Professional Documents

Culture Documents

18-Job Work Provisions

18-Job Work Provisions

Uploaded by

nisho tyagi0 ratings0% found this document useful (0 votes)

6 views8 pagesThis document discusses job work provisions under GST. It defines job work as any process undertaken on goods belonging to another person. The job work provision was introduced to treat the transfer of goods from principal to job worker as a supply, to avoid misuse of input tax credit. Job work is treated as a supply of services, whether or not it amounts to manufacturing. Goods must be returned within one year, otherwise it will be deemed as a supply from the date they were originally sent. Capital goods must be returned within three years, otherwise it will be deemed as a supply from the date sent. The document provides procedures and timelines for job work to control the movement of goods and avoid permanent transfer.

Original Description:

Original Title

18-Job work provisions

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses job work provisions under GST. It defines job work as any process undertaken on goods belonging to another person. The job work provision was introduced to treat the transfer of goods from principal to job worker as a supply, to avoid misuse of input tax credit. Job work is treated as a supply of services, whether or not it amounts to manufacturing. Goods must be returned within one year, otherwise it will be deemed as a supply from the date they were originally sent. Capital goods must be returned within three years, otherwise it will be deemed as a supply from the date sent. The document provides procedures and timelines for job work to control the movement of goods and avoid permanent transfer.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views8 pages18-Job Work Provisions

18-Job Work Provisions

Uploaded by

nisho tyagiThis document discusses job work provisions under GST. It defines job work as any process undertaken on goods belonging to another person. The job work provision was introduced to treat the transfer of goods from principal to job worker as a supply, to avoid misuse of input tax credit. Job work is treated as a supply of services, whether or not it amounts to manufacturing. Goods must be returned within one year, otherwise it will be deemed as a supply from the date they were originally sent. Capital goods must be returned within three years, otherwise it will be deemed as a supply from the date sent. The document provides procedures and timelines for job work to control the movement of goods and avoid permanent transfer.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

Job Work

Job Work Provisions

Definition of Job work

Origin of job work provision

Treatment of job work

Procedure of job work

ITC of goods sent on Job work

Job worker’s turnover as clarified under section 22.

Meaning of Job work

Job work means any process undertaken by the person on the

goods belonging to another person.

Origin of Job work provision

As per Sch. 1 of cgst act- entry 1 , if there is permanent transfer

of business assets without consideration where input tax credit

has been availed- it will be treated as supply.

Incase of principal transferring goods to job-worker for job work

,In the eye of law , it is a kind of permanent t/f of goods because

Inputs/goods sent to job worker are not returned back to

principal in the same form , so it can be proved as Permanent t/f

of goods to Job worker in absence of any controlling measures ,

hence Sec 143 inserted by the govt. to lay down time lines to

bring back such goods.

Treatment of Job work

As per Sch. 2 of cgst act- para 3 , Job work will be treated as

supply of Services irrespective such job work amounts to

manufacturing activity or not.

Procedure of Job work (Sec 143)

Job work Procedure

Input Sent for Job Capital goods sent for job

work work

Bring Back with in

one Year After 1 Year Bring back in time 3 After 3 years

Years

Deemed as Supply Deemed as Supply from the

No Tax from date when it was date it was sent

sent

No Tax Liable to Pay

Liable to pay (Tax

+Interest) ( Tax + Interest)

No Time limit to receive back

To Control

motion of

another

Tool

To

support

another

Tool

Moulds & dies Jigs & Fixtures Tools

Thank You

Presented by:

Compiled by:

CA Rahul Jain

Faculty of ICAI

FCA Gurjit Singhfor GST

Bhullar

(M) +9999413882

Email: gs.bhullar@rediffmail.com

getcarahuljain@gmail.com

You might also like

- 8D TemplateDocument9 pages8D TemplateCarlos Oliver MontejanoNo ratings yet

- Advanced Welding SystemsDocument151 pagesAdvanced Welding SystemsImam Buchairi100% (2)

- Uncommon GST TopicsDocument36 pagesUncommon GST TopicsEugeniePaxtonNo ratings yet

- Questions On Big DataDocument2 pagesQuestions On Big Dataabhijitp100% (3)

- CITSM2018-Master Data Management Maturity Assessment Supreme Court PDFDocument7 pagesCITSM2018-Master Data Management Maturity Assessment Supreme Court PDFHedy PamungkasNo ratings yet

- Material - GSTDocument18 pagesMaterial - GSTDeepak NimmojiNo ratings yet

- Cad/Cam Seminar On: Nx-UnigraphicsDocument18 pagesCad/Cam Seminar On: Nx-Unigraphicschirag3110No ratings yet

- Elisco-Elirol Labor Union (NAFLU) vs. Noriel 80 SCRA 681Document13 pagesElisco-Elirol Labor Union (NAFLU) vs. Noriel 80 SCRA 681juan dela cruzNo ratings yet

- IFRIC 23 Client Memo TemplateDocument8 pagesIFRIC 23 Client Memo TemplateCk Bongalos Adolfo100% (1)

- GST PPT (Group 5)Document20 pagesGST PPT (Group 5)Hanna GeorgeNo ratings yet

- All The Due Dates and Time Limits in GSTDocument10 pagesAll The Due Dates and Time Limits in GST2d77gp69kzNo ratings yet

- Invoice InterDocument10 pagesInvoice InterKaylee WrightNo ratings yet

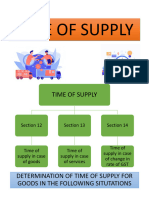

- Levy in GST S.No Particulars 1 Time of SupplyDocument7 pagesLevy in GST S.No Particulars 1 Time of SupplyAnonymous ikQZphNo ratings yet

- GST1Document25 pagesGST1DeepikaNo ratings yet

- Goods and Service TaxDocument15 pagesGoods and Service TaxSanket MhetreNo ratings yet

- 5 Time of SupplyDocument18 pages5 Time of SupplyDhana SekarNo ratings yet

- Job Work Under GSTDocument3 pagesJob Work Under GSTanurag3069No ratings yet

- Time & Value of SupplyDocument2 pagesTime & Value of SupplyRahul NegiNo ratings yet

- Indirect Tax and GST - Unit IIIDocument43 pagesIndirect Tax and GST - Unit IIIPRATIK JAINNo ratings yet

- Time of SupplyDocument31 pagesTime of SupplyNalin KNo ratings yet

- GST - Time of Supply of Goods (Summary)Document1 pageGST - Time of Supply of Goods (Summary)Saksham KathuriaNo ratings yet

- Amendment in Income Tax Act Through Finance Act 2021Document14 pagesAmendment in Income Tax Act Through Finance Act 2021rahul dantkaleNo ratings yet

- Impact of GST On Real Estate Sector: by Ca Umesh SharmaDocument58 pagesImpact of GST On Real Estate Sector: by Ca Umesh SharmaRavindra PoteNo ratings yet

- GST NotesDocument121 pagesGST NotesVikram KatariaNo ratings yet

- Chapter 6 - Time of SupplyDocument7 pagesChapter 6 - Time of SupplyDrafts StorageNo ratings yet

- WorksContractServices PraDocument22 pagesWorksContractServices PraManikantaNo ratings yet

- Tax Points - Reference Material: Pro Forma InvoicesDocument2 pagesTax Points - Reference Material: Pro Forma Invoicesanon_178447188No ratings yet

- Presentation On RCMDocument13 pagesPresentation On RCMCA Nakul GuptaNo ratings yet

- Invoicing Under Goods and Service TAXDocument21 pagesInvoicing Under Goods and Service TAXMichealNo ratings yet

- Tax Invoice & E-Way BillDocument33 pagesTax Invoice & E-Way BillDayal SinghNo ratings yet

- Time of Supply: General Time Limit For Raising InvoicesDocument4 pagesTime of Supply: General Time Limit For Raising InvoicesPrasanthNo ratings yet

- Time of Supply of ServicesDocument10 pagesTime of Supply of ServicesShiwang AgrawalNo ratings yet

- Tos & Vos PDFDocument42 pagesTos & Vos PDFRatulNo ratings yet

- Levy and SupplyDocument37 pagesLevy and SupplydurairajNo ratings yet

- Invoicing Under Goods and Service TAXDocument37 pagesInvoicing Under Goods and Service TAXAmit GuptaNo ratings yet

- Time of Supply: When Invoice Is Issued Within Statutory Period (30 Days or 45 Days)Document3 pagesTime of Supply: When Invoice Is Issued Within Statutory Period (30 Days or 45 Days)DebaNo ratings yet

- Form VDocument4 pagesForm VNavaneethakrishnan RangasamyNo ratings yet

- Time of Supply PDFDocument16 pagesTime of Supply PDFNaveed AnsariNo ratings yet

- Chapter 5 WhentoPayTaxonSupplyofGoods ServicesDocument24 pagesChapter 5 WhentoPayTaxonSupplyofGoods ServicesDR. PREETI JINDALNo ratings yet

- GST 5.1Document46 pagesGST 5.1Raghav TiwariNo ratings yet

- Para 3 Schedule II: Treatment or Process (Job Work Supply of Service)Document3 pagesPara 3 Schedule II: Treatment or Process (Job Work Supply of Service)dinesh kasnNo ratings yet

- GST Assignment II: Question 1: Enumeration The Provision Related To TDS and TCS Under GST. AnswerDocument4 pagesGST Assignment II: Question 1: Enumeration The Provision Related To TDS and TCS Under GST. AnswerMansi SainiNo ratings yet

- Management of Value Added Tax (VAT)Document19 pagesManagement of Value Added Tax (VAT)wellawalalasithNo ratings yet

- Operations Document eBikeGoDocument12 pagesOperations Document eBikeGoE SEVA KENDRA VISHRANTWADINo ratings yet

- Time of Supply Under Goods and Service Tax ActDocument8 pagesTime of Supply Under Goods and Service Tax ActNarayan KabraNo ratings yet

- GST Seminar: Hosted By:-Akola Branch of WICASA of ICAIDocument40 pagesGST Seminar: Hosted By:-Akola Branch of WICASA of ICAINavneetNo ratings yet

- Job Work: Learning OutcomesDocument12 pagesJob Work: Learning OutcomesAnkitaNo ratings yet

- Time of SupplyDocument4 pagesTime of SupplyAarushi GuptaNo ratings yet

- Job Work Under GSTDocument10 pagesJob Work Under GSTbrqps1542fNo ratings yet

- GST For Nov 2022 & May 2023 Exams (GST Time of Supply of ServicesDocument1 pageGST For Nov 2022 & May 2023 Exams (GST Time of Supply of ServicesVikasNo ratings yet

- 3.levy of GSTDocument16 pages3.levy of GSTTanishka NagpalNo ratings yet

- Bill of SupplyDocument3 pagesBill of SupplyAnas QasmiNo ratings yet

- Tax, GST, Transfer PricingDocument11 pagesTax, GST, Transfer Pricingbiplav2uNo ratings yet

- GST Remark Related FileDocument14 pagesGST Remark Related FileAnonymous ikQZphNo ratings yet

- UNIT 2 (4) Time of SupplyDocument15 pagesUNIT 2 (4) Time of SupplySania KhanNo ratings yet

- Guide To E-Way Bill 1Document2 pagesGuide To E-Way Bill 1Latha VenugopalNo ratings yet

- Why Are Time Place and Value of Supply important-DESKTOP-RLCBC05Document6 pagesWhy Are Time Place and Value of Supply important-DESKTOP-RLCBC05Angelica JacobNo ratings yet

- Time of Supply: CMA Bhogavalli Mallikarjuna GuptaDocument5 pagesTime of Supply: CMA Bhogavalli Mallikarjuna Guptagurusha bhallaNo ratings yet

- Time and Value of Supply-4Document73 pagesTime and Value of Supply-4Muhammad MehrajNo ratings yet

- Imports Under GSTDocument12 pagesImports Under GSThumanNo ratings yet

- Jobwork: Extension of Period For Receiving Back The Goods Sent For Job Work (Section 143 of The CGST Act)Document4 pagesJobwork: Extension of Period For Receiving Back The Goods Sent For Job Work (Section 143 of The CGST Act)Manish K JadhavNo ratings yet

- Time of SupplyDocument53 pagesTime of SupplySumeetNo ratings yet

- Idt 2Document10 pagesIdt 2manan agrawalNo ratings yet

- Time of Supply-IDocument50 pagesTime of Supply-IVaibhav GawadeNo ratings yet

- A Practical Guide To GST (Chapter 15 - Transition To GST)Document43 pagesA Practical Guide To GST (Chapter 15 - Transition To GST)Sanjay DwivediNo ratings yet

- SupplyDocument24 pagesSupplynisho tyagiNo ratings yet

- Transpose Function in ExcelDocument4 pagesTranspose Function in Excelnisho tyagiNo ratings yet

- GSTR 01Document9 pagesGSTR 01nisho tyagiNo ratings yet

- BOARD O F DIRECTORS Promotor DirectorsDocument60 pagesBOARD O F DIRECTORS Promotor Directorsnisho tyagiNo ratings yet

- BSBPMG621 - T1 - Michael Johan Cruz VerdugoDocument21 pagesBSBPMG621 - T1 - Michael Johan Cruz VerdugoLaura VargasNo ratings yet

- Activities/ Assessment:: Sky's The Limit: The China Sky Saga Discussion QuestionsDocument2 pagesActivities/ Assessment:: Sky's The Limit: The China Sky Saga Discussion QuestionsANH NGUYEN DANG QUENo ratings yet

- Authentic ListeningDocument90 pagesAuthentic Listeningenfa.work.confNo ratings yet

- S1 Metals House Inc USCG Bond Issue - November 2023Document19 pagesS1 Metals House Inc USCG Bond Issue - November 2023matt.rolesNo ratings yet

- COD-EMS-PRO-003 Objectives Targets and Environmental ProgramsDocument5 pagesCOD-EMS-PRO-003 Objectives Targets and Environmental ProgramsBRPLNo ratings yet

- Chapter TwoDocument3 pagesChapter TwoBạn Hữu Nhà ĐấtNo ratings yet

- ICICI Bank I InternshipDocument21 pagesICICI Bank I InternshipAyan SinhaNo ratings yet

- Peterproctor - STIRRINGDocument2 pagesPeterproctor - STIRRINGVeasBamNo ratings yet

- Note 7 Battery Explosion PresentationDocument11 pagesNote 7 Battery Explosion PresentationBaber AliNo ratings yet

- DPO Template Appointment LetterDocument3 pagesDPO Template Appointment LetterArete JinseiNo ratings yet

- Business English 2 2022 d4Document78 pagesBusiness English 2 2022 d4salisa maulidahNo ratings yet

- McqsDocument65 pagesMcqsMuhammad Yaqoob AslamNo ratings yet

- Rivera v. Chua G.R. No. 184458 January 14, 2015Document1 pageRivera v. Chua G.R. No. 184458 January 14, 2015Jonnel GohilNo ratings yet

- Vocational TrainingDocument29 pagesVocational TrainingMohammad AfzalNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasAmorfina SanpedroNo ratings yet

- Comprehensive Catalogue 2023 PRECITURN TOOLS NEW 加水印Document176 pagesComprehensive Catalogue 2023 PRECITURN TOOLS NEW 加水印Abdennadher MahdiNo ratings yet

- Job Analysis Questionnaire: Page 1 of 24Document24 pagesJob Analysis Questionnaire: Page 1 of 24abusyed alhasanNo ratings yet

- Swot Analysis - TCSDocument6 pagesSwot Analysis - TCSAditya JhaNo ratings yet

- DPW Annual Report 2019Document68 pagesDPW Annual Report 2019ankit singhNo ratings yet

- Ventura Securities Limited CIN No: U67120MH1994PLC082048Document2 pagesVentura Securities Limited CIN No: U67120MH1994PLC082048Pranav PatilNo ratings yet

- Reading Text 2 U1Document2 pagesReading Text 2 U1NHI HUỲNH XUÂNNo ratings yet

- Design MBA - Economics 101 (d.MBA)Document38 pagesDesign MBA - Economics 101 (d.MBA)World CitizenNo ratings yet

- Mirae Asset Sekuritas Indonesia Indocement Tunggal PrakarsaDocument7 pagesMirae Asset Sekuritas Indonesia Indocement Tunggal PrakarsaekaNo ratings yet