Professional Documents

Culture Documents

ACCA - IAS 29 Presentation - CPD Tinashe

Uploaded by

Tawanda NgoweOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCA - IAS 29 Presentation - CPD Tinashe

Uploaded by

Tawanda NgoweCopyright:

Available Formats

ACCA BULAWAYO

Financial Reporting CPD

IAS 21 AND IAS29

TINASHE MUREREKWA

PARTNER – MJV CHARTERED ACCOUNTANTS

Knowledge, Growth, Impact

ICAZ Accredited Training Office

BACKGROUND: THE ZIMBABWEAN STORY

• 2000-2008 Zimbabwe experienced a devaluation of currency through sustained inflation

• In 2007 and 2008 Inflation figures were suspended

• In 2009 Zimbabwe adopted a multicurrency system. On 12 April 2009 Zimbabwe

abandoned the Zimbabwe Dollar and was de-monetised in 2015.

• The USD became both a Functional and Reporting Currency

• On the changeover assets and liabilities were recognized through the Foreign Currency

Translation Reserve

• In 2014 bond coins were introduced to ease the shortage of change

• In November 2016 Bond notes were introduced as an export incentive

• In February 2018 the RBZ gave a directive for the ring fencing of actual Foreign currency

deposits

• 1 October 2018 the RBZ instructs banks to separate Foreign Currency FCA Nostro and RTGS

FCA maintaining 1:1

• 21 February 2019 the RTGS dollar was introduced which effectively marked the return of

the Zim dollar

Knowledge, Growth, Impact

ICAZ Accredited Training Office

FINANCIAL ACCOUNTING SINCE 2000

2000-2003

• By definition Zimbabwe was hyper-inflationary but most entities had not

adopted Inflation adjusted accounting (26% per annum over 3 years)

(Economists view vs Accountants View) (IAS21 fully functional)

2004-2008

• There was consensus among accountants that the economy was now

hyper-inflationary

• 2004-2007 Financial Reports were restated using Consumer Price Indexes

• After suspension of year on year figures, accountants started using the Old

Mutual Implied Rate (OMIR) (IAS21 & IAS29 fully functional)

Knowledge, Growth, Impact

ICAZ Accredited Training Office

FINANCIAL ACCOUNTING SINCE 2000

2009

• Zimbabwe abandoned the use of the Zimbabwe Dollar (ZWD) and

introduced the multi currency with the USD becoming the Functional

Currency as accepted by business and monetary authorities.

• Foreign Currency Translation Reserve (NDR) created to migrate Balance

Sheet to USD(Monetary Balances Suffered Impairment) (IAS 21)

2009-2016

• USD now functional but with a multicurrency IAS21 applied. The Zim $ was

demonetized

• Cash shortages surfaced in 2016, the Bond Note was introduced, this was not

a currency

• Expansionary monetary and fiscal policy resulted in a premium between

USD Cash, Bond Note and Electronic Funds (IAS21 not permissible as at law

USD, Bond and Electronic Funds were said to be 1)

Knowledge, Growth, Impact

ICAZ Accredited Training Office

FINANCIAL ACCOUNTING SINCE 2000

2017-Feb 2019

• The premium between the USD, Electronic Funds and Bond Note increased

• Auditors should have qualified 2017 accounts for failure to allow IAS 21 when

substance showed it was existing.

• 2018 the prices surged by more than 100% October 1 Monetary & Fiscal

Policy pronouncements. This in essence should have triggered inflationary

reporting, but the functional currency was still the USD

• Financial Statements for the FY18 were debated as to their usefulness seeing

that IAS21 was being pervasively violated

• SI33 of 2019 then enabled accountants to unilaterally issue adverse opinions

Knowledge, Growth, Impact

ICAZ Accredited Training Office

CURRENT FINANCIAL ACCOUNTING

2017-Feb 2019 contd The Effects of SI33 (21 February 2019)

• Heralded the return of the Zimbabwean Dollar (RTGS$)

• PAAB pleaded with the government for it to be backdated to 1 January 2019

• PAAB gave guidance to its members to consider the ‘substance over form’

and duly adverse opinions with scenarios where issued

• This marked the institution of IAS21 between the USD and Bond Notes/RTGS

• The return of the ZWL also paved way for the possible use of IAS29 as should

have been done since 2018

• The FY19 now has 2 months of Financial Reporting in USDs without a

translation rate and thereafter ZWL (Adverse possibly disclaimers loading)

Knowledge, Growth, Impact

ICAZ Accredited Training Office

CURRENT FINANCIAL ACCOUNTING

2017-Feb 2019 contd The Effects of SI33 (21 February 2019)

SI 33 of 2019

(d)that, for ACCOUNTING AND OTHER PURPOSES, all assets and liabilities that were,

immediately before the effective date, valued and expressed in United States dollars (other

than assets and liabilities referred to in section 44C (2) of the principal Act) shall on and after

the effective date be deemed to be values in RTGS dollars at a rate of one-to-one to the

United States dollar.

• The above resulted in the impairment of monetary items of the balance sheet e.g. Trade &

other Payables & Receivables, Debt Securities, Cash & Equivalents

• The above resulted in any entity with foreign obligations becoming increasingly insolvent as

rate was escalating. The RBZ responded by ‘absorbing’ obligations at 1:1

• THE move by the RBZ possibly created a violation of IAS21 or alternatively will result in

unusual hedging instruments (IFRS 9) appearing in the financial statements

• The move endorsed adverse opinions due to IAS21 and IAS10 (Events After Reporting

Period) working together against a standing Law.

Knowledge, Growth, Impact

ICAZ Accredited Training Office

FINANCIAL ACCOUNTING SINCE 2000

Feb 2019 onwards

• The interbank debuted at 2.5 and is currently hovering at 16

• Prices soared and conditions for application of IAS 29 started appearing

• Year on year figures were suspended

• Culminated in PAAB pronouncing that IAS29 be used in preparation of

Accounts

• Several Statutory Instruments were issued including one that made

International Public Sector Accounting Standards (IPSAS), the Public sector

equivalent of International Financial Reporting Standards (IFRS) the

standards to use in all public sector accounting. IAS29 is the same as IPSAS

10.

Knowledge, Growth, Impact

ICAZ Accredited Training Office

IAS 29 UNMASKED

WHO DOES IAS 29 apply to?

IAS 29 Financial Reporting in Hyperinflationary Economies applies when

an entity’s functional currency is that of a hyperinflationary economy.

Background

• Issued in 1989 and first used in periods 1 January 1990 onwards

• No amendments to the Standard since 2017

Scope

IAS 29 is applied to the individual financial statements, and the

consolidated financial statements of an entity whose functional

currency is the currency of a hyperinflationary economy

Knowledge, Growth, Impact

IAS 29 UNMASKED

At what rate of inflation does IAS 29 apply ?

The standard does not prescribe an absolute rate at which hyperinflation

occurs, it is deemed a matter of judgment.

5 indicators that IAS 29 might be applicable

i. The general population prefers to keep its wealth in non-monetary assets or in a relatively stable

foreign currency. Amounts of local currency held are immediately invested to maintain

purchasing power

ii. The general population regards monetary amounts not in terms of the local currency but in

terms of a relatively stable foreign currency. Prices may be quoted in that currency.

iii. Sales and purchases on credit take place at prices that compensate for the expected loss of

purchasing power during the credit period, even if the period is short

iv. Interest rates, wages and prices are linked to a price index; and

v. The cumulative inflation rate over three years approaches, or exceeds, 100 per cent.

‘Monetary Illusion vs Real Basis’ “ZSE”

Knowledge, Growth, Impact

IAS 29 UNMASKED

RESTATEMENT OF FINANCIAL STATEMENTS

• The financial statements of an entity whose

functional currency is the currency of a

hyperinflationary economy should be restated

• Consistency from period to period in applying the

procedures is more important than the precision of

the amounts.

• Financial statements prepared under IAS 29 should

be definitive i.e. they are not supplementary

information or in notes to the financial statements.

Knowledge, Growth, Impact

IAS 29 UNMASKED

RESTATEMENT OF FINANCIAL STATEMENTS CONT’D

IAS 29 REQUIRES:

• A restatement of current period financial statements in terms of the

measuring unit at the end of the reporting period

• A restatement of comparative figures for the previous periods reported in

the same way (i.e. using a general measuring unit)

• Recognition of a gain or loss on the net monetary position to be included

in profit or loss, and separately disclosed

Approaches to Restatement of Financial Reporting

• - Restatement of Historical Financial Statements

- Restatement of Current Cost Financial Statements

Knowledge, Growth, Impact

IAS 29 UNMASKED

RESTATEMENT OF HISTORICAL FINANCIAL STATEMENTS

STATEMENT OF FINANCIAL POSITION

ITEM Treatment Example

Assets and liabilities that have a Adjust in accordance with the Interbank Rate Linked Financial

predefined link to price changes particular agreements in place Instruments

Other monetary items No need for restatement as Cash, receivables and payables

already at current level

Non-monetary assets carried at a No need for restatement as Inventories carried at NRV.

valuation that is current at the already expressed at current Investment Property carried at

end of the reporting period measuring unit Fair Value

Non-monetary assets carried at a Restatement is required from the Property revalued at a date

valuation that is not current at date of the valuation to the end other than the end of the

the end of the reporting period of the reporting period reporting period

Other items in the statement of These are restated in terms of the When carried at cost: property,

financial position, i.e. items measuring unit current at the end plant and equipment,

carried at cost, or cost less of the reporting period by inventories, goodwill and

depreciation and impairment applying a general price index intangible assets. Also prepaid

losses expenses and deferred income.

Knowledge, Growth, Impact

IAS 29 UNMASKED

RESTATEMENT OF HISTORICAL FINANCIAL STATEMENTS

Example (Property, Plant & Equipment)

Property Purchase 31/12/2017 for $1000 (Price Index 100) (10yrs Straight Line)

31/12/2018 (Price Index 150) Adjust Cost to 150/100X1000= $1,500

Depreciation 10% of $1500 = $150

Accumulated Depreciation= $150

31/12/2019 (Price Index 240) Adjust cost to 240/150x1500 = $2,400

Depreciation 10% of $2,400 = $240

Accumulated Depreciation = $480

(240/150*150+$240)

Knowledge, Growth, Impact

IAS 29 UNMASKED

RESTATEMENT OF HISTORICAL FINANCIAL STATEMENTS

Example (Inventories)

July Aug Sep Oct Nov Dec

Price Index

100 110 130 200 260 300

Description Date of Index Historical Indexing 31 December

Purchase Cost Adjustment Balance

Flour 30 Sep 130 50 300/130x50 115

Premix 30 Nov 260 60 300/260*60 69

WiP – Raw Mat 31 Oct 200 90 300/200*90 135

WiP – Labour 30 Nov 260 25 300/260*25 29

Knowledge, Growth, Impact

IAS 29 UNMASKED

RESTATEMENT OF HISTORICAL FINANCIAL STATEMENTS

Impairment

• When restated amount is more than recoverable amount, Impairment is

recognized

• Inventories will be written down to NRV (IAS2). PPE and intangible Assets

will be written down in accordance with IAS36.

Equity

On first application of IAS29

• any revaluation surplus that arose in previous periods is eliminated (i.e. it

is absorbed in adjusted retained earnings);

• with the exception of retained earnings, other components (equity,

share premium and any other existing reserves) are restated by applying

a general price index from the dates the components were contributed

or otherwise arose; and

• restated retained earnings are calculated as the balancing figure after

all adjustments have been made to all other components of the

statement of financial position.

Knowledge, Growth, Impact

IAS 29 UNMASKED

RESTATEMENT OF HISTORICAL FINANCIAL STATEMENTS

Statement of Comprehensive Income

• All items must be expressed in terms of the measuring unit current at

the end of the reporting period. This like the SFP is through price index

• Due to volume of transactions, an average or some fair estimation might

be more appropriate. Judgement is key, but remember Consistency

over precision.

Gain or loss arising on net monetary position

• The gain or loss arising on the net monetary position as a result of all of

the adjustments to items in the statement of financial position is included

in profit or loss and separately disclosed.

Knowledge, Growth, Impact

IAS 29 UNMASKED

RESTATEMENT OF HISTORICAL FINANCIAL STATEMENTS

Statement of Comprehensive Income

• All items must be expressed in terms of the measuring unit current at

the end of the reporting period. This like the SFP is through price index

• Due to volume of transactions, an average or some fair estimation might

be more appropriate. Judgement is key, but remember Consistency

over precision.

Gain or loss arising on net monetary position

• The gain or loss arising on the net monetary position as a result of the

adjustments to items in the statement of financial position is included in

profit or loss and separately disclosed.

Knowledge, Growth, Impact

IAS 29 UNMASKED

RESTATEMENT OF CURRENT COST FINANCIAL

STATEMENTS

STATEMENT OF FINANCIAL POSITION

• Items are already at current value so they do not need restatement

STATEMENT OF COMPREHENSIVE INCOME

• All amounts in the statement of comprehensive income should be

restated in the measuring unit current at the end of the reporting period

by applying a general price index

• Gains/Losses in net monetary position should be treated the same as

historical

Knowledge, Growth, Impact

IAS 29 UNMASKED

DISCLOSURE REQUIREMENTS

• The accounting policies should state that the financial statements and

the corresponding figures have been restated for changes in the general

purchasing power of the functional currency and, consequently, are

stated in terms of the measuring unit current at the end of the reporting

period;

• The accounting policies should also state whether the financial

statements are based on a historical cost approach or a current cost

approach; and

• The price index that has been used, its level at the end of the reporting

period and the movement in the index during the current and previous

reporting periods.

Knowledge, Growth, Impact

IAS 29 UNMASKED

IMPLEMENTATION CHALLENGES

1) What index should be used to restate figures?

2) If Interbank rate is applied, is it the fair rate to use, what

about the alternative market or OMIR

3) How practical is it to apply restatement in the Profit and

Loss on every transaction? If we use an average how

fair is it when a currency is shading ≥2% per day?

4) Will the application of IAS29 be possible to the

comparative figures, if so will the restatement be

enough to discard of adverse opinions passed in the

prior year?

5) What happens to foreign denominated loans that

crossed over on SI33 pronouncement?

6) How will adjusting journals be passed in ERPs like Sage,

Navision & Quickbooks, Opening Balances and

Statutory returns

Knowledge, Growth, Impact

You might also like

- Government Accounting and BudgetingDocument56 pagesGovernment Accounting and BudgetingMheng Glico100% (1)

- Can BusDocument11 pagesCan BusING. RUBENS100% (1)

- CBZ Holdings Audited Financial Results For The Year Ending 31 December 2020Document23 pagesCBZ Holdings Audited Financial Results For The Year Ending 31 December 2020Brilliant Mungani100% (1)

- Afa Ipsas and Adoption of Ipsas in NigeriaDocument25 pagesAfa Ipsas and Adoption of Ipsas in Nigeriat4fgmwcb2kNo ratings yet

- International AccountingDocument52 pagesInternational AccountingimaneNo ratings yet

- Summaries of International Accounting StandardsDocument69 pagesSummaries of International Accounting Standardsmaryam rajputtNo ratings yet

- Nepal Accounting StandardDocument47 pagesNepal Accounting StandardShreejan Bhandari100% (3)

- IAS 34 Summary PDFDocument1 pageIAS 34 Summary PDFHaezel Santos VillanuevaNo ratings yet

- Contemporary Issues On International Financial Standards and Reporting1Document19 pagesContemporary Issues On International Financial Standards and Reporting1Sikiru SalamiNo ratings yet

- 201.03 Accounting For Joint Ventures, Installment Sales and Consignments (IAS-31), IAS-31 Superseded by IFRS-11& IFRS-12 in 2013Document11 pages201.03 Accounting For Joint Ventures, Installment Sales and Consignments (IAS-31), IAS-31 Superseded by IFRS-11& IFRS-12 in 2013Biplob K. SannyasiNo ratings yet

- Chapter OneDocument56 pagesChapter OneKamal MoyerNo ratings yet

- CH 03Document34 pagesCH 03Nirupa DudhatraNo ratings yet

- CH 11 FGEDocument17 pagesCH 11 FGEFirdows SuleymanNo ratings yet

- International Accounting Standards (IAS)Document10 pagesInternational Accounting Standards (IAS)Om Prakash AgrawalNo ratings yet

- CH 03Document31 pagesCH 03Tyler NielsenNo ratings yet

- Financial Reporting in Public Sector: Topic 9Document29 pagesFinancial Reporting in Public Sector: Topic 9Nur ImanNo ratings yet

- Framework For The Preparation and Presentation of FinancialDocument44 pagesFramework For The Preparation and Presentation of FinancialPetrinaNo ratings yet

- International Public Sector Accounting Standards: Training Notes For Shifting From Ifrs To The Accrual Based IpsasDocument35 pagesInternational Public Sector Accounting Standards: Training Notes For Shifting From Ifrs To The Accrual Based IpsasNaveed KhanNo ratings yet

- 1ZWEEA2022003Document120 pages1ZWEEA2022003manchandasaanvi4No ratings yet

- Intricacies of Corporate Bs and FsDocument33 pagesIntricacies of Corporate Bs and FsR.K.GUPTANo ratings yet

- PPT1-IPSAS and Government Accounting SystemDocument23 pagesPPT1-IPSAS and Government Accounting Systemratna sulistianaNo ratings yet

- Acn 305 Final AssignmentDocument17 pagesAcn 305 Final AssignmentRich KidNo ratings yet

- Accounting Q&ADocument6 pagesAccounting Q&AIftikharNo ratings yet

- Issue27 Jun2009Document20 pagesIssue27 Jun2009rodode9102No ratings yet

- ACCOUNTIDocument18 pagesACCOUNTIIpang NoyoNo ratings yet

- Accounting StandardsDocument109 pagesAccounting StandardsJugal Shah100% (1)

- Accounting Standards Tanmay AroraDocument133 pagesAccounting Standards Tanmay AroratanmayaroraNo ratings yet

- Background To IPSAS Implementation in NigeriaDocument28 pagesBackground To IPSAS Implementation in NigeriaAkinmulewo Ayodele67% (3)

- Accrual Accounting CPSA 1 Jul 2019Document24 pagesAccrual Accounting CPSA 1 Jul 2019JOHN TUMWEBAZENo ratings yet

- Module 1A - ACCCOB2 - Introduction To Financial Accounting - FHVDocument25 pagesModule 1A - ACCCOB2 - Introduction To Financial Accounting - FHVCale Robert RascoNo ratings yet

- Banking IndustryDocument122 pagesBanking IndustryRitesh BhansaliNo ratings yet

- Topic Three: Bases of Public Sector Accounting and ReportingDocument20 pagesTopic Three: Bases of Public Sector Accounting and ReportingProf. SchleidenNo ratings yet

- Accounting Standards S.ClementDocument109 pagesAccounting Standards S.Clementabhi_chess22No ratings yet

- Pertemuan 1-Financial Reporting Standards Conceptual FrameworkDocument61 pagesPertemuan 1-Financial Reporting Standards Conceptual Frameworkanggi anythingNo ratings yet

- Syed Wajeeh Hasan Zaidi-CVDocument4 pagesSyed Wajeeh Hasan Zaidi-CVmba2135156No ratings yet

- Topic 1Document18 pagesTopic 1rbnbalachandranNo ratings yet

- Accounting StandardsDocument47 pagesAccounting StandardsManish SinghNo ratings yet

- January 2024 BoltDocument110 pagesJanuary 2024 BoltKundan Kumar 1115No ratings yet

- Ind As - 1 Presentation of Financial Statements: Shambhavi Singh MS20GF077Document15 pagesInd As - 1 Presentation of Financial Statements: Shambhavi Singh MS20GF077SHAMBHAVI SINGHNo ratings yet

- MPERSDocument1 pageMPERSKen ChiaNo ratings yet

- Ind As On Presentation of General Purpose Financial StatementsDocument71 pagesInd As On Presentation of General Purpose Financial StatementsSk ThaneeshNo ratings yet

- IAS 32, 39, IFRS 7, 9 - Long-Term LiabilitiesDocument48 pagesIAS 32, 39, IFRS 7, 9 - Long-Term Liabilitiesdzenita5beciragic5kaNo ratings yet

- 26 International Financial Reporting StandardsDocument3 pages26 International Financial Reporting StandardsClyleo Eddard YoupaNo ratings yet

- Ind As On Presentation of Items in The Financial StatementsDocument64 pagesInd As On Presentation of Items in The Financial Statementspulkitddude_24114888No ratings yet

- Ind As 1Document64 pagesInd As 1vijaykumartaxNo ratings yet

- NBFC Compliance: by Swarit AdvisorsDocument8 pagesNBFC Compliance: by Swarit AdvisorsDhruv SharmaNo ratings yet

- Aaoifi On Zakat CalculationDocument10 pagesAaoifi On Zakat CalculationUstaz Jibril YahuzaNo ratings yet

- IFRS Overview ConferenceDocument12 pagesIFRS Overview ConferenceYagnesh DesaiNo ratings yet

- CIFRSSDocument3 pagesCIFRSSfarhantariq_89No ratings yet

- Ver1.2Document8 pagesVer1.2Ambrish ChaudharyNo ratings yet

- 1.3) Accounting StandardsDocument15 pages1.3) Accounting StandardsF93 SHIFA KHANNo ratings yet

- f7f8601d805d458ab36eff46cb5d7146Document645 pagesf7f8601d805d458ab36eff46cb5d7146imgopi9999No ratings yet

- Ifs Banks 2006Document96 pagesIfs Banks 2006Hannen MohamedNo ratings yet

- CompaniesDocument39 pagesCompaniesSaleh RaoufNo ratings yet

- Commercial Bank Project: Annual Report 2018 Credit Libanais SAL & Bank of BeirutDocument10 pagesCommercial Bank Project: Annual Report 2018 Credit Libanais SAL & Bank of BeirutNaja NaddafNo ratings yet

- Governance: ReportsDocument25 pagesGovernance: ReportsFardin MarufNo ratings yet

- IFRSDocument34 pagesIFRSnav33nNo ratings yet

- ACCG835 International AccountingDocument41 pagesACCG835 International AccountingSophie DaoNo ratings yet

- Imf Report On Zambia's EcfDocument135 pagesImf Report On Zambia's EcfHibajene MweembaNo ratings yet

- Revised Accounting StandardDocument11 pagesRevised Accounting StandardAnoop SinghNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Toyota Rav4 GR Sport 2023 IDDocument6 pagesToyota Rav4 GR Sport 2023 IDTawanda NgoweNo ratings yet

- Toyota Rav4 2023 USADocument29 pagesToyota Rav4 2023 USATawanda NgoweNo ratings yet

- Toyota Rav4 2023 AUDocument26 pagesToyota Rav4 2023 AUTawanda NgoweNo ratings yet

- Acca Zimbabwe - Ias 29 Implementation GuidanceDocument11 pagesAcca Zimbabwe - Ias 29 Implementation GuidanceTawanda NgoweNo ratings yet

- Registration of CASA With Other Professional BodiesDocument24 pagesRegistration of CASA With Other Professional BodiesTawanda NgoweNo ratings yet

- ICAZ Guidance On 2020 Audit OpinionsDocument16 pagesICAZ Guidance On 2020 Audit OpinionsTawanda NgoweNo ratings yet

- Department of Accounting: Taxation 200 (Tax2Ab0)Document6 pagesDepartment of Accounting: Taxation 200 (Tax2Ab0)Tawanda NgoweNo ratings yet

- Tax 200 - Rubric CGT AssignmentDocument3 pagesTax 200 - Rubric CGT AssignmentTawanda NgoweNo ratings yet

- Tax 200 TUTORIAL QUESTION: Capital Gains Tax (CGT) (60) Week: 22 - 26 August 2016Document2 pagesTax 200 TUTORIAL QUESTION: Capital Gains Tax (CGT) (60) Week: 22 - 26 August 2016Tawanda NgoweNo ratings yet

- Indebted Demand and Economic Policy in A Post-Covid World Paper SlidesDocument113 pagesIndebted Demand and Economic Policy in A Post-Covid World Paper SlidesTawanda NgoweNo ratings yet

- Hedge Funds - Evolution and Perspectives: D. A. Tsenov Academy of Economics, Department of Finance and CreditDocument12 pagesHedge Funds - Evolution and Perspectives: D. A. Tsenov Academy of Economics, Department of Finance and CreditTawanda NgoweNo ratings yet

- Disrupting The $8T Payment Card Business:: The Outlook On Buy Now, Pay Later'Document34 pagesDisrupting The $8T Payment Card Business:: The Outlook On Buy Now, Pay Later'Tawanda Ngowe0% (1)

- CB Insights - Global Unicorn Club - 2021Document72 pagesCB Insights - Global Unicorn Club - 2021Tawanda NgoweNo ratings yet

- Dynamic Presentations Feedback FormsDocument15 pagesDynamic Presentations Feedback FormsAnastasiia DrapakNo ratings yet

- KIST PYP Unit Planner PDFDocument9 pagesKIST PYP Unit Planner PDFMarrian JNo ratings yet

- GN Divisions - P Codes: LegendDocument1 pageGN Divisions - P Codes: LegendRavindra KumaraNo ratings yet

- Module 2-Introduction To Chemistry (Week 2)Document3 pagesModule 2-Introduction To Chemistry (Week 2)Ian ParoneNo ratings yet

- Impossible CrimeDocument2 pagesImpossible CrimeBEST OF ONE PIECENo ratings yet

- Af400 PCDocument462 pagesAf400 PCRicardo MarínNo ratings yet

- Thesis Topics List PhilippinesDocument5 pagesThesis Topics List Philippinesfc5wsq30100% (2)

- Data Management Assistant Job at UNHCRDocument3 pagesData Management Assistant Job at UNHCRShams QiamNo ratings yet

- Connection ApplicationDocument35 pagesConnection ApplicationLeo KhkNo ratings yet

- Aircraft General (Indo)Document81 pagesAircraft General (Indo)Rico SuhandaNo ratings yet

- Block 2: Question Block Created by Wizard 1 of 6Document6 pagesBlock 2: Question Block Created by Wizard 1 of 6wcatNo ratings yet

- R.A 9292 Article Vi: Penal Provision and Assistance of Law Enforcement AgenciesDocument12 pagesR.A 9292 Article Vi: Penal Provision and Assistance of Law Enforcement AgenciesMagNo ratings yet

- System Configuration ARCDocument13 pagesSystem Configuration ARCSantiago CorreaNo ratings yet

- Schools PDFDocument211 pagesSchools PDFpankajbaberwalNo ratings yet

- Tamil Names For Male and Female Babies 111003052735 Phpapp01Document257 pagesTamil Names For Male and Female Babies 111003052735 Phpapp01Raja Sekar MNo ratings yet

- Impact of Decentralization On Public Service Delivery and Equity - Education and Health Sectors in Poland 1998 To 2003Document55 pagesImpact of Decentralization On Public Service Delivery and Equity - Education and Health Sectors in Poland 1998 To 2003kotornetNo ratings yet

- Analysis of The Seismic Coda of Local Earthquakes As Scattered WavesDocument9 pagesAnalysis of The Seismic Coda of Local Earthquakes As Scattered WavesAS LCNo ratings yet

- VOLVO XC70 2004 User ManualDocument241 pagesVOLVO XC70 2004 User Manualkir0i100% (2)

- Artificial IntelligenceDocument331 pagesArtificial IntelligenceMukul.A. MaharajNo ratings yet

- Ferric Ammonium SulfateDocument6 pagesFerric Ammonium SulfatemkgchemNo ratings yet

- The 108 Star Bearers in The Suikoden TierkiesDocument51 pagesThe 108 Star Bearers in The Suikoden TierkiesEkky Maretha PrathiwiNo ratings yet

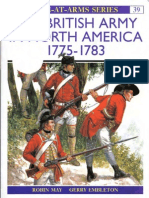

- Osprey, Men-At-Arms #039 The British Army in North America 1775-1783 (1998) (-) OCR 8.12Document49 pagesOsprey, Men-At-Arms #039 The British Army in North America 1775-1783 (1998) (-) OCR 8.12mancini100% (13)

- The Bible, King James Version, Book 49: Ephesians by AnonymousDocument17 pagesThe Bible, King James Version, Book 49: Ephesians by AnonymousGutenberg.orgNo ratings yet

- 2020 Chrysler Voyager LXi 3.6LDocument134 pages2020 Chrysler Voyager LXi 3.6LGerardo MejiasNo ratings yet

- IBM x3850X5 x3950X5 HX5 OverviewDocument118 pagesIBM x3850X5 x3950X5 HX5 OverviewTruong Anh VuNo ratings yet

- Bamboo ArchitectureDocument48 pagesBamboo ArchitectureAnees Abdulla100% (6)

- Steel Connection MethodsDocument18 pagesSteel Connection MethodsVishnuVardhan100% (1)

- Gas Engine Technical Data: Load 100% 75% 50% Rating and EfficiencyDocument3 pagesGas Engine Technical Data: Load 100% 75% 50% Rating and EfficiencyAM76No ratings yet

- V2.0.1 Windows Server and SQL Server Migration Audit ChecklistDocument27 pagesV2.0.1 Windows Server and SQL Server Migration Audit ChecklistFarisuddinFNo ratings yet