Professional Documents

Culture Documents

(I) (Ii) (A) : Section 28 in The Income-Tax Act, 1995

Uploaded by

AlezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(I) (Ii) (A) : Section 28 in The Income-Tax Act, 1995

Uploaded by

AlezCopyright:

Available Formats

Section 28 in The Income- Tax Act, 1995

28. Profits and gains of business or profession 1The following income shall be chargeable to

income- tax under the head" Profits and gains of business or profession",-

(i) the profits and gains of any business or profession which was carried on by the assessee at

any time during the previous year;

(ii) any compensation or other payment due to or received by,-

(a) any person, by whatever name called, managing the whole or substantially the whole of

the affairs of an Indian company, at or in connection with the termination of his management

or the modification of the terms and conditions relating thereto;

(b) any person by whatever name called, managing the whole or substantially the whole of

the affairs in India of any other company, at or in connection with the termination of his

office or the modification of the terms and conditions relating thereto;

(c) any person, by whatever name called, holding an agency in India for any part of the

activities relating to the business of any other person, at or in connection with the termination

of the agency or the modification of the terms and conditions relating thereto;

(d) 2 any person, for or in connection with the vesting in the Government, or in any

corporation owned or controlled by the Government, under any law for the time being in

force, of the management of any property or business;]

(iii) income derived by a trade, professional or similar association from specific services

performed for its members;

(iiia) 3 profits on sale of a licence granted under the Imports (Control) Order, 1955 , made

under the Imports and Exports (Control) Act, 1947 (18 of 1947 );]

(iiib) 4 cash assistance (by whatever name called) received or receivable by any person

against exports under any scheme of the Government of India;]

(iiic) 5 any duty of customs or excise re- paid or re- payable as drawback to any person

against exports under the Customs and Central Excise Duties Drawback Rules, 1971 ;]

(iv) 6 the value of any benefit or perquisite, whether convertible into money or not, arising

from business or the exercise of a profession;]

any interest, salary, bonus, commission or remuneration, by whatever name called, due to, or

received by, a partner of a firm from such firm: Provided that where any interest, salary,

bonus, commission or remuneration, by whatever name called, or any part thereof has not

been allowed to be deducted under clause (b) of section 40, the income under this clause

shall be adjusted to the extent of the amount not so allowed to be deducted.] 2

You might also like

- A Treatise on Indian Transfer Pricing Regulations - Part II: A Treatise on Indian Transfer Pricing Regulations, #2From EverandA Treatise on Indian Transfer Pricing Regulations - Part II: A Treatise on Indian Transfer Pricing Regulations, #2No ratings yet

- S - Viii: Bba - LL.B (Hons) Corporate LawsDocument20 pagesS - Viii: Bba - LL.B (Hons) Corporate LawsSalonee NayakNo ratings yet

- Corpoate Taxation: Income From Profits and Gains of Business or ProfessionDocument13 pagesCorpoate Taxation: Income From Profits and Gains of Business or ProfessionGanesh ChindanuruNo ratings yet

- Profits and Gains of Business or ProfessionDocument148 pagesProfits and Gains of Business or ProfessionSuvadip PalNo ratings yet

- CTP MergedDocument146 pagesCTP MergedRadhika ShingankuliNo ratings yet

- Basic Concepts of Income Tax Act: "Income Tax Is Levied On The Total Income of The Previous Year of Every Person."Document3 pagesBasic Concepts of Income Tax Act: "Income Tax Is Levied On The Total Income of The Previous Year of Every Person."babita_27No ratings yet

- Unit-1: Basic Concepts and Framework of Income Tax Act, 1961Document40 pagesUnit-1: Basic Concepts and Framework of Income Tax Act, 1961Saurab JainNo ratings yet

- Income Deemed To Accrue or Arise in IndiaDocument12 pagesIncome Deemed To Accrue or Arise in IndiaSuryaNo ratings yet

- Tax 2Document8 pagesTax 2arshithgowda01No ratings yet

- Direct Taxation: Topic:-"Profit and Gain From Business and Profession"Document12 pagesDirect Taxation: Topic:-"Profit and Gain From Business and Profession"Rajat MishraNo ratings yet

- Unit 4 Profits and Gains of Business or ProfessionDocument119 pagesUnit 4 Profits and Gains of Business or ProfessionRishikaysh KaakandikarNo ratings yet

- Basics of Income From Business & ProfessionDocument30 pagesBasics of Income From Business & ProfessionKiran BendeNo ratings yet

- Prof Ca S P Desai Important Definitions: Assessee (Section 2 (7) )Document10 pagesProf Ca S P Desai Important Definitions: Assessee (Section 2 (7) )Jay SangoiNo ratings yet

- Taxation Ions B1Document8 pagesTaxation Ions B1Saurabh SanjayNo ratings yet

- LLB Subject: Tax Law: Unit 1: Introduction A. DefinitionsDocument133 pagesLLB Subject: Tax Law: Unit 1: Introduction A. DefinitionsTahaNo ratings yet

- UntitledDocument92 pagesUntitledPawandeep SinghNo ratings yet

- Taxs Law ExamDocument15 pagesTaxs Law ExamSaif AliNo ratings yet

- Basic Oncepts of Income Tax: - Dr. P. Sree Sudha, Associate Professor, DsnluDocument47 pagesBasic Oncepts of Income Tax: - Dr. P. Sree Sudha, Associate Professor, Dsnluleela naga janaki rajitha attiliNo ratings yet

- 2 (9) of The Income Tax Act, 1961, Unless The Context Otherwise Requires, The Term 'Assessment Year' Means The Period of TwelveDocument24 pages2 (9) of The Income Tax Act, 1961, Unless The Context Otherwise Requires, The Term 'Assessment Year' Means The Period of TwelveAlezNo ratings yet

- Profits and Gains of Business or ProfessionDocument27 pagesProfits and Gains of Business or ProfessionShubhankar ThakurNo ratings yet

- Dr. P. Sree Sudha, Associate Professor, DsnluDocument47 pagesDr. P. Sree Sudha, Associate Professor, Dsnluammu arellaNo ratings yet

- Definitions: Section 2 (2 (1A) ) "Agricultural Income" MeansDocument4 pagesDefinitions: Section 2 (2 (1A) ) "Agricultural Income" Meanskrishna6941No ratings yet

- Madhya Pradesh Professional Tax Act, 1995Document40 pagesMadhya Pradesh Professional Tax Act, 1995sumitkejriwalNo ratings yet

- In Come Tax 1979Document247 pagesIn Come Tax 1979Salman MalikNo ratings yet

- Section 44ABDocument3 pagesSection 44ABkarthik_140886No ratings yet

- PGBP Chapter - Ay 2021-22 (May & Nov 2021 Exam)Document130 pagesPGBP Chapter - Ay 2021-22 (May & Nov 2021 Exam)hgoyal1998No ratings yet

- Ito 1984 2019 Final VersionDocument153 pagesIto 1984 2019 Final VersionJusefNo ratings yet

- Short NotesDocument4 pagesShort NotesFaisal AhmedNo ratings yet

- Profits and Gains of Business or ProfessionDocument18 pagesProfits and Gains of Business or ProfessionSurya MuruganNo ratings yet

- 1 PGBPDocument83 pages1 PGBPkashyapNo ratings yet

- Income Tax ActDocument50 pagesIncome Tax ActMahesh NaikNo ratings yet

- Income Tax: V SemesterDocument17 pagesIncome Tax: V SemesterAnzum anzumNo ratings yet

- Section 40Document4 pagesSection 40Anil MathewNo ratings yet

- ITO 1984 Up To 2022Document362 pagesITO 1984 Up To 2022KHONDOKER AHADUZZAMANNo ratings yet

- Presentation On Income Exempted From Income TaxDocument20 pagesPresentation On Income Exempted From Income Taxyatin rajputNo ratings yet

- Section 194Document10 pagesSection 194Hitesh NarwaniNo ratings yet

- General Meaning: Edit Source EditDocument38 pagesGeneral Meaning: Edit Source Editsri_bhairiNo ratings yet

- Law of Taxation NotesDocument49 pagesLaw of Taxation NotesBhoomika SinghNo ratings yet

- Explanation.-The Provisions of This Paragraph Shall Not Apply in The Case of A Non-GovernmentDocument9 pagesExplanation.-The Provisions of This Paragraph Shall Not Apply in The Case of A Non-GovernmentAl Amin SarkarNo ratings yet

- 76320bos61648 cp3Document222 pages76320bos61648 cp3DS NicknameNo ratings yet

- Exempt Income: Sec 10 (23D)Document5 pagesExempt Income: Sec 10 (23D)kalyanikamineniNo ratings yet

- Final ITO 1984 FA 2018Document176 pagesFinal ITO 1984 FA 2018Sarowar AlamNo ratings yet

- Unit 2 - Income From Business or ProfessionDocument13 pagesUnit 2 - Income From Business or ProfessionRakhi DhamijaNo ratings yet

- Profits and Gains From Business or Profession-NotesDocument20 pagesProfits and Gains From Business or Profession-NotesReema Laser60% (5)

- Exempted Income 34,35,36Document7 pagesExempted Income 34,35,36sriram29888142No ratings yet

- Business & Profession Theory-AY0910Document52 pagesBusiness & Profession Theory-AY0910Vijaya MandalNo ratings yet

- General Principles Regarding Computation of Income Taxable Under The Head " Profits and Gains of Business or Profession "Document14 pagesGeneral Principles Regarding Computation of Income Taxable Under The Head " Profits and Gains of Business or Profession "Ayisha NasnaNo ratings yet

- Income From Business & ProfessionDocument21 pagesIncome From Business & Professionjack2529007No ratings yet

- MFM-14 Pankaj Mahajan TaxationDocument10 pagesMFM-14 Pankaj Mahajan TaxationPankaj MahajanNo ratings yet

- Topic - 1 - Taxation - Notes by Legal Lab OfficialDocument16 pagesTopic - 1 - Taxation - Notes by Legal Lab OfficialGourav KumarNo ratings yet

- Short Title, Commencement and Application. - (1) These RulesDocument41 pagesShort Title, Commencement and Application. - (1) These Rulessuvendu beheraNo ratings yet

- Other SourceDocument43 pagesOther SourceJai RajNo ratings yet

- 40ADocument3 pages40Aashim1No ratings yet

- Income From Profits and Gains of Business and Profession: (A) (B) (C) (D)Document9 pagesIncome From Profits and Gains of Business and Profession: (A) (B) (C) (D)Harshit YNo ratings yet

- Benefits Available To Non ResidentsDocument16 pagesBenefits Available To Non ResidentsArchita TiwariNo ratings yet

- Payment of Wages Act, 1936: Regular PayDocument5 pagesPayment of Wages Act, 1936: Regular PayKavipriyaNo ratings yet

- Section 64: Incomes Which Do Not Form Part of Total Income Incomes Not Included in Total Income. 10Document33 pagesSection 64: Incomes Which Do Not Form Part of Total Income Incomes Not Included in Total Income. 10Mandar RaneNo ratings yet

- Unit - 5: Income From Other Sources: After Studying This Chapter, You Would Be Able ToDocument45 pagesUnit - 5: Income From Other Sources: After Studying This Chapter, You Would Be Able ToShantanuNo ratings yet

- Meaning of Payment of Bonus ActDocument16 pagesMeaning of Payment of Bonus ActDaljeet KaurNo ratings yet

- Income From Other Sources: Click To Add TextDocument14 pagesIncome From Other Sources: Click To Add TextAlezNo ratings yet

- Determination of Annual Value (Section 23)Document15 pagesDetermination of Annual Value (Section 23)AlezNo ratings yet

- Leave EncashmentsDocument9 pagesLeave EncashmentsAlezNo ratings yet

- SalariesDocument4 pagesSalariesAlezNo ratings yet

- 2 (9) of The Income Tax Act, 1961, Unless The Context Otherwise Requires, The Term 'Assessment Year' Means The Period of TwelveDocument24 pages2 (9) of The Income Tax Act, 1961, Unless The Context Otherwise Requires, The Term 'Assessment Year' Means The Period of TwelveAlezNo ratings yet

- GratuatyDocument9 pagesGratuatyAlezNo ratings yet

- IT TermsDocument9 pagesIT TermsAlezNo ratings yet

- SAlariesDocument12 pagesSAlariesAlezNo ratings yet

- Minutes of First Pta MeetingDocument2 pagesMinutes of First Pta MeetingRubie Ann Buenafe BibatNo ratings yet

- 02a - Rdg-1796 Treaty of TripoliDocument4 pages02a - Rdg-1796 Treaty of TripoliAnthony ValentinNo ratings yet

- FTP Port 20Document2 pagesFTP Port 20RajaRajan ManickamNo ratings yet

- Spec Pro Page 2 of 6Document39 pagesSpec Pro Page 2 of 6mccm92No ratings yet

- Tertiary ActivitiesDocument5 pagesTertiary Activitieshimanshu singhNo ratings yet

- Chapter 5 Regulations of Financial Market S and InstitutionsDocument7 pagesChapter 5 Regulations of Financial Market S and InstitutionsShimelis Tesema100% (1)

- PO Interview Questions and AnswersDocument6 pagesPO Interview Questions and AnswersSuneelTejNo ratings yet

- Business Organizations Grade 8: Private SectorDocument16 pagesBusiness Organizations Grade 8: Private SectorCherryl Mae AlmojuelaNo ratings yet

- Partnership: Owned by TWO or MORE People. Share Profits Equally. The Owner Is Called A PartnerDocument14 pagesPartnership: Owned by TWO or MORE People. Share Profits Equally. The Owner Is Called A PartnerGiann Lorrenze Famisan RagatNo ratings yet

- Introduction To Partnership Accounting Partnership DefinedDocument33 pagesIntroduction To Partnership Accounting Partnership DefinedMarcus MonocayNo ratings yet

- Ifrs 9 Financial Instruments Using Models in Impairment - AshxDocument38 pagesIfrs 9 Financial Instruments Using Models in Impairment - Ashxwan nur anisahNo ratings yet

- NSTP Mark Welson Chua 1Document19 pagesNSTP Mark Welson Chua 1Archie BanaybanayNo ratings yet

- Employer Employee SchemeDocument22 pagesEmployer Employee SchemeMaruthi RaoNo ratings yet

- Womens Voting Rights Sign On LetterDocument4 pagesWomens Voting Rights Sign On LetterMatthew HamiltonNo ratings yet

- Doctrine of Liberality of Technical ProceduresDocument18 pagesDoctrine of Liberality of Technical ProceduresLou Nonoi TanNo ratings yet

- A Critical Analysis of Arguments (Most Recent)Document3 pagesA Critical Analysis of Arguments (Most Recent)diddy_8514No ratings yet

- II Sem English NotesDocument8 pagesII Sem English NotesAbishek RajuNo ratings yet

- An English Settlement at JamestownDocument7 pagesAn English Settlement at JamestownPatrick ThorntonNo ratings yet

- Conception and Definition of TrademarkDocument10 pagesConception and Definition of TrademarkMohammad Ziya AnsariNo ratings yet

- Saran Blackbook FinalDocument78 pagesSaran Blackbook FinalVishnuNadar100% (3)

- 32 Machuca V ChuidanDocument2 pages32 Machuca V ChuidanFrancis FlorentinNo ratings yet

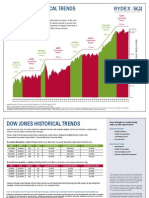

- Rydex Historical TrendsDocument2 pagesRydex Historical TrendsVinayak PatilNo ratings yet

- Legal Aspects of NursingDocument95 pagesLegal Aspects of NursingHannah aswiniNo ratings yet

- Navig8 Almandine - Inv No 2019-002 - Santa Barbara Invoice + Voucher PDFDocument2 pagesNavig8 Almandine - Inv No 2019-002 - Santa Barbara Invoice + Voucher PDFAnonymous MoQ28DEBPNo ratings yet

- Civil Application E039 of 2021Document4 pagesCivil Application E039 of 2021Edward NjorogeNo ratings yet

- MALAYSIA The Nightmare of Indian IT ProfessionalsDocument3 pagesMALAYSIA The Nightmare of Indian IT ProfessionalspenangNo ratings yet

- Physics 2 - Starts Heat JULY 2017Document282 pagesPhysics 2 - Starts Heat JULY 2017Irah Mae Escaro CustodioNo ratings yet

- Delima, Gail Dennisse F. - Customs of The TagalogsDocument2 pagesDelima, Gail Dennisse F. - Customs of The TagalogsGail DelimaNo ratings yet

- Case Study: TEAM-2Document5 pagesCase Study: TEAM-2APARNA SENTHILNo ratings yet

- Electromagnetic Induction - Revision Notes 1Document5 pagesElectromagnetic Induction - Revision Notes 1Suyash GuptaNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessFrom EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNo ratings yet

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthFrom EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNo ratings yet

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionRating: 5 out of 5 stars5/5 (27)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionFrom EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionNo ratings yet

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- The Payroll Book: A Guide for Small Businesses and StartupsFrom EverandThe Payroll Book: A Guide for Small Businesses and StartupsRating: 5 out of 5 stars5/5 (1)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.From EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.No ratings yet

- The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesFrom EverandThe Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesNo ratings yet

- The 6% Life: 7 Legal Tax Loopholes That Any Business Owner Can Use to Design Their Life and Pay the Government 6% or LessFrom EverandThe 6% Life: 7 Legal Tax Loopholes That Any Business Owner Can Use to Design Their Life and Pay the Government 6% or LessNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Official Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerFrom EverandOfficial Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerNo ratings yet

![The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS Penalties](https://imgv2-1-f.scribdassets.com/img/audiobook_square_badge/711600370/198x198/d63cb6648d/1712039797?v=1)