Professional Documents

Culture Documents

2019 QP Section C - Solution

Uploaded by

Samarth Nikkam0 ratings0% found this document useful (0 votes)

1 views2 pagesThe cash flow statement summarizes the company's cash flows from operating, investing and financing activities for the year ended 31 March 2017. It shows a net cash outflow from operating activities of Rs. 78,000, a net cash outflow from investing activities of Rs. 48,000 primarily due to purchase of land, building and machinery, and a net cash outflow from financing activities of Rs. 42,000 mainly due to loan repayments and drawings. The net decrease in cash and cash equivalents for the year was Rs. 12,000.

Original Description:

Ca QP participating configured official 8txitdguc

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe cash flow statement summarizes the company's cash flows from operating, investing and financing activities for the year ended 31 March 2017. It shows a net cash outflow from operating activities of Rs. 78,000, a net cash outflow from investing activities of Rs. 48,000 primarily due to purchase of land, building and machinery, and a net cash outflow from financing activities of Rs. 42,000 mainly due to loan repayments and drawings. The net decrease in cash and cash equivalents for the year was Rs. 12,000.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views2 pages2019 QP Section C - Solution

Uploaded by

Samarth NikkamThe cash flow statement summarizes the company's cash flows from operating, investing and financing activities for the year ended 31 March 2017. It shows a net cash outflow from operating activities of Rs. 78,000, a net cash outflow from investing activities of Rs. 48,000 primarily due to purchase of land, building and machinery, and a net cash outflow from financing activities of Rs. 42,000 mainly due to loan repayments and drawings. The net decrease in cash and cash equivalents for the year was Rs. 12,000.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

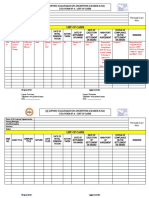

2019 Question paper – Section C – Solution

IN THE BOOKS OF RAMACHANDRA & SONS

Cash flow statement for the year ended 31.03.2017

Particulars Rs. Rs.

a) Cash flows from operating activities

Net profit after tax 55000

Add: Nil

Net profit before tax 55000

Add: Non-cash and non-operating expenses and losses:

Depreciation on machinery 19000

Loss on sale of machinery 10000

Cash flows before working capital changes 84000

Add: Decrease in stock 10000

Increase in creditors 4000

Less: Increase in debtors (20000)

Cash generated from operations /

Net cash flows from operating activities 78000

b) Cash flows from investing activities

Add: Sale of machinery 6000

Less: Purchase of land (15000)

Purchase of building (29000)

Purchase of machinery (10000)

Net cash flows from investing activities (48000)

c) Cash flows from financing activities

Add: Bank loan raised 10000

Less: Repayment of Mrs. Chitra’s loan (25000)

Drawings made by the proprietor (27000)

Net cash flows from financing activities (42000)

Net decrease in cash and cash equivalents (12000)

(a + b + c)

Add: Opening balance of cash and cash equivalents 20000

Closing balance of cash and cash 8000

equivalents

MACHINERY A/C

To balance b/d 90000 By Cash / bank a/c 6000

To Provision for depreciation 35000 By Provision for depreciation a/c 4000

a/c (On machinery sold)

To Cash / Bank a/c 10000 By P & L a/c 10000

(Balancing figure – Purchase) (Loss on sale)

By Provision for depreciation a/c 50000

By balance c/d 65000

135000 135000

PROVISION FOR DEPRECIATION ON MACHINERY A/C

To Machinery a/c 4000 By Machinery a/c 35000

By P & L a/c 19000

To Machinery a/c 50000 (Balancing figure - Current year’s

depreciation charged)

54000 54000

CAPITAL A/C

To Drawings a/c 27000 By balance b/d 135000

(Balancing figure) By P & L a/c (Net profit after tax 55000

To balance c/d 163000 for the current year)

190000 190000

Working note 1: Calculation of profit or loss on sale of machinery

Cost of machinery sold 20000

Less: Accumulated depreciation up to the date of sale (4000)

Book value 16000

Less: Sale value (6000)

Loss on sale 10000

You might also like

- Trading and Profit & Loss Account For The Year Ended 31st March 2020 Debit Amount Credit AmountDocument7 pagesTrading and Profit & Loss Account For The Year Ended 31st March 2020 Debit Amount Credit AmountNikhil RajNo ratings yet

- The Balance Sheet of Bharat LTD As at 31st MarchDocument4 pagesThe Balance Sheet of Bharat LTD As at 31st Marchsunny_masand1990No ratings yet

- HO and Branches Combined StatmentDocument5 pagesHO and Branches Combined Statmentmmh771984No ratings yet

- Amount (RS) Amount (RS) Cash Flow From Operating Activities Add: Non-Operating ItemsDocument8 pagesAmount (RS) Amount (RS) Cash Flow From Operating Activities Add: Non-Operating ItemsSanjana MouliNo ratings yet

- 001 Trading and PL AccountDocument15 pages001 Trading and PL Accountmrigang shekharNo ratings yet

- Common Size Statement Analysis PDF Notes 1Document10 pagesCommon Size Statement Analysis PDF Notes 124.7upskill Lakshmi V0% (1)

- Weller Company Cash FlowDocument3 pagesWeller Company Cash Flowsuske.uchiha2000No ratings yet

- Trading and Profit & Loss Account For The Year Ended 31st March 2020 Debit Amount Credit AmountDocument6 pagesTrading and Profit & Loss Account For The Year Ended 31st March 2020 Debit Amount Credit AmountNikhil RajNo ratings yet

- Bharat ChemicalDocument6 pagesBharat ChemicalgauravpalgarimapalNo ratings yet

- Liabilities 2010 2011 Assets 2010 2011Document27 pagesLiabilities 2010 2011 Assets 2010 2011afreen affuNo ratings yet

- Exercises On Cash Flow Statement: Additional Information: Particulars 2008 2009Document5 pagesExercises On Cash Flow Statement: Additional Information: Particulars 2008 2009Aanchal MahajanNo ratings yet

- Operating Profit Before WC Change 510000: Cash Flow Statement Cash Flow StatementDocument2 pagesOperating Profit Before WC Change 510000: Cash Flow Statement Cash Flow StatementDev Kamal ChauhanNo ratings yet

- Remidial Assignment B.tech - Bbs n'22Document9 pagesRemidial Assignment B.tech - Bbs n'22Ramagopal VemuriNo ratings yet

- Weller Company Cash FlowDocument3 pagesWeller Company Cash FlowMd. Omar Sakib HossainNo ratings yet

- Trading and Profit & Loss Account For The Year Ended 31st March 2020 Debit Amount Credit AmountDocument8 pagesTrading and Profit & Loss Account For The Year Ended 31st March 2020 Debit Amount Credit AmountNikhil RajNo ratings yet

- 0 20211022172312preparing PL Account Balance Sheet Cash Flow 3Document6 pages0 20211022172312preparing PL Account Balance Sheet Cash Flow 3VISHAL PATILNo ratings yet

- Cash Flow Statement 1Document2 pagesCash Flow Statement 14010 BonifaceNo ratings yet

- Corporate FinanceDocument3 pagesCorporate FinanceAdrien PortemontNo ratings yet

- Balance Sheet Liabilities 2004 2005 Capital 120000 150000 Sundry Creditors 37000 25000 Bills Payable 15000 17000 P&L A/c 60000 69000 232000 261000Document17 pagesBalance Sheet Liabilities 2004 2005 Capital 120000 150000 Sundry Creditors 37000 25000 Bills Payable 15000 17000 P&L A/c 60000 69000 232000 261000kumaranil_1983No ratings yet

- Cash Flow StatementDocument4 pagesCash Flow StatementNarayan DhunganaNo ratings yet

- Solution:: Explanation TK TKDocument5 pagesSolution:: Explanation TK TKসানজিদা সাঈদNo ratings yet

- Cash Flow Statements IIDocument7 pagesCash Flow Statements IIGood VibesNo ratings yet

- SP Uni CA 2013Document3 pagesSP Uni CA 2013mahendrabpatelNo ratings yet

- Cash Flow Statement ProblemDocument2 pagesCash Flow Statement Problemapi-3842194100% (2)

- Questions On Cash Flow StatementDocument5 pagesQuestions On Cash Flow StatementFaizSheikhNo ratings yet

- Botanical Garden Business PlanDocument17 pagesBotanical Garden Business Planabhishek.print100% (2)

- IndirectDocument6 pagesIndirectAdilagNo ratings yet

- Cash Flow StatementDocument10 pagesCash Flow StatementABOOBAKKERNo ratings yet

- Fund Flow StatementDocument41 pagesFund Flow StatementMahima SinghNo ratings yet

- Trading and Profit and Loss Account Format: DR CRDocument12 pagesTrading and Profit and Loss Account Format: DR CRHarshini AkilandanNo ratings yet

- FA With AdjustmentsDocument14 pagesFA With AdjustmentsHarshini AkilandanNo ratings yet

- Acc Final 2Document15 pagesAcc Final 2Tanvir OnifNo ratings yet

- Madaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Document17 pagesMadaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Maryjoy KilonzoNo ratings yet

- Financial Decision Making: Module Code: UMADFJ-15-MDocument9 pagesFinancial Decision Making: Module Code: UMADFJ-15-MFaraz BakhshNo ratings yet

- Budgetary ControlDocument14 pagesBudgetary ControlCool BuddyNo ratings yet

- Conversion of Firm To Company QuesDocument28 pagesConversion of Firm To Company QuesSakshi KoolwalNo ratings yet

- Cash Flow Statement: Performa and ProblemsDocument52 pagesCash Flow Statement: Performa and Problems727822TPMB005 ARAVINTHAN.SNo ratings yet

- Profit Is Rs 50000 After Providing FR Depreciation 20000: Add: DivDocument3 pagesProfit Is Rs 50000 After Providing FR Depreciation 20000: Add: DivOp BoyNo ratings yet

- Presentation1 ReshmaDocument26 pagesPresentation1 ReshmaJOE NOBLE 2020519No ratings yet

- Alpha Manufacturing Ltd. (AML) - Cash Flow: Nrti Poa-Quiz 2 Time: 40 MinutesDocument4 pagesAlpha Manufacturing Ltd. (AML) - Cash Flow: Nrti Poa-Quiz 2 Time: 40 MinutesDeepak KumarNo ratings yet

- Sujan Sir Assignment (MBA)Document18 pagesSujan Sir Assignment (MBA)Habibur RahmanNo ratings yet

- AccountingDocument16 pagesAccountingSheridan AcosmistNo ratings yet

- Cash FlowDocument8 pagesCash Flowswapnil choubeyNo ratings yet

- Trading and Profit and Loss Account Format: DR CRDocument14 pagesTrading and Profit and Loss Account Format: DR CRHarshini AkilandanNo ratings yet

- Cash Flow QN 3Document4 pagesCash Flow QN 3Takudzwa LanceNo ratings yet

- Business ValuationDocument6 pagesBusiness ValuationlenoraNo ratings yet

- Financial AccountingDocument9 pagesFinancial AccountingMayuri More-KadamNo ratings yet

- Business Plan of Event Management: Submitted To: Miss Gurpreet KaurDocument21 pagesBusiness Plan of Event Management: Submitted To: Miss Gurpreet KaurPrashantNo ratings yet

- Trial BalanceDocument17 pagesTrial BalanceIsha ParwaniNo ratings yet

- Luqman Auto Part Company Has Authorized Capital of Rs. 1000000 of Rs. 100 Each. The Following Trial Balance IsDocument5 pagesLuqman Auto Part Company Has Authorized Capital of Rs. 1000000 of Rs. 100 Each. The Following Trial Balance IsQasim KhokharNo ratings yet

- Problems On Ratio AnalysisDocument7 pagesProblems On Ratio AnalysisVinay H V MBA100% (1)

- Abc1 - FinalDocument7 pagesAbc1 - FinalSakshi ShardaNo ratings yet

- Accounting RatiosDocument7 pagesAccounting Ratios27h4fbvsy8No ratings yet

- Ultimate Book of Accountancy: Brilliant ProblemsDocument9 pagesUltimate Book of Accountancy: Brilliant ProblemsPramod VasudevNo ratings yet

- ExpensesDocument3 pagesExpensesneemthas761No ratings yet

- 12 Accounts Imp ch10 PDFDocument14 pages12 Accounts Imp ch10 PDFmukesh kumarNo ratings yet

- BBS - 1st - Financial Accounting and AnalysisDocument46 pagesBBS - 1st - Financial Accounting and AnalysisJALDIMAINo ratings yet

- Assingnment 7 SolutionDocument4 pagesAssingnment 7 Solutionshaza jocarlosNo ratings yet

- Vogue Co. JournalDocument8 pagesVogue Co. JournalParvathaneni KarishmaNo ratings yet

- Bdo PresentationDocument28 pagesBdo PresentationTen Balestramon100% (1)

- Cost Theory and Estimation PDFDocument14 pagesCost Theory and Estimation PDFAngie BobierNo ratings yet

- Domino's Pizza:: Writing The Recipe For Digital MasteryDocument12 pagesDomino's Pizza:: Writing The Recipe For Digital MasteryHarsh Vardhan AgrawalNo ratings yet

- Costing FinalDocument55 pagesCosting FinalDr Sachin Chitnis M O UPHC AiroliNo ratings yet

- Peaklife: Indexed Universal Life InsuranceDocument31 pagesPeaklife: Indexed Universal Life InsuranceJoseAliceaNo ratings yet

- ACCO TestDocument6 pagesACCO TestvrindadevigtmNo ratings yet

- Dairy Industry inDocument2 pagesDairy Industry inHasaan FarooqNo ratings yet

- Radio One - For ClassDocument26 pagesRadio One - For ClassRicha ChauhanNo ratings yet

- Mike's Loan Amortization & Early Payoff CalculatorDocument8 pagesMike's Loan Amortization & Early Payoff CalculatorLuis HernandezNo ratings yet

- Customer Preference Towards Traditional and Ulip Products With Respect To Shri Ram Life InsuranceDocument7 pagesCustomer Preference Towards Traditional and Ulip Products With Respect To Shri Ram Life InsuranceAbhay kumarNo ratings yet

- What Is Tax Residency CertificateDocument2 pagesWhat Is Tax Residency CertificateRahul SNo ratings yet

- OverHead ClassificationDocument17 pagesOverHead ClassificationKookie12No ratings yet

- TFA COMPILED (AutoRecovered)Document147 pagesTFA COMPILED (AutoRecovered)Asi Cas JavNo ratings yet

- Changing Consumer Behaviour Post Covid-19Document19 pagesChanging Consumer Behaviour Post Covid-19040V.SRIVATSANNo ratings yet

- Financial Management NotesDocument6 pagesFinancial Management NotesRAVI SONKARNo ratings yet

- Jollibee Foods CorporationDocument6 pagesJollibee Foods CorporationJudi CruzNo ratings yet

- 203A Eng 07 51Document4 pages203A Eng 07 51farithNo ratings yet

- CaseDocument2 pagesCaseAman Dheer KapoorNo ratings yet

- Modified Internal Rate of ReturnDocument5 pagesModified Internal Rate of ReturnGaluh DewandaruNo ratings yet

- Aung Zaw Oo (MBF - 3)Document57 pagesAung Zaw Oo (MBF - 3)delfierromeijiNo ratings yet

- Chapter2 AdvocatesDocument40 pagesChapter2 Advocatesaymane dibNo ratings yet

- Climate Tech TakeawaysDocument14 pagesClimate Tech TakeawaysShipra RajputNo ratings yet

- FOREX Part1Document1 pageFOREX Part1lender kent alicanteNo ratings yet

- Afrm Exam NotesDocument8 pagesAfrm Exam NotesSoumiya MuthurajaNo ratings yet

- Priyanka MiniprojectDocument56 pagesPriyanka Miniprojectkrishnarao kalidasuNo ratings yet

- Mphasis Ltd. Equity Research Report: Company InformationDocument21 pagesMphasis Ltd. Equity Research Report: Company InformationYashvi ShahNo ratings yet

- 9.-Jordi Gali - El Modelo Neokeynesiano)Document62 pages9.-Jordi Gali - El Modelo Neokeynesiano)VÍCTOR ALONSO ZAMBRANO ORÉNo ratings yet

- 5 TH Sem FI&M2023 BCom NEPDocument3 pages5 TH Sem FI&M2023 BCom NEPgurulinguNo ratings yet

- Saving FunctionDocument3 pagesSaving FunctionAsterisk SoulsNo ratings yet

- FORM 7 A List of CasesDocument2 pagesFORM 7 A List of CasesGianNo ratings yet