocument35 pagesApple Inc Presentation: Vanita Them Mary Tebby Gibril Sophiamdi sectionNo ratings yet

- 7 Entry and Competing in Foreign MarketsDocument22 pages7 Entry and Competing in Foreign MarketsVÂN LÊ NGUYỄN NHƯỢCNo ratings yet

- PGP30 Summers AsianPaints RGDocument2 pagesPGP30 Summers AsianPaints RGAbhishek Singh100% (1)

- Entry and Competing in Foreign MarketsDocument21 pagesEntry and Competing in Foreign MarketsArham NawawiNo ratings yet

- Group-3 BM RMDocument41 pagesGroup-3 BM RManjishilpa anjishilpaNo ratings yet

- K N P L (KNPL) : Ansai Erolac Aints TDDocument5 pagesK N P L (KNPL) : Ansai Erolac Aints TDsaran21No ratings yet

- Asian PaintsDocument26 pagesAsian PaintsAjinkya Nikam100% (1)

- Mdi Murshidabad: Role of Produc T in Gaining Sustai Nable Competitive Advantage Sustai Nable Competitive AdvantageDocument34 pagesMdi Murshidabad: Role of Produc T in Gaining Sustai Nable Competitive Advantage Sustai Nable Competitive AdvantageTushar SinghNo ratings yet

- Godrej & Boyce Mfg. Co. LTD.: - Diana Casoni - Sven Walter - Andreas RickenbacherDocument7 pagesGodrej & Boyce Mfg. Co. LTD.: - Diana Casoni - Sven Walter - Andreas RickenbacherStella NovaNo ratings yet

- Tata Motors SWOT TOWS CPM MatrixDocument6 pagesTata Motors SWOT TOWS CPM MatrixTushar Ballabh50% (2)

- Group-3 - Tata Bluescope Case - BWDocument21 pagesGroup-3 - Tata Bluescope Case - BWAnkit Bansal100% (2)

- New Microsoft Office Word DocumentDocument2 pagesNew Microsoft Office Word DocumentSijo JacobNo ratings yet

- Pidilite Industries: A Near-Monopoly With A 'Sticky' Business MoatDocument42 pagesPidilite Industries: A Near-Monopoly With A 'Sticky' Business MoatKaustubh SaksenaNo ratings yet

- Bharat Forge Limited: Presented byDocument14 pagesBharat Forge Limited: Presented byuday245No ratings yet

- Asian Paints - Global Expansion StrategyDocument29 pagesAsian Paints - Global Expansion StrategyshanthichNo ratings yet

- EA PPT IFMR SIBMB AdroitsDocument12 pagesEA PPT IFMR SIBMB AdroitsHomo SapienNo ratings yet

- Consulting 102Document19 pagesConsulting 102Simontika SenNo ratings yet

- Swot Analysis of Asian PaintsDocument4 pagesSwot Analysis of Asian Paintstomar_hariom21No ratings yet

- Asian Paints Final Report (Fundamental)Document20 pagesAsian Paints Final Report (Fundamental)Harushika MittalNo ratings yet

- BE 1 April 20 2022Document16 pagesBE 1 April 20 2022AnandNo ratings yet

- Paint Sector NewDocument14 pagesPaint Sector Newamisharatan202No ratings yet

- Odette Consulting Pepperfry - Com PresentationDocument26 pagesOdette Consulting Pepperfry - Com PresentationJeelNo ratings yet

- IMM Merged SlidesDocument287 pagesIMM Merged SlidesMukul GuptaNo ratings yet

- Global Enterprise and Competition: 66.511.202 Fall 2007 Ashwin Mehta, Visiting FacultyDocument62 pagesGlobal Enterprise and Competition: 66.511.202 Fall 2007 Ashwin Mehta, Visiting FacultyJuha PropertiesNo ratings yet

- Lecture 1Document28 pagesLecture 1sourabh312No ratings yet

- RM - Group 3 - TESCO PLCDocument11 pagesRM - Group 3 - TESCO PLCRishabh SanghaviNo ratings yet

- C&S Final Presentation - Pidilite - Group 1Document9 pagesC&S Final Presentation - Pidilite - Group 1Ashutosh kumarNo ratings yet

- Asianpaintppt 191211182449Document19 pagesAsianpaintppt 191211182449Meena MalcheNo ratings yet

- Tools of Business AnalysisDocument25 pagesTools of Business AnalysisAryan GargNo ratings yet

- Strategy Maruti SuzukiDocument30 pagesStrategy Maruti SuzukiAjith SankaranNo ratings yet

- Rupshi: Founded in 2015Document11 pagesRupshi: Founded in 2015Samrin HassanNo ratings yet

- Chapter 7Document2 pagesChapter 7Alma CoronadoNo ratings yet

- Nirmal Bang Paint Sector Update 010920Document88 pagesNirmal Bang Paint Sector Update 010920Anish AnandNo ratings yet

- Group 8 - Tomorrow's Global Giants - Not The Usual Suspects - GammaDocument7 pagesGroup 8 - Tomorrow's Global Giants - Not The Usual Suspects - GammaAishwarya SekarNo ratings yet

- BRM DS2 Jyotsna 2019023Document1 pageBRM DS2 Jyotsna 2019023Jyotsna MehtaNo ratings yet

- Big Bazaar Case Study 11.07.10Document18 pagesBig Bazaar Case Study 11.07.10Bhawna Gosain0% (1)

- Presentation 1Document19 pagesPresentation 1Hrithik GuptaNo ratings yet

- By: Loy Lobo Aapa Angchekar Priyanka BendaleDocument45 pagesBy: Loy Lobo Aapa Angchekar Priyanka BendaleLoy LoboNo ratings yet

- Optimisation of Supply Chain of Smart ColoursDocument29 pagesOptimisation of Supply Chain of Smart ColoursPooja ShahNo ratings yet

- Model Answer: E-Commerce store launch by Unilever in Sri LankaFrom EverandModel Answer: E-Commerce store launch by Unilever in Sri LankaNo ratings yet

- Model Answer: Launch of a laundry liquid detergent in Sri LankaFrom EverandModel Answer: Launch of a laundry liquid detergent in Sri LankaNo ratings yet

- 12) Case Study - Mrs Fields CookiesDocument2 pages12) Case Study - Mrs Fields CookiesAdarsh UnnyNo ratings yet

- 7) Case Study - INGDocument2 pages7) Case Study - INGAdarsh UnnyNo ratings yet

- Problems SwotDocument2 pagesProblems SwotAdarsh UnnyNo ratings yet

- 1) Case Study - Four VignettesDocument2 pages1) Case Study - Four VignettesAdarsh UnnyNo ratings yet

- (Eng) February Monthly Current Affairs Capsule by Vikas TayaDocument6 pages(Eng) February Monthly Current Affairs Capsule by Vikas TayariyasharmastudiesNo ratings yet

- Pma3143 Chapter 4 Budgeting 0422Document23 pagesPma3143 Chapter 4 Budgeting 0422SYIMINNo ratings yet

- Ch.1 Welcome To The New Normal: 1 Alek Terho-StreckDocument41 pagesCh.1 Welcome To The New Normal: 1 Alek Terho-Streckapi-605949886No ratings yet

- Bulding Better-Cagayan de Oro-2017Document2 pagesBulding Better-Cagayan de Oro-2017N.a. M. TandayagNo ratings yet

- IAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument4 pagesIAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsBagudu Bilal GamboNo ratings yet

- Oil & Gas: Global Salary GUIDE 2013Document18 pagesOil & Gas: Global Salary GUIDE 2013Michael ThaiNo ratings yet

- Review On POJK No. 14.POJK.04.2019 - Baker MckenzieDocument2 pagesReview On POJK No. 14.POJK.04.2019 - Baker MckenzietheresaNo ratings yet

- Business Mathematics Midterm ExamDocument10 pagesBusiness Mathematics Midterm ExamYasmin BeltranNo ratings yet

- This Content Downloaded From 14.139.214.181 On Fri, 10 Jul 2020 12:55:36 UTCDocument9 pagesThis Content Downloaded From 14.139.214.181 On Fri, 10 Jul 2020 12:55:36 UTCAyush PandeyNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument13 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceakhalikNo ratings yet

- Positive and Negative Effect of Globalization in CommunicationDocument17 pagesPositive and Negative Effect of Globalization in CommunicationCarl Alexis SaulanNo ratings yet

- Economic Diplomacy For Development Partnership: Rajendra ShresthaDocument20 pagesEconomic Diplomacy For Development Partnership: Rajendra ShresthaSagar KhadkaNo ratings yet

- Oct2014 EirDocument61 pagesOct2014 Eirnadhiya2007No ratings yet

- 15 Report of The Procurement CommitteeDocument2 pages15 Report of The Procurement CommitteeAwoh DanielNo ratings yet

- Ypf DayDocument15 pagesYpf DayLPONo ratings yet

- Assignment 3: Revised Penalties Under Ra 10951Document14 pagesAssignment 3: Revised Penalties Under Ra 10951jon jonNo ratings yet

- Theoretical Framework of IMPACTS OF INFLATION AMONG MICRO BUSINESSES IN MASINLOC ACADEMIC YEAR 2022Document4 pagesTheoretical Framework of IMPACTS OF INFLATION AMONG MICRO BUSINESSES IN MASINLOC ACADEMIC YEAR 2022John Brad Angelo LacuataNo ratings yet

- Asbini Sitharam - Globalisation Final Exam - QuestionDocument4 pagesAsbini Sitharam - Globalisation Final Exam - QuestionAsbini SitharamNo ratings yet

- Measure of VariationDocument16 pagesMeasure of VariationMayank MajokaNo ratings yet

- Axia Price List (2023)Document1 pageAxia Price List (2023)Aitys OfficeNo ratings yet

- Financial Accounting For Business 2Document5 pagesFinancial Accounting For Business 2ainonlelaNo ratings yet

- Vietnam Macro Monitoring: What'S News?Document5 pagesVietnam Macro Monitoring: What'S News?Nguyễn TriếtNo ratings yet

- PMD Challan From PDFDocument1 pagePMD Challan From PDFGhulam RazaNo ratings yet

- Mishkin - Chapter 5Document35 pagesMishkin - Chapter 5Jeet JainNo ratings yet

- UK Energy in Brief 2021Document52 pagesUK Energy in Brief 2021amirlngNo ratings yet

- AFAR First Preboard May 2023 BatchDocument14 pagesAFAR First Preboard May 2023 BatchRhea Mae CarantoNo ratings yet