Professional Documents

Culture Documents

Exempt Income: Sec 10 (23D)

Uploaded by

kalyanikamineniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exempt Income: Sec 10 (23D)

Uploaded by

kalyanikamineniCopyright:

Available Formats

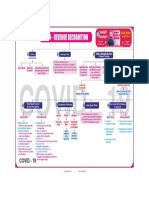

Exempt Income

Sec 10(23D)

Income of Mutual Fund

Sec 10(23EA)

Income of Investor Protection Funds set up by recognised stock exchanges in

India

Sec 10(23EC)

Specified income of Investor Protection Fund set up by commodity

exchanges

Sec 10(23ED)

Income of Investor Protection Fund set up by depositories

Sec 10(23EE)

Specified income of Core Settlement Guarantee Fund (SGF) set up by a

recognized Clearing Corporation

Sec. 10(24)

House proper income & Income from other sources arising to a registered

trade union

Sec 10(25)

Income of provident funds, superannuation funds, gratuity funds

Sec 10(25A)

Income of Employees’ State Insurance (ESI) Fund

Sec. 10(26)

1. Any income, which accrues or arises to a Member of Schedule Tribes (ST),

would be exempt from income-tax –

a. income from any source in such area; or

b. income by way of dividend or interest on securities.

2. Such person shall reside in specified areas.

Sec 10(26AAA)

1. Any income, which accrues or arises to a Sikkimese individual, would be

exempt from income-tax –

a. income from any source in the State of Sikkim; or

b. income by way of dividend or interest on securities.

2. However, this exemption will not be available to a Sikkimese woman who,

on or after 1st April, 2008, marries a non-Sikkimese individual.

Sec 10(26AAB)

Income of an Agricultural Produce Market Committee or Board

Sec 10(26B)

Income of a corporation etc. for the promotion of interests of members of

Scheduled Casts or Tribes or backward classes or any two or for all

Sec 10(26BB)

Income of corporations established to protect interests of minority

community

Sec 10(26BBB)

Income of corporation established by Central or State Govt for welfare and

economic upliftment of ex- servicemen

Sec 10(27)

Income of a co-operative society for promoting interest of members of

Scheduled castes or Tribes or both

Sec 10(29A)

Incomes of certain bodies like Coffee Board, etc.

Sec 10(30)

Tea board subsidy

The amount of any subsidy received by any assessee engaged in the business

of growing and manufacturing tea in India through or from the Tea Board will

be wholly exempt from tax.

Conditions:

a. The subsidy should have been received under any scheme for

replantation or replacement of the bushes or for rejuvenation or

consolidation of areas used for cultivation of tea, as notified by the

Central Government.

b. The assessee should furnish a certificate from the Tea Board, as to the

amount of subsidy received by him during the previous year, to the

Assessing Officer along with his return of the relevant assessment year

or within the time extended by the Assessing Officer for this purpose.

Sec 10(31)

Other subsidies

Amount of any subsidy received by an assessee engaged in the business of

growing and manufacturing rubber, coffee, cardamom or other specified

commodity in India, as notified by the Central Government, will be wholly

exempt from tax.

Conditions:

a. The subsidies should have been received from or through the Rubber

Board, Coffee Board, Spices Board or any other Board in respect of any

other commodity under any scheme for replantation or replacement

of rubber, coffee, cardamom or other plants or for rejuvenation or

consolidation of areas used for cultivation of all such commodities.

b. The assessee should furnish a certificate from the Board, as to the

amount of subsidy received by him during the previous year, to the

Assessing Officer along with his return of the relevant assessment year

or within the time extended by the Assessing Officer for this purpose.

Sec. 10(39)

Income arising from any International sporting event held in India if such

event is approved by international body regulating such sport has

participation by more than two countries & is notified by CG for this clause

Sec 10(40)

Certain grants etc. received by a subsidiary from its Indian holding company

engaged in the business of generation or transmission or distribution of

power

Sec 10(42)

Specified income of certain bodies or authorities

Sec 10(44)

Income received by any person on behalf of NPS Trust

Sec 10(46)

Specified income of notified entities not engaged in commercial activity

Sec 10(47)

Income of notified infrastructure debt funds

Sec 10(48C)

Certain income of Indian Strategic Petroleum Reserves Limited

Any income accruing or arising to the Indian Strategic Petroleum Reserves

Limited, being a wholly owned subsidiary of the Oil Industry Development

Board under the Ministry of Petroleum and Natural Gas, as a result of

arrangement for replenishment of crude oil stored in its storage facility in

pursuance of directions of the Central Government would be exempt.

However, exemption would not available in respect of an arrangement, if the

crude oil is not replenished in the storage facility within three years from the

end of the financial year in which the crude oil was removed from the storage

facility for the first time.

PREPARED BY: CA RAM PATIL

You might also like

- Exempted Incomes For Different CategoriesDocument10 pagesExempted Incomes For Different Categorieskmr_arnNo ratings yet

- As Amended by Finance Act, 2017Document3 pagesAs Amended by Finance Act, 2017JonnyNo ratings yet

- Section Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionDocument32 pagesSection Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionanilpeddamalliNo ratings yet

- Presentation On Income Exempted From Income TaxDocument20 pagesPresentation On Income Exempted From Income Taxyatin rajputNo ratings yet

- Tax 2Document8 pagesTax 2arshithgowda01No ratings yet

- Income Exempt From TaxDocument20 pagesIncome Exempt From TaxSaad AliNo ratings yet

- Taxs Law ExamDocument15 pagesTaxs Law ExamSaif AliNo ratings yet

- Exempted IncomeDocument3 pagesExempted IncomeSneha PotekarNo ratings yet

- LLB Subject: Tax Law: Unit 1: Introduction A. DefinitionsDocument133 pagesLLB Subject: Tax Law: Unit 1: Introduction A. DefinitionsTahaNo ratings yet

- Tax PlanDocument2 pagesTax PlanMrigendra MishraNo ratings yet

- Income Which Do Not Form Part of Total Income: HapterDocument33 pagesIncome Which Do Not Form Part of Total Income: HapterAleti NithishNo ratings yet

- Exemptions and DeductionsDocument72 pagesExemptions and DeductionsSyed Parveez AlamNo ratings yet

- Donations Eligible For 100% Deduction Without Qualifying LimitDocument11 pagesDonations Eligible For 100% Deduction Without Qualifying LimitShravani ShravNo ratings yet

- Unit 4Document14 pagesUnit 4Rupesh PatilNo ratings yet

- Bus (1) (1) - Inc.-3Document46 pagesBus (1) (1) - Inc.-3api-3758832No ratings yet

- Chapter - 1: Page - 1Document7 pagesChapter - 1: Page - 1Arunangsu ChandaNo ratings yet

- Business Taxation 1Document22 pagesBusiness Taxation 1AnshuNo ratings yet

- Section-10: Income Exempt From TaxDocument21 pagesSection-10: Income Exempt From TaxJitendra VernekarNo ratings yet

- Direct Taxes Ready ReckonerDocument74 pagesDirect Taxes Ready ReckonerNeha GuptaNo ratings yet

- Income Tax Unit-2 NotesDocument7 pagesIncome Tax Unit-2 NotesTrial 001No ratings yet

- Income Tax Exemptions: Income Type Under SectionDocument17 pagesIncome Tax Exemptions: Income Type Under Section12345566788990100% (2)

- A Book: Integrated Professional Competency Course (IPCC) Paper - 1: AccountingDocument12 pagesA Book: Integrated Professional Competency Course (IPCC) Paper - 1: AccountingSipoy SatishNo ratings yet

- Adobe Scan 09-Nov-2023Document5 pagesAdobe Scan 09-Nov-2023james17stevensNo ratings yet

- Explanation.-The Provisions of This Paragraph Shall Not Apply in The Case of A Non-GovernmentDocument9 pagesExplanation.-The Provisions of This Paragraph Shall Not Apply in The Case of A Non-GovernmentAl Amin SarkarNo ratings yet

- Section Wise - Income Tax DeductionsDocument25 pagesSection Wise - Income Tax DeductionsCaCs Piyush SarupriaNo ratings yet

- UntitledDocument92 pagesUntitledPawandeep SinghNo ratings yet

- Module-1: Basic Concepts and DefinitionsDocument35 pagesModule-1: Basic Concepts and Definitions2VX20BA091No ratings yet

- (I) (Ii) (A) : Section 28 in The Income-Tax Act, 1995Document1 page(I) (Ii) (A) : Section 28 in The Income-Tax Act, 1995AlezNo ratings yet

- 1.2 Module 1 Part 2Document4 pages1.2 Module 1 Part 2Arpita ArtaniNo ratings yet

- Exempted IncomesDocument17 pagesExempted IncomesMuskanNo ratings yet

- Section-10: Income Exempt From TaxDocument21 pagesSection-10: Income Exempt From TaxRakesh SharmaNo ratings yet

- Tax Laws Updates For June 2013 ExamsDocument68 pagesTax Laws Updates For June 2013 Examsnisarg_No ratings yet

- MFM-14 Pankaj Mahajan TaxationDocument10 pagesMFM-14 Pankaj Mahajan TaxationPankaj MahajanNo ratings yet

- Chapter 10 - Incomes Which Do Not Form Part of Total Income - NotesDocument10 pagesChapter 10 - Incomes Which Do Not Form Part of Total Income - NotesRahul TiwariNo ratings yet

- General Deductions (Under Section 80) : Basic Rules Governing Deductions Under Sections 80C To 80UDocument67 pagesGeneral Deductions (Under Section 80) : Basic Rules Governing Deductions Under Sections 80C To 80UVENKATESAN DNo ratings yet

- Name: Dilip Kumar. G: Sikkim Manipal University 3 Semester Fall 2010Document11 pagesName: Dilip Kumar. G: Sikkim Manipal University 3 Semester Fall 2010Dilipk86No ratings yet

- Tax Laws Updates For December 2013Document72 pagesTax Laws Updates For December 2013Archana ThirunagariNo ratings yet

- MF0003 - Taxation ManagementDocument7 pagesMF0003 - Taxation ManagementushasnNo ratings yet

- Exempted Income Under Section 10Document18 pagesExempted Income Under Section 10Komal NandanNo ratings yet

- S - Viii: Bba - LL.B (Hons) Corporate LawsDocument20 pagesS - Viii: Bba - LL.B (Hons) Corporate LawsSalonee NayakNo ratings yet

- Tax On Return On Investments in Sukuks.Document2 pagesTax On Return On Investments in Sukuks.rehmanzidNo ratings yet

- 49.income From Other SourcesDocument11 pages49.income From Other Sourcespratapnirbhay0551No ratings yet

- CTP MergedDocument146 pagesCTP MergedRadhika ShingankuliNo ratings yet

- Unit-1: Basic Concepts and Framework of Income Tax Act, 1961Document40 pagesUnit-1: Basic Concepts and Framework of Income Tax Act, 1961Saurab JainNo ratings yet

- Income From Other SourcesDocument12 pagesIncome From Other Sourcessanjul2008No ratings yet

- Income Exempt From Taxsection-10 To 13Document15 pagesIncome Exempt From Taxsection-10 To 13Rohit MohanNo ratings yet

- Income Exempt From TaxDocument12 pagesIncome Exempt From TaxAkshay SrivastavaNo ratings yet

- Exempted Income Tax Sec 10Document3 pagesExempted Income Tax Sec 10Sreepada KameswariNo ratings yet

- 11.tax Free Incomes FinalDocument40 pages11.tax Free Incomes FinalKARTHIK ANo ratings yet

- Basic Oncepts of Income Tax: - Dr. P. Sree Sudha, Associate Professor, DsnluDocument47 pagesBasic Oncepts of Income Tax: - Dr. P. Sree Sudha, Associate Professor, Dsnluleela naga janaki rajitha attiliNo ratings yet

- IT-03 Incomes Exempt From TaxDocument18 pagesIT-03 Incomes Exempt From TaxAkshat GoyalNo ratings yet

- Deduction Allowed and Not Allowed Under The Head Income From Business PDFDocument6 pagesDeduction Allowed and Not Allowed Under The Head Income From Business PDFMuhammad sheran sattiNo ratings yet

- 11.tax Free Incomes FinalDocument40 pages11.tax Free Incomes FinalGhs ShahpurkandiNo ratings yet

- Exempted Incomes U/S 10: B.Satyanarayana Rao Asso - Prof in Commerce ST - Joseph'S Degree & PG College King Koti, HyderabadDocument25 pagesExempted Incomes U/S 10: B.Satyanarayana Rao Asso - Prof in Commerce ST - Joseph'S Degree & PG College King Koti, HyderabadKumar RupeshNo ratings yet

- (A) (C) (D) (2) (A) : Section 5 in The Competition Act, 2002Document5 pages(A) (C) (D) (2) (A) : Section 5 in The Competition Act, 2002beejal ahujaNo ratings yet

- Law of Taxation NotesDocument49 pagesLaw of Taxation NotesBhoomika SinghNo ratings yet

- Income From Other SourcesDocument24 pagesIncome From Other Sourcesnikhilk222No ratings yet

- Tax Treatment of Dividend ReceivedDocument8 pagesTax Treatment of Dividend ReceivedAnanth DivakaruniNo ratings yet

- Submitted BY: A) DefinationsDocument35 pagesSubmitted BY: A) Definationsnitin0010No ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- MS Excel Workshop - B 30Document26 pagesMS Excel Workshop - B 30kalyanikamineniNo ratings yet

- Consignment Meaning of ConsignmentDocument1 pageConsignment Meaning of ConsignmentkalyanikamineniNo ratings yet

- Intro To Company AccDocument6 pagesIntro To Company AcckalyanikamineniNo ratings yet

- V'Smart Academy (88883 88886) Chapter 6:standard CostingDocument13 pagesV'Smart Academy (88883 88886) Chapter 6:standard CostingSANTHOSH KUMAR T MNo ratings yet

- Money Market Instruments (Original Maturity Up To One Year)Document11 pagesMoney Market Instruments (Original Maturity Up To One Year)kalyanikamineniNo ratings yet

- FMS PPT Group5Document22 pagesFMS PPT Group5kalyanikamineniNo ratings yet

- Vision - 2Document1 pageVision - 2kalyanikamineniNo ratings yet

- Global Superstore DatasetDocument5,701 pagesGlobal Superstore DatasetHaroon FareedNo ratings yet

- Sec 194 Ic, 194la, 194J (TDS)Document3 pagesSec 194 Ic, 194la, 194J (TDS)kalyanikamineniNo ratings yet

- Auditing BitsDocument48 pagesAuditing BitskalyanikamineniNo ratings yet

- Good Will in PatnershipDocument6 pagesGood Will in PatnershipkalyanikamineniNo ratings yet

- GAPs Model Survey QuestionsDocument3 pagesGAPs Model Survey QuestionskalyanikamineniNo ratings yet

- Ifos Part 2Document2 pagesIfos Part 2kalyanikamineniNo ratings yet

- Over SubscriptionDocument3 pagesOver SubscriptionkalyanikamineniNo ratings yet

- Method 3 of GoodwillDocument3 pagesMethod 3 of GoodwillkalyanikamineniNo ratings yet

- As - 9Document1 pageAs - 9kalyanikamineniNo ratings yet

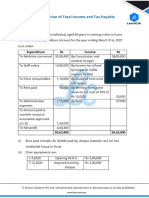

- Assesment of Individuals Q-1Document4 pagesAssesment of Individuals Q-1kalyanikamineniNo ratings yet

- Assesment of Individual Q-2Document4 pagesAssesment of Individual Q-2kalyanikamineniNo ratings yet

- Transfer Pricing - 1Document2 pagesTransfer Pricing - 1kalyanikamineniNo ratings yet

- Bna Article-8Document5 pagesBna Article-8kalyanikamineniNo ratings yet

- C2 - Human Resource Management-Class of 2024 - Trimester IIDocument8 pagesC2 - Human Resource Management-Class of 2024 - Trimester IIkalyanikamineniNo ratings yet

- SalaryDocument80 pagesSalarykalyanikamineniNo ratings yet

- GAPs Model Survey QuestionsDocument3 pagesGAPs Model Survey QuestionskalyanikamineniNo ratings yet

- Agricultural IncomeDocument2 pagesAgricultural IncomekalyanikamineniNo ratings yet

- Reissue Q-2Document4 pagesReissue Q-2kalyanikamineniNo ratings yet

- Sec 194 IDocument4 pagesSec 194 IkalyanikamineniNo ratings yet

- BoS - Session 1Document37 pagesBoS - Session 1kalyanikamineni100% (1)

- Assignment 1 - Probability TheoryDocument2 pagesAssignment 1 - Probability TheorykalyanikamineniNo ratings yet

- Edited Auditing BitsDocument48 pagesEdited Auditing BitskalyanikamineniNo ratings yet

- Calls in Arrers ND Calls in AdvanceDocument3 pagesCalls in Arrers ND Calls in AdvancekalyanikamineniNo ratings yet

- Aviation EbookDocument36 pagesAviation Ebookmeroka2000No ratings yet

- FSED 1F Application Form FSEC For Building Permit Rev02Document2 pagesFSED 1F Application Form FSEC For Building Permit Rev02Angelito RegulacionNo ratings yet

- Assignment CM Final PDFDocument9 pagesAssignment CM Final PDFRefisa JiruNo ratings yet

- Model Teaching CompetenciesDocument12 pagesModel Teaching CompetenciesTeachers Without BordersNo ratings yet

- Rack & Pinion DesignDocument9 pagesRack & Pinion Designmannu057No ratings yet

- A Simple and Convenient Synthesis of Pseudo Ephedrine From N-MethylamphetamineDocument2 pagesA Simple and Convenient Synthesis of Pseudo Ephedrine From N-Methylamphetaminedh329No ratings yet

- PIRCHLDocument227 pagesPIRCHLapi-3703916No ratings yet

- Comprehensive Land Use Plan-Tagaytay CityDocument87 pagesComprehensive Land Use Plan-Tagaytay CityCet R. Cabahug50% (4)

- Pseudomonas AeruginosaDocument26 pagesPseudomonas AeruginosaNur AzizahNo ratings yet

- P22Document9 pagesP22Aastha JainNo ratings yet

- CV KM Roy Supit 01 April 2019Document3 pagesCV KM Roy Supit 01 April 2019Ephanama TehnikNo ratings yet

- A New Approach To Air Quality in Hospitals: Www.p3italy - ItDocument19 pagesA New Approach To Air Quality in Hospitals: Www.p3italy - ItMuneer Ahmed ShaikNo ratings yet

- Lesson 12 FastenersDocument9 pagesLesson 12 FastenersEmerson John RoseteNo ratings yet

- RCB Dealers PHDocument3 pagesRCB Dealers PHJing AbionNo ratings yet

- Questão 13: Technology Anticipates Fast-Food Customers' OrdersDocument3 pagesQuestão 13: Technology Anticipates Fast-Food Customers' OrdersOziel LeiteNo ratings yet

- Contacts Modeling in AnsysDocument74 pagesContacts Modeling in Ansyssudhirm16100% (2)

- Motherboard Manual 6vem eDocument67 pagesMotherboard Manual 6vem eAri Ercilio Farias FereirraNo ratings yet

- Ac-Ppt On Crystal OscillatorDocument10 pagesAc-Ppt On Crystal OscillatorRitika SahuNo ratings yet

- Cyber CXDocument2 pagesCyber CXhplzNo ratings yet

- Kraft Foods Inc. in FranceDocument25 pagesKraft Foods Inc. in Francevishal211086No ratings yet

- Maintenance of Building ComponentsDocument4 pagesMaintenance of Building ComponentsIZIMBANo ratings yet

- Sand Cone Test ResultsDocument71 pagesSand Cone Test ResultsGayan Indunil JayasundaraNo ratings yet

- Test Method of Flammability of Interior Materials For AutomobilesDocument17 pagesTest Method of Flammability of Interior Materials For AutomobilesKarthic BhrabuNo ratings yet

- C1036 16Document10 pagesC1036 16masoudNo ratings yet

- Dialer AdminDocument5 pagesDialer AdminNaveenNo ratings yet

- Packing Lists AbroadDocument9 pagesPacking Lists AbroadAdit PinheiroNo ratings yet

- Name and Logo Design Contest For Public Wi-Fi Network Services Terms & ConditionsDocument2 pagesName and Logo Design Contest For Public Wi-Fi Network Services Terms & ConditionsAc RaviNo ratings yet

- Pump Foundation Design PDFDocument18 pagesPump Foundation Design PDFArchana ArchuNo ratings yet

- SAP On ASE Development UpdateDocument16 pagesSAP On ASE Development Updatebetoy castroNo ratings yet

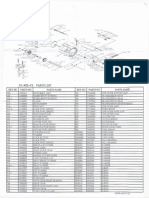

- Okuma CL302L Parts List & ManualDocument3 pagesOkuma CL302L Parts List & Manualcoolestkiwi100% (1)