Professional Documents

Culture Documents

Specialize Industries - Agriculture Practice Problems

Uploaded by

Iris FenelleCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Specialize Industries - Agriculture Practice Problems

Uploaded by

Iris FenelleCopyright:

Available Formats

Problem 01: Joan Company provided the following data: Value of biological asset at acquisition

cost on December 31, 2019, 600,000. Fair value surplus on initial recognition at fair value on

December 31, 2019, 700,000. Change in fair value to December 31, 2020 due to growth and

price fluctuation 100,000. Decrease in fair value due to harvest 90,000.

Required:

1. What is the carrying amount of the biological asset on December 31, 2020?

2. What is the gain from change in fair value of biological asset that should be shown in the

2020 income statement?

Answers:

1. Carrying amount = 600,000 + 700,000 + 100,000 – 90,000 = 1,310,000

2. Net gain = 100,000 – 90,000 = 10,000

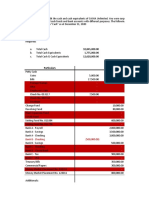

Problem 02: Honey Company has a herd of ten 2-year-old animals on January 1, 2020. One

animal aged 2.5 years was purchased on July 1, 2020 for P1,080, and one animal was born on

July 1, 2020. No animals were sold or disposed of during the year. The fair value less cost to

sell per unit is as follows:

2-year-old animal on January 1 1,000

2.5-year-old animal on July 1 1,080

Newborn animal on July 1 700

2-year-old animal on December 31 1,050

2.5-year-old animal on December 31 1,110

Newborn animal on December 31 720

3-year-old animal on December 31 1,200

0.5-year-old animal on December 31 80

Required:

1. What is the fair value of the biological assets on December 31, 2020?

2. What is the gain from change in fair value of biological assets to be recognized in 2020?

3. What is the gain from change in fair value due to price change?

Answers:

1. FV of 3-year-old animals on December 31 (11 x 1,200) 13,200

FV of 0.5-year-old animal on December 31 (1 x 800) 800

Total fair value – December 31,2020 14,000

2. FV of 10 animals on January 1 (10 x 1,000) 10,000

Acquisition cost of one animal on July 1 1,080

Total carrying amount of biological assets – Dec. 31 11,080

Fair value on December 31, 2020 14,000

Carrying amount 11,080

Gain from change in fair value 2,920

3. Gain from change in fair value to price change:

2-year-old animals (1,050 -1,000 = 50 x 10) 500

2.5-year-old animal (1,110 – 1080 = 30 x 1) 30

newborn on July 1 (720 – 700 = 20 x 1) 20

Total 550

Problem 03: GOAT Company provided the following assets in a forest plantation and farm:

Freestanding trees 5,000,000

Land under trees 600,000

Roads in forests 300,000

Animals related to recreational activities 1,000,000

Bearer plants 1,500,000

Bearer animals 2,000,000

Required:

1. What total amount of the assets should be classified as biological assets?

Answer:

1. Freestanding trees 5,000,000

Bearer animals 2,000,000

Biological assets 7,000,000

Problem 04: CHIKEN Company provided the following data:

Value of biological asset at acquisition cost on December 31, 2018 600,000

Fair value valuation surplus on initial recognition at fair value 700,000

on December 31, 2018

Change in fair value to December 31, 2019 due to growth and price fluctuation 100,000

Decrease in fair value due to harvest in 2019 90,000

Required:

1. What is the carrying amount of the biological assets on December 31, 2019?

2. What is the gain from change in fair value of biological asset that should be reported in

the 2019 income statement?

Answers:

1. Acquisition cost – December 31, 2018 600,000

Increase in fair value on initial recognition 700,000

Change in fair value in 2019 100,000

Decrease in fair value due to harvest (90,000)

Carrying amount – December 31, 2019 1,310,000

2. Change in fair value in 2019 100,000

Decrease in fair value due to harvest in 2019 (90,000)

Net gain from change in fair value in 2019 10,000

Problem 05: YCOMPANY produces milk for local ice cream producers. The entity began

operations on January 1, 2017 by purchasing milking cows for P5,000,000. The entity provided

the following information at year-end relating to the milking cows:

Carrying amount - January 15,000,000

Change in fair value due to growth and price change 2,000,000

Decrease in fair value due to harvest 250,000

Newborn calf at year-end at fair value 400,000

Milk harvested during the year but not yet sold 850,000

Required:

1. What amount of gain on biological asset should be reported in the current year?

2,150,000

2. What amount of gain on agricultural produce should be recognized in the current year?

850,000

3. What is the carrying amount of the biological asset on December 31, 2015? 7,150,000

Answers:

1. Change in fair value due to growth and price change 2,000,000

Decrease in fair value due to harvest (250,000)

Newborn calf at year-end at fair value 400,000

Gain on biological asset 2,150,000

2. Gain on agriculture produce 850,000

3. Acquisition cost on January 1, 2017 5,000,000

Change in fair value due to growth and price change 2,000,000

Decrease in fair value due to harvest (250,000)

Newborn calf at year-end at fair value 400,000

Carrying amount of the biological asset 7,150,000

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Question 2: FeedbackDocument43 pagesQuestion 2: FeedbackIris FenelleNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- TAX MidtermsDocument6 pagesTAX MidtermsIris FenelleNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- QUESTIONDocument14 pagesQUESTIONIris FenelleNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Cost Behavior AnalysisDocument3 pagesCost Behavior AnalysisIris FenelleNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Notes CVPDocument2 pagesNotes CVPIris FenelleNo ratings yet

- Midterm QuizzesDocument7 pagesMidterm QuizzesIris FenelleNo ratings yet

- Under Variable Costing:: Question 1Document35 pagesUnder Variable Costing:: Question 1Iris FenelleNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Law On SuccessionDocument46 pagesLaw On SuccessionIris FenelleNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- INTACC MOCkDocument26 pagesINTACC MOCkIris FenelleNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Strategic Cost ManagementDocument7 pagesStrategic Cost ManagementIris FenelleNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- QUIZDocument3 pagesQUIZIris FenelleNo ratings yet

- Internal Environment QuizDocument1 pageInternal Environment QuizIris FenelleNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Intacc Finals Sw&QuizzesDocument57 pagesIntacc Finals Sw&QuizzesIris FenelleNo ratings yet

- Audit of Shareholders Equity ActivityDocument31 pagesAudit of Shareholders Equity ActivityIris FenelleNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- SPL - Study NotesDocument13 pagesSPL - Study NotesIris FenelleNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Midterms Quiz 1 GdocsDocument41 pagesMidterms Quiz 1 GdocsIris FenelleNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Bininbin Corp.: Problem 1Document27 pagesBininbin Corp.: Problem 1Iris FenelleNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Intacc Midterm Sw&QuizzesDocument68 pagesIntacc Midterm Sw&QuizzesIris FenelleNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- TAX Create LawDocument4 pagesTAX Create LawIris FenelleNo ratings yet

- Intacc3 Cash FlowsDocument3 pagesIntacc3 Cash FlowsIris FenelleNo ratings yet

- (En) Amber LiSi-POM Manual EnglishDocument20 pages(En) Amber LiSi-POM Manual EnglishAnas AbassiNo ratings yet

- United India Insurance Company Limited: M/S Neeraj KumarDocument3 pagesUnited India Insurance Company Limited: M/S Neeraj KumarB&R HSE BALCO SEP SiteNo ratings yet

- Mincer (1958) - Investment in Human Capital and Personal Income DistributionDocument23 pagesMincer (1958) - Investment in Human Capital and Personal Income DistributionOscar Andree Flores LeonNo ratings yet

- Ades Waters Indonesia TBK Ades: Company History Dividend AnnouncementDocument3 pagesAdes Waters Indonesia TBK Ades: Company History Dividend AnnouncementJandri Zhen TomasoaNo ratings yet

- PICC Profile - fINALDocument11 pagesPICC Profile - fINALAbhay JainNo ratings yet

- Payments User Guide - English (2006)Document39 pagesPayments User Guide - English (2006)Gláucia CarvalhoNo ratings yet

- Train LawDocument3 pagesTrain LawEthel Joi Manalac MendozaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- RFQ 021Document3 pagesRFQ 021Samir AjiNo ratings yet

- GHOSTWRITER AUTHOR NDA AGREEMENT - PDF Changes - ShortDocument1 pageGHOSTWRITER AUTHOR NDA AGREEMENT - PDF Changes - ShortEmmanuel535100% (3)

- NTA NET Economics 30 September 2020 Evening Shift Part 1Document4 pagesNTA NET Economics 30 September 2020 Evening Shift Part 1Ulaganathan SNo ratings yet

- Become A Pro TraderDocument7 pagesBecome A Pro TraderAntonio MartellaNo ratings yet

- IFRS and The Adoption of IFRS in VietnamDocument2 pagesIFRS and The Adoption of IFRS in VietnamBui AnNo ratings yet

- Moodys State Bond Rating AnalysisDocument9 pagesMoodys State Bond Rating Analysisapi-324076716No ratings yet

- Ch08 TB Loftus 3e - Textbook Solution Ch08 TB Loftus 3e - Textbook SolutionDocument12 pagesCh08 TB Loftus 3e - Textbook Solution Ch08 TB Loftus 3e - Textbook SolutionTrinh LêNo ratings yet

- Chapter 3Document100 pagesChapter 3HayamnotNo ratings yet

- An Utopia of Le Corbusier PDFDocument77 pagesAn Utopia of Le Corbusier PDFJavier MoraNo ratings yet

- E-Way Bill: Government of IndiaDocument1 pageE-Way Bill: Government of IndiaVIVEK N KHAKHARANo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Standard Cost and Variances Final ReportDocument45 pagesStandard Cost and Variances Final ReportChristian AribasNo ratings yet

- BBLD0919Document93 pagesBBLD0919Syifa Musvita Ul BadriahNo ratings yet

- ANANAYO - Midterm Examination Problem SolvingDocument3 pagesANANAYO - Midterm Examination Problem SolvingCherie Soriano AnanayoNo ratings yet

- W2. Decision Tree PDFDocument32 pagesW2. Decision Tree PDFHENRIKUS HARRY UTOMONo ratings yet

- What Is Capitalism?: Sarwat Jahan and Ahmed Saber MahmudDocument3 pagesWhat Is Capitalism?: Sarwat Jahan and Ahmed Saber MahmudBrunoRonchiNo ratings yet

- ds11 SpecsheetDocument4 pagesds11 Specsheet13421301508No ratings yet

- Solved The Demand For Good X Is Given by QDX 1200Document1 pageSolved The Demand For Good X Is Given by QDX 1200M Bilal SaleemNo ratings yet

- ESci 14 - Mid TermADocument1 pageESci 14 - Mid TermAje solarteNo ratings yet

- Statistics The Second.Document8 pagesStatistics The Second.Oliyad KondalaNo ratings yet

- Printed by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsDocument1 pagePrinted by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsLearning WebsiteNo ratings yet

- ESD Audit Check Sheet r1Document20 pagesESD Audit Check Sheet r1ecpuneetsharma01100% (1)

- Macro Unsolved Numericals EnglishDocument18 pagesMacro Unsolved Numericals EnglishajeshNo ratings yet

- Sector ModelDocument6 pagesSector ModelKranthikumar PrathiNo ratings yet