Professional Documents

Culture Documents

MGU Applied Costing 6th Semester March 2016 Question Paper

MGU Applied Costing 6th Semester March 2016 Question Paper

Uploaded by

Rainy GoodwillOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MGU Applied Costing 6th Semester March 2016 Question Paper

MGU Applied Costing 6th Semester March 2016 Question Paper

Uploaded by

Rainy GoodwillCopyright:

Available Formats

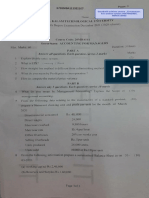

E 1575 (Pages:4)

Name....... ..... t?%)g:gt .

B.Com. DEGREE (C.B.C.S.S.) DGMINATION, MARCH

Z0t6

,Sixth Semester

Core Course 1E-ApPLIED COST ACCOUNTING

(common for Model I B.com Model II B.com and

uGc sponsored B.com.)

t2018 Admissionsl

Time.: Three Hours

Maximum:80 Marks

part A

,",f;Y:;#'"#::J:'i";,,u

1. What is Job costing ?

2. What is Batch Costing ?

3. What is Escalation Clause ?

4. What is meant by Retention money ?

5. What is Process costing ?

6. What do you mean by by-products ?

7. What is break-even chart ?

8. What is key factor ?

L What is meant by budgetary control ?

10. What is performance budgeting ?

(10x1=10)

Part B

Answer any eigbt questions.

Each question carcies 2 marks.

11' \Mhat are the various techniques q{cpsting useful for business decision

ma}ing ?

L2.Whatismeantbycontractcosting?S;teitsfea{tltres

13. Explain Cost-volume-profit Analysis.

14. What are the uses of Break-Even Chart ?

15. What is differential costing ? State its features

16. Explain the nature and usesgf batch costing.

L7 ' Why is a portion of profrt on Jrr"o*oleted contracts transferred to the profrt

and ioss accont ?

Tum over

Goodwill tuition centre , Ernakulam

For online tuition: 9846710963,

9567902805

2 F,1575

:-rz/

18. From the following information, determine economic batch quantity ,'.,.

Annual requirements 1600 units.

Cost of materials Per unit Rs. 40

order

Cost of piacing and receiving one Rs. 50

Annual carryrng cost of inventory LO Vo of inventory value.

19. You are given the following data;-

R*.-,' 80%

20000 / 80% = 25000

Fixed cost 20,000 100000 - 25000 = 75000

Variable cost

' 20,000

Sales 1,00,000

Calculate : P/V ratio, BEP a4d Margin of safety'

20. from the following information, prepare a process account, 1,000 unitq at Rs. 40 per unit were

/introduced in Process I :

\' //

Rs'

Labour cost 5,000

Material 20,000

Production overhead 3,500

The normal process loss has been estimated at LO Vo of ttre input which qanle sold at Rs. 10 per

unit. Actual production was 920 units.

(g x 2 = 16)

Part C

Answer any si* questions.

Each question carries 4 marhs.

U,

\-/ I

Explain the features of Job costing'

?rh What are the objectives of contract costing ?

'rr. Mention the advantages and disadvantages of break-even analysis.

24. State the advantages ofbudgetary control'

,/

Distinguish between Job Costing and Process Costing'

,/

26.. The following was the expenditule on a contract for Rs. 6,00,000 commenced in

-,/ .l*r"ary,2009 :-

' Rs.

Materiai 1,20,000

Wages 1,64,400

Plant 20,000

Business charges 8,600

Goodwill tuition centre , Ernakulam

For online tuition: 9846710963,

9567902805

3 9,L575

Cash received on account to 31st December,2009 amounted to Rs.2,40,000 being 80 7o of work

certified; the value of materials in hand at 31st December, 2009 was Rs" 10,000. Piepare thc

L'lantract Account for 2009 showing the profit to be credited to the year's Profrt and Loss Accouut,

Plant is to be depreciated at lO Vo.

2/ The information given below has been taken from the costing records of an Engineering works in

respect ofJob No. 62 :

Materials Rs. 4,010

Wages : Department 4'-60 hours @ Rs. 3 per hour.

Department B-40 hours @ Rs. 2 per hour.

Department C.60 hours @ Rs. 5 per hour.

.Overheads for these three departments were estimated as follows :

Variable overheads :

Department A Rs. 5;000 for 5,000 labour hours.

. Department B Rs. 3,000 for L,500labour hours.

Department C Rs. 2,000 for 500labour hours.

Fixed overheads i

Estimated at Rs. 20,000 for 10,000 normal working hours.

You are required to calculate the costro f Job 62 and calculate the price to give profit of 25 tio an

selling price.

28. Present the following infbrmation to show to the management : (a) The marginal procluct cost, and

the contribution per unit ; (b) The total contribution and profrts resulting from each of the fbllowing

sales niixture and state which of the alternative sales mix you would recommend to the management

and why ?

Particulars ProductA Product B

Rs. Rs.

Direct materials per unit ... 10 o

Direct wages 3 2

Sales price 20 15

Total fixed expenses Rs. 800.Yariable expenses are allocated to products as 100 7o of direct wages'

Sales mixturcs : \,

(i) 1,000 units of product A and 2,00G'wdts of product B.

(ii) 1,500 units of product A and 1,500 units of product B.

(iii) 2,000 units of product A and 1,000 units of product B.

(6x4=24't

Turn over

Goodwill tuition centre , Ernakulam

For online tuition: 9846710963,

9567902805

n L575

Part D

Answer any two questions.

Each question carries 15 marks.

29. Explain various accountrng treatment ofjoint products and by-products.

30. Product X is obtained after it passes through three distinct processes. You are requiled to prepare

process account frorn the following information :-

Total Rs. Process

I Rs. II Rs. III Rs.

Material 15,084 5,200 3,960 5,924

Direct wages l-8,000 4,000 6,000 8,000

Production overheads 18,000

+rec 6m0 8000

unit were introduced in Process I.

1,000 units at Rs. 6 per

Production overhead is to be distributed as 100 Vo on direct wages.

Actual outpttt Normal Value of scarp per

Process Unit Loss unit P"s.

I 950 5 7o 4

II 840 l0 Vo 8

III 750 15 7o 10

3i^ The expenses tcr the production of 5,00C units in a factory are given as follows :

Per Unit

Rs.

Materials 50

Labour 20

Variable Overheads 15

F'ixed Overhead (Rs. 50,000) ... 10{

Administrative expenses (5 Vo variable) 10

Selling expenses (2A 7o fixed) 6

Distribution expenses (L0 Va fixed) 5

Total cost ofsales per unit 116

You are required to prepare a budge!; for the production of 7,000 units.

(2x15=30)

Goodwill tuition centre , Ernakulam

For online tuition: 9846710963,

f ,s.18o

9567902805 4'l T,m

You might also like

- Marathon S 2023 2024 Global Credit Whitepaper 1678838357Document23 pagesMarathon S 2023 2024 Global Credit Whitepaper 1678838357SwaggyVBros MNo ratings yet

- Financial StatementsDocument3 pagesFinancial StatementsSoumendra RoyNo ratings yet

- Unit 3: Trial Balance: Learning OutcomesDocument13 pagesUnit 3: Trial Balance: Learning Outcomesviveo23No ratings yet

- 11 Accountancy Notes Ch03 Recording of Transactions 02Document20 pages11 Accountancy Notes Ch03 Recording of Transactions 02Subodh Saxena100% (1)

- 9 CHDocument44 pages9 CHvishwas jagrawal100% (1)

- Chapter 31 Payment Entry in TallyDocument1 pageChapter 31 Payment Entry in TallyTEJA SINGHNo ratings yet

- Exercises On Acc Eqn - 26 QuesDocument12 pagesExercises On Acc Eqn - 26 QuesNeelu AggrawalNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument29 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalsePiyush GoyalNo ratings yet

- FA Problems SolutionsDocument246 pagesFA Problems SolutionsK. Pavithraa SreeNo ratings yet

- Basics of AccountingDocument3 pagesBasics of AccountingAjesh Mukundan PNo ratings yet

- JM Institute of Technologies: Duration: 1 Hr. MM: 50Document2 pagesJM Institute of Technologies: Duration: 1 Hr. MM: 50Rahul NigamNo ratings yet

- As 7 Construction ContractDocument5 pagesAs 7 Construction ContractPankaj MeenaNo ratings yet

- AAT Model Paper 2019 JulDocument6 pagesAAT Model Paper 2019 JulShihan HaniffNo ratings yet

- Tally SlipsDocument10 pagesTally Slipsmanishudasi689No ratings yet

- Branch AccountingDocument38 pagesBranch AccountingUmra khatoonNo ratings yet

- Joint Product by ProductDocument19 pagesJoint Product by ProductDhilipkumarNo ratings yet

- Accounts - Journal EntriesDocument3 pagesAccounts - Journal Entriessjjjsjs0% (1)

- 4.service & Operating CostingDocument60 pages4.service & Operating CostingNaga ChandraNo ratings yet

- Tally Module 1 Assignment SolutionDocument6 pagesTally Module 1 Assignment Solutioncharu bishtNo ratings yet

- Tally Sample Paper With GST Feb 2023Document3 pagesTally Sample Paper With GST Feb 2023Bhumi NavtiaNo ratings yet

- Tally With GST Workshop Jan 2023 QuestionDocument3 pagesTally With GST Workshop Jan 2023 QuestionAryan GuptaNo ratings yet

- Exercise (Final Accounts)Document14 pagesExercise (Final Accounts)Abhishek Bansal100% (1)

- 68 Practical Questions of House PropertyDocument14 pages68 Practical Questions of House PropertyshrikantNo ratings yet

- Fin Account-Sole Trading AnswersDocument9 pagesFin Account-Sole Trading AnswersAR Ananth Rohith BhatNo ratings yet

- VAT Compilation CAP IIDocument15 pagesVAT Compilation CAP IIbinuNo ratings yet

- Problem 1: Use The Accounting Equation To Show Their Effect On His Assets, Liabilities and CapitalDocument2 pagesProblem 1: Use The Accounting Equation To Show Their Effect On His Assets, Liabilities and CapitalMadeeha KhanNo ratings yet

- Class 11 Accountancy Worksheet - 2023-24Document17 pagesClass 11 Accountancy Worksheet - 2023-24Yashi BhawsarNo ratings yet

- Income Tax Divyastra CH 6 - House Property - Nov 23 by CA Kishan KumarDocument40 pagesIncome Tax Divyastra CH 6 - House Property - Nov 23 by CA Kishan KumarSUMIT PANDEYNo ratings yet

- Ratio Problems 1Document6 pagesRatio Problems 1Vivek MathiNo ratings yet

- TYBAF UnderwritingDocument49 pagesTYBAF UnderwritingJaimin VasaniNo ratings yet

- 11 CaipccaccountsDocument19 pages11 Caipccaccountsapi-206947225No ratings yet

- Partnership: AdmissionDocument7 pagesPartnership: AdmissionSweta SinghNo ratings yet

- Accts Project For Class Xi 2015 16-1Document2 pagesAccts Project For Class Xi 2015 16-1Narsingh Das AgarwalNo ratings yet

- Class Discussion Questions For Capital Gains ChapterDocument3 pagesClass Discussion Questions For Capital Gains ChapterHdkakaksjsbNo ratings yet

- Personal Loan EMI Accounting Entry in Tally PrimeDocument17 pagesPersonal Loan EMI Accounting Entry in Tally PrimeVansh Gusai0% (1)

- CA Inter Adv Accounts (New) Suggested Answer Dec21Document30 pagesCA Inter Adv Accounts (New) Suggested Answer Dec21omaisNo ratings yet

- Corporate Accounting ProblemDocument6 pagesCorporate Accounting ProblemparameshwaraNo ratings yet

- Golden Rules of Accounts: Prof. Pallavi Ingale 9850861405Document32 pagesGolden Rules of Accounts: Prof. Pallavi Ingale 9850861405Pallavi Ingale100% (1)

- 10 Illustration of Ledger 24.10.08Document7 pages10 Illustration of Ledger 24.10.08denish gandhi100% (2)

- Study Note 3, Page 148-196Document49 pagesStudy Note 3, Page 148-196samstarmoonNo ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 5 Journal PDFDocument46 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 5 Journal PDFQueen MNo ratings yet

- Financial Accounting: Semester - IvDocument63 pagesFinancial Accounting: Semester - IvKARANNo ratings yet

- Special QuestionsDocument42 pagesSpecial QuestionsSaloni BansalNo ratings yet

- Problem in Subsidiary Book Cash BookDocument2 pagesProblem in Subsidiary Book Cash Bookkamalkav0% (1)

- Direct Materials APFL Uses A Weighted Average Method For The Pricing of Materials IssuesDocument5 pagesDirect Materials APFL Uses A Weighted Average Method For The Pricing of Materials IssuesAbimanyu ShenilNo ratings yet

- NON INTEGRATED TheoryDocument26 pagesNON INTEGRATED TheorySushant MaskeyNo ratings yet

- Important Points of Our Notes/Books:: TH THDocument42 pagesImportant Points of Our Notes/Books:: TH THpuru sharmaNo ratings yet

- CARO 2020 Question BankDocument9 pagesCARO 2020 Question BankRitikaNo ratings yet

- CA Inter Cost Important Questions For CA Nov'22Document93 pagesCA Inter Cost Important Questions For CA Nov'2202 Tapasvee ShahNo ratings yet

- CBSE Quick Revision Notes and Chapter Summary: Class-11 Accountancy Chapter 1 - Introduction To AccountingDocument6 pagesCBSE Quick Revision Notes and Chapter Summary: Class-11 Accountancy Chapter 1 - Introduction To AccountingSai Surya Stallone50% (2)

- Basics of Accounting - Bridge CourseDocument7 pagesBasics of Accounting - Bridge Coursebikshapati50% (2)

- Tally Erp 9 Practise Set 1Document28 pagesTally Erp 9 Practise Set 1Anusha Shetty100% (1)

- Group 2 May 07Document73 pagesGroup 2 May 07princeoftolgate100% (1)

- CA Inter Costing Practical Questions With SolutionsDocument311 pagesCA Inter Costing Practical Questions With SolutionsAnkit KumarNo ratings yet

- Inp 2234 Tax Question PaperDocument11 pagesInp 2234 Tax Question PaperAnshit BahediaNo ratings yet

- NandaniDocument6 pagesNandanikumarhimanshu1301100% (1)

- Basu and Dutta Journal EntriesDocument7 pagesBasu and Dutta Journal EntriesAranya Haldar100% (2)

- ITC Report and Accounts 2018Document332 pagesITC Report and Accounts 2018Anonymous DfSizzc4lNo ratings yet

- Accounts RTP May 23Document34 pagesAccounts RTP May 23ShailjaNo ratings yet

- Bcom 5 Sem Cost Accounting 1 22100106 Jan 2022Document4 pagesBcom 5 Sem Cost Accounting 1 22100106 Jan 2022Internet 223No ratings yet

- Cost Accounting (781) Sample Question Paper Class XII 2018-19Document5 pagesCost Accounting (781) Sample Question Paper Class XII 2018-19Saif HasanNo ratings yet

- Income Tax 1 B.com St. Alberts College Mgu 5th Semester Question Paper Free Download October 2022Document4 pagesIncome Tax 1 B.com St. Alberts College Mgu 5th Semester Question Paper Free Download October 2022Rainy GoodwillNo ratings yet

- October 22 Semester 3 Corporate Accounting S H College, Thevara Question PaperDocument4 pagesOctober 22 Semester 3 Corporate Accounting S H College, Thevara Question PaperRainy GoodwillNo ratings yet

- Accounting For Management SCMS Question PapersDocument7 pagesAccounting For Management SCMS Question PapersRainy GoodwillNo ratings yet

- Second Semester October 2022 Financial Accounting 2 Question Paper MGUDocument5 pagesSecond Semester October 2022 Financial Accounting 2 Question Paper MGURainy GoodwillNo ratings yet

- MGU B.com 1st Semester Financial Accounting Question Paper 2022 FebruaryDocument6 pagesMGU B.com 1st Semester Financial Accounting Question Paper 2022 FebruaryRainy GoodwillNo ratings yet

- Cusat Question Paper Mba Accounting For Managers 2022 MarchDocument3 pagesCusat Question Paper Mba Accounting For Managers 2022 MarchRainy GoodwillNo ratings yet

- Income Tax 5th Sem B.com November 2022 Question Paper Rajagiri College MGUDocument3 pagesIncome Tax 5th Sem B.com November 2022 Question Paper Rajagiri College MGURainy GoodwillNo ratings yet

- MGU CBCSS March 2018 Sixth Sem Question Paper Income Tax Assessment and Procedure.Document4 pagesMGU CBCSS March 2018 Sixth Sem Question Paper Income Tax Assessment and Procedure.Rainy GoodwillNo ratings yet

- Agriculture Income - Income TaxDocument5 pagesAgriculture Income - Income TaxRainy GoodwillNo ratings yet

- IGNOU Elements of Income Tax Question Paper Free Download B.com June 2017Document4 pagesIGNOU Elements of Income Tax Question Paper Free Download B.com June 2017Rainy GoodwillNo ratings yet

- Final Accounts AdjustmentsDocument7 pagesFinal Accounts AdjustmentsRainy GoodwillNo ratings yet

- MGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFDocument62 pagesMGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFRainy GoodwillNo ratings yet

- IFRS B.com SH College Model Question Paper 2017 March 2Document2 pagesIFRS B.com SH College Model Question Paper 2017 March 2Rainy GoodwillNo ratings yet

- 2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805Document4 pages2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill0% (1)

- Advanced Financial Accounting Degree Question Paper Free Download Goodwill Tuition Centre, Kochi, Kerala PH: 9567902805, 9846710963Document7 pagesAdvanced Financial Accounting Degree Question Paper Free Download Goodwill Tuition Centre, Kochi, Kerala PH: 9567902805, 9846710963Rainy GoodwillNo ratings yet

- MGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Document4 pagesMGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Rainy GoodwillNo ratings yet

- CBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Document4 pagesCBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill75% (4)

- 2017 March B.com 5th SemesterDocument4 pages2017 March B.com 5th SemesterRainy GoodwillNo ratings yet

- 2018 March B.com 4th Sem SH College Autonomous March Corporate Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Document4 pages2018 March B.com 4th Sem SH College Autonomous March Corporate Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNo ratings yet

- 2018 March B.com CBCSS Fifth Sem Special Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Document4 pages2018 March B.com CBCSS Fifth Sem Special Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNo ratings yet

- 2018 March B.com 4th Sem SH College Autonomous March Accounting For Managerial Decision Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Document3 pages2018 March B.com 4th Sem SH College Autonomous March Accounting For Managerial Decision Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNo ratings yet

- 2017 March B.com 5th Semester Special Accounting Question Paper MG University Goodwill Tuition Centre Thevara 9846710963 9567902805Document4 pages2017 March B.com 5th Semester Special Accounting Question Paper MG University Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy Goodwill50% (2)

- Campus ActivewearDocument25 pagesCampus Activeweargarima52goyalNo ratings yet

- BUS 5110 Managerial Accounting - Written Assignment Unit 6 V2Document7 pagesBUS 5110 Managerial Accounting - Written Assignment Unit 6 V2LaVida LocaNo ratings yet

- Problem Assignment 08 - Job Order Costing-Lucero, Mils Dio RaffDocument5 pagesProblem Assignment 08 - Job Order Costing-Lucero, Mils Dio RaffMils Dio Raff LuceroNo ratings yet

- Module 7 - MarketingDocument23 pagesModule 7 - MarketingAnkit AgrawallaNo ratings yet

- (DS Smith) : Academic Year Assessment Number Assessment TypeDocument45 pages(DS Smith) : Academic Year Assessment Number Assessment Typeprajwal sedhaiNo ratings yet

- CHAPTER5 AudTheoDocument18 pagesCHAPTER5 AudTheoadarose romaresNo ratings yet

- Du Pont 1983 SlidesDocument5 pagesDu Pont 1983 Slidesp23ayushsNo ratings yet

- Chapter 1 Introduction To Supply ChainsDocument3 pagesChapter 1 Introduction To Supply ChainsAnup DasNo ratings yet

- Accm4200 Online A Week 9 - Danica GarciaDocument4 pagesAccm4200 Online A Week 9 - Danica Garciaddga2003No ratings yet

- Enoch ControlsDocument10 pagesEnoch ControlsmagiNo ratings yet

- Project On Online Trading at Sharekhan LTDDocument136 pagesProject On Online Trading at Sharekhan LTDNITIKESH GORIWALENo ratings yet

- Lecture 26 - Advanced Cost and Management AccountingDocument18 pagesLecture 26 - Advanced Cost and Management AccountingawaisjinnahNo ratings yet

- Analytical Review ProceduresDocument5 pagesAnalytical Review ProceduresnderitulinetNo ratings yet

- W1 Module 1-Introduction To Production and Operations ManagementDocument42 pagesW1 Module 1-Introduction To Production and Operations Managementalleah joy sabuyanNo ratings yet

- LBR JWB Sesi 2 - MEDIKA ADIJAYA - 2021Document13 pagesLBR JWB Sesi 2 - MEDIKA ADIJAYA - 2021Sandi RiswandiNo ratings yet

- Activity - Statement of Comprehensive IncomeDocument6 pagesActivity - Statement of Comprehensive IncomeGrace HernandezNo ratings yet

- Strategic Management - Managing Growth at Coty - Version 1Document34 pagesStrategic Management - Managing Growth at Coty - Version 1Biciin MarianNo ratings yet

- Accountancy Question BankDocument41 pagesAccountancy Question BankKashishlalwaniNo ratings yet

- Made BY-Sunny KumarDocument27 pagesMade BY-Sunny KumarShivam GuptaNo ratings yet

- Treasury Management Presentation Group 6Document24 pagesTreasury Management Presentation Group 6David AkoNo ratings yet

- 3.2 Project Feasibility StudyDocument20 pages3.2 Project Feasibility Studydawit tibebuNo ratings yet

- San Miguel Industrias PET 1Q17 - ReportDocument7 pagesSan Miguel Industrias PET 1Q17 - Reportcésarz_5No ratings yet

- 1 Tourism MarketingDocument33 pages1 Tourism MarketingCristi ŞerbanNo ratings yet

- Lecture 6 - Agricultural Enterprise Selection and Management-1Document41 pagesLecture 6 - Agricultural Enterprise Selection and Management-1Rogers Soyekwo KingNo ratings yet

- Financial ManagementfDocument3 pagesFinancial ManagementfSamarth BhatiaNo ratings yet

- Cost ClassificationDocument13 pagesCost ClassificationRashmi Ranjan MishraNo ratings yet

- Samcis - Ae212 - Module 12 Standard CostingDocument22 pagesSamcis - Ae212 - Module 12 Standard CostingMamaril John NathanielNo ratings yet

- Module 3 CVP AnswersDocument18 pagesModule 3 CVP AnswersSophia DayaoNo ratings yet

- Ashish Wanjari CVDocument5 pagesAshish Wanjari CVAshish WanjariNo ratings yet