Professional Documents

Culture Documents

Form 12BB

Uploaded by

deepak.payalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 12BB

Uploaded by

deepak.payalCopyright:

Available Formats

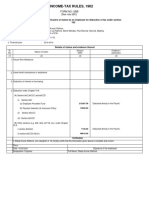

FORM No.

12BB

(See rule 26C)

Statement showing particulars of claims by an employee for deduction of tax under section 192

1. Name and address of the employee: Deepak Payal 2. Employee Code: 15583

___________________________________________________________________________________________________ .

3. Permanent Account Number (PAN) of the employee: ASLPJ5452G

4. Financial year: 2022-23

Details of claims and evidence thereof

S.No. Nature of claim Amount (Rs.) Evidence / particulars

(1) (2) (3) (4)

1 House Rent Allowance:

(i) Rent paid to the landlord Rs. (15000*12) =180000 . from _April-2022 to Mar-2023 - Annual.

(ii) Address of premises - C508, Ramson's Kshitij Gurgaon

(iii) Name of the landlord - Ravindra

(iv) Address of the land lord

(v) Permanent Account Number (PAN) of the landlord - BXZPR2420L

Note: Permanent Account Number (PAN) of landlord shall be furnished if the aggregate rent paid during the year exceeds one Lac Rupees.

2 Leave travel concessions or assistance

3 Deduction of Interest on Housing Loan :

(i) Interest payable/paid to the lender -

(ii) Name of the lender: ___________________________________________________________________________________

(iii) Address of the lender: _________________________________________________________________________________

(iv) Permanent Account Number of the lender : _________________________________________________________________

(a) Financial Institutions(if available) : _______________________________________________________________________

(b) Employer(if available) : ________________________________________________________________________________

(c) Others (if available, pls Specify) : ________________________________________________________________________

4 Deduction under Chapter VI-A Amount (Rs.) Evidence / particulars

A Section 80C,80CCC and 80CCD lic

(i) Section 80C:

(a) Life Insurance Policies 6778

(b) SSA 150,000

(c) PPF -

(d) NSC -

(e) Tution Fees -

No. of School/College going children 01 & staying in Hostel : Yes / No __NO

(f) Repayment of Housing Loan -

(g) Mutual Fund/Fixed Deposit (Under Tax Saving Scheme) -

(h) Other Investments (Give Details) -

(ii) Section 80CCC (Not Applicable-clubbed with 80C) -

(iii) Section 80CCD(1B) NPS (by employee, Max limit - 50,000) -

(iv) Section 80CCD(2) NPS (through employer, max limit 10% of basic) -

(v) Section 80D (Mediclaim Policy) CARE Health Insurance

For Section 80D, max qualifying amount towards Premium paid on the health of :- a) himself, spouse & children Rs.25,000/-, in case senior citizen then

Rs.30,000/-, b) If separate premium for parents then additional amount of Rs.25,000/-, in case of parent senior citizen then Rs.30,000/-.

(vi) Section 80DD (Physical Handicapped Dependent) -

B Other sections (e.g. 80E, 80G, 80TTA, etc.) under Chapter VI-A

(i) Section 80E (Interest on Loan for Higher Education) -

(ii) Section 80G (Donation if exempted 100%) -

(iii) Section 80TTA (Interest on saving bank a/c, max limit - 10,000) -

Total Interest received from saving bank account - To claim deduction u/s 80TTA

Verification

I, DEEPAK PAYAL , Son of Mr. OM PRAKASH do hereby certify that the information given above is complete and correct.

Place : Gurgaon

Date : 14.09.2022 _______________________

(Signature of the employee)

DesignManager Production Full Name : DEEPAK PAYAL

You might also like

- Form 12 BBSampleDocument2 pagesForm 12 BBSampleAbhishekChauhanNo ratings yet

- Form12BB 1Document2 pagesForm12BB 1kolhe2377No ratings yet

- BY Pass SysDocument2 pagesBY Pass SyssanjchandanNo ratings yet

- Form-12BB 2019-20Document1 pageForm-12BB 2019-20sabir aliNo ratings yet

- Form-No.12bb 2020-21Document1 pageForm-No.12bb 2020-21Sk SerafatNo ratings yet

- Anb Form 16 ITR (Saral II) 2010 ModelDocument7 pagesAnb Form 16 ITR (Saral II) 2010 Modelvanbu1967No ratings yet

- Income Tax Declaration Form - FORM-NO. 12BBDocument10 pagesIncome Tax Declaration Form - FORM-NO. 12BBPrince MittalNo ratings yet

- Investment Declaration (Form-12BB) For FY 2020-21 (Old Regime)Document2 pagesInvestment Declaration (Form-12BB) For FY 2020-21 (Old Regime)Ranga.SathyaNo ratings yet

- Money SavingDocument2 pagesMoney SavingRanga.SathyaNo ratings yet

- Section 12BB IT ExampleDocument2 pagesSection 12BB IT Examplebhaskar ghoshNo ratings yet

- Section 12BBDocument2 pagesSection 12BBbhaskar ghoshNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationKranthi kakumanuNo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Henna KadyanNo ratings yet

- Investment Declaration Form - 2023-24Document2 pagesInvestment Declaration Form - 2023-24shrlsNo ratings yet

- Form. 12BBDocument6 pagesForm. 12BBaruyl001No ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Guru RajNo ratings yet

- Employee Tax Declaration - AY 2019-20Document4 pagesEmployee Tax Declaration - AY 2019-20mathuNo ratings yet

- Form 12BDocument2 pagesForm 12BNageswar MakalaNo ratings yet

- "FORM NO.12BB (See Rule 26C) " Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pages"FORM NO.12BB (See Rule 26C) " Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Snehasish PadhyNo ratings yet

- Income Tax Savings Declaration Form EngDocument2 pagesIncome Tax Savings Declaration Form EngDedyTo'tedongNo ratings yet

- Form 12 BBDocument2 pagesForm 12 BBshrivastavs035No ratings yet

- Address: of The of The Employee 2021-2022Document3 pagesAddress: of The of The Employee 2021-2022Dipak PArmarNo ratings yet

- 12bb NR Baria 00402749 2122Document3 pages12bb NR Baria 00402749 2122Dipak PArmarNo ratings yet

- SL No. Amount (RS.) Evidence / Particulars Nature of ClaimDocument1 pageSL No. Amount (RS.) Evidence / Particulars Nature of ClaimJayanth vNo ratings yet

- Annexure To Income Tax CircularDocument6 pagesAnnexure To Income Tax CircularDipti BhanjaNo ratings yet

- IT Declaration - Form 12BBDocument4 pagesIT Declaration - Form 12BBmkharb941No ratings yet

- IT DeclarationDocument1 pageIT Declarationswapna vijayNo ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsDocument11 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainNo ratings yet

- Employees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022Document3 pagesEmployees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022neeta rautelaNo ratings yet

- HDFC Ltd.Document3 pagesHDFC Ltd.Parag KusalkarNo ratings yet

- Mercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageMercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Shubham ShrivastavaNo ratings yet

- Form 12 BBDocument2 pagesForm 12 BBHarsh GandhiNo ratings yet

- Serv Let ControllerDocument2 pagesServ Let ControllerAbhishekShuklaNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationprasathNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- Final-Investment Declaration Form FY 19 - 20Document12 pagesFinal-Investment Declaration Form FY 19 - 20Bhupender RawatNo ratings yet

- Direct Tax Laws Detail Test 1 May 2024 Test Paper 1702105507Document9 pagesDirect Tax Laws Detail Test 1 May 2024 Test Paper 1702105507shauryagupta20013007No ratings yet

- 2023 Tax DeclarationDocument2 pages2023 Tax Declarationmanikandan BalasubramaniyanNo ratings yet

- IT DeclarationDocument1 pageIT Declarationsiva kumaarNo ratings yet

- Form No 16 (By Sagar Goyal)Document3 pagesForm No 16 (By Sagar Goyal)sagarNo ratings yet

- Epsf Form12bb 93445Document1 pageEpsf Form12bb 93445dasari.samratNo ratings yet

- Form12bb 5663202Document2 pagesForm12bb 5663202uttamraochopade52No ratings yet

- Form No 12BB FY 2020-21 (AY 2021-22)Document6 pagesForm No 12BB FY 2020-21 (AY 2021-22)Avinash ChandraNo ratings yet

- Division "A": VIDYA SAGAR CAREER INSTITUTE LIMITED, Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54Document281 pagesDivision "A": VIDYA SAGAR CAREER INSTITUTE LIMITED, Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54mktg.seagullshippingNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- GN Industrial AFDocument3 pagesGN Industrial AFNitteshdas ChatergiNo ratings yet

- Tax Decalaration 2023-24Document3 pagesTax Decalaration 2023-24thetrilight2023No ratings yet

- ProceduresDocument89 pagesProceduresmayur_jadav54No ratings yet

- New IT Declaration FormDocument2 pagesNew IT Declaration FormMahakaal Digital PointNo ratings yet

- Income Tax Calculation F.Y.2019-20 AGIPC1111K Particulars AmountDocument3 pagesIncome Tax Calculation F.Y.2019-20 AGIPC1111K Particulars AmountNihit SandNo ratings yet

- Sickness Reimbursement B-304 PDFDocument2 pagesSickness Reimbursement B-304 PDFkaateviNo ratings yet

- ADEPY3125F 2018-19 Form 16 Part BDocument2 pagesADEPY3125F 2018-19 Form 16 Part BAnilNo ratings yet

- Bob PensionerDocument1 pageBob Pensionerabhijit majarkhedeNo ratings yet

- G Vittal Annexer 2Document1 pageG Vittal Annexer 2SRINIVAS MNo ratings yet

- Form 12BB (See Rule 26C)Document2 pagesForm 12BB (See Rule 26C)Biswadip BanerjeeNo ratings yet

- Nilesh DateDocument2 pagesNilesh Date1stapril15No ratings yet

- Srimadh BhagavathamDocument2 pagesSrimadh Bhagavathamprabha sureshNo ratings yet

- FormDocument2 pagesFormdileepNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- A Study of The Impact of 80-20 Rule On Social Media Marketing - Sameer A SawantDocument8 pagesA Study of The Impact of 80-20 Rule On Social Media Marketing - Sameer A SawantSawant SameerNo ratings yet

- Extrajudicial Settlement of EstateDocument3 pagesExtrajudicial Settlement of EstateSamae Kanda100% (2)

- Sample Question Paper, 12 EconomicsDocument7 pagesSample Question Paper, 12 EconomicsSubhamita DasNo ratings yet

- Week 2: How To Write A Concept Paper: at The End of The Lesson, You Should Be Able ToDocument8 pagesWeek 2: How To Write A Concept Paper: at The End of The Lesson, You Should Be Able ToDharyn KhaiNo ratings yet

- Sampling Aggregates: Standard Practice ForDocument7 pagesSampling Aggregates: Standard Practice ForAnonymous x7VY8VF7100% (1)

- Ethiopian Chamber of Commerce & Sectoral Associations (ECCSA) Request For ProposalDocument31 pagesEthiopian Chamber of Commerce & Sectoral Associations (ECCSA) Request For Proposalcheru koreNo ratings yet

- Britannia IndustriesDocument40 pagesBritannia IndustriesabhilashjadhavNo ratings yet

- NipponIndia Nifty Alpha Low Volatility 30 Index Fund Aug 2023Document6 pagesNipponIndia Nifty Alpha Low Volatility 30 Index Fund Aug 2023kishore13No ratings yet

- Travel Market Research 2019 AGN OfficialDocument25 pagesTravel Market Research 2019 AGN Officialcarere teiNo ratings yet

- Project Report of Itc LTD PDF FreeDocument75 pagesProject Report of Itc LTD PDF FreeSaad SiddiquiNo ratings yet

- Module 1 - Bidding Process (Sample Problems)Document2 pagesModule 1 - Bidding Process (Sample Problems)Anna Daniella LunaNo ratings yet

- Kaizen Assignment 2Document4 pagesKaizen Assignment 2Walia Raunaq Rajiv PGP 2022-24 BatchNo ratings yet

- HOpe Not You To Read ThisDocument29 pagesHOpe Not You To Read ThisWigindragaNo ratings yet

- Apple Inc - Research ReportDocument1 pageApple Inc - Research Reportapi-554762479No ratings yet

- RJ MotorDocument8 pagesRJ Motortamillarasi a/p MuruganNo ratings yet

- Solution To Econ Subject Guide 2016Document169 pagesSolution To Econ Subject Guide 2016Nguyễn Đức Bình GiangNo ratings yet

- Walmart Sample Training ProgramDocument17 pagesWalmart Sample Training ProgramNisha BrosNo ratings yet

- Servicenow Interview Question and AnswersDocument72 pagesServicenow Interview Question and Answersswapneshsurwade29No ratings yet

- ST - Joseph's Degree & PG College Business Law Unit1Document14 pagesST - Joseph's Degree & PG College Business Law Unit1Saud Waheed KhanNo ratings yet

- Developments in Freight Derivatives and Shipping Risk ManagementDocument29 pagesDevelopments in Freight Derivatives and Shipping Risk ManagementBiplab RayNo ratings yet

- GDR - Bharat ForgeDocument12 pagesGDR - Bharat ForgevaishnaviNo ratings yet

- CBSE Class 3 Mathematics Worksheet (47) - Indian CurrencyDocument4 pagesCBSE Class 3 Mathematics Worksheet (47) - Indian CurrencyVinayak KhedekarNo ratings yet

- Business Law: Certificate in Accounting and Finance Stage ExaminationDocument8 pagesBusiness Law: Certificate in Accounting and Finance Stage ExaminationMuhammad FaisalNo ratings yet

- Ba 4055 Warehouse ManagementDocument40 pagesBa 4055 Warehouse ManagementDEAN RESEARCH AND DEVELOPMENT100% (1)

- Strategic Supply Chain Management PPT ScheduleDocument3 pagesStrategic Supply Chain Management PPT ScheduleMan unitedNo ratings yet

- AHKFTA - Chapter - 6Document12 pagesAHKFTA - Chapter - 6Tuyết Cương TrầnNo ratings yet

- Online Summer ReportDocument23 pagesOnline Summer ReportajendraNo ratings yet

- Hs Entrepreneurship Performance Indicators 3Document20 pagesHs Entrepreneurship Performance Indicators 3api-374581067No ratings yet

- GCC Guide For Control On Imported Foods - Final PDFDocument69 pagesGCC Guide For Control On Imported Foods - Final PDFValeria DumitrescuNo ratings yet

- Marriage Biodata Doc Word Formate ResumeDocument2 pagesMarriage Biodata Doc Word Formate ResumeIqbal Kabir50% (4)