Professional Documents

Culture Documents

Deductions Under Chapter VI A (Section)

Uploaded by

ashim kumar PramanickOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Deductions Under Chapter VI A (Section)

Uploaded by

ashim kumar PramanickCopyright:

Available Formats

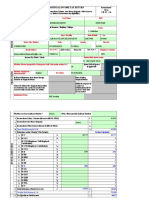

First Name Middle Name Last Name PAN

ASHIM KUMAR PRAMANICK AGIPP3702G

Flat / Door / Building Status

0 I

INFORMATION

Road/Street/Post Office Area/Locality DOB (YYYY/MM/DD)

PERSONAL

78, MOTILAL COLONY 0 1968-11-22

Town/City/District State Pin code Sex

KOLKATA WEST BENGAL 700081 M

Country

91- INDIA Employer Category

Email id (STDcode)-Ph No Mobile No.

mukhopadhyay3102@gmail.com ( )- 9830357496 PSU

,

Income Tax Ward/Circle Return filed under Section- 12

[Please see instruction number-9(ii)]

Whether Original or Revised return? O

FILING STATUS

If revised, enter Original Ack no / Date

Date

If u/s 139(9)-defective return , enter

Original Ack No

If u/s 139(9)-defective return , enter If u/s 139(9)-defective return , enter

Notice No Notice Date

Residential Status RES Tax Status NT

Whether Person governed by N

Portuguese Civil Code under Sec 5A ?

1 Income from Salary / Pension (Ensure to fill Sch TDS1) 1 643618

Type of House Property Self Occupied

2 Income from one House Property -23827

3 Income from Other Sources (Ensure to fill Sch TDS2) 1016

4 Gross Total Income (1+2+3) 4 620807

5 Deductions under chapter VI A (Section)

a 80C 100000 100000 h 80G 0 0

b 80CCC 0 0i 80GG 0 0

c 80 CCD 0 0 j 80GGA 0 0

INCOME & DEDUCTIONS

(i) (Employers

Contribution)

c 80 CCD 0 0 k 80GGC 0 0

(ii) (Employees /

Self Employed

Contribution)

d 80D 0 0l 80U 0 0

e 80DD 0 0 m 80CCG 0 0

f 80DDB 0 0 n 80RRB 0 0

g 80E 0 0 o 80QQB 0 0

p 80TTA 1016 1016

6 Deductions (Total of 5a to 5p) 6 101016

7 Total Income (4-6) 7 519790

8 Tax Payable on Total Income 8 33958

9 Education Cess, including secondary and higher secondary cess on 8 9 1019

COMPUTATION

10 Total Tax and Education Cess (Payable)(8+9) 10 34977

11 Relief under Section 89 11 0

12 Balance Tax Payable (10-11) 12 34977

TAX

13(i) Interest u/s 234A 0

13(ii) Interest u/s 234B 0

13(iii) Interest u/s 234C 0

14 Total Interest u/s 234A 234B 234C 14 0

15 Total Tax and Interest Payable (12+14) 15 34980

16 Taxes Paid

TAXES PAID a Advance Tax (from item 25) 16a 0

b TDS (Total from item 23 + item 24) 16b 34976

c Self Assessment Tax (item 25) 16c 0

Total Taxes Paid(16a + 16b + 16c) 17 34976

17

18 Tax Payable (15-17) (if 15 is greater than 17) 18 0

19 Refund (17-15) if 17 is greater than 15 19 0

20 Enter your Bank Account Number 10150663799

REFUND

21 Select Yes if you want your refund by direct deposit into bank account, select No if you want refund by cheque

Y

22 In case of direct deposit to your bank account give additional details

IFSC Code Type of Account SAV

SBIN0002054

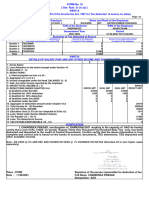

23 Details of Tax Deducted at Source from Salary [As per Form 16 issued by Employer(s)]

SI.NO Tax Deduction Name of the Employer Income chargeable Total Tax Deducted

Account Number under the

(TAN) of the head Salaries

Employer

1 CALI00434A AIR INDIA LTD 643618 34976

26 Exempt income for reporting purposes only 0

VERIFICATION

xyz

I, ASHIM KUMAR PRAMANICK son/daughter of SANTOSH KUMAR PRAMANICK solemnly declare that to the best of my

knowledge and belief, the information given in the return thereto is correct and complete and that the amount of total income and other

particulars shown therein are truly stated and are in accordance with the provisions of the Income- tax Act, 1961, in respect of income

chargeable to Income-tax for the previous year relevant to the Assessment Year 2013-14.

Place KOLKATA Date 2013-08-18 PAN AGIPP3702G

27 If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

Identification No. of TRP Name of TRP Counter Signature of TRP

28 If TRP is entitled for any reimbursement from the Government, amount thereof

You might also like

- Deductions Under Chapter VI A (Section)Document2 pagesDeductions Under Chapter VI A (Section)Dharmendra SinghNo ratings yet

- Deductions Under Chapter VI A (Section)Document2 pagesDeductions Under Chapter VI A (Section)Vikas KumarNo ratings yet

- Form PDF 860011410060114Document2 pagesForm PDF 860011410060114prakashdebleyNo ratings yet

- Form PDF 301906800310714Document2 pagesForm PDF 301906800310714deepkaryan1988No ratings yet

- Form PDF 692100430280713Document2 pagesForm PDF 692100430280713sunilNo ratings yet

- Deductions Under Chapter VI A (Section) : Date of Filing of Original ReturnDocument2 pagesDeductions Under Chapter VI A (Section) : Date of Filing of Original Returnismailkhan.dbaNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnசிவா நடராஜன்No ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnSiddhant SwainNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnpavanNo ratings yet

- Itr 1Document2 pagesItr 1zakirhusssainNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnDr-Firoz ShaikhNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnValesh MonisNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnsky2flyboy@gmail.comNo ratings yet

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument7 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnShivam DixitNo ratings yet

- 12 Itr1 10 11Document6 pages12 Itr1 10 11ramanwweNo ratings yet

- 2019-01-24-Amit Swaroop 1 - Atgps5835e - 2017Document6 pages2019-01-24-Amit Swaroop 1 - Atgps5835e - 2017ApoorvNo ratings yet

- 2018 03 31 12 23 14 702 - 1958189601Document5 pages2018 03 31 12 23 14 702 - 1958189601Kethavarapu RamjiNo ratings yet

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument7 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnShivam JainNo ratings yet

- (DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)Document3 pages(DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)nilihitaNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnram4a5No ratings yet

- Income Tax Return Form-1 Sahaj - Excel FormatDocument9 pagesIncome Tax Return Form-1 Sahaj - Excel Formatswapnil007salunkeNo ratings yet

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument6 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnMANOJNo ratings yet

- 2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFDocument5 pages2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFMohammed MaazNo ratings yet

- 2019 09 18 18 03 50 397 - Ehbps8472n - 2016Document5 pages2019 09 18 18 03 50 397 - Ehbps8472n - 2016Darvesh mishraNo ratings yet

- Salma Bano: Indian Income Tax ReturnDocument3 pagesSalma Bano: Indian Income Tax Return9956272017No ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnchinna rajaNo ratings yet

- Ferrer 0000 12312022Document1 pageFerrer 0000 12312022Vincent FerrerNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnSijo Kaviyil JosephNo ratings yet

- 2017 09 18 16 47 37 050 - 118817245Document5 pages2017 09 18 16 47 37 050 - 118817245Nitin KumarNo ratings yet

- 2011 ITR1 r2Document3 pages2011 ITR1 r2notybhardwajNo ratings yet

- ITR-1 SAHAJ filing for Salary IncomeDocument5 pagesITR-1 SAHAJ filing for Salary IncomeGanesh DasaraNo ratings yet

- Form%20ITR-1Document2 pagesForm%20ITR-1vinay.bpNo ratings yet

- Receipt No/ Date Seal and Signature of Receiving OfficialDocument10 pagesReceipt No/ Date Seal and Signature of Receiving OfficialRAMAPPA100% (2)

- Amit Kumar Mudgal ComputationDocument4 pagesAmit Kumar Mudgal ComputationSHELESH GARGNo ratings yet

- Sahaj Individual Income Tax Return Assessment Year 2 0 15 - 1 6Document9 pagesSahaj Individual Income Tax Return Assessment Year 2 0 15 - 1 6Prince BalaNo ratings yet

- Form 1622052023 130017Document3 pagesForm 1622052023 130017Amit Singh NegiNo ratings yet

- Form ITR-1-2009-10Document7 pagesForm ITR-1-2009-10vikram_enercon3941No ratings yet

- Form16 W0000000 GS164200X 2021 20211Document1 pageForm16 W0000000 GS164200X 2021 20211gaganNo ratings yet

- NotificationDocument7 pagesNotificationapi-25886395No ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

- Receipt No/ Date Seal and Signature of Receiving OfficialDocument4 pagesReceipt No/ Date Seal and Signature of Receiving Officialtsrahod@yahoo.comNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnhavejsnjNo ratings yet

- Form 1612052021 111453Document3 pagesForm 1612052021 111453SandhyaNo ratings yet

- Form16 1945007 JC570193L 2020 2021Document2 pagesForm16 1945007 JC570193L 2020 2021Ranjeet RajputNo ratings yet

- Anil Ganvir Form 16 (21 22)Document3 pagesAnil Ganvir Form 16 (21 22)DrAndrew WillingtonNo ratings yet

- J - d035f71001 - As Per DdoDocument1 pageJ - d035f71001 - As Per DdoWasim RajaNo ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementGOPAL CHOUHANNo ratings yet

- Form 16 TDS CertificateDocument2 pagesForm 16 TDS CertificateRanjeet RajputNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryKrishna Chaitanya JonnalagaddaNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- Form 1601012023 101258Document3 pagesForm 1601012023 101258Bhura SinghNo ratings yet

- FORM 16 TAX DETAILSDocument2 pagesFORM 16 TAX DETAILSAkshay ShettyNo ratings yet

- ITR-1 SAHAJ for Salary IncomeDocument5 pagesITR-1 SAHAJ for Salary IncomeSk SahuNo ratings yet

- ITR 4 SUGAM filing for FY 2020-21 with total income of Rs. 692480Document10 pagesITR 4 SUGAM filing for FY 2020-21 with total income of Rs. 692480PANKAJ KOTHARINo ratings yet

- For Individuals and Hufs Not Carrying Out Business or Profession Under Any ProprietorshipDocument25 pagesFor Individuals and Hufs Not Carrying Out Business or Profession Under Any ProprietorshipSahil GuptaNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- 1701qjuly2008 (ENCS)Document5 pages1701qjuly2008 (ENCS)Mary Rose AnilloNo ratings yet

- Capital GainDocument10 pagesCapital GainSunny MittalNo ratings yet

- Sison vs. Ancheta, 130 SCRA 654 (1984)Document4 pagesSison vs. Ancheta, 130 SCRA 654 (1984)Christiaan CastilloNo ratings yet

- Gaytor C04 v4Document12 pagesGaytor C04 v4gpm-81100% (1)

- Labour Law Merged MCQDocument57 pagesLabour Law Merged MCQsandip Vispute100% (1)

- EY-Kazakhstan Oil and Gas Tax Guide 2014Document24 pagesEY-Kazakhstan Oil and Gas Tax Guide 2014shankar_embaNo ratings yet

- Tata Business Support Services LTD: 00150785 Amir KhanDocument2 pagesTata Business Support Services LTD: 00150785 Amir KhanAamir KhanNo ratings yet

- CA Final Case Laws SummaryDocument7 pagesCA Final Case Laws SummaryAnamika Chauhan VermaNo ratings yet

- Income From Other SourcesDocument16 pagesIncome From Other SourcesRewant MehraNo ratings yet

- Diversified Approach To Self-Financing: A Case Study of Hogar de CristoDocument28 pagesDiversified Approach To Self-Financing: A Case Study of Hogar de CristoSynergos Institute100% (1)

- Abs CBN Broadcasting Corp. Vs Court of Tax AppealsDocument4 pagesAbs CBN Broadcasting Corp. Vs Court of Tax AppealsshinNo ratings yet

- Transfer and Business TaxationDocument8 pagesTransfer and Business TaxationabbelleNo ratings yet

- F 1040 SaDocument1 pageF 1040 SaPrekelNo ratings yet

- Anglo PersianDocument11 pagesAnglo Persianeghl89No ratings yet

- Commissioner of Internal Revenue V. Shinko Electric Industries Co. LTD., CTA EB No: 1180, Jan. 4, 2016 Mindaro-Grulla, J.Document11 pagesCommissioner of Internal Revenue V. Shinko Electric Industries Co. LTD., CTA EB No: 1180, Jan. 4, 2016 Mindaro-Grulla, J.Oppa KyuNo ratings yet

- IRA Deduction CalculationsDocument4 pagesIRA Deduction CalculationsKNVS Siva KumarNo ratings yet

- Form PDF 973858280311220Document34 pagesForm PDF 973858280311220Sourabh PunshiNo ratings yet

- DA4399 CFA Level III Quick SheetDocument9 pagesDA4399 CFA Level III Quick SheetNivedita Nitesh Nawge100% (1)

- Taxation Law 1 Case DigestsDocument165 pagesTaxation Law 1 Case DigestsGerard Anthony Teves RosalesNo ratings yet

- 07 Accounting Methods and PeriodsDocument26 pages07 Accounting Methods and PeriodsLuis Felipe RodriguezNo ratings yet

- 2010 TC Summary 94Document10 pages2010 TC Summary 94taxcrunchNo ratings yet

- Table of Contents - Federal Income Tax and Benefit GuideDocument32 pagesTable of Contents - Federal Income Tax and Benefit GuideJorge VichyNo ratings yet

- Taxguru - In-Guide To Approved Gratuity FundDocument12 pagesTaxguru - In-Guide To Approved Gratuity FundnanuNo ratings yet

- Income Tax-Atty. CabanDocument4 pagesIncome Tax-Atty. CabanCelyn PalacolNo ratings yet

- Estate Tax Deductions IllustratedDocument8 pagesEstate Tax Deductions IllustratedRona RososNo ratings yet

- Commissioner of Internal Revenue Vs Algue Inc., and Court of Tax Appeals GR No. L-28896. February 17, 1988 FactsDocument61 pagesCommissioner of Internal Revenue Vs Algue Inc., and Court of Tax Appeals GR No. L-28896. February 17, 1988 FactsShall PMNo ratings yet

- Taxation IssuesDocument23 pagesTaxation IssuesBianca Jane GaayonNo ratings yet

- Partnership Return Guide 2017Document90 pagesPartnership Return Guide 2017Sutraraj175No ratings yet

- Strategic Tax Management ReviewerDocument47 pagesStrategic Tax Management ReviewerJoyce Macatangay100% (1)

- KetanDocument60 pagesKetanKetan SagwekarNo ratings yet