Professional Documents

Culture Documents

Declaration Form (23-24) - NMPL

Uploaded by

Ramamoorthy RamuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Declaration Form (23-24) - NMPL

Uploaded by

Ramamoorthy RamuCopyright:

Available Formats

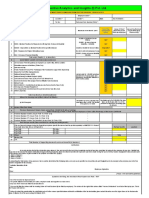

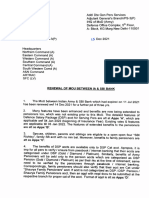

NEEL METAL PRODUCTS LIMITED

INCOME TAX SAVINGS DECLARATION

(F.Y. 23-24)

Employee Name ________________________________________ Emp. Code : _____________

Plant Location ________________________________________ Designation : _____________

PAN (Capital letters only) ________________________________________ DOJ : _____________

Residential Address ________________________________________ Deptt. : _____________

S. S.

PARTICULARS AMOUNT PARTICULARS AMOUNT

No. No.

A. House Rent Paid (Per Month) * B. Section 24-Interest Paid on Home Loan : **

- City Name : - City Name :

- Land Lord PAN : - Financer Name :

- Land Lord Name : - Date of Possession :

C. Section 80C

1 LIC 9 Principal paid for Home Loan

2 PPF 10 ELSS

3 NSC 11 ULIP

4 NSS 12 Infrastructure Bonds

5 Tuition Fees (Max. 2 Children) 13 Post Office term deposit 5 Years

6 Pension Fund Contribution 14 Bank Fixed Deposit for 5 Years

7 Sukanya Samriddhi Yojana 15 Mutual Fund (Infrastructure)

8 Stamp duty and registration fee 16 Equity shares or debentures

D. Section 80D

Medical Ins. Premium (Non-Sr. Citizen), Self, Medical Ins. Premium (Paid by Sr. Citizen)

1 4

Spouse & Children (Max. 25,000) (Max. 50,000)

Medical Ins. Premium (behalf of parents non- Medical Ins. Premium (behalf of parents Sr.

2 5

Sr. Ctz) (Max. 25,000) Citizen) (Max 50000)

Preventive Health Check up (Parents) (Max.

3 Preventive Health Check up (Self) (Max. 5,000) 6

5,000)

E. OTHERS

80EEB - Electric Vehicle Interest deduction 80CCD(1B) - National Pension Scheme (Max

1 4

(Max. 1,50,000) 50,000)

2 80E - Education Loan Interest 5 80U - For person with a disability

80DD - Medical treatment of dependent

3

person with disability

* Document required for HRA (without below details HRA treated maximum Rs. 1 lacs yearly)

1. Up to Rs. 8,300/- PM : Rent Receipt. 2. Up to Rs. 10,000/- PM : Rent Receipt, PAN of Land Lord.

4. Above Rs. 50,000/- PM : Rent Receipt, PAN of Land Lord, Rent Agreement copy,

3. Up to Rs. 50,000/- PM : Rent Receipt, PAN of Land Lord, Rent Agreement copy.

TDS deduct Proof / Certificate.

(if any one want change HRA amount in mid financial year, please inform same month, back date change not acceptable.)

** Without home possession not eligible for this rebate. / PF deduction automatically consider, no need to fill in declaration form

I hereby solemnly declare that the entire particular given above are true and correct. I shall be bound to get deduction Salary and /or to pay Tax with interest, due to change or shortfall in

Investment plan or due to change in my Income or dues to short recovery of Monthly tax or on account of abnormal reasons.

I understand all above saving documents related (23-24) will be submit by 07th Feb., 2024, if I am unable to submit the self-attested saving proofs till 07th Feb., 2024, than I authorise due tax

may be deduct from my salary for the month of Feb. & March 2024 & other receiving payable to me.

Date : ____/____/2023 Contact No. : ___________________________

Place : ___________ Mail ID __________________________________@jbmgroup.com Signature of Employee

You might also like

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Employee Tax Declaration - FY 22-23-DBMPDocument3 pagesEmployee Tax Declaration - FY 22-23-DBMPthetrilight2023No ratings yet

- Investment Declaration FY 22-23Document2 pagesInvestment Declaration FY 22-23Ahfaz ShaikhNo ratings yet

- Final-Investment Declaration Form FY 19 - 20Document12 pagesFinal-Investment Declaration Form FY 19 - 20Bhupender RawatNo ratings yet

- Investment Declaration Form - 2021-22Document3 pagesInvestment Declaration Form - 2021-22rajamani balajiNo ratings yet

- Investment Declaration Form F.Y 2023-24Document4 pagesInvestment Declaration Form F.Y 2023-24Aditi Suryavanshi100% (1)

- Income Tax Form Guide for 2006-07Document9 pagesIncome Tax Form Guide for 2006-07Chalan B SNo ratings yet

- Investment Declaration Form For FY - 2017-18Document2 pagesInvestment Declaration Form For FY - 2017-18arunNo ratings yet

- Investment Proof Guidelines - Fy 2021-22Document14 pagesInvestment Proof Guidelines - Fy 2021-22vibha sharmaNo ratings yet

- Employees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022Document3 pagesEmployees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022neeta rautelaNo ratings yet

- Employees Proof Submission Form (EPSF) - 2010-11Document1 pageEmployees Proof Submission Form (EPSF) - 2010-11amararenaNo ratings yet

- Tax Decalaration 2023-24Document3 pagesTax Decalaration 2023-24thetrilight2023No ratings yet

- TAX Saving Investment ProofDocument1 pageTAX Saving Investment ProofAmit ShuklaNo ratings yet

- Yuken India Savings Declaration FY 2010-11Document3 pagesYuken India Savings Declaration FY 2010-11maiudayNo ratings yet

- AIL-Investment Declaration Form 2013-2014Document2 pagesAIL-Investment Declaration Form 2013-2014G A PATELNo ratings yet

- IT DeclarationDocument3 pagesIT DeclarationMusef BagwanNo ratings yet

- Atria Institute of TechnologyDocument3 pagesAtria Institute of TechnologykiranNo ratings yet

- Investment Declaration Form FY 2019-20 v2Document5 pagesInvestment Declaration Form FY 2019-20 v2Rehan ElectronicsNo ratings yet

- Form 12BBDocument1 pageForm 12BBdeepak.payalNo ratings yet

- IT Declaration Form 2014-15 - After BudgetDocument2 pagesIT Declaration Form 2014-15 - After BudgetAkram M. AlmotaaNo ratings yet

- Receipt of house rent submissionDocument3 pagesReceipt of house rent submissionPatrick Jude Lucas PsychologyNo ratings yet

- Investment Declaration Form-2Document2 pagesInvestment Declaration Form-2Pramod KumarNo ratings yet

- Employee Tax Declaration - AY 2019-20Document4 pagesEmployee Tax Declaration - AY 2019-20mathuNo ratings yet

- Investment Declaration Format FY 2022-23Document3 pagesInvestment Declaration Format FY 2022-23Divya WaghmareNo ratings yet

- Income Tax Declaration FormDocument1 pageIncome Tax Declaration FormRahul GuptaNo ratings yet

- Tax Calculator 2010 11Document2 pagesTax Calculator 2010 11Sanjay DasNo ratings yet

- Saln 2023Document3 pagesSaln 2023Osman G. Lumbos LptNo ratings yet

- Investment Declaration Form 21-22Document14 pagesInvestment Declaration Form 21-22Jigar PatelNo ratings yet

- Severe Financial Hardship 09 - 19Document6 pagesSevere Financial Hardship 09 - 19anthony rudduckNo ratings yet

- Investment and tax saving proofs for 2017-18Document5 pagesInvestment and tax saving proofs for 2017-18vishalkavi18No ratings yet

- Salary Structure and Benefits - EClerxDocument5 pagesSalary Structure and Benefits - EClerxBhanuNo ratings yet

- Employee Investment Details - Filled 2018-19Document2 pagesEmployee Investment Details - Filled 2018-19RAVINo ratings yet

- Tax filing title generatorDocument1 pageTax filing title generatorAkshay AcchuNo ratings yet

- Investment PlanDocument1 pageInvestment PlanNitin AgarwalNo ratings yet

- IT Declaration Form 2016-17Document11 pagesIT Declaration Form 2016-17JoooNo ratings yet

- Income Tax Declarations Form (SMCI) FY 2022 2023Document1 pageIncome Tax Declarations Form (SMCI) FY 2022 2023Nitesh KumarNo ratings yet

- Declaration Format For Salary For FY 2017-18 A.Y 2018-19Document1 pageDeclaration Format For Salary For FY 2017-18 A.Y 2018-19Sudeep Singh78% (9)

- Form 12 BBDocument2 pagesForm 12 BBshrivastavs035No ratings yet

- Annexure To Income Tax CircularDocument6 pagesAnnexure To Income Tax CircularDipti BhanjaNo ratings yet

- IT Declaration Form 2019-20Document1 pageIT Declaration Form 2019-20KarunaNo ratings yet

- Guidelines For Actual Proofs F.Y. 2022-23Document15 pagesGuidelines For Actual Proofs F.Y. 2022-23tania mahatoNo ratings yet

- Othguide For Act Invt Proof Submission - FY 2021-22 - Guide For Act Invt Proof Submission - FY 2021-22Document19 pagesOthguide For Act Invt Proof Submission - FY 2021-22 - Guide For Act Invt Proof Submission - FY 2021-22Dhruv JainNo ratings yet

- Srimadh BhagavathamDocument2 pagesSrimadh Bhagavathamprabha sureshNo ratings yet

- Month Basic DA Convey CCA HRA Bonus Medical LTA OtherDocument6 pagesMonth Basic DA Convey CCA HRA Bonus Medical LTA Othersmartb0yNo ratings yet

- Employees Declaration For IncomeDocument1 pageEmployees Declaration For Incomehareesh13hNo ratings yet

- Employee Declaration FormDocument1 pageEmployee Declaration FormShitesh YuvrajNo ratings yet

- Investment Declaration FormDocument3 pagesInvestment Declaration FormRahul BahalNo ratings yet

- Investment POI Guidance Notes (FY 23-24)Document33 pagesInvestment POI Guidance Notes (FY 23-24)Puneet GuptaNo ratings yet

- The ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationDocument1 pageThe ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationLantNo ratings yet

- Employee Declaration Form FY 2020-21Document2 pagesEmployee Declaration Form FY 2020-21Harsha I100% (2)

- Form 12 BBSampleDocument2 pagesForm 12 BBSampleAbhishekChauhanNo ratings yet

- D COMPUTATION OF TOTAL INCOME (TAX) LatestDocument6 pagesD COMPUTATION OF TOTAL INCOME (TAX) LatestOmkar NakasheNo ratings yet

- IA-SBI-NEW-MOU-15-DEC-2021Document11 pagesIA-SBI-NEW-MOU-15-DEC-2021Jitendra Raliya JatNo ratings yet

- PNP Nup Loan Application Form and Promissory NoteDocument2 pagesPNP Nup Loan Application Form and Promissory NoteEnteng Teng TengitsNo ratings yet

- (Company Name) : Income Tax Declaration Form For Fy 2022-23Document3 pages(Company Name) : Income Tax Declaration Form For Fy 2022-23Jude Philip WilfredNo ratings yet

- Bob PensionerDocument1 pageBob Pensionerabhijit majarkhedeNo ratings yet

- INVESTMENT DECLARATION FOR FY 2022-23Document4 pagesINVESTMENT DECLARATION FOR FY 2022-23Ankush SinghNo ratings yet

- Employee Tax Declaration - AY 2019-20Document1 pageEmployee Tax Declaration - AY 2019-20mathuNo ratings yet

- Employee Declaration Form 15Document4 pagesEmployee Declaration Form 15Bliss BilluNo ratings yet

- SL No. Amount (RS.) Evidence / Particulars Nature of ClaimDocument1 pageSL No. Amount (RS.) Evidence / Particulars Nature of ClaimJayanth vNo ratings yet

- Decision Making and Problem Solving & Managing - Gashaw PDFDocument69 pagesDecision Making and Problem Solving & Managing - Gashaw PDFKokebu MekonnenNo ratings yet

- Project Feasibility Study and Evaluation 2011 Sports ComplexDocument264 pagesProject Feasibility Study and Evaluation 2011 Sports ComplexFongbeerNo ratings yet

- Sirteoil Company: #X Y #X YDocument4 pagesSirteoil Company: #X Y #X YMohammed H SaeedNo ratings yet

- 5973 Fast Electronics Upgrade 2 PDFDocument2 pages5973 Fast Electronics Upgrade 2 PDFMarine JolieNo ratings yet

- FB Secondary DataDocument8 pagesFB Secondary DataraheelismNo ratings yet

- Obdprog mt401 Pro Mileage Correction ToolDocument6 pagesObdprog mt401 Pro Mileage Correction ToolYounes YounesNo ratings yet

- DRAFT Certificate From KVMRTv3 - CommentDocument2 pagesDRAFT Certificate From KVMRTv3 - CommentTanmoy DasNo ratings yet

- ICG Change Magazine 1 - 2019Document156 pagesICG Change Magazine 1 - 2019Jozsef KosztandiNo ratings yet

- Thời gian làm bài: 60 phút không kể thời gian phát đềDocument4 pagesThời gian làm bài: 60 phút không kể thời gian phát đềNguyen Trung HuyNo ratings yet

- ExpreDocument34 pagesExpreAC AgustinNo ratings yet

- ACF-Dog - Cat Adoption ApplicationDocument5 pagesACF-Dog - Cat Adoption ApplicationBrittneyNo ratings yet

- Case 3-1 Southwest AirlinesDocument2 pagesCase 3-1 Southwest AirlinesDebby Febriany86% (7)

- Ruta 57CDocument1 pageRuta 57CUzielColorsXDNo ratings yet

- Gender Representation in A Prescribed Efl Textbook of Junior High School in IndonesiaDocument15 pagesGender Representation in A Prescribed Efl Textbook of Junior High School in IndonesiaJasa Skripsi AmanahNo ratings yet

- Can I Legally Drop Out of School in Switzerland If I Am 16 - Google SucheDocument1 pageCan I Legally Drop Out of School in Switzerland If I Am 16 - Google SucheWilhelm AgenciesNo ratings yet

- Diminish MusharakahDocument1 pageDiminish MusharakahNur IskandarNo ratings yet

- Treaty of Detroit 1807Document3 pagesTreaty of Detroit 1807Hiram MillerNo ratings yet

- Environmental Activity PlanDocument2 pagesEnvironmental Activity PlanMelody OclarinoNo ratings yet

- BibliographyDocument8 pagesBibliographyVysakh PaikkattuNo ratings yet

- Charles DickensDocument2 pagesCharles DickensNour HishamNo ratings yet

- Assignment 2 Sociology For EngineersDocument5 pagesAssignment 2 Sociology For EngineersLiaqat Hussain BhattiNo ratings yet

- ClearSCADA 2017R2 - CustomerReleasePresentation v3Document13 pagesClearSCADA 2017R2 - CustomerReleasePresentation v3Cesar Santiago Marquez YanezNo ratings yet

- Installment Plans at 0% Markup Rate: Credit CardDocument2 pagesInstallment Plans at 0% Markup Rate: Credit CardHeart HackerNo ratings yet

- SOCSCI 1105 Exercise 3Document3 pagesSOCSCI 1105 Exercise 3Jerrold MadronaNo ratings yet

- Myp-Brief Individuals-Societies 2015Document2 pagesMyp-Brief Individuals-Societies 2015api-520325350No ratings yet

- Gender and Sexuality Justice in Asia 2020Document246 pagesGender and Sexuality Justice in Asia 2020Axel Bejarano JerezNo ratings yet

- Ashv Finance Limited BC Mar2023Document46 pagesAshv Finance Limited BC Mar2023Swarna SinghNo ratings yet

- Banker Customer RelationshipDocument4 pagesBanker Customer RelationshipSaadat Ullah KhanNo ratings yet

- Population: Lebanon State of The Environment Report Ministry of Environment/LEDODocument7 pagesPopulation: Lebanon State of The Environment Report Ministry of Environment/LEDO420No ratings yet

- GST Invoice Format No. 20Document1 pageGST Invoice Format No. 20email2suryazNo ratings yet