Professional Documents

Culture Documents

ATS - Daily Trading Plan 4april2019

Uploaded by

KPH BaliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ATS - Daily Trading Plan 4april2019

Uploaded by

KPH BaliCopyright:

Available Formats

Telegram Channel : atstradingstrategies.

com ATS - Daily Stocks Exploration Registrasi :

www.atstradingstrategies.com atsstrategies@gmail.com

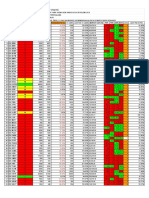

ATS Active Trader v2.7 Trading System

Date : Thursday, 4 April 2019 TELEGRAM Channel : atstradingstrategies.com Periodicity : Daily Chart

Source : Metastock Professional Exploration Type : Daily Trading Plan

System : ATS Active Trader v2.7 Expert Advisor Developed by : Widiarto Wibowo

Daily Trading Plan (Bullish)

Tabel saham dengan kecenderungan harga naik

Stocks Close Stop Loss Stop Loss Price Tgt 1 Price Tgt 2 Support Resistance Stochastic Oversold Overbought Price Volatility Stocks Accumulation Directional Market MACD

Code Price (IDR) (%) (IDR) (IDR) (IDR) (IDR) (%) (IDR) (IDR) (IDR) % Code Distribution Price Movement Phase Signal

AALI 11,900 11,451 3.77% 12,201 12,352 11,451 12,250 31 11,435 12,202 301 2.5% AALI Accumulate Upward Sideway Golden Cross

KLBF 1,525 1,505 1.31% 1,555 1,570 1,505 1,548 35 1,498 1,541 30 2.0% KLBF Distribute Limited upside Sideway Golden Cross

GJTL 690 686 0.58% 717 731 686 713 36 679 725 27 3.9% GJTL Accumulate Upward Sideway Death Cross

BJBR 2,050 2,021 1.41% 2,114 2,146 2,021 2,110 40 2,010 2,079 64 3.1% BJBR Accumulate Upward Sideway Golden Cross

LSIP 1,145 1,070 6.55% 1,193 1,217 1,070 1,218 40 1,060 1,159 48 4.2% LSIP Accumulate Upward Sideway Golden Cross

SSIA 565 553 2.12% 590 603 553 612 40 542 584 25 4.4% SSIA Distribute Upward Sideway Death Cross

MEDC 890 888 0.22% 920 935 888 937 41 881 918 30 3.4% MEDC Accumulate Upward Sideway Golden Cross

BSDE 1,430 1,424 0.42% 1,477 1,501 1,424 1,490 47 1,406 1,478 47 3.3% BSDE Distribute Upward Sideway Golden Cross

POWR 935 933 0.21% 957 968 933 958 50 926 948 22 2.4% POWR Distribute Upward Trend Death Cross

ANTM 920 911 0.98% 957 976 911 960 54 890 959 37 4.0% ANTM Accumulate Upward Sideway Death Cross

KBLI 336 331 1.49% 357 368 331 349 55 315 348 21 6.3% KBLI Distribute Limited upside Trend Golden Cross

BBNI 9,425 9,398 0.29% 9,598 9,685 9,398 9,575 56 9,204 9,545 173 1.8% BBNI Distribute Upward Sideway Golden Cross

ASRI 320 316 1.25% 329 334 316 331 58 310 325 9 2.8% ASRI Accumulate Upward Sideway Golden Cross

HMSP 3,810 3,773 0.97% 3,868 3,897 3,773 3,837 60 3,744 3,806 58 1.5% HMSP Accumulate Upward Sideway Death Cross

RALS 1,800 1,780 1.11% 1,852 1,878 1,780 1,827 60 1,731 1,833 52 2.9% RALS Accumulate Upward Sideway Death Cross

INCO 3,470 3,448 0.63% 3,590 3,650 3,448 3,637 61 3,374 3,585 120 3.5% INCO Accumulate Upward Sideway Death Cross

UNVR 49,400 49,064 0.68% 50,166 50,549 49,067 49,617 62 48,359 49,452 766 1.6% UNVR Distribute Upward Sideway Death Cross

EXCL 2,670 2,657 0.49% 2,781 2,837 2,657 2,763 64 2,589 2,720 111 4.2% EXCL Distribute Limited upside Sideway Death Cross

ITMG 23,875 23,797 0.33% 24,392 24,651 23,797 24,142 65 22,936 24,114 517 2.2% ITMG Distribute Upward Trend Golden Cross

BWPT 167 161 3.59% 172 175 161 173 73 158 164 5 3.0% BWPT Accumulate Upward Sideway Golden Cross

BMRI 7,450 7,383 0.90% 7,633 7,725 7,383 7,633 76 7,221 7,453 183 2.5% BMRI Distribute Limited upside Sideway Golden Cross

PTPP 2,130 2,109 0.99% 2,202 2,238 2,109 2,197 76 2,019 2,150 72 3.4% PTPP Distribute Upward Trend Golden Cross

PTBA 4,190 4,171 0.45% 4,280 4,325 4,171 4,290 78 4,049 4,210 90 2.1% PTBA Distribute Limited upside Sideway Golden Cross

ADHI 1,650 1,637 0.79% 1,691 1,712 1,637 1,683 80 1,551 1,653 41 2.5% ADHI Distribute Upward Trend Golden Cross

SMRA 1,015 985 2.96% 1,059 1,081 985 1,072 81 935 1,017 44 4.3% SMRA Accumulate Upward Trend Golden Cross

PWON 755 721 4.50% 784 799 728 768 82 679 741 29 3.8% PWON Accumulate Upward Trend Golden Cross

ELSA 372 367 1.34% 383 389 367 385 83 355 374 11 3.0% ELSA Accumulate Upward Sideway Golden Cross

WSBP 410 405 1.22% 419 424 405 421 84 390 410 9 2.2% WSBP Accumulate Upward Trend Golden Cross

WTON 620 612 1.29% 647 661 612 637 84 570 619 27 4.4% WTON Accumulate Limited upside Sideway Golden Cross

ASII 7,450 7,295 2.08% 7,607 7,686 7,295 7,550 85 7,080 7,344 157 2.1% ASII Accumulate Upward Sideway Golden Cross

KAEF 3,660 3,559 2.76% 3,868 3,972 3,559 3,927 85 3,162 3,692 208 5.7% KAEF Accumulate Upward Trend Golden Cross

ESSA 420 406 3.33% 435 443 406 440 86 381 410 15 3.6% ESSA Accumulate Upward Trend Golden Cross

WSKT 1,995 1,981 0.70% 2,045 2,070 1,981 2,035 86 1,882 1,987 50 2.5% WSKT Accumulate Upward Trend Golden Cross

TINS 1,400 1,303 6.93% 1,469 1,504 1,303 1,487 87 1,234 1,347 69 4.9% TINS Accumulate Upward Sideway Golden Cross

TLKM 3,950 3,911 0.99% 4,015 4,048 3,911 3,977 88 3,767 3,922 65 1.6% TLKM Accumulate Upward Trend Golden Cross

CTRA 1,090 1,052 3.49% 1,134 1,156 1,053 1,133 89 957 1,072 44 4.0% CTRA Distribute Upward Trend Golden Cross

BBRI 4,150 4,120 0.72% 4,216 4,249 4,120 4,190 90 3,998 4,126 66 1.6% BBRI Distribute Upward Trend Golden Cross

BRPT 3,600 3,577 0.64% 3,692 3,738 3,577 3,720 91 3,297 3,582 92 2.6% BRPT Accumulate Limited upside Trend Golden Cross

JSMR 6,000 5,858 2.37% 6,206 6,309 5,867 6,067 92 5,235 5,839 206 3.4% JSMR Accumulate Limited upside Trend Golden Cross

INTP 22,350 21,980 1.66% 23,081 23,447 22,017 22,667 93 19,941 21,871 731 3.3% INTP Accumulate Upward Trend Golden Cross

WIKA 2,170 2,146 1.11% 2,234 2,266 2,146 2,217 93 1,957 2,143 64 2.9% WIKA Accumulate Limited upside Trend Golden Cross

Stocks Close Stop Loss Stop Loss Price Tgt 1 Price Tgt 2 Support Resistance Stochastic Oversold Overbought Price Volatility Stocks Accumulation Directional Market MACD

Code Price (IDR) (%) (IDR) (IDR) (IDR) (IDR) (%) (IDR) (IDR) (IDR) % Code Distribution Price Movement Phase Signal

Daily Trading Plan (Bearish)

Tabel saham dengan kecenderungan harga turun

Stocks Close Buy back Buy back Price Tgt 1 Price Tgt 2 Support Resistance Stochastic Oversold Overbought Price Volatility Stocks Accumulation Directional Market MACD

Code Price (IDR) (%) (IDR) (IDR) (IDR) (IDR) (%) (IDR) (IDR) (IDR) % Code Distribution Price Movement Phase Signal

NIKL 2,530 2,746 8.54% 2,881 2,949 2,397 2,797 0 2,677 3,077 135 5.3% NIKL Distribute Downward Trend Death Cross

HRUM 1,405 1,421 1.14% 1,451 1,466 1,398 1,421 2 1,422 1,477 30 2.1% HRUM Distribute Downward Trend Death Cross

PPRO 143 147 2.80% 152 155 140 148 2 145 156 5 3.5% PPRO Distribute Downward Trend Death Cross

KRAS 446 464 4.04% 477 484 430 478 4 461 487 13 2.9% KRAS Distribute Downward Trend Death Cross

INDF 6,225 6,379 2.47% 6,593 6,700 6,025 6,425 5 6,417 7,169 214 3.4% INDF Distribute Downward Trend Death Cross

INKP 8,325 8,631 3.68% 9,134 9,386 8,075 8,631 5 8,576 10,048 503 6.0% INKP Distribute Downward Trend Death Cross

BBTN 2,340 2,412 3.08% 2,494 2,535 2,280 2,440 8 2,380 2,494 82 3.5% BBTN Distribute Downward Trend Golden Cross

JPFA 1,690 1,824 7.93% 1,942 2,001 1,577 1,887 8 1,791 2,153 118 7.0% JPFA Distribute Limited downside Trend Death Cross

BUMI 122 125 2.46% 131 134 118 128 9 123 137 6 4.9% BUMI Accumulate Limited downside Trend Death Cross

ADRO 1,325 1,345 1.51% 1,389 1,411 1,292 1,362 12 1,340 1,424 44 3.3% ADRO Distribute Downward Sideway Death Cross

CPIN 6,500 6,693 2.97% 7,048 7,226 6,267 6,717 13 6,543 7,581 355 5.5% CPIN Distribute Downward Trend Death Cross

INDY 1,790 1,830 2.23% 1,899 1,934 1,740 1,850 13 1,818 2,041 69 3.9% INDY Accumulate Downward Trend Death Cross

PGAS 2,250 2,336 3.82% 2,407 2,443 2,163 2,403 13 2,313 2,456 71 3.2% PGAS Distribute Downward Trend Death Cross

SCMA 1,645 1,655 0.61% 1,701 1,724 1,585 1,685 13 1,650 1,757 46 2.8% SCMA Accumulate Downward Trend Death Cross

GGRM 82,750 83,477 0.88% 85,919 87,140 81,750 84,150 20 82,559 89,278 2,442 3.0% GGRM Accumulate Limited downside Trend Death Cross

BKSL 106 107 0.94% 111 113 103 107 21 104 113 4 3.8% BKSL Accumulate Downward Trend Death Cross

ACES 1,760 1,795 1.99% 1,846 1,872 1,713 1,823 25 1,771 1,850 51 2.9% ACES Accumulate Downward Sideway Death Cross

PTRO 1,835 1,860 1.36% 1,906 1,929 1,772 1,912 25 1,826 1,911 46 2.5% PTRO Accumulate Limited downside Trend Death Cross

UNTR 26,625 27,110 1.82% 27,757 28,081 26,142 27,542 25 26,825 27,724 647 2.4% UNTR Distribute Downward Sideway Death Cross

ERAA 1,820 1,848 1.54% 1,925 1,964 1,787 1,887 28 1,794 1,990 77 4.2% ERAA Distribute Limited downside Trend Death Cross

TKIM 10,900 11,084 1.69% 11,589 11,842 10,450 11,300 29 10,718 11,756 505 4.6% TKIM Distribute Downward Sideway Golden Cross

DOID 565 576 1.95% 597 608 555 585 30 564 595 21 3.7% DOID Accumulate Downward Sideway Golden Cross

SMBR 1,310 1,330 1.53% 1,386 1,414 1,203 1,363 43 1,253 1,381 56 4.3% SMBR Accumulate Downward Trend Death Cross

BBCA 27,500 27,627 0.46% 27,988 28,169 27,133 28,033 45 27,255 27,681 361 1.3% BBCA Distribute Limited downside Sideway Golden Cross

AKRA 4,770 4,788 0.38% 4,982 5,079 4,703 4,863 47 4,574 4,980 194 4.1% AKRA Accumulate Limited downside Sideway Death Cross

BJTM 655 657 0.31% 671 678 652 662 50 648 661 14 2.1% BJTM Accumulate Limited downside Sideway Golden Cross

SRIL 338 340 0.59% 344 346 337 341 50 337 340 4 1.2% SRIL Accumulate Limited downside Sideway Death Cross

SMGR 13,600 13,835 1.73% 14,254 14,464 13,017 14,167 71 13,001 13,823 419 3.1% SMGR Distribute Downward Sideway Golden Cross

PPRE 398 404 1.51% 415 421 387 411 76 386 403 11 2.8% PPRE Distribute Downward Sideway Death Cross

Stocks Close Buy back Buy back Price Tgt 1 Price Tgt 2 Support Resistance Stochastic Oversold Overbought Price Volatility Stocks Accumulation Directional Market MACD

Code Price (IDR) (%) (IDR) (IDR) (IDR) (IDR) (%) (IDR) (IDR) (IDR) % Code Distribution Price Movement Phase Signal

Stocks

ATS Active Trader Trading System Base on Technical Market Indicator

and only intended to define tendencies of price movement.

Disclaimer On.

You might also like

- Facebook Blueprint Study Guide (2019 Update) PDFDocument65 pagesFacebook Blueprint Study Guide (2019 Update) PDFKhizar Nadeem Syed50% (2)

- Lehman Brothers - The Short-End of The CurveDocument20 pagesLehman Brothers - The Short-End of The CurveunicycnNo ratings yet

- Final Lego CaseDocument20 pagesFinal Lego CaseJoseOctavioGonzalez100% (1)

- ABC Trading Plan Pressure Points Road Map: Entry Stop Exit Stop 376.70Document16 pagesABC Trading Plan Pressure Points Road Map: Entry Stop Exit Stop 376.70vasanth3675% (8)

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: Happy New Year 2019Document1 pageATS Active Trader v2.7 Trading System: Happy New Year 2019KPH BaliNo ratings yet

- ATS - Daily Trading Plan 6februari2019Document1 pageATS - Daily Trading Plan 6februari2019KPH BaliNo ratings yet

- ATS - Daily Trading PlanDocument1 pageATS - Daily Trading PlanRonAlNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: ATS - Daily Stocks ExplorationDocument1 pageATS Active Trader v2.7 Trading System: ATS - Daily Stocks ExplorationKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS - Daily Trading Plan 15maret2019Document1 pageATS - Daily Trading Plan 15maret2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelSeroja NTT 2021No ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: Happy New Year 2019Document1 pageATS Active Trader v2.7 Trading System: Happy New Year 2019KPH BaliNo ratings yet

- ATS - Daily Trading Plan 8januari2019Document1 pageATS - Daily Trading Plan 8januari2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: Happy New Year 2019Document1 pageATS Active Trader v2.7 Trading System: Happy New Year 2019KPH BaliNo ratings yet

- ATS - DAILY TRADING PLAN 27juli2022Document1 pageATS - DAILY TRADING PLAN 27juli2022Martin WibowoNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM Channel: WebsiteDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM Channel: WebsitewahidNo ratings yet

- ATS - DAILY TRADING PLAN 15sept2022Document1 pageATS - DAILY TRADING PLAN 15sept2022Martin WibowoNo ratings yet

- ATS - DAILY TRADING PLAN 16sept2022Document1 pageATS - DAILY TRADING PLAN 16sept2022Martin WibowoNo ratings yet

- ATS - Daily Trading Plan 27agustus2018Document1 pageATS - Daily Trading Plan 27agustus2018wahidNo ratings yet

- Ats - Daily Trading Plan 16juni2023Document1 pageAts - Daily Trading Plan 16juni2023AxelNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS - Daily Trading Plan 14januari2019Document1 pageATS - Daily Trading Plan 14januari2019KPH BaliNo ratings yet

- Ats - Daily Trading Plan 16okt2023Document1 pageAts - Daily Trading Plan 16okt2023Diense ZhangNo ratings yet

- ATS - Daily Trading Plan 20agustus2018Document1 pageATS - Daily Trading Plan 20agustus2018wahidNo ratings yet

- ATS - DAILY TRADING PLAN 14sept2022Document1 pageATS - DAILY TRADING PLAN 14sept2022Martin WibowoNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM Channel: WebsiteDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM Channel: WebsitewahidNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.8 Trading SystemDocument1 pageATS Active Trader v2.8 Trading SystemChi ChikyuuNo ratings yet

- ATS - Daily Trading Plan 4oktober2017Document1 pageATS - Daily Trading Plan 4oktober2017bayuadjie134No ratings yet

- Ats - 70 Sharia Stocks - Trading Plan 6okt2023Document1 pageAts - 70 Sharia Stocks - Trading Plan 6okt2023Diense ZhangNo ratings yet

- ATS - Daily Trading Plan 14agustus2018Document1 pageATS - Daily Trading Plan 14agustus2018wahidNo ratings yet

- ATS - DAILY TRADING PLAN 1juli2022Document1 pageATS - DAILY TRADING PLAN 1juli2022Martin WibowoNo ratings yet

- 05 03 2019anDocument120 pages05 03 2019anNarnolia'sNo ratings yet

- Daily Market Sheet 1-5-10Document2 pagesDaily Market Sheet 1-5-10chainbridgeinvestingNo ratings yet

- Enablers ReportDocument32 pagesEnablers ReportAhmerNo ratings yet

- Beta Portofolio Saham PCA Kel 4 - FinalDocument46 pagesBeta Portofolio Saham PCA Kel 4 - FinalMuhibbuddin NoorNo ratings yet

- Daihatsu Addm MaretDocument2 pagesDaihatsu Addm MaretAntonNo ratings yet

- 05 2023 Sales Out Report MTDDocument2 pages05 2023 Sales Out Report MTDNOCINPLUSNo ratings yet

- NDBS - Stock Tracker - 30.07.2021Document15 pagesNDBS - Stock Tracker - 30.07.2021Darshana FernandoNo ratings yet

- DSE. MKT REP 5 May 2016Document6 pagesDSE. MKT REP 5 May 2016Antony KashubeNo ratings yet

- OMSEC Morning Note 13 09 2022Document6 pagesOMSEC Morning Note 13 09 2022Ropafadzo KwarambaNo ratings yet

- IAMv3 Individual Sample Reports PDFDocument23 pagesIAMv3 Individual Sample Reports PDFAnonymous xv5fUs4AvNo ratings yet

- ResearchDocument1 pageResearchshaalimNo ratings yet

- Harga Wajar DBIDocument40 pagesHarga Wajar DBISeptiawanNo ratings yet

- Augmont Daily ReportDocument2 pagesAugmont Daily ReportSarthak KhandelwalNo ratings yet

- M Ceo Campaign As On 25.02.2024Document1 pageM Ceo Campaign As On 25.02.2024sivajaduNo ratings yet

- Daily Market Sheet 12-7-09Document2 pagesDaily Market Sheet 12-7-09chainbridgeinvestingNo ratings yet

- Daily FNO Overview: Retail ResearchDocument5 pagesDaily FNO Overview: Retail ResearchjaimaaganNo ratings yet

- ABC Trading Plan Pressure Points Road Map: Entry Stop Exit Stop 376.70Document16 pagesABC Trading Plan Pressure Points Road Map: Entry Stop Exit Stop 376.70lavhackNo ratings yet

- Daily 07 March 2024Document5 pagesDaily 07 March 2024enockmartha01No ratings yet

- Daily Technicals (08-Dec-2023)Document18 pagesDaily Technicals (08-Dec-2023)drtohogNo ratings yet

- Daily FNO Overview: Retail ResearchDocument5 pagesDaily FNO Overview: Retail ResearchjaimaaganNo ratings yet

- Beta Portofolio Saham PCA Kel 4 - 121022Document63 pagesBeta Portofolio Saham PCA Kel 4 - 121022Muhibbuddin NoorNo ratings yet

- Bulk Crystal Growth of Electronic, Optical and Optoelectronic MaterialsFrom EverandBulk Crystal Growth of Electronic, Optical and Optoelectronic MaterialsPeter CapperNo ratings yet

- Semua Data Berdasarkan Data Hots Mirae Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceDocument1 pageSemua Data Berdasarkan Data Hots Mirae Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceKPH BaliNo ratings yet

- Analisa 1-16Document1 pageAnalisa 1-16KPH BaliNo ratings yet

- Ciptadana Sekuritas PTPP - Lower TP Post Weak ResultsDocument6 pagesCiptadana Sekuritas PTPP - Lower TP Post Weak ResultsKPH BaliNo ratings yet

- Semua Data Berdasarkan Data Rti Business Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceDocument1 pageSemua Data Berdasarkan Data Rti Business Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceKPH BaliNo ratings yet

- Indo Premier BISI - A Good Start This YearDocument6 pagesIndo Premier BISI - A Good Start This YearKPH BaliNo ratings yet

- Semua Data Berdasarkan Data Rti Business Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceDocument1 pageSemua Data Berdasarkan Data Rti Business Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceKPH BaliNo ratings yet

- Analisa 1-25Document1 pageAnalisa 1-25KPH BaliNo ratings yet

- Weekly Flash Opportunity Accor Indonesia 12032019Document9 pagesWeekly Flash Opportunity Accor Indonesia 12032019KPH BaliNo ratings yet

- MNCN Investor Release FY 2018Document5 pagesMNCN Investor Release FY 2018KPH BaliNo ratings yet

- Semua Data Berdasarkan Data Hots Mirae Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceDocument1 pageSemua Data Berdasarkan Data Hots Mirae Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceKPH BaliNo ratings yet

- ATS - Daily Trading Plan 15maret2019Document1 pageATS - Daily Trading Plan 15maret2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS - Daily Trading Plan 14januari2019Document1 pageATS - Daily Trading Plan 14januari2019KPH BaliNo ratings yet

- ATS - Daily Trading Plan 8januari2019Document1 pageATS - Daily Trading Plan 8januari2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- Ciptadana Sekuritas PPRO - Company Update - Rapid Growth Through Innovative StrategyDocument8 pagesCiptadana Sekuritas PPRO - Company Update - Rapid Growth Through Innovative StrategyKPH BaliNo ratings yet

- Ciptadana Sekuritas SILO - Results Update FY18 - Healthy Operations To Support Long Term GrowthDocument9 pagesCiptadana Sekuritas SILO - Results Update FY18 - Healthy Operations To Support Long Term GrowthKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: Happy New Year 2019Document1 pageATS Active Trader v2.7 Trading System: Happy New Year 2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: ATS - Daily Stocks ExplorationDocument1 pageATS Active Trader v2.7 Trading System: ATS - Daily Stocks ExplorationKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: Happy New Year 2019Document1 pageATS Active Trader v2.7 Trading System: Happy New Year 2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- Investment AppraisalDocument24 pagesInvestment AppraisalDeepankumar AthiyannanNo ratings yet

- Equity Research Report - CIMB 27 Sept 2016Document14 pagesEquity Research Report - CIMB 27 Sept 2016Endi SingarimbunNo ratings yet

- EEM MOD003477 Module GuideDocument24 pagesEEM MOD003477 Module GuideSamar SalahNo ratings yet

- Goldin Financial / Bon Pasteur Acquisition / HKex Public FilingDocument9 pagesGoldin Financial / Bon Pasteur Acquisition / HKex Public Filingskadden1No ratings yet

- Vaya Group Organizational Culture White PaperDocument10 pagesVaya Group Organizational Culture White Paperapye1836No ratings yet

- M310 11 ConstructionProgressScheduleDocument10 pagesM310 11 ConstructionProgressScheduleIan DalisayNo ratings yet

- Digital Banking, Customer PDFDocument27 pagesDigital Banking, Customer PDFHafsa HamidNo ratings yet

- Chapt Er: Nature and Scope of Investment DecisionsDocument21 pagesChapt Er: Nature and Scope of Investment DecisionschitkarashellyNo ratings yet

- Bse Data PolicyDocument6 pagesBse Data Policyvishalsharma8522No ratings yet

- Judge Kaplan's Ruling in Lehman Brothers LitigationDocument110 pagesJudge Kaplan's Ruling in Lehman Brothers LitigationDealBookNo ratings yet

- Reference Form 2011Document473 pagesReference Form 2011LightRINo ratings yet

- Understanding and Applying Innovation Strategies in The Public SectorDocument21 pagesUnderstanding and Applying Innovation Strategies in The Public SectorEda Paje AdornadoNo ratings yet

- Classified Data AnalysisDocument6 pagesClassified Data Analysiskaran976No ratings yet

- MECO 121-Principles of Macroeconomics-Daud A DardDocument5 pagesMECO 121-Principles of Macroeconomics-Daud A DardHaris AliNo ratings yet

- SAP FI Sensitive T Codes List: General LedgerDocument5 pagesSAP FI Sensitive T Codes List: General Ledgerprakash_kumNo ratings yet

- Caltex Phils. Vs Palomar (18 SCRA 247)Document6 pagesCaltex Phils. Vs Palomar (18 SCRA 247)Doris Moriel Tampis100% (1)

- Cityam 2011-09-19Document36 pagesCityam 2011-09-19City A.M.No ratings yet

- Presented By:: Pranav V Shenoy Gairik Chatterjee Kripa Shankar JhaDocument20 pagesPresented By:: Pranav V Shenoy Gairik Chatterjee Kripa Shankar JhaPranav ShenoyNo ratings yet

- Presentation On Facebook Advertising For Business.Document10 pagesPresentation On Facebook Advertising For Business.Joshna ElizabethNo ratings yet

- Export PromotionDocument16 pagesExport Promotionanshikabatra21167% (3)

- Accounting For Managers - Assignment 5 - Chapter 5Document4 pagesAccounting For Managers - Assignment 5 - Chapter 5Abeba GselassieNo ratings yet

- Lovell, Jonathan PDFDocument2 pagesLovell, Jonathan PDFAnonymous viLMwYNo ratings yet

- Structural Consultants Registered With Dda Sl. No. Name & Address of The Agency ValidityDocument4 pagesStructural Consultants Registered With Dda Sl. No. Name & Address of The Agency ValidityRupali ChadhaNo ratings yet

- Agile User Stories and Workshop - Moduele 1Document24 pagesAgile User Stories and Workshop - Moduele 1Ajersh Paturu100% (1)

- Encyclopaedia Britannica vs. NLRCDocument1 pageEncyclopaedia Britannica vs. NLRCYsabel PadillaNo ratings yet

- ID Analisis Produktivitas Tanaman Padi Di Kabupaten Badung Provinsi BaliDocument15 pagesID Analisis Produktivitas Tanaman Padi Di Kabupaten Badung Provinsi BaliSugi Esa FirmansyahNo ratings yet