Professional Documents

Culture Documents

Personal Tax Planning 2020

Personal Tax Planning 2020

Uploaded by

Faiz RaffOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Personal Tax Planning 2020

Personal Tax Planning 2020

Uploaded by

Faiz RaffCopyright:

Available Formats

THINGS TO BE DONE BEFORE

31 DECEMBER 2020

Matrix Taxation Agency Sdn Bhd

TAX RELIEF Page: 3 – 8

1

2 TAX DEDUCTION Page: 9 – 10

HIGHLIGHTS

3 TAX REBATE Page: 11

4

TAX EXEMPTION Page: 12 – 13

2 Matrix Taxation Agency Sdn Bhd PERSONAL TAX PLANNING

TAX RELIEF - PARENTHOOD

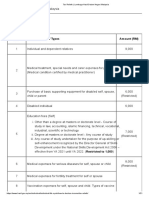

No Tax Relief Item Amount (RM) Remark

1 Breastfeeding equipment 1,000 (R) - Child aged ≤ 2 years

- Claimed once every 2 years

- Qualified: breast pump kit & ice

pack, breast milk collection &

storage equipment, cooler set /

cooler bag

2 Net deposit in SSPN 8,000 (R) - Net deposit for 2020

Increment of Tax Relief (Penjana) - Child aged ≤ 6 years

Child care relief (current: 2,000) - Claimable by either parent

3 3,000 (R)

- Registered child care centre /

kindergarten

* (R) : Restricted

3 Matrix Taxation Agency Sdn Bhd PERSONAL TAX PLANNING

TAX RELIEF - EDUCATION

No Tax Relief Item Amount (RM)

Education fees – self:

a) Other than master’s degree or doctorates Course of

study in law, accounting, Islamic financial, technical

1 7,000 (R)

vocational, industrial, scientific or technology

b) Master’s degree or doctorates

Any course of study

* (R) : Restricted

4 Matrix Taxation Agency Sdn Bhd PERSONAL TAX PLANNING

TAX RELIEF - MEDICAL EXPENSES

No Tax Relief Item Amount (RM) Remark

1 Self, spouse & children 6,000 (R) - Serious diseases

- Include cost of fertility

treatment for self / spouse

2 Full complete health screening 500 (R)

** Total deduction allowable for items (1) & (2) is restricted to RM6,000 * (R) : Restricted

5 Matrix Taxation Agency Sdn Bhd PERSONAL TAX PLANNING

TAX RELIEF - LIFESTYLE

No Tax Relief Item Amount (RM) Remark

Purchase of reading materials

Personal computer, smartphone / tablet

1 Sports equipment 2,500 (R)

Internet subscription

Gym membership

Special Tax Relief (Penjana)

2

Personal computer, smartphone / tablet 2,500 (R) - Purchase within 1/6/2020 - 31/12/2020

New Tax Relief (Penjana) - Accommodation fees paid at premises

registered with the Ministry of

3 Tax relief for domestic travelling 1,000 (R) Tourism, Arts and Culture Malaysia

expenses - Entrance fees to tourist attractions

- Incurred within 1/3/2020 - 31/12/2021

* (R) : Restricted

6 Matrix Taxation Agency Sdn Bhd PERSONAL TAX PLANNING

TAX RELIEF - INSURANCE & INVESTMENT

No Tax Relief Item Amount (RM)

Life insurance :

1 a) Working at Public Sector 7,000 (R)

b) Working at Private Sector 3,000 (R)

2 Education & medical insurance 3,000 (R)

3 Private retirement scheme (PRS) 3,000 (R)

* (R) : Restricted

7 Matrix Taxation Agency Sdn Bhd PERSONAL TAX PLANNING

TAX RELIEF - DISABLED PERSON

No Tax Relief Item Amount (RM)

1 Equipment for disabled self, spouse, child / parent 5,000 (R)

2 Disabled individual 6,000

3 Disabled husband / wife 3,500

Disabled child (unmarried) 6,000

4 Additional relief for disabled child in higher education

8,000

(18+ & unmarried)

* (R) : Restricted

8 Matrix Taxation Agency Sdn Bhd PERSONAL TAX PLANNING

TAX DEDUCTION – APPROVED DONATIONS

No Type of Donation Limit Remark

Approved institutions /

1

organisations / funds Up to 10% of

2 Approved sports activity aggregate income

Any approved projects of

3 - Cash / benefit in kind

national interest

9 Matrix Taxation Agency Sdn Bhd TAX DEDUCTIONS HIGHLIGHTS

TAX DEDUCTION – OTHER APPROVED DONATIONS

No Type of Donation Limit Remark

Government / state government /

1

local authority

Artefacts, manuscripts or

2

paintings

3 Libraries Value of gift unless - ≤ RM 20,000

otherwise stated

Disability facilities in public

4 - Cash / benefit in kind

places

5 Approved healthcare facilities - Cash / medical equipment

Paintings to the National Art

6

Gallery / state art galleries

10 Matrix Taxation Agency Sdn Bhd TAX DEDUCTIONS HIGHLIGHTS

TAX REBATE – ZAKAT / FITRAH

No Type of Rebate Limit (RM) Remark

1 Zakat / Fitrah Amount paid - Paid in calendar year

11 Matrix Taxation Agency Sdn Bhd TAX REBATES HIGHLIGHTS

TAX EXEMPTION - GIFTS FROM EMPLOYER

No Exemption Item Exemption (RM) Remark

- Advisable to have written policy stating the

Receiving gifts of

provision on facilitating the work from home

1 handphones, notebooks & 5,000 (R)

arrangement

tablets - Effective 1/7/2020 – 31/12/2020

12 Matrix Taxation Agency Sdn Bhd PERSONAL TAX PLANNING

RPGT EXEMPTION – DISPOSAL OF RESIDENTIAL HOMES

No Exemption Item Remark

- Disposed within 1/6/2020 - 31/12/2021

Real Property Gains Tax (RPGT) exemption

1 - Limited to 3 units of residential homes

for disposal of residential homes by an individual

13 Matrix Taxation Agency Sdn Bhd PERSONAL TAX PLANNING

THANK YOU

Email us : MTAX@CPAGROUP.COM.MY

Website : cpagroup.com.my

PERSONAL TAX PLANNING

You might also like

- Eaton Orbital Motors SteeringDocument20 pagesEaton Orbital Motors SteeringIslam Attia0% (1)

- Investment Declaration Form - 2022-2023Document3 pagesInvestment Declaration Form - 2022-2023Bharathi KNo ratings yet

- M012-Consumer Mathematics (Taxation)Document5 pagesM012-Consumer Mathematics (Taxation)Tan Jun YouNo ratings yet

- Tax Compliance and Risks Management Overview 15 Feb 2022 (A)Document27 pagesTax Compliance and Risks Management Overview 15 Feb 2022 (A)alex.royer94.arNo ratings yet

- Form TP3 2022 (English Translation)Document1 pageForm TP3 2022 (English Translation)abu sufianNo ratings yet

- PBL (Mathematics) - Income Tax Assessment-Poah Zhi XianDocument14 pagesPBL (Mathematics) - Income Tax Assessment-Poah Zhi XianZhi Xian PoahNo ratings yet

- Investment Declaration FY 22-23Document2 pagesInvestment Declaration FY 22-23Ahfaz ShaikhNo ratings yet

- LHDN Tax Relief 2021 GuideDocument21 pagesLHDN Tax Relief 2021 GuideJeffrey YeeNo ratings yet

- Example Calculation For Chapter Tax PlanningDocument5 pagesExample Calculation For Chapter Tax PlanningSiti Nur Aisya Bt GhazaliNo ratings yet

- TaxPlanning06 07Document17 pagesTaxPlanning06 07Lathif PashaNo ratings yet

- Income Tax Declarations Form (SMCI) FY 2022 2023Document1 pageIncome Tax Declarations Form (SMCI) FY 2022 2023Nitesh KumarNo ratings yet

- Kunci NL PD - SejahteraDocument7 pagesKunci NL PD - SejahteraWidya Putri DamayantiNo ratings yet

- Declaration Form (23-24) - NMPLDocument1 pageDeclaration Form (23-24) - NMPLRamamoorthy RamuNo ratings yet

- Soumyaranjan RoutrayDocument3 pagesSoumyaranjan RoutraySounmya LikuNo ratings yet

- D COMPUTATION OF TOTAL INCOME (TAX) LatestDocument6 pagesD COMPUTATION OF TOTAL INCOME (TAX) LatestOmkar NakasheNo ratings yet

- Tax Reliefs For Year of Assessment 2022 - 230227 - 175314Document6 pagesTax Reliefs For Year of Assessment 2022 - 230227 - 175314Sinex TechyNo ratings yet

- Bir Form 2307Document3 pagesBir Form 2307Benjie R. RefilNo ratings yet

- (Company Name) : Income Tax Declaration Form For Fy 2022-23Document3 pages(Company Name) : Income Tax Declaration Form For Fy 2022-23Jude Philip WilfredNo ratings yet

- Investment Declaration Form-2Document2 pagesInvestment Declaration Form-2Pramod KumarNo ratings yet

- Tax Decalaration 2023-24Document3 pagesTax Decalaration 2023-24thetrilight2023No ratings yet

- Atx Acca Grand RevisionDocument35 pagesAtx Acca Grand Revisioncontact.xinanneNo ratings yet

- Birla Premium Paid Certificate 2020Document2 pagesBirla Premium Paid Certificate 2020SindhuNo ratings yet

- SOA FOR REGULAR PRIVATE PLAN OldDocument1 pageSOA FOR REGULAR PRIVATE PLAN OldRodrigo AbanNo ratings yet

- DT Group ProjectDocument17 pagesDT Group ProjectAnusha GoelNo ratings yet

- Presentation 1Document16 pagesPresentation 1RituNo ratings yet

- Summary of Budget 2022Document27 pagesSummary of Budget 2022Rozana Abdul GhafarNo ratings yet

- Employee Tax Declaration - FY 22-23-DBMPDocument3 pagesEmployee Tax Declaration - FY 22-23-DBMPthetrilight2023No ratings yet

- Bernas Karla Pauline 11 Bonifacio FABM1 Q4Document45 pagesBernas Karla Pauline 11 Bonifacio FABM1 Q4Karla pauline BernasNo ratings yet

- 03 NP Chap 03 Income Exempt From Tax Additional Questions 2022Document6 pages03 NP Chap 03 Income Exempt From Tax Additional Questions 2022xgnz1630No ratings yet

- 2022TaxReturn StarnesDocument17 pages2022TaxReturn StarnesjpneebNo ratings yet

- Investment Declaration Form - FY 2022-23Document7 pagesInvestment Declaration Form - FY 2022-23varaprasadNo ratings yet

- Atria Institute of TechnologyDocument3 pagesAtria Institute of TechnologykiranNo ratings yet

- Union Budget 2019: An OverviewDocument8 pagesUnion Budget 2019: An OverviewReuben SalisNo ratings yet

- Special Deductions ReviewerDocument4 pagesSpecial Deductions ReviewerPunkkaroNo ratings yet

- Adobe Scan Nov 27, 2023-CompressedDocument7 pagesAdobe Scan Nov 27, 2023-Compressedswainsachidananda1950No ratings yet

- FABM 2 Module 9 Income Tax DueDocument11 pagesFABM 2 Module 9 Income Tax DueJOHN PAUL LAGAO100% (1)

- Economy of PakistanDocument24 pagesEconomy of PakistanSajjad AfridiNo ratings yet

- Form 11Document44 pagesForm 11gilbert.belciugNo ratings yet

- SME Seminar 7 March Afternoon SlidesDocument83 pagesSME Seminar 7 March Afternoon Slidesallenyap233No ratings yet

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- Solution Tax467 - Jul 2017Document7 pagesSolution Tax467 - Jul 2017Putri Nurin Hasnida HassanNo ratings yet

- Question One's Answer: MR Nass Tax Computation For The Year of Assessment 2008Document6 pagesQuestion One's Answer: MR Nass Tax Computation For The Year of Assessment 2008Smith AkanchawaNo ratings yet

- Chapter 5 DDR A231Document14 pagesChapter 5 DDR A231Patricia TangNo ratings yet

- Economy of Pakistan 2012 13Document24 pagesEconomy of Pakistan 2012 13Zeeshan AshrafNo ratings yet

- Economy of PakistanDocument24 pagesEconomy of PakistanamberNo ratings yet

- GET - Indicative Compensation Details - B.TechsDocument1 pageGET - Indicative Compensation Details - B.Techskush 9031No ratings yet

- Bifurcation of Salary ArrearsDocument3 pagesBifurcation of Salary ArrearsSrikant SheelNo ratings yet

- Investment POI Guidance Notes (FY 23-24)Document33 pagesInvestment POI Guidance Notes (FY 23-24)Puneet GuptaNo ratings yet

- Income TaxDocument14 pagesIncome Taxanjuu2806No ratings yet

- Income Tax Calculator 2018-19Document15 pagesIncome Tax Calculator 2018-19Raju Ranjan SinghNo ratings yet

- Bos 48771 Finalp 7Document24 pagesBos 48771 Finalp 7Mahaveer DhelariyaNo ratings yet

- Financial Planning Case 22 - 10 - 07Document9 pagesFinancial Planning Case 22 - 10 - 07888 BiliyardsNo ratings yet

- ACC4002H Taxation III 2023 April Test Suggested SolutionDocument3 pagesACC4002H Taxation III 2023 April Test Suggested SolutionJessica albaNo ratings yet

- Rochak Agrawal-Offer PDFDocument4 pagesRochak Agrawal-Offer PDFrochak agrawalNo ratings yet

- PracticeDocument17 pagesPracticeSmarty ShivamNo ratings yet

- Investment PlanDocument1 pageInvestment PlanNitin AgarwalNo ratings yet

- Binder 1Document2 pagesBinder 1PARAMJEETSINGHNo ratings yet

- 9Document2 pages9Le Lhiin CariñoNo ratings yet

- Employees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022Document3 pagesEmployees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022neeta rautelaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 4 Elements of CGDocument6 pages4 Elements of CGFaiz RaffNo ratings yet

- 3 The Core Principles of CGDocument16 pages3 The Core Principles of CGFaiz RaffNo ratings yet

- 2 CG DevelopmentsDocument15 pages2 CG DevelopmentsFaiz RaffNo ratings yet

- 1 Introduction To CGDocument12 pages1 Introduction To CGFaiz RaffNo ratings yet

- 0 What IsDocument14 pages0 What IsFaiz RaffNo ratings yet

- Spectrum Fusion Course Level 2 Quiz - Attempt ReviewDocument26 pagesSpectrum Fusion Course Level 2 Quiz - Attempt ReviewThang NguyenNo ratings yet

- Poverty CSSDocument7 pagesPoverty CSSsohailbabarNo ratings yet

- Learner Centered Lesson Plan PPT FinalDocument53 pagesLearner Centered Lesson Plan PPT Finalrodriguezroselle12No ratings yet

- CTR Ball JointDocument19 pagesCTR Ball JointTan JaiNo ratings yet

- TVL EIM11 Q1 Mod1 Prepare Electronic and Hydraulic Tools v3Document72 pagesTVL EIM11 Q1 Mod1 Prepare Electronic and Hydraulic Tools v3Ampolitoz100% (2)

- Reference:-MACE Material: Prepared By: - Nitesh PandeyDocument27 pagesReference:-MACE Material: Prepared By: - Nitesh PandeyDilawar KumarNo ratings yet

- 08Document3 pages08Irfan SaleemNo ratings yet

- Ams 2000Document262 pagesAms 2000Vương NhânNo ratings yet

- Pip PDFDocument5 pagesPip PDFVitan BogdanNo ratings yet

- Liqui Moly Product CatalogDocument144 pagesLiqui Moly Product Catalognod69assNo ratings yet

- Unit 1 WadDocument30 pagesUnit 1 WadWe TogetherNo ratings yet

- CR User Station - Technical DocumentationDocument33 pagesCR User Station - Technical DocumentationfelipeNo ratings yet

- Geutebruck H2 Promo PDFDocument6 pagesGeutebruck H2 Promo PDFehott23No ratings yet

- Underline The Adverbs in The Following Sentences and State Their Kind. (G CH Chân Các TR NG T Trong Câu)Document2 pagesUnderline The Adverbs in The Following Sentences and State Their Kind. (G CH Chân Các TR NG T Trong Câu)Nguyễn QuỳnhNo ratings yet

- IT144 ICT WorkshopDocument4 pagesIT144 ICT WorkshopDeep ShakhiyaNo ratings yet

- Egg Drop ExperimentDocument4 pagesEgg Drop ExperimentalyannaxysabelleNo ratings yet

- BBC Sky at Night (2017-09)Document110 pagesBBC Sky at Night (2017-09)georgetacaprarescuNo ratings yet

- Measuring Cycles SinumerikDocument276 pagesMeasuring Cycles SinumerikmarianhainarosieNo ratings yet

- DBMS-2 QuestionsDocument3 pagesDBMS-2 QuestionsXoroNo ratings yet

- Case STUDY O.BDocument7 pagesCase STUDY O.BLucas0% (2)

- CIVPRO: Asia's Emerging Dragon V DOTC Republic V CADocument3 pagesCIVPRO: Asia's Emerging Dragon V DOTC Republic V CAM50% (2)

- 303chapter 1. Foundation of AccountingDocument43 pages303chapter 1. Foundation of AccountingCherry ManandharNo ratings yet

- Link Engineering Books - Libros de IngenieriaDocument21 pagesLink Engineering Books - Libros de IngenieriaBazan Antequera Ruddy0% (1)

- Academic Writing Book IIDocument148 pagesAcademic Writing Book IIAshley RaynoldNo ratings yet

- Disbursement VoucherDocument1 pageDisbursement VoucherDebbie Ann ArdenioNo ratings yet

- Student Details Report Report Date:-Wednesday, October 19, 2022 Region Name: HYDERABAD School Name: KV AFS Begumpet Shift: 1Document29 pagesStudent Details Report Report Date:-Wednesday, October 19, 2022 Region Name: HYDERABAD School Name: KV AFS Begumpet Shift: 1babbi kumariNo ratings yet

- Explicit Lesson Plan: Teacher: Isah Marie George R. Paglinawan IDocument4 pagesExplicit Lesson Plan: Teacher: Isah Marie George R. Paglinawan IBanjo De Los SantosNo ratings yet

- BVPDocument23 pagesBVPamyounisNo ratings yet

- Etiquetas Markup v93Document5 pagesEtiquetas Markup v93Andrea Katherine Ceballos PiambaNo ratings yet