Professional Documents

Culture Documents

Travel Policy, Expense Claim & Reimbusement

Uploaded by

TinsuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Travel Policy, Expense Claim & Reimbusement

Uploaded by

TinsuCopyright:

Available Formats

1.

02 : Hotel policies and procedures

1.02.03 : Finance Department

Procedure no. : 1.02.03.01.08 Effective date : 01/03/2012

Prepared by : Director of Finance GM approval :

Affecting : Finance Team

Subject : Travel Policy, Expense Claims & Reimbursement

Purpose

Purpose of this policy is to have a travel policy and business expense policy and to

ensure that the reimbursable expenses are approved and documented in a

consistent manner.

To meet business requirements, ambassadors need to travel locally and abroad.

During such travel, employees need to spend money on ordinary, necessary, and

reasonable business expenses. It is the policy of the hotel to reimburse such

expenses along with arranging air ticket for overseas travel. Ordinary expenses are

those expenses, which are customary or usual to a business community, and

necessary business expenses are those expenses, which are appropriate and helpful

for business development and relations.

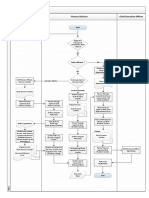

Procedure

Business Travel (Overnight travel out of U.A.E)

Business travel policy for the hotel and convention center will be broken up into four

categories as follows:

Category I - Executive Committee Members which include General Manager,

Hotel Manager, Director of Finance, Director of Sales & Distribution, Director of

Human Resources, Director of Rooms, Director of F&B, Executive Chef and

Director of Engineering

Category II –Head of Departments and number two positions in each department.

Category III – Assistant Managers and Supervisors.

Category IV - Line Staff.

Before any business travel ambassador has to fill Travel Approval Form (TAF) and

needs to be approved by immediate Manager/Excom, Director of Finance and

General Manager. Any business trips taken without such approvals will not be

reimbursed.

Employee shall submit the approved TAF to the Accounts Department at least one

(1) week before the scheduled date of departure. It will be used to arrange for

advance payment or to arrange foreign currency (US Dollars, Euros and UK Pounds

only) in required denomination from authorized exchange dealer to meet the

approved expenses.

All business trip airline tickets need to be purchased from hotel recommended travel

agent using the services of Executive Secretary. Here are certain guidelines for air

tickets and hotel bookings:

All ambassadors will be allowed to travel by air in economy class.

Stay in Four Star Hotel is allowed which will be duly supported by hotel

statements. Locations where the Accor property is in operation, the

ambassadors will be required to stay in any classification of Accor Hotels.

Company expects ambassadors to exercise good judgment when

distinguishing between comfort and extravagance. Ambassadors should

travel and conduct business in comfort.

Meals, Laundry, Intra city transport, business telephone calls duly supported

with documents will be allowed for reimbursement.

Expenses incurred on cigarettes, cigars and liquor is to be borne by the

ambassador (except while entertaining business associates/clients).

One personal call of maximum five minutes duration on daily basis is also

allowed for reimbursement. All calls made over above this limit will be borne

by the associate.

It is understood that in few cases proper documents will not be available e.g.

transportation, reasonable expenses will be reimbursed in absence of such

documents.

Upon return, excess foreign currency shall be returned back to respective

agent. Any realized losses or gain during exchange will be considered as a

part of the expenses.

.

The Travel Expense Report shall be made promptly upon returning to the office and

must be settled within five (5) working days. No new travel approval form will be

approved if the previous travel advance or expense report has not yet been settled.

Lodging expenses need to have a hotel folio as backup for the hotel patronized.

Business Meals includes meal expenses incurred by an employee while on an over-

night business trip. Business meals also include meals taken with suppliers,

business consultants, prospects or customers during which a specific business

discussion takes place. The details of business expenses must be documented on

the expense report under food on expense report.

The following information is required for Business Meals expenses:

o Cost (including tax & service charge)

o Date

o Name and location of Restaurant

o Full names, titles, and business relationship of all persons attending

Employee relation Expenses

All authorized Ambassador Relations Expenses incurred for the benefit of hotel

employees will be reimbursed. Ambassador relations expenses are expenditures for

departmental picnics, workshops, holiday parties, service anniversaries, etc which

provide a business benefit in form of improved moral, motivation and future job

performance. Please record these expenses under other and provide details on why

incurred and the names of associates present. Such expenses shall be pre-approved

by Director of Finance and General Manager.

Entertainment Expenses

Similarly, reimbursement of entertainment expenditures is appropriate only when the

entertainment facilities a bona fide discussion of business, the persons being

entertained are not affiliated with the company, and those in attendance are

necessary to facilitate the business discussion. Entertainment should be extended

only to third parties with whom the Company does business or exploring potential

customers.

Other Expenses

All the personal expenses which need to be reimbursed according to the employment

contract such as school fees and utility bills etc. will be done once a month on the

submission of the expense voucher.

Omission

Compensatory Expenses are expenses which are not ordinary, necessary and

reasonable business expenses (e.g. spouse travel costs, dinner with family friends

on business trip). These expenses if reported in expense reports will not be

reimbursed or if the advance provided to associate was used for this purpose then

associate needs to repay it. If the repayment is not made within 5 working days

after return then the amount owed to the company will be deducted from their

salary.

For ambassadors who use their credit card or cash, reimbursements will be made by

company promptly after expenses have been:

Itemized in Expense Claim Form (please refer to the form).

Substantiated by attaching receipts for expenses. Please remember that

receipts are mandatory to support these expenses.

Approved by the authorized person on the expense report. All expense

reports for Executive Committee members need to be approved by the GM

and DOF before reimbursement. Rest of the expense reports need to be

approved by the respective Executive Committee Member additionally to the

GM and DOF.

Expense Claim Form

Please consult the Accounting Department prior to the completion of this report if it is

new to you.

List down all the expenses in date chronologic order.

Document exchange rates for all currencies utilized, supported by exchange

memos issued by a bank or financial establishment or obtained from website

www.xe.com/ucc. Mention the exchange rate in Rate column.

Document all expenses in the respective currencies they were incurred. The

exception to this is hotel bills which are to be divided in to Accommodation,

F&B, transportation, Laundry etc. Separate lines shall be used for different

hotels. All hotel expenses shall include service charges and taxes.

Meals include only daily meal costs for self. Therefore, meal charges with

outsider(s) should be treated as entertainment. (Please refer to Entertainment

Policy)

Telephone & Internet include business related incurred at a hotel or from any

other sources.

All other expenses will be recorded as miscellaneous and an explanation is to

be given.

Last line shall mention the advance if any given to start the mission.

The differences, if expenses exceed advances, represent the amount to be

reimbursed to the employee. If the advances exceed the expenses, the

amount is recorded as amount due to company.

When the Expense Claim is completed, it is to be dated, signed and approved

by the Division Head and passed to the Finance & Accounting Department for

further processing. All Expense Account Report should be approved by the

General Manager.

Expense Account Reports should be filed for reimbursement within five (5)

working days after the trip and must be submitted by the end of the month

covered by the report.

Expenses which were incurred more than two months prior to the submission

of the report will not be reimbursed.

All expenses should be covered by supporting receipts including checks

included in a hotel folio, with the exception of certain items (such as tips or

taxi fare). Expenses claimed without supporting documentation will not be

reimbursed.

-End of Policy-

You might also like

- Finance MannualDocument228 pagesFinance Mannualadithyaiyer009No ratings yet

- Policy For Reimbursement of ExpensesDocument4 pagesPolicy For Reimbursement of ExpensesSuraj SinghNo ratings yet

- Employee Reimbursement Policy - 09Document25 pagesEmployee Reimbursement Policy - 09ksankar_2005100% (1)

- Financial Policy For Travel and Meal Expense Reimbursement PolicyDocument7 pagesFinancial Policy For Travel and Meal Expense Reimbursement PolicyJonahNo ratings yet

- HR Policy Manual Main - DIPLDocument82 pagesHR Policy Manual Main - DIPLasefzaman5769No ratings yet

- Purchasing Policy and ProceduresDocument5 pagesPurchasing Policy and ProceduresKhuzama ZafarNo ratings yet

- Accounts PayableDocument4 pagesAccounts PayablemaheshNo ratings yet

- JD of The Chief Financial OfficerDocument6 pagesJD of The Chief Financial OfficerSampatmaneNo ratings yet

- Cash Payments PDFDocument6 pagesCash Payments PDFAsad ZahidNo ratings yet

- Sop For Manual DaybookDocument2 pagesSop For Manual DaybookAudit helpNo ratings yet

- Duties and Responsibility of Finance ManagerDocument2 pagesDuties and Responsibility of Finance ManagerMohd ArifNo ratings yet

- Cannot Set Up New Joiners Without Information About Employee NumberDocument2 pagesCannot Set Up New Joiners Without Information About Employee NumberZELDA ARAMINTA YASMINNo ratings yet

- NPC Audit of Travel Meal Hospitality Expenses - Final Report 2011Document37 pagesNPC Audit of Travel Meal Hospitality Expenses - Final Report 2011Corey Larocque ReviewNo ratings yet

- Employee Travel ReimbursementDocument16 pagesEmployee Travel ReimbursementAnonymous XTPMQENo ratings yet

- ACCTG AP002 5-15 - Invoice ProcessingDocument1 pageACCTG AP002 5-15 - Invoice ProcessingDebbie LangolfNo ratings yet

- Petty Cash Funds Guide - Policies, Procedures & ManagementDocument7 pagesPetty Cash Funds Guide - Policies, Procedures & ManagementyonportesNo ratings yet

- CASH ADVANCES AND REIMBURSEMENTSDocument4 pagesCASH ADVANCES AND REIMBURSEMENTSSuranga Fernando100% (1)

- Petty Cash ControlDocument3 pagesPetty Cash ControlLeonard Roberts100% (1)

- Cash AdvanceDocument2 pagesCash AdvanceMatths Apoche100% (2)

- FINANCIAL GUIDE FOR UCSCUDocument29 pagesFINANCIAL GUIDE FOR UCSCUAleyn AtuhaireNo ratings yet

- Accounting Policies and Procedures1Document29 pagesAccounting Policies and Procedures1Paul Julius de Pio100% (1)

- Finance SopDocument46 pagesFinance SopOsman Zaheer100% (1)

- Sop CashierDocument15 pagesSop CashierMuhammad alqodri29No ratings yet

- Cashier Checkout Opening and Product Scanning GuideDocument39 pagesCashier Checkout Opening and Product Scanning Guidebaashii4No ratings yet

- Receptionist Job Description D11701Document2 pagesReceptionist Job Description D11701AlinBitoleanuNo ratings yet

- Sop For Cash PaymentDocument3 pagesSop For Cash PaymentAudit help100% (2)

- 04.floor Captain JDDocument5 pages04.floor Captain JDmexanjNo ratings yet

- Resignation Process FlowDocument7 pagesResignation Process FlowAroosa nazNo ratings yet

- Finance: Best PracticesDocument5 pagesFinance: Best PracticesSameera100% (1)

- Night AuditingDocument3 pagesNight AuditingGurminder Preet Singh100% (1)

- Angar Restaurant Tips Policy: ObjectiveDocument4 pagesAngar Restaurant Tips Policy: Objectivesayeed sonuNo ratings yet

- Accounting Policy - Cash Receipts and Bounced ChecksDocument13 pagesAccounting Policy - Cash Receipts and Bounced ChecksneilNo ratings yet

- Sop's On Accounts PayableDocument3 pagesSop's On Accounts PayableJoy SelphaNo ratings yet

- Customer Feedback Form for Pos MalaysiaDocument2 pagesCustomer Feedback Form for Pos MalaysiaMuhammad Syafiq Haidzir75% (4)

- Internal Audit and Budget Department - Cash ReceiptsDocument13 pagesInternal Audit and Budget Department - Cash ReceiptsMarineth Monsanto100% (1)

- Front Office Manager Job Description Free PDF DownloadDocument2 pagesFront Office Manager Job Description Free PDF DownloadTix Virak100% (1)

- ACCTG CASH004 11-15 - Cashiers Variance ReportDocument1 pageACCTG CASH004 11-15 - Cashiers Variance ReportDebbie LangolfNo ratings yet

- Policy On Disbursements 08Document3 pagesPolicy On Disbursements 08Jeh EusebioNo ratings yet

- Policies and Guidelines on Cash AdvancesDocument3 pagesPolicies and Guidelines on Cash Advancesmarvinceledio100% (3)

- Standard Operating Procedure Human Resources Department - SOP HR DepartmentDocument6 pagesStandard Operating Procedure Human Resources Department - SOP HR Departmentmoazzam100% (1)

- Employee Exit ProcedureDocument10 pagesEmployee Exit ProcedureHafidzh HaritsahNo ratings yet

- 2 - Sop - ModDocument2 pages2 - Sop - ModSusanto100% (1)

- Disciplinary Procedure Sop: Document AttributeDocument4 pagesDisciplinary Procedure Sop: Document AttributeHRNo ratings yet

- Accountant Job DescriptionDocument2 pagesAccountant Job DescriptionPavan SinghNo ratings yet

- SOP-HR-DocumentManagementDocument7 pagesSOP-HR-DocumentManagementEntoori Deepak ChandNo ratings yet

- Job Description For Banquet Coordinator in HotelsDocument3 pagesJob Description For Banquet Coordinator in HotelsNevian R Ahadiat100% (1)

- Policy On Revolving Fund and Petty Cash FundDocument6 pagesPolicy On Revolving Fund and Petty Cash Fundmarvinceledio100% (3)

- HR ManualDocument302 pagesHR ManualVijayakumar Kuduva Narasimman100% (1)

- Cash and Bank Disbursement - SOP ExampleDocument5 pagesCash and Bank Disbursement - SOP ExampleMochammad IqbalNo ratings yet

- Worldwide Gift and Entertainment Policy - ENGLISH - 06!03!2013Document13 pagesWorldwide Gift and Entertainment Policy - ENGLISH - 06!03!2013Sarvesh AhluwaliaNo ratings yet

- Chapter 2 Cashiering and Banking May 2010Document32 pagesChapter 2 Cashiering and Banking May 2010Berbagi UsahaNo ratings yet

- Internal Controls Manual Updated PDFDocument25 pagesInternal Controls Manual Updated PDFJawad ShehayebNo ratings yet

- Employee Identification and Access Cards Policy and ProcedureDocument2 pagesEmployee Identification and Access Cards Policy and Procedurechelly100% (1)

- Fixed Assets PolicyDocument3 pagesFixed Assets PolicyShinil Nambrath100% (1)

- Employee Reimbursement PolicyDocument11 pagesEmployee Reimbursement Policygemconsulting limitedNo ratings yet

- Account, Audit and Control Account, Audit and ControlDocument5 pagesAccount, Audit and Control Account, Audit and ControlMelissa Formento LustadoNo ratings yet

- Employee Expense Reimbursement ProceduresDocument3 pagesEmployee Expense Reimbursement Proceduresneha ahujaNo ratings yet

- Employee Expense Report TemplateDocument4 pagesEmployee Expense Report TemplateTyler Beth VandeWaterNo ratings yet

- Travel and Expense PolicyDocument6 pagesTravel and Expense PolicyLee Cogburn100% (1)

- MYMT PersonalBudgetWorksheet TrackingWeeklyExpenses Final Version 1 Jan 2004Document7 pagesMYMT PersonalBudgetWorksheet TrackingWeeklyExpenses Final Version 1 Jan 2004gopi100% (2)

- Lesson 10 - Beverage Control Systems (Revised)Document17 pagesLesson 10 - Beverage Control Systems (Revised)Daniela FotaNo ratings yet

- MYMT PersonalBudgetWorksheet TrackingWeeklyExpenses Final Version 1 Jan 2004Document7 pagesMYMT PersonalBudgetWorksheet TrackingWeeklyExpenses Final Version 1 Jan 2004gopi100% (2)

- Cash Handling Procedures "Don't Lose The Lettuce": Pepperdine University Cashier's Office Tac 2 Floor, Malibu x4107Document23 pagesCash Handling Procedures "Don't Lose The Lettuce": Pepperdine University Cashier's Office Tac 2 Floor, Malibu x4107TinsuNo ratings yet

- Parsa REVISED Version Revenue Management Conference Paris Dec 22 2015Document39 pagesParsa REVISED Version Revenue Management Conference Paris Dec 22 2015TinsuNo ratings yet

- Use of Communication Facilities in The HotelDocument3 pagesUse of Communication Facilities in The HotelTinsuNo ratings yet

- Prepaid, Provision and AccrualsDocument2 pagesPrepaid, Provision and AccrualsTinsuNo ratings yet

- Hotel Finance Department Dos and Don'tsDocument2 pagesHotel Finance Department Dos and Don'tsTinsuNo ratings yet

- Accounting of Barter DealsDocument2 pagesAccounting of Barter DealsTinsuNo ratings yet

- RBI's Vital Role in Regulating India's Economy and Financial SystemDocument2 pagesRBI's Vital Role in Regulating India's Economy and Financial SystemSimran hreraNo ratings yet

- Jose Lopez Vito For Appellants. Roman Lacson For AppelleeDocument31 pagesJose Lopez Vito For Appellants. Roman Lacson For AppelleeRomelyne MaligayaNo ratings yet

- Homeroom Guidance: Siyahan Nga Bahin - Modyul 2: An Akon GintikanganDocument10 pagesHomeroom Guidance: Siyahan Nga Bahin - Modyul 2: An Akon GintikangansaraiNo ratings yet

- Becoming an Operations Consultant in 40 StepsDocument2 pagesBecoming an Operations Consultant in 40 StepsNicolae NistorNo ratings yet

- Hyper Launch BrochureDocument22 pagesHyper Launch BrochureQuintin McDonaldNo ratings yet

- Macroeconomics Encapsulated in Three Models (Recovered)Document33 pagesMacroeconomics Encapsulated in Three Models (Recovered)Katherine Asis NatinoNo ratings yet

- Developing Lean and Agile Automotive Suppliers ManDocument12 pagesDeveloping Lean and Agile Automotive Suppliers ManLia Nurul MulyaniNo ratings yet

- Configure Saral PayPack HR & PayrollDocument145 pagesConfigure Saral PayPack HR & PayrollGarry MehrokNo ratings yet

- K WaterDocument113 pagesK WaterAmri Rifki FauziNo ratings yet

- Rajasthan Technical University, Kota: Syllabus IV Year-VIII Semester: B. Tech. (Civil Engineering)Document1 pageRajasthan Technical University, Kota: Syllabus IV Year-VIII Semester: B. Tech. (Civil Engineering)Bhavy Kumar JainNo ratings yet

- The Air Rules 1982Document20 pagesThe Air Rules 1982visutsiNo ratings yet

- Assignment Model Typical QuestionDocument17 pagesAssignment Model Typical Questionjagritiprakash00100No ratings yet

- ABS ISPS Company - Vessel Audit ChecklistDocument1 pageABS ISPS Company - Vessel Audit ChecklistredchaozNo ratings yet

- NIC Asia Bank Brand PositioningDocument29 pagesNIC Asia Bank Brand PositioningRaushan ChaudharyNo ratings yet

- Financial Literacy Levels of Small Businesses Owners and It Correlation With Firms' Operating PerformanceDocument72 pagesFinancial Literacy Levels of Small Businesses Owners and It Correlation With Firms' Operating PerformanceRod SisonNo ratings yet

- Aaaa Whipshaw PDFDocument121 pagesAaaa Whipshaw PDFMaphosa Nhlapo100% (3)

- Tax Invoice-Cum-Receipt: Railtel Corporation of India Limited. Gstin PanDocument1 pageTax Invoice-Cum-Receipt: Railtel Corporation of India Limited. Gstin PanAshihsNo ratings yet

- Deposits in Transit and Outstanding Checks PDFDocument1 pageDeposits in Transit and Outstanding Checks PDFAaliyah Joize LegaspiNo ratings yet

- Att-2.1 SowDocument5 pagesAtt-2.1 SowAgung FitrillaNo ratings yet

- PPM02 Project Portfolio Prioritization Matrix - AdvancedDocument5 pagesPPM02 Project Portfolio Prioritization Matrix - AdvancedHazqanNo ratings yet

- Chapter 1 KTQTDocument38 pagesChapter 1 KTQTHà LiênNo ratings yet

- Group assignment on financial analysis of projects A, B, C and DDocument62 pagesGroup assignment on financial analysis of projects A, B, C and DSameer AsifNo ratings yet

- Adv 1 - 6 - Intercompany Profit Transactions - Plant Assets - Handout #1Document12 pagesAdv 1 - 6 - Intercompany Profit Transactions - Plant Assets - Handout #1ria fransiscaieNo ratings yet

- SW One DXP Cost Sheet (4.5BHK+Utility) Phase 2Document1 pageSW One DXP Cost Sheet (4.5BHK+Utility) Phase 2assetcafe7No ratings yet

- Capr 1-1Document2 pagesCapr 1-1Giovanni CambareriNo ratings yet

- Business Plan of BoutiqueDocument22 pagesBusiness Plan of BoutiqueSazzad Shahriar50% (4)

- Service InvoiceDocument7 pagesService InvoiceRealliance PHNo ratings yet

- SHEQ Monthly Report SummaryDocument17 pagesSHEQ Monthly Report SummaryArif NugrohoNo ratings yet

- Ir l04 U06 TestDocument5 pagesIr l04 U06 TestghostarixNo ratings yet

- Technical Letter StructureDocument33 pagesTechnical Letter Structuresayed Tamir janNo ratings yet