Professional Documents

Culture Documents

Illustrative Examples: A Statement of Cash Flows For An Entity Other Than A Financial Institution

Uploaded by

johnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Illustrative Examples: A Statement of Cash Flows For An Entity Other Than A Financial Institution

Uploaded by

johnCopyright:

Available Formats

IAS 7 IE

Illustrative examples

These illustrative examples accompany, but are not part of, IAS 7.

A Statement of cash flows for an entity other than a financial

institution

1 The examples show only current period amounts. Corresponding amounts for

the preceding period are required to be presented in accordance with IAS 1

Presentation of Financial Statements.

2 Information from the statement of comprehensive income and statement of

financial position is provided to show how the statements of cash flows under

the direct method and indirect method have been derived. Neither the

statement of comprehensive income nor the statement of financial position is

presented in conformity with the disclosure and presentation requirements of

other Standards.

3 The following additional information is also relevant for the preparation of the

statements of cash flows:

● all of the shares of a subsidiary were acquired for 590. The fair values of

assets acquired and liabilities assumed were as follows:

Inventories 100

Accounts receivable 100

Cash 40

Property, plant and equipment 650

Trade payables 100

Long-term debt 200

● 250 was raised from the issue of share capital and a further 250 was

raised from long-term borrowings.

● interest expense was 400, of which 170 was paid during the period. Also,

100 relating to interest expense of the prior period was paid during the

period.

● dividends paid were 1,200.

● the liability for tax at the beginning and end of the period was 1,000 and

400 respectively. During the period, a further 200 tax was provided for.

Withholding tax on dividends received amounted to 100.

● during the period, the group acquired property, plant and equipment

with an aggregate cost of 1,250 of which 900 was acquired by means of

finance leases. Cash payments of 350 were made to purchase property,

plant and equipment.

● plant with original cost of 80 and accumulated depreciation of 60 was

sold for 20.

● accounts receivable as at the end of 20X2 include 100 of interest

receivable.

B1080 姝 IFRS Foundation

IAS 7 IE

Consolidated statement of comprehensive income for the period ended

20X2(a)

Sales 30,650

Cost of sales (26,000)

Gross profit 4,650

Depreciation (450)

Administrative and selling expenses (910)

Interest expense (400)

Investment income 500

Foreign exchange loss (40)

Profit before taxation 3,350

Taxes on income (300)

Profit 3,050

(a) The entity did not recognise any components of other comprehensive income in the

period ended 20X2

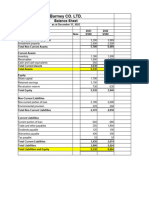

Consolidated statement of financial position as at end of 20X2

20X2 20X1

Assets

Cash and cash equivalents 230 160

Accounts receivable 1,900 1,200

Inventory 1,000 1,950

Portfolio investments 2,500 2,500

Property, plant and equipment

at cost 3,730 1,910

Accumulated depreciation (1,450) (1,060)

Property, plant and equipment

net 2,280 850

Total assets 7,910 6,660

Liabilities

Trade payables 250 1,890

Interest payable 230 100

Income taxes payable 400 1,000

Long-term debt 2,300 1,040

Total liabilities 3,180 4,030

continued...

姝 IFRS Foundation B1081

IAS 7 IE

...continued

Consolidated statement of financial position as at end of 20X2

20X2 20X1

Shareholders’ equity

Share capital 1,500 1,250

Retained earnings 3,230 1,380

Total shareholders’ equity 4,730 2,630

Total liabilities and

shareholders’ equity 7,910 6,660

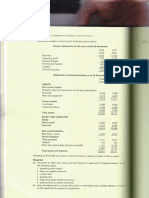

Direct method statement of cash flows (paragraph 18(a))

20X2

Cash flows from operating activities

Cash receipts from customers 30,150

Cash paid to suppliers and employees (27,600)

Cash generated from operations 2,550

Interest paid (270)

Income taxes paid (900)

Net cash from operating activities 1,380

Cash flows from investing activities

Acquisition of subsidiary X, net of cash acquired

(Note A) (550)

Purchase of property, plant and equipment (Note B) (350)

Proceeds from sale of equipment 20

Interest received 200

Dividends received 200

Net cash used in investing activities (480)

continued...

B1082 姝 IFRS Foundation

IAS 7 IE

...continued

Direct method statement of cash flows (paragraph 18(a))

20X2

Cash flows from financing activities

Proceeds from issue of share capital 250

Proceeds from long-term borrowings 250

Payment of finance lease liabilities (90)

Dividends paid(a) (1,200)

Net cash used in financing activities (790)

Net increase in cash and cash equivalents 110

Cash and cash equivalents at beginning of

period (Note C) 120

Cash and cash equivalents at end of period

(Note C) 230

(a) This could also be shown as an operating cash flow.

Indirect method statement of cash flows (paragraph 18(b))

20X2

Cash flows from operating activities

Profit before taxation 3,350

Adjustments for:

Depreciation 450

Foreign exchange loss 40

Investment income (500)

Interest expense 400

3,740

Increase in trade and other receivables (500)

Decrease in inventories 1,050

Decrease in trade payables (1,740)

Cash generated from operations 2,550

Interest paid (270)

Income taxes paid (900)

Net cash from operating activities 1,380

continued...

姝 IFRS Foundation B1083

IAS 7 IE

...continued

Indirect method statement of cash flows (paragraph 18(b))

20X2

Cash flows from investing activities

Acquisition of subsidiary X net of cash acquired

(Note A) (550)

Purchase of property, plant and equipment (Note B) (350)

Proceeds from sale of equipment 20

Interest received 200

Dividends received 200

Net cash used in investing activities (480)

Cash flows from financing activities

Proceeds from issue of share capital 250

Proceeds from long-term borrowings 250

Payment of finance lease liabilities (90)

Dividends paid(a) (1,200)

Net cash used in financing activities (790)

Net increase in cash and cash equivalents 110

Cash and cash equivalents at beginning of

period (Note C) 120

Cash and cash equivalents at end of period

(Note C) 230

(a) This could also be shown as an operating cash flow.

Notes to the statement of cash flows (direct method and

indirect method)

A. Obtaining control of subsidiary

During the period the Group obtained control of subsidiary X. The fair values of assets

acquired and liabilities assumed were as follows:

B1084 姝 IFRS Foundation

IAS 7 IE

Cash 40

Inventories 100

Accounts receivable 100

Property, plant and equipment 650

Trade payables (100)

Long-term debt (200)

Total purchase price paid in cash 590

Less: Cash of subsidiary X acquired (40)

Cash paid to obtain control net of cash acquired 550

B. Property, plant and equipment

During the period, the Group acquired property, plant and equipment with an aggregate

cost of 1,250 of which 900 was acquired by means of finance leases. Cash payments of 350

were made to purchase property, plant and equipment.

C. Cash and cash equivalents

Cash and cash equivalents consist of cash on hand and balances with banks, and

investments in money market instruments. Cash and cash equivalents included in the

statement of cash flows comprise the following amounts in the statement of financial

position:

20X2 20X1

Cash on hand and balances with banks 40 25

Short-term investments 190 135

Cash and cash equivalents as previously reported 230 160

Effect of exchange rate changes – (40)

Cash and cash equivalents as restated 230 120

Cash and cash equivalents at the end of the period include deposits with banks of 100 held

by a subsidiary which are not freely remissible to the holding company because of currency

exchange restrictions.

The Group has undrawn borrowing facilities of 2,000 of which 700 may be used only for

future expansion.

D. Segment information

Segment A Segment B Total

Cash flows from:

Operating activities 1,520 (140) 1,380

Investing activities (640) 160 (480)

Financing activities (570) (220) (790)

310 (200) 110

姝 IFRS Foundation B1085

IAS 7 IE

Alternative presentation (indirect method)

As an alternative, in an indirect method statement of cash flows, operating profit before

working capital changes is sometimes presented as follows:

Revenues excluding investment income 30,650

Operating expense excluding depreciation (26,910)

Operating profit before working capital changes 3,740

B Statement of cash flows for a financial institution

1 The example shows only current period amounts. Comparative amounts for the

preceding period are required to be presented in accordance with IAS 1

Presentation of Financial Statements.

2 The example is presented using the direct method.

20X2

Cash flows from operating activities

Interest and commission receipts 28,447

Interest payments (23,463)

Recoveries on loans previously written off 237

Cash payments to employees and suppliers (997)

4,224

(Increase) decrease in operating assets:

Short-term funds (650)

Deposits held for regulatory or monetary control

purposes 234

Funds advanced to customers (288)

Net increase in credit card receivables (360)

Other short-term negotiable securities (120)

Increase (decrease) in operating liabilities:

Deposits from customers 600

Negotiable certificates of deposit (200)

Net cash from operating activities before income tax 3,440

Income taxes paid (100)

Net cash from operating activities 3,340

continued...

B1086 姝 IFRS Foundation

IAS 7 IE

...continued

20X2

Cash flows from investing activities

Disposal of subsidiary Y 50

Dividends received 200

Interest received 300

Proceeds from sales of non-dealing securities 1,200

Purchase of non-dealing securities (600)

Purchase of property, plant and equipment (500)

Net cash from investing activities 650

Cash flows from financing activities

Issue of loan capital 1,000

Issue of preference shares by subsidiary

undertaking 800

Repayment of long-term borrowings (200)

Net decrease in other borrowings (1,000)

Dividends paid (400)

Net cash from financing activities 200

Effects of exchange rate changes on cash and cash

equivalents 600

Net increase in cash and cash equivalents 4,790

Cash and cash equivalents at beginning of

period 4,050

Cash and cash equivalents at end of period 8,840

姝 IFRS Foundation B1087

You might also like

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- FRS 107 Ie 2016BBDocument10 pagesFRS 107 Ie 2016BBAmelia RahmawatiNo ratings yet

- Sb-Frs 7: Statutory Board Financial Reporting StandardDocument11 pagesSb-Frs 7: Statutory Board Financial Reporting StandardLuthfiWaeLaahNo ratings yet

- FRS - 7 - Ie - (2016)Document9 pagesFRS - 7 - Ie - (2016)David LeeNo ratings yet

- Cash Flow Statement ExerciseDocument3 pagesCash Flow Statement ExerciseVikas YadavNo ratings yet

- From The Following Information, Prepare A Cash Flow StatementDocument2 pagesFrom The Following Information, Prepare A Cash Flow StatementAgANo ratings yet

- Statement of Cash Flows Lecture Questions and AnswersDocument9 pagesStatement of Cash Flows Lecture Questions and AnswersSaaniya AbbasiNo ratings yet

- Statement of CF - Dallas Ltd - Intermediate Level Exercise (1)Document4 pagesStatement of CF - Dallas Ltd - Intermediate Level Exercise (1)Như QuỳnhNo ratings yet

- Analyze financial statements and construct cash flow statementDocument14 pagesAnalyze financial statements and construct cash flow statementMirkan OrdeNo ratings yet

- Apply Your Knowledge: Case Study 1Document3 pagesApply Your Knowledge: Case Study 1Queen ValleNo ratings yet

- Company Financial Statements - FORMAT LTDDocument5 pagesCompany Financial Statements - FORMAT LTDrumelrashid_seuNo ratings yet

- 3.BACC III 2016 End - Docx ModeratedDocument7 pages3.BACC III 2016 End - Docx ModeratedsmlingwaNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Cashflwo TABBA F7Document6 pagesCashflwo TABBA F7Pocpoca100% (2)

- OLC Chap 5Document6 pagesOLC Chap 5Isha SinghNo ratings yet

- CR Inter QuestionsDocument22 pagesCR Inter QuestionsRichie BoomaNo ratings yet

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision QuestionskelvinmunashenyamutumbaNo ratings yet

- © The Institute of Chartered Accountants of India: ST STDocument6 pages© The Institute of Chartered Accountants of India: ST STVishal MehraNo ratings yet

- ACC9005M - Lecture 4 - Financial Analysis (Recycle LTD) QUESTIONDocument2 pagesACC9005M - Lecture 4 - Financial Analysis (Recycle LTD) QUESTIONPravallika RavikumarNo ratings yet

- Cash Flow QuestionsDocument5 pagesCash Flow QuestionssigiryaNo ratings yet

- Chapters ExcelDocument121 pagesChapters ExcelRohan VermaNo ratings yet

- Duch Ravi (16ACT41sb1)Document3 pagesDuch Ravi (16ACT41sb1)chhayloeng60No ratings yet

- Ass For BMDocument6 pagesAss For BMMeron TemisNo ratings yet

- 20 Additional Practice IAS 7Document20 pages20 Additional Practice IAS 7Nur FazlinNo ratings yet

- Malik Group of Companies (Disposal + Acquisition) : Cfap 1: A A F RDocument1 pageMalik Group of Companies (Disposal + Acquisition) : Cfap 1: A A F R.No ratings yet

- Exhibit 3.1 Balance Sheet of Horizon Limited As at March 31, 20x1Document102 pagesExhibit 3.1 Balance Sheet of Horizon Limited As at March 31, 20x1Vasudev lahotiNo ratings yet

- Хариу HW2 ACC732Document6 pagesХариу HW2 ACC732ZayaNo ratings yet

- Final Examinations Advanced AccountingDocument5 pagesFinal Examinations Advanced AccountingBilal Khan BangashNo ratings yet

- Exhibit 3.1 Balance Sheet of Horizon Limited As at March 31, 20x1Document121 pagesExhibit 3.1 Balance Sheet of Horizon Limited As at March 31, 20x1DrSwati BhargavaNo ratings yet

- SCF With DODocument3 pagesSCF With DOMuhammad Asif KhanNo ratings yet

- 1.90 IAS 7 CFL Omnium 22 - 23 IAS 33 EpsDocument3 pages1.90 IAS 7 CFL Omnium 22 - 23 IAS 33 Epsarmaan ryanNo ratings yet

- Cash Flow Tutorial QnsDocument13 pagesCash Flow Tutorial QnsCristian Renatus100% (1)

- FAWCM - Cash Flow 2Document29 pagesFAWCM - Cash Flow 2Jake RoosenbloomNo ratings yet

- Practice QNSDocument2 pagesPractice QNSIan chisemaNo ratings yet

- Practice Question On Group AccountsDocument12 pagesPractice Question On Group Accountsemerald75% (4)

- CORPORATE REPORTING Icag PDFDocument31 pagesCORPORATE REPORTING Icag PDFmohedNo ratings yet

- Lecture 1 & 2 ExamplesDocument5 pagesLecture 1 & 2 ExamplesAbubakari Abdul MananNo ratings yet

- Assignment 2Document4 pagesAssignment 2Loveness Mphande100% (1)

- Revision QN On Ratio AnalysisDocument3 pagesRevision QN On Ratio Analysisamosoundo59No ratings yet

- Chapter 2. Understanding The Income StatementDocument10 pagesChapter 2. Understanding The Income StatementVượng TạNo ratings yet

- Accountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsDocument5 pagesAccountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsEricha MutiaNo ratings yet

- Statement of Cash Flow - Thorstved CoDocument5 pagesStatement of Cash Flow - Thorstved Cotun ibrahimNo ratings yet

- CfasDocument2 pagesCfassyramaebillones26No ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Assets 2005 2004: Ques2. Prepare A Cash Flow Statement As Per As-3Document4 pagesAssets 2005 2004: Ques2. Prepare A Cash Flow Statement As Per As-3Harsh GuptaNo ratings yet

- FR 1 QDocument17 pagesFR 1 QG INo ratings yet

- Ind As 7Document5 pagesInd As 7qwertyNo ratings yet

- HKICPA QP Exam (Module A) Feb2006 Question PaperDocument7 pagesHKICPA QP Exam (Module A) Feb2006 Question Papercynthia tsuiNo ratings yet

- Tutorial 2 A192 QuestionDocument9 pagesTutorial 2 A192 QuestionMastura Abd HamidNo ratings yet

- CPA Review Center Final Exam SolutionsDocument16 pagesCPA Review Center Final Exam SolutionsMike Oliver NualNo ratings yet

- Practice Exercise - Cobble Hill Part 3 Cash Flow - SolutionDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Solution155- Salsabila GadingNo ratings yet

- 01 - Exercises Session 1 - EmptyDocument4 pages01 - Exercises Session 1 - EmptyAgustín RosalesNo ratings yet

- BU51009 (5BA) - Assessed Coursework - EBT 2019-20Document2 pagesBU51009 (5BA) - Assessed Coursework - EBT 2019-20Sravya MagantiNo ratings yet

- Income Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsDocument1 pageIncome Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsAik Luen LimNo ratings yet

- Interactive Question 4: Acquisition of A Subsidiary: Non-Current AssetsDocument4 pagesInteractive Question 4: Acquisition of A Subsidiary: Non-Current AssetsRiad FaisalNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Assignment 6 SolutionsDocument4 pagesAssignment 6 SolutionsjoanNo ratings yet

- Tut 05 SolnDocument4 pagesTut 05 Soln张婧姝No ratings yet

- Advanced Acct - II ProblemsDocument4 pagesAdvanced Acct - II ProblemsSamuel DebebeNo ratings yet

- Income Taxes: International Accounting Standard 12Document40 pagesIncome Taxes: International Accounting Standard 12johnNo ratings yet

- Good Group (International) LimitedDocument132 pagesGood Group (International) LimitedjohnNo ratings yet

- IAS 8 Accounting Policies - Changes in Accounting Estimates and Errors PDFDocument20 pagesIAS 8 Accounting Policies - Changes in Accounting Estimates and Errors PDFMichelle TanNo ratings yet

- Inventories: International Accounting Standard 2Document16 pagesInventories: International Accounting Standard 2johnNo ratings yet

- 1101 Kas 1103 Piutang Usaha 1106 Biaya Dibayar Dimuka: Account No Account Name Account TypeDocument3 pages1101 Kas 1103 Piutang Usaha 1106 Biaya Dibayar Dimuka: Account No Account Name Account TypeAmelia LarasatiNo ratings yet

- Aguilar Jules QuizDocument4 pagesAguilar Jules QuizJules AguilarNo ratings yet

- Cut FlowerDocument14 pagesCut FlowerMobasharNo ratings yet

- ASSIGNMENTDocument15 pagesASSIGNMENTKeith Joshua Gabiason100% (1)

- SC Chapter 08 Absorption Variable Costing Invty MGMNTDocument21 pagesSC Chapter 08 Absorption Variable Costing Invty MGMNTDaniel John Cañares Legaspi50% (2)

- OrecalDocument56 pagesOrecalßunty PrajaÞatiNo ratings yet

- 2 Ratio Analysis Financial Statement Analysis 1652097843303Document8 pages2 Ratio Analysis Financial Statement Analysis 1652097843303vroommNo ratings yet

- Template Update Harian CS & Advertiser (Plus Roi)Document19 pagesTemplate Update Harian CS & Advertiser (Plus Roi)Indra Al FatihNo ratings yet

- Sanulac Nutricion Colombia S.A.S. (Colombia) : SourceDocument2 pagesSanulac Nutricion Colombia S.A.S. (Colombia) : SourceCatalina Echeverry AldanaNo ratings yet

- Skip To Main ContentDocument15 pagesSkip To Main ContentShmels AsmamawNo ratings yet

- Contoh DTA DTLDocument23 pagesContoh DTA DTLZahra MawarNo ratings yet

- TAFA Profit SharingDocument5 pagesTAFA Profit SharingRiza D. SiocoNo ratings yet

- FA 4 Chapter 1 - AllDocument5 pagesFA 4 Chapter 1 - AllVasant SriudomNo ratings yet

- Piecemeal DistributionDocument5 pagesPiecemeal DistributionYashfeen HakimNo ratings yet

- SOW Form 5 POA Term 2 2020 2021Document9 pagesSOW Form 5 POA Term 2 2020 2021Peta-Gay Brown-JohnsonNo ratings yet

- BCom VI Analysis of Financial StatementsDocument3 pagesBCom VI Analysis of Financial StatementsVaibhav BanjanNo ratings yet

- Assets and liabilities questionsDocument371 pagesAssets and liabilities questionsPeter Osundwa Kiteki50% (2)

- The Effects of IFRS Adoption On Taxation in NigeriDocument15 pagesThe Effects of IFRS Adoption On Taxation in NigeriJoseph OlugbamiNo ratings yet

- Corporate Reporting Practices in IndiaDocument25 pagesCorporate Reporting Practices in IndiaClary Dsilva67% (3)

- Preparation of Master BudgetDocument43 pagesPreparation of Master Budgetsaran_16100% (1)

- Cairo Consulting: Explore Business Options With What-If ToolsDocument14 pagesCairo Consulting: Explore Business Options With What-If ToolsJacob SheridanNo ratings yet

- Bangladesh Accounting Standard BAS 1Document9 pagesBangladesh Accounting Standard BAS 1Foyez AhammedNo ratings yet

- MBA Financial & Managerial Accounting GuideDocument71 pagesMBA Financial & Managerial Accounting GuideSbelishoNo ratings yet

- Chapter 16 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document33 pagesChapter 16 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- TradeDocument78 pagesTradeawal cokroNo ratings yet

- Brand New Accounting Books (Softbound) /BAKER LEMBKE KING - Advanced Financial Accounting 8e/baker - Ab - Az.chap013Document40 pagesBrand New Accounting Books (Softbound) /BAKER LEMBKE KING - Advanced Financial Accounting 8e/baker - Ab - Az.chap013Alyssa KyleNo ratings yet

- Toaz - Info Ch06 PRDocument60 pagesToaz - Info Ch06 PRErica Joy BatangNo ratings yet

- Lesson Plan-Business EthicsDocument3 pagesLesson Plan-Business EthicsGraceann CasundoNo ratings yet

- 15.1 Illustrative Problems For Ncahfs and DoDocument4 pages15.1 Illustrative Problems For Ncahfs and DoStefany M. SantosNo ratings yet

- Camouflage AccountingDocument28 pagesCamouflage AccountingKishore AgarwalNo ratings yet