Professional Documents

Culture Documents

Sss Law Reviewer

Uploaded by

Ysza Gian VispoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sss Law Reviewer

Uploaded by

Ysza Gian VispoCopyright:

Available Formats

lOMoARcPSD|5916110

SSS Law Reviewer copy

BS Accountancy (Ateneo de Zamboanga University)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Ysza Gian Vispo (yszavispo@gmail.com)

lOMoARcPSD|5916110

Social Security Law Reviewer Atty. Cesar Santamaria

University of Santo Tomas Faculty of Civil Law Professor – 2C (2017-2018)

Social Security System Law A: Yes the definition of the term "employer" is, we

(Republic Act No. 1161, as amended) think, sufficiently comprehensive as to include

religious and charitable institutions or entities not

Q: What is the purpose of the SSS Law? organized for profit, like here in appellant, within its

meaning.

A: to establish, develop, promote and perfect a sound This is made more evident by the fact that it contains

and viable tax-exempt social security system an exception in which said institutions or entities are

–suitable to the needs of the people throughout the not included. And, certainly, had the Legislature really

Philippines intended to limit the operation of the law to entities

–which shall promote social justice and organized for profit or gain, it would not have defined

–provide meaningful protection to members and their an "employer" in such a way as to include the

beneficiaries against the hazards of Government and yet make an express exception of it.

disability, (In re Catholic Archbishop of Manila v. Social Security

sickness, Commission, G.R. No. L15045, [January20,1961],

maternity, 110 PHIL 616-622)

old age,

death, and 2. Employees

other contingencies resulting in loss of All employees not over sixty (60) years of age

income or financial burden.

Employee -- Any person who performs services for

Towards this end, the State shall endeavor to extend an employer in which either or both mental and

social security protection to workers and their physical efforts are used and who receives

beneficiaries. compensation for such services, where there is an

employer-employee relationship

Its purpose is to provide social security, which means

funds for the beneficiary, if the employee dies, or for Well-settled is the rule that the mandatory coverage of

the employee himself and his dependents if he is RA 1161, as amended, is premised on the existence

unable to perform his task because of illness or of an employer-employee relationship. (Co v. People,

disability xxx (Tecson v. SSS, G.R. No. L-15798, G.R. No. 160265, [July 13, 2009], 610 PHIL 60-71)

[December 28, 1961], 113 PHIL 703-707)

3. Domestic helpers earning not less than One

Q: Who are compulsorily covered by the SSS? thousand pesos (P1,000.00) a month

A: The minimum wage of domestic workers is now

1. Employers P1,500 to P2,500 pursuant to Section 24 of RA

Any person, natural or juridical, domestic or foreign 10361 (Batas Kasambahay).

Who carries on in the Philippines any trade,

business, industry, undertaking or activity of Consequently, all domestic workers should be

any kind; and covered.

Uses the services of another person who is

Per RA 10361, a domestic worker who has rendered

under his orders as regards the employment.

at least one (1) month of service shall be covered by

EXCEPT the Government and any of its

the Social Security System (SSS), the Philippine

political subdivisions, branches or

Health Insurance Corporation (PhilHealth), and the

instrumentalities, including corporations

Home Development Mutual Fund or Pag-IBIG, and

owned or controlled by the Government.

shall be entitled to all the benefits in accordance with

the pertinent provisions provided by law.

Q: Are religious, charitable and non-profit

institutions covered?

4. Self Employed Persons

Including, but not limited to the following:

1. All self-employed professionals;

Agrarian Law and Social Legislation Reviewer Page 1 of 14

Downloaded by Ysza Gian Vispo (yszavispo@gmail.com)

lOMoARcPSD|5916110

Social Security Law Reviewer Atty. Cesar Santamaria

University of Santo Tomas Faculty of Civil Law Professor – 2C (2017-2018)

2. Partners and single proprietors of Gocheco Lumber Co., G.R. No. L-8017, [April 30,

businesses; 1955], 96 PHIL 941-946)

3. Actors and actresses, directors, scriptwriters

and news correspondents who do not fall In the case at bar the employment of respondent A to

within the definition of the term "employee" in help in the repair or replacement of the eave of a

Sec. 8 commercial store owned by petitioner UC was purely

4. (d) of this Act; casual because such work was needed only when

5. Professional athletes, coaches, trainers and the said structure was damaged or broken. When it

jockeys; and would be broken and repaired nobody could foresee.

6. Individual farmers and fishermen. Work on the eave could not be made at fixed

intervals. The employment of a carpenter and a

Q: Is this compulsory coverage and therefore, tinsmith for its repair or replacement was therefore

compulsory contribution, Constitutional? only occasional, sporadic and for a short time. (Uy

Chao v. Aguilar, G.R. No. L-9069, [March 28, 1958],

A: Yes. The Social Security Law is a legitimate 103 PHIL 219-223)

exercise of the police power of the State.

2. Employees on an alien vessel employed when

It affords protection to labor, especially to working such vessel is outside the Philippines;

women and minors, and is in full accord with the 3. Employees of the Philippine Government or

constitutional provisions on the "promotion of social instrumentality or agency thereof;

justice to insure the well-being and economic security 4. Employees of a foreign government or

of all the people.― (Roman Catholic Archbishop of international organization, or their wholly- owned

Manila v. SSC; GR L-15045, January 20, 1961) instrumentality; and

5. Temporary and other employees excluded by

Q: Can the parties still agree to a private benefit regulation of the Commission.

plan providing for greater benefits?

Q: What are the effective dates of coverage of

A: Yes. Nothing in this Act shall be construed as a employers and employees?

limitation on the right of employers and employees to

agree on and adopt benefits which are over and A: Section 10 of RA 1161

above those provided under this Act. (Section 9) Employer = on the 1st day of operation.

Employee = on the day of his employment.

Q: Who may volunteer for coverage? Self-employed = upon registration.

A: Q: What are the obligations of an employer under

1. Spouses who devote full time to managing the law?

the household and family affairs; and

2. Filipinos recruited by foreign-based A:

employers for employment abroad. 1. Reporting of Covered Employees; Section

24(a).

Q: Who are excluded from the coverage of the 2. Remittance of Contributions; Sections 18,

law? 19, 19-A, and 22.

A: Q: What is the employer required to report?

1. Purely casual employees; (see also Viernes

case) A: Names, ages, civil status, occupations, salaries

and dependents of all his employees who are subject

Casual means occasional, coming without regularity. to compulsory coverage

The work

is purely casual when it is not a part of the business in Q: In case of a legitimate contracting

which the employer is engaged. (Mansal v. P.P. arrangement, who has the obligation to report?

Agrarian Law and Social Legislation Reviewer Page 2 of 14

Downloaded by Ysza Gian Vispo (yszavispo@gmail.com)

lOMoARcPSD|5916110

Social Security Law Reviewer Atty. Cesar Santamaria

University of Santo Tomas Faculty of Civil Law Professor – 2C (2017-2018)

A: Employees of bona fide independent contractors Example: If employee begins work on June 20,

shall not be deemed employees of the employer deduction and contribution should be made by June

engaging the services of said contractors. (Section 30.

8(j))

– Principal shall be subsidiarily liable for the civil Q: What about the obligation to remit?

liabilities of the contractor under the SSS Law.

A: The contribution imposed in the preceding section

Q: What are the consequences of an employer’s shall be remitted to the SSS within the first ten (10)

failure to report? days of each calendar month following the month for

which they are applicable or within such time as the

A: Effect of Failure to Report; Section 24(a) Commission may prescribe. (Section 22)

1. DAMAGES if the employee subject to

compulsory coverage Example: June contributions should be remitted by

2. Dies; July 10.

3. Becomes sick or disabled; or

4. Reaches the age of sixty (60) Q: What are the consequences if the employer

Without the SSS having previously received any fails or refuses to remit?

report or written communication about him from his

employer. A: Employer shall be liable for:

1. Payment of the contributions.

1. The said employer shall pay to the SSS damages 2. Penalty of 3% per month from due date until

equivalent to the benefits to which said paid.

employee member would have been 3. Fine and imprisonment under Section 28(e).

entitled had his name been reported on 4. Estafa under Article 315 of the RPC.

time by the employer to the SSS Misappropriation is presumed if he deducts

but does not remit within 30 days. Section

In case of pension benefits, damages shall be 28(h).

equivalent to the accumulated pension due as of the 5. If employer fails to remit prior to date of

date of settlement of the claim or the five (5) years' contingency, resulting in reduction of

pension, whichever is higher, including benefits, employer shall be liable to pay the

dependents' pension. SSS damages equivalent to the difference

between the amount of benefit which the

2. The employer shall also be liable for the payment member should have received and the

of the corresponding unremitted contributions and amount payable based on the contributions

penalties thereon. actually remitted.

o except that in case of pension

3. Section 28(e) -- where the violation consists in benefits, the employer shall be

failure or refusal to register employees xxx the liable to pay the SSS damages

penalty shall be a FINE of not less than Five equivalent to the accumulated

thousand pesos (P5,000) nor more than Twenty pension due as of the date of

thousand pesos (P20,000) AND IMPRISONMENT for settlement of the claim or the five

not less than six (6) years and one (1) day nor more (5) years' pension, whichever is

than twelve (12) years. higher, including dependents'

pension

Q: When does the employer’s obligation to deduct o

and contribute begin? Failure or refusal of the employer to pay or remit the

contributions herein prescribed shall not prejudice the

A: The last day of the calendar month when an right of the covered employee to the benefits of the

employee's compulsory coverage takes effect. coverage.

(Sections 18 and 19)

Agrarian Law and Social Legislation Reviewer Page 3 of 14

Downloaded by Ysza Gian Vispo (yszavispo@gmail.com)

lOMoARcPSD|5916110

Social Security Law Reviewer Atty. Cesar Santamaria

University of Santo Tomas Faculty of Civil Law Professor – 2C (2017-2018)

Q: The United Christian Missionary Society is a BENEFITS

religious organization. It believed that it is not

covered by the SSS and therefore, did not remit Q: What are the benefits given under the SSS

any contribution to the System. It filed a petition Law?

for the condonation of penalties. Decide.

A:

A: Good faith or bad faith is rendered irrelevant, since 1. Sickness Benefits; Section 14

the law makes no distinction between an employer 2. Maternity Benefits; Section 14-A.

who professes good reasons for delaying the 3. Permanent Disability Benefits; Section 13-A

remittance of premiums and another who deliberately 4. Retirement Benefits; Section 12-B.

disregards the legal duty imposed upon him to make 5. Death Benefits; Section 13.

such remittance. From the moment the remittance of 6. Funeral Benefits; Section 13-B

premiums due is delayed, the penalty immediately 7. Member loans; Section 26(e).

attaches to the delayed premium payments by force

of law. Sickness Benefit

No discretion or alternative is granted respondent

Commission in the enforcement of the law's mandate It is a DAILY ALLOWANCE for each day of

that the employer who fails to comply with his legal compensable confinement or fraction thereof

obligation to remit the premiums to the System within

the prescribed period shall pay a penalty of three Remember, purpose of SSS is to provide meaningful

(3%) per month. protection against contingencies resulting in loss of

income or financial burden.

Being a mere trustee of the funds of the System

which actually belong to the members, respondent Equivalent to 90% of the employee‘s average daily

Commission cannot legally perform any acts affecting salary credit

the same, including condonation of penalties, that

would diminish the property rights of the owners and Average daily salary credit — The result obtained

beneficiaries of such funds without an express or by dividing the sum of the six (6) highest monthly

specific authority therefor. (United Christian salary credits in the twelve-month period immediately

Missionary Society, et al. v. Social Security preceding the semester of contingency by one

Commission, et al. (G.R. No. L-26712-16, December hundred eighty (180).

27, 1969)

―The six (6) highest monthly salary credits in the

Q: What is the effect of separation of employee on twelve-month period immediately preceding the

the obligation to contribute and remit? semester of contingency‖

A: His employer's contribution on his account and his Semester — A period of 2 consecutive quarters

obligation to pay contributions arising from that ending in the quarter of contingency.

employment shall cease at the end of the month of

separation, Quarter — A period of 3 consecutive calendar

Said employee shall be credited with all months ending on the last day of March, June,

contributions paid on his behalf and entitled September and December.

to benefits according to the provisions of this

Act. Q: What are the conditions for entitlement to the

He may, however, continue to pay the total sickness benefit?

contributions to maintain his right to full

benefit. (Section 11) A:

Any contribution paid in advance by the employer but 1. The member has paid at least 3 monthly

not due shall be credited or refunded to his employer. contributions in the twelve-month period

(Section 22) immediately preceding the semester of

sickness.

Agrarian Law and Social Legislation Reviewer Page 4 of 14

Downloaded by Ysza Gian Vispo (yszavispo@gmail.com)

lOMoARcPSD|5916110

Social Security Law Reviewer Atty. Cesar Santamaria

University of Santo Tomas Faculty of Civil Law Professor – 2C (2017-2018)

2. The member was confined for more than 3 Elsewhere: 1 year from start of confinement.

days (whether in a hospital or elsewhere with

the SSC‘s approval). – the SSS shall reimburse the employer or pay the

3. The member has exhausted his company unemployed member only for confinement within the

granted sick leaves with pay, if any. one-year period immediately preceding the date the

4. The employee member shall notify his claim for benefit or reimbursement is received by the

employer of the fact of his sickness or injury SSS, except confinement in a hospital in which case

within five (5) calendar days after the start of the claim for benefit or reimbursement must be filed

his confinement within one (1) year from the last day of confinement.

notification to the employer

is not necessary where -- Q: How long is the benefit payable?

confinement is in a

hospital; or A: The compensable confinement shall begin on the

the employee became first day of sickness (assuming notification was given

sick or was injured on time if required)

while working or within

the premises of the – Provided, That such allowance shall begin only

employer after all sick leaves of absence with full pay to the

credit of the employee member shall have been

SECTION 11. Effect of Separation from Employment. exhausted.

— When an employee under compulsory coverage is 120 days max. per year; no carry over

separated from employment xxxsaid employee shall 240 days max. per confinement

be credited with all contributions paid on his behalf

and entitled to benefits according to the provisions of Q: When payments should be made?

this Act. He may, however, continue to pay the total

contributions to maintain his right to full benefit. A: The payment of such allowances shall be

promptly made by the employer every regular payday

Q: What happens where the employee member or on the fifteenth and last day of each month, and

has given the required notification but the similarly in the case of direct payment by the SSS, for

employer fails to notify the SSS of the as long as such allowances are due and payable.

confinement or to file the claim for reimbursement

within the period prescribed in this section Maternity Benefits

resulting in the reduction of the benefit or denial

of the claim? DAILY ALLOWANCE given to an employee who gives

birth or suffers a miscarriage.

A: Where the employee member has given the

required notification but the employer fails to notify the It is equivalent to 100% of the employee‘s average

SSS of the confinement or to file the claim for daily salary credit.

reimbursement within the period prescribed in this

section resulting in the reduction of the benefit or Benefits:

denial of the claim, such employer shall have no right • Normal, miscarriage = 60 days

to recover the corresponding daily allowance he • Caesarean = 78 days

advanced to the employee member as required in this

section. Q: What are the conditions for entitlement to the

(Section 14 (d)) maternity benefit?

Period to File Claim A:

1. The female member has given birth or

Hospital confinement: 1 year from last day of suffers a miscarriage and such is not yet in

confinement. excess of four deliveries or miscarriages;

Agrarian Law and Social Legislation Reviewer Page 5 of 14

Downloaded by Ysza Gian Vispo (yszavispo@gmail.com)

lOMoARcPSD|5916110

Social Security Law Reviewer Atty. Cesar Santamaria

University of Santo Tomas Faculty of Civil Law Professor – 2C (2017-2018)

2. The female member has paid at least 3 – Remember: Failure or refusal of the employer to

monthly contributions within the 12 month pay or remit the contributions herein prescribed shall

period immediately preceding the semester not prejudice the right of the covered employee to the

of childbirth or miscarriage. benefits of the coverage. (Section 22(b))

– Same as sickness benefit.

Disability Benefits

Example: Delivery: December 2014

The semester of contingency would be July- Q: What are the two types of permanent disability

December 2014 benefits?

The twelve (12)-month period before the semester of

contingency would be July 2013 to June 2014 A:

Assume that the six (6) highest monthly salary credits 1. Permanent TOTAL disability benefits

during this period are P15,000 each. The average 2. Permanent PARTIAL disability benefits

daily allowance would be P500.00

• The daily maternity allowance would be Q: What disabilities are deemed PERMANENT

P500.00 TOTAL?

• The total maternity benefit due would be

P30,000 for normal delivery or P39,000 for A:

caesarian cases. 1. Complete loss of sight of both eyes;

2. Loss of two limbs at or above the ankle or

Q: What is the procedure for availment of the wrists;

maternity leave benefit? 3. Permanent complete paralysis of two limbs;

4. Brain injury resulting to incurable imbecility

A: or insanity; and

1. The employee notifies the employer of her 5. Such cases as determined and approved by

pregnancy and the probable date of her the SSS.

delivery Q: What are the PT disability benefits?

2. The employer transmits the notice to the

SSS A: If member has paid AT LEAST 36 monthly

3. The employer advances the payment of the contributions prior to the semester of disability =

benefit within 30 days from the filing of the MONTHLY PENSION plus

maternity leave application; and DEPENDENT‘S PENSION for each

4. The SSS shall reimburse the employer upon dependent child (up to 5) conceived on or

satisfactory proof of such payment and before the date of contingency

legality thereof. o Counting is from youngest, no

substitutions

Q: What is the effect on the member’s entitlement o Legitimate children shall be

to the maternity benefit in case she should give preferred.

birth or suffer miscarriage

without the required contributions having SECTION 12-A. Dependents' Pension. — Where

been remitted for her by her employer to monthly pension is payable on account of death,

the SSS, or permanent total disability or retirement,

without the SSS having been previously dependents' pension equivalent to ten percent

notified by the employer of the time of (10%) of the monthly pension or Two hundred fifty

the pregnancy? pesos (P250.00), whichever is higher, shall also be

paid for each dependent child conceived on or

A: The employer shall pay to the SSS damages before the date of the contingency but not

equivalent to the benefits which said employee exceeding five (5), beginning with the youngest

member would otherwise have been entitled to. and without substitution: Provided, That where

there are legitimate and illegitimate children, the

former shall be preferred.

Agrarian Law and Social Legislation Reviewer Page 6 of 14

Downloaded by Ysza Gian Vispo (yszavispo@gmail.com)

lOMoARcPSD|5916110

Social Security Law Reviewer Atty. Cesar Santamaria

University of Santo Tomas Faculty of Civil Law Professor – 2C (2017-2018)

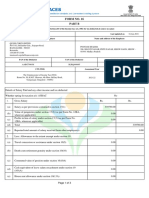

Q: What disabilities are deemed PP?

Q: What is the effect of death of a PT disabled

pensioner? Complete and Permanent Loss

No. of Months

of Use of

A: Upon the death of the permanent total disability

One thumb 10

pensioner, his primary beneficiaries as of the date of

disability shall be entitled to receive the monthly One index finger 8

pension:

One middle finger 6

Provided, That if he has no primary

beneficiaries and he dies within sixty (60) One ring finger 5

months from the start of his monthly pension,

his secondary beneficiaries shall be entitled One little finger 3

to a lump sum benefit

o Equivalent to the total monthly One big toe 6

pensions corresponding to the One hand 39

balance of the five-year guaranteed One arm 50

period excluding the dependents'

pension. One foot 31

One leg 46

Note: Should a member who is on partial disability One ear 10

pension retire or die, his disability pension shall cease

upon his retirement or death. Both ears 20

Hearing of one ear 10

Q: What are the PT disability benefits? Hearing of both ears 50

A: If member has paid LESS THAN 36 monthly Sight of one eye 25

contributions prior to the semester of disability =

LUMP SUM equivalent to no. of contributions x

monthly pension, or 12 monthly pensions, whichever Q: What are the PP disability benefits?

is higher.

A:

Q: What is effect of re-employment not earlier If disability occurs after thirty-six (36) monthly

than 1 year from PT disability? contributions have been paid prior to the semester of

disability, the benefit shall be the monthly pension for

A: A member who -- permanent total disability payable not longer than the

1. Has received a lump sum benefit and period designated in the foregoing schedule.

2. Is re-employed or has resumed self- The monthly pension benefit shall be given

employment not earlier than one (1) year in lump sum if it is payable for less than

from the date of his disability twelve months.

-- shall again be subject to compulsory coverage and For the purpose of adjudicating retirement,

shall be considered a new member. death and permanent total disability pension

benefits, contributions shall be deemed paid

Q: X paid 36 monthly contributions from October for the months during which the member

2009 to September 2012. received partial disability pension

X lost both eyes on January 1, 2013, Pension or

lump sum? Q: What about dependent’s pension?

What if disability occurred on December 31, 2012?

Pension or lump sum?

Agrarian Law and Social Legislation Reviewer Page 7 of 14

Downloaded by Ysza Gian Vispo (yszavispo@gmail.com)

lOMoARcPSD|5916110

Social Security Law Reviewer Atty. Cesar Santamaria

University of Santo Tomas Faculty of Civil Law Professor – 2C (2017-2018)

A: No. It is given only where monthly pension is PDD = 102.67% or 103%

payable on account of death, permanent total

disability or retirement. PTD even though person lost only 1 thumb, 4

fingers, 1 big toe, and 1 hand

Should a member who is on partial disability pension

retire or die, his disability pension shall cease upon Q: May a PP disability be converted into a PT

his retirement or death. disability?

What if re-employed? No effect. A: Yes. See SSC and SSS v. CA; G.R. No. 152058.

September 27, 2004.

If disability occurs before thirty-six (36) monthly

contributions have been paid prior to the semester SSC and SSS v. CA; G.R. No. 152058. September

of disability, the benefit shall be such percentage of 27, 2004

the lump sum benefit for PTD with due regard to

the degree of disability as the Commission may The Court of Appeals correctly observed that Rago‘s

determine. injury made him unable to perform any gainful

occupation for a continuous period exceeding 120

Q: May a PP disability be converted into a PT days.

disability?

The SSS had granted Rago sickness benefit for 120

A: Yes. If ―percentage degree of disability‖ equals or days and, thereafter, permanent partial disability for

exceed 100% 38 months

Percentage Degree of Disability = [Total no. of Such grant is an apparent recognition by the SSS that

months of deteriorating and related permanent partial his injury is permanent and total as we have

disabilities] ÷ 75 pronounced in several cases.

The percentage degree of disability, which is ―xxx if by reason of the injury or sickness he

equivalent to the ratio that the designated number of sustained, the employee is unable to perform his

months of compensability bears to seventy-five (75), customary job for more than 120 days and he does

rounded to the next higher integer, shall not be not come within the coverage of Rule X of the

additive for distinct, separate and unrelated Amended Rules on Employees Compensability xxx

permanent partial disabilities, but shall be additive for then the said employee undoubtedly suffers from

deteriorating and related permanent partial 'permanent total disability' regardless of whether

disabilities, to a maximum of one hundred percent or not he loses the use of any part of his body.

(100%), in which case the member shall be deemed

as permanently totally disabled. We further reiterate that disability should be

understood less on its medical significance than

Example: Suppose that a single disease has on the loss of earning capacity.

resulted in the disability and deterioration of:

One thumb (10) Permanent total disability means disablement of an

One index finger (8) employee to earn wages in the same kind of work, or

One middle finger (6) work of similar nature that he was trained for or

One ring finger (5) accustomed to perform, or any kind of work which a

One little finger (3) person of his mentality and attainment could do. It

One big toe (6) does not mean absolute helplessness.

One hand (39)

A person's disability may not manifest fully at one

PDD = [10 + 8 + 6 + 5 + 3 + 6 + 39] ÷ 75 precise moment in time but rather over a period of

PDD = 77 ÷ 75 time. It is possible that an injury which at first was

considered to be temporary may later on become

Agrarian Law and Social Legislation Reviewer Page 8 of 14

Downloaded by Ysza Gian Vispo (yszavispo@gmail.com)

lOMoARcPSD|5916110

Social Security Law Reviewer Atty. Cesar Santamaria

University of Santo Tomas Faculty of Civil Law Professor – 2C (2017-2018)

permanent or one who suffers a partial disability behalf. Provided, that he is separated from

becomes totally and permanently disabled from the employment and is not continuing payment of

same cause. contributions to the SSS on his own.

Retirement Benefits Death Benefits

Q: Who is entitled to a monthly pension upon Pension or Lump sum

retirement?

Upon the death of a member who has paid at least

A: A member who has paid at least one hundred thirty-six (36) monthly contributions prior to the

twenty (120) monthly contributions prior to the semester of death, his primary beneficiaries shall be

semester of retirement and entitled to the MONTHLY PENSION:

1. has reached the age of sixty (60) years and If he has no primary beneficiaries, his

is already separated from employment or secondary beneficiaries shall be entitled to a

has ceased to be self-employed or LUMP SUM benefit equivalent to thirty-six

2. has reached the age of sixty-five (65) years (36) times the monthly pension.

Note: He shall have the option to receive his first If he has not paid the required thirty-six (36)

eighteen (18) monthly pensions in lump sum monthly contributions, his primary or secondary

discounted at a preferential rate of interest to be beneficiaries shall be entitled to a LUMP SUM benefit

determined by the SSS.

equivalent to the monthly pension times the number

Dependents’ Pension also payable? – Yes. of monthly contributions paid to the SSS or twelve

(12) times the monthly pension, whichever is higher.

Q: What are the effects of the reemployment or

resumption of self-employment of a retired Note: In case of death benefits, if no beneficiary

member who is less than 65 years old? qualifies under this Act, said benefits shall be paid to

the legal heirs in accordance with the law of

A: succession.

1. The monthly pension shall be suspended.

2. ER and EE contributions shall resume. Funeral Benefits

Q: What is the effect of the death of the retired A funeral grant equivalent to Twelve thousand pesos

member? (P12,000.00) shall be paid, in cash or in kind, to help

defray the cost of funeral expenses upon the death of

A: His primary beneficiaries shall be entitled to a member, including, permanently totally disabled

receive the monthly pension. member or retiree.

The proviso "as of the date of his retirement" in Q: May the SSS give a coffin worth P12,000?

Section 12-B(d) is unconstitutional; Dycaico v. SSS,

et al.; GR No. 161357, November 30, 2005. A: Yes.

The proviso infringes the equal protection

clause Q: X suffered PTD in 2000. He hasn’t paid any

The proviso infringes the due process clause contributions since. He died in 2013. Are his

beneficiaries entitled to the funeral benefit?

Q: Who is entitled to a lump sum only?

A: Yes.

A: A covered member who is sixty (60) years old at

retirement and who does not qualify for pension Q: What are the types of loans available to

benefits xxx shall be entitled to a lump sum benefit members?

equal to the total contributions paid by him and on his

Agrarian Law and Social Legislation Reviewer Page 9 of 14

Downloaded by Ysza Gian Vispo (yszavispo@gmail.com)

lOMoARcPSD|5916110

Social Security Law Reviewer Atty. Cesar Santamaria

University of Santo Tomas Faculty of Civil Law Professor – 2C (2017-2018)

A: (SSS v. Aguas; GR 165546, February 27,

• Salary 2006)

• Educational

• Livelihood Note: The dependent illegitimate children shall be

• Marital entitled to fifty percent (50%) of the share of the

• Calamity and legitimate, legitimated or legally adopted children:

• Emergency loans

– In the absence of the dependent legitimate,

Beneficiaries and Dependents legitimated or legally adopted children of the member,

his/her dependent illegitimate children shall be

Primary Beneficiaries entitled to one hundred percent (100%) of the

benefits.

The dependent spouse until he or she remarries.

Secondary Beneficiaries

Dependent spouse: The legal spouse entitled by law

to receive support from the member. The dependent parents

– i.e. parents who are receiving regular support from

The claimant-spouse must therefore establish two the member.

qualifying factors:

1. that she is the legitimate spouse, and In the absence of all of the foregoing, any other

2. that she is dependent upon the member for person designated by the member as his/her

support. secondary beneficiary.

o a husband and wife are obliged to In short, if there is a named beneficiary and

support each other, but whether the designation is not invalid (as it is not so

one is actually dependent for in this case), it is not the heirs of the

support upon the other is employee who are entitled to receive the

something that has to be shown; it benefits (unless they are the designated

cannot be presumed from the fact beneficiaries themselves).

of marriage alone. (SSS v. Aguas; It is only when there is no designated

GR 165546, February 27, 2006.) beneficiaries or when the designation is void,

that the laws of succession are applicable.

The dependent legitimate, legitimated or legally And we have already held that the Social

adopted, and illegitimate children Security Act is not a law of succession. (SSS

unmarried, not gainfully employed and has v. Davac; GR L-21642, July 30, 1966)

not reached twenty-one years (21) of age,

or Q: May a national of a foreign country be a

if over twenty-one (21) years of age, he is beneficiary?

congenitally or while still a minor has been

permanently incapacitated and incapable of A: Yes, provided that his country extends benefits to

self- support, physically or mentally a Filipino beneficiary residing in the Philippines, or is

recognized by the Philippines.

Legally Adopted

– Provided further, that notwithstanding the foregoing,

Under Section 8 (e) of Republic Act No. 1161, as where the best interest of the SSS will be served, the

amended, only "legally adopted" children are Commission may direct payments without regard to

considered dependent children. nationality or country of residence:

Absent any proof that the family has legally adopted Q: Who may receive benefits for a minor or

Janet, the Court cannot consider her a dependent incompetent beneficiary?

child of Pablo, hence, not a primary beneficiary.

Agrarian Law and Social Legislation Reviewer Page 10 of 14

Downloaded by Ysza Gian Vispo (yszavispo@gmail.com)

lOMoARcPSD|5916110

Social Security Law Reviewer Atty. Cesar Santamaria

University of Santo Tomas Faculty of Civil Law Professor – 2C (2017-2018)

A: If the recipient is a minor or a person incapable of be entitled to attorney's fees not exceeding ten

administering his own affairs, the Commission shall percent (10%) of the benefits awarded by the

appoint a representative under such terms and Commission, which fees shall not be payable before

conditions as it may deem proper: the actual payment of the benefits, and any

Provided, further, that such appointment shall not be stipulation to the contrary shall be null and void.

necessary in case –

the recipient is under the custody of or living Q: What if the lawyer merely prepared the claim

with the parents or spouse of the member in documents and assisted in filing and collecting?

which case the benefits shall be paid to

such parents or spouse, as representative A: No. He must have appeared as counsel in a case

payee of the recipient. heard by the SSC.

Q: May persons other than the beneficiary collect "Any violation of the provisions of this Section shall

under an SPA? be punished by a fine of not less than five hundred

pesos (P500.00) nor more than five thousand pesos

A: Such benefits are not transferable and no power (P5,000.00), or imprisonment for not less than six (6)

of attorney or other document executed by those months nor more than one (1) year, or both, at the

entitled thereto, in favor of any agent, attorney or any discretion of the court.

other person for the collection thereof on their behalf

shall be recognized, except when they are physically Exemption from Tax, Legal Process and Lien

unable to collect personally such benefits:

All benefit payments made by the SSS shall likewise

Settlement of Disputes be exempt from all kinds of taxes, fees or charges

and shall not be liable to attachments, garnishments,

The Social Security Commission (SSC) has levy or seizure by or under any legal or equitable

jurisdiction over disputes arising under the SSS law process whatsoever, either before or after receipt by

with respect to coverage, benefits, contributions and the person or persons entitled thereto, except to pay

penalties thereon or any other matter related thereto. any debt of the member to the SSS.

GR: The Court of Appeals has jurisdiction to review

the decisions of the SSC BAR EXAM QUESTIONS

XPN: If the decision of the Commission involves only GSIS

questions of law, the same shall be reviewed by the

Supreme Court. Compulsory Coverage (Bar 2009)

NOTE: No appeal shall act as a supersedeas or a Q: No. X. a. State briefly the compulsory coverage of

stay of the order of the Commission unless the the Government Service Insurance Act. (2%)

Commission itself, or the Court of Appeals or the

Supreme Court, shall so order. SUGGESTED ANSWER:

Q: May fees be charged for the preparation, filing The following are compulsorily covered by the GSIS

or pursuing any claim for benefit under this Act? pursuant to Sec. 3 of R.A. 8291. (A) All employees

receiving compensation who have not reached the

A: No, even as deductions from the benefits. Any compulsory retirement age, irrespective of

stipulation to the contrary shall be null and void. employment status. (B) Members of the judiciary and

constitutional commission for life insurance policy.

Q: What about attorney’s fees?

Paternity Leave Act of 1996 (Bar 2013)

A: Any member of the Philippine Bar who appears as

counsel in any case heard by the Commission shall

Agrarian Law and Social Legislation Reviewer Page 11 of 14

Downloaded by Ysza Gian Vispo (yszavispo@gmail.com)

lOMoARcPSD|5916110

Social Security Law Reviewer Atty. Cesar Santamaria

University of Santo Tomas Faculty of Civil Law Professor – 2C (2017-2018)

Q: No. IV. b. Because of the stress in caring for her maternity benefits? If yes, how many days can she go

four (4) growing children, Tammy suffered a on maternity leave? If not, why is she not entitled?

miscarriage late in her pregnancy and had to undergo (3%)

an operation. In the course of the operation, her

obstetrician further discovered a suspicious-looking SUGGESTED ANSWER:

mass that required the subsequent removal of her

uterus (hysterectomy). After surgery, her physician Yes, the SSS Law does not discriminate based on the

advised Tammy to be on full bed rest for six (6) civil status of a female member-employee. As long as

weeks. Meanwhile, the biopsy of the sample tissue said female employee has paid at least three (3)

taken from the mass in Tammy's uterus showed a monthly contributions in the twelve-month period

beginning malignancy that required an immediate immediately preceding the semester of her childbirth,

series of chemotherapy once a week for four (4) she can avail of the maternity benefits under the law.

weeks. What can Roger-Tammy's 2nd husband and

the father of her two (2) younger children -claim as Since A gave birth through C-section, she is entitled

benefits under the circumstances? (4%) to one hundred percent (100%) of her average salary

credit for seventy-eight (78) days, provided she

SUGGESTED ANSWER: notifies her employer of her pregnancy and the

probable date of her childbirth, among others (See

Under R.A. No. 8187 or the Paternity Leave Act of Section 14-A, Rep. Act No. 8282). The same

1996, Roger can claim paternity leave of seven (7) maternity benefits are ensured by Sec. 22 (b)(2) of

days with full pay if he is lawfully married to Tammy the magna Carta of Women (Rep. Act No. 9710).

and cohabiting with her at the time of the miscarriage.

SSS; Maternity Benefits (Bar 2007)

SSS; Compulsory Coverage; Cooperative Member

(2009) Q: No. XIV. AB, single and living-in with CD (a

married man), is pregnant with her fifth child. She

Q: No. X. b. Can a member of a cooperative be applied for maternity leave but her employer refused

deemed an employee for purposes of compulsory the application because she is not married. Who is

coverage under the Social Security Act? Explain. right? Decide. (5%)

(2%)

SUGGESTED ANSWER:

SUGGESTED ANSWER:

AB is right. The Social Security Law, which

Yes, an employee of a cooperative, not over sixty (60) administers the Maternity Benefit Program does not

years of age, under the SSS Law, subject to require that the relationship between the father and

compulsory coverage. The Section 8(d) SSS Law the mother of the child be legitimate. The law is

defines an employee as – compensating the female worker because of her

―Sec. 8(d) – any person who performs services for an maternal function and resultant loss of compensation.

employer in which either or both mental and physical The law is morality free.

efforts are used and who receives compensation for

such service, where there is an employer-employee ALTERNATIVE ANSWER:

relationship‖

Neither party is correct. The employer cannot refuse

SSS; Maternity Benefits (Bar 2010) the application on the ground that she is only living

with CD, as legitimate marriage is not a precondition

Q: No. III. A, single, has been an active member of for the grant of maternity leave. Neither AB is correct,

the Social Security System for the past 20 months. since maternity leave is only available for the first four

She became pregnant out of wedlock and on her 7th deliveries or miscarriage.

month of pregnancy, she was informed that she would

have to deliver the baby through caesarean section SSS; Magna Carta of Women (2013)

because of some complications. Can A claim

Agrarian Law and Social Legislation Reviewer Page 12 of 14

Downloaded by Ysza Gian Vispo (yszavispo@gmail.com)

lOMoARcPSD|5916110

Social Security Law Reviewer Atty. Cesar Santamaria

University of Santo Tomas Faculty of Civil Law Professor – 2C (2017-2018)

Q: No. VI. a. Because of the stress in caring for her contribution, reasoning out that he is waiving his

four (4) growing children, Tammy suffered a social security coverage.

miscarriage late in her pregnancy and had to undergo

an operation. In the course of the operation, her Q: If you were Tito's employer, would you grant his

obstetrician further discovered a suspicious-looking request? Why? (6%)

mass that required the subsequent removal of her

uterus (hysterectomy). After surgery, her physician SUGGESTED ANSWER:

advised Tammy to be on full bed rest for six (6)

weeks. Meanwhile, the biopsy of the sample tissue No, payment of SSS monthly contribution is

taken from the mass in Tammy's uterus showed a compulsory and cannot be waived. To grant Tito‗s

beginning malignancy that required an immediate request will violate the SSS law and expose me to the

series of chemotherapy once a week for four (4) risk of punishment of fine or imprisonment or both at

weeks. What benefits can Tammy claim under the discretion of the Court (Sec. 9, Social Security

existing social legislation? (4%) Act, R.A. 8282).

SUGGESTED ANSWER: MULTIPLE CHOICE QUESTIONS

Assuming she is employed, Tammy is entitled to a Q: Which of the following is not considered an

special leave benefit of two moths with full pay employer by the terms of the Social Security Act?

(Gynecological Leave) pursuant to R.A. No. 9710 or (A) A self-employed person;

the Magna Carta of Women. She can also claim (B) The government and any of its political

Sickness Leave benefit in accordance with the SSS subdivisions, branches or instrumentalities, including

Law. corporations owned or controlled by the government;

(C) A natural person, domestic or foreign, who carries

SSS; Money Claims (2008) on in the Philippines, any trade, business, industry,

undertaking or activity of any kind and uses the

Q: No. VIII. Carol de la Cruz is the secretary of the services of another person who is under his orders as

proprietor of an auto dealership in Quezon City. She regards the employment;

resides in Caloocan City. Her office hours start at 8 (D) A foreign corporation.

a.m. and end at 5 p.m. On July 30, 2008, at 7 a.m.

while waiting for public transport at Rizal Avenue SUGGESTED ANSWER:

Extension as has been her routine, she was

sideswiped by a speeding taxicab resulting in her (B) The government and any of its political

death. The father of Carol filed a claim for employee's subdivisions, branches or instrumentalities. Including

compensation with the Social Security System. Will corporations owned or controlled by the government.

the claim prosper? Why? (6%) [Sec. 8 (c), RA 8282]

SUGGESTED ANSWER: Q: Jennifer, a receptionist at Company X, is covered

by the SSS. She was pregnant with her fourth child

Yes, under the ―Going-To-And-Coming-From-Rule,‖ when she slipped in the bathroom of her home and

the injuries (or death, as in this case) sustained by an had a miscarriage. Meanwhile, Company X neglected

employee ―going to and coming from‖ his place of to remit the required contributions to the SSS.

work are compensable (Bael v. Workmen‗s Jennifer claims maternity leave benefits and sickness

Compensation Commission, G.R. No. L-42255, benefits. Which of these two may she claim?

January 31, 1977). SSS; Monthly Contribution (2008) (A) None of them;

No. VII. Tito Paciencioso is an employee of a foundry (B) Either one of them;

shop in Malabon, Metro Manila. He is barely able to (C) Only maternity leave benefits;

make ends meet with his salary of P4,000.00 a (D) Only sickness benefits.

month. One day, he asked his employer to stop

deducting from his salary his SSS monthly SUGGESTED ANSWER:

Agrarian Law and Social Legislation Reviewer Page 13 of 14

Downloaded by Ysza Gian Vispo (yszavispo@gmail.com)

lOMoARcPSD|5916110

Social Security Law Reviewer Atty. Cesar Santamaria

University of Santo Tomas Faculty of Civil Law Professor – 2C (2017-2018)

C) Only maternity leave benefits [Sec. 14-A (c), RA

1161 (SSS) Law) as amended by RA 8282]

Q: H files for a seven-day paternity leave for the

purpose of lending support to his wife, W, who

suffered a miscarriage through intentional abortion. W

also filed for maternity leave for five weeks. H and W

are legally married but the latter is with her parents,

which is a few blocks away from H's house. Which of

the following statements is the most accurate?

(A) Paternity leave shall be denied because it does

not cover aborted babies;

(B) Paternity leave shall be denied because W is with

her parents;

(C)Maternity leave shall be denied because it does

not cover aborted babies;

(D) Maternity leave shall be denied because grant of

paternity leave bars claim for maternity leave.

SUGGESTED ANSWER:

(B) Paternity leave shall be denied because W is with

her parents [RA 8187, Section 2]

Q: Which of the following statements is the most

accurate?

(A) Domestic helpers with monthly income of at least

P3,000.00 are compulsory members of the SSS Law;

(B) House helpers with monthly income of at least

P2,000.00 are compulsory members of the SSS Law;

(C) Domestic helpers, 55 years of age and who

worked for at least five (5) years, are covered by the

Retirement Pay Law under optional retirement, in the

absence of a CBA;

(D) Domestic helpers in the personal service of

another are not entitled to 13th month pay.

SUGGESTED ANSWER:

(D) Domestic helpers in the personnel service of

another are not entitled to 13th month pay.

Agrarian Law and Social Legislation Reviewer Page 14 of 14

Downloaded by Ysza Gian Vispo (yszavispo@gmail.com)

You might also like

- SSS ReviewerDocument14 pagesSSS ReviewerIsnihayah Pangandaman100% (1)

- IFT CFA Level I Facts and Formula Sheet 2021 - v1.0Document12 pagesIFT CFA Level I Facts and Formula Sheet 2021 - v1.0Tsaone Fox100% (1)

- 2017 SSS GuidebookDocument134 pages2017 SSS GuidebookChimney sweep100% (2)

- And Agrarian Law: Course/SubjectDocument17 pagesAnd Agrarian Law: Course/SubjectIsnihayah Pangandaman100% (2)

- SSS Law PDFDocument147 pagesSSS Law PDFTiff Dizon100% (3)

- SSS VS GsisDocument25 pagesSSS VS GsisLea Rose Jeorgia SalongaNo ratings yet

- Sss Vs Gsis: Prepared By: Salonga, Lea Rose Jeorgia CDocument25 pagesSss Vs Gsis: Prepared By: Salonga, Lea Rose Jeorgia CLea Rose Jeorgia Salonga100% (1)

- Sss Case Study (Final)Document48 pagesSss Case Study (Final)Cutie Cat100% (1)

- No.21642, July 30, 1966) EXCEPTION: The Estate May BasicallyDocument12 pagesNo.21642, July 30, 1966) EXCEPTION: The Estate May BasicallyVikki AmorioNo ratings yet

- Roman Catholic Archbishop of Manila v. Social Security CommissionDocument4 pagesRoman Catholic Archbishop of Manila v. Social Security CommissionMarj PerdonNo ratings yet

- SocLeg - 1st HWDocument37 pagesSocLeg - 1st HWPre PacionelaNo ratings yet

- SSS and Termination of EmployeesDocument30 pagesSSS and Termination of EmployeesArlein Cess MercadoNo ratings yet

- Feria, Manglapus and Associates For Petitioner-Appellant. Legal Staff, Social Security System and Solicitor General For Respondent-AppelleeDocument3 pagesFeria, Manglapus and Associates For Petitioner-Appellant. Legal Staff, Social Security System and Solicitor General For Respondent-AppelleeGen CabrillasNo ratings yet

- Dean LR Property NotesDocument41 pagesDean LR Property NotesalliqueminaNo ratings yet

- Catholic Archbishop of Manila Vs Social Security Commission (SSC) 110 Phil 616Document3 pagesCatholic Archbishop of Manila Vs Social Security Commission (SSC) 110 Phil 616Maria Aerial AbawagNo ratings yet

- Feria, Manglapus and Associates For Petitioner-Appellant. Legal Staff, Social Security System and Solicitor General For Respondent-AppelleeDocument3 pagesFeria, Manglapus and Associates For Petitioner-Appellant. Legal Staff, Social Security System and Solicitor General For Respondent-AppelleethefiledetectorNo ratings yet

- RCB v. SSCDocument2 pagesRCB v. SSCAkkinaojNo ratings yet

- SSS CasesDocument46 pagesSSS CasesianmichaelvillanuevaNo ratings yet

- Cases of Elvin 1Document122 pagesCases of Elvin 1Elvin Nobleza PalaoNo ratings yet

- Feria, Manglapus and Associates For Petitioner-Appellant. Legal Staff, Social Security System and Solicitor General For Respondent-AppelleeDocument55 pagesFeria, Manglapus and Associates For Petitioner-Appellant. Legal Staff, Social Security System and Solicitor General For Respondent-AppelleenilesrevillaNo ratings yet

- Social Security Law Coverage of Religious and Charitable InstitutionsDocument19 pagesSocial Security Law Coverage of Religious and Charitable InstitutionsFe FernandezNo ratings yet

- UST Golden Notes 2013 Social LegislationDocument20 pagesUST Golden Notes 2013 Social LegislationCleinJonTiuNo ratings yet

- Roman Catholic Archbishop of Manila vs. SSS, G.R. No. 15045 (1961)Document3 pagesRoman Catholic Archbishop of Manila vs. SSS, G.R. No. 15045 (1961)MIGUEL JOSHUA AGUIRRENo ratings yet

- Feria, Manglapus and Associates For Petitioner-Appellant. Legal Staff, Social Security System and Solicitor General For Respondent-AppelleeDocument44 pagesFeria, Manglapus and Associates For Petitioner-Appellant. Legal Staff, Social Security System and Solicitor General For Respondent-AppelleeGeanelleRicanorEsperonNo ratings yet

- Socleg 1ST CaseDocument30 pagesSocleg 1ST CaseJem PagantianNo ratings yet

- Roman Catholic V SSC R L-15045Document4 pagesRoman Catholic V SSC R L-15045aionzetaNo ratings yet

- (Roman Catholic Archbishop of Manila vs. Social Security Commission, 1 SCRA 10 (1961) )Document9 pages(Roman Catholic Archbishop of Manila vs. Social Security Commission, 1 SCRA 10 (1961) )Jillian BatacNo ratings yet

- SALES Compiled Cases 08-14-18Document42 pagesSALES Compiled Cases 08-14-18Mrs. WanderLawstNo ratings yet

- SSS Case DigestsDocument10 pagesSSS Case DigestsGeanelleRicanorEsperonNo ratings yet

- Feria, Manglapus and Associates For Petitioner-Appellant. Legal Staff, Social Security System and Solicitor General For Respondent-AppelleeDocument30 pagesFeria, Manglapus and Associates For Petitioner-Appellant. Legal Staff, Social Security System and Solicitor General For Respondent-AppelleeMarion Yves MosonesNo ratings yet

- Atty.-Lopez-Kaw-SocLeg-Syllabus-based-notes-and-digest (By Zek)Document4 pagesAtty.-Lopez-Kaw-SocLeg-Syllabus-based-notes-and-digest (By Zek)Cedric KhoNo ratings yet

- Social Security Law Covers Religious InstitutionsDocument19 pagesSocial Security Law Covers Religious InstitutionsThessaloe B. FernandezNo ratings yet

- 2016 Sss Guidebook PDFDocument128 pages2016 Sss Guidebook PDFagent_ros9956100% (1)

- Feria, Manglapus and Associates For Petitioner-Appellant. Legal Staff, Social Security System and Solicitor General For Respondent-AppelleeDocument21 pagesFeria, Manglapus and Associates For Petitioner-Appellant. Legal Staff, Social Security System and Solicitor General For Respondent-AppelleeCarlu YooNo ratings yet

- AL-SL - Social Security Act of 2018 CASESDocument107 pagesAL-SL - Social Security Act of 2018 CASESJonathan BravaNo ratings yet

- In Re Petition For Exemption From Coverage by The Social Security System. Roman Catholic Archbishop of Manila vs. SSCDocument3 pagesIn Re Petition For Exemption From Coverage by The Social Security System. Roman Catholic Archbishop of Manila vs. SSCgraceNo ratings yet

- Comparative Matrix of The Salient Features of SSS, Gsis, and Ecsif g07 Group 4Document18 pagesComparative Matrix of The Salient Features of SSS, Gsis, and Ecsif g07 Group 4Ruby Santillana50% (2)

- Social Security Act of 1997 - Accessibility LawDocument5 pagesSocial Security Act of 1997 - Accessibility LawYordi PastulioNo ratings yet

- SOCLEG Prelims Transcribed PDFDocument48 pagesSOCLEG Prelims Transcribed PDFMax RamosNo ratings yet

- SSS, GSIS, & Portability LawDocument101 pagesSSS, GSIS, & Portability LawMark Soneil SaludoNo ratings yet

- 1.roman Catholic Archbishop of Manila vs. SSCDocument2 pages1.roman Catholic Archbishop of Manila vs. SSCJonathan Brava100% (1)

- Purpose, Republic Act No. 1161 As Amended, Otherwise Known As The Social Security LawDocument10 pagesPurpose, Republic Act No. 1161 As Amended, Otherwise Known As The Social Security LawHerrieGabicaNo ratings yet

- Phr222-Content-Module 4Document12 pagesPhr222-Content-Module 4Peybi Lazaro ChamchamNo ratings yet

- RFBT - Chapter 3 - Social Security LawDocument3 pagesRFBT - Chapter 3 - Social Security Lawlaythejoylunas21No ratings yet

- Non-Bank Financial InstitutionsDocument11 pagesNon-Bank Financial InstitutionsArgilyn MagaNo ratings yet

- Socleg Prelims CompilationDocument11 pagesSocleg Prelims CompilationLincy Jane AgustinNo ratings yet

- Social Security Law Comparative Table: Social Security System (SSS) Government Service Insurance System (GSIS)Document34 pagesSocial Security Law Comparative Table: Social Security System (SSS) Government Service Insurance System (GSIS)Cath VillarinNo ratings yet

- Social Security Source: Monthly Labor Review, DECEMBER 1943, Vol. 57, No. 6 (DECEMBER 1943), Pp. 1174-1176 Published byDocument4 pagesSocial Security Source: Monthly Labor Review, DECEMBER 1943, Vol. 57, No. 6 (DECEMBER 1943), Pp. 1174-1176 Published byAliveNo ratings yet

- Upload 3Document1 pageUpload 3maanyag6685No ratings yet

- Presentation Ap Apr 11Document8 pagesPresentation Ap Apr 11Ace ShanNo ratings yet

- Gsis and SSSDocument18 pagesGsis and SSSRoselle OngNo ratings yet

- Labor LawDocument384 pagesLabor LawJill SulitNo ratings yet

- Frando Detailed Learning Module 3Document7 pagesFrando Detailed Learning Module 3Ranz Kenneth G. FrandoNo ratings yet

- Labor RelationsDocument382 pagesLabor RelationsRiva Rebadulla100% (1)

- Roman Catholic Archbishop of Manila vs. SSC PDFDocument9 pagesRoman Catholic Archbishop of Manila vs. SSC PDFdanexrainierNo ratings yet

- Labor Standards Azucena NotesDocument43 pagesLabor Standards Azucena NotesanjisyNo ratings yet

- SSS Ira Version EditedDocument52 pagesSSS Ira Version EditedOscar E ValeroNo ratings yet

- Labor Relations NotesDocument207 pagesLabor Relations NotesRepolyo Ket Cabbage100% (2)

- Hizon Notes - Social LegislationDocument27 pagesHizon Notes - Social Legislationdnel13No ratings yet

- Social Security: The New Rules, Essentials & Maximizing Your Social Security, Retirement, Medicare, Pensions & Benefits Explained In One PlaceFrom EverandSocial Security: The New Rules, Essentials & Maximizing Your Social Security, Retirement, Medicare, Pensions & Benefits Explained In One PlaceNo ratings yet

- Risk Management PlanDocument3 pagesRisk Management PlanYsza Gian VispoNo ratings yet

- Total Investment IncomeDocument9 pagesTotal Investment IncomeYsza Gian VispoNo ratings yet

- Process of Making The ProductDocument2 pagesProcess of Making The ProductYsza Gian VispoNo ratings yet

- AR Management Impacts Firm PerformanceDocument3 pagesAR Management Impacts Firm PerformanceYsza Gian VispoNo ratings yet

- Jobs-865-Advertisement STA PDFDocument4 pagesJobs-865-Advertisement STA PDFShalin NairNo ratings yet

- 3000 VocabularyDocument17 pages3000 VocabularyHữu PhátNo ratings yet

- Cebuana FormDocument6 pagesCebuana FormVMNo ratings yet

- LS4 - Workers, Wages & BenefitsDocument9 pagesLS4 - Workers, Wages & BenefitsAlanie Grace Beron TrigoNo ratings yet

- Paper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1Document21 pagesPaper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1vikash guptaNo ratings yet

- PROBLEM NO. 3 - Various Current LiabilitiesDocument2 pagesPROBLEM NO. 3 - Various Current LiabilitiesMark Michael LegaspiNo ratings yet

- Source Documents & Books of Original Entries (Chapter-3) & Preparing Basic Financial Statements (Chapter-5)Document11 pagesSource Documents & Books of Original Entries (Chapter-3) & Preparing Basic Financial Statements (Chapter-5)Mainul HasanNo ratings yet

- Manonmaniam Sundaranar University: Insurance and Risk ManagementDocument190 pagesManonmaniam Sundaranar University: Insurance and Risk ManagementDevanshu JulkaNo ratings yet

- Nedbank Commercial Release - NedbankInsurancePersonalProtectionPlanBrochureUniversalDocument1 pageNedbank Commercial Release - NedbankInsurancePersonalProtectionPlanBrochureUniversalMartin NelNo ratings yet

- Family Pension For LIC and General Insurance PensionersDocument1 pageFamily Pension For LIC and General Insurance PensionersParesh BorboruahNo ratings yet

- PD 1354Document5 pagesPD 1354Dorothy PuguonNo ratings yet

- Kindly Find The Complete Steps For Indian Payroll ConfigurationDocument10 pagesKindly Find The Complete Steps For Indian Payroll ConfigurationAmruta HanagandiNo ratings yet

- Form 3-Details of Family MembersDocument1 pageForm 3-Details of Family MembersNagamahesh100% (1)

- Taxation Answers for MalawiDocument12 pagesTaxation Answers for MalawiangaNo ratings yet

- Induction V23 PDFDocument20 pagesInduction V23 PDFNagendra Kumar100% (1)

- Introduction to Taxation and Income Tax PrinciplesDocument11 pagesIntroduction to Taxation and Income Tax Principlesjulius art maputiNo ratings yet

- Bill 2023-23Document76 pagesBill 2023-23LVNewsdotcomNo ratings yet

- P60 End of Year Certificate 2021 P60 End of Year CertificateDocument1 pageP60 End of Year Certificate 2021 P60 End of Year CertificateIsmael GomesNo ratings yet

- Gross Income (Exclusions and Inclusions From Gross Income) - REVISED 2022Document34 pagesGross Income (Exclusions and Inclusions From Gross Income) - REVISED 2022rav dano100% (1)

- Adobe Scan Dec 28, 2022Document6 pagesAdobe Scan Dec 28, 2022Vijay 0011No ratings yet

- Social Security System in IndiaDocument49 pagesSocial Security System in Indiamansavi bihaniNo ratings yet

- WM Unit 8 Retirement Planning 6th Jan 2022Document32 pagesWM Unit 8 Retirement Planning 6th Jan 2022Aarti GuptaNo ratings yet

- Pention SCHDocument2 pagesPention SCHAmbarish AsthanaNo ratings yet

- Form 16-Part B - 2020-2021Document3 pagesForm 16-Part B - 2020-2021Ravi S. SharmaNo ratings yet

- Renewal of IBA Group Health Insurance SchemeDocument5 pagesRenewal of IBA Group Health Insurance SchemesandeshavadhaniNo ratings yet

- Anna Mae Mateo vs. Coca-Cola Bottler Philippines, IncDocument2 pagesAnna Mae Mateo vs. Coca-Cola Bottler Philippines, IncAlelie MalazarteNo ratings yet

- Excel Salary Slip Format DownloadDocument2 pagesExcel Salary Slip Format DownloadFARAZ KHANNo ratings yet

- Retiree Entitled to Monthly Pension for LifeDocument2 pagesRetiree Entitled to Monthly Pension for LifeEarvin Joseph BaraceNo ratings yet

- Form T.D.-1 Employee Tax DeclarationDocument3 pagesForm T.D.-1 Employee Tax DeclarationwhatdacowcowNo ratings yet