Professional Documents

Culture Documents

S.No. HSN Code Description of Goods or Service ERP Code Qty Unit Rate INR Disc.% Total Value of Orders CGST %rate SGST %rate Igst %rate

Uploaded by

rajend thakurOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

S.No. HSN Code Description of Goods or Service ERP Code Qty Unit Rate INR Disc.% Total Value of Orders CGST %rate SGST %rate Igst %rate

Uploaded by

rajend thakurCopyright:

Available Formats

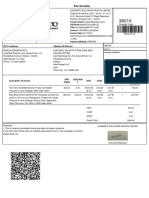

Consumable PO PURCHASE ORDER Page No. 1/3.

GSTIN. 08AAACU6815C1ZJ UKB ELECTRONICS PRIVATE LIMITED

CIN No. U32109DL2004PTC126250 A-152-153, Ghiloth Industrial Area, Ghiloth,

PAN No. AAACU6815C Alwar-301705, Rajasthan,India

Phone: Email:

State. Rajasthan

Website:www.ukbindia.com

State Code. 08

Details of Supplier: A/C Code 1001150 Delivery Terms :Ex Works Purch.Order No. : 1200002863

Metalube Pvt Limited Mode Of Dispatch : Purch.Order. Dt. : 22.04.2022

Gala: 3C,H.No 162/GA-2,Kukase,Bhiwandi,Sumit Logistics Park Freight :

District Thane 400604 Insurance :

State: Maharashtra State Code: 27 Valid Upto : 30.05.2022

GSTIN: 27AAHCM4626J1Z8 PAN No: AAHCM4626J

Kind: Cont.No: Payment Terms : Advance 100% Before

Email:

Dear Sir, We are pleased to place an order for the following items.

S.No. HSN Code Description of goods or service ERP Code Qty Unit Rate Disc.% Total Value of Orders CGST SGST IGST

INR %Rate %Rate %Rate

1 27101980 F101010 / Lubricool 22G 530001042 1025.000 L 300 0.00 307500.00 0.00 0.00 18.00

2 27101980 F102010 / Lubricool 318 530001043 615.000 L 310 0.00 190650.00 0.00 0.00 18.00

Remarks: Freight 0.00

Taxable Amount 498150.00

IGST Amount 89667.00

Grand Total INR 587817.00

Total Order Value(in Words) For UKB Electronic PVT.LTD.

FIVE LAKH EIGHTY SEVEN THOUSAND EIGHT HUNDRED SEVENTEEN RUPEES

UKB_N2PR02 UKB_N2PR02 UKB_N2MM02

Prepared By Chk By Authorised By

Regd Office Address GROUND FLOOR, C-117, PUSHPANJALI ENCLAVE, VIKAS MARG,KARKARDOOMA,DELHI-110032 Ph:-

This is a Computer Generated Digitally Signed/ Approved P.O and does not require Manual Signature.

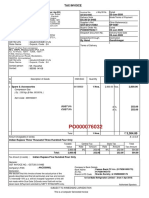

Page No. 2/3.

Delivery Schedule

PO No 1200002863 PO Date 22.04.2022

Last Revision No 0 Last Revision Dt 22.04.2022

SNO ERP Code Description of Goods or Service PO Qty Schedule Qty Delivery Date

1 530001042 F101010 / Lubricool 22G 1025.000 1.025,000 19.04.2022

2 530001043 F102010 / Lubricool 318 615.000 615,000 19.04.2022

Page No. 3/3.

PO No 1200002863 PO Date 22.04.2022

PURCHASE ORDER CONDITIONS

Following terms and conditions shall be applicable for this Purchase Order (PO).

1 Supplier agrees to supply UKB with Material in the quantities ordered and in accordance with the schedule of deliveries as specified in PO by UKB.

2 Invoicing shall be done strictly as per PO price, Quantity, Delivery schedule, Tax structure, Incoterms, Payment terms and other instructions mentioned therein.

3 Supplier shall quote the reference of PO number, Part number, Quantities , Price, Tax details and other mandatory conditions on each invoice.

4 All material shall be supplied in the proper packing and through appropriate mode of transport so as to ensure that the material is delivered to UKB in good condition.

5 Supplier shall send each shipment along with their internal inspection report. All the material should meet all the specifications and shall be as per ROHS2 / REACH compliance.

6 UKB shall check the quality of material supplied and verify as per approval provided. Material not found good will be returned back to Supplier on Supplier#s

expenses. Supplier shall immediately compensate with good quality material if demanded by UKB and make good of any loss occurred by UKB.

7 UKB shall clear the accepted invoices that are received meeting the mandatory requirements and shall make the payment to Supplier as per the payment terms

mentioned in PO. All payments are subject to applicable taxes.

8 Supplier shall disclose the detailed information related to specifications, data sheets, raw material and process related to the parts in PO, on request of UKB.

The supplier shall maintain complete and accurate records and books of raw material used in supplying the material. Buyer shall have the right to audit

the production process and inspect the parts at any stage of production.

9 UKB will receive material between 9:00am and 4:00pm during all working days. Supplier shall intimate shipping details immediately after the dispatch of material.

10 UKB shall not be liable for Supplier#s commitments or production arrangements in excess of the amount, or in advance of the time, necessary to meet UKBs

delivery schedule specified in a Purchase Order. UKB may cancel or reschedule any past-due deliveries on Purchase Orders without any liability whatsoever

unless delayed shipment is mutually agreed in advance.

11 The parties also agrees that the TDS deductions made on the invoices of supplier or the deposition of TDS in advance against the invoice of supplier

shall not be construed to be an admission of liability on the part of UKB. After receipt of the goods UKB shall be entitled to reject the Goods at its

Discretion without attracting any Liability.

12 UKB shall make payment of GST of all accepted invoices after deposition and filing of GST return and availability of GST input by UKB at GST portal.

You might also like

- Tax Invoice: A-3/7, Mayapuri Industrial Area, Phase-Iimayapuriwest Delhi110064Delhi07 Cin: U74899Dl1988Ptc031785Document1 pageTax Invoice: A-3/7, Mayapuri Industrial Area, Phase-Iimayapuriwest Delhi110064Delhi07 Cin: U74899Dl1988Ptc031785MSEB WalujNo ratings yet

- E InvoiceDocument5 pagesE InvoiceVinodh KannaNo ratings yet

- Tax Invoice P K EnterprisesDocument2 pagesTax Invoice P K EnterprisesSanjay LoyalkaNo ratings yet

- Tax Invoice Deccan Sales & Service PVT - Ltd. (Division Deccan Earthmovers)Document1 pageTax Invoice Deccan Sales & Service PVT - Ltd. (Division Deccan Earthmovers)Jonathan KaleNo ratings yet

- Subhag Inv AgniDocument1 pageSubhag Inv AgniChandanNo ratings yet

- Prototype Courier ChargesDocument16 pagesPrototype Courier ChargesDeepak BhanjiNo ratings yet

- Cremica Food Industries Limited: Tax InvoiceDocument1 pageCremica Food Industries Limited: Tax InvoiceKartik DhimanNo ratings yet

- Invoice 00002Document1 pageInvoice 00002Asad AhmedNo ratings yet

- In0878 GlobalDocument1 pageIn0878 Globalanshag631No ratings yet

- Adventure Auto Repair Invoice for Audi Q3Document2 pagesAdventure Auto Repair Invoice for Audi Q3Kushal KarNo ratings yet

- Invoice for 10 HP laptops under Rs. 428,000Document2 pagesInvoice for 10 HP laptops under Rs. 428,000aryandjNo ratings yet

- D-524 BiomeriuxDocument4 pagesD-524 BiomeriuxVinay KatochNo ratings yet

- Tax Invoice: Sold From / Dispatch FromDocument2 pagesTax Invoice: Sold From / Dispatch FromBharat BhushanNo ratings yet

- Tax Invoice: Enertech Electric Enterprises PVT LTD No S-2201073Document1 pageTax Invoice: Enertech Electric Enterprises PVT LTD No S-2201073karthik achudhanNo ratings yet

- JK LakshmiDocument1 pageJK Lakshmipatel vimalNo ratings yet

- Nakodar Jan 2023Document1 pageNakodar Jan 2023Randhir ChaubeyNo ratings yet

- QTL Inv Q2-2022Document2 pagesQTL Inv Q2-2022irshad khanNo ratings yet

- Tax Invoice Euronics Industries PVT - LTD: Michigan Engineers Pvt. LTD Michigan Engineers Pvt. LTDDocument1 pageTax Invoice Euronics Industries PVT - LTD: Michigan Engineers Pvt. LTD Michigan Engineers Pvt. LTDSrikanth BhaskaraNo ratings yet

- In1 2022 1009 80085208Document2 pagesIn1 2022 1009 80085208Careers and DreamsNo ratings yet

- TK Elevator India Private Limited: Tax InvoiceDocument3 pagesTK Elevator India Private Limited: Tax InvoiceNarayan Kumar GoaNo ratings yet

- FEB- MAR 2023Document1 pageFEB- MAR 2023sarikaam92No ratings yet

- Invoice_1250938210Document1 pageInvoice_1250938210writetorajesh1987No ratings yet

- Negbuy 02 09 2022Document1 pageNegbuy 02 09 2022Aditya SinghNo ratings yet

- TASL Export Commercial Invoice (ZHEX)Document1 pageTASL Export Commercial Invoice (ZHEX)Vinod KumarNo ratings yet

- Rourkela PP2 Administrative Building, CPP II, Rourkela 769011 (India) Tel No.: 0661-2510355 Fax No.: 0661-2513179 CIN - U74899DL1999PLC098274Document6 pagesRourkela PP2 Administrative Building, CPP II, Rourkela 769011 (India) Tel No.: 0661-2510355 Fax No.: 0661-2513179 CIN - U74899DL1999PLC098274Preeti YaduNo ratings yet

- CG04NH9088 EndorsementDocument2 pagesCG04NH9088 EndorsementSiddhantNo ratings yet

- Invoice 1257764293Document2 pagesInvoice 1257764293johnalvish25No ratings yet

- Tax Invoice: CIN:U72900DL2020PTC361314 GSTIN: 07AAFCE8193A1ZPDocument1 pageTax Invoice: CIN:U72900DL2020PTC361314 GSTIN: 07AAFCE8193A1ZPAbhijit SarkarNo ratings yet

- EPC - 4201170000613 - V. D. PATKAR - PGCIL Vemagiri Pkg. PO For Design & Detail Engineering of Illumination System For Madhugiri & Srikakulam Sites.Document8 pagesEPC - 4201170000613 - V. D. PATKAR - PGCIL Vemagiri Pkg. PO For Design & Detail Engineering of Illumination System For Madhugiri & Srikakulam Sites.Vanraj DodiaNo ratings yet

- BillDocument2 pagesBilltalibNo ratings yet

- HMB Ispat Pi 81022Document1 pageHMB Ispat Pi 81022Suman PramanikNo ratings yet

- Tax Invoice: EVM Passenger Cars (I) PVT LTDDocument3 pagesTax Invoice: EVM Passenger Cars (I) PVT LTDgeorgy wilsonNo ratings yet

- Tax Invoice: Ccbd51b450ad5f3f8c9947df5Document1 pageTax Invoice: Ccbd51b450ad5f3f8c9947df5amman online serviceNo ratings yet

- 11. TPI ChargesDocument1 page11. TPI ChargesPrem KumarNo ratings yet

- BCL 025 Inv 9677Document2 pagesBCL 025 Inv 9677Sanjay LoyalkaNo ratings yet

- 23si0055 - Ace WaterDocument1 page23si0055 - Ace WaterDeshan SingNo ratings yet

- T John Mathew - Philips OCDocument2 pagesT John Mathew - Philips OCDAMBALENo ratings yet

- Invoice 202401Document4 pagesInvoice 202401Vignesh WerNo ratings yet

- 2223TBS0002241Document1 page2223TBS0002241Huskee CokNo ratings yet

- Tax Invoice: INVOICE NO. B2320473 21.12.2022 Invoice / Issue DateDocument1 pageTax Invoice: INVOICE NO. B2320473 21.12.2022 Invoice / Issue DateRanjith PatelNo ratings yet

- Fosroc 518Document1 pageFosroc 518vinoth kumar SanthanamNo ratings yet

- Duben DasDocument9 pagesDuben DasHariom Professional Education & Training CentreNo ratings yet

- Hist Benikdus YudiDocument3 pagesHist Benikdus YudiRia 12345No ratings yet

- Tax Invoice For WB Opex Enclosure199 - 22000009Document2 pagesTax Invoice For WB Opex Enclosure199 - 22000009Mohammed ZubairNo ratings yet

- Adobe Scan 02 Jul 2022Document2 pagesAdobe Scan 02 Jul 2022pankajchauhannoidaNo ratings yet

- Scan 05 May 2022Document5 pagesScan 05 May 2022Mukesh SainiNo ratings yet

- BTI-013 Bolt,Nut,Washer Park GroveDocument2 pagesBTI-013 Bolt,Nut,Washer Park GroveGARIMANo ratings yet

- Tax Invoice: Ice Make Refrigeration Limited - (From 1-Apr-2019)Document1 pageTax Invoice: Ice Make Refrigeration Limited - (From 1-Apr-2019)Sunil PatelNo ratings yet

- Mrs. Tripti Awasthi: GSTIN: 23AAFCA9135J1ZO TIN: 23661104190 CIN: U40107MP2006PLC018684Document1 pageMrs. Tripti Awasthi: GSTIN: 23AAFCA9135J1ZO TIN: 23661104190 CIN: U40107MP2006PLC018684AashutoshNo ratings yet

- Z13 Re - NPD Po: Page 1 / 1Document1 pageZ13 Re - NPD Po: Page 1 / 1sprabhaNo ratings yet

- Tax-InvoiceDocument4 pagesTax-InvoiceLazzieey RahulNo ratings yet

- Quotation: IEEPC-PI-22-23-010 25-Aug-22 IEEPC-PI-22-23-010 Indian Energy and Epc Solutions - (2021-22)Document1 pageQuotation: IEEPC-PI-22-23-010 25-Aug-22 IEEPC-PI-22-23-010 Indian Energy and Epc Solutions - (2021-22)Avinash KumarNo ratings yet

- Samsung Invoice 12357051967-7156716887-27W0I0234223Document1 pageSamsung Invoice 12357051967-7156716887-27W0I0234223BarunMondalNo ratings yet

- Bill P2 872Document3 pagesBill P2 872DATTANA INTERNATIONALNo ratings yet

- Inv G487Document1 pageInv G487ALOK SINGHNo ratings yet

- Catalyst - C22-2300505Document1 pageCatalyst - C22-2300505Tea CozyNo ratings yet

- Inter Tech 1Document3 pagesInter Tech 1Harsh DiwakerNo ratings yet

- This Is An Auto-Generated Purchase Order Based On Online Tender DecisionDocument3 pagesThis Is An Auto-Generated Purchase Order Based On Online Tender DecisionvivekNo ratings yet

- Advance To PayDocument1 pageAdvance To PayMayank RathodNo ratings yet

- Radiation Physics Lecture Notes 2018Document75 pagesRadiation Physics Lecture Notes 2018Niyas UmmerNo ratings yet

- Ukb Electronics Quotation For Ceramic Tubes Doc No.17268Document1 pageUkb Electronics Quotation For Ceramic Tubes Doc No.17268rajend thakurNo ratings yet

- Adobe Scan Apr 19, 2022Document1 pageAdobe Scan Apr 19, 2022rajend thakurNo ratings yet

- UNIFORM SHEDULE - 2022-23 ChangesDocument1 pageUNIFORM SHEDULE - 2022-23 Changesrajend thakurNo ratings yet

- Date Sheet For 1 Term Exams.Document1 pageDate Sheet For 1 Term Exams.rajend thakurNo ratings yet

- Department Production S No. Item Code Item Name Unit Quantity in Stock Delivery Date Source/ Vendor Aprox. Rate Approx. ValueDocument1 pageDepartment Production S No. Item Code Item Name Unit Quantity in Stock Delivery Date Source/ Vendor Aprox. Rate Approx. Valuerajend thakurNo ratings yet

- Proforma Invoice: Total Amount To Be Paid Bank DetailsDocument1 pageProforma Invoice: Total Amount To Be Paid Bank Detailsrajend thakurNo ratings yet

- Shiv Shakti Engineering Works: QuotationDocument3 pagesShiv Shakti Engineering Works: Quotationrajend thakurNo ratings yet

- Pressure SleeveDocument2 pagesPressure Sleeverajend thakurNo ratings yet

- Radiation Physics Lecture Notes 2018Document75 pagesRadiation Physics Lecture Notes 2018Niyas UmmerNo ratings yet

- Activity Based Costing-AssignmentDocument3 pagesActivity Based Costing-Assignmentmamasita25No ratings yet

- Sourcebook On Local Public FinanceDocument84 pagesSourcebook On Local Public FinanceAlce Quitalig0% (1)

- Factors Affecting Audit Quality, An Auditor's Opinion 2Document33 pagesFactors Affecting Audit Quality, An Auditor's Opinion 2AGBA NJI THOMASNo ratings yet

- Internship Opportunity: International Civil Aviation OrganizationDocument2 pagesInternship Opportunity: International Civil Aviation Organizationlees10088No ratings yet

- Control and Accounting Information SystemsDocument314 pagesControl and Accounting Information SystemsDr Rushen Singh100% (5)

- Nino Maurin's ResumeDocument2 pagesNino Maurin's ResumeNiñoMaurinNo ratings yet

- The Impact of Financial Management System On Human Resource Utilization (A Case in Gondar Municipality)Document67 pagesThe Impact of Financial Management System On Human Resource Utilization (A Case in Gondar Municipality)meseret sisayNo ratings yet

- Condominium AccountingDocument51 pagesCondominium AccountingJamey SimpsonNo ratings yet

- Audit Documentation RequirementsDocument13 pagesAudit Documentation RequirementsPaul Michael JaramilloNo ratings yet

- Crisis Audit Report Raises Security ConcernsDocument4 pagesCrisis Audit Report Raises Security ConcernsDiego Alf AlfieNo ratings yet

- PWC Annual Report 2019 2020Document128 pagesPWC Annual Report 2019 2020Bảo ChâuuNo ratings yet

- RESO No. 03-Signatory of PB and TreasDocument3 pagesRESO No. 03-Signatory of PB and TreasRaquel dg.Bulaong100% (2)

- Article 5 - Advancing Financial Reporting in The Age of Technology An Interview With Robert H. HerzDocument9 pagesArticle 5 - Advancing Financial Reporting in The Age of Technology An Interview With Robert H. HerzFakhmol RisepdoNo ratings yet

- Resume: Elie Abboud Lebanon - Badaro Wadih Naim STDocument4 pagesResume: Elie Abboud Lebanon - Badaro Wadih Naim STELee E. AbboudNo ratings yet

- Whitepaper en Iatf16949Document12 pagesWhitepaper en Iatf16949Archana SinghNo ratings yet

- Exam DiscussionDocument4 pagesExam DiscussionChelliah SelvavishnuNo ratings yet

- MCQs Book by Sanidhya Saraf SirDocument171 pagesMCQs Book by Sanidhya Saraf SirCa FinalsNo ratings yet

- Lanka Credit and Business Finance PLC (The Company) Errata Notice - Provisional Financial Statements For The Nine Months Ended 31 December 2021Document12 pagesLanka Credit and Business Finance PLC (The Company) Errata Notice - Provisional Financial Statements For The Nine Months Ended 31 December 2021girihellNo ratings yet

- Integrated Management System ManualDocument41 pagesIntegrated Management System ManualMikku Katta100% (2)

- CV Archil JainDocument3 pagesCV Archil JainArchil JainNo ratings yet

- Annual Audit Report: Republic of The Philippines Commission On Audit Regional Office No. IX Zamboanga CityDocument8 pagesAnnual Audit Report: Republic of The Philippines Commission On Audit Regional Office No. IX Zamboanga CityJuan Luis LusongNo ratings yet

- Research Proposal For Risk Management: HIRE Verified WriterDocument8 pagesResearch Proposal For Risk Management: HIRE Verified WriteraiahikehNo ratings yet

- Chapter 1 - Introduction To Management AccountingDocument32 pagesChapter 1 - Introduction To Management Accountingyến lêNo ratings yet

- Fund TransfersDocument32 pagesFund TransfersvangieNo ratings yet

- Kasneb Examinations Information BookletDocument58 pagesKasneb Examinations Information BookletCollins OgiloNo ratings yet

- Integrated Financial Management Information System and Financial Reporting Effectiveness of District Local Governments in UgandaDocument7 pagesIntegrated Financial Management Information System and Financial Reporting Effectiveness of District Local Governments in UgandaAnonymous izrFWiQ100% (2)

- Financial Fraud SchemesDocument9 pagesFinancial Fraud SchemesPrabhu SachuNo ratings yet

- 03-PUP2020 Executive SummaryDocument16 pages03-PUP2020 Executive SummaryMiss_AccountantNo ratings yet

- Export DocumentationDocument20 pagesExport DocumentationNikhil Kothavale100% (1)