Professional Documents

Culture Documents

Account details for expenses and assets

Uploaded by

Maryvic DomendenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Account details for expenses and assets

Uploaded by

Maryvic DomendenCopyright:

Available Formats

Account No.

Account Type Detail type Description

Undeposited Funds Other Current Assets Undeposited Funds

Furniture and equipment with useful life

15000 Furniture and Equipment Fixed Assets Other fixed assets exceeding one year

Tractors, trailers, and other delivery

16300 Tractors and Trailers Fixed Assets Other fixed assets vehicles

Shelving (not permanently attached),

16500 Warehouse Equipment Fixed Assets Other fixed assets forklifts, and other warehouse equipment

Accumulated depreciation on equipment,

17000 Accumulated Depreciation Fixed Assets Other fixed assets buildings and improvements

Unpaid payroll liabilities. Amounts

24000 Payroll Liabilities Other Current Liabilities Payroll Tax Payable withheld or accrued, but not yet paid

Opening balances during setup post to this

account. The balance of this account

30000 Opening Balance Equity {3} Equity Opening Balance Equity should be zero after

32000 Retained Earnings Equity Retained Earnings Undistributed earnings of the business

47900 Sales Income Service/Fee Income Gross receipts from sales

48900 Shipping and Delivery Income Income Service/Fee Income Freight and delivery income

Markup Income Service/Fee Income

Services Income Service/Fee Income

Costs of freight and delivery for

51200 Freight Costs Cost of Goods Sold Supplies & Materials - COGS merchandise purchased

Credit card merchant account discount

51800 Merchant Account Fees Cost of Goods Sold Supplies & Materials - COGS fees, transaction fees, and related costs

Other Miscellaneous Service Advertising, marketing, graphic design, and

60000 Advertising and Promotion Expenses Cost other promotional expenses

Other Miscellaneous Service Fuel, oil, repairs, and other automobile

60100 Auto and Truck Expenses Expenses Cost maintenance for business autos and trucks

Other Miscellaneous Service Bank account service fees, bad check

60400 Bank Service Charges Expenses Cost charges and other bank fees

Computer supplies, off-the-shelf software,

Other Miscellaneous Service online fees, and other computer or

61700 Computer and Internet Expenses Expenses Cost internet related expen

Other Miscellaneous Service Depreciation on equipment, buildings and

62400 Depreciation Expense Expenses Cost improvements

Other Miscellaneous Service

63300 Insurance Expense Expenses Cost Insurance expenses

Other Miscellaneous Service Interest payments on business loans, credit

63400 Interest Expense Expenses Cost card balances, or other business debt

Business meals and entertainment

Other Miscellaneous Service expenses, including travel-related meals

64300 Meals and Entertainment Expenses Cost (may have limited deductib

Other Miscellaneous Service

64900 Office Supplies Expenses Cost Office supplies expense

66000 Payroll Expenses Expenses Payroll Expenses Payroll expenses

Other Miscellaneous Service Printing, copies, and other reproduction

66600 Printing and Reproduction Expenses Cost expenses

Other Miscellaneous Service Payments to accounting professionals and

66700 Professional Fees Expenses Cost attorneys for accounting or legal services

Other Miscellaneous Service Rent paid for company offices or other

67100 Rent Expense Expenses Cost structures used in the business

Incidental repairs and maintenance of

Other Miscellaneous Service business assets that do not add to the

67200 Repairs and Maintenance Expenses Cost value or appreciably pr

Other Miscellaneous Service Taxes paid on property owned by the

68000 Taxes - Property Expenses Cost business, franchise taxes, excise taxes, etc.

Telephone and long distance charges,

Other Miscellaneous Service faxing, and other fees Not equipment

68100 Telephone Expense Expenses Cost purchases

Business-related travel expenses including

Other Miscellaneous Service airline tickets, taxi fares, hotel and other

68400 Travel Expense Expenses Cost travel expen

Other Miscellaneous Service Water, electricity, garbage, and other basic

68600 Utilities Expenses Cost utilities expenses

Transactions to be discussed with

80000 Ask My Accountant Other Expense Other Miscellaneous Expense accountant, consultant, or tax preparer

You might also like

- QB - Transportation and Trucking - Chart of AccountsDocument1 pageQB - Transportation and Trucking - Chart of AccountsMaryvic DomendenNo ratings yet

- Company Income Statement Report and Analysis 2015-2014Document4 pagesCompany Income Statement Report and Analysis 2015-2014Charmaine ShaninaNo ratings yet

- Project Proposal: Eloan (Loan Management System) - Visual Basic 6 + Ms AccessDocument2 pagesProject Proposal: Eloan (Loan Management System) - Visual Basic 6 + Ms Accessvikram vikram100% (1)

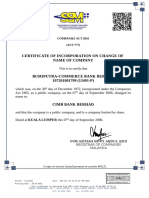

- Companies Act 2016 certificate name change CIMB BankDocument1 pageCompanies Act 2016 certificate name change CIMB BankNurul musaNo ratings yet

- Obata - Grab Bucket Type Ship UnloaderDocument20 pagesObata - Grab Bucket Type Ship UnloaderLeonardo Candito100% (1)

- Vendor Registration Form 2020 v10Document14 pagesVendor Registration Form 2020 v10Mohd Khusairy Bin HaronNo ratings yet

- DV Consulting Inc Summary of ServicesDocument5 pagesDV Consulting Inc Summary of ServicesDv AccountingNo ratings yet

- Configuring Cybertech Pro With Avaya CM and AESDocument48 pagesConfiguring Cybertech Pro With Avaya CM and AESIsaac PinheiroNo ratings yet

- Lease Letter of Intent (Don Ramon)Document2 pagesLease Letter of Intent (Don Ramon)TBA PacificNo ratings yet

- Process of Export of New or Used Vehicles From RSADocument7 pagesProcess of Export of New or Used Vehicles From RSAmarshy bindaNo ratings yet

- GMCAC - Follow-Up Clarification On Taxability of Purchase of GCs - 11.19.15Document4 pagesGMCAC - Follow-Up Clarification On Taxability of Purchase of GCs - 11.19.15Monica SorianoNo ratings yet

- FOSSIL Warranty Booklet DW9F1 Draft 4015506 PDFDocument72 pagesFOSSIL Warranty Booklet DW9F1 Draft 4015506 PDFhollman ojedaNo ratings yet

- 2020form MC28s2020 Annexes DDocument4 pages2020form MC28s2020 Annexes DRegina B. AdlaonNo ratings yet

- Seller Agreement PDFDocument18 pagesSeller Agreement PDFBuyer BNo ratings yet

- NEMA SB 10 - Audio Standard, Nurse Call Systems - 2010Document19 pagesNEMA SB 10 - Audio Standard, Nurse Call Systems - 2010AriefBukhari'abhi'No ratings yet

- DBCS Hardware Service Manual PDFDocument228 pagesDBCS Hardware Service Manual PDFΝΑΝΟΣ ΑΘΑΝΑΣΙΟΣNo ratings yet

- 3 BHK Cost SheetDocument6 pages3 BHK Cost SheetADESHNo ratings yet

- An Absolute Banking Solution Using KioskDocument9 pagesAn Absolute Banking Solution Using KioskYamraj YamrajNo ratings yet

- Benefits of Udyam Certificate MSME Udyam RegistrationDocument2 pagesBenefits of Udyam Certificate MSME Udyam Registrationudyog aadharNo ratings yet

- JDE Document Type DescriptionDocument7 pagesJDE Document Type DescriptionKelvin Tai Wei LimNo ratings yet

- Tax Invoice for Gaming LaptopDocument1 pageTax Invoice for Gaming LaptopAnupam ThackarNo ratings yet

- 11 Student Evaluation of InternshipDocument2 pages11 Student Evaluation of InternshipOidumas AziallaNo ratings yet

- Tally Ledger ListDocument7 pagesTally Ledger ListShaluNo ratings yet

- Annex C-1 - Summary of System DescriptionDocument4 pagesAnnex C-1 - Summary of System DescriptionChristian Albert HerreraNo ratings yet

- APPLICATION FOR POLICE CHARACTER CERTIFICATEDocument1 pageAPPLICATION FOR POLICE CHARACTER CERTIFICATEMudassar RehmanNo ratings yet

- Marketing Proposal TemplateDocument4 pagesMarketing Proposal TemplateBenNo ratings yet

- Conflict of Interest Declaration TemplateDocument2 pagesConflict of Interest Declaration TemplateJEXNo ratings yet

- 800 GigaFamily ReleaseNotes R12.2.5Document26 pages800 GigaFamily ReleaseNotes R12.2.5Shawn HolderNo ratings yet

- Cadet Training Agreement 19 July 2022 DC LanoDocument4 pagesCadet Training Agreement 19 July 2022 DC LanoHONEYBELLE TAPELNo ratings yet

- CableOS 1.15 CLI Reference VersionCDocument781 pagesCableOS 1.15 CLI Reference VersionCAntonio ReneNo ratings yet

- China Konnwei Kw860 Obd2 Car Diagnostic Scanner With Printer Free Update - China Obd Scanner - Car Obd2 ScannerDocument12 pagesChina Konnwei Kw860 Obd2 Car Diagnostic Scanner With Printer Free Update - China Obd Scanner - Car Obd2 ScannerSalehe abdallahNo ratings yet

- Promo Mei 2021 FixDocument24 pagesPromo Mei 2021 FixIndah DestianiNo ratings yet

- Form No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarDocument9 pagesForm No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarHardik KalariaNo ratings yet

- We Will Be Known As An Indian Company: InteractionDocument3 pagesWe Will Be Known As An Indian Company: Interactionnitesh_suvarna2003No ratings yet

- Account Closure (Trading or Demat) Request Form PDFDocument2 pagesAccount Closure (Trading or Demat) Request Form PDFSaravanan Elumalai100% (1)

- Marine Cargo Insurance-Proposal FormDocument4 pagesMarine Cargo Insurance-Proposal FormRavneet KaurNo ratings yet

- Installation Guide: KayleighDocument37 pagesInstallation Guide: KayleighDoicho AndonovNo ratings yet

- Novotel IT Indicative Budget 25052015Document1 pageNovotel IT Indicative Budget 25052015HemantSharmaNo ratings yet

- PC 950 DataValidationOption UserGuide enDocument161 pagesPC 950 DataValidationOption UserGuide enNirmal NayakNo ratings yet

- RuckusWireless DeployingHighDensityWiFi PDFDocument47 pagesRuckusWireless DeployingHighDensityWiFi PDFBagus SusantoNo ratings yet

- Kayleigh User ManualDocument226 pagesKayleigh User ManualDoicho AndonovNo ratings yet

- Paid CrowdsourcingDocument17 pagesPaid CrowdsourcingdgsorianoNo ratings yet

- Novatek nt96655 Data SheetDocument56 pagesNovatek nt96655 Data Sheetapi-432313169No ratings yet

- Understanding Shariah-Compliant Investment PrinciplesDocument31 pagesUnderstanding Shariah-Compliant Investment Principleshidayatul raihanNo ratings yet

- PREG DocuSign Indirect Channel Partner AgreeDocument32 pagesPREG DocuSign Indirect Channel Partner AgreeMohammad AkhrassNo ratings yet

- Amazon Easysell MarchDocument23 pagesAmazon Easysell MarchBala Krishna100% (1)

- OEM authorization formDocument1 pageOEM authorization formPRASAD MALLIPEDDINo ratings yet

- SIRV Annual Report FormDocument2 pagesSIRV Annual Report FormMarius AngaraNo ratings yet

- FULLY AUTOMATED DATA ENTRY CODES (Module1)Document10 pagesFULLY AUTOMATED DATA ENTRY CODES (Module1)Papa VaughnNo ratings yet

- Email Policyv2Document9 pagesEmail Policyv2tcNo ratings yet

- BP Op Entpr S4hana2021 08 Co Master Data en XXDocument159 pagesBP Op Entpr S4hana2021 08 Co Master Data en XXVinay Borbachhi (IN)No ratings yet

- ABC Lecture Notes PDFDocument24 pagesABC Lecture Notes PDFJose Ramer MegioNo ratings yet

- Company. EngagementDocument2 pagesCompany. EngagementChartered AccountsNo ratings yet

- Craig's Design and Landscaping Services: Account ListDocument3 pagesCraig's Design and Landscaping Services: Account Listudit guptaNo ratings yet

- Chart of AccountsDocument4 pagesChart of Accountsjyllstuart100% (3)

- Skipped Number To Allow For Expansion of All Items in The Notes Section 1Document15 pagesSkipped Number To Allow For Expansion of All Items in The Notes Section 1Deepanshu ChauhanNo ratings yet

- Balance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of AccountsDocument27 pagesBalance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of Accountsrisc1No ratings yet

- Daftar Akun MyobDocument1 pageDaftar Akun MyobJuan ErlanggaNo ratings yet

- ACCT Sample WorksheetDocument3 pagesACCT Sample WorksheetMa. Kelly Cassandra RiveraNo ratings yet

- North South University Accounting Course ReportDocument23 pagesNorth South University Accounting Course ReportAntor Podder 1721325No ratings yet

- QB - Rental - Chart of AccountsDocument2 pagesQB - Rental - Chart of AccountsMaryvic DomendenNo ratings yet

- QB - Repairs and Maintenance - Chart of AccountsDocument1 pageQB - Repairs and Maintenance - Chart of AccountsMaryvic DomendenNo ratings yet

- QB - Retail Shop - Chart of AccountsDocument1 pageQB - Retail Shop - Chart of AccountsMaryvic DomendenNo ratings yet

- Use and Care Guide - 3955869Document24 pagesUse and Care Guide - 3955869Giovanni GuerreroNo ratings yet

- Adobe - Photoshop - Every - Tool.Explained PDFDocument130 pagesAdobe - Photoshop - Every - Tool.Explained PDFsmachevaNo ratings yet

- Adobe - Photoshop - Every - Tool.Explained PDFDocument130 pagesAdobe - Photoshop - Every - Tool.Explained PDFsmachevaNo ratings yet

- 47129rmc No. 45-2009 (Letter of Intent - SAMPLE)Document1 page47129rmc No. 45-2009 (Letter of Intent - SAMPLE)rain06021992No ratings yet

- Photoshop Cs4 Tools ExplainedDocument29 pagesPhotoshop Cs4 Tools ExplainedManjot Singh100% (1)

- EnronDocument21 pagesEnronMaryvic DomendenNo ratings yet

- Opportunities in An Integrated Supply Chain: Jay Heizer, Barry Render Operations Management 9 Edition Chapter 11 pg.442Document5 pagesOpportunities in An Integrated Supply Chain: Jay Heizer, Barry Render Operations Management 9 Edition Chapter 11 pg.442Maryvic DomendenNo ratings yet

- RRA Snacks Market Research ReportDocument17 pagesRRA Snacks Market Research ReportSUPPLYOFFICE EVSUBCNo ratings yet

- Sbi BPCL Card Feb21Document2 pagesSbi BPCL Card Feb21vinod guptaNo ratings yet

- Financial Management Theory Practice 15th Edition Ebook PDFDocument51 pagesFinancial Management Theory Practice 15th Edition Ebook PDFdon.anderson433100% (37)

- Indonesia - Law 8-1995 The Capital MarketDocument76 pagesIndonesia - Law 8-1995 The Capital MarketKris WinartoNo ratings yet

- Group14 - Reliance Baking SodaDocument10 pagesGroup14 - Reliance Baking SodaPreetam Singh100% (5)

- Chapter 1Document27 pagesChapter 1Jchelle Lustre DeligeroNo ratings yet

- COST 1 Costing ProblemsDocument75 pagesCOST 1 Costing Problemstrixie maeNo ratings yet

- Chapter 23 - Weygandt Financial and Managerial Accounting, 3e Challenge ExercisesDocument3 pagesChapter 23 - Weygandt Financial and Managerial Accounting, 3e Challenge ExercisesTien Thanh DangNo ratings yet

- Business Plan - Riva Nanda G3Document11 pagesBusiness Plan - Riva Nanda G3Riva PramathanaNo ratings yet

- FIN 440: International Finance: Larry Schrenk, Instructor Video 14.1 Multinational Capital BudgetingDocument23 pagesFIN 440: International Finance: Larry Schrenk, Instructor Video 14.1 Multinational Capital BudgetingYến NhiNo ratings yet

- Valuation - ScriptDocument2 pagesValuation - ScriptBhaveek OstwalNo ratings yet

- Strategy Index 10 UpdateDocument1 pageStrategy Index 10 UpdateChanuka PrabhashNo ratings yet

- Grameenphone Marketing Mix AnalysisDocument34 pagesGrameenphone Marketing Mix AnalysisTanvir ChowdhuryNo ratings yet

- Mediasi Brand LoyalityrDocument33 pagesMediasi Brand LoyalityrYarsiniNo ratings yet

- N. Gregory Mankiw: Powerpoint Slides by Ron CronovichDocument36 pagesN. Gregory Mankiw: Powerpoint Slides by Ron CronovichTook Shir LiNo ratings yet

- DepreciationDocument14 pagesDepreciationprjiviNo ratings yet

- Name Mahrish Akhtar ID: 022-20-121366: POF Assignment 2 - (Stock Valuation)Document3 pagesName Mahrish Akhtar ID: 022-20-121366: POF Assignment 2 - (Stock Valuation)shoaib akhtarNo ratings yet

- Bloomberg For Education Links 9.12Document27 pagesBloomberg For Education Links 9.12Amogh SumanNo ratings yet

- Distribution of A Product DEINER VARGAS ZAPATADocument3 pagesDistribution of A Product DEINER VARGAS ZAPATADeiner Vargas ZapataNo ratings yet

- Milestone 4 Sem2 FinalDocument28 pagesMilestone 4 Sem2 FinalDisha BasakNo ratings yet

- RMIT International University Vietnam BUSM 3311 - International BusinessDocument6 pagesRMIT International University Vietnam BUSM 3311 - International BusinessNguyễn Ngọc Đại KimNo ratings yet

- Yordanoff, Goran - The Power of GapsDocument3 pagesYordanoff, Goran - The Power of GapsskorpiohpNo ratings yet

- A Walzerian Theory of ExploitationDocument19 pagesA Walzerian Theory of ExploitationJamie LinNo ratings yet

- Processes 06 00238 PDFDocument45 pagesProcesses 06 00238 PDFgoogley71No ratings yet

- Retail Layout Management at TescoDocument9 pagesRetail Layout Management at TescoRowanAtkinson88% (8)

- QUIZ 1 - Sheena Cab & Katricia FritzDocument2 pagesQUIZ 1 - Sheena Cab & Katricia FritzSheena CabNo ratings yet

- CV PROF Apr23Document8 pagesCV PROF Apr23DaniNo ratings yet

- Nfo Process in Mutual Funds Nfo Process in Mutual Funds AT AT India Infoline India InfolineDocument72 pagesNfo Process in Mutual Funds Nfo Process in Mutual Funds AT AT India Infoline India InfolineAmol BhawariNo ratings yet

- Group Account Manager experienceDocument2 pagesGroup Account Manager experienceIshaan YadavNo ratings yet

- MJ Hudson Fund Guide 1Document55 pagesMJ Hudson Fund Guide 1sukitraderNo ratings yet