Professional Documents

Culture Documents

ATS Active Trader v2.7 Trading System: TELEGRAM Channel

Uploaded by

KPH BaliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ATS Active Trader v2.7 Trading System: TELEGRAM Channel

Uploaded by

KPH BaliCopyright:

Available Formats

Telegram Channel : atstradingstrategies.

com ATS - Daily Stocks Exploration Registrasi :

www.atstradingstrategies.com atsstrategies@gmail.com

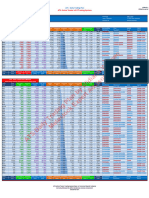

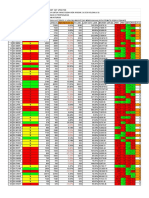

ATS Active Trader v2.7 Trading System

Date : Monday, 25 March 2019 TELEGRAM Channel : atstradingstrategies.com Periodicity : Daily Chart

Source : Metastock Professional Exploration Type : Daily Trading Plan

System : ATS Active Trader v2.7 Expert Advisor Developed by : Widiarto Wibowo

Daily Trading Plan (Bullish)

Tabel saham dengan kecenderungan harga naik

Stocks Close Stop Loss Stop Loss Price Tgt 1 Price Tgt 2 Support Resistance Stochastic Oversold Overbought Price Volatility Stocks Accumulation Directional Market MACD

Code Price (IDR) (%) (IDR) (IDR) (IDR) (IDR) (%) (IDR) (IDR) (IDR) % Code Distribution Price Movement Phase Signal

BUMI 133 132 0.75% 140 144 132 137 30 130 142 7 5.3% BUMI Distribute Upward Sideway Death Cross

SRIL 342 339 0.88% 347 350 339 343 30 339 346 5 1.5% SRIL Accumulate Limited upside Trend Death Cross

TINS 1,295 1,287 0.62% 1,369 1,406 1,287 1,362 33 1,272 1,379 74 5.7% TINS Accumulate Upward Sideway Death Cross

BKSL 112 111 0.89% 117 120 111 116 36 110 116 5 4.5% BKSL Accumulate Upward Sideway Death Cross

HMSP 3,800 3,768 0.84% 3,868 3,902 3,768 3,833 42 3,746 3,833 68 1.8% HMSP Accumulate Upward Sideway Death Cross

BJTM 665 654 1.65% 683 692 654 672 52 640 676 18 2.7% BJTM Accumulate Upward Sideway Death Cross

POWR 950 939 1.16% 975 988 939 963 56 932 957 25 2.6% POWR Accumulate Upward Sideway Death Cross

KRAS 484 481 0.62% 497 504 481 491 60 470 490 13 2.7% KRAS Accumulate Limited upside Trend Golden Cross

PPRE 404 392 2.97% 417 424 392 415 60 383 406 13 3.2% PPRE Accumulate Upward Trend Golden Cross

NIKL 3,140 3,073 2.13% 3,244 3,296 3,073 3,253 62 2,958 3,151 104 3.3% NIKL Distribute Upward Trend Golden Cross

WTON 575 573 0.35% 605 620 573 598 65 547 587 30 5.2% WTON Distribute Limited upside Sideway Death Cross

BJBR 2,060 2,048 0.58% 2,134 2,171 2,048 2,107 66 1,947 2,102 74 3.6% BJBR Accumulate Upward Sideway Golden Cross

WSBP 396 393 0.76% 405 410 393 409 69 382 399 9 2.3% WSBP Distribute Upward Trend Golden Cross

WSKT 1,935 1,922 0.67% 1,981 2,004 1,922 1,985 77 1,867 1,942 46 2.4% WSKT Distribute Limited upside Sideway Golden Cross

MEDC 920 900 2.17% 953 970 900 937 78 865 914 33 3.6% MEDC Accumulate Upward Sideway Death Cross

ADHI 1,595 1,590 0.31% 1,631 1,649 1,590 1,632 80 1,528 1,606 36 2.3% ADHI Accumulate Limited upside Sideway Golden Cross

CPIN 7,750 7,664 1.11% 8,038 8,182 7,664 7,967 80 7,149 7,800 288 3.7% CPIN Accumulate Upward Sideway Golden Cross

SMRA 980 954 2.65% 1,017 1,036 960 1,000 80 876 978 37 3.8% SMRA Accumulate Upward Trend Golden Cross

ACES 1,840 1,813 1.47% 1,885 1,908 1,813 1,913 81 1,773 1,841 45 2.4% ACES Accumulate Upward Trend Golden Cross

ASRI 324 320 1.23% 333 338 320 333 83 305 324 9 2.8% ASRI Accumulate Upward Trend Golden Cross

PTBA 4,100 4,043 1.39% 4,168 4,202 4,043 4,153 83 3,992 4,067 68 1.7% PTBA Accumulate Upward Sideway Golden Cross

WIKA 1,980 1,976 0.20% 2,032 2,058 1,976 2,030 83 1,835 1,984 52 2.6% WIKA Distribute Limited upside Trend Golden Cross

TLKM 3,820 3,790 0.79% 3,884 3,916 3,790 3,840 84 3,724 3,805 64 1.7% TLKM Accumulate Upward Sideway Golden Cross

BBRI 4,060 4,000 1.48% 4,133 4,170 4,000 4,113 85 3,833 4,006 73 1.8% BBRI Distribute Upward Trend Golden Cross

EXCL 2,700 2,665 1.30% 2,811 2,867 2,665 2,760 85 2,415 2,679 111 4.1% EXCL Distribute Limited upside Trend Golden Cross

JSMR 5,325 5,286 0.73% 5,489 5,571 5,286 5,608 85 5,039 5,363 164 3.1% JSMR Accumulate Limited upside Trend Golden Cross

KAEF 3,360 3,185 5.21% 3,523 3,605 3,185 3,667 85 2,990 3,284 163 4.9% KAEF Accumulate Upward Trend Golden Cross

TKIM 11,750 11,647 0.88% 12,194 12,416 11,647 12,050 88 10,151 11,623 444 3.8% TKIM Distribute Limited upside Sideway Golden Cross

PWON 695 684 1.58% 716 727 684 718 89 633 691 21 3.0% PWON Accumulate Upward Trend Golden Cross

CTRA 1,030 970 5.83% 1,067 1,086 970 1,073 90 885 986 37 3.6% CTRA Accumulate Upward Trend Golden Cross

SMGR 13,675 13,374 2.20% 14,090 14,298 13,374 14,108 91 12,607 13,529 415 3.0% SMGR Accumulate Upward Trend Golden Cross

BSDE 1,450 1,427 1.59% 1,490 1,510 1,427 1,477 92 1,330 1,429 40 2.8% BSDE Accumulate Upward Trend Golden Cross

INTP 21,050 20,359 3.28% 21,712 22,043 20,617 21,467 92 19,005 20,656 662 3.1% INTP Accumulate Upward Trend Golden Cross

INDF 7,400 7,275 1.69% 7,568 7,652 7,275 7,500 93 7,071 7,303 168 2.3% INDF Accumulate Upward Sideway Golden Cross

ITMG 23,325 23,126 0.85% 23,882 24,161 23,142 23,542 93 22,422 23,189 557 2.4% ITMG Accumulate Upward Trend Golden Cross

BMRI 7,450 7,400 0.67% 7,621 7,707 7,400 7,533 94 6,816 7,358 171 2.3% BMRI Accumulate Upward Sideway Golden Cross

BBNI 9,600 9,455 1.51% 9,784 9,876 9,467 9,717 95 8,729 9,395 184 1.9% BBNI Accumulate Upward Trend Golden Cross

BRPT 3,440 3,370 2.03% 3,537 3,586 3,393 3,493 95 3,064 3,370 97 2.8% BRPT Distribute Upward Trend Golden Cross

BBTN 2,520 2,466 2.14% 2,596 2,634 2,473 2,553 96 2,303 2,476 76 3.0% BBTN Accumulate Upward Sideway Golden Cross

UNTR 28,000 27,544 1.63% 28,707 29,061 27,544 28,317 98 26,246 27,540 707 2.5% UNTR Accumulate Upward Trend Golden Cross

Stocks Close Stop Loss Stop Loss Price Tgt 1 Price Tgt 2 Support Resistance Stochastic Oversold Overbought Price Volatility Stocks Accumulation Directional Market MACD

Code Price (IDR) (%) (IDR) (IDR) (IDR) (IDR) (%) (IDR) (IDR) (IDR) % Code Distribution Price Movement Phase Signal

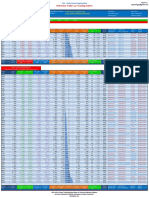

Daily Trading Plan (Bearish)

Tabel saham dengan kecenderungan harga turun

Stocks Close Buy back Buy back Price Tgt 1 Price Tgt 2 Support Resistance Stochastic Oversold Overbought Price Volatility Stocks Accumulation Directional Market MACD

Code Price (IDR) (%) (IDR) (IDR) (IDR) (IDR) (%) (IDR) (IDR) (IDR) % Code Distribution Price Movement Phase Signal

INDY 1,980 2,038 2.93% 2,121 2,163 1,947 2,047 3 2,024 2,120 83 4.2% INDY Distribute Downward Sideway Death Cross

AKRA 4,630 4,785 3.35% 5,034 5,159 4,490 4,810 4 4,792 5,372 249 5.4% AKRA Distribute Downward Trend Death Cross

AALI 11,775 12,027 2.14% 12,348 12,509 11,508 12,108 6 11,890 12,510 321 2.7% AALI Distribute Downward Trend Death Cross

LSIP 1,145 1,160 1.31% 1,203 1,225 1,118 1,168 14 1,144 1,240 43 3.8% LSIP Distribute Downward Trend Death Cross

PGAS 2,360 2,410 2.12% 2,487 2,526 2,320 2,420 15 2,376 2,493 77 3.3% PGAS Distribute Downward Trend Death Cross

BWPT 162 163 0.62% 168 171 159 167 16 161 167 5 3.1% BWPT Distribute Limited downside Sideway Death Cross

GGRM 85,900 88,523 3.05% 91,207 92,549 81,983 90,033 16 87,161 92,013 2,684 3.1% GGRM Distribute Downward Sideway Death Cross

PPRO 157 159 1.27% 164 167 153 161 17 157 166 5 3.2% PPRO Accumulate Downward Sideway Death Cross

BMTR 350 363 3.71% 384 395 338 366 19 350 385 21 6.0% BMTR Distribute Downward Sideway Death Cross

ERAA 1,990 2,011 1.06% 2,079 2,113 1,970 2,030 20 1,992 2,090 68 3.4% ERAA Distribute Limited downside Sideway Golden Cross

RALS 1,730 1,779 2.83% 1,848 1,883 1,660 1,810 20 1,739 1,843 69 4.0% RALS Distribute Downward Sideway Death Cross

ANTM 960 968 0.83% 1,003 1,021 943 973 21 960 1,009 35 3.6% ANTM Accumulate Downward Sideway Death Cross

KLBF 1,515 1,526 0.73% 1,556 1,571 1,498 1,528 25 1,507 1,555 30 2.0% KLBF Distribute Downward Sideway Golden Cross

JPFA 2,200 2,229 1.32% 2,329 2,379 2,180 2,240 27 2,178 2,371 100 4.5% JPFA Distribute Downward Sideway Golden Cross

HRUM 1,470 1,483 0.88% 1,522 1,542 1,460 1,490 28 1,468 1,511 39 2.7% HRUM Accumulate Downward Sideway Golden Cross

DOID 570 583 2.28% 605 616 557 597 33 568 596 22 3.9% DOID Distribute Downward Sideway Death Cross

GJTL 705 718 1.84% 748 763 678 728 34 695 744 30 4.3% GJTL Accumulate Downward Trend Death Cross

ELSA 368 371 0.82% 381 386 363 375 35 362 383 10 2.7% ELSA Distribute Limited downside Sideway Death Cross

BBCA 27,450 27,533 0.30% 27,884 28,060 27,250 27,600 37 27,339 27,711 351 1.3% BBCA Accumulate Downward Sideway Death Cross

INCO 3,540 3,584 1.24% 3,694 3,749 3,500 3,600 38 3,511 3,678 110 3.1% INCO Accumulate Limited downside Sideway Death Cross

SCMA 1,745 1,771 1.49% 1,821 1,846 1,688 1,818 39 1,745 1,812 50 2.9% SCMA Accumulate Limited downside Sideway Golden Cross

KBLI 332 338 1.81% 359 370 313 353 44 313 348 21 6.3% KBLI Distribute Limited downside Trend Golden Cross

PTRO 1,900 1,910 0.53% 1,948 1,967 1,887 1,917 44 1,876 1,928 38 2.0% PTRO Distribute Downward Sideway Death Cross

ASII 7,250 7,288 0.52% 7,446 7,525 7,183 7,333 50 7,157 7,343 158 2.2% ASII Accumulate Limited downside Sideway Golden Cross

SSIA 580 588 1.38% 611 623 573 593 50 572 597 23 4.0% SSIA Distribute Limited downside Sideway Death Cross

ADRO 1,425 1,434 0.63% 1,484 1,509 1,385 1,455 52 1,386 1,458 50 3.5% ADRO Accumulate Downward Trend Golden Cross

INKP 9,800 10,136 3.43% 10,665 10,930 9,433 10,433 60 9,157 10,405 529 5.4% INKP Accumulate Downward Sideway Golden Cross

UNVR 49,250 49,478 0.46% 50,235 50,614 48,850 49,700 62 48,390 49,584 757 1.5% UNVR Distribute Downward Sideway Golden Cross

SMBR 1,390 1,401 0.79% 1,442 1,463 1,370 1,410 66 1,327 1,415 41 2.9% SMBR Accumulate Limited downside Sideway Death Cross

PTPP 2,080 2,109 1.39% 2,174 2,207 2,040 2,140 76 1,982 2,102 65 3.1% PTPP Distribute Downward Sideway Golden Cross

Stocks Close Buy back Buy back Price Tgt 1 Price Tgt 2 Support Resistance Stochastic Oversold Overbought Price Volatility Stocks Accumulation Directional Market MACD

Code Price (IDR) (%) (IDR) (IDR) (IDR) (IDR) (%) (IDR) (IDR) (IDR) % Code Distribution Price Movement Phase Signal

Stocks

ATS Active Trader Trading System Base on Technical Market Indicator

and only intended to define tendencies of price movement.

Disclaimer On.

You might also like

- ATS - Daily Trading Plan 4april2019Document1 pageATS - Daily Trading Plan 4april2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: Happy New Year 2019Document1 pageATS Active Trader v2.7 Trading System: Happy New Year 2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: Happy New Year 2019Document1 pageATS Active Trader v2.7 Trading System: Happy New Year 2019KPH BaliNo ratings yet

- ATS - Daily Trading Plan 8januari2019Document1 pageATS - Daily Trading Plan 8januari2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelSeroja NTT 2021No ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS - Daily Trading Plan 15maret2019Document1 pageATS - Daily Trading Plan 15maret2019KPH BaliNo ratings yet

- ATS - Daily Trading Plan 6februari2019Document1 pageATS - Daily Trading Plan 6februari2019KPH BaliNo ratings yet

- ATS - Daily Trading PlanDocument1 pageATS - Daily Trading PlanRonAlNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: ATS - Daily Stocks ExplorationDocument1 pageATS Active Trader v2.7 Trading System: ATS - Daily Stocks ExplorationKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS - Daily Trading Plan 14januari2019Document1 pageATS - Daily Trading Plan 14januari2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: Happy New Year 2019Document1 pageATS Active Trader v2.7 Trading System: Happy New Year 2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM Channel: WebsiteDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM Channel: WebsitewahidNo ratings yet

- ATS - DAILY TRADING PLAN 27juli2022Document1 pageATS - DAILY TRADING PLAN 27juli2022Martin WibowoNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS - Daily Trading Plan 27agustus2018Document1 pageATS - Daily Trading Plan 27agustus2018wahidNo ratings yet

- Ats - Daily Trading Plan 16juni2023Document1 pageAts - Daily Trading Plan 16juni2023AxelNo ratings yet

- ATS - DAILY TRADING PLAN 16sept2022Document1 pageATS - DAILY TRADING PLAN 16sept2022Martin WibowoNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM Channel: WebsiteDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM Channel: WebsitewahidNo ratings yet

- Ats - Daily Trading Plan 16okt2023Document1 pageAts - Daily Trading Plan 16okt2023Diense ZhangNo ratings yet

- ATS - DAILY TRADING PLAN 15sept2022Document1 pageATS - DAILY TRADING PLAN 15sept2022Martin WibowoNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS - DAILY TRADING PLAN 14sept2022Document1 pageATS - DAILY TRADING PLAN 14sept2022Martin WibowoNo ratings yet

- ATS Active Trader v2.8 Trading SystemDocument1 pageATS Active Trader v2.8 Trading SystemChi ChikyuuNo ratings yet

- ATS - Daily Trading Plan 20agustus2018Document1 pageATS - Daily Trading Plan 20agustus2018wahidNo ratings yet

- ATS - Daily Trading Plan 4oktober2017Document1 pageATS - Daily Trading Plan 4oktober2017bayuadjie134No ratings yet

- Ats - 70 Sharia Stocks - Trading Plan 6okt2023Document1 pageAts - 70 Sharia Stocks - Trading Plan 6okt2023Diense ZhangNo ratings yet

- ATS - Daily Trading Plan 14agustus2018Document1 pageATS - Daily Trading Plan 14agustus2018wahidNo ratings yet

- ATS - DAILY TRADING PLAN 1juli2022Document1 pageATS - DAILY TRADING PLAN 1juli2022Martin WibowoNo ratings yet

- 05 03 2019anDocument120 pages05 03 2019anNarnolia'sNo ratings yet

- Daily Market Sheet 1-5-10Document2 pagesDaily Market Sheet 1-5-10chainbridgeinvestingNo ratings yet

- 05 2023 Sales Out Report MTDDocument2 pages05 2023 Sales Out Report MTDNOCINPLUSNo ratings yet

- Average Spins For Top 10 HitsDocument3 pagesAverage Spins For Top 10 HitsEilonwyNo ratings yet

- DSE. MKT REP 5 May 2016Document6 pagesDSE. MKT REP 5 May 2016Antony KashubeNo ratings yet

- Daihatsu Addm MaretDocument2 pagesDaihatsu Addm MaretAntonNo ratings yet

- NDBS - Stock Tracker - 30.07.2021Document15 pagesNDBS - Stock Tracker - 30.07.2021Darshana FernandoNo ratings yet

- Augmont Daily ReportDocument2 pagesAugmont Daily ReportSarthak KhandelwalNo ratings yet

- ABC Trading Plan Pressure Points Road Map: Entry Stop Exit Stop 376.70Document16 pagesABC Trading Plan Pressure Points Road Map: Entry Stop Exit Stop 376.70lavhackNo ratings yet

- ABC Trading Plan Pressure Points Road Map: Entry Stop Exit Stop 376.70Document16 pagesABC Trading Plan Pressure Points Road Map: Entry Stop Exit Stop 376.70vasanth3675% (8)

- Beta Portofolio Saham PCA Kel 4 - FinalDocument46 pagesBeta Portofolio Saham PCA Kel 4 - FinalMuhibbuddin NoorNo ratings yet

- Enablers ReportDocument32 pagesEnablers ReportAhmerNo ratings yet

- M Ceo Campaign As On 25.02.2024Document1 pageM Ceo Campaign As On 25.02.2024sivajaduNo ratings yet

- Eao Ab5 25102021Document1 pageEao Ab5 25102021Ovel WoworNo ratings yet

- Gmeet WHS 1 Nov-1-1Document88 pagesGmeet WHS 1 Nov-1-1adyNo ratings yet

- Weekly Monitoring Active Outlet - MTD W4 May 19Document462 pagesWeekly Monitoring Active Outlet - MTD W4 May 19rizq 3103No ratings yet

- Daily Market Sheet 12-7-09Document2 pagesDaily Market Sheet 12-7-09chainbridgeinvestingNo ratings yet

- Aily NFO: Market Review & OutlookDocument5 pagesAily NFO: Market Review & OutlookRizqi HarryNo ratings yet

- OMSEC Morning Note 13 09 2022Document6 pagesOMSEC Morning Note 13 09 2022Ropafadzo KwarambaNo ratings yet

- Daily Market Sheet 12-14-09Document2 pagesDaily Market Sheet 12-14-09chainbridgeinvestingNo ratings yet

- Basic Indicators From The 2014 Myanmar Census ReportsDocument44 pagesBasic Indicators From The 2014 Myanmar Census ReportsnayNo ratings yet

- Contoh Evaluasi Cost & Produksi Riil (21-20)Document173 pagesContoh Evaluasi Cost & Produksi Riil (21-20)bahriNo ratings yet

- Dily Gainers and LosersDocument10 pagesDily Gainers and LosersAnshuman GuptaNo ratings yet

- Semua Data Berdasarkan Data Hots Mirae Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceDocument1 pageSemua Data Berdasarkan Data Hots Mirae Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceKPH BaliNo ratings yet

- Analisa 1-16Document1 pageAnalisa 1-16KPH BaliNo ratings yet

- Ciptadana Sekuritas PTPP - Lower TP Post Weak ResultsDocument6 pagesCiptadana Sekuritas PTPP - Lower TP Post Weak ResultsKPH BaliNo ratings yet

- Semua Data Berdasarkan Data Rti Business Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceDocument1 pageSemua Data Berdasarkan Data Rti Business Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceKPH BaliNo ratings yet

- Indo Premier BISI - A Good Start This YearDocument6 pagesIndo Premier BISI - A Good Start This YearKPH BaliNo ratings yet

- Semua Data Berdasarkan Data Rti Business Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceDocument1 pageSemua Data Berdasarkan Data Rti Business Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceKPH BaliNo ratings yet

- Analisa 1-25Document1 pageAnalisa 1-25KPH BaliNo ratings yet

- Weekly Flash Opportunity Accor Indonesia 12032019Document9 pagesWeekly Flash Opportunity Accor Indonesia 12032019KPH BaliNo ratings yet

- MNCN Investor Release FY 2018Document5 pagesMNCN Investor Release FY 2018KPH BaliNo ratings yet

- Semua Data Berdasarkan Data Hots Mirae Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceDocument1 pageSemua Data Berdasarkan Data Hots Mirae Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceKPH BaliNo ratings yet

- ATS - Daily Trading Plan 15maret2019Document1 pageATS - Daily Trading Plan 15maret2019KPH BaliNo ratings yet

- ATS - Daily Trading Plan 14januari2019Document1 pageATS - Daily Trading Plan 14januari2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- Ciptadana Sekuritas PPRO - Company Update - Rapid Growth Through Innovative StrategyDocument8 pagesCiptadana Sekuritas PPRO - Company Update - Rapid Growth Through Innovative StrategyKPH BaliNo ratings yet

- Ciptadana Sekuritas SILO - Results Update FY18 - Healthy Operations To Support Long Term GrowthDocument9 pagesCiptadana Sekuritas SILO - Results Update FY18 - Healthy Operations To Support Long Term GrowthKPH BaliNo ratings yet

- ATS - Daily Trading Plan 6februari2019Document1 pageATS - Daily Trading Plan 6februari2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: ATS - Daily Stocks ExplorationDocument1 pageATS Active Trader v2.7 Trading System: ATS - Daily Stocks ExplorationKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: Happy New Year 2019Document1 pageATS Active Trader v2.7 Trading System: Happy New Year 2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet