Professional Documents

Culture Documents

STUDENT Examination NO: : Date: 10

Uploaded by

Ishu GunasekaraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

STUDENT Examination NO: : Date: 10

Uploaded by

Ishu GunasekaraCopyright:

Available Formats

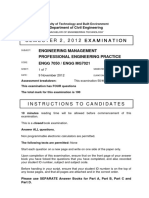

STUDENT Examination NO: ………………………

KIU Faculty of Management

Bachelor of Management Honors in HRM- 0606 01004/0606 05001/0606 01005/0606 05002

Bachelor of Management Honors in MKT- 0706 01004/0706 05001/ 0706 01005/0706 05002

Bachelor of Management Honors in ACC- 0806 05001/0806 01005/0806 05002

2nd Year 2nd Semester – Special Repeat Examination - May 2022

ACT2302 – Financial Management

Date: 10th May 2022 Duration 02 hours

Time : 09.00 am – 11.00 am Marks 100%

This paper consists of Three Open Book questions. Answer all.

Please read the following instructions carefully before you answer questions.

All the exams should be carried out using Microsoft Teams.

The students should indicate the following details on the front page when submitting the answer sheets:

Index number

Subject name

Date

Number of questions attempted

Number of papers used

Group number

The students should indicate the examination ID number in all papers that are submitted as answers.

All the papers should be numbered in an order and sent as a single document.

Students should rename the answer script as “B03, Module code, Last four digits of ID.(e.g.B03, MGT3406,1234)

Upload your answer scripts as per the instruction given below.

1. Typed answer script

a. Make PDF format

b. Upload the file to the Assignment, My work,

c. Enter the “Turn In/Hand In” key

2. Hand-written answer script

a. Take clear photographs of the answer script

b. Make PDF format

c. Upload the file to the Assignment, My work,

d. Enter the “Turn In/Hand In” key

In an instance where the students fail to submit answers in Ms. Teams, within the given time, the student should

immediately contact the assigned lecturer/supervisor/invigilator to inform the issue and then use the following

as the answer submission methods.

KIU Department of Examinations

Page 1 of 7

STUDENT Examination NO: ………………………

Question No. 01

1.1.Discuss the importance of studying Financial Management.

(10 marks)

1.2.What are the reasons that determine the time value of money?

(08 marks)

1.3.Imagine you are going to buy an asset for Rs. 67,000 and you would sell the asset in 3 years for

Rs. 75,000. If you could invest the Rs. 67,000 elsewhere at 10% interest, critically evaluate the

investment opportunities and select the best option with relevant calculations.

(12 marks)

(Total 30 marks)

Question 02

2.1.Cost of capital computation is based on certain assumptions. Evaluate the assumptions.

(10 marks)

2.2.Briefly discuss the difference between capital structure and financial structure of an organization.

(08 Marks)

2.3.ABC Ltd. has the following capital structure.

Equity (expected dividend 12%) – Rs. 1,000,000

10% preference shares - Rs. 500,000

8% loan - Rs. 1,500,000

You are required to calculate the weighted average cost of capital, assuming that the rate of

income tax is 50%. (08 marks)

2.4.The shares of Amana PLC are currently selling at Rs. 70 per share. The company expects to pay a

dividend of Rs. 6 per share. If the shareholders’ required rate is 11%, what is the growth rate of

common stock? (04 Marks)

(Total 30 Marks)

KIU Department of Examinations

Page 2 of 7

STUDENT Examination NO: ………………………

Question No. 03

3.1.Some scholars argue that "ratio analysis is not a sound method to analyze the financial

statements." Do you agree with this statement? Justify your answer.

(10 Marks)

3.2.Financial statements of ABC Ltd are given below.

ABC Co. Ltd

Statement of Financial Position

as at 31st March 2019 (Rs. in Millions)

Non-current Assets

Property, plant and equipment 5,500

Furniture 2,900

Net Non-Current Assets 8,400

Current Assets

Inventory 1,500

Accounts receivable 1,100

Cash 400

Total current assets 3,000

Total Assets 11,400

Liabilities and owners' equity

Common Stocks 1,000

Reserves 1,100

Retained Earnings 3,300

Total equity 5,400

Non-current liabilities

Long term debts 2,400

Total Non-current liabilities 2,400

Current Liabilities

Accounts payables 2,400

Notes payables 1,200

Total Current liabilities 3,600

Total Liabilities and equity 11,400

KIU Department of Examinations

Page 3 of 7

STUDENT Examination NO: ………………………

ABC Co. Ltd

Comprehensive Income Statement

for the Year Ending 31st March 2019

(RS. in

Millions)

Sales 12,920

Cost of Goods Sold 2,400

Administrative Expenses 3,600

Depreciation 1,200

Interest Expense 120

Taxes 2,200

Dividends 1,000

Addition to Retained Earnings 2,400

You are required to calculate,

1. Current Ratio

2. Liquid Ratio

3. Debt-Equity Ratio

4. Gross Profit Ratio

5. Operating Profit Ratio

6. Return on Capital Employed

7. Earnings Per Share

8. Dividend Per Share

9. Sock Turnover Ratio

10. Debtors Turnover Ratio

(30 Marks)

(Total 40 Marks)

KIU Department of Examinations

Page 4 of 7

You might also like

- Time: 3 Hours Total Marks: 100: Printed Pages: 03 Sub Code: KMB103 Paper Id: 270103 Roll NoDocument4 pagesTime: 3 Hours Total Marks: 100: Printed Pages: 03 Sub Code: KMB103 Paper Id: 270103 Roll NoAbhishek ChaubeyNo ratings yet

- BCHDE5311 - Regular MORNINGDocument10 pagesBCHDE5311 - Regular MORNINGDhruv ShahNo ratings yet

- Far670 - Q - Feb 2021Document5 pagesFar670 - Q - Feb 2021AMIRA BINTI AMRANNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- Feb 2021Document4 pagesFeb 2021Muhammad ZulhisyamNo ratings yet

- 250 Question PaperDocument3 pages250 Question PaperSam NayakNo ratings yet

- 426 - 393 - 370 - Manajemen Keuangan - Reguler 2021Document2 pages426 - 393 - 370 - Manajemen Keuangan - Reguler 2021gifa azriaNo ratings yet

- Accounting GR 11 Paper 1Document11 pagesAccounting GR 11 Paper 1Muneebah HajatNo ratings yet

- 1.2 Managerial AccountingDocument4 pages1.2 Managerial AccountingAshik PaulNo ratings yet

- INS2009 - Nguyên Lý Kế ToánDocument6 pagesINS2009 - Nguyên Lý Kế ToánHuyen NguyenNo ratings yet

- F2 - Financial ManagementDocument20 pagesF2 - Financial ManagementRobert MunyaradziNo ratings yet

- Ba7106-Accounting For ManagementDocument10 pagesBa7106-Accounting For ManagementVaibhavNo ratings yet

- Final Exam FM Summer 2021Document2 pagesFinal Exam FM Summer 2021AAYAN FARAZNo ratings yet

- Financial Accounting Assignment Sept 2019Document7 pagesFinancial Accounting Assignment Sept 2019Emma HusinNo ratings yet

- Not Permissible. Give Supporting Calculations Where Necessary)Document4 pagesNot Permissible. Give Supporting Calculations Where Necessary)Danial QureshiNo ratings yet

- 5533-Financial AccountingDocument9 pages5533-Financial Accountingharoonsaeed12No ratings yet

- Finance Assignment 1 GuideDocument3 pagesFinance Assignment 1 GuideBanda SamsonNo ratings yet

- University of Cambridge International Examinations Advanced Subsidiary Level and Advanced LevelDocument12 pagesUniversity of Cambridge International Examinations Advanced Subsidiary Level and Advanced LevelProto Proffesor TshumaNo ratings yet

- Ca Exm Fa1 2012 09 PDFDocument20 pagesCa Exm Fa1 2012 09 PDFJerlin PreethiNo ratings yet

- Bca 04 Ba It 03Document4 pagesBca 04 Ba It 03Jatin SinghNo ratings yet

- University of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelDocument16 pagesUniversity of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelJhagantini PalaniveluNo ratings yet

- BBAW2103Document13 pagesBBAW2103Nurul IzzatyNo ratings yet

- Allam Iqbal Open University, Islamabad: WarningDocument4 pagesAllam Iqbal Open University, Islamabad: WarningNoo UllahNo ratings yet

- MS 04-Jan 2014Document3 pagesMS 04-Jan 2014Devendar SinghNo ratings yet

- Assignment - DMBA104 - MBA1 2 - Set-1 and 2 - Sep - 2023Document3 pagesAssignment - DMBA104 - MBA1 2 - Set-1 and 2 - Sep - 2023ANSHU MAURYA0% (1)

- Bbaw2103 Financial AccountingDocument15 pagesBbaw2103 Financial AccountingSimon RajNo ratings yet

- Solution 5Document29 pagesSolution 5HariNo ratings yet

- Class 11 Acc FinalDocument3 pagesClass 11 Acc Finalmnmehta1990No ratings yet

- Far410 Test Dec2020Document3 pagesFar410 Test Dec20202022478048No ratings yet

- MEFA Nov2003 RR211701Document10 pagesMEFA Nov2003 RR211701Nizam Institute of Engineering and Technology LibraryNo ratings yet

- Internal Imp TybmsDocument2 pagesInternal Imp Tybmstandelrishabh648No ratings yet

- Q.P. Code: 62202: Managerial AccountingDocument6 pagesQ.P. Code: 62202: Managerial Accountinganshul bhutangeNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- SEO-Optimized Title for Faculty Exam DocumentDocument7 pagesSEO-Optimized Title for Faculty Exam DocumentdonNo ratings yet

- 427 Question PaperDocument4 pages427 Question PaperSam NayakNo ratings yet

- 63 Question PaperDocument4 pages63 Question PaperSam NayakNo ratings yet

- Accounting Title for Document on Financial Accounting ExamDocument10 pagesAccounting Title for Document on Financial Accounting ExamjamespotheadNo ratings yet

- IIM Ahmedabad Financial Reporting and Analysis ExamDocument4 pagesIIM Ahmedabad Financial Reporting and Analysis ExamPulkit SethiaNo ratings yet

- Mca Accounts Model QuestionDocument2 pagesMca Accounts Model QuestionAnonymous 1ClGHbiT0JNo ratings yet

- University of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelDocument16 pagesUniversity of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelMunyaradzi MhlangaNo ratings yet

- University of Zimbabwe: Professional and Industrial StudiesDocument7 pagesUniversity of Zimbabwe: Professional and Industrial StudiesBrightwell InvestmentsNo ratings yet

- Bbaw2103 - Financial AccountingDocument13 pagesBbaw2103 - Financial AccountingSimon RajNo ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- Csec Poa June 2010 p2Document12 pagesCsec Poa June 2010 p2Renelle RampersadNo ratings yet

- ACC030 Comprehensive Project April2018 (Q)Document5 pagesACC030 Comprehensive Project April2018 (Q)Fatin AkmalNo ratings yet

- Class 12 Accountancy Practice Paper 02Document6 pagesClass 12 Accountancy Practice Paper 02Ankit Kumar100% (1)

- Corporate Accounting IIDocument5 pagesCorporate Accounting II2vj77sn8x5No ratings yet

- MCS-035-Accountancy and Financial ManagementDocument5 pagesMCS-035-Accountancy and Financial ManagementShainoj KunhimonNo ratings yet

- Accounts Test 100 Marks PDFDocument9 pagesAccounts Test 100 Marks PDFAruna RajappaNo ratings yet

- Accounts Test 100 Marks PDFDocument9 pagesAccounts Test 100 Marks PDFAruna RajappaNo ratings yet

- AssignmentsDocument7 pagesAssignmentspratikshakurhade04No ratings yet

- Fma PaperDocument2 pagesFma Paperfishy18No ratings yet

- Gr08 Ems Term2 Pack01 Practice PaperDocument4 pagesGr08 Ems Term2 Pack01 Practice Paperkehindekevan223No ratings yet

- Finance 745Document5 pagesFinance 745Sara KarenNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingHarsh KumarNo ratings yet

- 25 Question PaperDocument4 pages25 Question PaperPacific Tiger0% (1)

- Arab Final 90% Fall2021 (YS)Document8 pagesArab Final 90% Fall2021 (YS)ahmed abuzedNo ratings yet

- Tax InfoDocument1 pageTax InfoIshu GunasekaraNo ratings yet

- Aviation Thailand 2019Document2 pagesAviation Thailand 2019Ishu GunasekaraNo ratings yet

- Business Ethics, Corporate Governance & CSRDocument24 pagesBusiness Ethics, Corporate Governance & CSRZedge100% (1)

- Cambodia - Aviation ProjectDocument5 pagesCambodia - Aviation ProjectIshu GunasekaraNo ratings yet

- Background of CBL CompanyDocument1 pageBackground of CBL CompanyIshu GunasekaraNo ratings yet

- Pathiraja Et AlDocument24 pagesPathiraja Et AlIshu GunasekaraNo ratings yet

- Treasurer's Directions: Accounting - Expenses (Section A6.2: Employee Benefits)Document9 pagesTreasurer's Directions: Accounting - Expenses (Section A6.2: Employee Benefits)Ishu GunasekaraNo ratings yet

- 2021 ThailandDocument1 page2021 ThailandIshu GunasekaraNo ratings yet

- Practical Guide On Project Report and Project Report Assessment - EnglishDocument5 pagesPractical Guide On Project Report and Project Report Assessment - EnglishIshu GunasekaraNo ratings yet

- Editor, Journal Manager, Dental Interns Attitudes Toward Case-Based Learning Ijier - Net Vol-3-2-6Document9 pagesEditor, Journal Manager, Dental Interns Attitudes Toward Case-Based Learning Ijier - Net Vol-3-2-6Ishu GunasekaraNo ratings yet

- PCMdemoDocument9 pagesPCMdemoIshu GunasekaraNo ratings yet

- Introduction EthicsDocument2 pagesIntroduction EthicsIshu GunasekaraNo ratings yet

- Marketing EnvironmentDocument4 pagesMarketing EnvironmentIshu GunasekaraNo ratings yet

- LEADERSHIP2Document2 pagesLEADERSHIP2Ishu GunasekaraNo ratings yet

- CBL Promotes Healthy Products GloballyDocument14 pagesCBL Promotes Healthy Products GloballyIshu GunasekaraNo ratings yet

- K P KumarasingheDocument3 pagesK P KumarasingheIshu GunasekaraNo ratings yet

- Effectiveness of Income Tax Collection in Sri Lanka EditedDocument38 pagesEffectiveness of Income Tax Collection in Sri Lanka EditedIshu GunasekaraNo ratings yet

- Coir Research SummaryDocument18 pagesCoir Research SummaryIshu GunasekaraNo ratings yet

- Toturial OTDocument2 pagesToturial OTIshu GunasekaraNo ratings yet

- Exercise 01Document1 pageExercise 01Ishu GunasekaraNo ratings yet

- Assignment 02.11.2020 2Document32 pagesAssignment 02.11.2020 2Ishu GunasekaraNo ratings yet

- Final Reasearch KasunDocument42 pagesFinal Reasearch KasunIshu GunasekaraNo ratings yet

- Microsoft Powerpoint Assignments: Mark Off Each Assignment After It Is CompleteDocument2 pagesMicrosoft Powerpoint Assignments: Mark Off Each Assignment After It Is CompleteIshu GunasekaraNo ratings yet

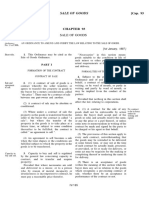

- Sale of GoodsDocument12 pagesSale of GoodsIshu GunasekaraNo ratings yet

- Tutorial 01Document1 pageTutorial 01Ishu GunasekaraNo ratings yet

- Find-Replace Part 2Document1 pageFind-Replace Part 2Ishu GunasekaraNo ratings yet

- Pringle Company monthly break-even analysisDocument3 pagesPringle Company monthly break-even analysisIshu GunasekaraNo ratings yet

- Dialog Case Analysis FinalDocument38 pagesDialog Case Analysis FinalIshu GunasekaraNo ratings yet

- Assignment DialogDocument16 pagesAssignment DialogIshu Gunasekara100% (1)

- FM Charts by ICAI PDFDocument19 pagesFM Charts by ICAI PDFAditya Raut100% (1)

- Mbof912d Assignment 1 PDFDocument8 pagesMbof912d Assignment 1 PDFArneet SarnaNo ratings yet

- Adam SugarDocument11 pagesAdam SugarshirazhaqNo ratings yet

- Purolite Investor PresentationDocument17 pagesPurolite Investor PresentationQuốc Anh KhổngNo ratings yet

- Crown Castle Presentation NAREIT 2014 ReportDocument33 pagesCrown Castle Presentation NAREIT 2014 ReportSafe Tech For SchoolsNo ratings yet

- Banking and Capital Markets - V1.2Document254 pagesBanking and Capital Markets - V1.2Abhiram DubeyNo ratings yet

- 2Document13 pages2Ashish BhallaNo ratings yet

- The Costs and Factors of a Company's Capital StructureDocument13 pagesThe Costs and Factors of a Company's Capital StructureAnanda RiskiNo ratings yet

- Chapter 19 - Financing and ValuationDocument49 pagesChapter 19 - Financing and Valuationnormalno100% (1)

- Wacc and MMDocument2 pagesWacc and MMThảo NguyễnNo ratings yet

- Sun_Microsystems_Case_Study.docxDocument7 pagesSun_Microsystems_Case_Study.docxJosé F. PeñaNo ratings yet

- Capital Structure NotesDocument56 pagesCapital Structure NotesChanchal Chawla100% (1)

- RJR Nabisco ValuationDocument38 pagesRJR Nabisco ValuationJCNo ratings yet

- Recommendation On The Acquisation of VitasoyDocument8 pagesRecommendation On The Acquisation of Vitasoyapi-237162505No ratings yet

- AES Adjusted WACC Case StudyDocument12 pagesAES Adjusted WACC Case StudyTim Castorena33% (3)

- Multiple Choice Answer For FM2Document14 pagesMultiple Choice Answer For FM2Sen Siew LingNo ratings yet

- Class25 EvaDocument21 pagesClass25 EvaAnshul SehgalNo ratings yet

- Return and RiskDocument20 pagesReturn and Riskdkriray100% (1)

- Hindustan Unilever Limited: CapitalisationDocument9 pagesHindustan Unilever Limited: CapitalisationRohit GoyalNo ratings yet

- Measuring The Moat PDFDocument70 pagesMeasuring The Moat PDFFlorent CrivelloNo ratings yet

- Mondelez International Final Project IBF (6848)Document30 pagesMondelez International Final Project IBF (6848)Imran UmarNo ratings yet

- Corporate Finance - Teaching Plan - 2019-21Document18 pagesCorporate Finance - Teaching Plan - 2019-21Dimpy KatharNo ratings yet

- Essays UOLs FIDocument34 pagesEssays UOLs FIAnna KucherukNo ratings yet

- VBM Book!!!Document254 pagesVBM Book!!!Buba AtanasovaNo ratings yet

- Investment Banking Spring 2021 Case Study #1 Mercury Athletic Footwear: Valuing The OpportunityDocument3 pagesInvestment Banking Spring 2021 Case Study #1 Mercury Athletic Footwear: Valuing The OpportunityRavi PatelNo ratings yet

- The Investment Setting: Answers To QuestionsDocument11 pagesThe Investment Setting: Answers To Questions12jd100% (1)

- Solman PortoDocument26 pagesSolman PortoYusuf Raharja0% (1)

- Flash Memory AnalysisDocument25 pagesFlash Memory AnalysisaamirNo ratings yet

- BIAYA MODAL CompressedDocument89 pagesBIAYA MODAL CompressedMuh IdhamsyahNo ratings yet

- Optimal Capital Structure AnalysisDocument35 pagesOptimal Capital Structure AnalysismelakuNo ratings yet